|

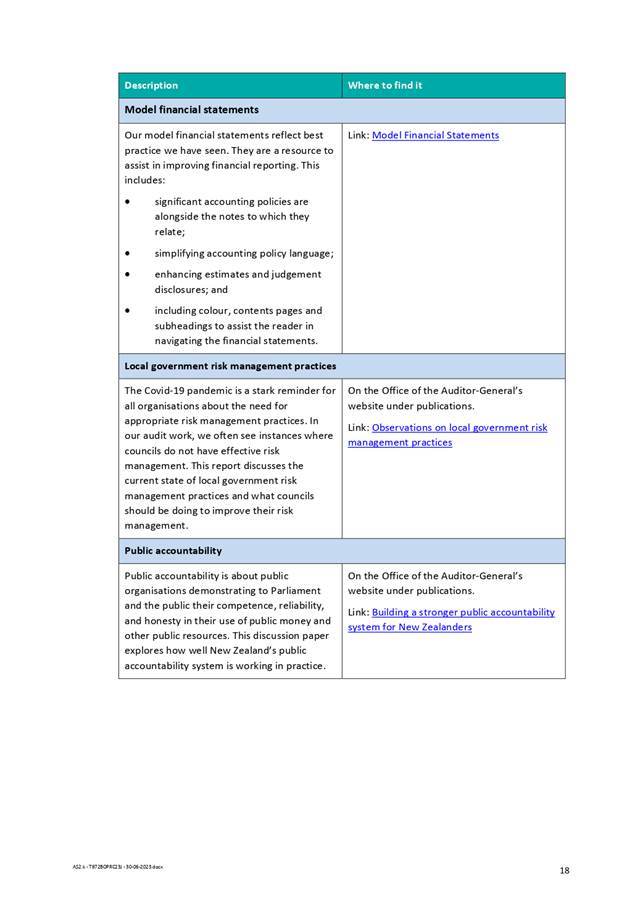

|

|

Risk

and Assurance Committee Agenda

NOTICE

IS GIVEN that the next meeting of the Risk and Assurance Committee will be

held in Council Chambers, Regional House, 1 Elizabeth Street, Tauranga on:

Wednesday

5 June 2024 COMMENCING AT 9.30 am

This

meeting will be livestreamed and recorded.

The Public section of

this meeting will be livestreamed and recorded and uploaded to Bay of Plenty

Regional Council’s website. Further details on this can be found

after the Terms of Reference within the Agenda. Bay of Plenty Regional

Council - YouTube

|

|

Fiona McTavish

Chief Executive, Bay

of Plenty Regional Council Toi Moana

27 May 2024

|

|

Risk and Assurance

Committee

|

Membership

|

Chairperson

|

Cr Stuart

Crosby

|

|

Deputy Chairperson (Independent)

|

Bruce

Robertson

|

|

Members

|

Cr Ron

Scott

Cr

Andrew von Dadelszen

Cr Te

Taru White

Cr

Kevin Winters

|

|

Ex Officio

|

Chairman Doug Leeder

|

|

Quorum

|

Three

members, consisting of half the number of members

|

|

Meeting frequency

|

Quarterly

|

Purpose

Monitor the effectiveness of Council’s funding and

financial policies and frameworks to ensure the Council is managing its

finances in an appropriate manner.

Monitor the effectiveness of Council's performance

monitoring framework.

Ensure that Council is delivering on agreed outcomes.

Role

·

Monitor the effectiveness of Council’s funding and

financial policies and Council’s performance monitoring framework

(financial and non-financial).

·

Review Council’s draft Annual Report prior to

Council’s adoption.

·

Receive and review external audit letters and management reports.

·

Approve and review the internal audit plan and review the annual

programme report.

·

Approve, review and monitor Council’s risk framework and

policy.

·

Review the risk register.

·

Monitor Council’s legislative compliance and receive

reporting on non-compliance matters as part of risk management reporting.

Power

to Act

To make all decisions necessary to fulfil the role and

scope of the committee subject to the limitations imposed.

Power

to Recommend

To Council and/or any standing committee as it deems

appropriate.

The Risk and

Assurance Committee is not delegated authority to:

·

Develop, review or approve strategic policy and strategy.

·

Develop, review or approve Council’s Financial Strategy, funding

and financial policies and non-financial operational policies and plans.

The Risk and Assurance Committee reports directly to the

Regional Council.

Recording

of Meetings

Please note the Public section of this

meeting is being recorded and streamed live on Bay of Plenty Regional

Council’s website in accordance with Council's Live Streaming and

Recording of Meetings Protocols which can be viewed on Council’s website.

The recording will be archived and made publicly available on Council's website

within two working days after the meeting on www.boprc.govt.nz for a period of

three years (or as otherwise agreed to by Council).

All care is taken to maintain your privacy;

however, as a visitor in the public gallery or as a participant at the meeting,

your presence may be recorded. By remaining in the public gallery, it is

understood your consent is given if your image is inadvertently broadcast.

Opinions expressed or statements made by

individual persons during a meeting are not the opinions or statements of the

Bay of Plenty Regional Council. Council accepts no liability for any opinions

or statements made during a meeting.

Bay of Plenty

Regional Council - Toi Moana

Governance Commitment

mō te taiao, mō ngā

tāngata - our environment and our people go hand-in-hand.

We provide excellent governance when,

individually and collectively, we:

· Trust and respect each

other

· Stay strategic and

focused

· Are courageous and

challenge the status quo in all we do

· Listen to our

stakeholders and value their input

· Listen to each other to

understand various perspectives

· Act as a team who can

challenge, change and add value

· Continually evaluate what

we do

TREAD LIGHTLY, THINK DEEPLY,

ACT WISELY, SPEAK KINDLY, JOURNEY TOGETHER.

Risk

and Assurance Committee 5 June 2024

Recommendations in reports are not to be construed as Council

policy until adopted by Council.

Agenda

1. Apologies

2. Public

Forum

3. Items

not on the Agenda

4. Order

of Business

5. Declaration

of Conflicts of Interest

6. Public Excluded

Business to be Transferred into the Open

7. Minutes

Minutes

to be Confirmed

7.1 Risk and Assurance

Committee Minutes - 6 March 2024 2

8. Reports

8.1 Chairperson's Report 2

Attachment 1 - Risk and Assurance

Work Programme Sept 2024 - Jun 2025 2

Attachment 2 - Risk and Assurance

Completed Work Programme March 2023 to March 2024 2

8.2 Audit New Zealand Report

on the audit of the Bay of Plenty Regional Council for the year ended 30 June

2023 2

Attachment 1 - Report to Council on

the audit of BOPRC for year ending 30 June 2023 2

8.3 Audit New Zealand Report

on the audit of the Long Term Plan 2024 - 2034 Consultation Document 2

Attachment 1 - Report to Council on

the audit of the BOPRC LTP 2024-34 Long Term Plan Consultation Document 2

8.4 Rates Setting for 2024/25

Financial Year - Legal Compliance 2

8.5 Internal Audit Work Plan

2024/25 to 2026/27 2

Attachment 1 - BOPRC Internal Audit

Work Plan FY2025-27 2

8.6 Internal Audit Status

Update 2

9. Public

Excluded Section

Resolution

to exclude the public

Excludes the

public from the following parts of the proceedings of this meeting as set out

below:

The general

subject of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the specific

grounds under section 48(1) of the Local Government Official Information and

Meetings Act 1987 for the passing of this resolution are as follows:

|

Item No.

|

Subject of each matter to be considered

|

Reason for passing this resolution in relation to each

matter

|

Grounds under Section 48(1) for the passing of this

resolution

|

When the item can be released into the public

|

|

9.1

|

Public

Excluded Risk and Assurance Committee Minutes - 6 March 2024

|

As

noted in the relevant Minutes.

|

As

noted in the relevant Minutes.

|

To

remain in public excluded.

|

|

9.2

|

Completed

Internal Audit Reviews

|

Withholding

the information is necessary to protect information which is subject to an

obligation of confidence or which any person has been or could be compelled

to provide under the authority of any enactment, where the making available

of the information would be likely to prejudice the supply of similar

information, or information from the same source, and it is in the public

interest that such information should continue to be supplied.

|

48(1)(a)(i)

Section 7 (2)(c)(i).

|

On

the Chief Executive's approval.

|

|

9.3

|

Key

Risks Workshop 2024 - Update

|

Withholding

the information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage.

|

48(1)(a)(i)

Section 7 (2)(j).

|

On

the Chief Executive's approval.

|

|

9.4

|

Key

Risk Register - March 2024

|

Withholding

the information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage.

|

48(1)(a)(i)

Section 7 (2)(j).

|

On

the Chief Executive's approval.

|

|

9.5

|

Update

on Flood Implications Work Programme

|

Withholding

the information is necessary to maintain legal professional privilege.

|

48(1)(a)(i)

Section 7 (2)(g).

|

On

the Chief Executive's approval.

|

Minutes

to be Confirmed

9.1 Public Excluded Risk and

Assurance Committee Minutes - 6 March 2024

Reports

9.2 Completed Internal Audit

Reviews

Attachment 1 - Executive Summary -

Sensitive Expenditure

Attachment 2 - Executive Summary -

CDEM Administering Authority

9.3 Key Risks Workshop 2024 -

Update

Attachment 1 - Risk and Assurance

Committee - Public Excluded Workshop Notes - 6 March 2024

Attachment 2 - Draft Key Risk

Register Example

9.4 Key Risk Register - March

2024

Attachment 1 - Key Risk Register -

March 2024

Attachment 2 - KRR - Heat Map March

2024

9.5 Update on Flood

Implications Work Programme

Attachment 1 - Current Potential

Liabilities - June 2024

10. Public Excluded Business to be

Transferred into the Open

11. Readmit the Public

12. Consideration

of Items not on the Agenda

|

Risk and Assurance Committee

Minutes

|

6 March 2024

|

Risk and Assurance Committee

Open Minutes

Commencing: Wednesday 6 March 2024, 10.00am

Venue: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga, and

via Zoom (audio visual meeting)

Chairperson: Bruce Robertson (Independent Member)

Members: Cr Stuart Crosby (via Zoom)

Cr Ron

Scott (via Zoom)

Cr

Andrew von Dadelszen

Cr Te

Taru White

Cr

Kevin Winters

Chairman

Doug Leeder (Ex Officio)

In Attendance: Councillors: Cr Matemoana McDonald (via

Zoom), Cr Jane Nees, Cr Paula Thompson (via Zoom), Cr Lyall Thurston (via Zoom)

Staff: Fiona McTavish – Chief Executive; Mat

Taylor – General Manager, Corporate; Kumaren Perumal – Chief

Financial Officer; Nolene Naude – Financial Accounting Team Lead (via

Zoom); Steven Slack – Risk & Assurance Manager; Monique Brooks - Legal and Commercial Manager; Jenny Teeuwen

– Committee Advisor

External: Leon Pieterse and Warren Goslett - Audit New Zealand

As Chairperson Cr

Stuart Crosby was unable to attend the meeting in person, the Deputy

Chairperson Bruce Robertson, assumed the Chair for this meeting.

1. Chairperson’s

Opening Statement

The Chairperson Bruce

Robertson declared the meeting open and immediately

adjourned the meeting.

10.02am

– the meeting adjourned.

10.20am

– the meeting reconvened.

When the meeting reconvened, the

Chairperson reminded members and the public that the public section of the

meeting was being livestreamed and recorded and that

the recording would be available on the Bay of Plenty Regional Council YouTube

channel following the meeting.

Recording link: Risk and

Assurance Committee - 6 March 2024 (youtube.com)

2. Declaration of Conflicts

of Interest

None declared.

3. Minutes

Minutes to

be Confirmed

|

3.1

|

Risk and Assurance Committee

Minutes - 7 December 2023

|

|

|

Resolved

That the Risk and Assurance Committee:

1 Confirms

the Risk and Assurance Committee Minutes - 7 December 2023 as a true and

correct record.

Robertson/White

CARRIED

|

4. Reports

|

4.1

|

Chairperson's Report

Presented by: Mat

Taylor – General Manager, Corporate

|

|

|

Resolved

That the Risk and Assurance

Committee:

1 Receives

the report, Chairperson's Report.

von Dadelszen/Winters

CARRIED

|

|

4.2

|

External Audit Engagement

Letter: Audit of the Consultation Document and 2024 - 2034 Long-Term Plan

(LTP)

Presented by: Kumaren

Perumal – Chief Financial Officer

Nolene Naude

– Financial Accounting Team Leader (via Zoom)

Leon Pieterse

– Audit New Zealand

Warren Goslett

– Audit New Zealand

In Response to Questions

· Audit

New Zealand advised that they were on track with the LTP audit.

|

|

|

Resolved

That the Risk and Assurance

Committee:

1 Receives

the report, External Audit Engagement Letter: Audit of the Consultation

Document and 2024 - 2034 Long-Term Plan.

Robertson/Winters

CARRIED

|

|

4.3

|

External Audit Plan 2023/24

Presented by: Kumaren

Perumal – Chief Financial Officer

Nolene Naude

– Financial Accounting Team Leader

Leon Pieterse

– Audit New Zealand

Warren Goslett

– Audit New Zealand

In

Response to Questions

· Audit

New Zealand were comfortable that the Audit Plan for the Annual Report

2023/24 audit deadlines were achievable.

