|

Regional Council LTP 2024-2034 (No 4) Informal Workshop Pack

DATE: Thursday 7 September 2023 COMMENCING AT: 09:30 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga and via Zoom (Audio Visual Link)

|

|

Regional Council LTP 2024-2034 (No 4) Informal Workshop Pack

DATE: Thursday 7 September 2023 COMMENCING AT: 09:30 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga and via Zoom (Audio Visual Link)

|

Informal Workshop Papers

1 Review of Rates Remission and Postponement Policy - Existing Remissions and Transition 1

Attachment 1 - Draft Principles for Rates Remission and Postponement Policy 1

Attachment 2 - Key differences in TLA rates remission policies 1

2 Regional Infrastructure Funding 1

Attachment 1 - Third Party Infrastructure Funding Policy 1

3 Presentation: 2024-2034 Pre-Engagement Communications and Engagement Options

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

7 September 2023 |

|

|

From: |

Gillian Payne, Principal Advisor; Kumaren Perumal, Chief Financial Officer and Jo Pellew, Rates Manager |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Review of Rates Remission and Postponement Policy - Existing Remissions and Transition

This paper presents information requested by Councillors at a workshop on 25 May 2023 and seeks further direction on several topics. Together with other matters that will be considered at workshops later in 2023, this will direct the development of a draft Rates Remission and Postponement Policy (RRP Policy) for public consultation in March-May 2024.

2. Guidance Sought from Councillors

· Note the draft principles, amended following Council direction at the workshop on 25 May 2023 (refer Attachment 1).

· Provide direction for rates remission policies on:

· Sports organisations

· Community organisations (non-sport)

· Contiguous properties

· Financial hardship

· Transition arrangements

3. Discussion

3.1 Draft Principles

A set of implied principles taken from Council’s existing RRP Policy were considered at the previous workshop on 25 May and Councillors provided guidance to staff on changes. Attachment 1 lists the updated principles that have resulted, and staff seek confirmation of them as a working draft.

3.2 Direction from workshop in May 2023

At the workshop on 25 May, Councillors gave direction:

· Provide analysis of the financial impact (for Council and ratepayers) of taking a region-wide approach to existing remissions by modelling the legislative minimum for sports and community organisations and contiguous properties.

Sections 3.3 through 3.5 discuss the cost of alternative policy positions to replace the transitional remissions, which are based on the respective TLA remission policies.

· Work to develop a region-wide approach to financial hardship. A recommendation for criteria is presented in section 3.6 of this report.

· Continue work to develop all the new remission ideas presented and where possible to provide estimates of revenue foregone if the remissions were approved. Draft criteria and financial modelling of these ideas will be presented in a subsequent workshop in September.

3.3 Sports organisations

3.3.1 Policy context

Councillors will recall from the workshop on 25 May 2023 that the TLAs remission policies for sports organisations differ. Some of the key differences are summarised in Attachment 2, Table A.

Councillors sought information on any particular reasons for the variations and staff have been advised that most of the policies (and practices) have been long-standing and reflect the objectives of the policies and the views of elected members at different TLAs at the time the policies were adopted.

The TLAs’ policy objectives included to:

· Recognise and support the social and health benefits to the community of sports facilities

· Help non-commercial or not-for-profit facilities and clubs to be financially viable and to support their continued existence

· Help ensure disadvantaged groups can access the services and facilities

· Support the efforts of volunteers.

Other considerations used by TLAs in assessing applications included:

· Whether the organisation had access to alternative financial support, for example corporate sponsorship or central government contracts for service

· Extent of services provided by volunteers.

3.3.2 Financial impact of options for region-wide approach - sports

Councillors requested staff to model the financial impact for Council and affected ratepayers of limiting remissions to the legislative minimum, set out in the Local Government (Rating) Act 2002 (LGRA), Schedule 1, Part 2, clause 2:

(2) Land owned or used by a society or association of persons (whether incorporated or not) for games or sports, except galloping races, harness races, or greyhound races.

For the purposes of this Part, unless the context otherwise requires, —

land does not include land used for the private pecuniary profit of any members of the society or association

land, in clause 2, excludes land in respect of which a club licence under the Sale and Supply of Alcohol Act 2012 is for the time being in force.

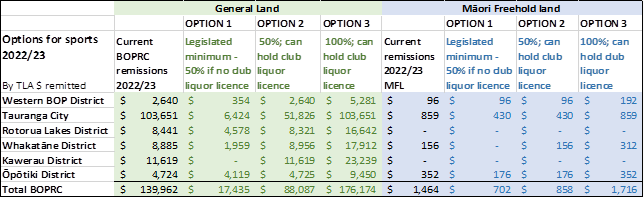

The legislated minimum is shown as Option 1 in Figure 1 below. It shows the amounts of remissions that would have been remitted in 2022/23 under each of the options, split between General Land and Māori Freehold Land.

