|

|

|

|

|

|

Report To:

|

Risk

and Assurance Committee

|

|

Meeting

Date:

|

21

October 2021

|

|

Report

Writer:

|

Debbie Hyland, Finance &

Transport Operations Manager; Zhivan Alach, Organisational Performance

Manager; Tobias Fransson, Performance Analyst and Andy Dixon, Treasury &

Tax Specialist

|

|

Report

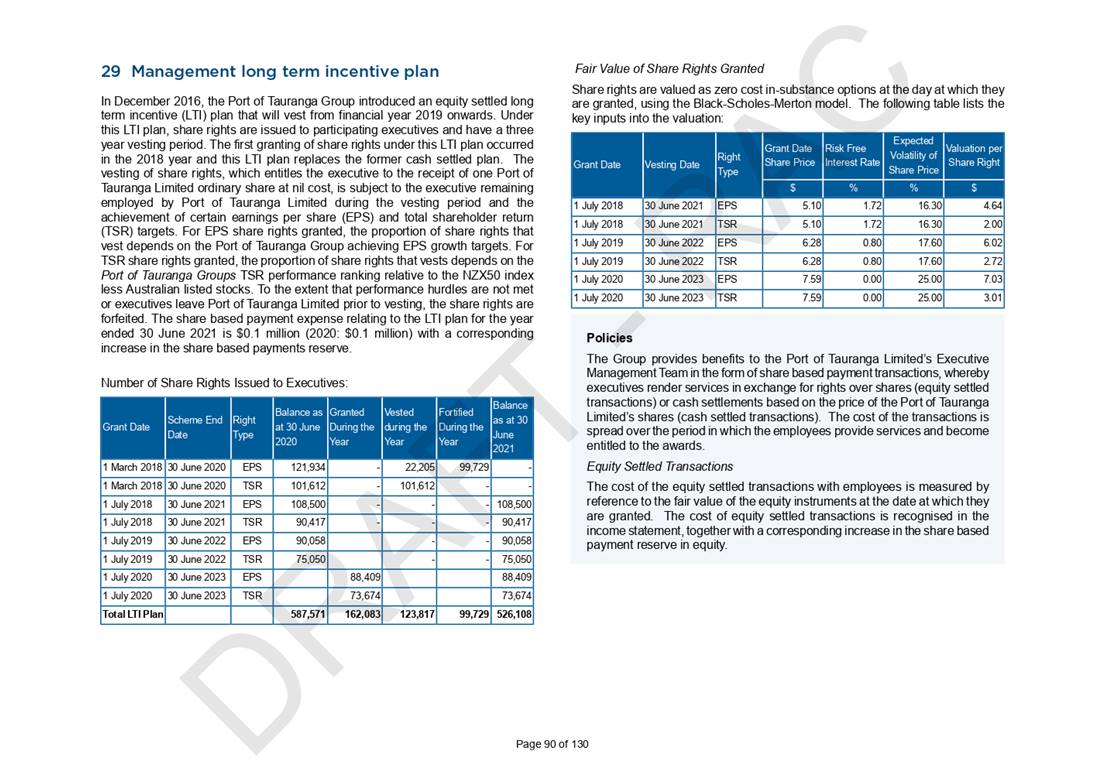

Authoriser:

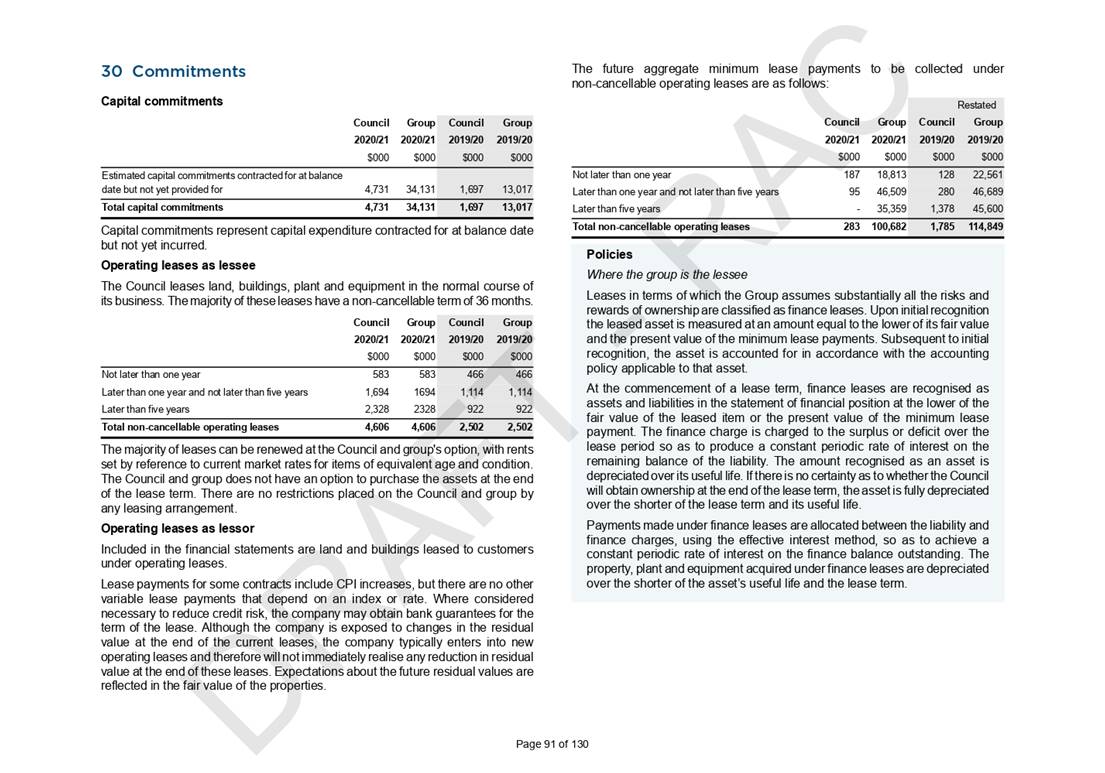

|

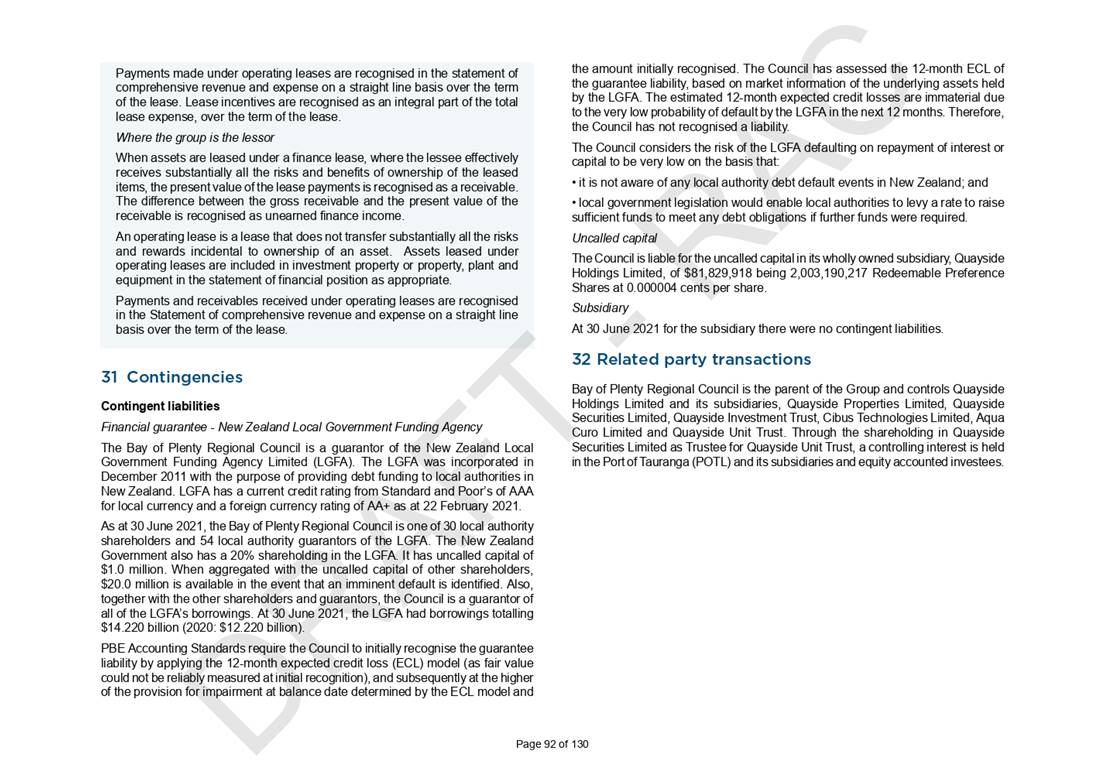

Mat

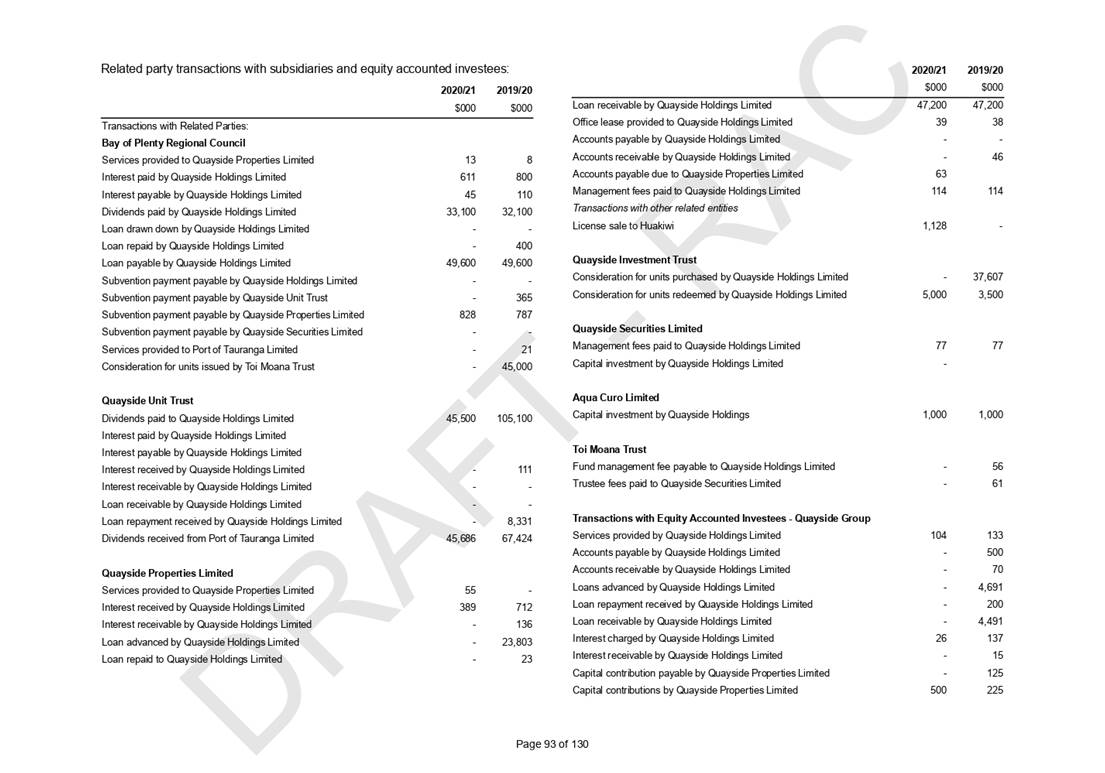

Taylor, General Manager, Corporate

|

|

Purpose:

|

Review of the 2020/21 Annual Report

and presentation by Audit NZ

|

|

|

|

2020/21 Draft Annual Report review

|

Executive Summary

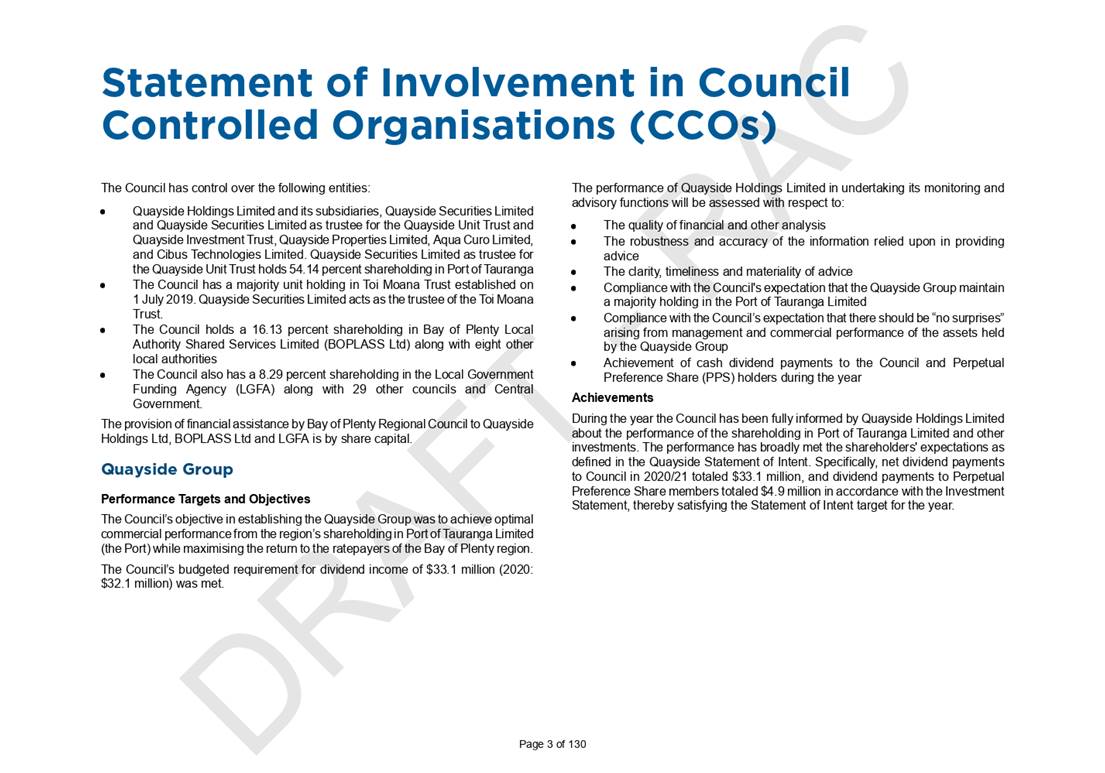

This report presents the Draft

Annual Report 2020/21 for the Bay of Plenty Regional Council to the Risk and

Assurance Committee. These reports contain the draft financial and

non-financial performance results of the Council for the year ended 30 June

2021 and consolidated financial statements for the Council Group which

includes our 100 percent Council-owned subsidiary, Quayside Holdings and

majority owned Council-owned subsidiary, Toi Moana Trust.

Council’s Long Term Plan

2018-2028 includes 33 performance measures with targets for 2020/21. We

achieved 28 (85%) of the targets that were set for the year ended 30 June

2021. The main reasons for financial and non-financial variations are

outlined in sections 2.1 and 2.2 of this report. This external audit of the

Council for the year ended 30 June 2021 is currently in progress. Staff

anticipate that Council will receive verbal audit clearance from Audit New

Zealand on 3 November 2021. The final 2020/21 Annual Report will be presented

for adoption by Council on 10 November 2021.

Council’s draft

operating surplus for year three of the Long Term Plan 2018-2028 is

$5.5 million which is $11.1 million higher than the budgeted deficit

of $5.6 million. Council delivered its work programme through operating

expenditure of $141.3 million (2020: $138.5 million) compared to a budget of

$142.4 million; this is $1.1 million lower than budget. Total revenue

is $146.8 million, this is $10.0 million higher than budget of $136.8

million (2020: $138.5 million). Council delivered a significant capital works

programme with expenditure of $27.6 million (2020: $36.4 million) compared to

a budget of $51.5 million; this is $24 million lower than budget

partly due to the impacts of Covid-19.

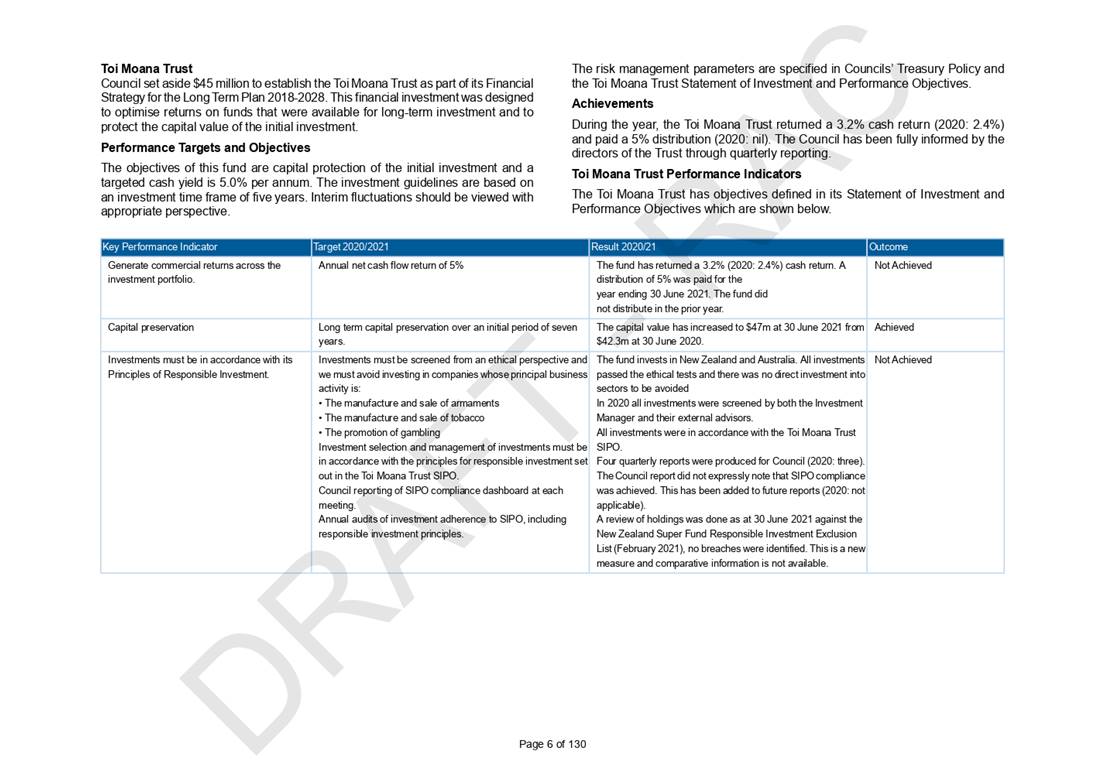

Staff have prepared a set of

draft consolidated accounts for the Council Group for review by Audit New

Zealand. The Draft Annual Report for the Council Group includes a record net

profit after tax attributed to Council of $85.5 million. The dividend pay-out

from Quayside to Council of $33.1 million is the largest to date, which has

helped to reduce general rates in 2020/21 by an average of $289 per property

in the region. Toi Moana Trust also paid a dividend to Council of $2.25

million in 2020/21 in line with its Statement of Intent. Council received the

audited Annual Report 2020/21 for Quayside and its subsidiaries on 30

September 2021.

