|

|

|

|

Informal Workshop Paper

|

|

To:

|

Regional

Council

|

|

|

25 May

2023

|

|

From:

|

Gillian Payne, Principal Advisor;

Kumaren Perumal, Chief Financial Officer and Jo Pellew, Rates Manager

|

|

|

Mat Taylor, General Manager,

Corporate

|

|

|

|

Review of Rates

Remission and Postponement Policy - Principles and Objectives

1. Purpose

On 12 April 2023 Councillors provided guidance on the

approach and process for review of the Rates Remission and Postponement Policy

(the Policy). This paper presents additional background information and

seeks Council’s guidance on draft principles and objectives of the Policy

to enable further work.

2. Guidance

Sought from Councillors

Council’s existing Policy includes an interim

provision to ensure that remissions based on the Territorial Local

Authorities’ (TLAs) policies will remain in place until a new or revised

Policy is adopted, for implementation 1 July 2024. This review gives

Council the opportunity to design the Policy to express its own values,

priorities and choices more fully.

The first step in this process is to agree draft principles

and objectives for the Policy, which will provide direction to staff for

further work, including policy design and options for remissions which Council

can consider at later workshops. It will also enable staff to identify

groups of ratepayers that should be made aware of the Policy review and the

impact it could have on the rates they currently pay.

Staff also seek guidance on whether to pursue several

opportunities to widen the existing remission provisions to support

Council’s strategic priorities.

3. Background

information

3.1 Previous

review in 2021/22

Prior to June 2022, Council’s Policy consisted

of the TLAs’ Rates Remissions policies, plus three policies to deal with

fairness and equity issues related to three targeted rates set by

Council. In 2021/22, work was done to develop new policies for adoption

in June 2022, ready for the first year of Council collecting its own rates.

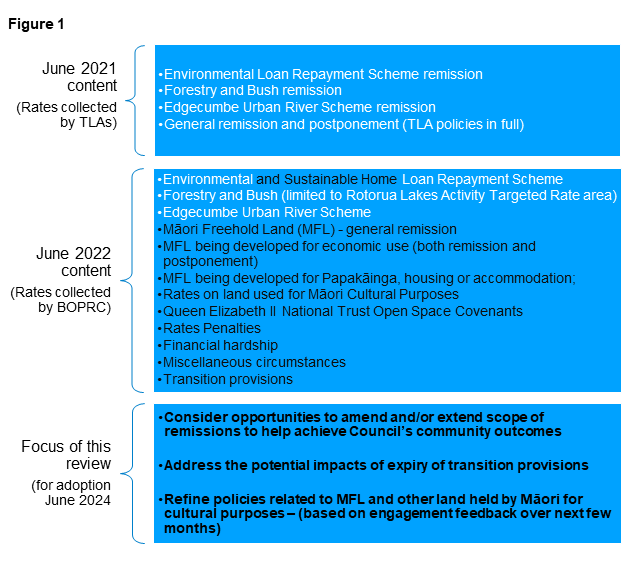

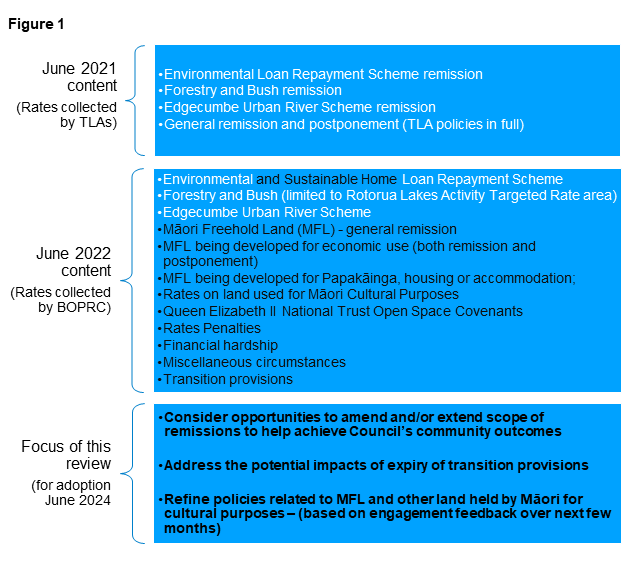

Figure 1 illustrates the evolution of the

Policy and sets the context of the work that this review covers.