Two other options have also been modelled for information:

Option 2 is the same as Option 1 except that organisations that hold a club liquor licence would also be eligible.

Option 3 is the same as Option 2 except that the remission increases to 100% of rates.

Examples of sports facilities represented in the table include rugby, golf, bowls, speedway, pony club, tennis, squash, marine.

For clarity, land that is used by a local authority for sports (except racing), swimming pools, and reserves are 100% non-rateable, under LGRA Schedule 1, so would not appear in Figure 1.

For reference, Option 2 resembles the approach taken by Waikato Regional Council. The approaches taken by other regional councils vary, including:

· no remission to organisations with a liquor licence

· partial remission for organisations with a club liquor licence, depending on the size of the organisation

· disregarding the question of a liquor licence.

Figure 1

To consider the impact of each option on types of ratepayers that would be affected, examples of properties are listed in Figure 2 below.

Figure 2

|

Examples for

sports |

TLA

|

BOPRC remission 2022/23 |

OPTION 1 Legislated minimum - 50% only if no club liquor licence |

OPTION 2 50%; can hold club liquor licence |

OPTION 3 100%; can hold club liquor licence |

|

Sport 1 - LV $231 million, 49 ha |

TCC |

$44,280 |

No remission |

$22,140 |

$44,280 |

|

Sport 1 – LV $5.7 million, 43 ha |

WBOPDC |

$1,340 |

No remission |

$1,340 |

$2,680 |

|

Sport 1 – LV $1.8 million, 33 ha |

KDC |

$11,620 |

No remission |

$11,620 |

$23,240 |

|

Sport 2 - LV $600,000, 0.6 ha |

WDC |

$196 |

No remission |

$196 |

$392 |

|

Sport 2 - LV $195,000, 0.8 ha |

ODC |

$606 |

No remission |

$606 |

$1,211 |

|

Sport 3 - LV $760,000, 0.7 ha |

WBOPDC |

$160 |

$160 |

$160 |

$320 |

|

Sport 4– LV $7.5 million, 8 ha |

TCC |

$1,870 |

No remission |

$935 |

$1,870 |

|

Sport 5 - LV $81,000, 0.5ha |

WDC |

$171 |

$171 |

$171 |

$343 |

|

Sport 6 - LV $26 million, 15ha |

TCC |

$5,247 |

$2,624 |

$2,624 |

$5,247 |

|

Sport 7 - apportionment, 154sqm |

TCC |

$409 |

$204 |

$204 |

$409 |

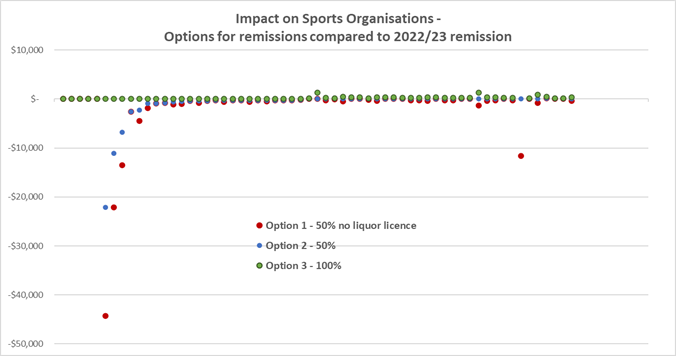

The full range of impacts on the sports organisations currently receiving remissions is illustrated in Figure 3 below.

Figure 3

Direction sought: Staff seek feedback on:

· Which of these options Council prefers as the basis for drafting a policy for consultation.

· Objectives and assessment criteria listed in section 3.3.1, and any additional considerations Councillors would like the policy to include.

3.4 Community organisations

3.4.1 Policy context

The legislation requires remissions for a subset of community organisations currently receiving remissions, i.e. the arts sector and showgrounds, as noted in Figure 4 below.

|

Figure 4 |

|

|

Purpose |

Legislative provisions |

|

Arts sector |

LGRA, Schedule 1, Part 2, clause 3 – Land* is 50% non-rateable (3) Land owned or used by a society or association of persons (whether incorporated or not) for the purpose of any branch of the arts. |

|

Showgrounds and meeting places |

LGRA, Schedule 1, Part 2, clause 1 – Land* is 50% non-rateable (1) Land owned or used by a society incorporated under the Agricultural and Pastoral Societies Act 1908 as a showground or place of meeting. |

|

*Land does not include land used for the private pecuniary profit of any members of the society or association |

|

3.4.2 Financial impact of options for region-wide approach – community organisations

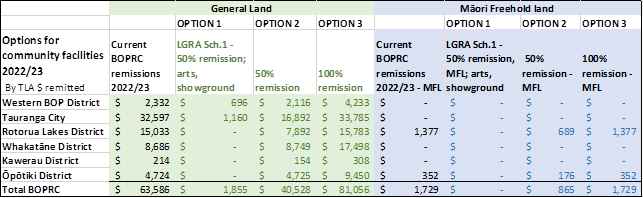

The financial analysis in Figure 5 below includes remissions for charities, non-sport recreation clubs, halls, health, heritage, arts sector and showgrounds.