Leon Pieterse, Audit NZ

Director and Anton Labuschagne, Audit NZ Manager will attend the Risk and

Assurance Meeting to discuss the audit process.

|

Recommendations

That the Risk and Assurance Committee:

1 Receives

the report, 2020/21 Draft Annual Report review.

1. Introduction

This report

presents the Draft Annual Report 2020/21 against the delivery of year three of

our Long Term Plan 2018-2028, as updated through our Annual Plan 2020/21. These

reports contain the draft financial and non-financial performance results of

the Council for the year ended 30 June 2021.

The beginning

of this financial year was dominated by ensuring a swift recovery from the

significant first effects of the COVID-19 global pandemic within the region,

and keeping a close watch on national and global developments. Thankfully, as

the year progressed there were no significant outbreaks in the region, which

meant Council’s service delivery levels were not significantly adversely

affected.

The Council

meeting on the 10 November 2021 is scheduled to receive and adopt the Annual

Report and Annual Report Summary for the year ended 30 June 2021. The

supporting documents, Draft Annual Report 2020/21 (Volume One and Volume Two

Financials) are provided to the Risk and Assurance Committee in its role to

receive and review the draft Annual Report.

The Audit New

Zealand Director, Leon Pieterse, and Audit Manager Anton Labuschagne will be in

attendance at the meeting to discuss the overall audit process.

1.1 Legislative Framework

The Draft Annual Report 2020/21

is prepared in accordance with the requirements of the Local Government Act

2002 and the Local Government (Financial Reporting and Prudence) Regulations

2014.

1.2 Alignment with

Strategic Framework

The Draft Annual Report 2020/21

provides a report on the financial and non-financial performance of Council as

set out in its Long Term Plan 2018-2028 and Annual Plan 2020/21. As a result it

supports the delivery of all four Community Outcomes and the Way We Work.

1.2.1 Community Well-beings Assessment

|

Dominant Well-Beings Affected

|

|

þ Environmental

|

þ Cultural

|

þ Social

|

þ Economic

|

The Draft Annual Report 2020/21

provides a report on the financial and non-financial performance of Council and

as such promotes all four aspects of community well-being.

2. Draft Annual Report 2020/21

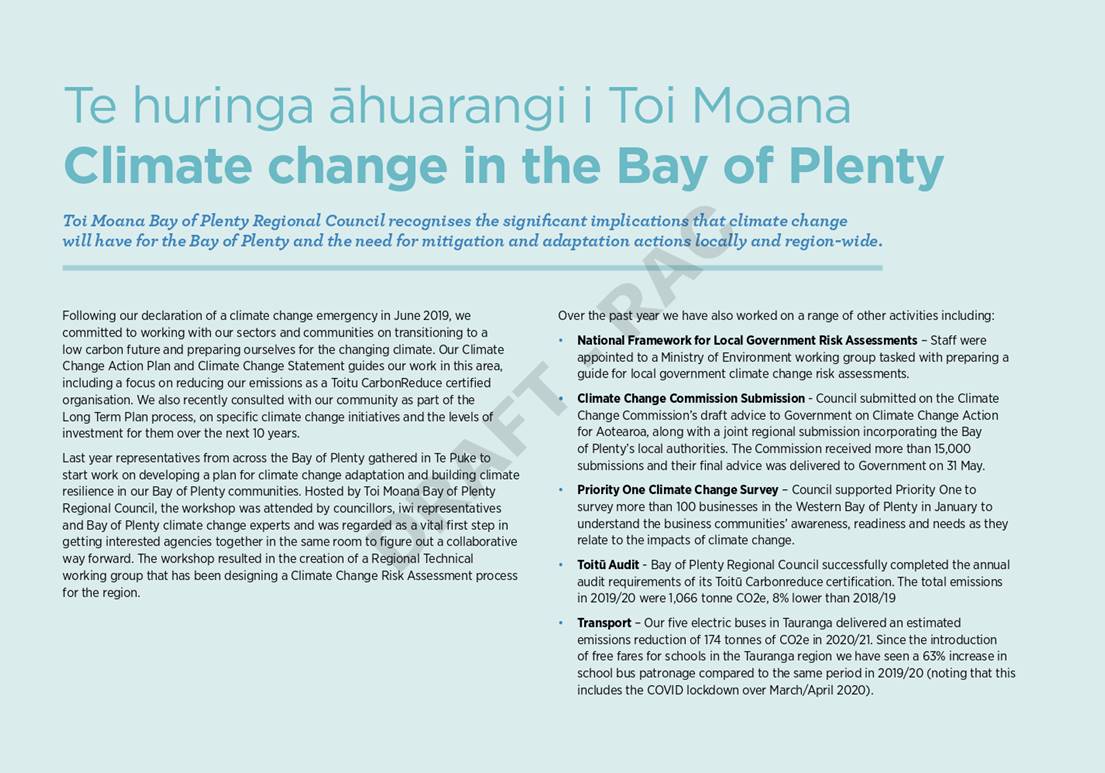

2.1 Non-Financial

Performance Summary 2020/21

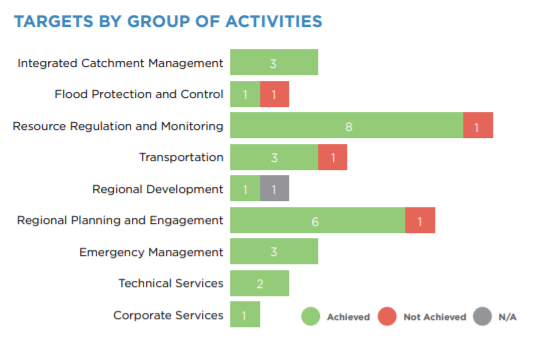

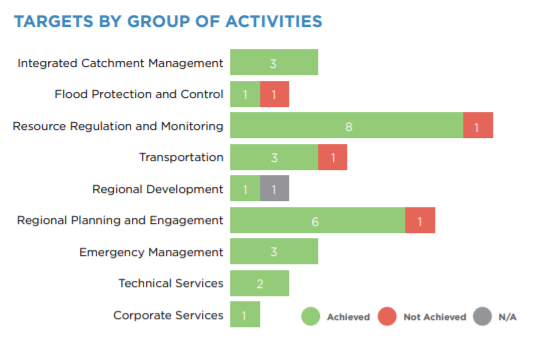

Through the

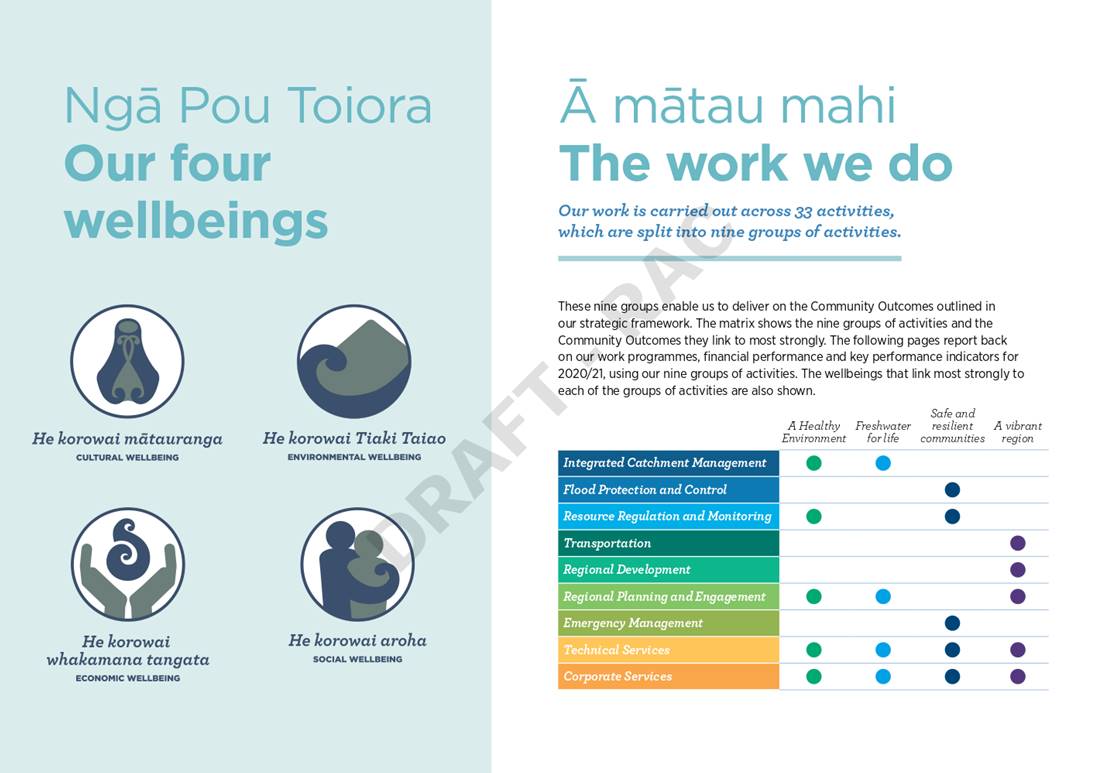

Long Term Plan 2018-2028, Council set the Levels of Service it will provide to

the community for each of the nine Groups of Activities. Council also set

performance measures and targets for those Levels of Service.

In 2020/21

Council achieved 28 out of 33, or 85% of targets for these measures and came

close with several others. While COVID-19 has had an impact on a number of our

services, we have still managed to see improvement in some of our levels of

service, including resource consent processing times and publishing of Council

and Committee meeting minutes.

By comparison,

in 2019/20 Council reported on 33 KPIs and achieved 28 (or 85%) of the targets

and did not achieve five.

Of the 33

measures that Council used to track its performance in 2020/21, the summary

graph below shows that:

- Council achieved the targets for 28 measures

(85%)

- Council did not achieve the targets for

four measures (12%)

- One measure is no longer considered applicable

(3%)

2.1.1 Performance Measures not achieved

Further detail on the measures

where the target has not been met are provided in the table below.

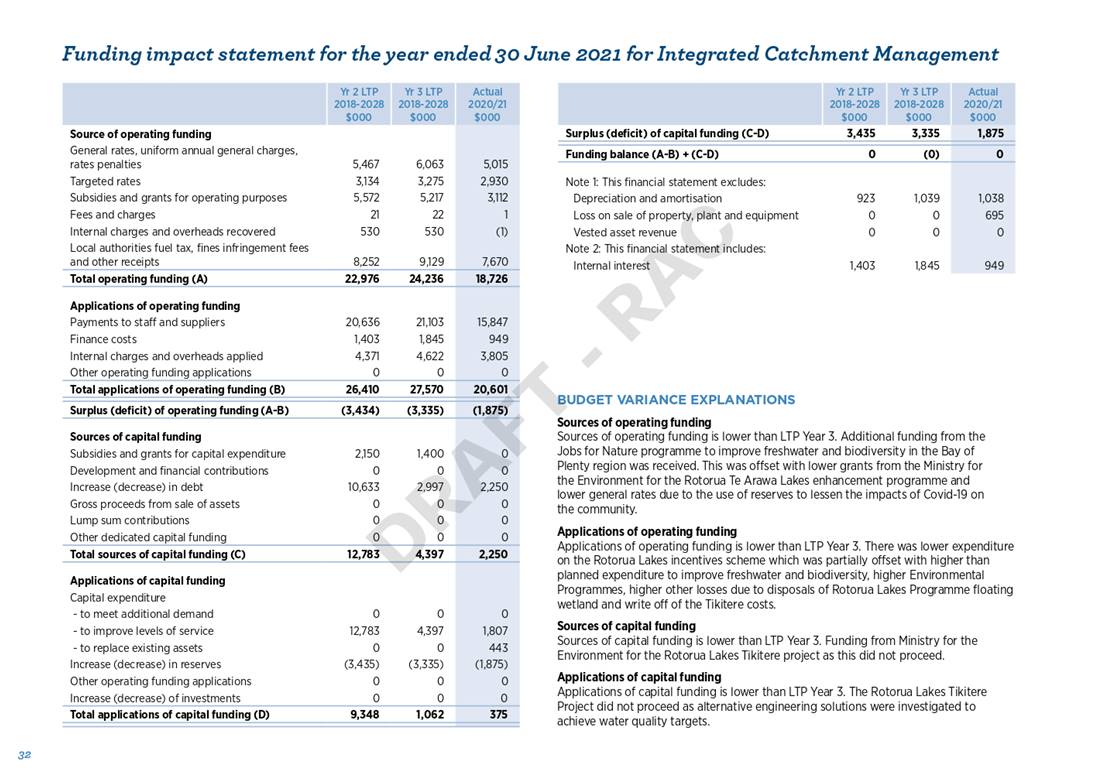

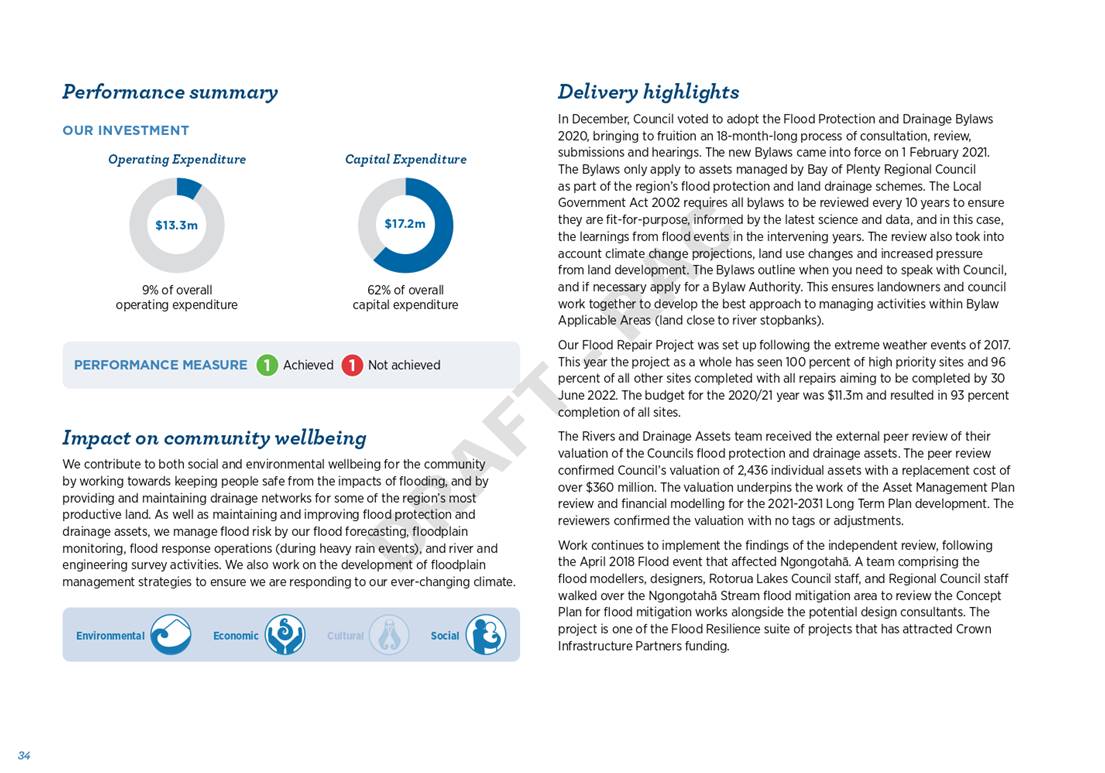

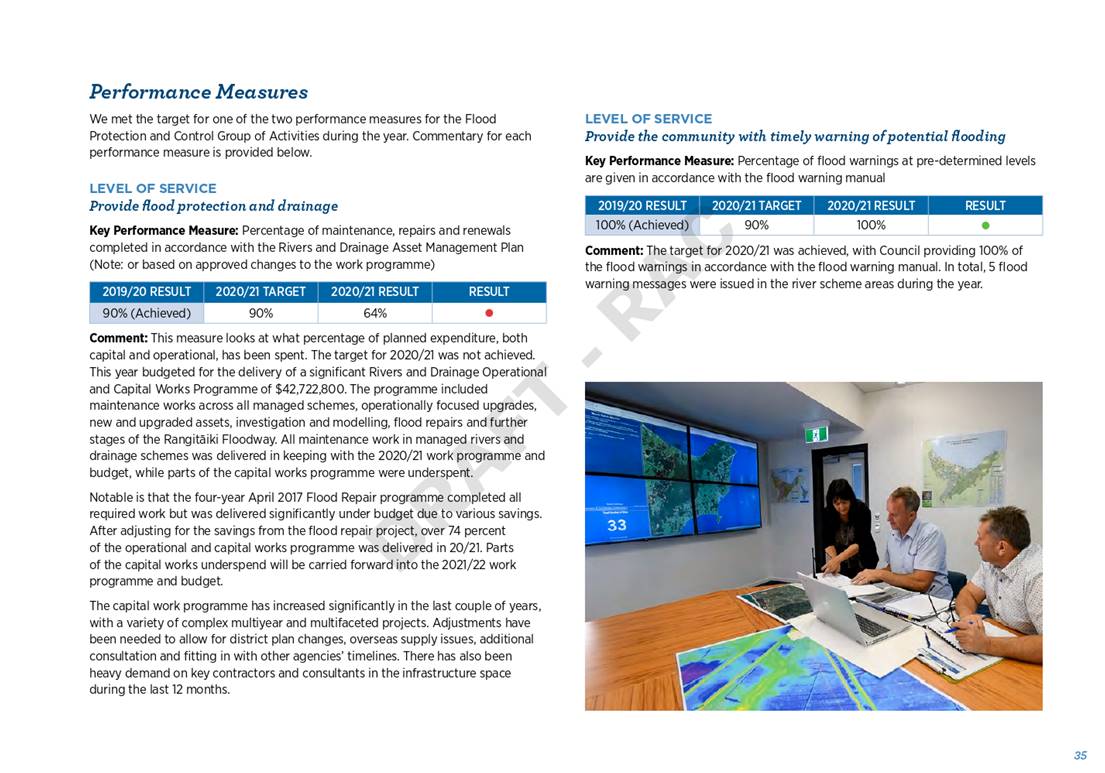

Flood

Protection & Control

Key

Performance Measure: Percentage of maintenance,

repairs and renewals completed in accordance with the Rivers and Drainage Asset

Management Plan (Note: or based on approved changes to the work programme)

|

2019/20

RESULT

|

2020/21

TARGET

|

2020/21

RESULT

|

RESULT

|

|

90% (Achieved)

|

90%

|

65%

|

Ÿ

|

This measure looks at what

percentage of planned expenditure, both capital and operational, has been

spent. The target for 2020/21 was not achieved. This year budgeted for the

delivery of a significant Rivers and Drainage Operational and Capital Works Programme

of $42,722,800. The programme included maintenance works across all managed

schemes, operationally focused upgrades, new and upgraded assets, investigation

and modelling, flood repairs and further stages of the Rangitāiki

Floodway. All maintenance work in managed rivers and drainage schemes was

delivered in keeping with the 2020/21 work programme and budget, whilst parts

of the capital works programme were underspent.