3.2 Current

remissions profile

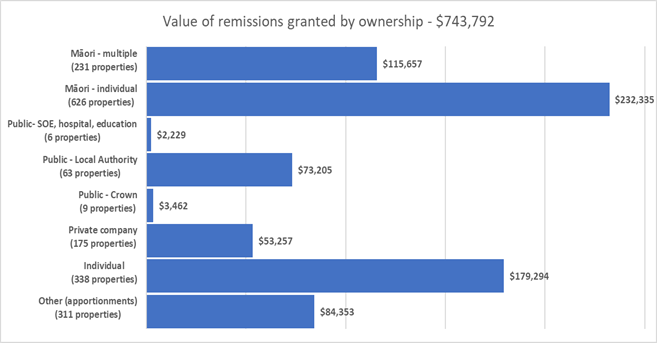

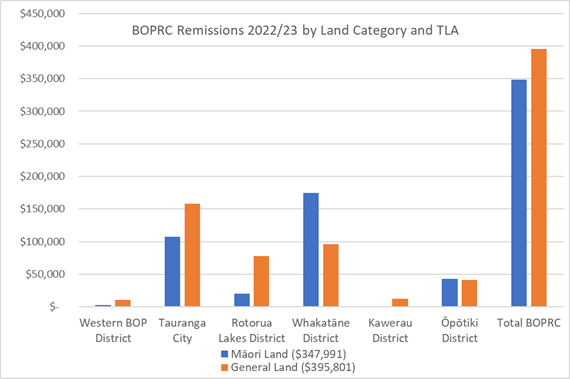

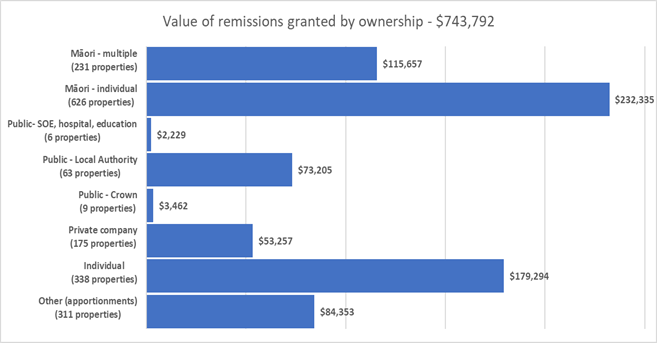

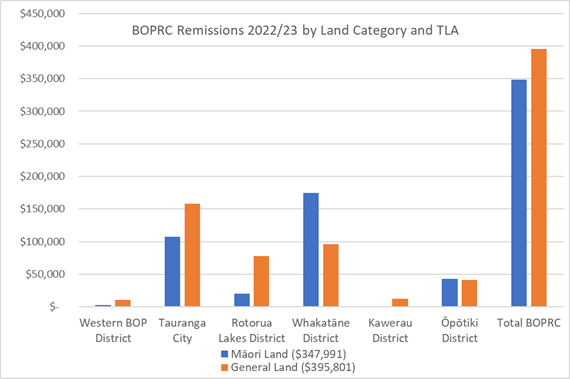

For the 2022/23 financial year, a total of $743,792

was remitted. At the LTP workshop on 12 April 2023, information was

presented on the high-level breakdown of remissions, by landowner type and land

category. Appendix 1 includes this analysis, in Figure 1 and Figure 2,

together with further detail on:

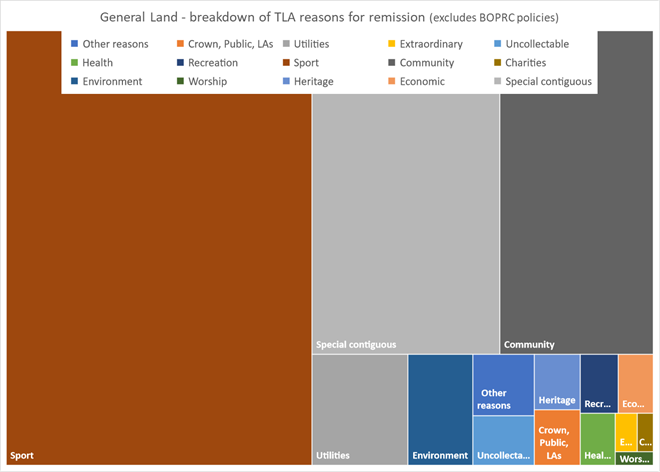

· Reasons

for remissions on General Land (Figure 3)

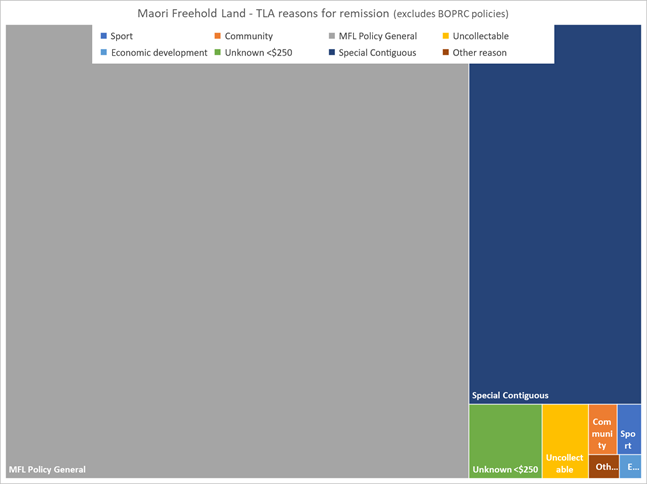

· Reasons

for remissions on Māori Freehold Land (Figure 4)

Understanding the current profile of remissions is

important because once the interim provision expires, unless Council has

adopted policies similar to those of the most generous TLAs, some ratepayers

will face increase rates bills from Council.