Option 1, the legislative minimum, only includes the properties that have been noted as arts or showgrounds, which are entitled to a 50% remission. Since most of the TLAs’ policies have a broader scope for remissions compared to the legislation, several do not record whether the properties in their “community remissions” category are in the arts sector. Without examining every remission entry, staff cannot accurately identify which properties are entitled to the legislative minimum. As a result, it is likely the estimates under Option 1 are materially understated, and the true figure for the legislative minimum will be somewhere between Option 1 and Option 2.

Option 2 includes the wider range of community organisations that most TLA policies recognise, modelled as receiving a 50% remission. It includes charities, non-sport recreation clubs, halls, health, heritage, arts sector and showgrounds.

Option 3 includes the properties in Option 2, modelled as receiving a 100% rates remission.

Figure 5

Other regional councils’ approaches vary. All provide remissions to a wider range of groups than arts and showgrounds. Several provide for a scale of remissions, up to 100%, using criteria that recognise volunteer effort, charitable status and contribution to community outcomes. Several exclude groups mainly providing for adult social purposes.

Staff recommend enabling remissions between 50% and 100%, with the default being 50%. Eligibility criteria could include:

· Having not-for-profit or charitable status

· Providing benefits to the public that support Council’s community outcomes and align with its goals.

Decisions on the size of the remission (50%-100%) could be made by staff under delegation after considering matters such as:

· The extent of voluntary effort to run the organisation, compared to paid staff

· The extent to which the organisation derives income from other sources (for example corporate sponsorship, local or central government contracts for service)

· Financial sustainability of the organisation and the impact that a remission would have on that.

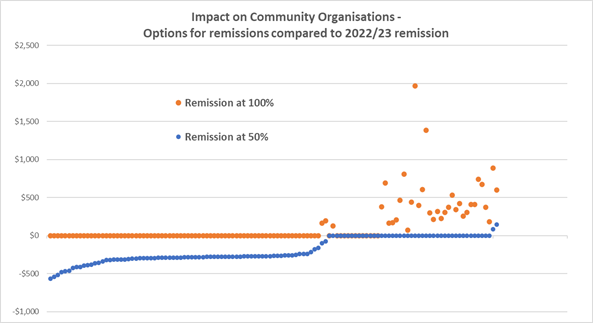

The impact on community organisations currently receiving remissions, of remitting either 50% or 100% of rates, is shown in Figure 6.

Figure 6

Feedback sought

Staff seek feedback on the recommended approach, eligibility criteria and matters for staff consideration in making remission decisions under delegation.

3.5 Contiguous properties

3.5.1 Policy context

The legislation (LGRA s20) sets out the conditions for treating adjacent rating units should as one for rating purposes:

Section 20 - Rating units in common ownership

Two or more rating units must be treated as 1 unit for assessing a rate if those units are—

(a) owned by the same person or persons; and

(b) used jointly as a single unit; and

(c) contiguous or separated only by a road, railway, drain, water race, river, or stream.

Under the legislation, all three of the conditions must be met. Three Bay of Plenty TLAs’ policies enable rating units to be treated as contiguous even if they do not meet all three in LGRA section 20 conditions. These are summarised in Attachment 2 Table B and outlined below.

· Western Bay of Plenty District Council (WBOPDC) provides that the ownership condition is met if an owner leases a neighbouring property under a registered lease for a term of 10 years or more and is responsible for paying the rates on the leased land. Developers undertaking subdivision are specifically excluded from eligibility.

· Ōpōtiki District Council’s (ODC) policy objective is to provide relief to developers, prior to dwellings being built, enabling the remission of UAGCs and flat targeted rates on all but one rating unit, provided there is only one dwelling among all the rating units under consideration. River scheme rating still applies to the individual rating unit, where applicable.

· Whakatāne District Council (WDC) cites fairness and equity as the objectives of its policy for remission of uniform annual general charges (UAGC), which provides for remission of the UAGC and/or any flat targeted rates set per rating unit. Eligible properties are those where LGRA s20 conditions are not met, but Council considers it inequitable for the rating units to be treated as separate.

Provided only one of the rating units has a habitable dwelling, WDC will consider remissions of all but one of the UAGC/flat targeted rates where land is subdivided into five or more lots where the titles have been issued; and

owned by the original developer who is holding the individual titles pending their sale to subsequent purchasers; and originally contiguous or separated only by road, railway, drain, water race, river, or stream.

River scheme rating still applies to the individual rating unit, where applicable.