· Quayside’s

audit timeframes were not expected to delay Audit New Zealand timeframes for

the BOPRC audit.

· The

LTP audit was going well, although acknowledged timeframes were tight.

· Provided

explanation for Audit Plan (Attachment 1) terminologies - uncorrected

misstatements (Page 10 of Audit Plan), and material measures/materiality

(Page 11 of Audit Plan).

|

|

|

Resolved

That the Risk and Assurance Committee:

1 Receives

the report, External Audit Plan 2023/24.

White/Robertson

CARRIED

|

10.45am

– Cr Scott withdrew from the meeting.

|

4.4

|

Internal Audit Status Update

Presented by: Steve

Slack - Risk & Assurance Manager

Key

Points

· Noted a correction in the report for Table 1 - 2.1 Cryptography

(page 63 of the agenda): the due date had been extended from 30 November 2023

to December 2024, therefore the item was not overdue for completion.

In Response to Questions

· No

incidents of fraud had been reported within the organisation in the past

year. As part of BOPRC’s fraud policy, Councillors would be

informed if fraud activity had been identified. Many internal audits included

a fraud component, and an organisation wide fraud risk assessment review was

also undertaken as part of the audit programme.

· Misinformation

versus fraud was dependent on circumstances.

· Noted

that following the resolution of the Strategy and Policy Committee at their

meeting on 20 February 2024 to “extend the

timeframe for notifying proposed Regional Policy

Statement (RPS) Change 7 (Freshwater) and proposed Regional Natural Resources

Plan (RNRP) Change 19 (Freshwater) from

December 2024 to September 2025”, the

status of the Freshwater Management Key Risk Mitigations internal audit

review was no longer on hold. Whether the item could be signed off as

completed would be reported back to the June meeting of this committee.

|

|

|

Resolved

That the Risk and Assurance

Committee:

1 Receives

the report, Internal Audit Status Update.

Winters/White

CARRIED

|

1. Public Excluded Section

|

Resolved

Resolution to exclude the public

1 Excludes the public from the following parts of the proceedings of

this meeting as set out below:

The general subject of each

matter to be considered while the public is excluded, the reason for passing

this resolution in relation to each matter, and the specific grounds under

section 48(1) of the Local Government Official Information and Meetings Act

1987 for the passing of this resolution are as follows:

|

Item No.

|

Subject of each matter to be considered

|

Reason for passing this resolution in relation to each

matter

|

Grounds under Section 48(1) for the passing of this

resolution

|

When the item can be released into the public

|

|

1.1

|

Public

Excluded Risk and Assurance Committee Minutes - 7 December 2023

|

As

noted in the relevant Minutes.

|

As

noted in the relevant Minutes.

|

To

remain in public excluded.

|

|

1.2

|

Key

Risk Register

|

Withholding

the information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage.

|

48(1)(a)(i)

Section 7 (2)(j).

|

On

the Chief Executive's approval.

|

Robertson/Winters

CARRIED

|

11.12am – the meeting closed.

Confirmed

Cr Stuart Crosby

Chairperson, Risk and Assurance Committee

|

|

|

|

|

|

Report To:

|

Risk

and Assurance Committee

|

|

Meeting

Date:

|

5 June

2024

|

|

Report

Writer:

|

Mat Taylor, General Manager,

Corporate

|

|

Report

Authoriser:

|

Mat

Taylor, General Manager, Corporate

|

|

Purpose:

|

Update on Risk and Assurance

Committee Activities

|

|

|

|

|

Executive Summary

This report provides the Committee with an update on Risk and

Assurance Committee activities.

|

Recommendations

That the Risk and Assurance Committee:

1 Receives the report, Chairperson's Report.

1. Introduction

The report shows an updated Risk

and Assurance Work Programme for the year ahead, and an updated Risk and

Assurance Completed Work Programme.

1.1 Alignment

with Strategic Framework

|

The Way We Work

|

We

continually seek opportunities to innovate and improve.

|

1.1.1 Community

Well-beings Assessment

|

Dominant Well-Beings Affected

|

|

¨ Environmental

|

¨ Cultural

|

¨ Social

|

þ Economic

|

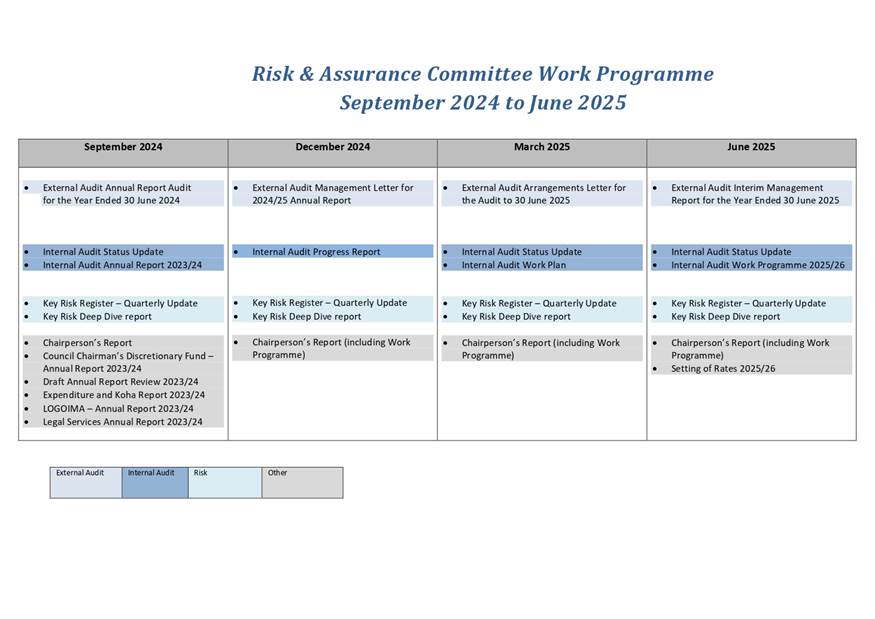

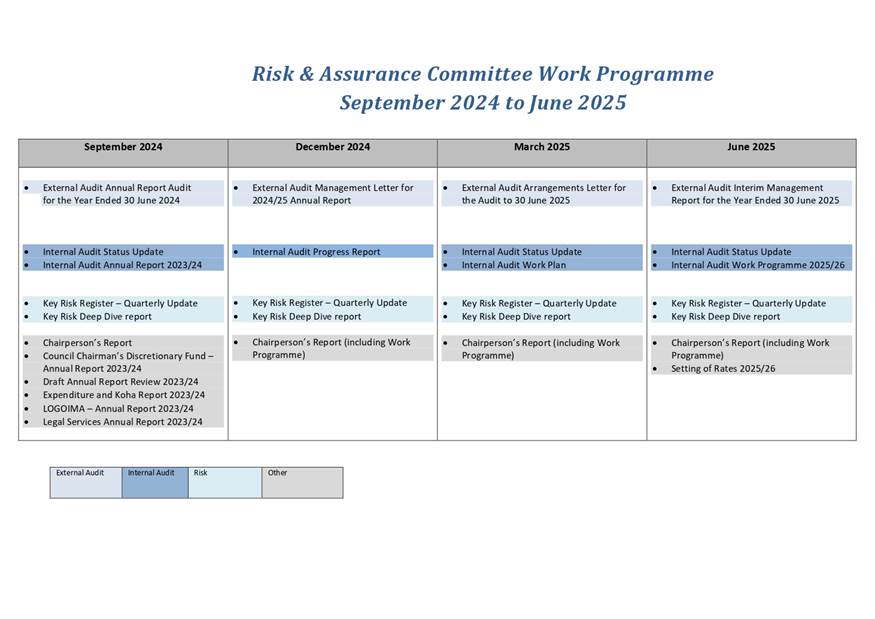

2. Risk

and Assurance Work Programme

Attachment 1 shows the Risk and

Assurance Work Programme for 2024. This Work Programme sets out the planned and

scheduled reporting to the Risk and Assurance Committee.

The attachment is categorised to

identify the broad areas of responsibility for the Committee. Other items may

be added by councillors and staff should this be required to respond to issues

as they occur throughout the year.

