|

Regional Council Informal Workshop Pack Annual Plan 2025/26 Workshop No. 2 DATE: Wednesday 13 November 2024 COMMENCING AT TIME: 09:30am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga

|

|

Regional Council Informal Workshop Pack Annual Plan 2025/26 Workshop No. 2 DATE: Wednesday 13 November 2024 COMMENCING AT TIME: 09:30am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga

|

Informal Workshop Papers

1 Annual Plan 2025/26 - Activity Review 2

Attachment 1 - September 2023 Savings made 2

Attachment 2 - Activity Review Savings 2

Attachment 3 - Savings with potential impact on Levels of Service 2

2 Annual Plan 2025/26 - Public Transport 2

3 2025/26 Fees and Charges Review 2

Attachment 1 - Guide to Resource Consents process 2

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

13 November 2024 |

|

|

From: |

Kumaren Perumal, Chief Financial Officer; AJ Prinsloo, Finance Manager and Olive McVicker, Corporate Performance Team Lead |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Annual Plan 2025/26 - Activity Review

1. Purpose

At the Annual Plan 2025/26 workshop held on 16 October 2024, Council directed staff to reduce the rates requirement forecast for Year 2 of the Long Term Plan 2024-2034 (LTP).

The purpose of this paper is to provide Councillors with the outcome of the activity reviews undertaken and present proposed budget adjustments for 2025/26 for consideration.

2. Guidance sought from Councillors

Consider and provide guidance on the following:

· the proposed budget adjustments for 2025/26 for each activity, and

· consequential potential impacts on activity levels of service (where relevant).

3. Discussion

3.1 Background

3.1.1 Savings during LTP development

The need to identify efficiencies in response to the economic environment was pivotal in the development of the LTP. At the time, $4.6 million in savings was identified for 2024/25 and $4.1 million in 2025/26. This contributed to reducing the projected general rates increase for 2024/25 (Year 1) to 8.2% including growth and inflation.

For reference these savings are listed in Attachment 1.

Since the adoption of the LTP, the economic situation has not improved and feedback about rates affordability has been received from our communities.

As part of the early stages of the process of setting the Annual Plan budget for 2025/26 (Year 2 of the LTP) the signalled rates increase, including growth and inflation, were:

· 8.2% for general rates

· 6.3% for total targeted rates, made up of targeted rates for the following activities:

o Transport Service Delivery (13.7%)

o Rivers and Drainage Schemes (6.0%)

o Community Engagement (3.9%)

o Emergency Management (2.4%)

o Rotorua Catchments (-22.1%), %), mainly driven by June 2024 change in Revenue and Financing Policy, moving from targeted rates to general rates over 3 years starting in 2025/26.

At the Annual Plan workshop on 16 October 2024 Council gave direction that the signalled 8.2% increase in general rates, and the targeted rates increases, were to be reviewed with options and implications brought to this second workshop.

3.1.2 Budget assumptions

Inflation

Budgeting assumptions continue to be reviewed. CPI inflation and weighted average borrowing costs are in line with LTP forecasts. Specific BERL Local Government cost indices are higher than forecast in the LTP which will add to cost pressures.

Short-term cash rates are lower than forecast in the LTP which will reduce interest revenue on cash holdings. The net impact of these changes, and options to mitigate any negative impacts, will be presented at future workshops.

Public Transport reserves

Subject to the 2024/25 financial performance of Public Transport, and referencing only the savings identified in the Public Transport workshop paper, we expect to transfer the general rates saving of $533K to the Regional Fund and the transport targeted rates saving of $867K to the targeted rates reserves.

This primarily relates to the Tauranga Public Transport Targeted Rate Reserve, assisting in restoring the reserve to a surplus position, given the deficit reported at the end of 2023/24.

There are no additional assumptions about funding projects from reserves other than those approved and adopted in the LTP.

3.1.3 Prudential benchmarks

The prudential benchmarks for the 2025/26 budget version 1 will be included as workshop reference material located in Diligent.

3.2 Review of activity expenditure for 2025/26

3.2.1 Savings identified that do not impact on levels of service

In response to the Council direction at the Annual Plan workshop on 16 October, staff have completed a review of operating expenditure for the 2025/26. This has identified savings options for Councillors to consider.

Full details of the savings identified and related commentary are contained in Attachment 2.

The list in Attachment 2 will be reviewed in the workshop and staff will take direction on the potential savings to be included in the draft Annual Plan 2025/26.

3.2.2 Options for treatment of Kanoa funding

The Kanoa funding is expected over Years 1–3 of the LTP, reducing the borrowing needed for capital works. This will lead to ongoing savings in interest costs and lower loan repayments, which have been incorporated into the draft 2025/26 Annual Plan Budget (Attachment 2).