Notable is that the 4-year April

2017 Flood Repair programme completed all required work but was delivered

significantly under budget due to various savings. After adjusting for the

savings from the flood repair project, over 74% of the operational and capital

works programme was delivered in 20/21. Parts of the capital works underspend

will be carried forward into the FY 2021/22 work programme and budget.

The capital work programme has

increased significantly in the last couple of years, with a variety of complex

multiyear and multifaceted projects. Adjustments have been needed to allow for

district plan changes, overseas supply issues, additional consultation and

fitting in with other agencies timelines. There has also been heavy demand on

key contractors and consultants in the infrastructure space over the last 12

months.

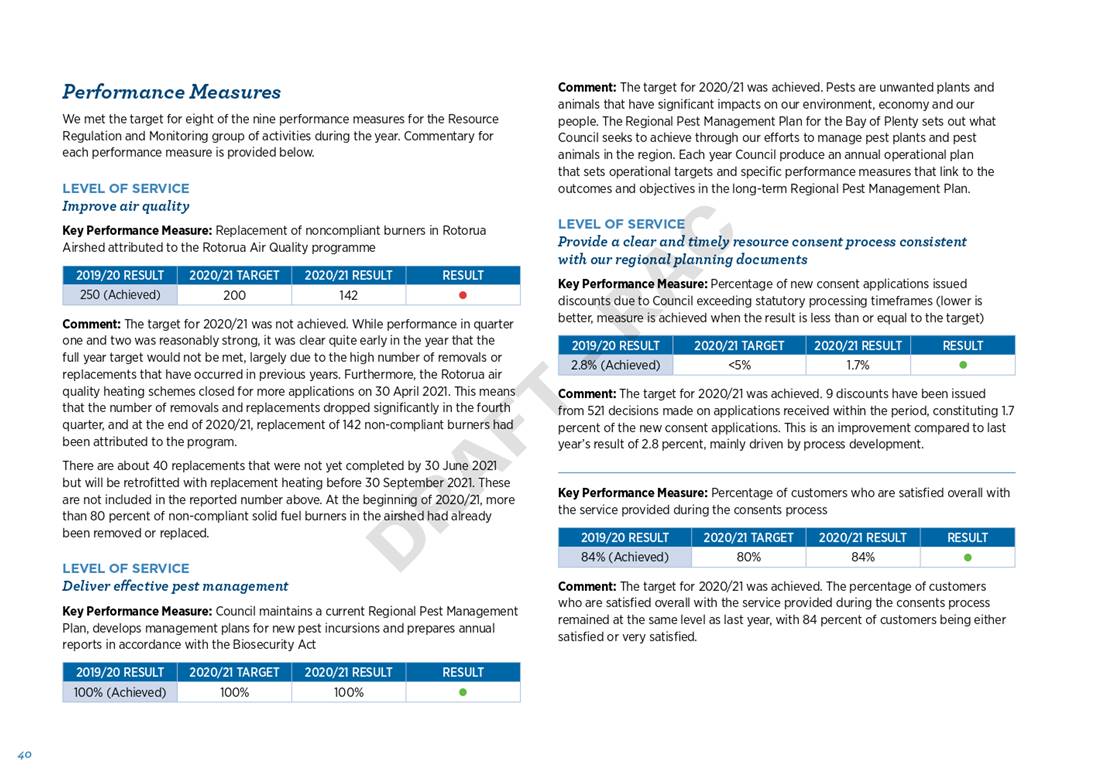

Resource Regulation and

Monitoring

Key Performance Measure:

Replacement of noncompliant burners in Rotorua Airshed attributed to the

Rotorua Air Quality programme.

|

2019/20

RESULT

|

2020/21

TARGET

|

2020/21

RESULT

|

RESULT

|

|

280

|

200

|

142

|

Ÿ

|

The target for 2020/21 was not

achieved. While performance in Quarter One and Two was reasonably strong, it

was clear quite early in the year that the full year target would not be met,

largely due to the high number of removals or replacements that have occurred

in previous years. Furthermore, the Rotorua air quality heating schemes closed

for more applications on 30 April 2021. This means that the number of removals

and replacements dropped significantly in the fourth quarter, and at the end of

2020/21, replacement of 142 non-compliant burners had been attributed to the

program.

There are about 40 replacements

that were not yet completed by 30 June 2021 but will be retrofitted with

replacement heating before 30 September 2021. These are not included in the

reported number above. At the beginning of 2020/21, more than 80 percent of

non-compliant solid fuel burners in the airshed had already been removed or

replaced.

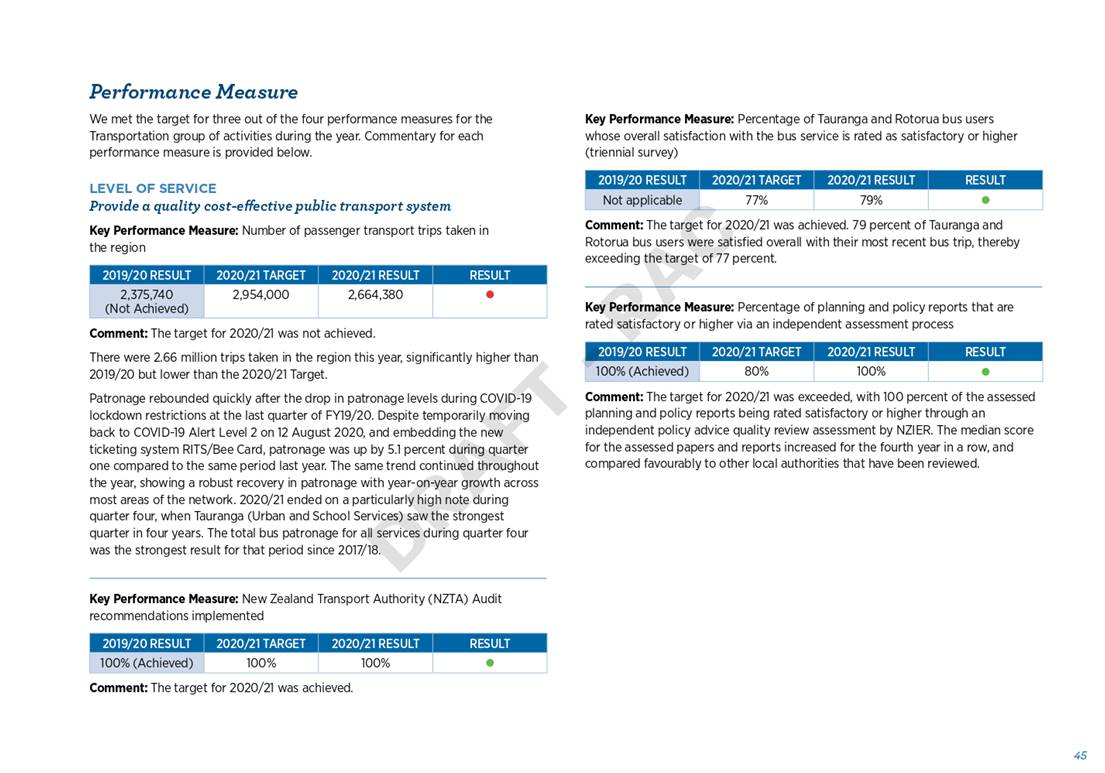

Transportation

Key Performance Measure:

Number of passenger transport trips taken in the region.

|

2019/20

RESULT

|

2020/21

TARGET

|

2020/21

RESULT

|

RESULT

|

|

2,375,740 (Not

Achieved)

|

2,954,000

|

2,664,380

|

Ÿ

|

The target for 2020/21 was not

achieved. There were 2.66 million trips taken in the region this year,

significantly higher than 2019/20, but lower than the 2020/21 Target.

Patronage rebounded quickly

after the drop in patronage levels during COVID-19 lockdown restrictions at the

last quarter of FY19/20. Despite temporarily moving back to COVID-19 Alert

Level 2 on 12 August 2020, and embedding the new ticketing system RITS/Bee

Card, patronage was up by 5.1% during Quarter 1 compared to the same period last

year. The same trend continued throughout the year, showing a robust recovery

in patronage with year-on-year growth across most areas of the network. 2020/21

ended on a particularly high note during Quarter 4, when Tauranga (Urban and

School Services) saw the strongest quarter in four years. The total bus

patronage for all services during Quarter 4 was the strongest result for that

period since 2017/18.

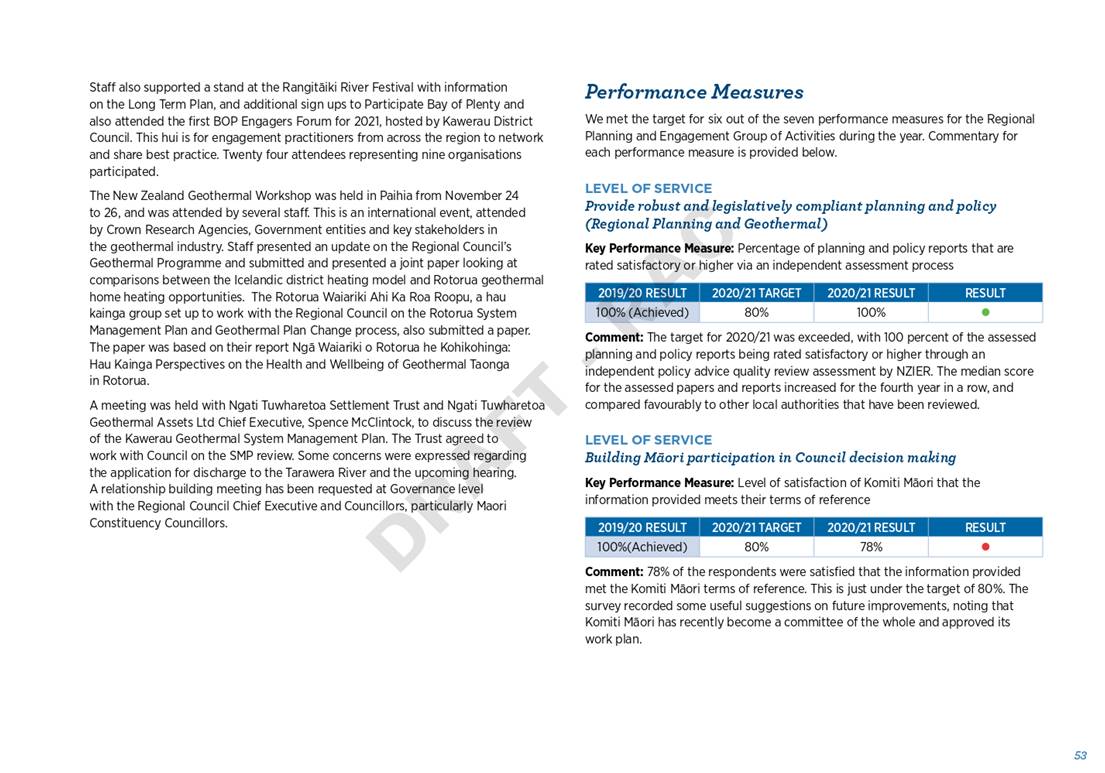

Building Māori

participation in Council decision making

Key Performance Measure:

Level of satisfaction of Komiti Māori that the information provided meets

their terms of reference.

|

2019/20 RESULT

|

2020/21 TARGET

|

2020/21 RESULT

|

RESULT

|

|

100%(Achieved)

|

80%

|

78%

|

Ÿ

|

78% of the respondents were

satisfied that the information provided met the Komiti Māori terms of reference. This is just under the target

of 80%. The survey

recorded some useful suggestions on future improvements, noting that Komiti

Māori has recently become a committee of the whole and approved its work

plan.