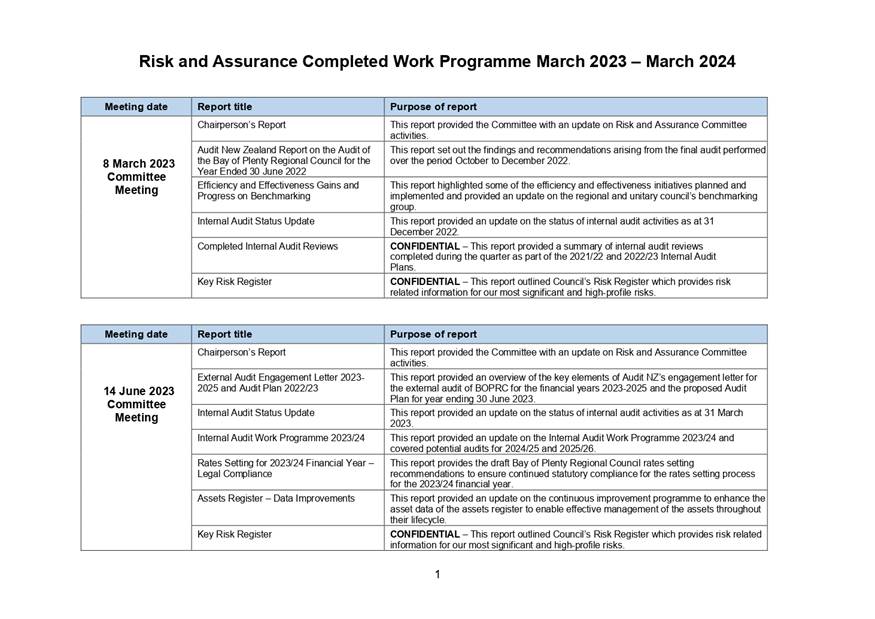

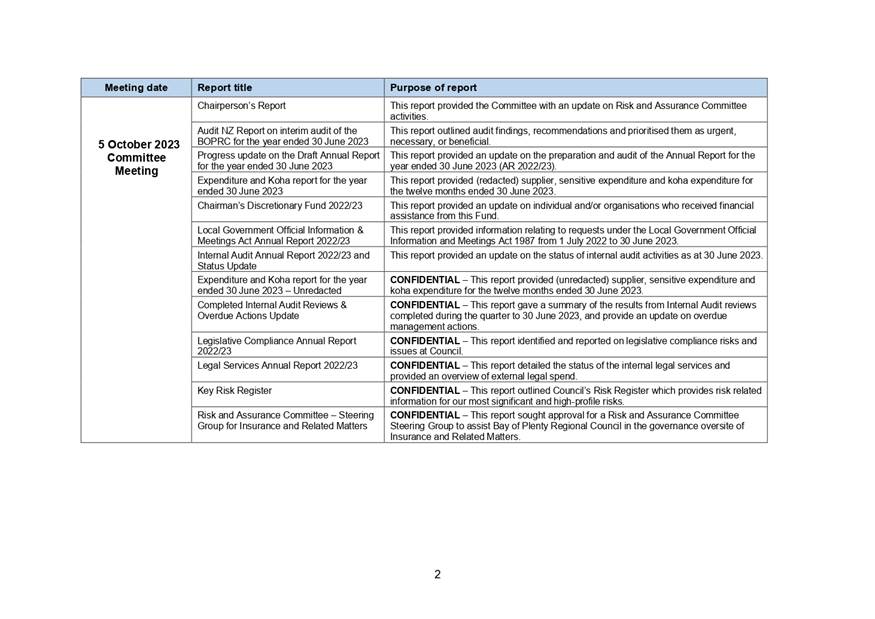

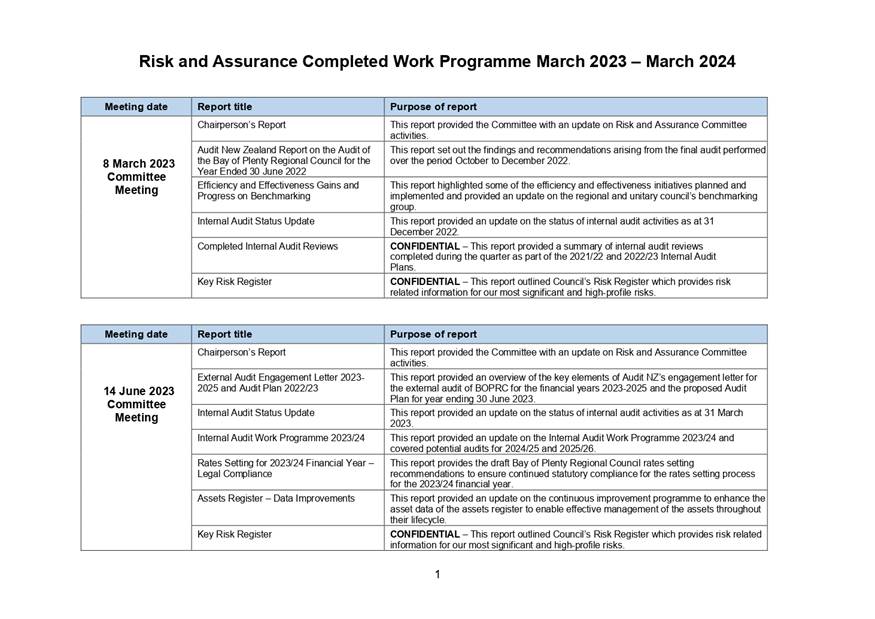

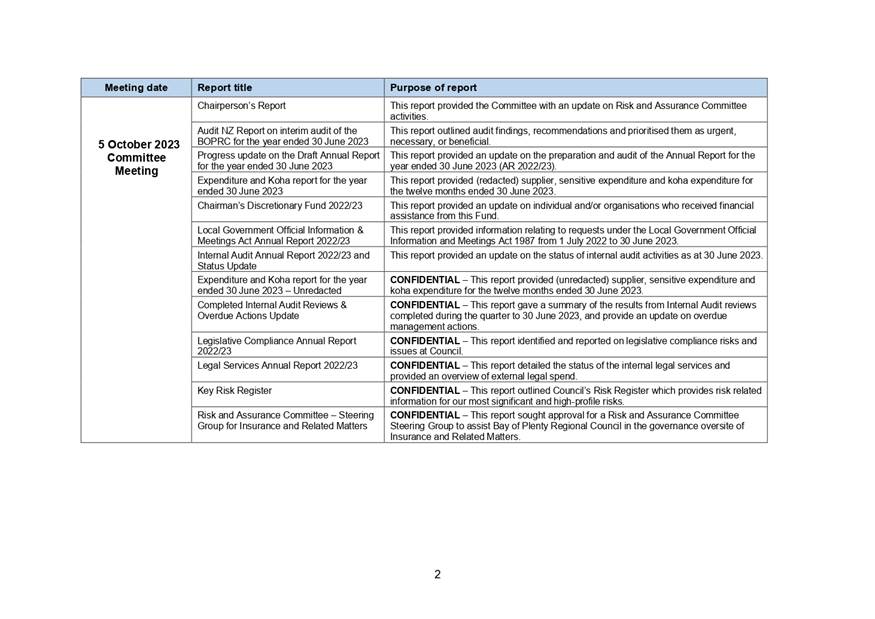

3. Risk

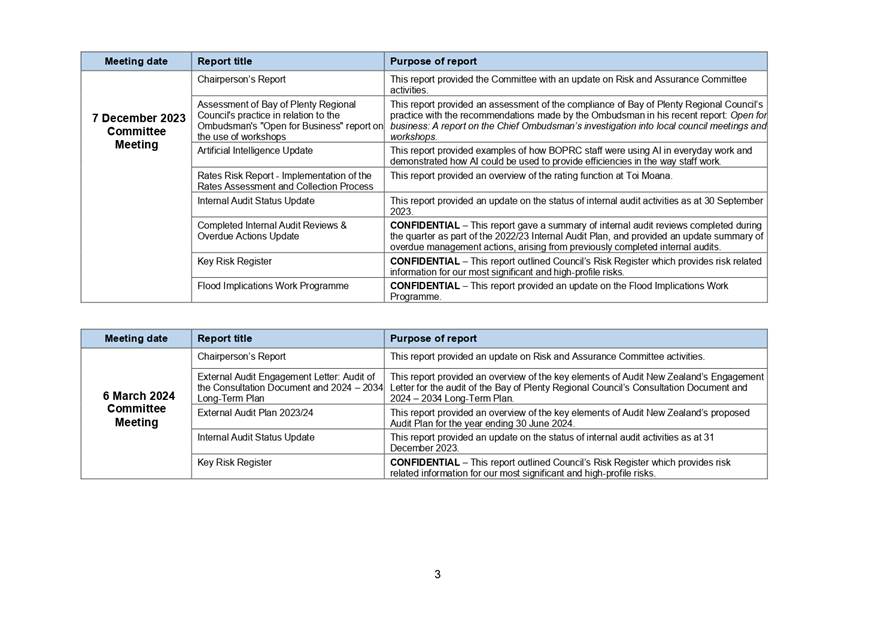

and Assurance Completed Work Programme

Attachment 2 shows the Risk and

Assurance Completed Work Programme for the period March 2023 – March

2024.

4. Considerations

4.1 Risks

and Mitigations

There are no significant risks

associated with this matter/subject/project/initiative.

4.2 Climate

Change

The matters addressed in this

report are of a procedural nature and there is no need to consider climate

change impacts.

4.3 Implications

for Māori

There are no implications for

Māori.

4.4 Financial

Implications

This work is being undertaken

within the current budget for the Governance Activity of the Long-Term Plan

2021 – 2031.

Attachments

Attachment 1 - Risk and Assurance Work Programme Sept 2024 - Jun

2025 ⇩

Attachment 2 - Risk and Assurance Completed Work Programme

March 2023 to March 2024 ⇩

Risk

and Assurance Committee 5 June 2024

Risk

and Assurance Committee 5 June 2024

|

|

|

|

|

|

Report To:

|

Risk

and Assurance Committee

|

|

Meeting

Date:

|

5 June

2024

|

|

Report

Writer:

|

Nolene Naude, Financial Accounting

Team Lead and Kumaren Perumal, Chief Financial Officer

|

|

Report

Authoriser:

|

Mat

Taylor, General Manager, Corporate

|

|

Purpose:

|

The Risk and Assurance Committee to receive

the Audit New Zealand Report on the audit of the Bay of Plenty Regional

Council for the year ending 30 June 2023

|

|

|

|

Audit

New Zealand Report on the audit of the Bay of Plenty Regional Council for the

year ended 30 June 2023

|

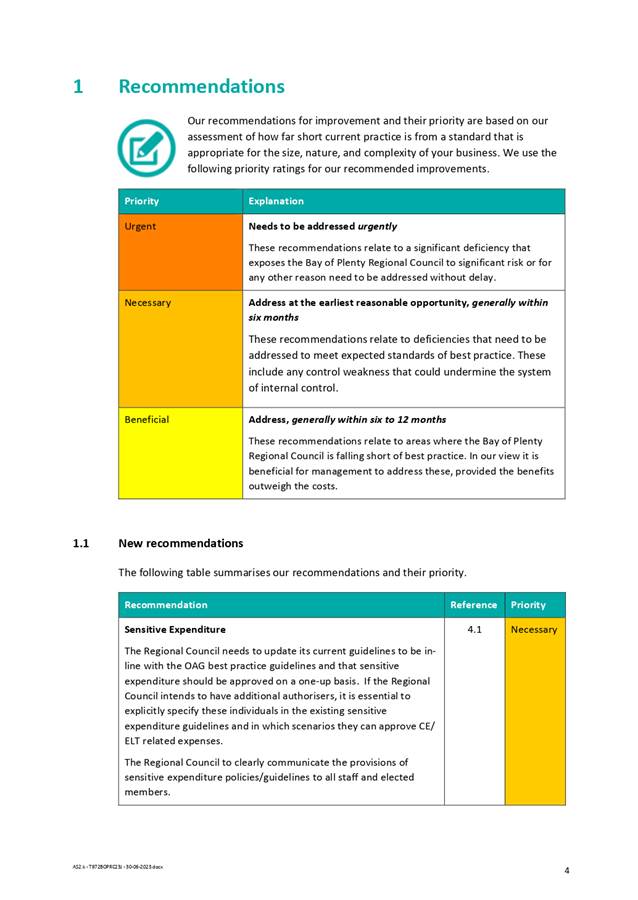

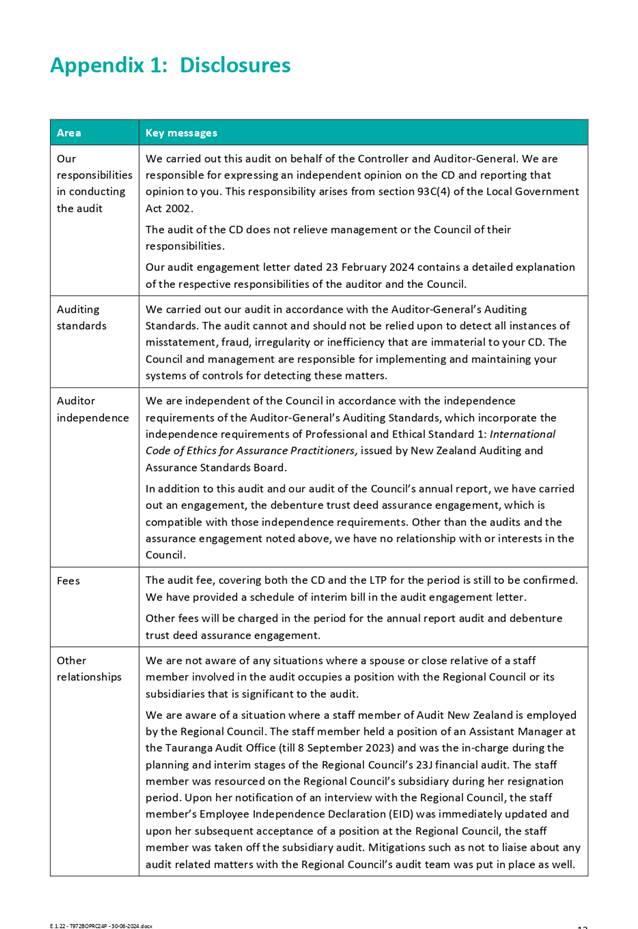

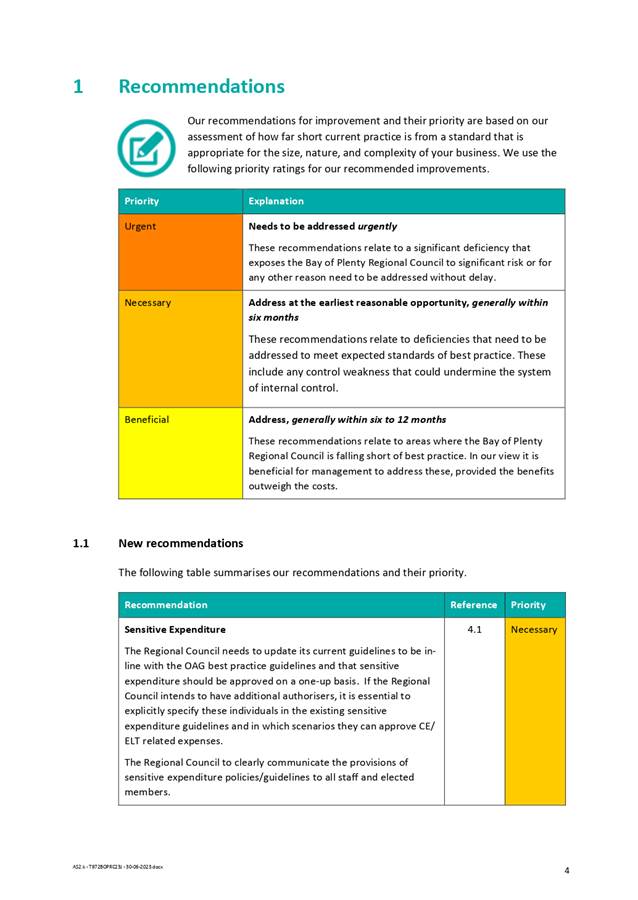

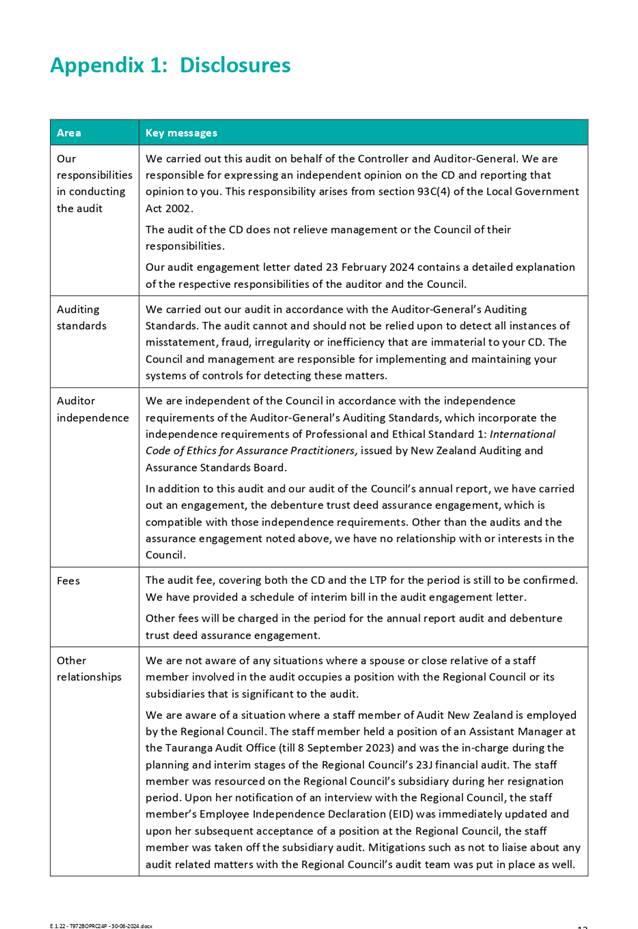

Executive Summary

The purpose of this report is to present the Audit

New Zealand Report (the Report) on the audit of the Bay of Plenty Regional

Council for the year ending 30 June 2023. The report outlines audit findings,

recommendations (with accompanying management responses) and prioritises them

as urgent, necessary or beneficial. There are a total of seven open

recommendations as at 30 June 2023, prioritised as necessary.