Council intends to engage with key groups that may be

particularly affected by changes to the policy and the direction provided to

staff at this workshop will help identify those groups.

4. Developing

principles

Purpose of the principles

The principles of the Policy underpin the objectives,

providing rationale for the objectives and direction for decision-making under

the Policy.

The principles should be concise and easy to

understand. Once the Policy is implemented, the principles also help

staff or Council make decisions on remission applications that are complex,

novel or that the Policy may not have anticipated.

Principles underpinning the existing Policy and

previous work in 2021/22

The current Policy does not have an explicit set of

principles, but Council will have considered several principles when

identifying the objectives in the Policy adopted in June 2022 (refer Figure 1

above). Deriving principles from these objectives could provide Council

with a starting point for discussion during the workshop.

During the Policy review in September 2021 Council

discussed the potential to develop policies to support its activities, for

example flood control and promoting environmental outcomes.

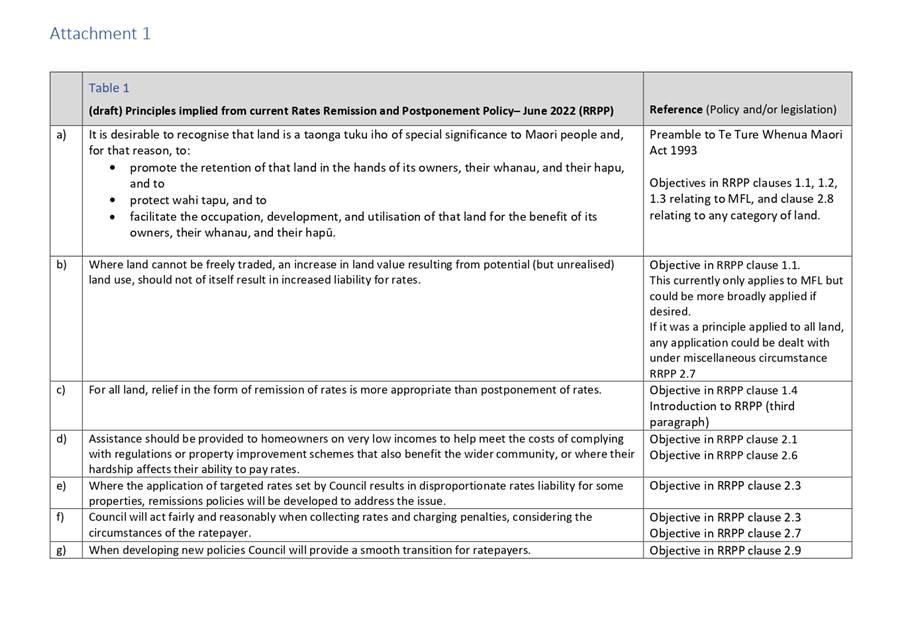

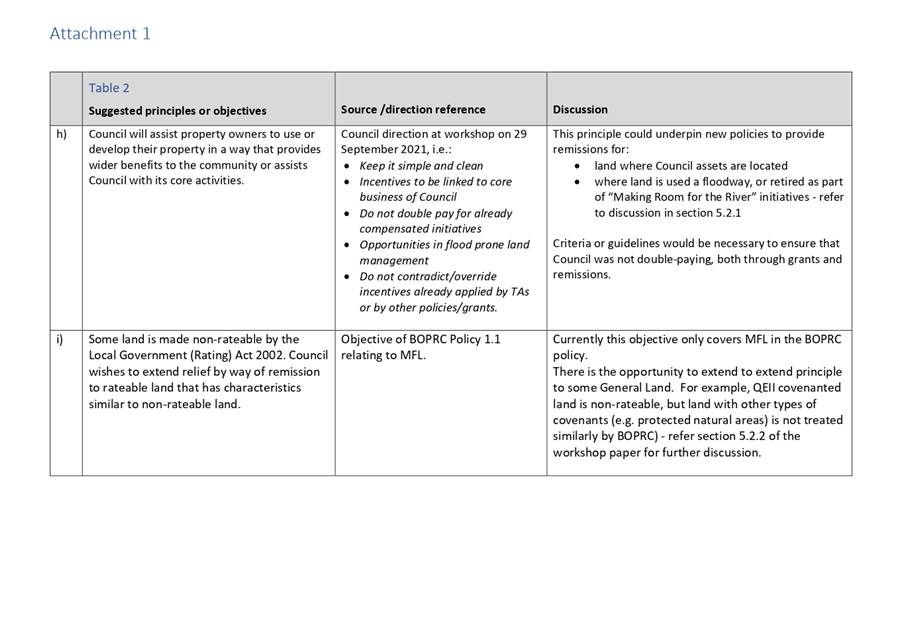

Combining these two sources, Attachment 1 contains:

· draft

principles derived from the existing Policy objectives (Table 1).