The TLAs’ contrasting policy objectives mean BOPRC’s current remissions under the transitions arrangements are likewise varied, as shown in Figure 7 below.

|

Figure 7 – BOPRC Rates Remissions 2022/23 – Special Contiguous |

||

|

General Land Special contiguous |

Māori Freehold Land Special contiguous |

|

|

Western Bay of Plenty District |

$ - |

$ - |

|

Tauranga City |

$ 440 |

$ - |

|

Rotorua Lakes District |

$ 926 |

$ - |

|

Whakatāne District |

$ 42,852 |

$ 44,769 |

|

Kawerau District |

$ - |

$ - |

|

Ōpōtiki District |

$ 20,739 |

$ 34,208 |

|

Total BOPRC |

$ 64,957 |

$78,977 |

3.5.2 Financial impact of options for region-wide approach – contiguous properties

Councillors requested information on the financial implications if Council relied on the legislative position for its definition of contiguous properties. A reasonable estimate of remissions that would no longer be granted, is the total shown in Table 6 above, but there are caveats.

For Māori Freehold Land the estimate may overstate the remissions reductions because remissions categorised in 2022/23 as “special contiguous” in previous years may now be part of the legislated minimum following Local Government (Rating of Whenua Māori) Amendment Act 2021.

Recommendation

Given that Council wishes to have a regionally consistent policy that delivers equal treatment to all areas, staff recommend relying on the legislative minimum, rather than choosing one TLA’s approach over another.

To illustrate the impact this would have on rating units currently receiving such remissions from Council, Figure 8 below groups the affected rating units into bands. Most rating units would see an increase in their rates of less than $500, if they lost their remission, typically the amount of Council’s UAGC. For eight properties, the impact would be higher.

It is possible that that a household or business could be receiving more than one remission (if they were the ratepayer of several rating units receiving a remission) so the impact would be greater than these statistics suggest. If the new policy resulted in any significant inequity, cases could be dealt with under the existing miscellaneous circumstances provisions, or any updated transition arrangements in the draft policy (refer section 3.7 below).

Figure 8 - Distribution of 2022/23 remissions for special contiguous properties

|

Size ranges of remissions |

General Land Number of properties |

Māori Freehold Land Number of properties |

|

Less than $500 |

248 |

344 |

|

$500-$1,000 |

4 |

0 |

|

$1,001-$1,500 |

3 |

0 |

|

$1,501-$2,000 |

1 |

0 |

3.6 Financial hardship

The current RRP Policy enables remissions for properties that are domestic residences, occupied by the applicant as their normal residence. It requires applicants to:

a) Be a natural person

b) Be eligible for the Government Rates Rebate scheme

c) Have received rates remission or postponement from their Territorial Local Authority (TLA)

d) Not own any other rating unit (excludes interests in multiply-owned Māori land)

e) Make acceptable arrangements for payment of future rates.

At the workshop in May, Council gave direction that the approach to financial hardship remissions should be consistent across the region, which means requirement c) above would no longer be relevant. The consequence is that Council would undertake investigations into the applicants’ financial circumstances to establish whether they were in “extreme financial hardship” instead of relying on the TLAs’ investigations and judgement. Staff consider that this additional administrative step would be manageable with current resources if applicants are encouraged to seek budget advice, as recommended below.

Staff recommend that the applications be approved for the current year only, with annual re-application required, because people’s circumstances will change.

Some Councils have a specified limit on the percentage of the total rates that can be remitted in any one year. Staff do not recommend this approach because it may constrain Council’s ability to address applications on a case-by-case basis and find a sustainable solution that would enable ratepayers to pay future rates.

Recommendation:

Staff recommend retaining the eligibility criteria a), b), d), and e) above, together with additional matters for Council to consider:

· the ability of the applicant to access other sources of finance (e.g. mortgage)

· Whether budget advice has been sought, and if any recommendations are relevant for Council to consider.

· Annual application required.

Staff seek Councillors’ feedback on this recommendation.

3.7 Transition approach

Council’s draft policy principles (Attachment 1) include that Council will consider a fair transition for ratepayers.

Depending on the option Council chooses, the biggest impact is likely to be felt by sports organisations with high land values that are currently receiving more than the legislative minimum remission. Figure 2 above provides an indication of the scale of individual impact.

Staff seek Council’s direction on transition provisions; options are summarised in Figure 9 below.