There were no recommendations prioritised as

urgent.

|

Recommendations

That the Risk and Assurance Committee:

1 Receives the report, Audit New Zealand Report on the audit

of the Bay of Plenty Regional Council for the year ended 30 June 2023.

1. Introduction

The Report sets out findings

arising from the final audit performed over the period August to October 2023.

Audit New Zealand has identified

areas where Council is performing well along with recommendations for areas

where improvements can be made. The report also provides an update on action

taken by staff against previous audit recommendations. The final report

includes management responses where appropriate.

The Report includes the results

for Council and the Quayside Group. The results for Council are summarised

below.

1.1 Alignment with Strategic

Framework

|

The Way We Work

|

We deliver

value to our ratepayers and our customers.

|

The Report provides audit

findings on the overall performance of Council outlining recommendations for

improvement and progress against prior recommendations. As a result, it

supports the delivery of all four Community Outcomes and the Way We Work.

1.1.1 Community Well-beings Assessment

|

Dominant Well-Beings Affected

|

|

þ Environmental

|

þ Cultural

|

þ Social

|

þ Economic

|

The Report outlines audit findings on Council’s

financial and non-financial performance for the year ending 30 June 2023,

recommendations for improvement and progress on management’s response to

prior year recommendations and promotes all four aspects of community

well-being.

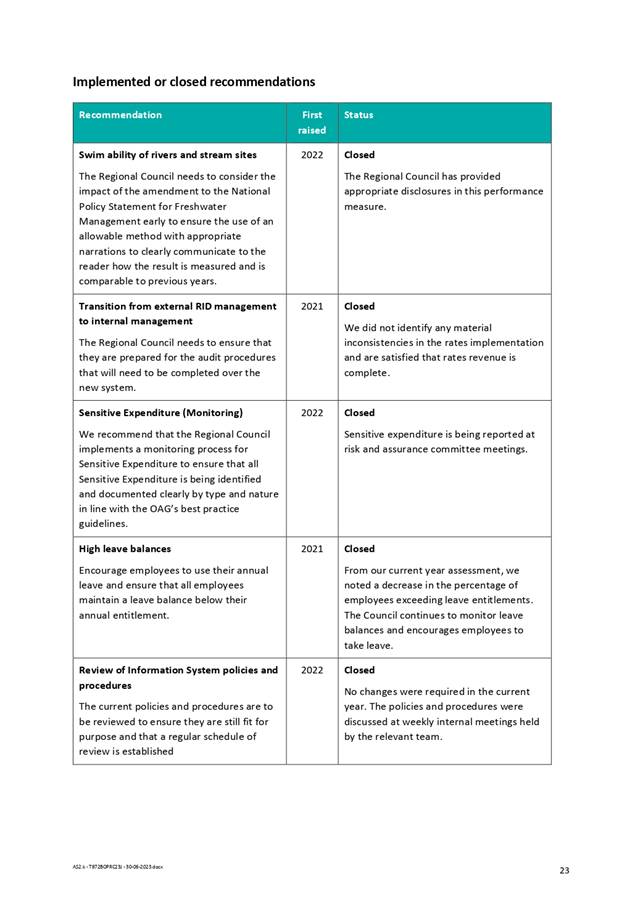

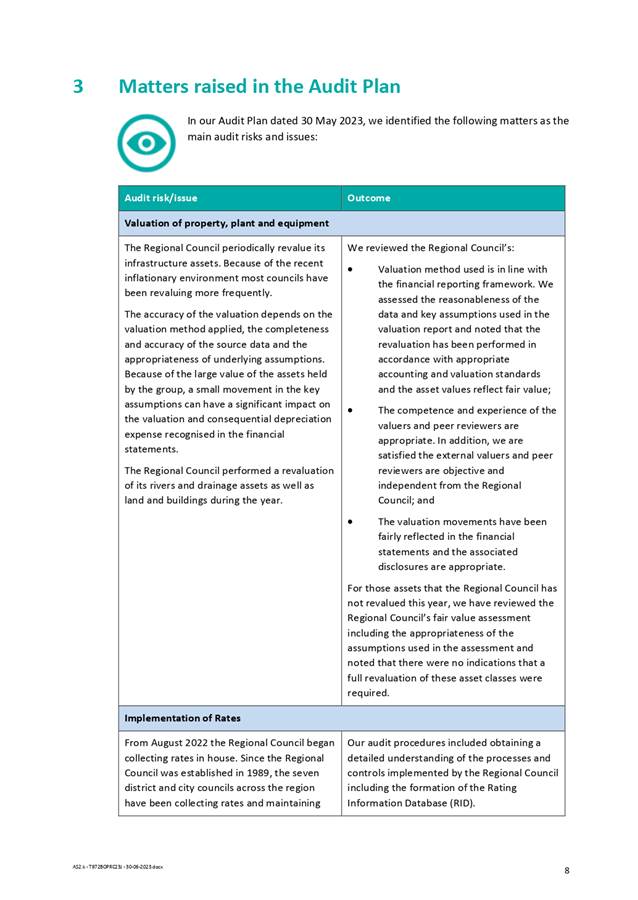

2. Findings from the report

The Report

outlines the matters identified during the audit, new recommendations, and the

status of previous recommendations.

In addition to the above, the

Report also includes the outcome of matters raised in the Audit Plan.

There were three new necessary

recommendations raised. Detailed information for each recommendation can be

found in Attachment 1.

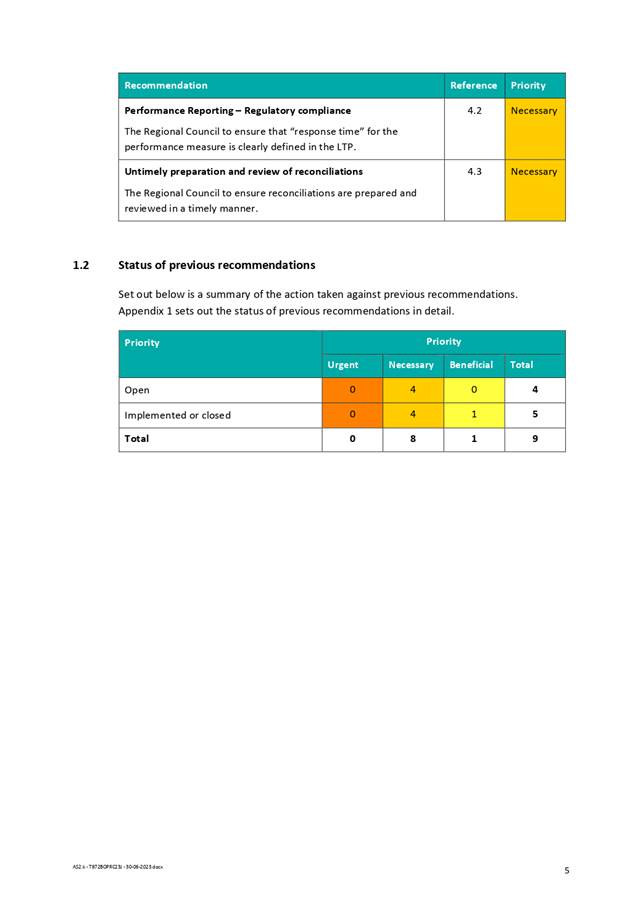

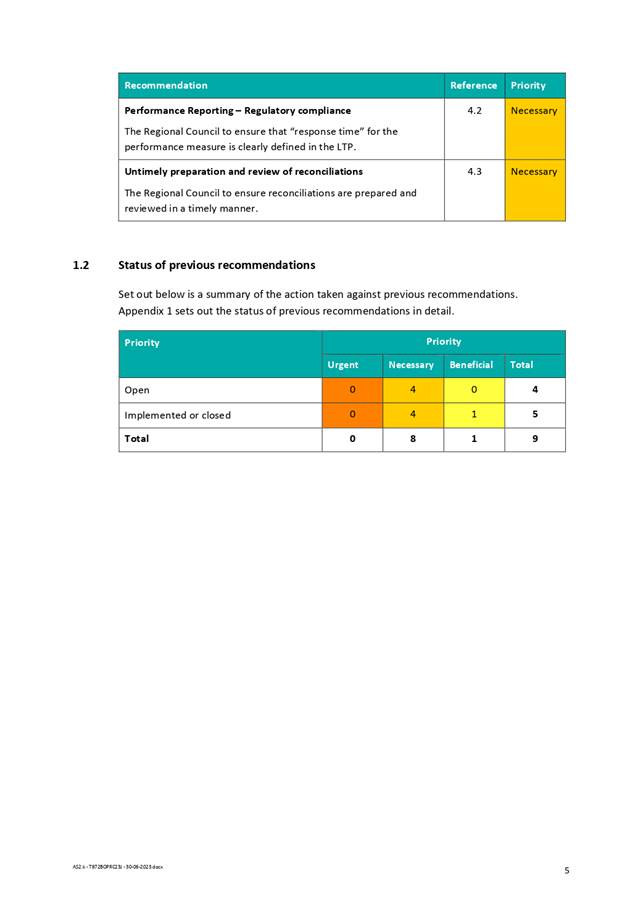

There are nine previous

recommendations of which five are closed and four open. A status summary of

Audit New Zealand’s recommendations is set out in the following table:

Table 1 Status of Audit New Zealand

Recommendations:

|

Priority

|

Previous Open Action

|

New Actions

|

Closed Actions

|

Current Open Actions

|

|

Beneficial

|

1

|

-

|

1

|

-

|

|

Necessary

|

8

|

3

|

4

|

7

|

|

Urgent

|

-

|

-

|

-

|

-

|

|

Total

|

9

|

3

|

5

|

7

|

3. Considerations

3.1 Risks and Mitigations

There are no direct risk

implications arising from this report.

3.2 Climate Change

The matters

addressed in this report are of a procedural nature and there is no need to

consider climate change impacts.

3.3 Implications for Māori

There are no direct implications

for Māori arising from this report.

3.4 Community Engagement

|

|

Engagement with the community is not required as the

recommended proposal / decision relates to internal Council matters only.

|

3.5 Financial Implications

There are no

material unbudgeted financial implications and this fits within the allocated

budget.

4. Next Steps

Audit New Zealand has highlighted recommendations from

the final audit for the year ending 30 June 2023. These have been appropriately

noted and actions are underway to address the remaining open recommendations.

Attachments

Attachment 1 - Report to Council on the audit of BOPRC for year

ending 30 June 2023 ⇩

Risk

and Assurance Committee 5 June 2024

|

|

|

|

|

|

Report To:

|

Risk

and Assurance Committee

|

|

Meeting

Date:

|

5 June

2024

|

|

Report

Writer:

|

Nolene Naude, Financial Accounting

Team Lead and Kumaren Perumal, Chief Financial Officer

|

|

Report

Authoriser:

|

Mat

Taylor, General Manager, Corporate

|

|

Purpose:

|

The Risk and Assurance Committee to

receive the Audit New Zealand Report on the audit of the Bay of Plenty

Regional Council Long Term Plan 2024 – 2034 Consultation Document

|

|

|

|

Audit

New Zealand Report on the audit of the Long Term Plan 2024 - 2034 Consultation

Document

|

Executive Summary

The purpose

of this paper is to present the Audit New Zealand Report (the Report) on the

audit of the Bay of Plenty Regional Council Long Term Plan 2024 – 2034

Consultation Document (LTP CD). The Report outlines the scope of the audit

review of Council’s LTP CD and supporting documents, plans, and

processes.

Audit New Zealand issued an unmodified audit opinion, with an

emphasis of matter on 6 March 2024 on the LTP CD.

|

Recommendations

That the Risk and Assurance Committee:

1 Receives the report, Audit New Zealand Report on the audit of the

Long Term Plan 2024 - 2034 Consultation Document.

1. Introduction

The Report sets out findings

arising from the audit performed on the LTP CD.

Audit New Zealand (Audit NZ) has

identified key findings in relation to the content of the consultation

document, financial model and forecasts and the performance management

framework.

1.1 Alignment

with Strategic Framework

|

A Healthy Environment

|

We

develop and implement regional plans and policy to protect our natural

environment.

|

|

Freshwater for Life

|

We

listen to our communities and consider their values and priorities in our

regional plans.

|

|

Safe and Resilient Communities

|

We work

with our partners to develop plans and policies, and we lead and enable our

communities to respond and recover from an emergency.

|

|

A Vibrant Region

|

We

contribute to delivering integrated planning and growth management strategies

especially for sustainable urban management.

|

|

The Way We Work

|

We

deliver value to our ratepayers and our customers.

|

The Report sets out findings on

the LTP CD, which has a primary purpose of the provision of an effective basis

for public participation in decisions on the content of the Long Term Plan 2024

-2034. As a result, it supports the delivery of all four Community Outcomes.

1.1.1 Community

Well-beings Assessment

|

Dominant Well-Beings Affected

|

|

þ Environmental

|

þ Cultural

|

þ Social

|

þ Economic

|

The Report outlines audit findings on Council’s

financial and non-financial planning and processes for the LTP CD and promotes

all four aspects of community well-being.

2. Findings

from the report

The Report outlines the findings

from the audit of the LTP CD, including the findings on the main risks and

issues identified in the Audit Plan.