· suggested

principles that were identified in September 2021 and raised through

development of this report (Table 2).

Identifying additional principles during

the workshop

During the workshop Councillors will have the

opportunity to discuss and provide direction on the draft principles.

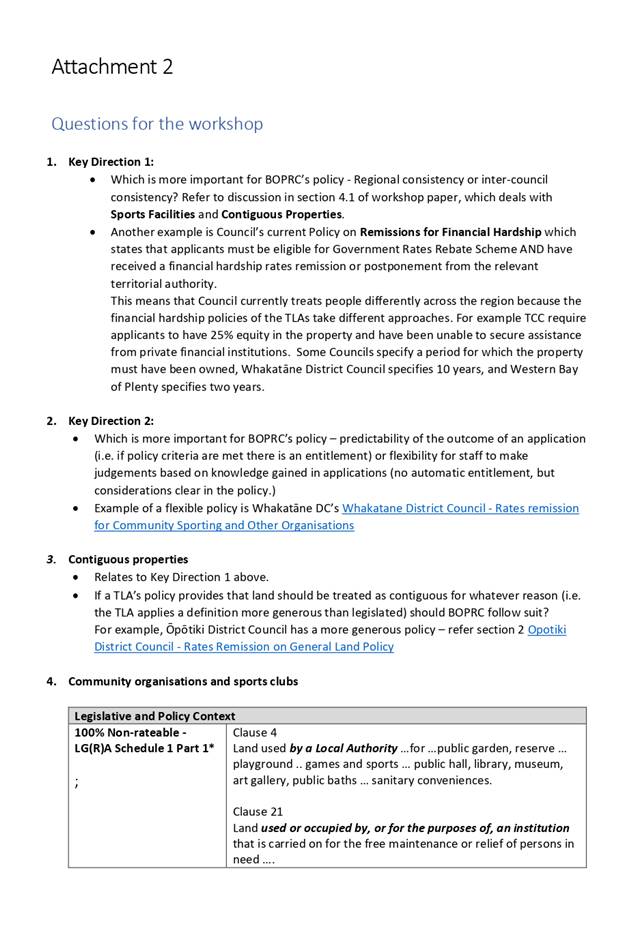

Attachment 2 is a list of questions that could focus

discussion during the workshop. If Councillors wish to raise additional

discussion points these can be added to the list before or at the start of the

workshop.

The following paragraphs in section 4 provide food for

thought regarding some of the draft principles in Attachment 1 and the

questions in Attachment 2.

4.1 Key

direction 1: Which is more important - Regional consistency or

inter-council consistency?

Currently, under the transitional arrangements,

Council treats ratepayers in different parts of the region differently,

according to the provisions of their respective TLAs’ rates remission

policies.

Ideally, Bay of Plenty TLAs and Council’s

policies would be consistent and have similar objectives, staff would interpret

legislation in a similar manner, and recognise matters such as community

benefit consistently. While there are efforts at staff level to achieve

consistency on a case-by-case basis as far as possible, policies differ for

reasons that reflect the independence of local decision-making, as well as

local preferences, councils’ different functions and priorities.

Through this review, Council has a choice of directing

staff to draft policies that either take a regional approach or look for

inter-council consistency. This means Council could set as a principle,

either:

· Option

1A: BOPRC will endeavour to treat similar properties and ratepayers

across the Bay of Plenty in a similar way;

Or

· Option

1B: BOPRC will endeavour to treat properties and ratepayers in a way

that is consistent with the approach of their respective TLA.

Option 1A values regional consistency over a

consistent inter-council approach at a property or ratepayer level, while the

reverse is true for Option 1B. From a ratepayer perspective, Option 1B

might be regarded as more coherent and easier to understand.

It is feasible that Council may want to take a

regionally consistent approach to some matters in the policy and an

inter-council consistent approach for other matters.

4.1.1 Examples

of how this choice would affect BOPRC remissions

Examples are provided in Tables 1 and 2 below of the

practical application and consequences of Options 1A and 1B above.

Similar analysis could be applied for other topics where policies differ among

the Bay of Plenty (BOP) Councils, for example the differing approaches taken in

addressing financial hardship which is discussed in Attachment 2.