Figure 9:

|

Dimension |

Policy choices |

Implications |

|

A: Transition period |

(i) Two years – i.e. in 2024/25 financial year, ratepayers would receive the average of the remission they received in 2023/2024 and the remission they would receive if the new policy was immediately implemented

OR |

Simple calculation, short transition |

|

(ii) More than two years

|

More administrative effort, more rates foregone; easier adjustment for affected ratepayers |

|

|

B: Eligibility |

(i) All ratepayers experiencing remission decreases

OR |

Administratively simple; rates foregone would be higher compared to setting a threshold.

|

|

(ii) Set a flat threshold for negative impact to qualify for remission transition provisions |

Could result in perverse results at the margins of the threshold, where those falling just below the threshold would face higher impacts in 2024/25 than those just above the threshold. |

|

|

Application |

(i) Automatically applied

OR |

Low administrative overhead; rates foregone would be higher compared to setting eligibility criteria and requiring application.

|

|

(ii) On application |

Would enable assessment of whether transition is warranted depending on impact in relation to organisation’s circumstances. High administrative cost. Lower amount of rates foregone.

|

Staff recommend options A(i), B(i) and C(i) as these are the most straightforward for ratepayers and to implement.

3.8 Engagement

3.8.1 Progress on engagement – Māori Freehold Land

As agreed at the Council workshop in May and a subsequent Komiti Māori meeting, engagement with owners and trustees of Māori Freehold Land began at the beginning of August. Feedback through a survey has already been received and hui have been arranged in August and September. The information received will be presented to Komiti Māori and Council in subsequent workshops in October or November.

3.8.2 Awareness raising for materially affected ratepayers

Staff plan to initiate direct communication with materially affected ratepayers later in 2023, once the direction for most aspects of a draft policy is known. This would aim to:

· raise awareness among the ratepayers most affected, explaining that the policy review was taking place, why it was important and that a draft policy would be adopted for public engagement in early 2024.

· provide community organisations with an opportunity to prepare themselves to make submissions on the formal draft proposal.

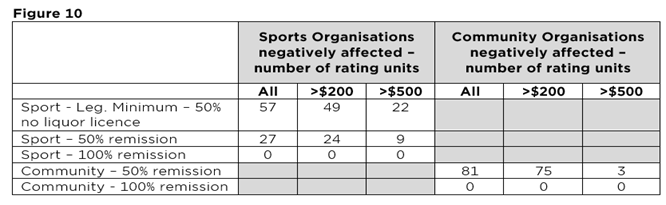

For context, the number of sports and community organisations negatively affected, and the extent of the effect (reduction compared to their 2022/23 remission) is shown in Figure 10 below.

4. Next Steps

Direction received in this workshop may influence the draft principles and if so, they will be updated and remain as a working draft as the policy development progresses.

Based on feedback received at the workshop, draft policy provisions and criteria will be developed for preliminary engagement with affected groups of ratepayers.

Attachment 1 - Draft Principles for Rates Remission and Postponement Policy ⇩

Attachment 2 - Key differences in TLA rates remission policies ⇩

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

7 September 2023 |

|

|

From: |

Mark Le Comte, Principal Advisor, Finance; Kumaren Perumal, Chief Financial Officer and Gillian Payne, Principal Advisor |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Regional Infrastructure Funding

1. Purpose

The purpose of this paper is to seek early guidance from Councillors on the potential to consider providing infrastructure funding support to councils and other entities as part of LTP 2024-2034.

Council has historically provided support under various policies with funding provided from the $200 million raised by the Perpetual Preference Share issue. If Council were to continue to provide funding support, a new funding source would be required which will have impacts on reserves, debt, and/or rates.

Providing funding for third party infrastructure can provide community benefits by accelerating projects that cannot be funded solely by other parties. In addition, by making small changes to the scope of projects, it is sometimes possible to better align benefit delivery with Council’s Strategic Direction.

2. Guidance Sought from Councillors

· Whether to proceed with investigating opportunities for improved delivery of Council’s Strategic Direction by helping fund Regional Infrastructure delivered and owned by third parties.

· Whether the current Third Party Infrastructure Policy and process is fit for purpose.

· Whether to propose as a consultation topic for LTP 2024-2034, a new targeted rate of approximately $150-200 per ratepayer, (either as a flat charge or land value-based charge, on average) to fund Regional Infrastructure.

3. Background

Quayside Holdings Limited and Council issued Perpetual Preference Shares in 2008, which raised $200 million to be used for funding infrastructure. This funding has been fully used to fund Council’s infrastructure and for infrastructure grants to third parties.

Depreciation on Council’s infrastructure is accumulated into reserves to fund asset renewals/replacements or loan repayments.

Council has also approved infrastructure grants to third parties totalling approximately $68 million, of which $62 million has been paid to date.