2.1 Audit

Plan

During the planning stage of the audit, and during the

review of the content of the LTP CD, Audit NZ identified the following areas of

audit focus and issues:

· Impact

of current economic environment on Council’s forecasts

· Central

Government reforms

· Financial

and Infrastructure strategies

· Assumptions

· Quality

of asset-related forecasting information

Audit NZ have reviewed the assumptions applied in the

financial forecasting and underlying supporting documents to the LTP CD,

including Council’s response to the government reforms and consider these

to be reasonable.

The financial strategy is reasonable, financially

prudent and compliant with legislation.

The infrastructure strategy is fit for purpose,

aligned with asset management plans and the financial strategy.

Two key assumptions have been highlighted by Audit NZ

as challenging or important to emphasize. They relate to capital expenditure

deliverability and climate change.

Due to the uncertainties pertaining to the

organisation’s capacity to deliver on the forecast capital programme,

Audit NZ have included an Emphasis of Matter in their Audit Report (received by

Council on 6 March 2024).

2.2 Other

matters

The other matters outlined in the Report relate to:

· The

content of the consultation document

· The

financial model and forecasts

· The

performance management framework

The Report does not identify any significant concerns regarding

the matters listed above.

3. Considerations

3.1 Risks

and Mitigations

There are no direct risk

implications arising from this report.

3.2 Climate

Change

The matters

addressed in this report are of a procedural nature and there is no need to

consider climate change impacts

3.3 Implications

for Māori

Consultation and engagement

incorporated a focus on iwi/Māori to ensure their views were incorporated

into the Long Term Plan deliberations. The Audit NZ audit

report to Council is of a procedural nature and there is no need to

specifically consider the implications for Māori.

3.4 Community

Engagement

|

|

Engagement with the community is not required as the

recommended proposal / decision relates to internal Council matters only.

|

3.5 Financial

Implications

There are no

material unbudgeted financial implications and this fits within the allocated budget.

4. Next

Steps

Audit NZ will commence their final audit of

Council’s Long Term Plan 2024 - 2034 on 6 June 2024, and expect to issue

an audit opinion at the Council meeting scheduled on 26 June 2024.

Attachments

Attachment 1 - Report to Council on the audit of the BOPRC LTP

2024-34 Long Term Plan Consultation Document ⇩

Risk

and Assurance Committee 5 June 2024

|

|

|

|

|

|

Report To:

|

Risk

and Assurance Committee

|

|

Meeting

Date:

|

5 June

2024

|

|

Report

Writer:

|

Mark Le Comte, Principal Advisor,

Finance and Kumaren Perumal, Chief Financial Officer

|

|

Report

Authoriser:

|

Mat

Taylor, General Manager, Corporate

|

|

Purpose:

|

For the Risk and Assurance Committee

to receive confirmation that the rates setting process for 2023/24 is legally

compliant.

|

|

|

|

Rates

Setting for 2024/25 Financial Year - Legal Compliance

|

Executive Summary

This report outlines the process to ensure that the Bay of Plenty

Regional Council rates setting recommendations are legally compliant for the

2024/25 financial year.

An external legal review of the rates resolution and rates Funding

Impact Statement for 2024/25 financial year is in progress. The amount of

each rate and the relevant dates relating to arrears being collected by other

councils will be added to the final rates setting report, when it is

available.

Council is scheduled to set rates for the 2024/25 financial year at

its meeting on 26 June 2024.

|

Recommendations

That the Risk

and Assurance Committee:

1 Receives the report, Rates Setting for 2024/25 Financial Year -

Legal Compliance.

2 Notes that an external legal review of the Rates Setting process and

draft Rates Resolution is in progress.

1. Introduction

Setting rates for the financial

year requires Council resolutions that comply with the requirements of the Local Government Act 2002 (LGA) and the Local Government (Rating)

Act 2002 (LG(R)A).

1.1 Legislative

Framework

The

LGA and LG(R)A set out the processes required to set rates. This involves adoption

of the Long Term Plan, including the Funding Impact Statement (FIS), and then

setting rates for the financial year in accordance with the FIS. The rates set

are required to be consistent with the Revenue and Financing Policy (RFP).

1.2 Alignment

with Strategic Framework

|

A Healthy Environment

|

|

|

Freshwater for Life

|

|

|

Safe and Resilient Communities

|

|

|

A Vibrant Region

|

|

|

The Way We Work

|

We

deliver value to our ratepayers and our customers.

|

Rates revenue supports the

delivery of all our work to achieve the Community Outcomes.

1.2.1 Community

Well-beings Assessment

|

Dominant Well-Beings Affected

|

|

¨ Environmental

|

¨ Cultural

|

¨ Social

|

¨ Economic

|

The purpose of Local Government includes

promoting the social, economic, environmental, and cultural well-being of

communities in the present and for the future.

Identify which dominant Community Well-being(s)

the project/proposal will affect. Also indicate what level of impact and

what effect the project/proposal will have on the relevant well-being(s).

For instance consider:

• Will the project/proposal have a

high, medium or low impact on the well-being(s)?

• Are the effects of the impacts

positive and/or negative?

• Describing simply the overall

impact of the project/proposal.

• Providing an explanation if there

are positive and negative impacts for each well-being(s).

• Identifying if your assessment of

the actual or proposed impact is backed by evidence.

Also consider identifying if there are any

relevant considerations against the Living Standards Framework.

Further

guidelines available here.

Rates revenue supports the delivery of all of our work to

improve the well-beings.

2. Rates

Setting

2.1 Rates

Resolution

To access the options table, in the

“Tools” pane click “Insert Text” “1 Options

Table”, you can do this as many times as necessary.

The Rates Resolution is a local authority’s

formal legal decision to impose specific rates on a community and creates the

obligation to pay. Each rate must be set in accordance with the relevant FIS

and Long Term Plan.

The preparation of the Rates Resolution must be in

accordance with section 23 of the LG(R)A. The rates set

in the resolution must:

a) Relate

to a financial year

b) Be

set in accordance with the relevant provisions of the Council’s Long Term

Plan and FIS for that financial year.

2.2 Long

Term Plan

The Long Term Plan shows what the Council intends to

do and how it will go about delivering on its objectives for the coming financial

years.

The detailed legal requirements for the content of the

Long Term Plan are set out in Schedule 10, Part 1 of the LGA. This includes the

FIS and rating base information which are directly related to the Rates

Resolution.

Deliberations on the draft 2024-2034 Long Term Plan

are scheduled for the 28/29 May 2024 Council meeting. Direction from this

meeting will be used to prepare the final draft 2024-2034 Long Term Plan

including updated financial estimates and FIS.

2.2.1 Funding

Impact Statement

The FIS is a detailed explanation to the community of the

rates that will be charged, how they will be calculated and what they will be

used for. Ratepayers should be able to work out what they will pay from this

document.

The FIS must be in the prescribed form, and must

identify:

a) The

sources of funding to be used by the local authority.

b) The

amount of funds expected to be produced from each source; and

c) How

the funds are to be applied.

2.3 Revenue

and Financing Policy

The RFP sets out the funding sources for each

activity, including the proportion of funding from general rates and targeted

rates.

Changes to the RFP were consulted on in conjunction

with the draft 2024-2034 Long Term Plan. Council will deliberate on the RFP

changes at its meeting on 28 and 29 May 2024. Council consulted on

several funding ratio changes and the removal of one targeted rate.

3. Local

Government Rate Setting Reviews

3.1 Audit

Implications

Audit New Zealand

carries out a full audit of the draft and final 2024-2034 Long Term Plan. No

issues were identified by Audit NZ in relation to the FIS or rates calculation

through the audit of the Consultation Document and supporting material. The

audit of the final draft 2024-2034 Long Term Plan will commence after the

deliberations meeting on 28 and 29 May 2024.

3.2 Legal

Review

External legal

advice has been sought to perform a statutory compliance review for the 2024/25

financial year’s rate setting process. This review is in progress, and

will not be completed until after the draft 2024-2034 Long Term Plan and RFP

deliberations have been completed and the relevant changes made in preparation

for the Long Term Plan adoption meeting scheduled on 26 June 2024.

4. Considerations

4.1 Risks

and Mitigations

Key risks: explain what is unknown and possible

financial, health and safety, reputational or environmental impacts could be.

Include proposed mitigations. Cover the full range of risks. Consider: Health

and Safety, Stakeholder, Legal, Financial, Trade-offs, Timing, and

Communications. See Guideline material for details.

Identify the risks that will occur if the above

decision is agreed upon vs the risks involved if the above decision is not

agreed.

Identify how these risks will be mitigated or

minimised.

If unsure or there is any doubt regarding the

level of risk, please discuss with your GM.

The main risk

relates to the rates setting process not being legislatively compliant. This has been

managed through a full external legal review of the FIS and draft Rates

Resolution.

Risks related to the amount of rates to be collected

and levels of service have been discussed separately through the draft

2024-2034 Long Term Plan process.

4.2 Climate

Change

The aim of this section is to ensure your

thinking and assumptions around climate change are explicit and to provide

visibility as to how our work relates to climate change. Consider:

· Is the initiative sensitive to

climate (e.g. changes in rainfall, temperature, wind, sea-level)? If so, what

are the likely impacts and how have they been accounted for?

· In what way does the initiative

relate to climate change (use the building block below to illustrate)?

· Which of the guiding principles does

the initiative encompass in relation to climate change (see the detailed

guidance for information on these principles)? Provide more detail where

appropriate.

Use the building block below when considering

Climate Change implications.

Crtl + click for guideline

material.

The matters

addressed in this report are of a procedural nature and there is no need to

consider climate change impacts.

4.3 Implications

for Māori

Council has responsibilities to Māori

under the LGA and the RMA. We are required to meet those responsibilities and

identify any potential implications for Māori. Please consider

including this section for reports going to all committees. The following

questions will aid your analysis:

· Are there any positive or negative

effects on Māori (social, cultural or economic)?

· What consultation/engagement has

been undertaken with Māori and what form did it take? How did Māori

contribute to this decision?

· Does the issue require consideration

of: iwi planning documents, Treaty settlement legislation or any other document

expressing matters of importance to Māori?

Crtl + click for Guideline

material.

Council’s

RFP and the policy on the Remission and Postponement of Rates on Māori

Freehold Land support the principles set out in the Preamble to Te Ture Whenua

Māori Act 1993. Both of these policies have been consulted on in

conjunction with the draft 2024-2034 Long Term Plan. Council will deliberate on

the policies at its meeting on 28/29 May 2024.

Māori

freehold land may, in certain circumstances, be eligible for rates remissions. Māori owners of General Land are affected in the same

way as any other member of the community in the same situation regarding

property ownership and ability to pay.

4.4 Community

Engagement

What level of engagement is council commited

to? What actions will be taken

Consider identifying in the report:

• Council’s knowledge of community

views on the subject.

• What aspect of the community is

involved.

• How the views of the community were

obtained.

• How the views were recorded and

reported.

|

|

CONSULT

Whakauiuia

|

To obtain input or feedback from affected communities

about our analysis, alternatives, and /or proposed decisions.

|

Council is scheduled to deliberate

on the draft 2024-2034 Long Term Plan and RFP at the 28/29 May 2024 Council

meeting. This follows a series of draft 2024-2034 Long Term Plan Council workshops

through 2023 and public consultation in 2024.

4.5 Financial

Implications

If the recommendation is adopted by Council,

will it result in:

- Unbudgeted work during the current financial

year?

- Unbudgeted work for any of the years remaining

in the current Long Term Plan?

If the answer is ‘no’ to

both questions please select the dropdown option 1 and complete appropriately.

If the answer is ‘yes’ to either

question please select “Budget Implications” in the building block

below and liaise with your Management Accountant in order to complete the

Financial Impact table.

The work required to set rates

for 2024/25 is planned under the Finance Activity in the Annual Plan 2023/24.

Costs related to rates collection are planned under the Finance Activity in the

draft 2024-2034 Long Term Plan.

5. Next

Steps

Next Steps: What next? What resources are

needed? Further analysis? Timeframes ahead. Any consultation planned. Remind

Council of the process ahead. Next update to Council?

Conclusion: Short concluding remarks. Referring

back to recommendations. No new content.

The next steps for this process

are to finalise the amount of all rates based on decisions from the draft

2024-2034 Long Term Plan deliberations meeting on 28/29 May 2024, and set any

relevant dates for rates arrears that remain under the administration of other

councils.