|

Table 1

|

|

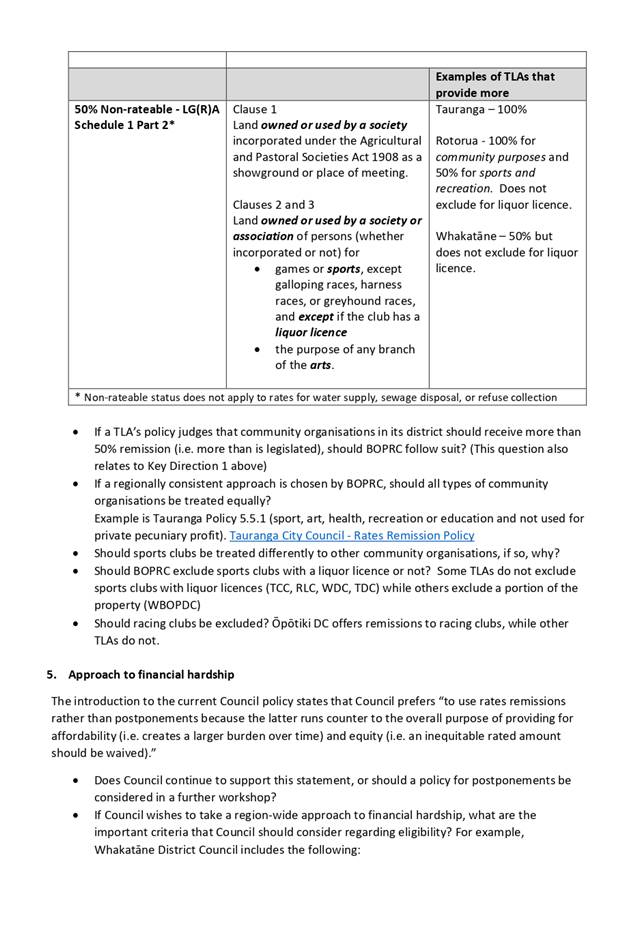

Topic: Sports facilities

|

|

Currently the TLAs across the

region treat sports facilities differently. This is a complex area

because under legislation some sports facilities

(used by local authorities) are 100% non-rateable, and others used for

similar purposes are 50% non-rateable (owned by a society or association)

provided they do not have a liquor licence. Several BOP councils’

policies provide for the remission of the remaining 50% of rates in the

latter category and/or override the liquor licence exception, but not all BOP

councils.

|

|

Principle 1A – Regional consistency

|

1B – Consistent inter-council approach

|

|

Council could choose to provide additional

remissions for sports facilities that are 50% non-rateable.

If Council chose to remit the

remaining 50% of rates, some sports facilities would be eligible for a BOPRC

rates remission that they had not previously enjoyed.

If Council chose not to provide

further remissions (beyond the legislated 50% non-rateable) some sport

facilities would lose the benefit they had previously enjoyed from BOPRC,

through the transition provisions. Given the land-based nature of many

of the sports, the impacts for some facilities would be substantial.

The most impacted ratepayer would face an increase of over $40,000 per year.

From a ratepayer perspective, if

their TLA treats them differently to BOPRC, it may be confusing. The reasons

for the difference would need to be clear, given that all local authorities

have the mandate to promote community wellbeing.

If there were instances where

BOPRC was more generous in its rates relief than the TLA, tension between the

organisations could result as the TLA may face pressure to conform to

BOPRC’s approach.

|

Council would follow the approach

taken by each of the respective TLAs and provide remissions to the same

extent as the TLA. Under current TLA policies, some sports facilities

in the region would receive remissions above 50% and others would not.

In effect, BOPRC would be

accepting that the TLA’s judgement, about community wellbeing, fairness

and equity, was sufficient to warrant a BOPRC remission.

If the TLA changed its policy,

BOPRC’s remissions policy would either automatically change, or be

updated.

This is similar to the

transitional arrangements, so no sports facilities would lose rates relief

they currently enjoy. Likewise, no sports facilities would receive new rates

relief from BOPRC, unless their TLA changed its policy.

Across the region, sports

facilities would continue to be treated differently by BOPRC, depending on

where they are located.

|

|

Topic: Special contiguous provisions

|

|

Section 20 of the Local

Government (Rating) Act (LGRA) provides that:

Two or more rating

units must be treated as 1 unit for assessing a rate if those units

are—

(a) owned by the same

person or persons; and

(b) used jointly as a

single unit; and

(c) contiguous or

separated only by a road, railway, drain, water race, river, or stream. land.

All three conditions must be met for this legislation to

apply, and the effect is that only one of the contiguous rating units

attracts fixed charges (e.g. one UAGC, one of each fixed targeted

rate). Value-based or area-based rates are not affected.

In addition, Section 20A of the LGRA (inserted in 2021)

relates to Māori Freehold Land (MFL) and directs local authorities to

treat rating units as one if:

(a) the units

are used jointly as a single unit by the person; and

(b) the local authority is satisfied the units are

derived from, or are likely to have been derived from, the same original

block of Māori freehold land, meaning the first Māori land block

that was held in an instrument of title and that included the land that

became the rating units.

Several BOP councils have included variations in their

remissions policies to make the definition of contiguous properties for their

policies more accommodating.

|

|

Principle 1A – Regional consistency

|

1B – Consistent inter-council approach

|

|

Council could choose either to

limit remissions to the legislated definition or broaden its definition in

the Policy.

If Council chose to retain the

legislated definition, some ratepayers would lose the benefit they had

previously enjoyed from BOPRC.