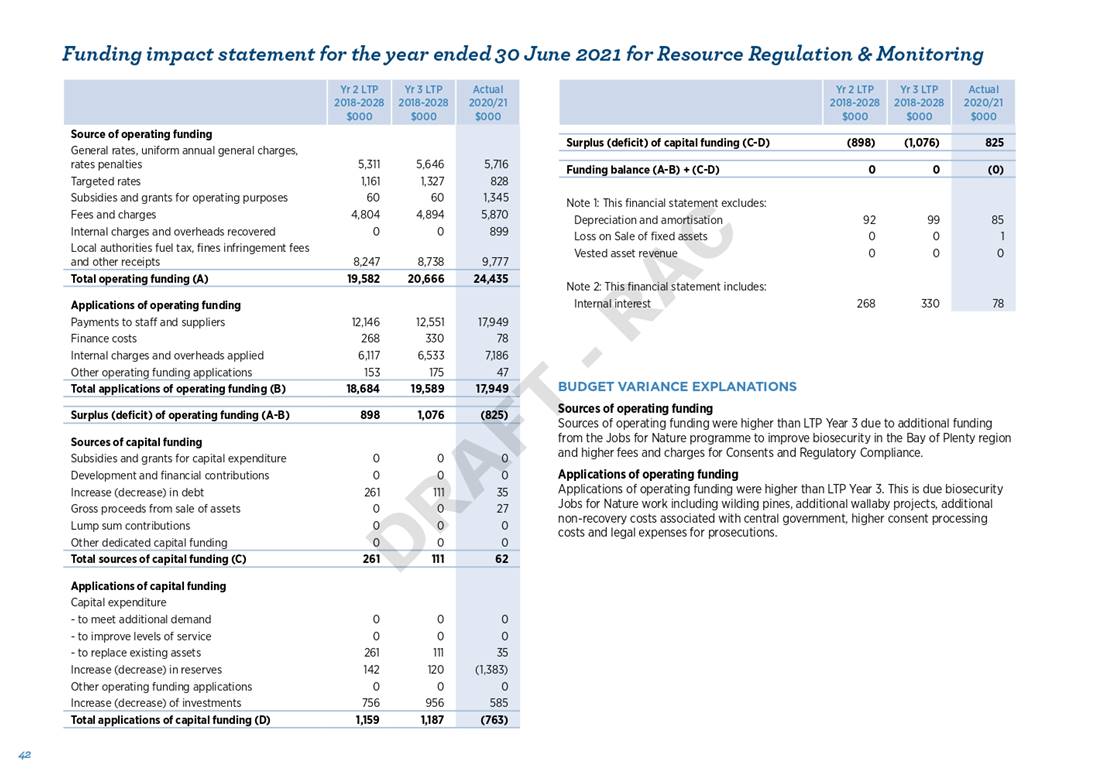

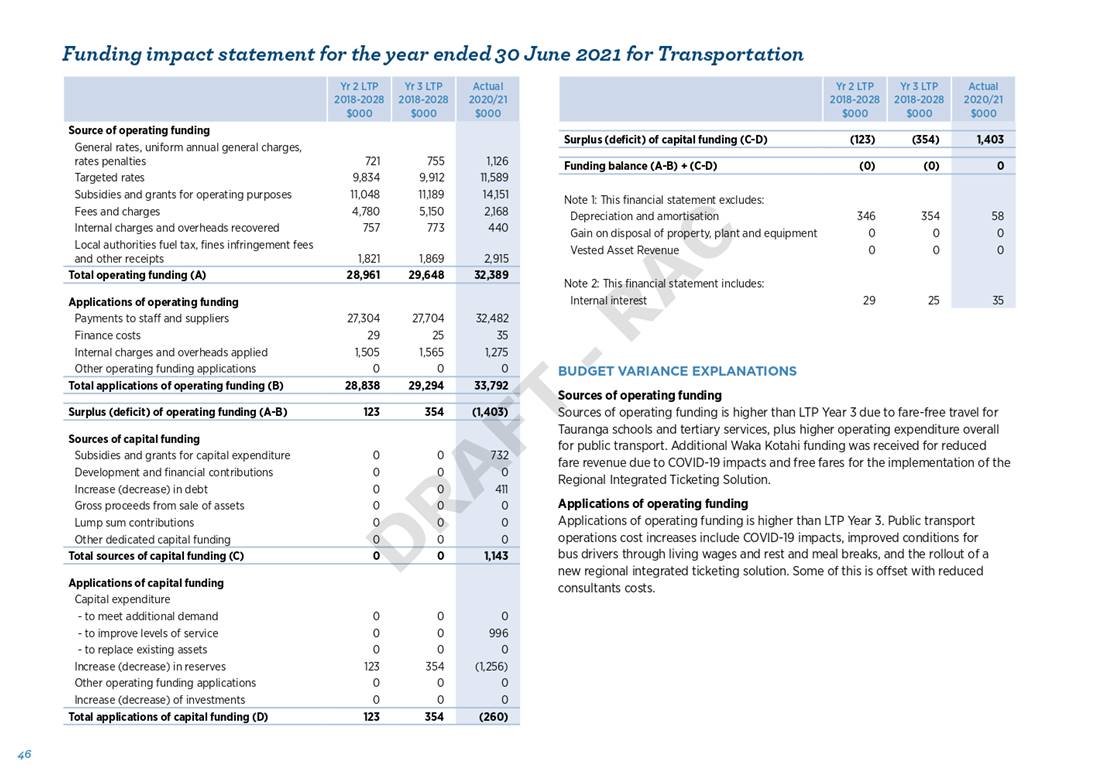

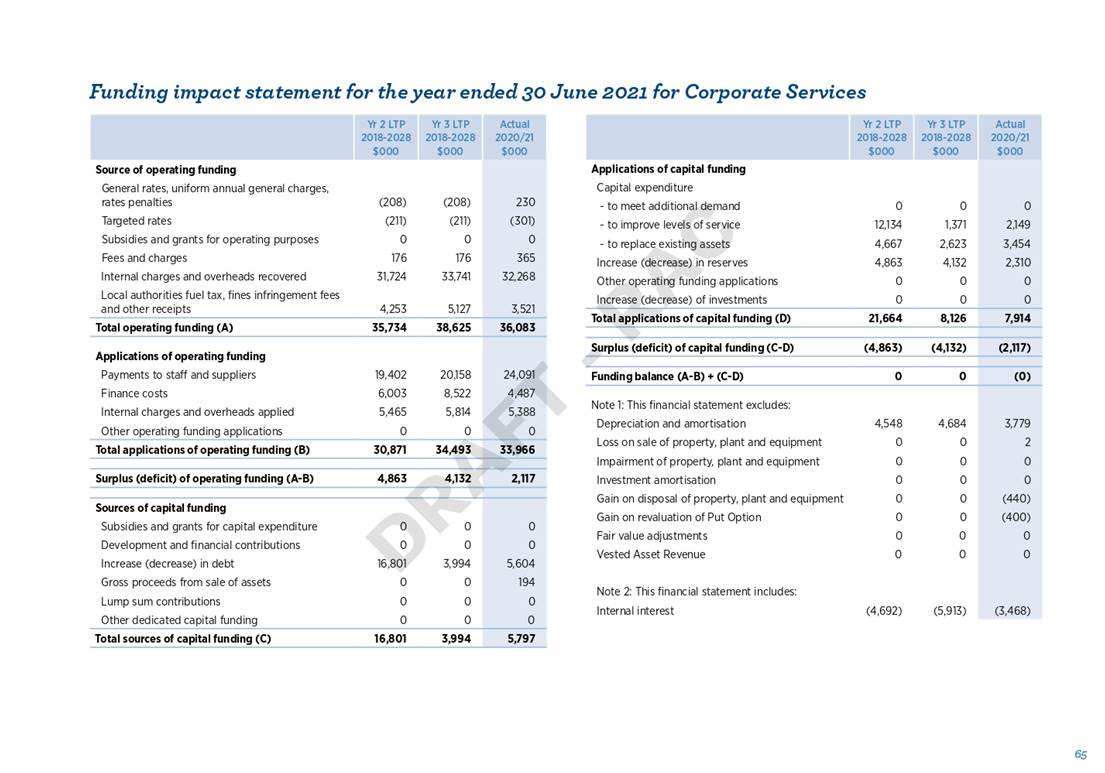

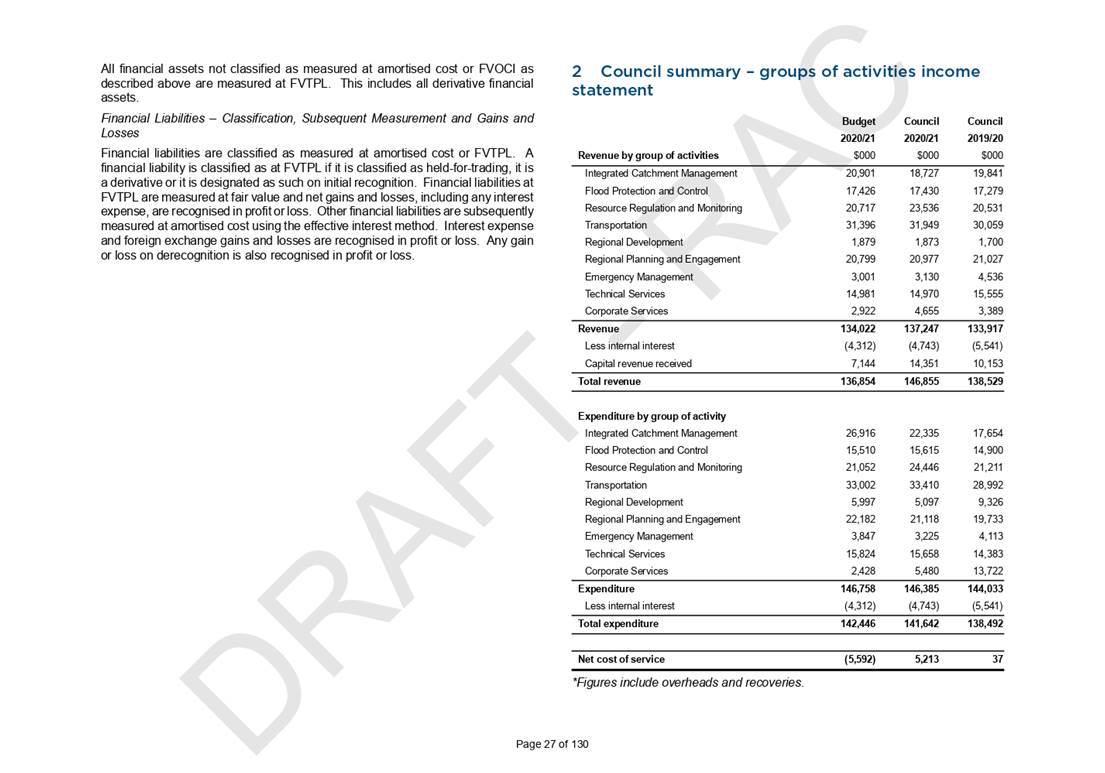

2.2 Financial Performance

Summary 2020/21

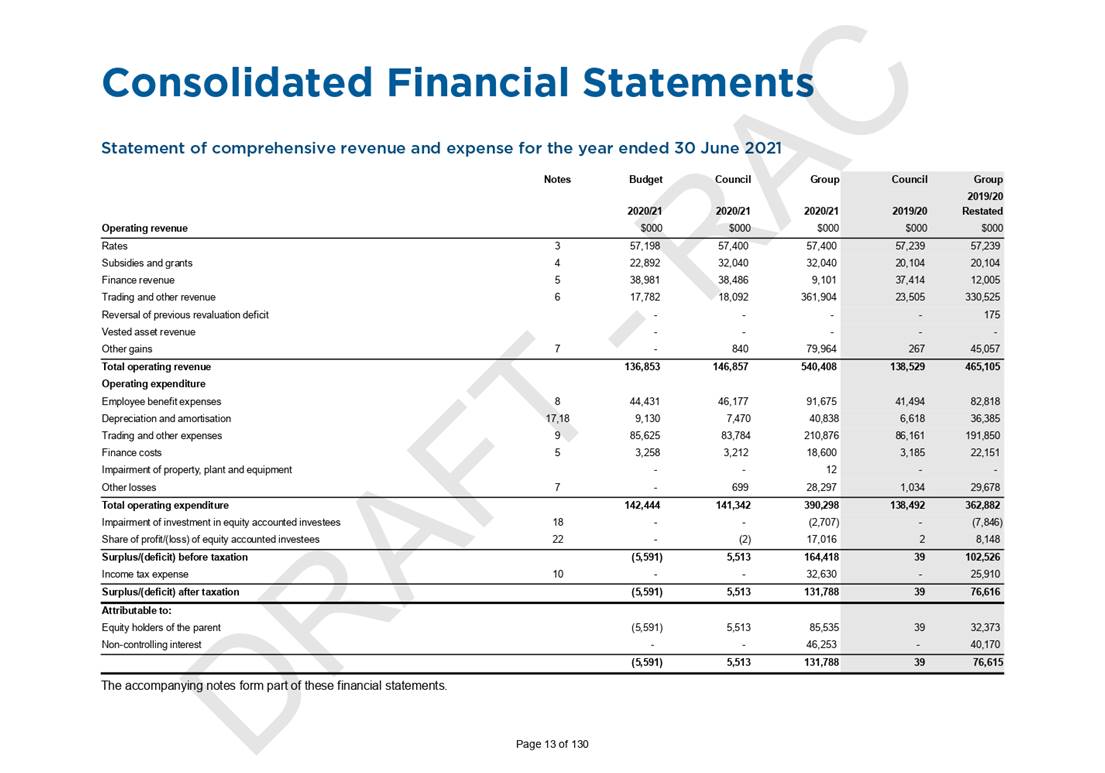

Council’s draft operating surplus

for year three of the Long Term Plan 2018-2028 is $5.5 million which is $11.1

million higher than the budgeted deficit of $5.6 million.

Council delivered its work

programme through operating expenditure of $141.3 million (2020: $138.5

million) compared to a budget of $142.4 million; this is $1.1 million lower

than budget. Total operating revenue is $146.8 million, this is $10.0 million higher

than budget of $136.8 million (2020: $138.5 million).

Council delivered a significant

capital works programme with expenditure of $27.6 million (2020: $36.4 million)

compared to a budget of $51.5 million; this is $24 million lower than

budget partly due to the impacts of Covid-19.