At the 26 June 2024 meeting,

Council will receive recommendations to adopt the 2024-2034 Long Term Plan and adopt

the Rates Resolutions. The adopted rates resolution will be published on

Council’s website.

|

|

|

|

|

|

Report To:

|

Risk

and Assurance Committee

|

|

Meeting

Date:

|

5 June

2024

|

|

Report

Writer:

|

Aaron Huggins, Principal Internal

Auditor

|

|

Report

Authoriser:

|

Mat Taylor,

General Manager, Corporate

|

|

Purpose:

|

To present the updated Internal Audit

Work Plan to the Risk and Assurance Committee for approval

|

|

|

|

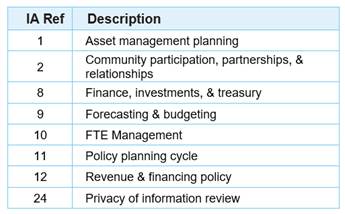

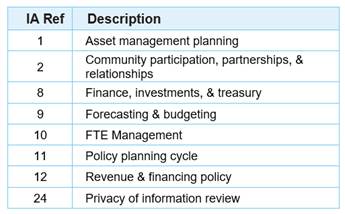

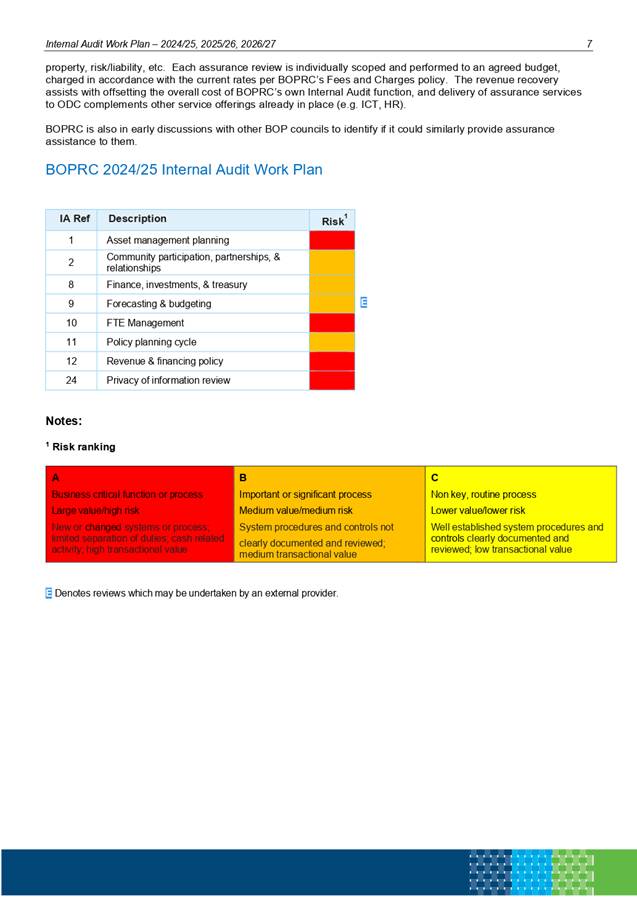

Internal

Audit Work Plan 2024/25 to 2026/27

|

Executive Summary

This report

presents the updated Internal Audit Work Programme 2024/25. It covers

audits to be performed in 2024/25, and potential audits for 2025/26 and

2026/27.

The Risk and

Assurance Committee is asked to:

· Review

the programme and note if any alterations are required

· Approve

the programme

|

Recommendations

That the Risk

and Assurance Committee:

1 Receives the report, Internal Audit Work Plan 2024/25 to 2026/27.

2 Approves the Internal Audit Work Plan 2024/25, 2025/26, 2026/27,

including the detailed work plan for 2024/25.

1. Introduction

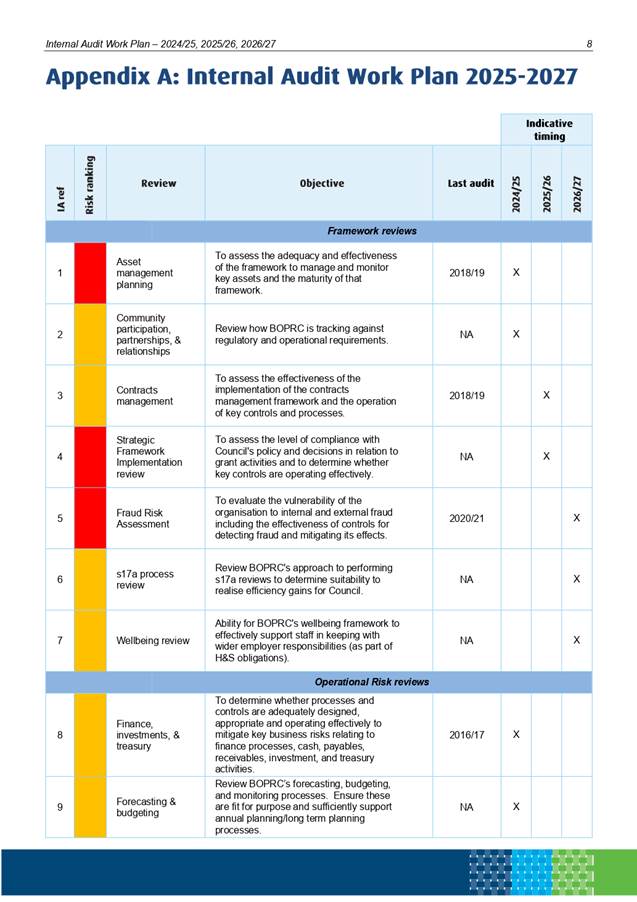

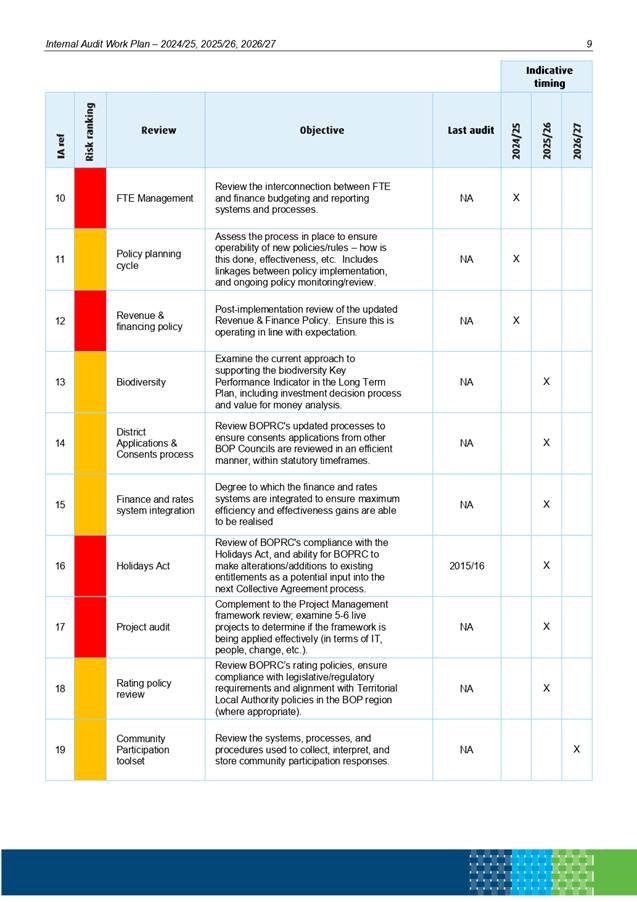

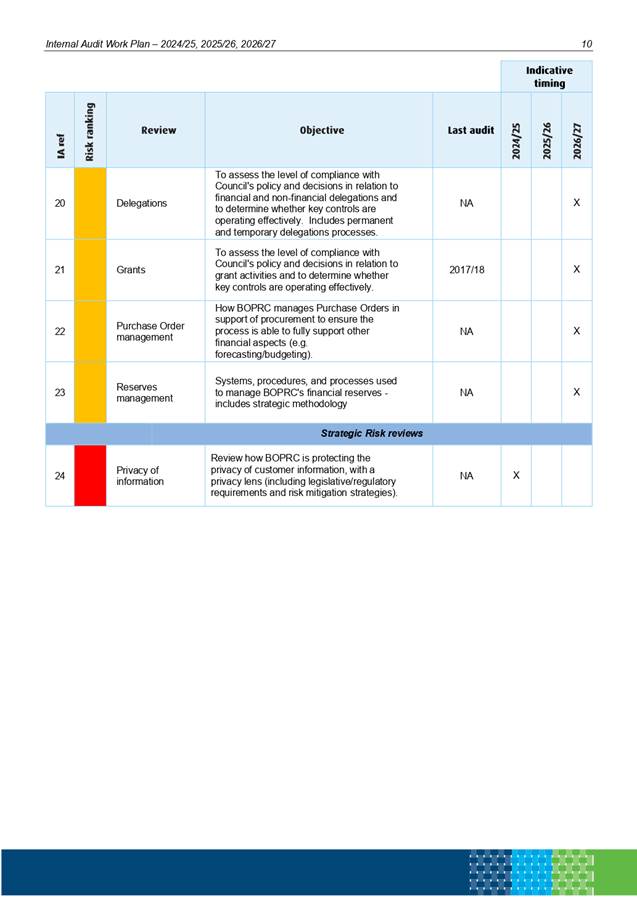

The Internal Audit Work

Programme is updated each year. It notes the internal audits that will be

performed during the upcoming financial year (2024/25) and potential audits to

be performed in the subsequent two years. It is prepared via review of the

BOPRC Key Risk Register, consideration of discussion during Risk and Assurance

Committee meetings, and formal discussions with BOPRC’s Leadership Team.

The Internal Audit Work

Programme has been presented to and endorsed by the Leadership Team. It

now requires approval by the Risk and Assurance Committee to enable the

internal audits for 2024/25 to be performed.

1.1 Alignment

with Strategic Framework

|

The Way We Work

|

We

continually seek opportunities to innovate and improve.

|

2. Proposed

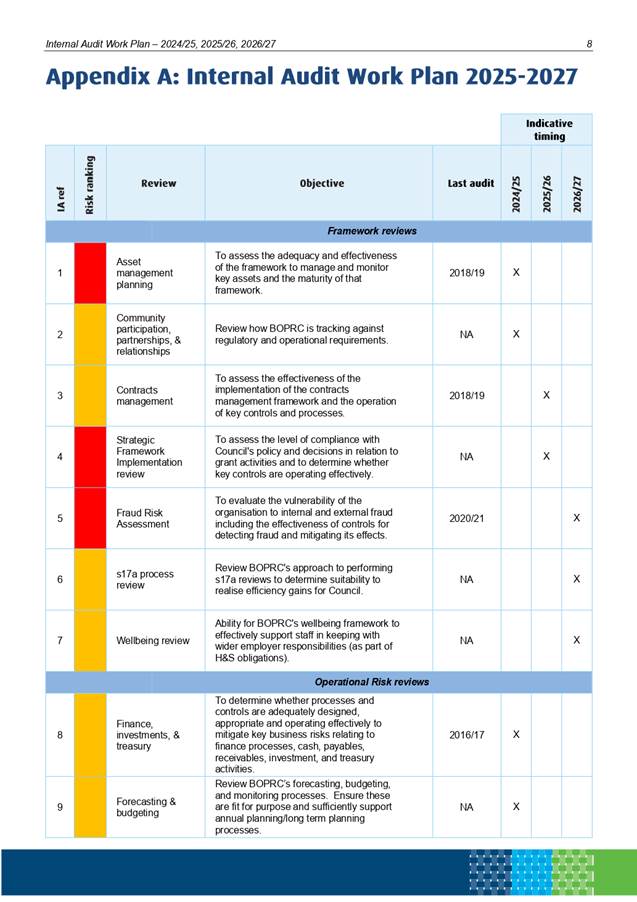

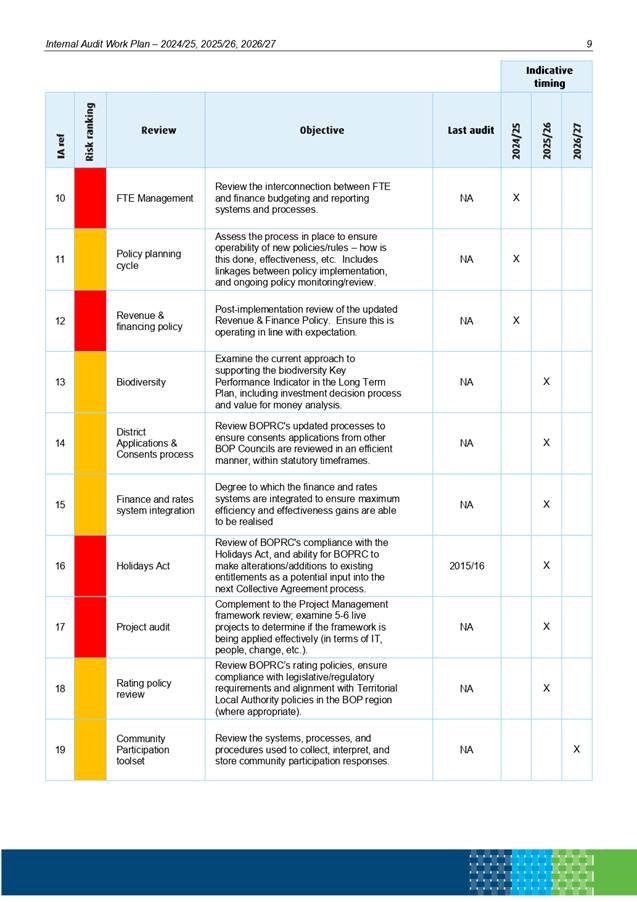

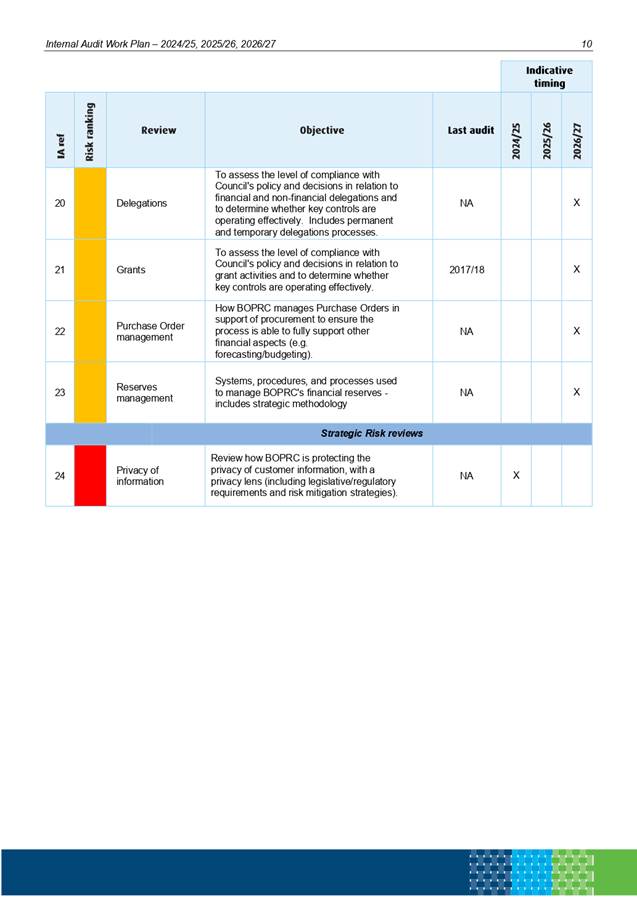

Internal Audit Work Plan to 2026/27

This Work Plan is a rolling

three-year plan which is reviewed annually.