3.1 Projects that have been funded

The following tables list the operating expenditure infrastructure grants that have been paid to date, grouped by project type.

|

Wastewater |

$000 |

|

Lake Rotomā reticulation |

5,665 |

|

Sewerage Subsidy - Maketū/Little Waihī |

2,216 |

|

Lake Rotoiti reticulation |

2,070 |

|

Southern Pipeline |

1,800 |

|

Sewerage Subsidy - Hamurana/Awahoa |

1,498 |

|

Te Puna West Wastewater scheme |

1,045 |

|

Ongare Point Reticulated Wastewater |

718 |

|

Sewerage Subsidy - Rotorua Lakes |

522 |

|

Sewerage Subsidy - Paradise Valley |

60 |

|

Total |

15,594 |

|

Regional Benefit |

$000 |

|

RIF Ōpōtiki Harbour |

20,000 |

|

RIF University Campus |

15,000 |

|

RIF - Tauranga Marine Precinct |

5,000 |

|

Rangiuru Culverts |

2,600 |

|

RIF Scion |

2,500 |

|

Awatarariki Fanhead - 1/3 share |

1,425 |

|

Tahataharoa Coastal Wetland |

100 |

|

Total |

46,625 |

|

Transport |

$000 |

|

Wainui Road |

461 |

|

Oropi Road |

200 |

|

Route Security - Wainui/Nukuhou Stream |

193 |

|

Total |

854 |

In addition, the grants listed below have been approved by Council, but not yet paid because agreed payment milestones have not yet been achieved.

|

Allocated Grants |

$000 |

|

Te Whare Taonga o Te Arawa (Rotoura Musuem) |

4,100 |

|

Lake Tarawera Wastewater |

750 |

|

Ōtāwhiwhi Marae |

100 |

|

Total Allocated |

4,950 |

3.2 Potential projects for consideration

Information on potential projects for consideration is provided for general context at this stage. Councillors are not required to comment on the relative merits of the various projects and more information will be provided at future workshops if Councillors provide direction to staff to proceed with an investigation. Detailed assessments of project costs for each proposal are at various stages of rigor and potential cost sharing arrangements with BOPRC, and other potential funders, are still to be developed.

Several councillors have potential conflicts of interest in various potential projects due to their membership of boards or trusts. None of these conflicts are known to result in a direct pecuniary benefit to any councillors at this stage, but they should at least still be considered, and managed as, a non-pecuniary conflict of interest. Councillors will be asked to abstain themselves from discussion and decision making on projects for which they have identified a potential or perceived conflict of interest. Depending on the nature of the conflict, as set out in the Standing Orders, Councillors may be required to leave the table or leave the room when the project in which they have an identified conflict of interest is considered.

|

Project |

Description |

Identified Potential Conflicts of Interest |

|

University of Waikato campus developments |

Further expansion of Tauranga Tertiary Campus for teaching and accommodation. Partially supported by Tauranga Energy Charitable Trust. Education and workforce development benefits. |

Cllr Von Dadelszen |

|

University of Waikato Coastal Marine Research Centre |

Development of Coastal Marine Research Centre. Environmental science, commercialisation and potential tourism/amenity benefits. |

Cllr Von Dadelszen |

|

Rotorua Museum |

Contribution to seismic upgrade of heritage building. Contribution already allocated to exhibition development (environmental and Māori heritage) based on economic benefit from tourism. |

Cllr White Cllr Thurston |

|

Tauranga Stadium |

Development of sports stadium based on business case developed by PriorityOne. Amenity, tourism and wider economic benefits. |

Cllr Crosby |

|

Tauranga Museum |

Development of Museum as part of Tauranga civic precinct. Amenity and potential tourism benefits. |

|

|

Ōpōtiki Harbour Masterplan |

Continued work related to Ōpōtiki Harbour. ODC have raised topics including Marine Development and ongoing dredging/maintenance costs (ongoing costs were a specific exclusion of the Ōpōtiki Harbour Funding Agreement). |

|

|

Rangiuru Development |

Potential funding to support development pending development contribution revenue and potential for other property investment. Regional economic development benefits. |

Cllr Crosby Cllr White |

|

Rotorua Regional Park |

Purchase of land in Rotorua to retire from productive use and to create a third Regional Park. Funding also to be considered through the Regional Parks activity. Environmental benefits from reduced nutrient flows into the Lakes and public amenity benefits. |

|

These, and other projects, may be assessed by staff for Councillor consideration at future workshops based on guidance received about how/whether to proceed with Regional Infrastructure Funding.

4. Joint Outcomes Bay of Plenty initiative

Council is leading a collaborative project called Joint Outcomes Bay of Plenty (JOBOP), which Councillors were briefed on during a workshop on 10 May 2023. The project involves assessing the local councils’ outcomes and goals in their developing Long Term Plans, and where they complement Council’s outcomes and goals, investigate opportunities to collaborate to hasten or improve delivery of outcomes to the community. Council’s contribution could be in kind, or by reprioritising (timing) or refocussing (changing scope) of Council projects included in LTP budgets, or by providing funding to partner councils to deliver a particular project, which would mean additional funding in Council’s LTP.

JOBOP is likely to identify opportunities for Council to assist other councils in projects that would be additional to those listed in section 3.2 above.

To manage partner councils’ expectations, staff seek guidance on Council’s appetite for providing JOBOP support which would require additional funding, over and above Council’s usual level of service.