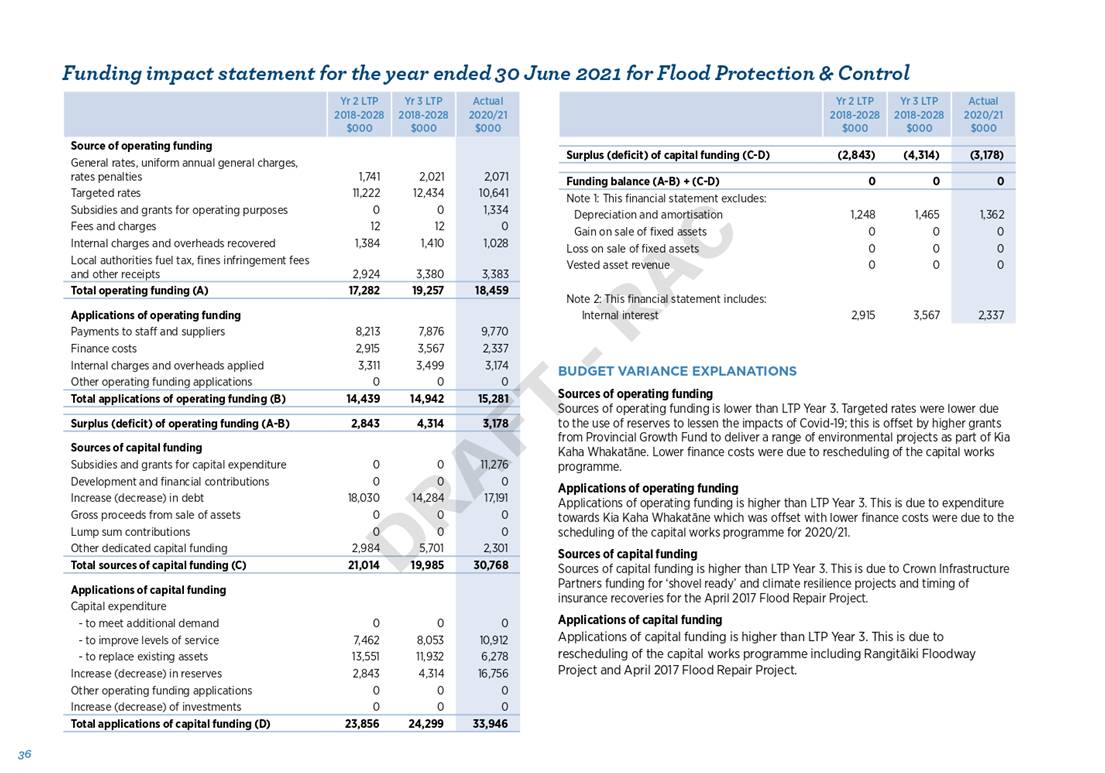

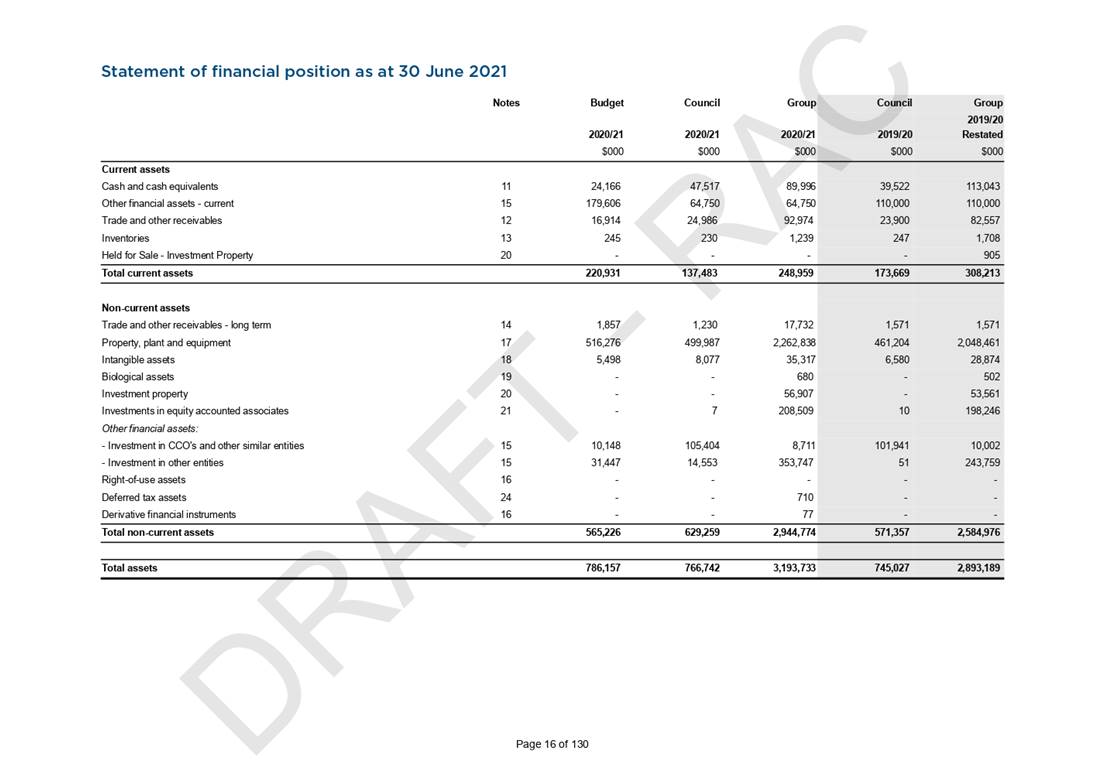

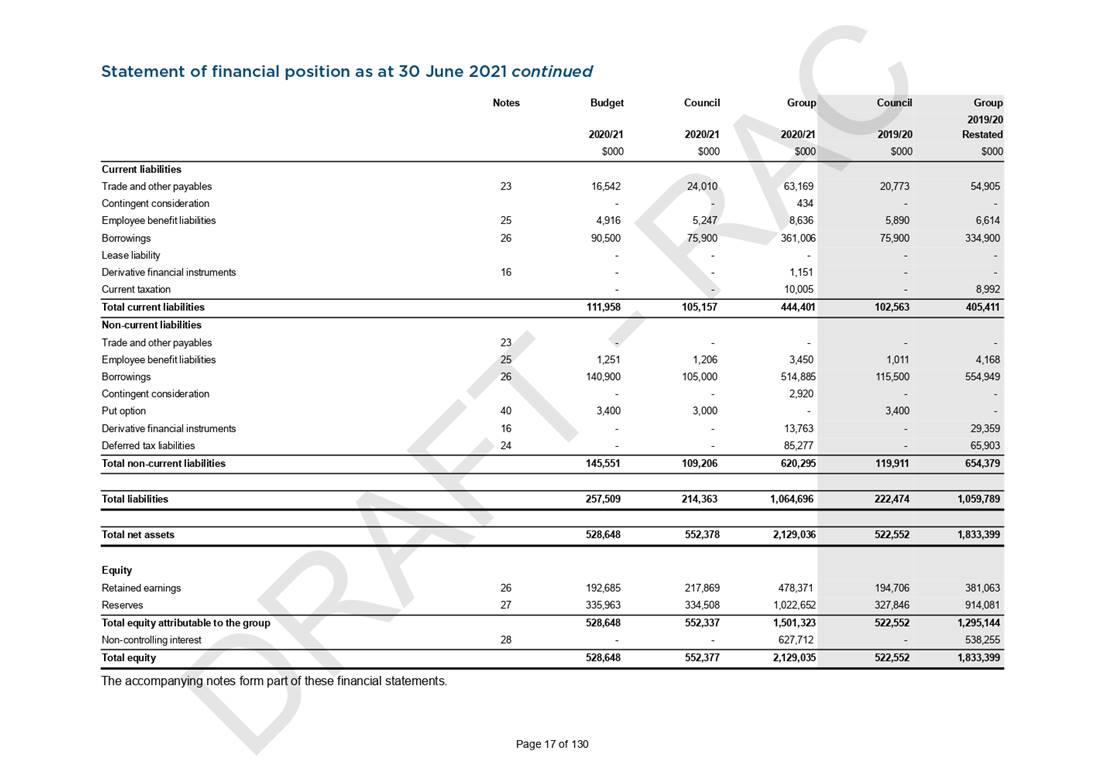

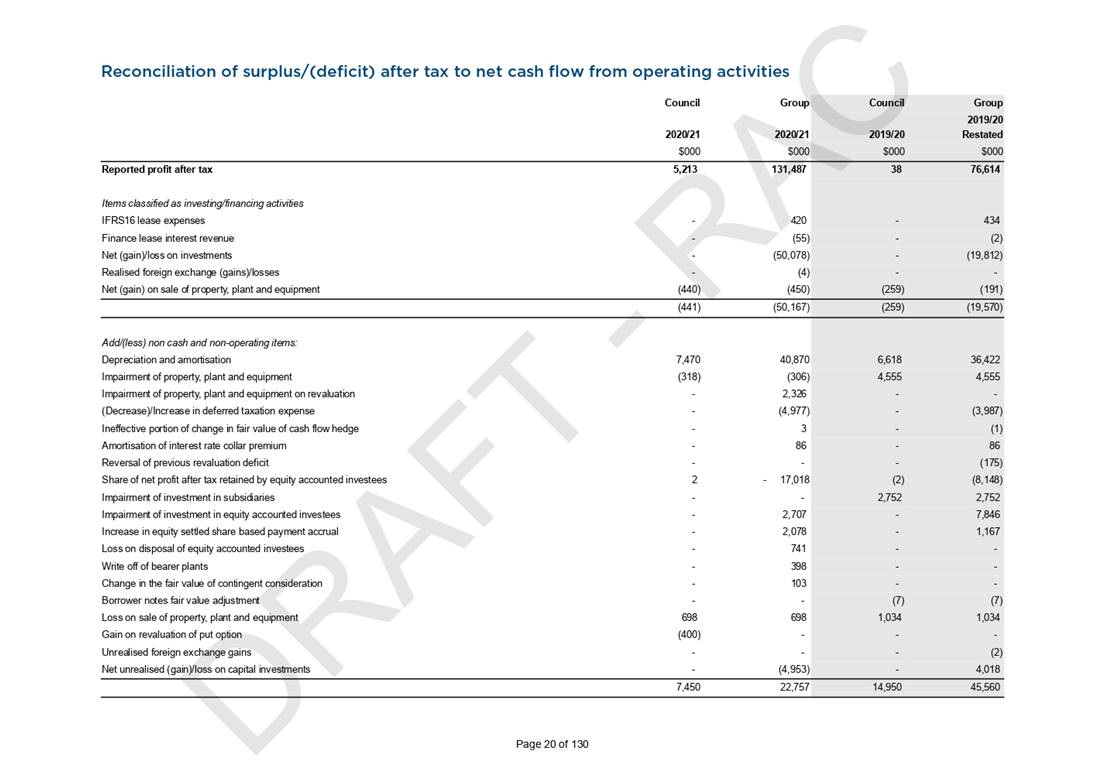

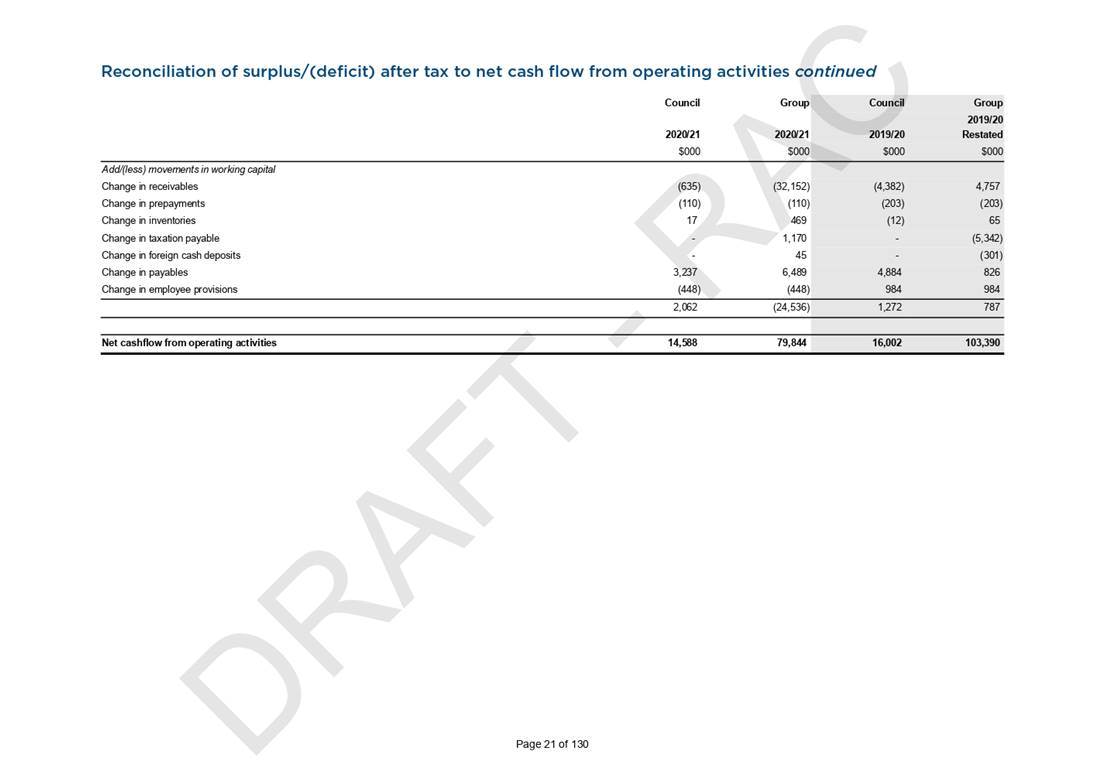

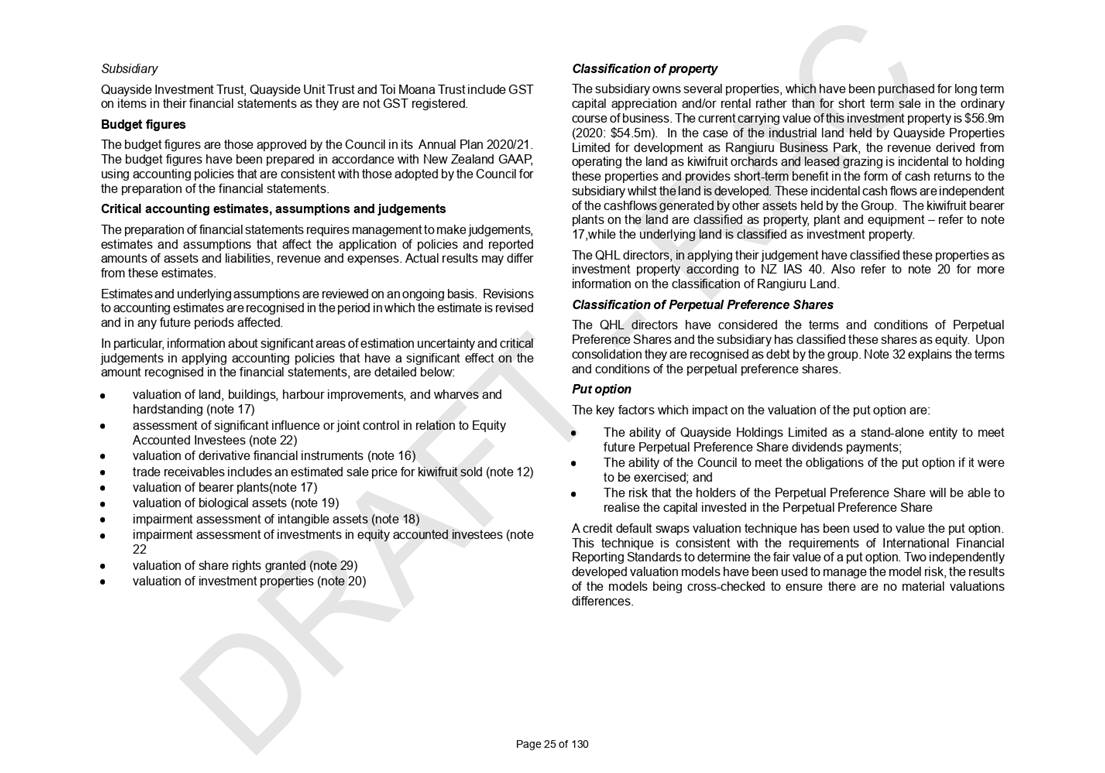

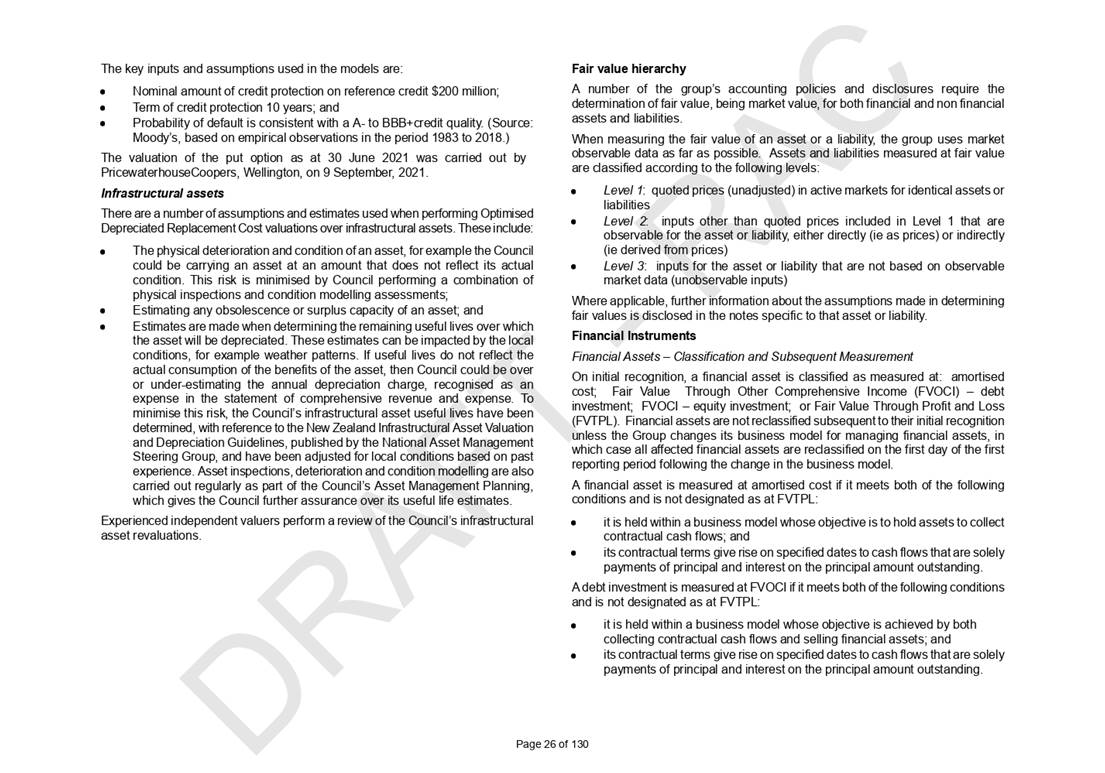

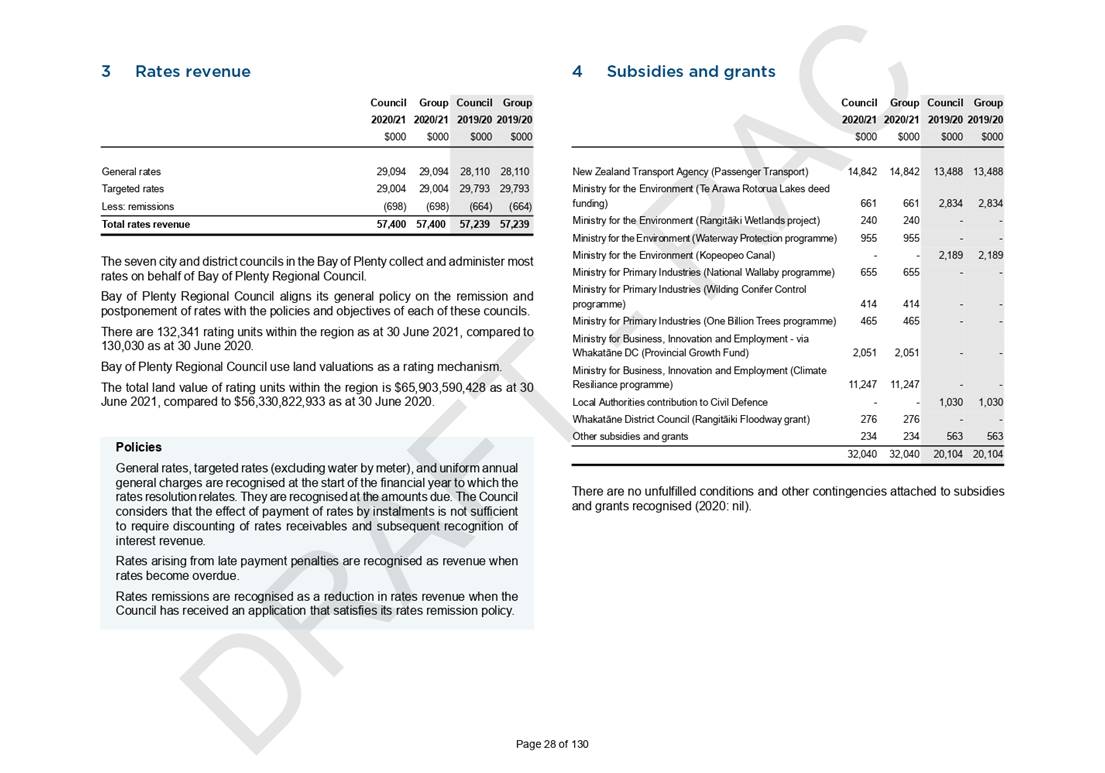

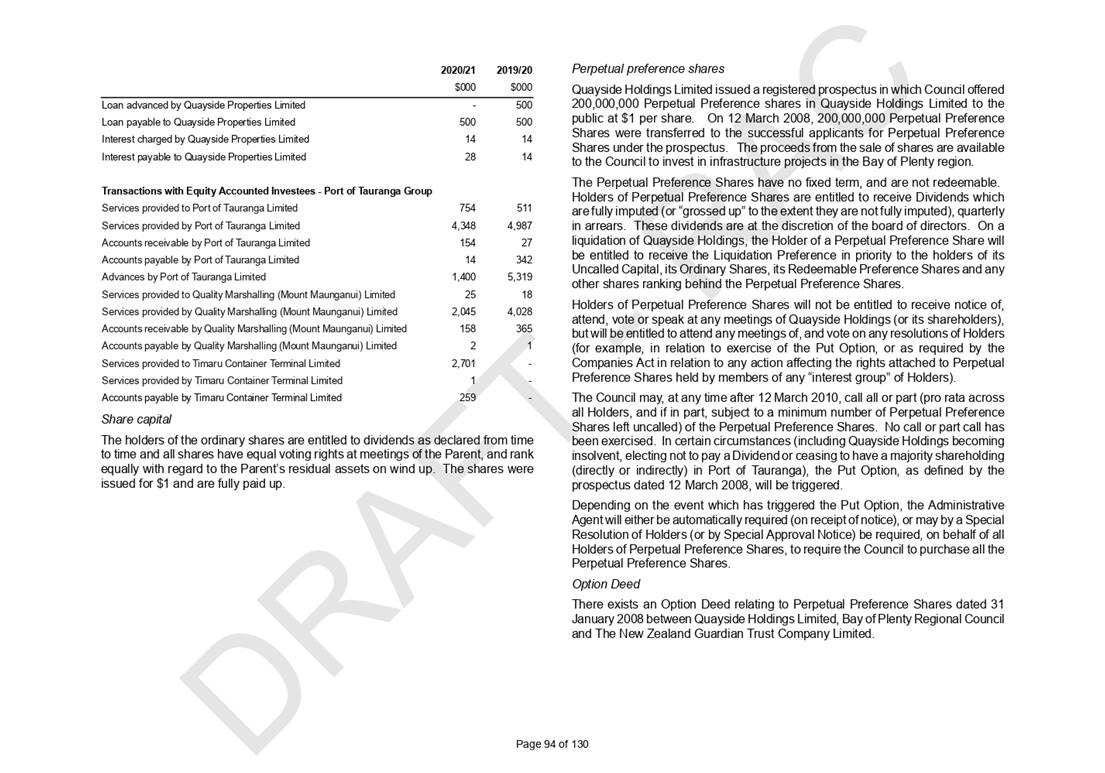

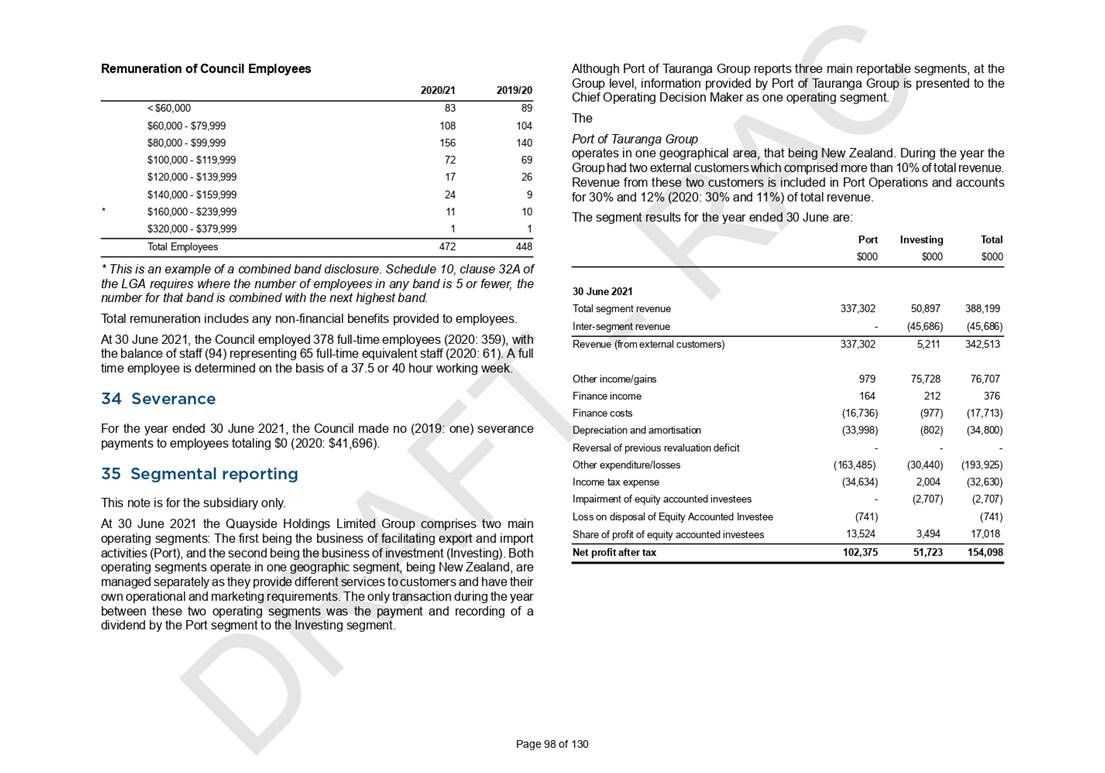

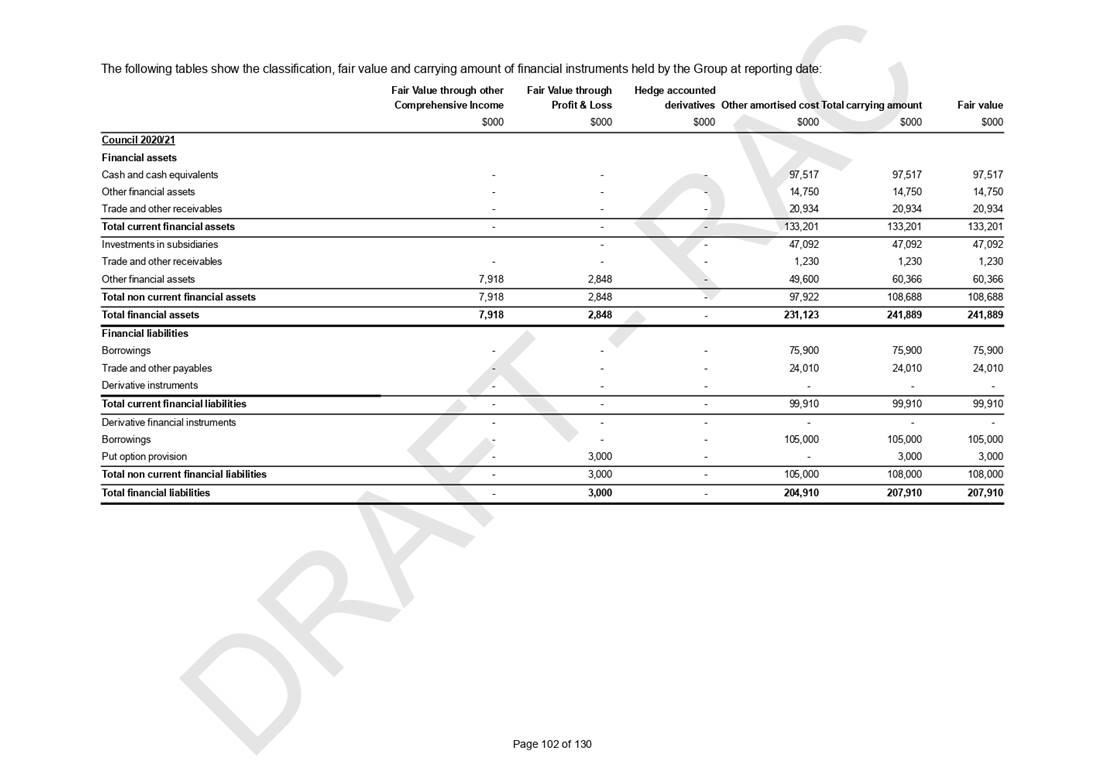

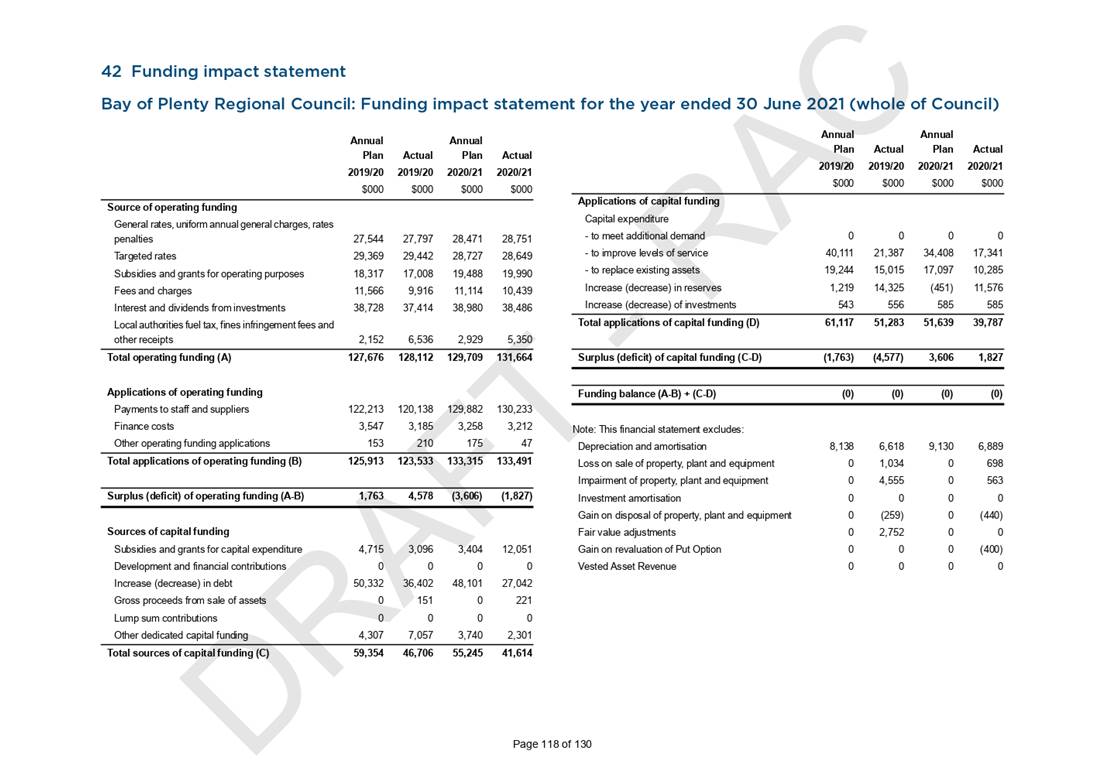

The following table provides a summary of

financial results for the year ended 30 June 2021 as per the Draft Annual

Report 2020/21.

|

Statement of Comprehensive Revenue and

Expense

|

Annual Plan

|

Council

|

Budget v

Actual Variance

|

Group

|

|

2020/21

|

2020/21

|

2020/21

|

2020/21

|

|

$000

|

$000

|

$000

|

$000

|

|

Operating Revenue

|

129,709

|

132,506

|

2,797

|

|

|

Capital Revenue

|

7,144

|

14,351

|

7,207

|

|

|

Total Operating

Revenue

|

136,853

|

146,857

|

10,004

higher

|

540,408

|

|

Total Operating

Expenditure

|

(142,444)

|

(141,342)

|

1,102

lower

|

(390,298)

|

|

Equity Accounted

Investees

|

0

|

2

|

2

|

(14,309)

|

|

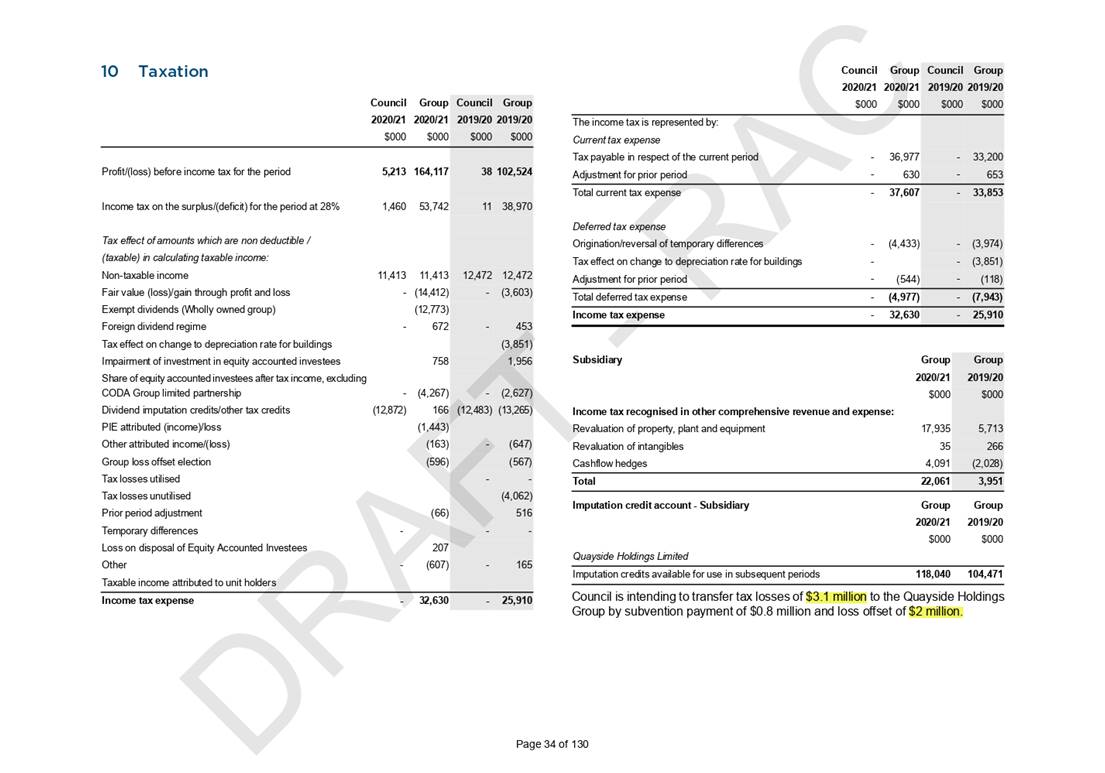

Income Tax

|

|