During 2024, Internal Audit

undertook a planning process to refresh the Internal Audit Work Plan for the

three years 2024/25 to 2026/27 (provided in

Attachment 1).

A risk-based approach has

continued to be used to assess the internal audit needs of the Bay of Plenty

Regional Council and audit priorities.

The Audit Team held discussions

with the Chief Executive, General Managers and selected Managers, reviewed

prior plans and reviewed the ‘audit universe’ of other Councils.

The Internal Audit work

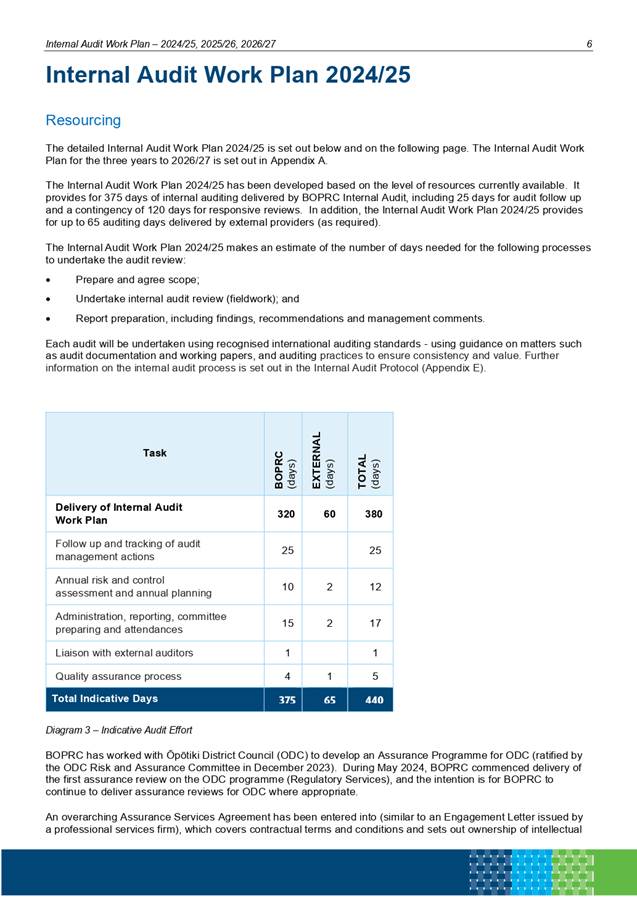

programme for 2024/25 has been developed based on the level of resources

currently available. This is one full time Principal Internal Auditor, and

funding for consultancy services sufficient for two to three reviews –

depending on scope. Note delivery of assurance services to

Ōpōtiki District Council commenced in May 2024, and while charged on

a cost-recovery basis (in accordance with the current BOPRC Fees and Charges

policy), will assist in offsetting the cost of BOPRC’s Internal Audit

function.

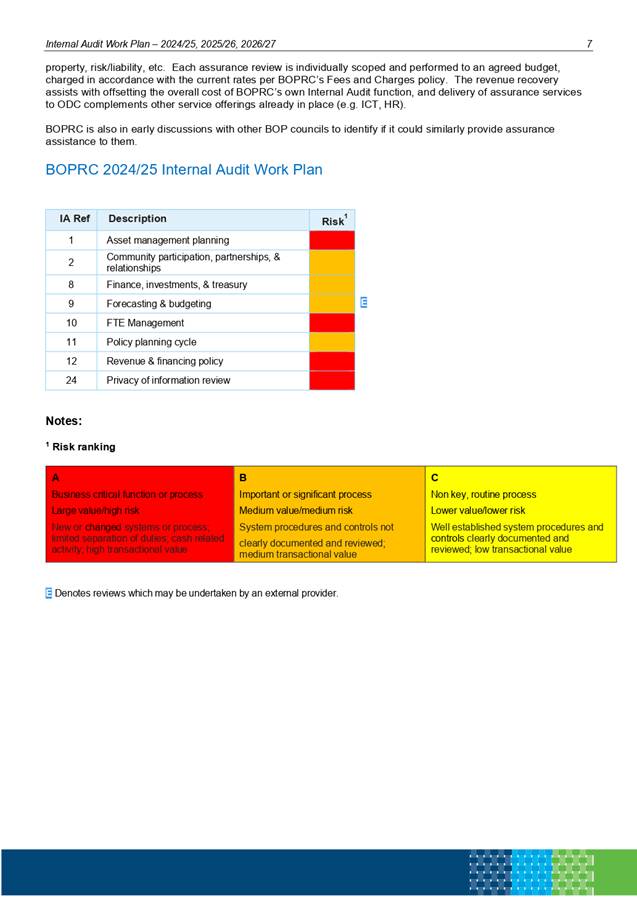

The proposed detailed work plan

for 2024/25 is provided within the plan and is shown in the following table:

The Internal Audit Work Plan for the three

years 2024/25 to 2026/27 has been given management approval by the Chief

Executive and is now provided to the Risk and Assurance Committee for its

review and approval.

3. Considerations

3.1 Risks

and Mitigations

There are no

significant risks associated with this matter/subject/project/initiative.

3.2 Climate

Change

The matters

addressed in this report are of a procedural nature and there is no need to

consider climate change impacts.

3.3 Implications

for Māori

No implications identified

– matters are of a procedural nature only.

3.4 Community

Engagement

|

|

Engagement with the community is not required as the

recommended proposal / decision [relates to internal Council matters only].

|

3.5 Financial

Implications

If the recommendation is adopted by Council,

will it result in:

- Unbudgeted work during the current financial

year?

- Unbudgeted work for any of the years remaining

in the current Long Term Plan?

If the answer is ‘no’ to

both questions please select the dropdown option 1 and complete appropriately.

If the answer is ‘yes’ to either

question please select “Budget Implications” in the building block

below and liaise with your Management Accountant in order to complete the

Financial Impact table.

There are no

material unbudgeted financial implications and this fits within the allocated

budget.

4. Next

Steps

Next Steps: What next? What resources are

needed? Further analysis? Timeframes ahead. Any consultation planned. Remind

Council of the process ahead. Next update to Council?

Conclusion: Short concluding remarks. Referring

back to recommendations. No new content.

To approve the Internal Audit Work Plan as per the

recommendations.

Attachments

Attachment 1 - BOPRC Internal Audit Work Plan FY2025-27 ⇩

Risk

and Assurance Committee 5 June 2024

|

|

|

|

|

|

Report To:

|

Risk

and Assurance Committee

|

|

Meeting

Date:

|

5 June

2024

|

|

Report

Writer:

|

Aaron Huggins, Principal Internal

Auditor

|

|

Report

Authoriser:

|

Mat

Taylor, General Manager, Corporate

|

|

Purpose:

|

To provide an update on the internal

audit programme and the audit plan.

|

|

|

|

Internal

Audit Status Update

|

Executive Summary

This report provides an

update on the status of internal audit activities as at 31 March 2024 and

includes:

· The

status of internal audit reviews in the current year;

· The

status of follow up of internal audit recommendations and management actions

to 31 March 2024;

· Information

on other relevant assurance reviews performed at BOPRC.

|

Recommendations

That the Risk and Assurance Committee:

1 Receives the report, Internal Audit Status Update.

1. Introduction

This report provides an update on internal

audit activity undertaken by internal audit staff and external assurance

specialists as part of Bay of Plenty Regional Council’s co-sourced

internal audit approach. It includes:

· The status of internal

audit reviews in the current year;

· The status of follow up of

internal audit recommendations and management actions to 31 March 2024;

· Information on other

relevant assurance reviews performed at BOPRC.

1.1 Alignment

with Strategic Framework

|

The Way We Work

|

We

continually seek opportunities to innovate and improve.

|

2. Internal

Audit Work Plan 2023/24 Status

Based on the Internal Audit Work

Plan 2023/24 the following table summarises the status of internal audit

reviews for 2023/24.

|

Review

|

Field work

|

GM Sponsor

|

Status

|

Status of Internal Audit

|

|

Planning /Scope

|

Fieldwork

|

Draft Report

|

Mgmt Actions

|

Final Report

|

|

CDEM Administering Authority

(2022/23)

|

BOPRC

|

Regulatory Services

|

Complete

|

Complete

|

Complete

|

Complete

|

Complete

|

Complete

|

|

External partner project management

|

BOPRC

|

Chief Executive

|

In Progress

|

In Progress (75%)

|

|

|

|

|

|

Focus Catchments

|

BOPRC

|

Integrated Catchments

|

In Progress

|

Complete

|

In Progress (25%)

|

|

|

|

|

Forecasting & budgeting

|

BOPRC

|

Corporate

|

Deferred to 2024/25

|

|

|

|

|

|

|

Freshwater management key risk mitigations

|

BOPRC

|

Strategy & Science

|

In Progress

|

Complete

|

|

|

|

|

|

Health & Safety

|

External

|

Corporate

|

In Progress

|

Complete

|

In Progress (10%)

|

|

|

|

|

Procurement

|

BOPRC

|

Corporate

|

In Progress

|

Complete

|

In Progress (90%)

|

|

|

|

|

Science management framework

|

BOPRC

|

Strategy & Science

|

In Progress

|

Complete

|

In Progress

(25%)

|

|

|

|

|

Sensitive expenditure

|

BOPRC

|

Corporate

|

Complete

|

Complete

|

Complete

|

Complete

|

Complete

|

Complete

|

Delivery of the 2023/24 internal

audit programme is largely progressing on schedule.

The CDEM Administering Authority

review completed the FY22/23 work plan, and is presented in a separate paper

along with the Sensitive Expenditure review (FY23/24).

An external provider has been

appointed to perform the Health & Safety review, and is expected to perform

the review during Q4 of FY24.

The Procurement review is

nearing completion, with fieldwork almost complete.

The Forecasting & Budgeting

audit has been deferred to FY24/25; this is due to resource constraints within

the Finance Team due to LTP preparation.

3. Internal

Audit Follow Up

Internal Audit

has reviewed all open management actions as part of the follow up work in the

2023/24 Work Plan.

3.1 Management

Actions

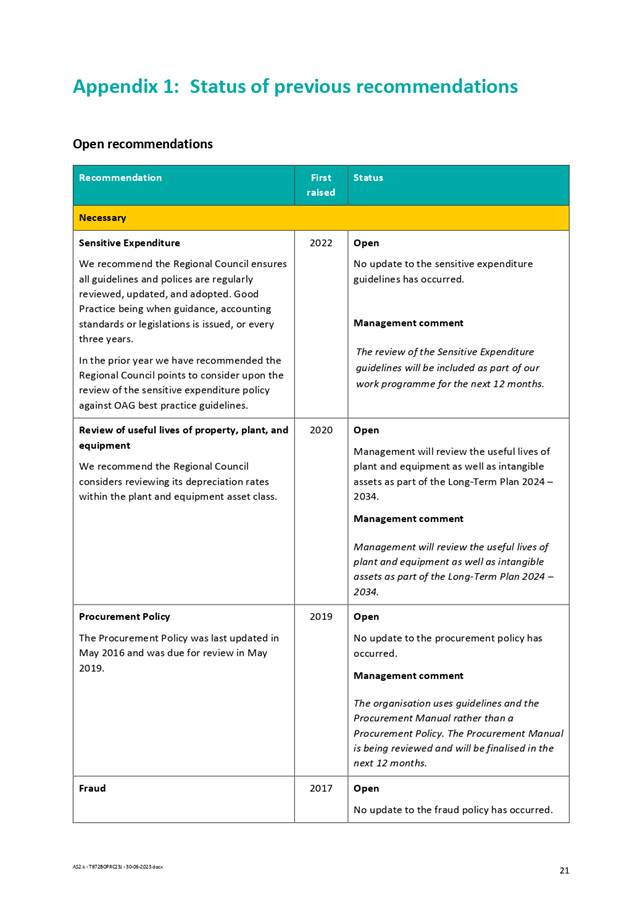

At the start of

the quarter (1 January 2024) there were 72 open management actions.