Funding shares for the relevant projects in the LTP are 80% targeted rates and 20% general rates, in accordance with the current Revenue and Financing Policy.

Guidance is sought on how to treat the Kanoa grant savings in the 2025/26 Annual Plan.

Option 1

The impact of the saving in the draft 2025/26 budgets (Attachment 2) has been calculated based on current funding policies that did not anticipate this level of external grant funding.

Estimated savings of $280,000 will reduce targeted rates by $224,000 and general rates by $56,000, based on the current project phasing.

Once all Kanoa funding is received (Years 4–10), the net impact will, on average, reduce targeted rates by $1.2 million per year and general rates by $300,000 per year.

Option 2

Alternatively, Council may consider applying all Kanoa funding savings to reduce only targeted rates.

The impact on the draft 2025/26 budget would be that the total savings of $280,000 in Attachment 2 would reduce the targeted rates only.

Longer term, this approach would result in an average annual reduction, from LTP Year 4 onwards, of $1.5 million for the Rivers and Drainage targeted rates, instead of $1.2 million.

3.2.3 Savings identified that potentially impact service levels

Further savings that may have an impact on some levels of service have also been identified and are listed in Attachment 3.

Some of the affected levels of service may impact measures/targets in the LTP. Pursuing the related savings may result in some targets not being achieved. As an example, for Resource Consents, the LTP measure is the percentage of non-notified consents issued within statutory timeframes. The removal of the free advice time for resource consent applications may result in processing delays, which could mean the 95% target is not achieved.

Council guidance is sought on the potential savings that should be included in the draft Annual Plan 2025/26.

3.2.4 Additional expenditure not envisaged in LTP

Some new projects have been identified since the LTP was approved, which will require additional funding. They include:

· Biosecurity: $280,000 required due to the changes to the Regional Pest Management Plan (RPMP). These changes will increase the number of species covered by the RPMP.

· Governance: $150,000 additional costs for the 2025 elections.

3.2.5 Impact of potential savings and proposed cost increases on draft rates increases for 2025/26

As a result of this review, a total of $5.5 million in potential savings has been identified for Council’s consideration and $430,000 has been identified as additional expenditure. Of the savings, $3.7 million is funded by general rates and $1.8 million is funded by targeted rates.

Taking into account all the savings identified in Attachments 2 and 3, and the additional expenditure in paragraph 3.2.3, the general rates increase signalled in year 2 of the LTP would reduce from 8.2% to 2%.

The total targeted rates increase would reduce from 6.3% forecast in the LTP to 3%, made up of:

o Transport Service Delivery (9%)

o Rivers and Drainage Schemes (3%)

o Community Engagement (4%)

o Emergency Management (2%)

o Rotorua Catchments (-28%).

Council direction is sought on the items to include in subsequent versions of the draft 2025/26 budgets.

4. Freshwater – Programme and Implementation

Through the LTP process a range of budget reductions were identified in the Policy and Planning Activity (which covers freshwater policy). These resulted in an overall saving of $1,650,000 in 2024/35 and $1,154,000 in 2025/26. These savings reflected the changing operating environment at the time and the delay in the proposed notification timeframe.

The operating environment has now changed again. Specifically on 22 October 2024 Central Government made amendments to the Resource Management Act to restrict councils from notifying freshwater planning instruments before the end of December 2025 or following the enactment of a new NPSFM. On 10 December 2024 the Strategy and Policy Committee will consider how the Essential Freshwater programme should proceed from this point.

This decision will have an impact on two activities:

· Policy and Planning; and

· Freshwater Implementation.

The Policy and Planning Activity holds the freshwater policy function. Clearly there will be a further delay in notification which was previously planned for September 2025. A budget reduction (of $75,000) has been identified due to the notification/hearings/commissioner costs being pushed further out.

The Freshwater Implementation Activity was introduced into the LTP to respond to a number of matters where actions and initiatives above BAU were seen as being important. An example of this is introducing Mātauranga Māori projects to respond to the “portals” approach for identifying cultural values into the future. The activity is $400,000 in Year 1, and $800,000 for Year 2 to Year 10. This activity also needs to respond to the delay in notification. An initial 20% reduction ($160,000) has been signalled but a zero-based approach will be used from here.