|

|

(32,630)

|

|

Total Surplus /

(Deficit) After Tax

|

(5,591)

|

5,513

|

11,104

higher

|

131,788

|

|

Equity Holders of

Parent

|

5,591

|

(5,513)

|

|

85,535

|

|

Non-Controlling

Interest

|

|

|

|

46,253

|

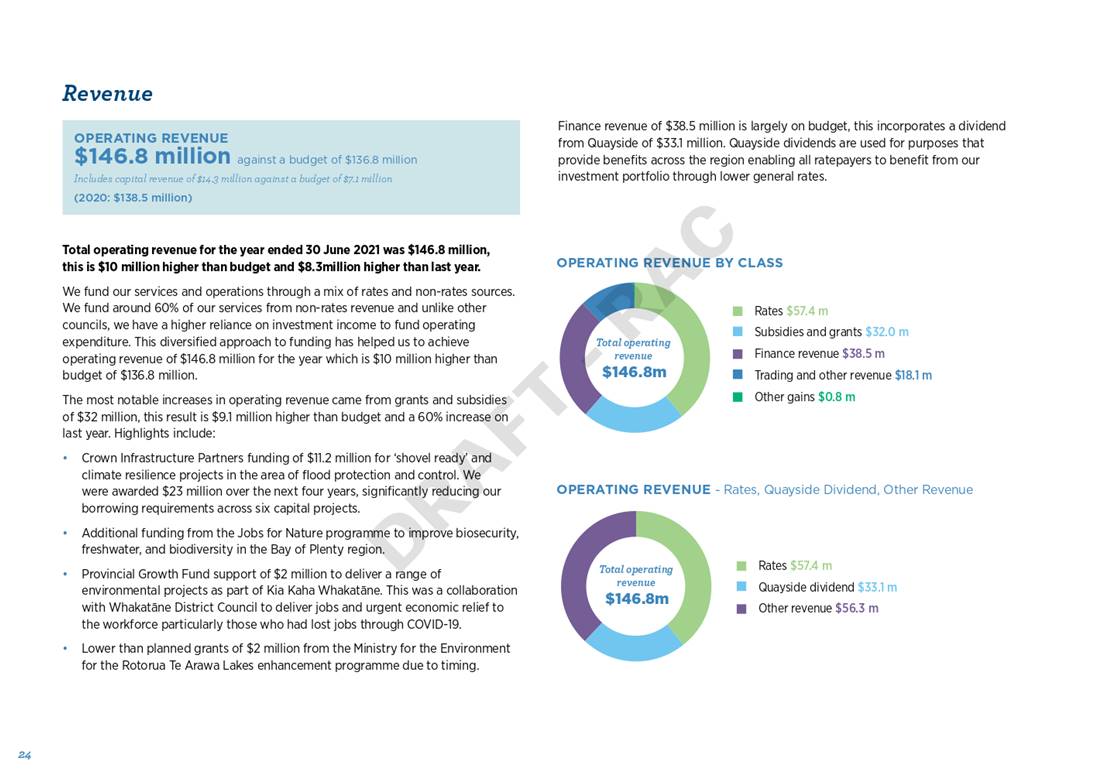

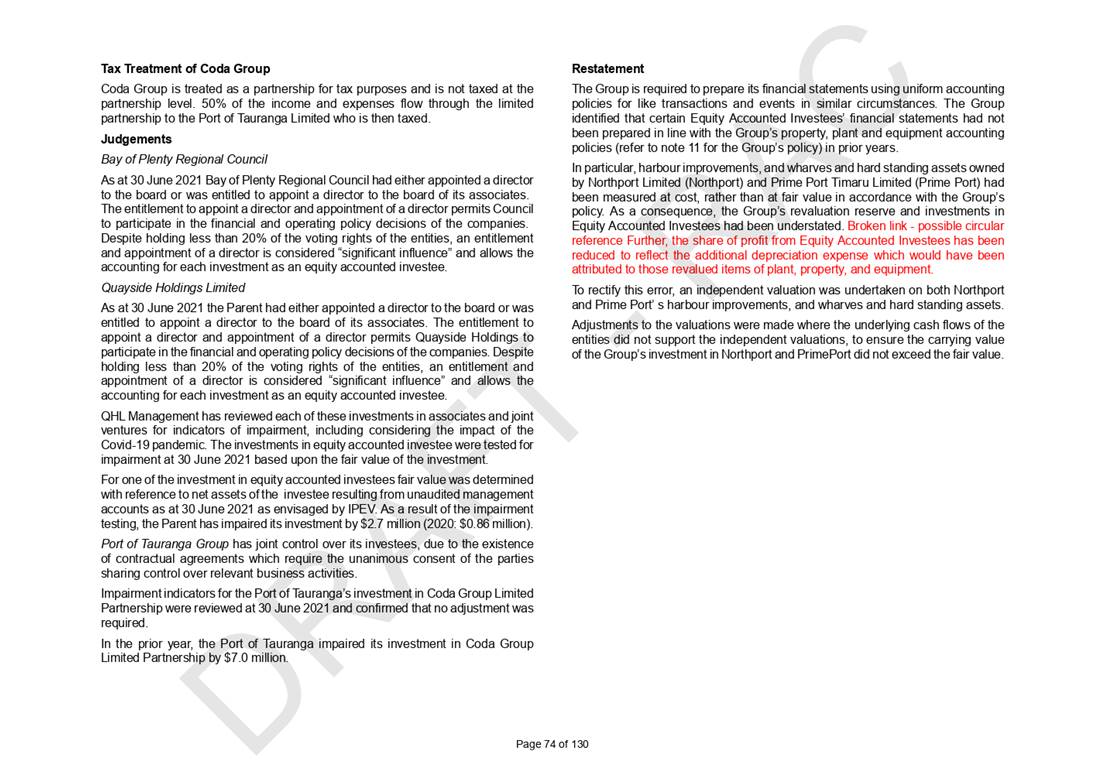

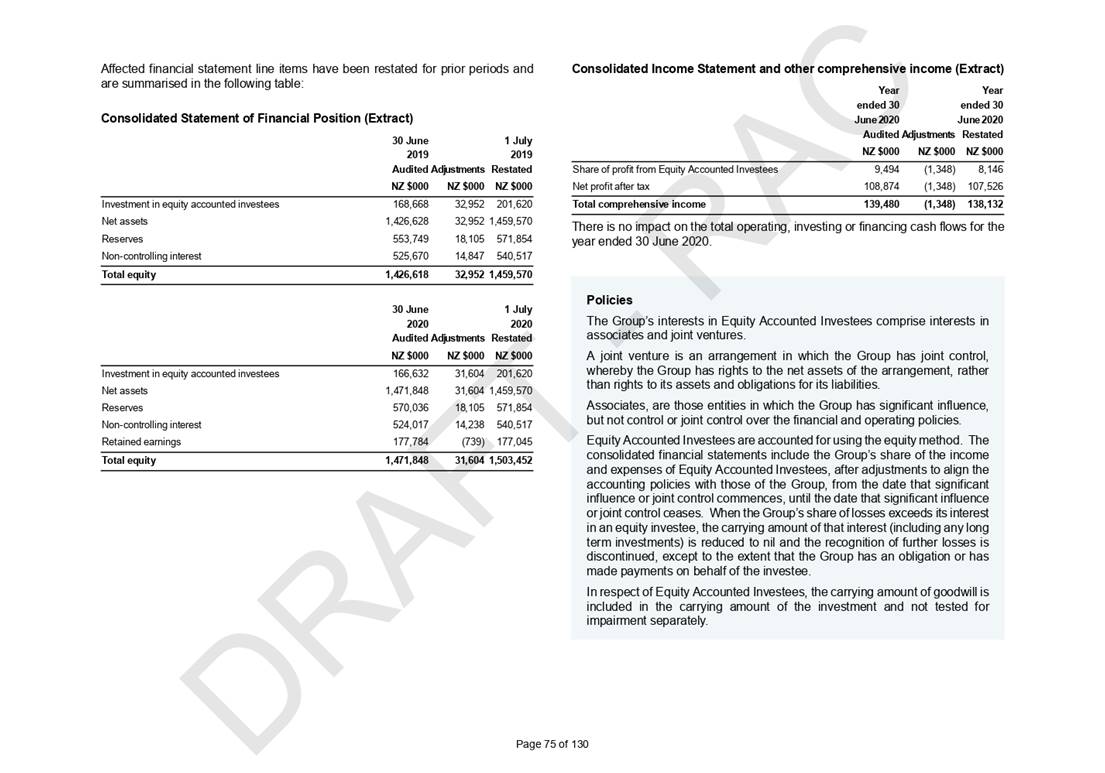

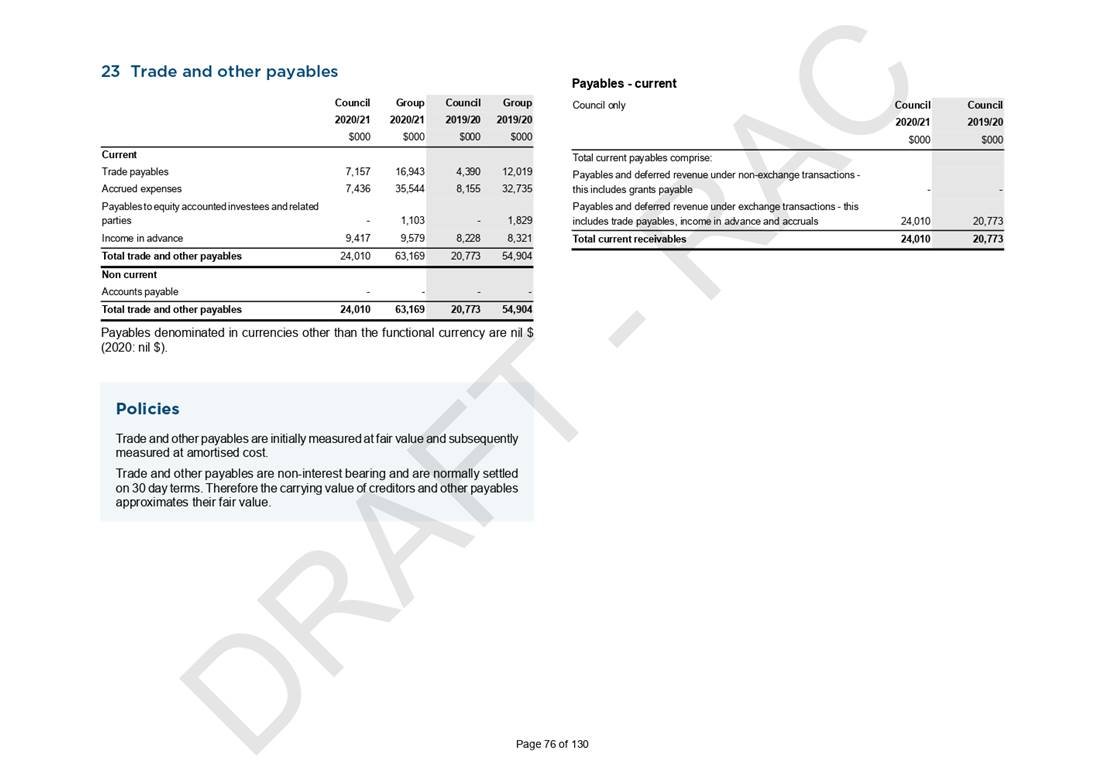

2.2.1 Operating Revenue

Draft operating

revenue for the year ended 30 June 2021 was $146.8 million, this is $10.0

million higher than budget of $136.8 million, and $8.3 million higher

than last year (2020: $138.5 million). Includes capital revenue of $14.3

million against a budget of $7.1 million. The key reasons for the variances are

identified as follows:

Subsidies

and grants: The most notable increases in operating

revenue came from grants and subsidies of $32 million, this result is $9.1

million higher than budget and a 60% increase on last year. Highlights include:

· Crown Infrastructure Partners funding of $11.2 million for

‘shovel ready’ and climate resilience projects in the area of flood

protection and control. We were awarded $23 million over the next four years,

significantly reducing our borrowing requirements across six capital projects.