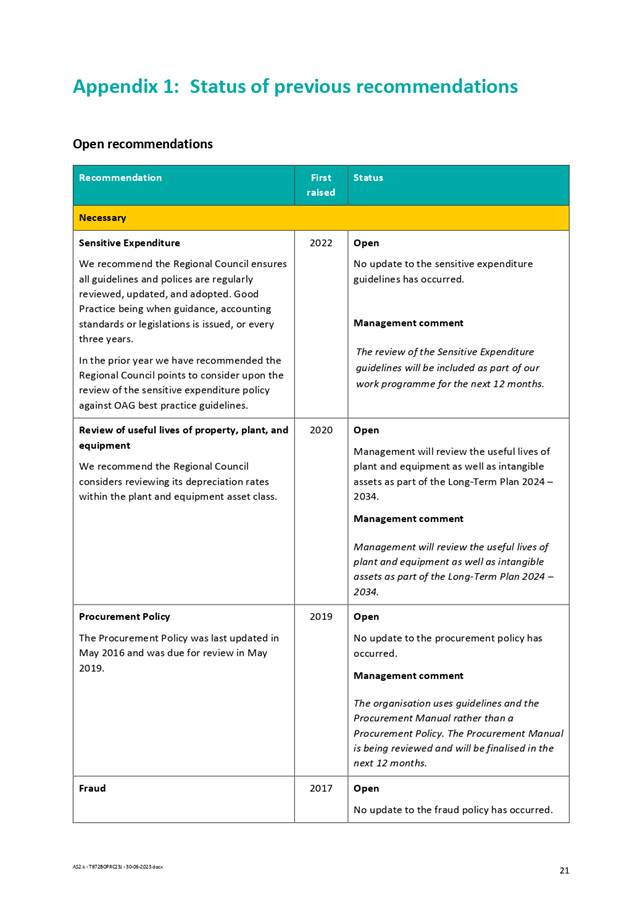

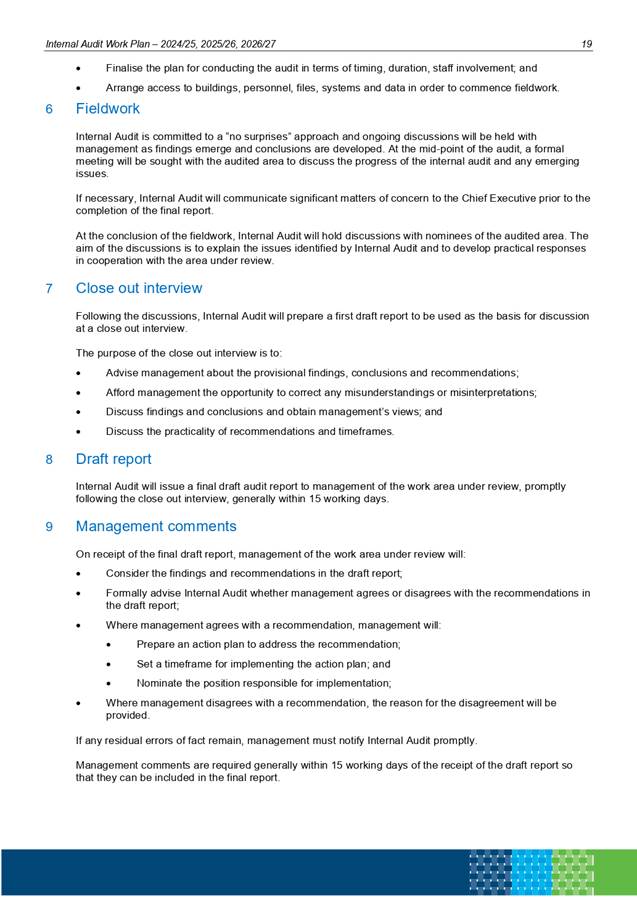

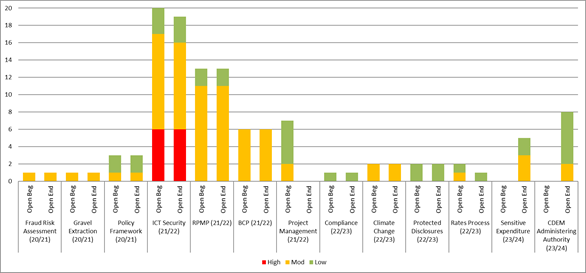

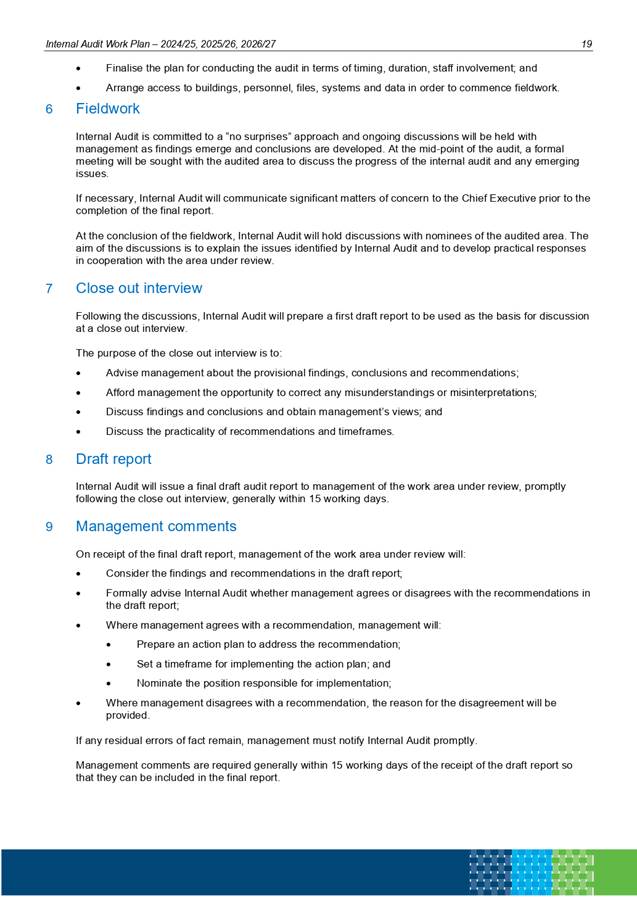

The following graph highlights the progress made

within BOPRC to address open audit actions during the quarter to 31 March 2024:

Figure 1 Open management actions (1 January

2024 vs 31 March 2024)

During the

quarter nine actions were closed. The total of actions open as at 31 March 2024

is 62, the majority of these relate to ICT Security (19), Regional Pest

Management Plan (13), and CDEM Administering Authority (newly added this

quarter – 8).

Two actions are

overdue (one each from Fraud Risk Assessment and Gravel Extraction); these are

reported separately with the Completed Internal Audit Reviews paper.

3.2 Improvement

Actions

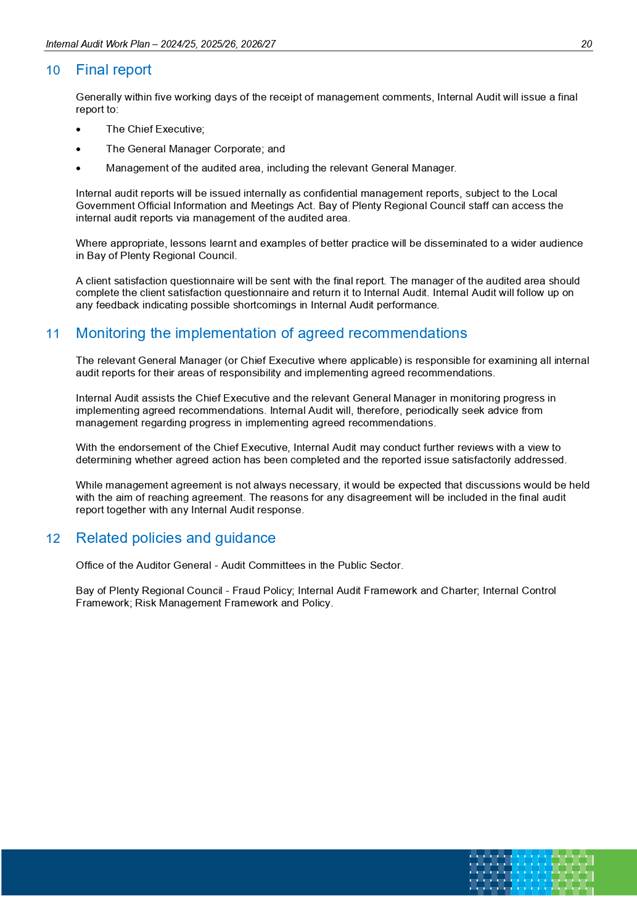

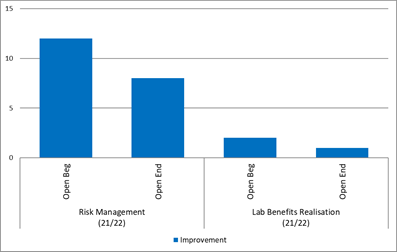

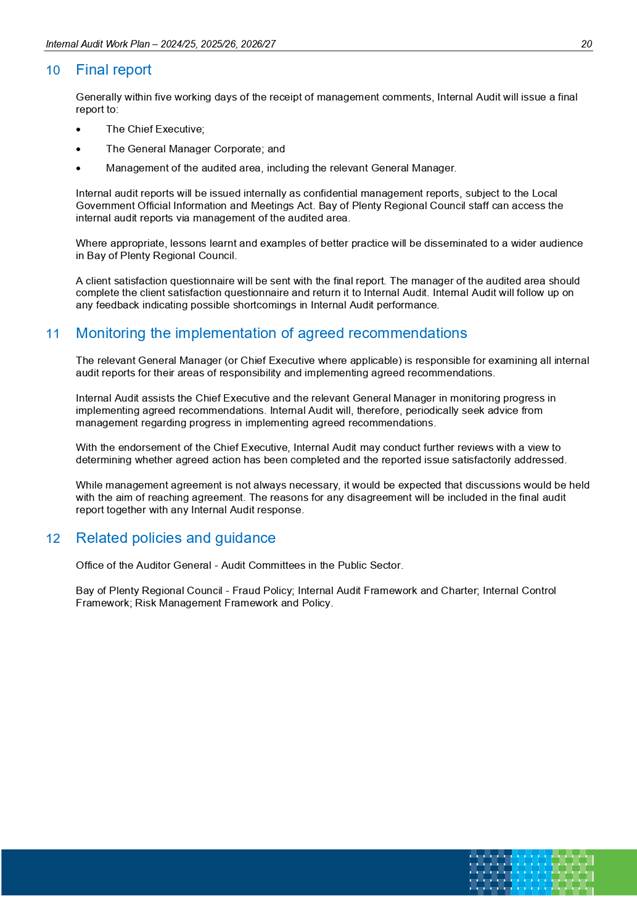

At the start of the quarter (1 January 2024) there

were fourteen open improvement actions. These typically have a longer

estimated completion timeframe than audit actions, and refer to operational

improvements rather than formal risk mitigations.

The following graph highlights the progress made

within BOPRC to address open improvement opportunity actions during the quarter

to 31 March 2024:

Figure 2 Open improvement actions (1 January

2024 vs 31 March 2024)

The Risk

Management and the Laboratory Services Benefits Realisation reviews were

completed during the 2021/22 financial year and are not yet due for completion.

4. Other

Assurance Activity

4.1 Ōpōtiki

District Council

Over the past year, the BOPRC Risk & Assurance

Team have been working with Ōpōtiki District Council (ODC) to prepare

their Internal Assurance Programme; this was presented to (and endorsed by)

their Leadership Team in November 2023 and subsequently ratified by the ODC

Risk and Assurance Committee.

As a result, BOPRC are conducting the inaugural

assurance review (ODC Regulatory Services). Initial fieldwork was completed

in early May 2024, and the report is expected to be finalised in June 2024

before being presented to ODC Risk and Assurance at the next applicable

meeting.

The review is budgeted for 126 hours of BOPRC Risk

& Assurance staff time, and is on-charged on a cost-recovery basis using

applicable rates per the BOPRC Fees and Charges Policy. The overall

service provision is covered by an Assurance Services Agreement (which sets out

general Terms and Conditions, similar in nature to an Engagement Letter issued

by a Professional Services Firm), and each assurance review is covered by an

agreed Scope and accompanying Work Brief (costed per the applicable staff rates

in the current BOPRC Fees & Charges Policy).

Assurance service provision is offered by BOPRC to enable

ODC to establish and conduct their own Assurance Programme, within ODC’s

fixed budgetary constraints.

4.2 BOPRC

EDRMS replacement

BOPRC is currently undertaking a

project to replace its current Electronic Data Records Management System

(EDRMS) (from ‘Objective’ to Microsoft

‘Sharepoint’). Risk and Assurance Team members are providing

risk management support to the Project Manager and leading the legislative

compliance workstream for the project.

5. Considerations

5.1 Risks

and Mitigations

No significant risks identified;

matters presented in this report are of a procedural nature only.

5.2 Climate

Change

The matters

addressed in this report are of a procedural nature and there is no need to

consider climate change impacts.

5.3 Implications

for Māori

No implications for Māori

identified – procedural matters only.

5.4 Community

Engagement

|

|

Engagement with the community is not required as the

recommended proposal / decision [relates to internal Council matters only].

|

5.5 Financial

Implications

There are no

material unbudgeted financial implications and this fits within the allocated

budget.

6. Next

Steps

To note the Internal Audit status update (as at 31

March 2024).