There are two salient points to consider in exploring further budget reductions across the two linked activities:

1. Through the process of developing a draft plan and supporting science platform, a number of gaps have been identified in Council’s management of freshwater. Examples of this include:

a. surface water gauging sites are located inland to help predict flood risk but sites/methodologies are needed to manage low flow events.

b. the need to better understand lowland drainage waterbodies has highlighted a lack of monitoring in this area.

c. the lack of a fully functional water quantity accounting system/model.

d. freshwater fish investigation records are generally only from remote areas.

e. Low level of freshwater cultural values identification.

These activities are about making improvements to how we can appropriately manage the region’s freshwater resource – with or without a plan change. Some of these initiatives become of even greater importance in the absence of new, robust policy. Further information on this will be included in the 10 December 2024 Report.

2. Information to support the Draft Annual Plan process is contingent on decisions on the programme. This means staff are unable to provide a comprehensive analysis of the thinking on budgets at this point but after receiving direction at the Strategy and Policy Committee meeting on 10 December, budget implications can be incorporated into subsequent versions of the Draft Annual Plan.

Year 1 of the LTP consists of building on engagement with tangata whenua, building the cultural baseline for the programme, and developing a plan for years 2 to 10. This last project (developing a plan) will now focus on the above two points in recognition of the changed operating environment.

It is thought that current commitments to tangata whenua groups will be able to be accommodated within the retained budget however any additional projects will need to be considered carefully within organisational budgets (such as the Māori Initiatives Fund). It is noted that Central Government funding is reducing in this area which may lead to increased requests to Council.

Current forecasted Freshwater Programme and Implementation activity expenditure 2024/25 is:

|

Cultural Baseline Information |

$60,000 (consultancy) |

|

· Cultural Monitoring · Freshwater Plan development/updates · Wānanga Mātauranga Māori Projects |

$100,000 (confirmed via funding agreements) $180,000 (discussions on scope and timing, not confirmed) |

|

Total Forecast |

$340,000 |

It is anticipated that there will be further budget reductions. Clearly the ground has shifted however there are initiatives that would have been progressed in the normal course of things and that are still important -or now more important - to fulfil Council’s resource management responsibilities. Staff will be seeking to find a balance for reporting to Council.

5. Next Steps

Staff will process the guidance received at the workshop and will present the updated rates increases at the next Annual Plan workshop.

Attachment 1 - September 2023 Savings made ⇩

Attachment 2 - Activity Review Savings ⇩

Attachment 3 - Savings with potential impact on Levels of Service ⇩

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

13 November 2024 |

|

|

From: |

Oliver Haycock, Director, Public Transport and Jamie Hall, Manager, Transport Programme Delivery |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Annual Plan 2025/26 - Public Transport

1. Purpose

At the Annual Plan 2025/26 workshop held on 16th October, Council directed staff to reduce the rating requirement as identified in Long Term Plan 2024-2034 (LTP) Year 2.

The purpose of this paper is to highlight recent changes to the national transport funding environment and outline a high level approach to reducing Regional Council transport programme costs prior to more detailed consideration of options at the workshop.

This paper also suggests some initial opportunities for savings from the Transport programme of work. Further considerations that could impact the Transport programme of work, which may present additional opportunities for savings, will be presented to the Regional Council workshop on the 13 November 2024.

1.1 Guidance Sought from Councillors

Consider and provide guidance on the following:

• the proposed budget adjustments for each activity, and,

• subsequent impact on the activity’s agreed level of service (where relevant).

2. Discussion

2.1 Background

The Bay of Plenty Regional Council Long Term Plan 2024-2034 (LTP) was released in June 2024. The LTP outlined a balanced approach to providing essential services, while planning for the future and maintaining rates affordability.

The LTP transport programme included several activities that were rated for on the assumption that a national funding share would be provided from the National Land Transport Programme 2024-2027 (NLTP).

The NLTP contains all of the land transport activities that the New Zealand Transport Agency (NZTA) anticipates funding over the three years to give effect to Government direction in the Government Policy Statement on Land Transport 2024-2034 (GPS). The current NLTP was released in September 2024.

The NLTP is an oversubscribed contestable fund, which leads to many of the projects put forward not attracting funding. Consequently, NZTA commits funding to some activities. Others are assigned a status awaiting further planning, information or funding to confirm their priority and be approved, while some activities are not included in the NLTP three-year programme at all.