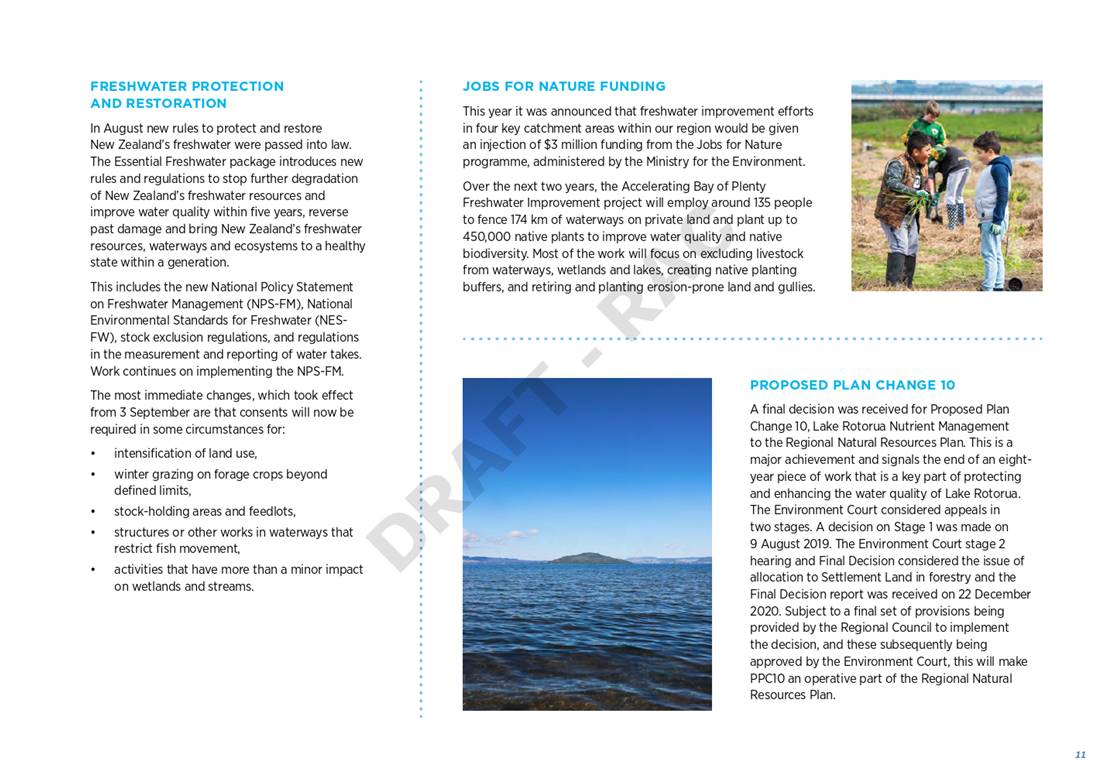

· Additional funding from the Jobs for Nature programme to improve

biosecurity, freshwater, and biodiversity in the Bay of Plenty region.

· Lower than planned grants of $2 million from the Ministry for the

Environment for the Rotorua Te Arawa Lakes enhancement programme.

Finance

revenue: Corporate finance revenue of $38.5 million

is largely on budget, this incorporates a dividend from Quayside of $33.1

million. Toi Moana Trust paid a distribution of $2.25 million meeting its target

for 2020/21. The unfavourable variance comprises $0.5 million lower than

planned interest revenue off cash and other financial assets.

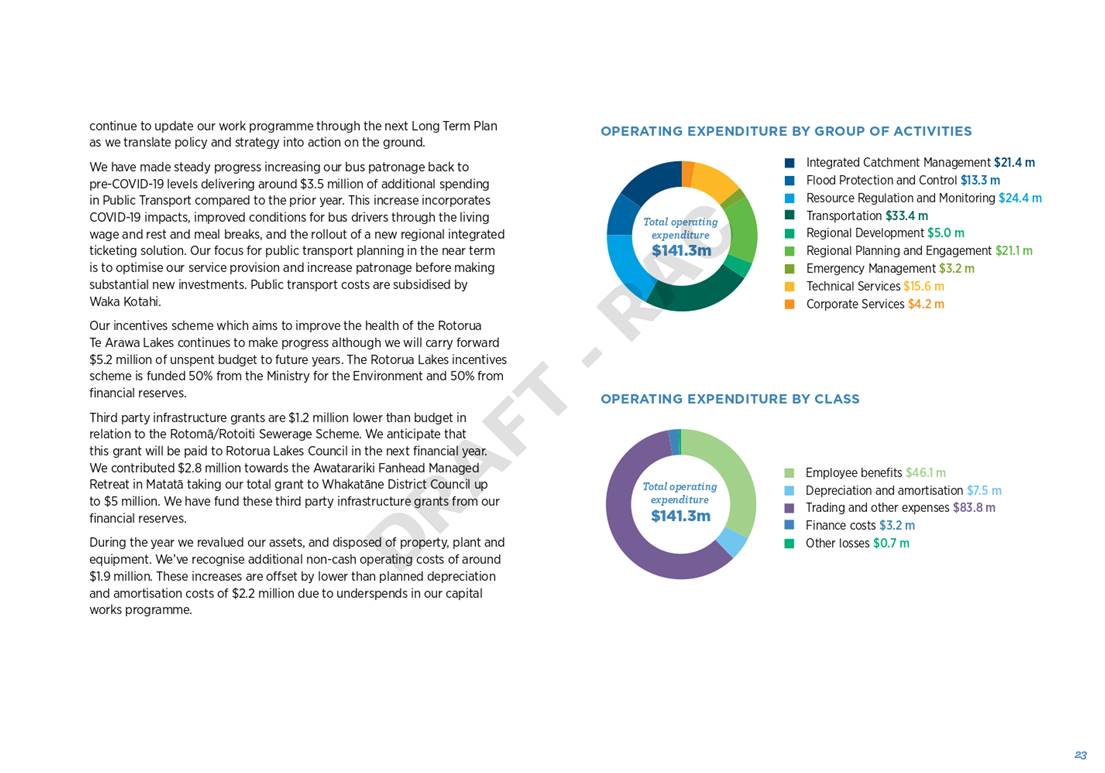

2.2.2 Operating Expenditure

Draft operating

expenditure for the year ended 30 June 2021 was $141.3 million, this is $1.1

million lower than budget of $142.4 million, and $2.8 million higher

than last year (2020: $138.5 million). The key reasons for the variances are

identified below:

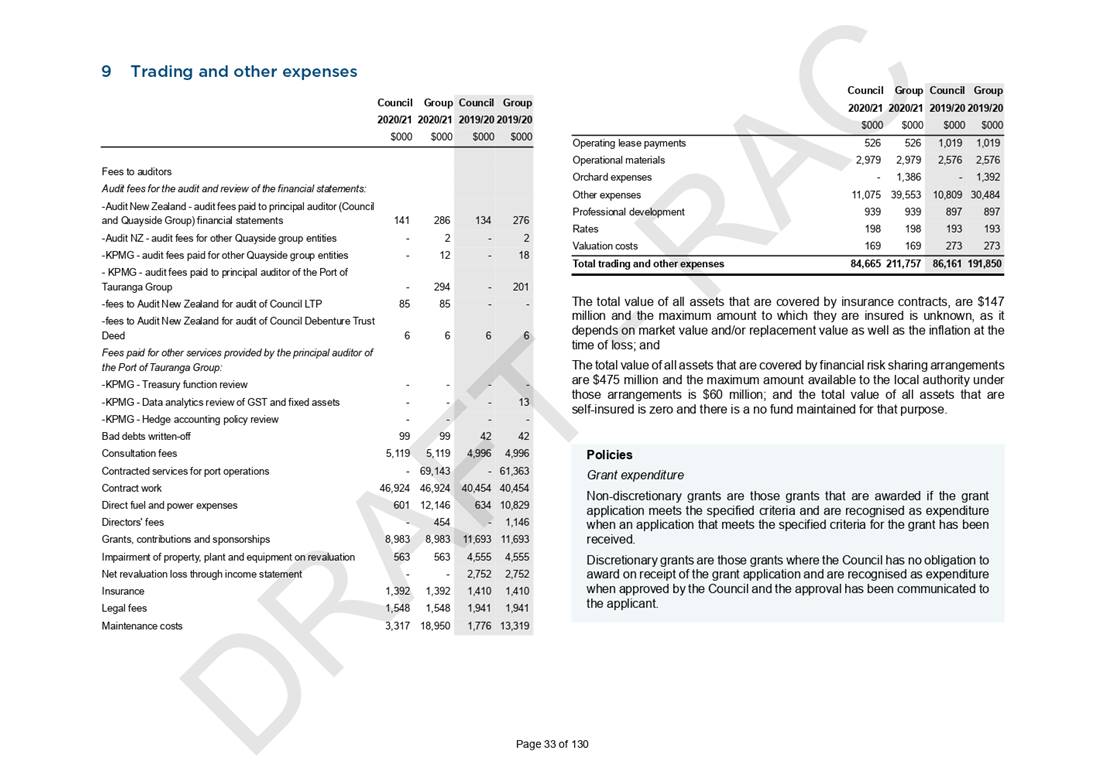

Trading and

other expenses: Trading and other expenses is $83.8

million which is $1.8 million lower than budget. The key reasons for the

variances are identified below:

· We invested a further $4.5 million to improve biosecurity,

freshwater, and biodiversity in the region. This increase has been driven by

successful funding bids to central government’s Jobs for Nature

programme.

· We also experienced higher than planned levels of engagement from

landowners to access our Environmental Programmes which provide grants and

subsidies for biodiversity and sustainable land management activities.

· During the year we revalued our assets. We’ve recognised

additional non-cash operating costs of around $0.6 million in relation to

Regional Parks.

· We have grown our capacity and capability to implement central

government direction on freshwater, and to build thriving partnerships with

tangata whenua. Regional planning and Māori policy costs were around $1.5

million lower than plan.

· Consenting and environmental enforcement has contributed to

increased costs of $1.4 million.

· Public Transport operations cost increases include $0.5 million due

to COVID-19 impacts, improved conditions for bus drivers through living wages

and rest and meal breaks, and the rollout of a new regional integrated

ticketing solution. Some of this is offset with reduced consultant’s

costs.

· Our incentives scheme which aims to improve the health of the

Rotorua Te Arawa Lakes continues to make progress although we will carry

forward $5.2 million of unspent budget to future years.

· Third party infrastructure grants are $1.2 million lower than

budget in relation to the Rotomā/Rotoiti Sewerage Scheme. We anticipate

that this grant will be paid to Rotorua Lakes Council in the next financial

year.

· Emergency Management were $0.5 million lower than budget

primarily due to lower than planned COVID-19 costs.

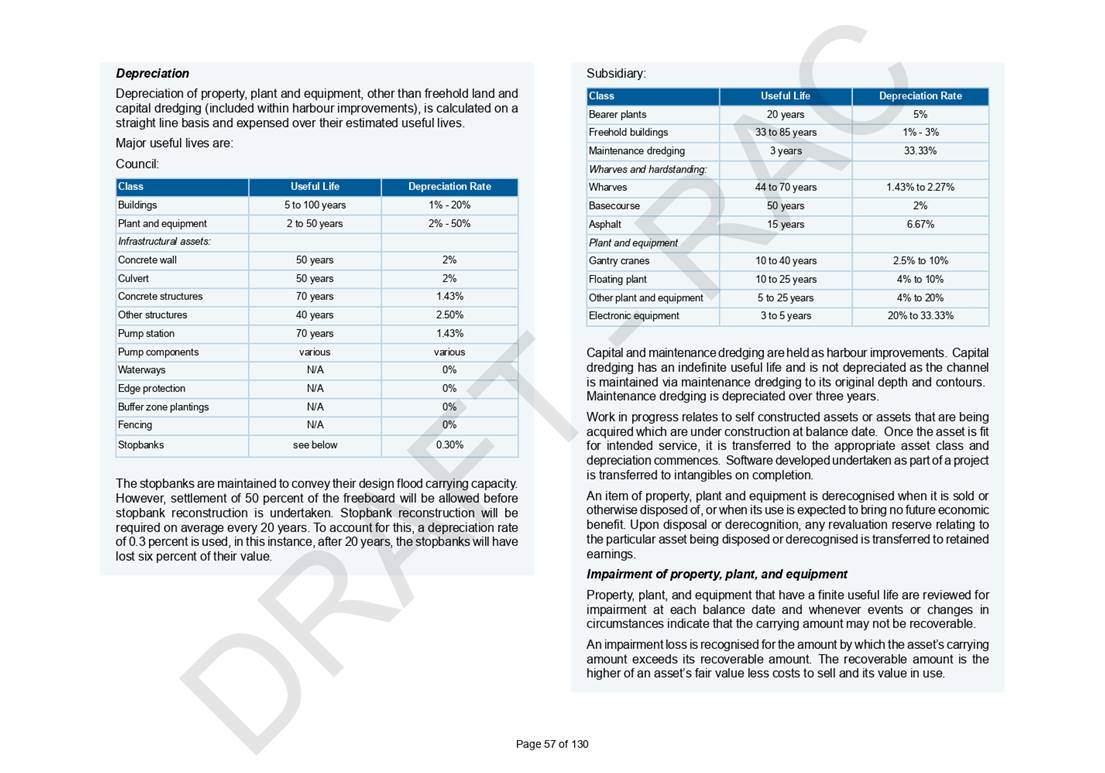

Depreciation

and amortisation: Depreciation and amortisation

expenditure of $7.5 million is $1.7 million lower than planned due to

the timing of capital projects, in particular technical services and technology

projects.

Other losses: Other losses is $0.7 million higher than budget due to the

loss on disposals of property, plant and equipment in relation to the Rotorua

Lakes Programme (floating wetland, Tikitere).

Employee

benefit expenses: Employee benefit expenses is

$46.1 million, this is $1.7 million higher than budget due to increasing

our capacity for example in biosecurity, regulatory compliance, governance,

engineering, and corporate services; adapting our recruitment processes to

market conditions.