Alternatively, Council could choose

to adopt a region-wide policy to match those of more accommodating TLAs and

as a result a greater number of properties would qualify for remission.

Depending on the number of newly

eligible properties, this could have a material effect on the fixed charges

per property, to make up the revenue difference.

In this scenario, tensions could

arise with TLAs using the more conservative (legislated) criteria as

ratepayers may challenge the TLAs to follow the BOPRC approach.

|

Council would follow the

approach taken by each of the respective TLAs and provide contiguous property

remissions using the same criteria as the TLA.

In effect, BOPRC would be

accepting the TLA’s judgement regarding rationale for why the policy

should apply to their district.

If the TLA changed its policy,

BOPRC’s remissions policy could automatically change, or be

updated. The effect for the ratepayer would be similar to the current

transitional arrangements.

|

5. Using

remissions to support Council’s strategic direction

During the previous Policy review in 2021/22, Council

recognised that there may be opportunities to use rates remissions as incentives

to encourage actions or behaviour to promote Council’s objectives. At the

time, there was not enough information to progress the work, so it was referred

to this review.

5.1 Guidance

sought

Initial investigations have identified several areas

that could be further explored, and the following paragraphs describe the scope

and potential of each idea.

Staff seek Council guidance whether to undertake

further work on each of the ideas, noting that rates remissions are not the

only tools Council can use to promote some of the objectives listed. Rates

remissions could provide additional incentive for voluntary action to be taken

by landowners. Remissions could also be regarded as a sign of good faith to

accompany future regulation, or recognition of applying fairness to individual

circumstances.

If Council directs that staff progress these ideas,

more analysis can be done, with a view to presenting and assessing options for

remission policies to be presented at later workshops and meetings.

Guidance on priorities among these ideas would also be helpful.

5.2 Opportunities

identified by staff for Council direction

5.2.1 Flood

Protection and Control - Making Room for the River

Background

Making Room for the River

is a global approach to river and flood management that is expected to become

more widely used in future and involves working more with natural river

processes and relying less on hard protection structures. This approach may

mean that some landowners, who formerly, expected Council’s

infrastructure to protect their land, would accept more frequent flooding and

be willing to use natural methods to manage the effects of the river on their

land.

Objective

A rates remission policy could

be used to encourage land use change, for example by reducing the rateable land

value of the property by the proportion that was permanently retired from

economic use and planted and managed to reduce erosion.

At this stage staff do not have an estimate of the

area of land that could potentially be involved. This is expected to

become more evident over the next three years as planning for the Making

Room for the Rivers approach develops.

Implementation

There would be an

administrative cost to identify land and establish formal protection on land

titles, as well as ongoing monitoring and pest management. If

practicable, this approach would be less costly than the alternative approach

(taken by some other regional councils) to buy the land in question, retire it

and have Council manage it.

In the first instance, an enabling policy, to allow

for staff discretion within broad guidelines, could be useful to support the

management of the Kaituna Catchment Control Scheme, Waioeka-Otara

Rivers Scheme, Whakatāne-Tauranga Rivers Scheme, and

Rangitāiki-Tarawera River Schemes, over the next few years.

5.2.2 Catchment

Management – Protected natural areas not already receiving rates relief

Objective

There is an opportunity to encourage

landowners to fence, protect and restore land such as Significant Natural Areas

(SNAs) and Priority Biodiversity Sites (PBSs), that could support biodiversity

outcomes, and reward those that have done so.

Similar land, e.g. Queen Elizabeth II Trust land,

(QEII), is legislatively non-rateable and there are currently few incentives to

encourage active maintenance of biodiversity, for example pest control.

This idea is high priority for

the Catchment Management Team.

Remission target

If land was covenanted, had

significant ecological or biodiversity value and was actively managed, it could

be eligible for rates remission. If this idea is progressed, staff

suggest that a minimum land area threshold be set, and a remission agreed for a

set period, after which an assessment of the environmental effectiveness could

be undertaken.

At the workshop, staff will

present rough estimates of the potential areas that may be eligible and rates

that would be foregone if these areas were eligible for a full remission of

rates.

Implementation

Methodology to determine level

of ecological significance and extent of management required, would have to be

developed. Administration to establish covenants would require extra

resources. Monitoring of active management already takes place.

5.2.3 Catchment

management – Retired land with low or no ecological value

Objective

Council could encourage

landowners to retire land from production, even where there is low or no

ecological value (e.g., pasture), but some other community benefit can be

expected e.g., improved water quality.

Remission target

Remissions could be considered

for any land that is no longer used for production, is protected, and managed

or allowed to revert to its natural state. Land would be fenced and

actively managed to prevent weeds.

This could be a broad category

including land that is expected to be affected by sea level rise, including

salt marsh areas and land likely to return to wetlands. Unless criteria and

priorities were established, thousands of hectares would qualify, and some may

have already received incentive funding through the Catchment Management

activities incentives like planting and fencing.