4.1 Current Policy

Council has a Third Party Infrastructure Funding Policy (TPIFP), which was the basis on which the proposed Regional Infrastructure Targeted Rate (RITR) was publicly consulted as part of the 2022/23 Annual Plan (refer Attachment 1). The RITR was established through that consultation process but has not had a dollar value set since then.

The TPIFP outlines eligibility criteria for projects and a process for providing information to enable Council to evaluate funding applications. It notes that Council funding decisions will include consideration of long-term financial prudence and sustainability, long-term equity of funding allocated; and any potential precedent that may be set.

Funding limitations include:

· Only for new infrastructure, and for direct infrastructure costs (excludes investigation, business case development, design, consenting, project management or preliminary and general costs.

· Council will generally not fund replacement or renewal of existing infrastructure or increasing capacity of network infrastructure to allow for growth.

The application evaluation factors are:

a. Alignment with Council’s Community Outcomes, Priorities and Objectives

b. Demonstration that the project delivers benefits in a more efficient way or that cannot be achieved directly by Council

c. The level of benefit and how this is shared, including any potential financial returns

d. The impact if Council does not fund this project i.e. whether the project and benefits will not be delivered or delayed

e. The funding model and affordability of the project

f. Sources of funding other than Council and potential repayment or financial returns

g. The level of certainty of costs, benefits and risks.

In addition, the TPIFP requires Council staff to conduct a full due-diligence review of the applicant, covering at least:

· The financial position of the applicant, available capital or debt capacity, and why funding is required

· Potential for other funding sources to be applied for

· The applicant’s track record for delivery of projects of similar scale and complexity.

To enable the evaluation and due-diligence review, applicants are required to prepare documentation including:

· Initial funding application – 10 pages, no supporting information required (refer Appendix 1 in Attachment 1).

· Business case – detailed documentation including costs, benefits, risks, community engagement undertaken, milestones and timelines.

· Funding agreement (if application proceeds) - includes funding conditions relating to consents, other funding being obtained, delivery milestones.

· Completion report and ongoing monitoring.

5. Funding

This section outlines the main options for funding Regional Infrastructure grants. For modelling purposes, the indicative size of the programme has been assumed at $20 million per annum i.e. $200 million over 2024-2034. Initial discussions appear to show that this is roughly the size that would be required to make an appreciable difference for Council’s partners and the community.

The funding options in this paper are the high-level options and have been prepared in advance of the full Financial Strategy and Revenue and Financing Policy. This allows Councillors an early opportunity to rule-out any (or all) options so that staff work is appropriately focussed. Any options remain to be investigated in detail will still be subject to confirmation later in the LTP 2024-2034 process when full Council financials are available.

5.1 Funding Options

5.1.1 Option 1 - Principal from Reserves

Council has historically used the Infrastructure Fund and/or the Regional Fund to pay for infrastructure grants. Neither of these funds have sufficient projected balances available at this time, however, Council could consider utilising the $70 million Toi Moana Fund.

While the Toi Moana Fund could be used to fund the principal amount for infrastructure grants, there would also be a consequential cost of reduced investment income which is budgeted at 5% per annum. Consideration would have to be given to how to cover the loss of income, and whether to recoup the principal amount of the grant.

As a general indication, funding $20 million from the Toi Moana Reserve would require $1.6 million per annum (approximately $12 per annum per ratepayer) for 20 years to cover the principal and foregone interest income.

As more funding is drawn down the amount to be paid per ratepayer would also increase, i.e. assuming $20 million per annum is drawn down the rating impact would increase by a cumulative $12 per annum per rate payer.

The $70 million Toi Moana Trust could potentially fund 3.5 years of infrastructure grants at $20 million per annum. When fully drawn, the rating impact of this would be approximately $42 per annum. After these 3.5 years, Council would need to consider another funding source or stop providing RI grants.

5.1.2 Option 2 - Principal from Borrowing

Instead of drawing from Reserves, Council could borrow from the LGFA to fund infrastructure grants. Assuming that rates are set to cover principal and interest costs the financial impact on ratepayers is approximately the same as option 1, noting the interest rates will fluctuate over time.

Council has borrowing headroom under the LGFA lending covenants which work on a net borrowing basis (excludes on-lending to QHL and subtracts investments). In contrast Standard and Poor’s have noted the large amount of gross borrowing for the Council Group (which includes the PPS borrowing and does not subtract investments) and has put Council on a negative credit rating outlook.

If Council were to borrow more than planned, Standard and Poor’s might down-grade Council’s credit rating. A down-grade from AA to AA- would increase Council’s cost of borrowing by 0.05%. For Council’s core borrowing of $127 million this would increase annual interest costs by $63,500, and any further down-grades would incur a similar additional annual cost. Council would also need to consider any reputational impact of a credit rating down-grade.