2.2 NLTP investment in the Bay of Plenty Regional Council transport programme

The NLTP funding outcome for Regional Council is shown in the table below. These amounts are the totals across the three-year NLTP funding period (2024-2027).

|

Activity Class |

Funding Requested $000 |

Funding Approved $000 |

Difference

$000 |

|

Public Transport Services |

128,088 |

111,890 |

-16,198 -13% |

|

Public Transport Infrastructure |

4,551 |

4,551 |

$0 0% |

|

Safety |

731 |

308 |

-423 -58% |

|

Improvement Projects |

11,369 |

3,612 |

-$7,757 -68% |

|

Low Cost, Low Risk |

4,677 |

1,299 |

-$3,378 -72% |

|

TOTAL |

149,415 |

121,659 |

-$27,776 -19% |

The Public Transport Services category predominantly funds the contract costs associated with the operation of bus services, as well as total mobility. The funding requested did assume modest increases in the levels of service over the next three years, as a result of network refreshes, as well as the higher costs anticipated at the commencement of new contracts.

There is sufficient funding to maintain the current levels of public transport services. However, there is a limited contingency for any unforeseen costs over the next three years.

The Public Transport Infrastructure category funds bus shelter operations and maintenance. Regional Council administer this funding on behalf of Local Authorities, and pass on 100% of this funding, with no net cost incurred by Regional Council. Also included in this category is funding for security costs for Tauranga and Rotorua. 100% of the funding requested in this category has been approved.

The Safety category has seen a substantial reduction, due to a change in road safety strategy at a national level.

At a Regional Council LTP workshop in November 2023, direction was given by Councillors to remove the Road Safety Programme (RSP) budget from the LTP. This position was one recommended by staff because of the change in government direction coupled with the fact Territorial Local Authorities (TLA) already deliver their own comprehensive RSP programmes and often the regional role is comparatively small.

Therefore, in the context of the LTP, the RSP budget was removed, and ultimately saved. The $308,000 of National Land Transport Fund (NLTF) funding requires a 49% local contribution.

Improvement Projects and Low Cost, Low Risk[1] projects are listed below, along with their NLTP funding status:

Probable – (funded, subject to procedural compliance)

· National Ticketing Solution (NTS)

Possible – (only funded if other approved activities fail to progress)

· Public Transport Services and Infrastructure (PTS&I) Transformation (Tauranga)

· Tauranga Refresh Phase 2

Not included in NLTP 2024-2027

· Papamoa Park and Ride Trial

· Tertiary Commuter Services

· Bus de-carbonisation Initiatives

· Passenger rail (Hamilton-Tauranga) note: no local share budgeted in LTP

· Route 85 Paeroa Extension

· Infrastructure improvements to support Rotorua Refresh

· Travel Demand Management (TDM) Programme

2.3 Review of Activity Expenditure

In response to the Council direction, staff have completed a review of operating expenditure to identify cost savings for Council consideration.

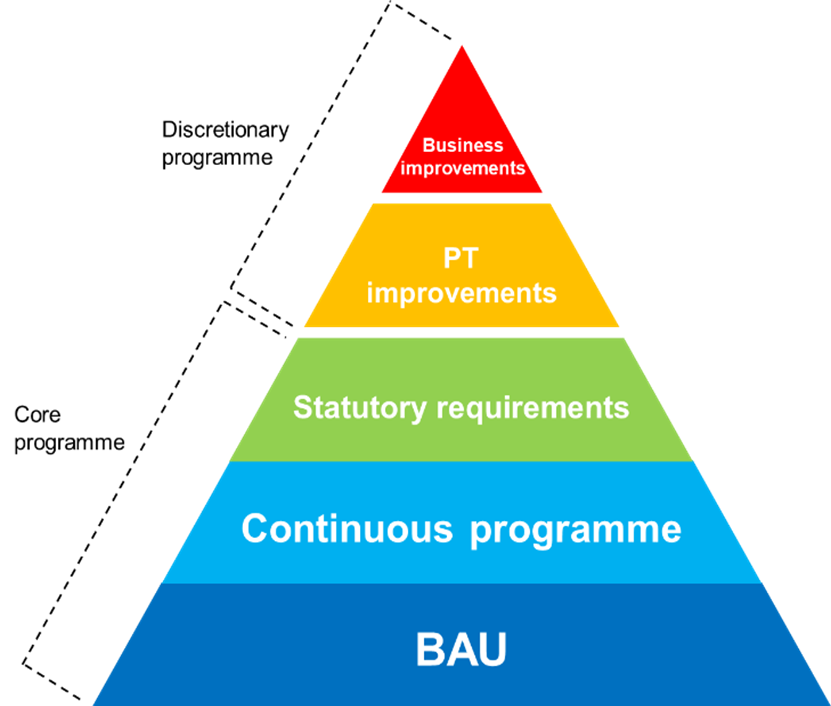

The following diagram shows the types of activities that form the building blocks of the BOPRC transport programme.

The core programme is comprised of business as usual (BAU) activities, the continuous programme (existing public transport services), and activities that are necessary to meet statutory requirements.