There would be potential for

land to qualify for multiple incentives from different agencies (e.g.,

incentives for riparian areas under anticipated agricultural emissions pricing

scheme). Also, for some land of this type, regulatory requirements already

achieve the objective, so the policy should only be used where necessary,

rather than creating an entitlement.

Implementation

Administration to establish

covenants would require extra resources, as would ongoing monitoring of the

effectiveness of active management. A minimum size should be set to

reduce administration costs.

Consideration would also have to be given to how this

policy would work alongside the existing policy for Lake Rotorua Incentives

Scheme (Forestry and Bush Remission, BOPRC policy 2.2) to avoid double dipping

and achieve equity of treatment through different policies.

There could be opportunities to

work with other organisations to develop incentive packages, provide any BOPRC policy

was flexible enough to enable staff to tailor solutions to individual situations.

5.2.4 Rivers

and Drainage Schemes, Catchment Management –Council assets on private

land

Objective

Council could recognise

the community benefit of Council assets situated on private land, where

landowner retains ownership of the land. In some situations, this could smooth

the negotiation process with landowners, in others, landowners may have agreed

without the need for a remission.

Remission target

Examples of Council assets on

private land (including those co-funded with landowner) are:

· detainment bunds

· treatment wetlands

· hard infrastructure

· set-backs on drainage scheme drains.

Some Council

assets may already be non-rateable through LGRA Schedule 1 Part 1, Clause 4(e)

which makes the following land 100% non-rateable: Land used by a local

authority for soil conservation and river control purposes, being land for

which no revenue is received.

This potential

remission would apply to those that did not meet this test, which staff

estimate could be hundreds of hectares.

Policy design

should be enabling rather than prescriptive, to take account of individual

circumstances, including:

· any reduction in productive capacity and the balance of private

benefit of the Council assets to the landowner (if any),

· landowner contribution to establish asset,

· landowner obligations for maintenance of the land (if any).

Implementation

Administration to establish the

extent of the initial remission would be required. Legal agreements or

covenants would be required for drain setbacks. Council assets are

already monitored so that would not require additional resources.

5.2.5 Rivers

and Drainage Schemes, Catchment Management – Land between rivers and stop

banks

Objective

Rates remissions could

encourage landowners to keep stock off the areas between rivers and stop-banks,

to improve water quality and biodiversity e.g., inanga spawning.

Additional

stock exclusion rules for water quality are also being considered in the development

of the new Regional Natural Resources Plan and may partially overlap with some

of these proposals for rates remission following land retirement. Rates

remission is just one possible incentive that could be considered for the land

retirement associated with compulsory stock exclusion rules.

Alternatively, the objective

could be narrower, and encourage land to be permanently retired and managed for

biodiversity.

Remission target

Remissions could either apply

to productive land where animals were excluded but production remains (e.g.,

cut and carry hay operations) or where land is permanently retired from

production.

Implementation

Administration to establish the

extent of the initial remission would be required along with monitoring of any

conditions and standards of management agreed.

5.2.6 Rivers

and Drainage Schemes – Access compromised where river changes its course

Objective

Council could recognise any reduction

in productive potential for landowner where a river changes course and land is

“stranded” on the other side.

Remission

target

Rates could be remitted for

portions of land not practicably accessible to the landowner because of the

change in a river course.

In some cases, the cut-off land

is used by the landowner over the river, in which case landowners could come to

a private agreement on payment for the use of the land. In other cases,

agreement may not be possible, or land may not be useable.

Implementation

For land value-based rates,

valuations usually take account of loss of access to part of a rating unit, but

for flat targeted rates, the valuation adjustment would not make any

difference.

Per property, there would be a

significant administration cost to implement this remission, including

monitoring the river movement regularly, and liaising with the valuers

annually, but there would probably be a low number of properties that would be

affected in this way.

5.2.7 Retiring

marginal pastoral land and developing native forestry

Objective

Council could use rate

remissions to further incentivise landowners to retire pastoral land and

develop native forestry, as opposed to exotic forestry. This would support

Council’s climate change and water quality aspirations.

Subject to future Council decisions, a remission could

reduce any financial impact on landowners from a potential land retirement

policy, which is being considered as part of the Essential Freshwater Policy.

Remission target

Properties or portions of

properties that convert from a pastoral land use to native forestry land use

after a certain date.

Rationale

Large scale conversion of pasture to pine (primarily

for carbon farming) can result in significant financial returns. This type of

land use change has been observed across the country, although not so much in

the Bay of Plenty to date, and has resulted in concerns from environmental,

rural community and farming interests.

Conversion of pasture to native forest generally has a

much weaker financial performance, and often relies on additional support

(e.g., Council grants) so it is not as common. As a land use, native forest has

greater environmental benefits compared to marginal pasture and pine. A

remission policy could be designed to provide an additional incentive to

landowners that choose to retire marginal pastoral land into native forest

and/or reduce any financial impacts on landowners from Essential Freshwater

Policy being developed.