Standard and Poor’s would be less likely to down-grade Council’s credit rating if reserves were used instead of borrowing. This is because Standard and Poor’s is focussed on gross, rather than net, borrowing and already applies a 50% scale-down to the value of the Toi Moana Trust when assessing liquidity.

5.1.3 Option 3 - Principal from Targeted Rates

Council could set a new targeted rate to directly pay for infrastructure grants. This would ensure that any funds collected are used for this purpose. Any funds collected in advance of expenditure could be invested in term deposits (or similar) to gain interest income to reduce the amount of future targeted rates required.

As a general indication, funding $20 million directly from rates would cost an average of $150 per ratepayer for one year. If this option were to proceed, Councillors would need to work through the basis for how this rate would be set, which could include consideration of district/location differentials to reflect proximity to funded projects and whether to assess rates based on property value or as a fixed amount. If Council were to use a fixed region-wide targeted rate, this would need to be counted against the 30% limit on the Uniform Annual General Charge.

5.1.4 Option 4 - Principal from Investment Income

Council could consider directly applying part of its investment income, like the dividend from Quayside Holdings Limited or the Toi Moana Trust, towards funding infrastructure. Investment income is currently used to reduce the general rates requirement. While using investment income to fund infrastructure would remove the need for a new targeted rate, this would be offset by an increased requirement for general rates. This means that the total rates impact is the same for this option and option 5.1.3, however, the incidence of rates on individual ratepayers could be different.

|

|

Scale |

Rates Impact |

Equity |

Notes |

|

Reserves |

Could cover 3.5 years |

Principal and Interest amortised via targeted rate. Each $20m increases rates by $12 per ratepayer per annum for 20 years. |

Intergenerational equity provided for. Targeted rate could be property value based (vertical equity) and differentiated by location (horizontal equity) |

|

|

Borrowing |

Large Capacity

|

Principal and Interest amortised via targeted rate. Each $20m increases rates by $12 per ratepayer per annum for 20 years. |

Intergenerational equity provided for. Targeted rate could be property value based (vertical equity) and differentiated by location (horizontal equity) |

May result in credit rating down-grade |

|

Targeted Rates |

Capacity limited by affordability. |

Immediate targeted rates impact. Capacity limited by affordability. $20m is approx. $150 per ratepayer for one year. |

Current ratepayers could be funding future benefits. Targeted rate could be property value based (vertical equity) and differentiated by location (horizontal equity). Uniform Annual General Charge is able to be increased (if desired). |

Basis of targeted rate, and incidence across the region to be determined, which could vary by project. |

|

Investment income |

Capacity limited by affordability. $20m is approx. $150 per ratepayer for one year.

|

Immediate General Rates impact. Capacity limited by affordability. $20m is approx. $150 per ratepayer for one year. |

Current ratepayers could be funding future benefits. General rate impact based on land value.

|

Basis of rates impact as per general rates. |

5.2 Option 5 - Do not provide funding

Council is not required to provide funding for external projects. If other councils are constrained by their ability to raise borrowing for capital, they can consider using Special Purpose Vehicles (SPV) under the Infrastructure Funding and Financing (IFF) Act for part of their capital programme. Generally the IFF is focussed on housing infrastructure, noting that this may free up a council’s borrowing capacity for other purposes.

An approved SPV raises borrowing for the approved capital works, which is repaid via levies on a defined area. The power to set levies mirrors most of the powers of the Local Government (Rating) Act including the categories that may be used to set levies and methods that may be used to calculate the amounts to be paid.

The borrowing and levy revenue does not flow through a council’s financial statements i.e. the financial transaction is ‘off balance sheet’.

5.2.1 Crown Infrastructure Partners

Crown Infrastructure Partners (CIP) provides a summary of the IFF as follows:

In August 2020 the Government enacted a new legislative tool under the Infrastructure Funding and Financing Act (IFF) and appointed CIP to the role of facilitator.

The tool will make the cost of new infrastructure more transparent while spreading the cost so it falls primarily on the property owners who benefit, including across generations. Water and transport infrastructure (including cycleways and public transport projects) could be funded using the tool, as well as certain community amenities and environmental resilience infrastructure, such as flood protection.

Typically, the infrastructure funding required will be over $50m and with a minimum of 1,500 beneficiaries.

Key to the tool’s success is the ability to ring-fence infrastructure projects from the relevant council’s balance sheet so that there is no recourse to that council if the project fails.

6. Next Steps

If Councillors choose to proceed with more detailed consideration, staff will work with potential project partners to prepare more detailed information including consideration under the Third Party Infrastructure Funding Policy and any other Councillor direction.

Updated financial modelling will be completed and included for consideration of impacts on the Financial Strategy and any consideration relevant to the Revenue and Financing Policy.

Potential consultation approaches will be developed, which are likely to include consultation on the overall funding approach and the list of projects to be funded.

Attachment 1 - Third Party Infrastructure Funding Policy ⇩