Any reduction in the core programme is likely to impact on current levels of service and may expose the Regional Council to additional reputational and legal risks. Consequently, staff have treated the core programme as being relatively fixed.

Above the core transport programme sits a number of public transport service improvement and business improvement activities. These activities form the discretionary part of the programme.

Constrained national funding in the NLTP has the most significant impacts on public transport service improvements. Consequently, staff have focused cost reduction efforts on this aspect of the programme. Each activity has been reviewed in terms of its strategic alignment with national and regional policy direction, and likelihood of delivery under the current NLTP.

Using the approach outlined above, staff will take Councillors through more detailed options for the transport programme at the workshop.

3. Initial Transport Programme Savings Identified

Further to the methodology presented in the previous session, the table below presents activities suggested for removal from the Transport programme of work, along with the associated cost / rating implications:

|

Activity |

2024/25 $000 |

2025/26 $000 |

2026/27 $000 |

|

Papamoa Park and Ride Trial |

856 |

872 |

0 |

|

Tertiary Commuter Services |

108 |

215 |

215 |

|

Bus de-carbonisation Initiatives |

284 |

288 |

294 |

|

Route 85 Paeroa Extension |

0 |

39 |

40 |

|

152 |

155 |

159 |

|

|

TOTAL

General Rate share Targeted Rate share |

1,400

533 867 |

1,569

556 1,013 |

708

478 230 |

The proposed savings identified in the table above equate to a reduction in general rates funding of $556k, and targeted rates funding of $1,013k for the 2025/26 Annual Plan.

It should be noted that for these activities, significant savings are also anticipated in the 2024/25 financial year with rates already set. Any savings in 2024/25 will impact targeted rates reserves, and potentially available funding from 2025/26.

Each activity is described further below.

3.1 Papamoa Park and Ride Trial ($1,728k)

Originally proposed as a joint initiative between BOPRC, Tauranga City Council and NZTA Waka Kotahi, this trial did not attract funding through the NLTF.

This trial was not identified as a priority for the region through the Regional Land Transport Plan (RLTP) process. Furthermore, TCC Staff have indicated that they will be recommending the removal of this project from the City Council programme of work.

Due to the lack of central government funding, lack of priority in the RLTP and signalled lack of ongoing support from partner agencies, the recommendation is to remove this activity from the programme of work.

This trial was to be funded 90% by a Tauranga targeted rate and 10% from general rates. In addition, no spending has been incurred against this activity in the 2024/25 financial year at this stage.

3.2 Tertiary Commuter Services ($538k)

These services have operated since the beginning of the 2020 academic year. At the Regional Council meeting on 23 October 2024, it was resolved to cease these services at the end of the 2024 academic year, due to the lack of NLTF funding and lack of agreed funding from the tertiary institutes.

As these services span the region, they are funded 90% from targeted rates (targeted depending on the location of the service) and 10% from general rates. As these services will cease mid-financial year, this activity will also contribute a saving in the 2024/25 financial year.

3.3 Bus Decarbonisation Initiatives ($866k)

Work was undertaken between 2022-2023 to develop a “Transport Emissions Reduction Programme” (TERP). This work recommended a number of activities to support emissions reduction, specifically related to bus decarbonisation.

Much of this programme was developed under guidance provided by the previous government, where it was anticipated that Public Transport Authorities would play a leading role. The current government have signalled a market-led approach to the transition to zero-emission vehicles and have therefore not made funding available for initiatives such as this.

Due to the lack of central government funding and now misalignment with the national direction, the recommendation is to remove this activity from the programme of work.

This activity was to be funded from general rates. In addition, no spending has been incurred against this activity in the 2024/25 financial year at this stage.

3.4 Route 85 Paeroa Extension ($79k)

Through the RLTP process, funding for an extension to Paeroa was requested for Route 85 (Waihi Town Connector). This was in partnership with Waikato Regional Council, in response to feedback from the community.

Due to the lack of central government funding and signalled lack of ongoing commitment from Waikato Regional Council, the recommendation is to remove this activity from the programme of work.

This service was to be funded 90% by a Western Bay targeted rate and 10% from general rates. This service was signalled to commence from the 2025/26 financial year of the LTP.

3.5 Travel Demand Management (TDM) Programme ($466k)

Funding was received from the previous NLTP to undertake several scoping studies, which defined a programme of travel demand management initiatives across the region. These initiatives were designed to encourage communities to make more informed choices about travel, to deliver against some of the key outcomes sought in the RLTP.

The TDM programme required a high level of collaboration with Territorial Local Authorities, many of which have signalled a desire to significantly curtail or remove their own funding in this area.