The financial impact of this

remission policy on Council would be entirely dependent on landowners’

willingness to retire marginal pasture into native forest. However, when

considered at a minimum scale of 1 hectare, there are about 40,000 hectares of

marginal pasture on slopes greater than 30 degrees across the region which

would be considered suitable for retirement.

For fairness, consideration

could be given to land which has already been converted from pasture to native

forestry, although that would not result in any additional environmental

benefits and would increase the cost of the remission policy to the rest of the

region’s ratepayers.

Māori Freehold Land and

DOC land in native forestry is already exempt from rates along with QEII

covenanted land. This policy would provide an opportunity to assess

relative fairness among similar types of land use, provided the restrictions on

the land (e.g., through covenants) were similar.

Implementation

Remissions could be subject to

a land covenant or encumbrance. Administration to establish covenants or

encumbrances would be required as well as regular confirmation that the

affected properties remain in a native forestry land use. This could be done

through aerial or satellite imagery but may occasionally require ground-truthing.

6. Next

Steps

Staff will take the feedback from this workshop and

progress work on:

· Creating a working draft of principles and objectives for the policy

· further work to establish the feasibility of new avenues for

remission

· identify landowners that may lose their current remissions and plan

for engagement with them

· Progress the engagement on Māori Freehold Land

remissions.

APPENDIX 1

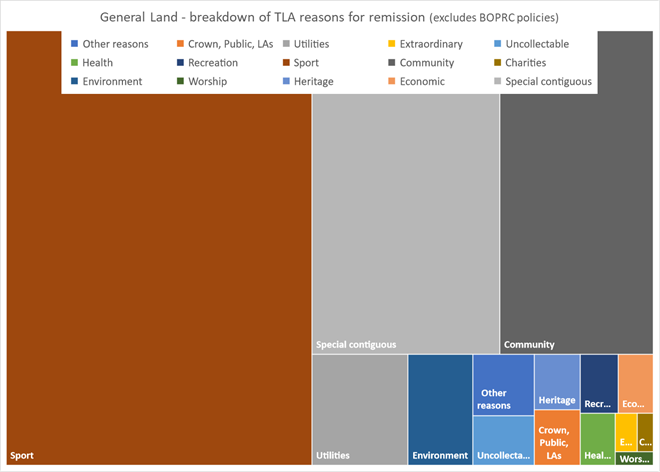

The following analysis

has been derived from data currently held for the rating year 2022/23.

Analysis of the reasons

for remissions, under TLA policies, relies on data inherited from TLAs which is

not always complete and categorised differently by each TLA. As a result,

Figures 3 and 4 are well-informed estimates which staff consider fit for the

purpose of today’s workshop.

Figure 1

Figure 2

Figure 3

|

Figure 3 Values

|

$000

|

|

|

$000

|

|

Sport

|

142

|

|

Crown,

Public, LAs

|

3

|

|

Special

contiguous

|

65

|

|

Recreation

|

2

|

|

Community

|

53

|

|

Health

|

2

|

|

Utilities

|

11

|

|

Economic

|

2

|

|

Environment

|

8

|

|

Extraordinary

|

1

|

|

Other

reasons

|

4

|

|

Charities

|

1

|

|

Uncollectable

|

3

|

|

Worship

|

1

|

|

Heritage

|

3

|

|

|

|

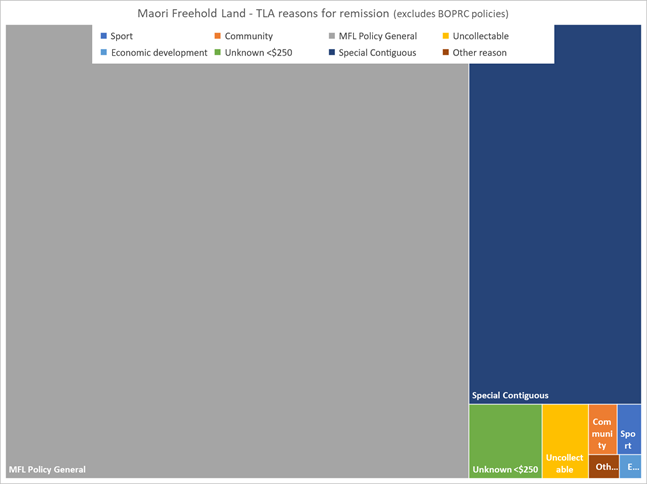

Figure 4

|

Figure 4 Values

|

$000

|

|

|

$000

|

|

MFL

Policy General

|

253

|

|

Community

|

2

|

|

Special

contiguous

|

79

|

|

Sport

|

1

|

|

Unknown

<$250

|

7

|

|

Other

|

1

|

|

Uncollectable

|

4

|

|

Economic

development

|

1

|

Attachments

Attachment 1 - Implied Policy Principles - Draft for discussion ⇩

Attachment 2 - Questions for Discussion in Workshop ⇩