TDM activities do not align with the direction of the current government and as such, central government funding has not been forthcoming. It is therefore recommended that this activity be removed from the programme of work.

This activity was to be funded from general rates. In addition, no spending has been incurred against this activity in the 2024/25 financial year at this stage.

4. Wider Transport Programme of Work Considerations

In addition to the potential savings identified in the previous section, there are a number of wider considerations that could impact the Transport programme of work, which may present further opportunities for savings.

These more detailed considerations will be presented to the Regional Council workshop on the 13 November 2024.

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

13 November 2024 |

|

|

From: |

Alicia Burningham, Corporate Planner; Ella Tennent, Consents Manager; Matthew Harrex, Compliance Manager - Land and Water and Kumaren Perumal, Chief Financial Officer |

|

|

|

Mat Taylor, General Manager, Corporate |

|

2025/26 Fees and Charges Review

1. Purpose

The Fees and Charges (F&C) policy outlines the fees and charges associated with a range of services provided by the Bay of Plenty Regional Council. Council uses these fees and charges to recover the costs of undertaking certain activities, to ensure the individuals and organisations responsible meet the cost for benefiting from those activities. This principle is directly provided for through Section 36(1)(c) of the Resource Management Act 1991, alongside other legislation specific to the activities.

Amending the Fees and Charges Policy requires a Special Consultative Procedure, and this will run in parallel with any consultation process for the 2025/26 Annual Plan or separately if consultation on the Annual Plan is not taking place.

2. Guidance Sought from Councillors

It is proposed that the Fees and Charges Policy be updated for the following activities or charges and staff request guidance on the following:

· Proposed increase in resource consent deposits

· Proposed inclusion to recover the actual and reasonable cost of work on Fast-Track Approval projects (expected to be passed into law before the end of 2024).

· Minor adjustments to some compliance inspection frequencies

· Increases in Harbour dues

· Applying increased cost of service delivery to fixed fees, which were omitted in the 2024/25 review

· Applying a general increase to most charges in line with CPI to address the increased cost of service delivery

3. Discussion

3.1 Proposed increase to resource consent deposits

Staff propose an increase in the deposit fees currently set out in the Fees and Charges Policy for a resource consent application. Please see Attachment 1 for information on what goes into the consent process/what the cost is for.

Before Council begins to process an application, the deposit or fixed application fee is paid in full to begin covering the costs of processing the consent.

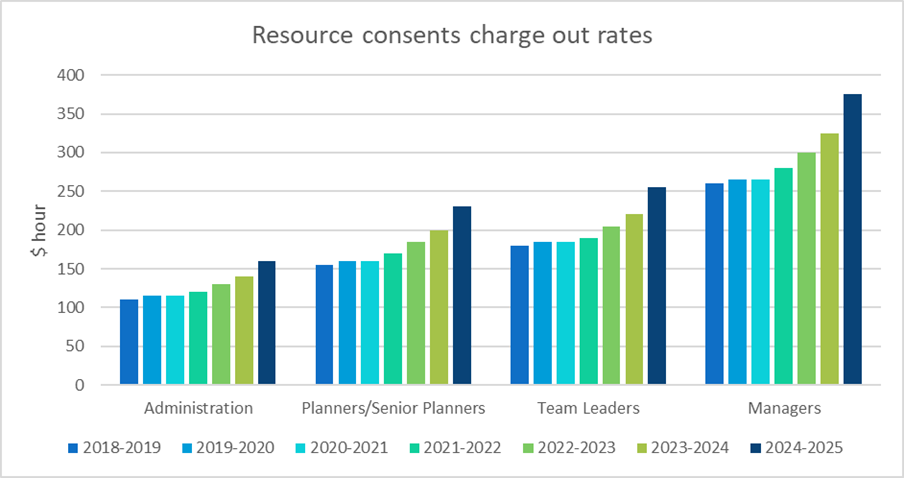

Each financial year when the fees and charges policy is reviewed, there is generally an increase in the charge out rates for the officers involved in processing a resource consent. In the last LTP, this increase was 15%. These increases are shown in the graph below and are per hour:

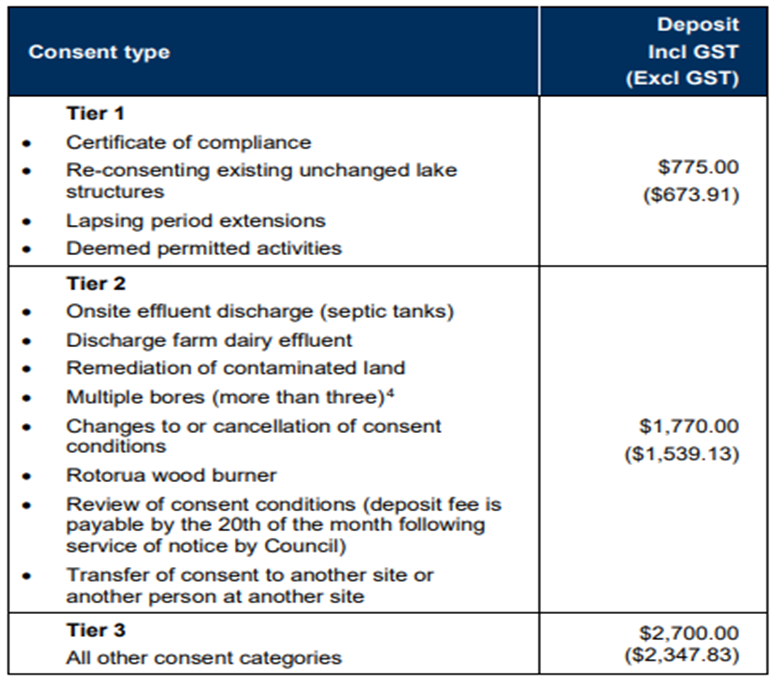

The deposit fees were last adjusted in 2018/19 and as shown in the table above, the charge-out rates have changed since then. The current resource consent application deposit fees are based on the three tiers below, which are for applications that are charged by the hour.

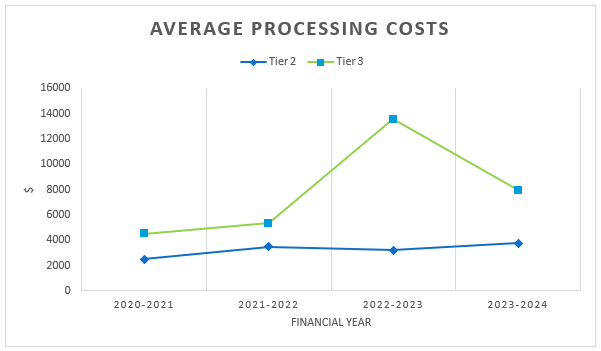

The graph and table below presents the average processing costs for tiers 2 and 3 across the last few financial years:

|

|

2020-2021 |

2021-2022 |

2022-2023 |

2023-2024 |

|

Tier 2 |

2514.60 |

3492.90 |

3209.50 |

3765 |

|

Tier 3 |

4515 |

5327.90 |

13542.50* |

7948 |

*The Tier 3 average for the 2022/23 financial year reflects a number of complex consents. There were 18 with a final invoice over $10,000.

The trend of increasing processing costs which is directly influenced by the rising charge out rates.

There are a number of benefits for a higher deposit fee:

· Provides applicants with a more realistic expectation of the total cost of their consent, which could increase customer satisfaction

· Reduces complaints about final costs

· Administratively easier to return money than to charge for shortfalls

· Chasing up fees, including with Baycorp is difficult, time consuming and costly.

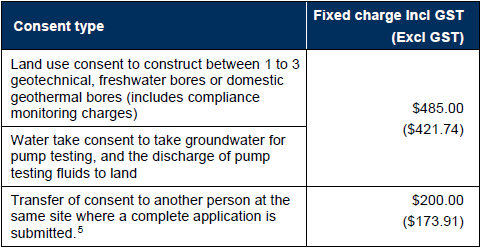

The other type of Consent Fees are fixed fee consent applications:

The fee for transfer of a consent is currently an accurate amount, however, based on the last 15 Bore and Pump Test Fluid Discharge consents processed, it appears the $485 fixed fee for these activities is low. Staff recommend this be increased to $550 to cover actual and reasonable costs.

Based on the above, staff propose that the deposit fees be raised as follows:

Table 1 - Consents Deposits proposed changes

|

Deposit Fees (inc GST) |

Current 2024/25 |

Proposed 2025/26 |

|

Tier 1 |

$775 |

$1000 |

|

Tier 2 |

$1770 |

$2500 |

|

Tier 3 |

$2700 |

$4000 |

|

Fixed Fee Bore and Pump Test Discharges |

$485 |

$550 |

3.2 Fast Track Approval Projects

It is also recommended that a fee for recovering the actual and reasonable cost of work on Fast-Track Approval projects be included in the Fees and Charges Policy 2025/2026. These approvals are expected to be passed into law before the end of 2024.

3.3 Minor adjustments to some compliance inspection frequencies

The proposed changes fairly reflect the risk associated with each compliance category based on officer experience and compliance reporting data (refer to the rationale contained in the table). Since these are currently on an actual and reasonable basis, the impact of this change is relatively minor.

Each of the compliance categories proposed for amendment have a high Performance Monitoring (PM) component to them. The proposed changes do not affect the PM management component of the monitoring.

In addition, the proposed changes will help reduce staff workload pressure and enable better use of their time by focussing on the higher risk activities.

Table 2 - Compliance inspection frequency proposed changes

|

Schedule 2A - Consents subject to variable compliance monitoring charges |

|||||

|

Compliance Category |

Code |

Current Frequency |

Proposed Frequency |

Description |

Rationale |

|

Consumptive Water use with 5 or more Abstraction Points with Manual or Telemetry Water Use Record Submission, or any Consumptive Water Use with additional use management |

CWMX |

As required |

5 yearly |

Water use record compliance on a regular basis and additional or more frequent compliance monitoring e.g. when flow restrictions require cease-take compliance, or non-concurrent use, water quality sampling etc. |

These takes are still monitored closely though the submission of regular PM records and reports. Although manual records generate more staff time spent on administration, it does not affect the onsite performance of the individual abstraction points. Therefore, it is appropriate to align the site inspection frequency of this category with the telemetered takes i.e. 5 yearly. |

|

Hydro Dams |

Hydro |

1 yearly |

3-5 yearly |

Large hydro schemes are generally well managed, however, impact of non-compliance can be very significant |

Hydro schemes infrastructure is closely monitored and managed by the scheme owners. Compliance site inspections rarely highlight onsite issues. All hydro schemes have a heavy PM reporting burden, which are closely monitored by the compliance team. Therefore it is appropriate to reduce the site inspection frequency of this category down to 3/5 yearly |

3.4 Increasing Port Charges (Harbour Dues)

Due to ongoing increases in the cost-of-service delivery to the Harbourmaster it is proposed to increase the Harbour Dues from the current rate of $19.27 excluding GST per 1,000 gross tonnage. The proposed rate for 2025/26 will be provided at the 11 December Council meeting, once shipping information is received from Port of Tauranga. If this is not available prior to adoption of the draft Fees and Charges Policy 2025/26 for consultation, then the proposal is to apply CPI to the current charge.

3.5 Increased cost of service delivery to fixed fees omitted in 2024/25 review

During the 2024/25 review, a 10% increase was applied to cover the increased cost of service delivery. This increase was reflected in the fees listed in the schedules, but several fixed fees in the policy were not adjusted. It is now proposed to apply this 10% increase to those fixed fees (listed below in Table 3) for 2025/26.

Table 3 – Proposed increases to fixed fees

|

Table |

Type |

Current

|

Proposed |

|

Table 2: Fixed consent application fees |

Land use consent to construct between 1 to 3 geotechnical, freshwater bores or domestic geothermal bores (includes compliance monitoring charges) |

$485.00 |

$535.00 |

|

Table 2: Fixed consent application fees |

Water take consent to take groundwater for pump testing, and the discharge of pump testing fluids to land |

$485.00 |

$535.00 |

|

Table 6: Administration charge |

Standard charge |

$150.00 |

$165.00 |

|

Table 6: Administration charge |

Multiple consents: additional charge per consent holder where separate invoicing and correspondence is required |

$130.00 |

$145.00 |

|

Table 7: Compliance monitoring charges |

'Fixed administration fee relating to late or non-submission of records and monitoring reports' |

$265.00 |

$290.00 |

|

Table 12: Enforcement charges |

Issue of an abatement notice |

$250.00 |

$275.00 |

3.6 Apply a general increase to remaining charges in line with CPI

To address the increased cost of service delivery, such as staff and overhead costs, it is proposed to apply an increase to the remaining charges in line with the CPI adjustment used for the 2025/26 Annual Plan. Note the alternative to such an increase would be to cover a greater share of costs from general rates.

4. Other considerations

Council is considering cost saving scenarios under the Annual Plan 2025/26 - Activity Review item in this workshop. Direction on these scenarios given by Councillors may have implications for the draft fees and charges outlined in this report. Any relevant changes will be captured in the next iteration of the fees and charges schedule for Council consideration at future workshops.

Following the guidance from this workshop including direction regarding the Annual Plan 2025/26 Activity Reviews, a draft Fees and Charges Policy for 2025/26 will be prepared. This draft will include tracked changes reflecting the proposed amendments. The draft will be presented for confirmation of direction at the Council meeting on December 11, 2024.

Attachment 1 - Guide to Resource Consents process ⇩

[1] Improvement activities with a value lower than $2m (low cost) which have a high alignment with Central Government’s direction (low risk)