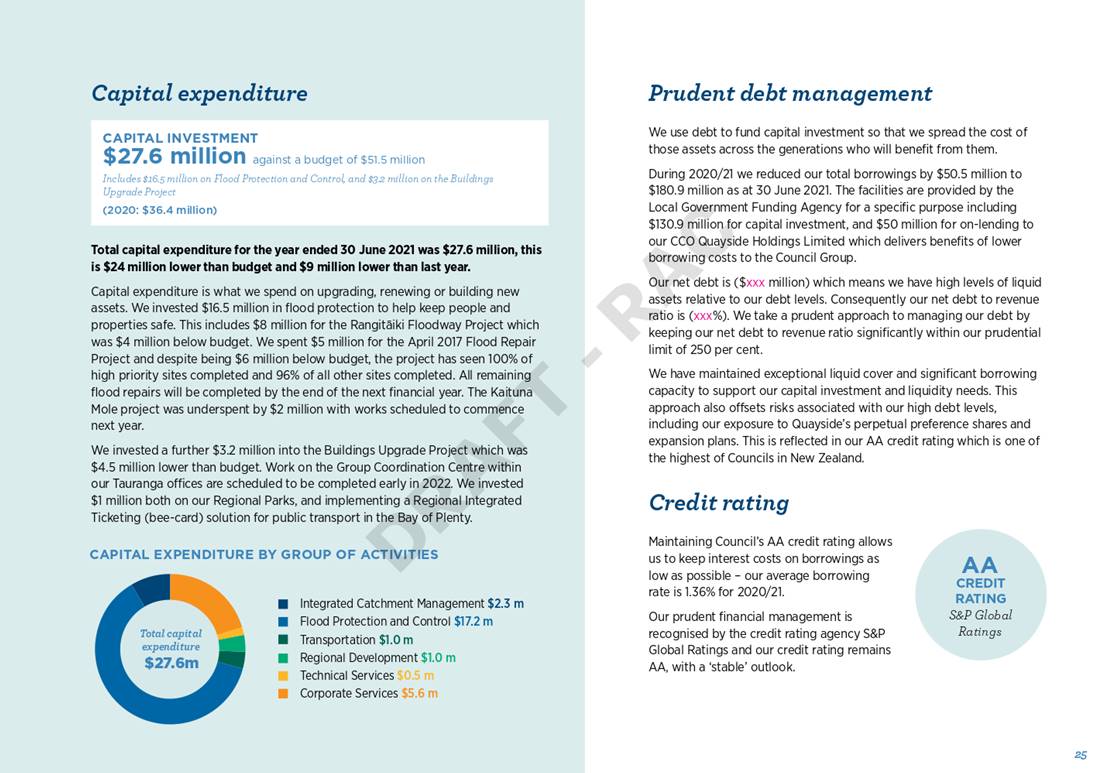

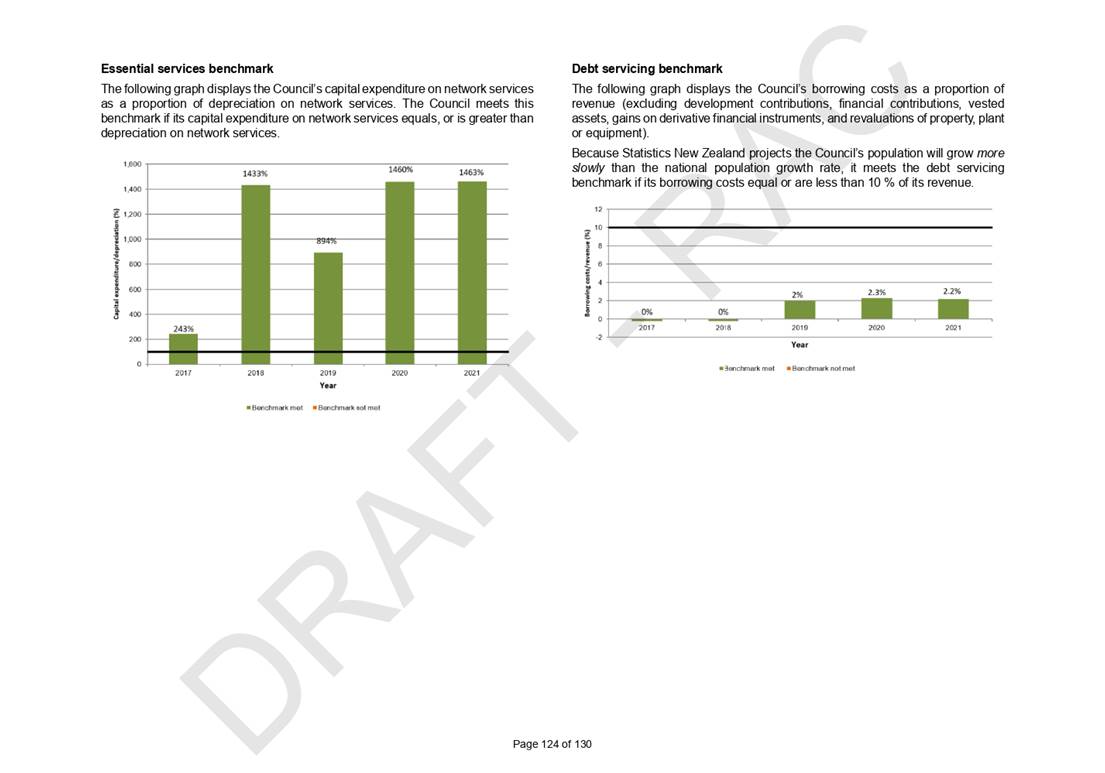

2.2.3 Capital Expenditure

Draft capital

expenditure for the year ended 30 June 2021 was $27.6 million, this is $24

million lower than budget and $9 million lower than last year

(2020: $36.4 million).

We invested

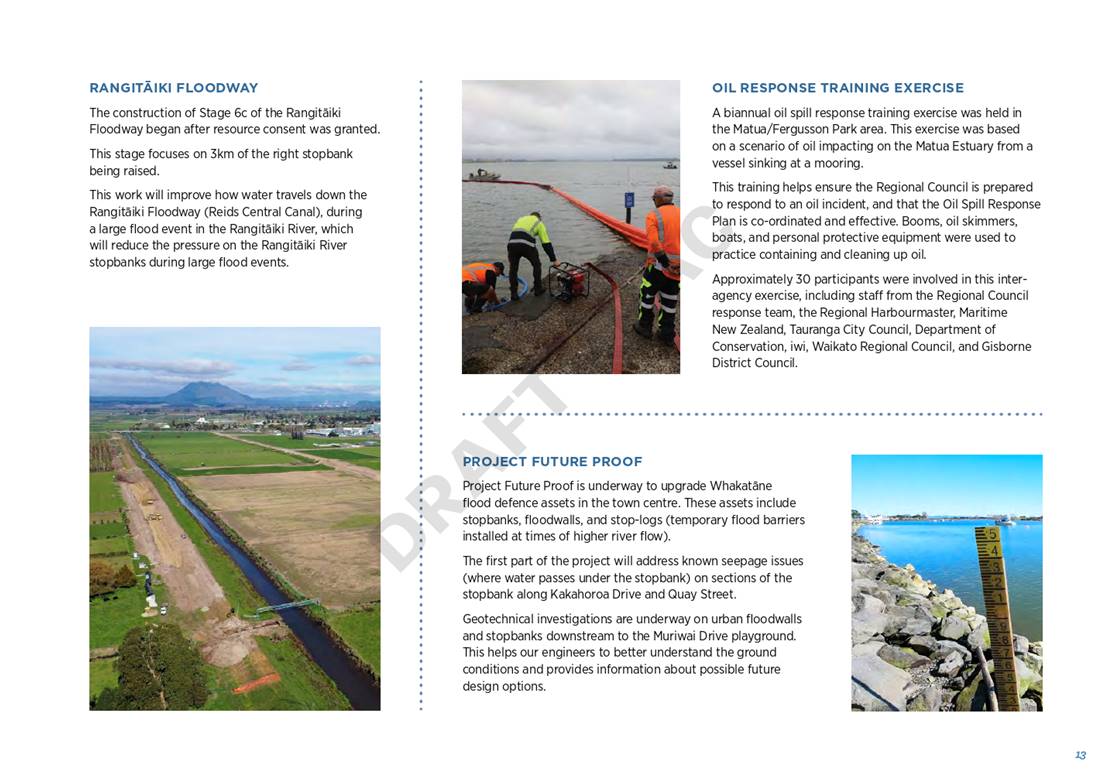

$16.5 million in flood protection to help keep people and properties safe. This

includes $8 million for the Rangitāiki Floodway Project which was $4

million lower than budget.

We spent $5

million for the April 2017 Flood Repair Project and despite being $6 million

below budget, the project has seen 100% of high priority sites completed and

96% of all other sites completed. All remaining flood repairs will be completed

by the end of the next financial year.

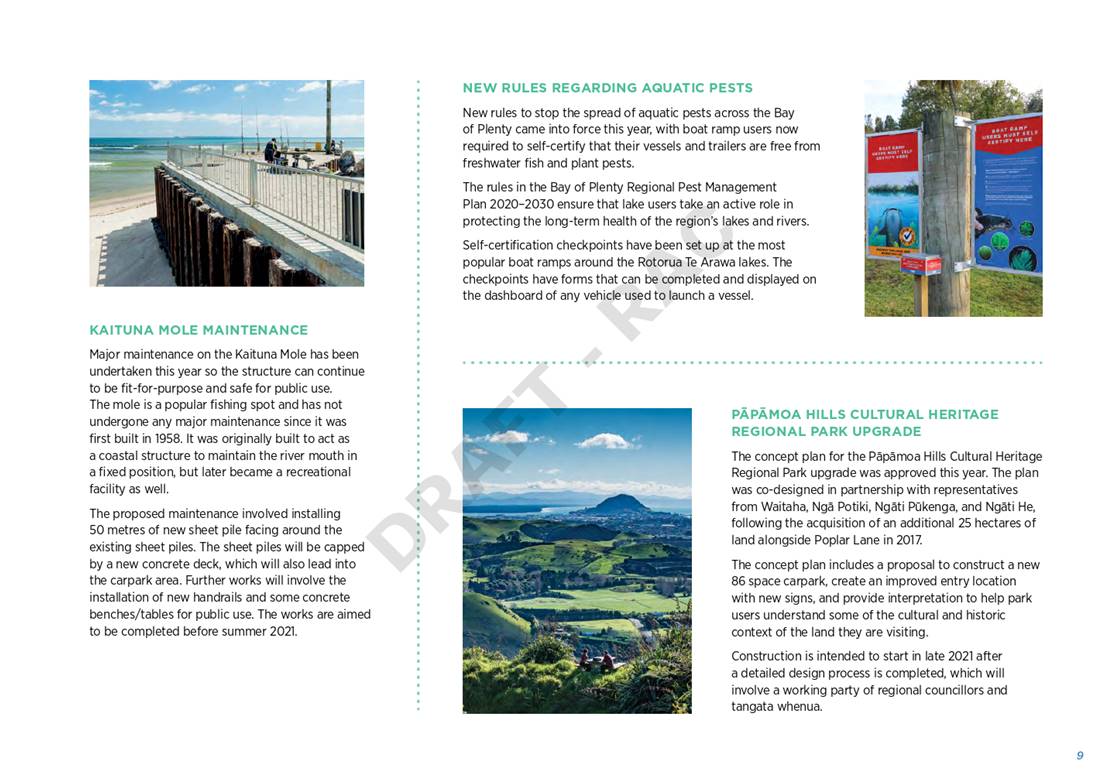

The Kaituna

Mole project was underspent by $2 million with works scheduled to commence next

year.

We invested a

further $3.2 million into the Buildings Upgrade Project which was $4.5 million lower

than budget. Work on the Group Coordination Centre within our Tauranga offices

are scheduled to be completed early in 2022.

We invested $1

million both on our Regional Parks, and implementing a Regional Integrated

Ticketing (bee-card) solution for public transport in the Bay of Plenty.

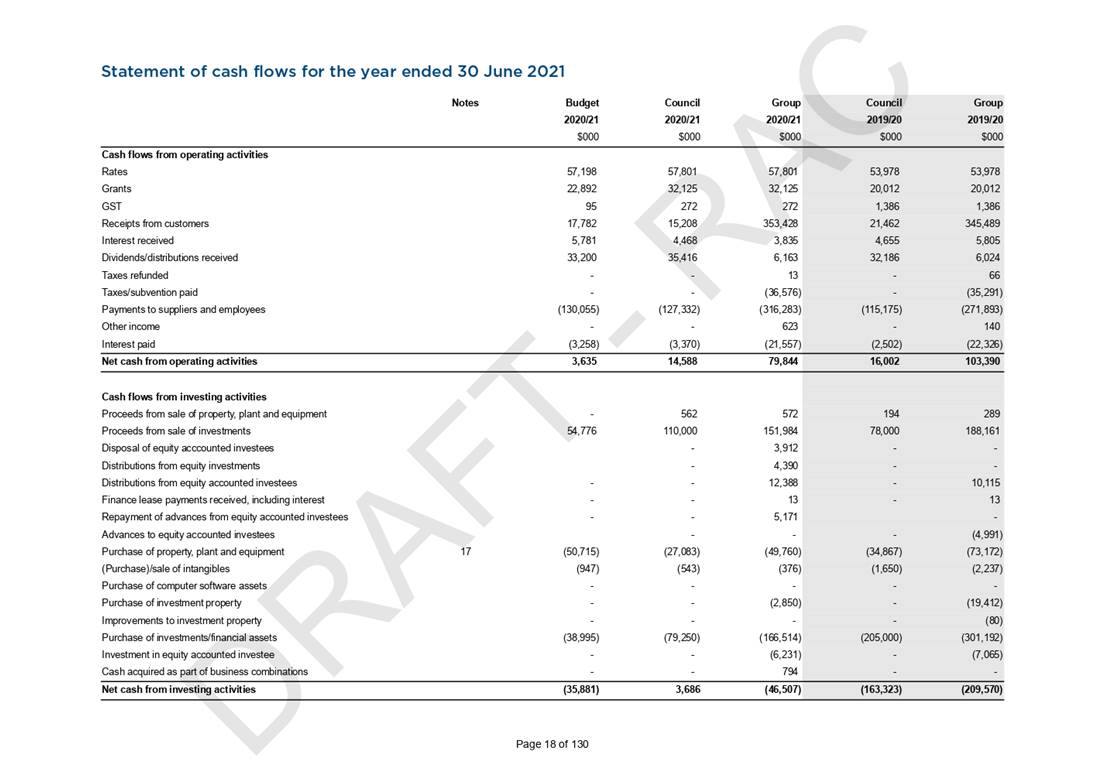

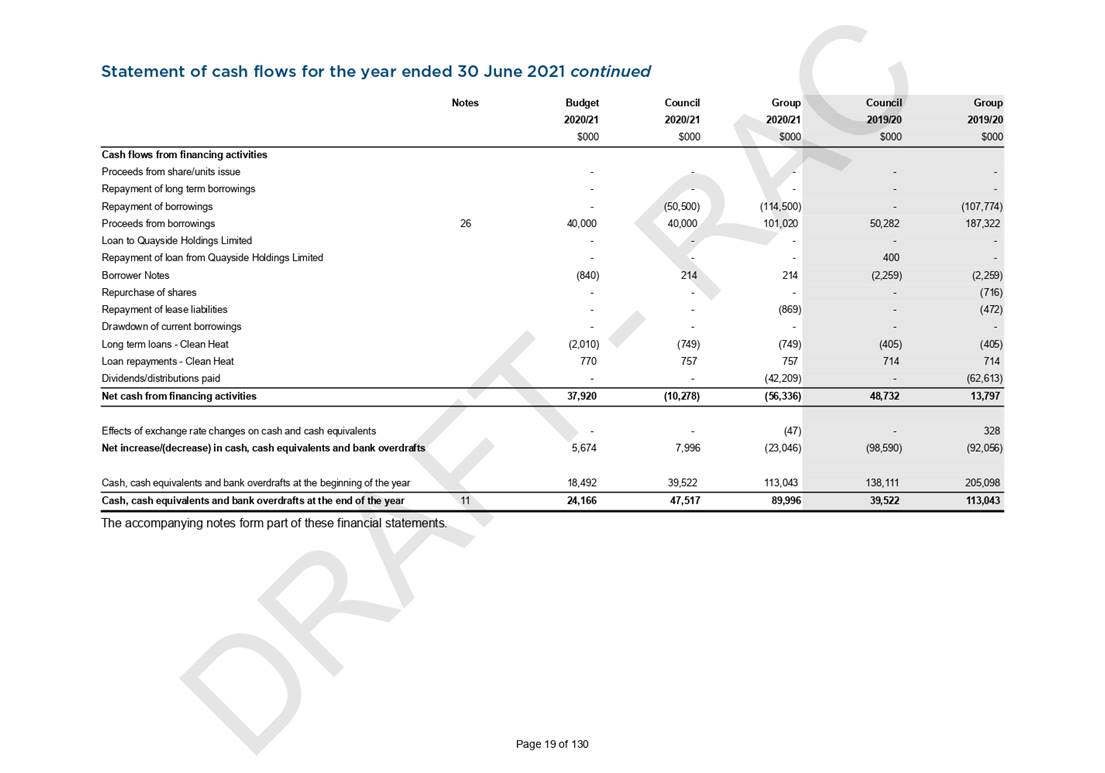

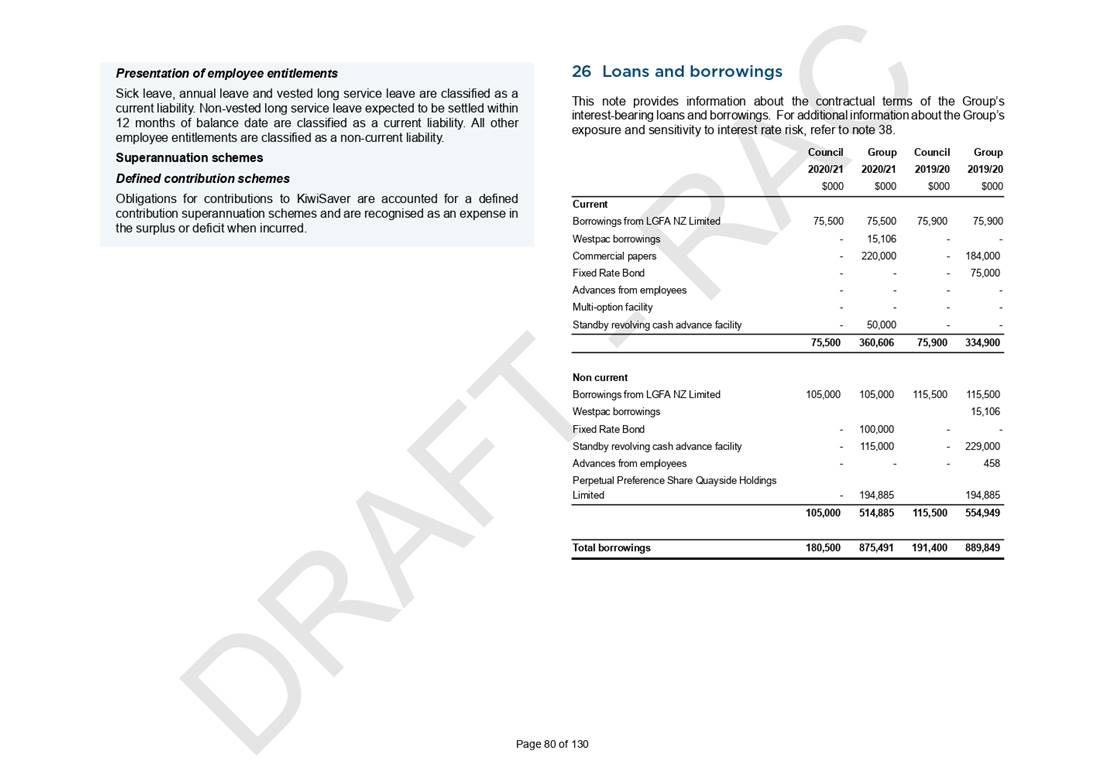

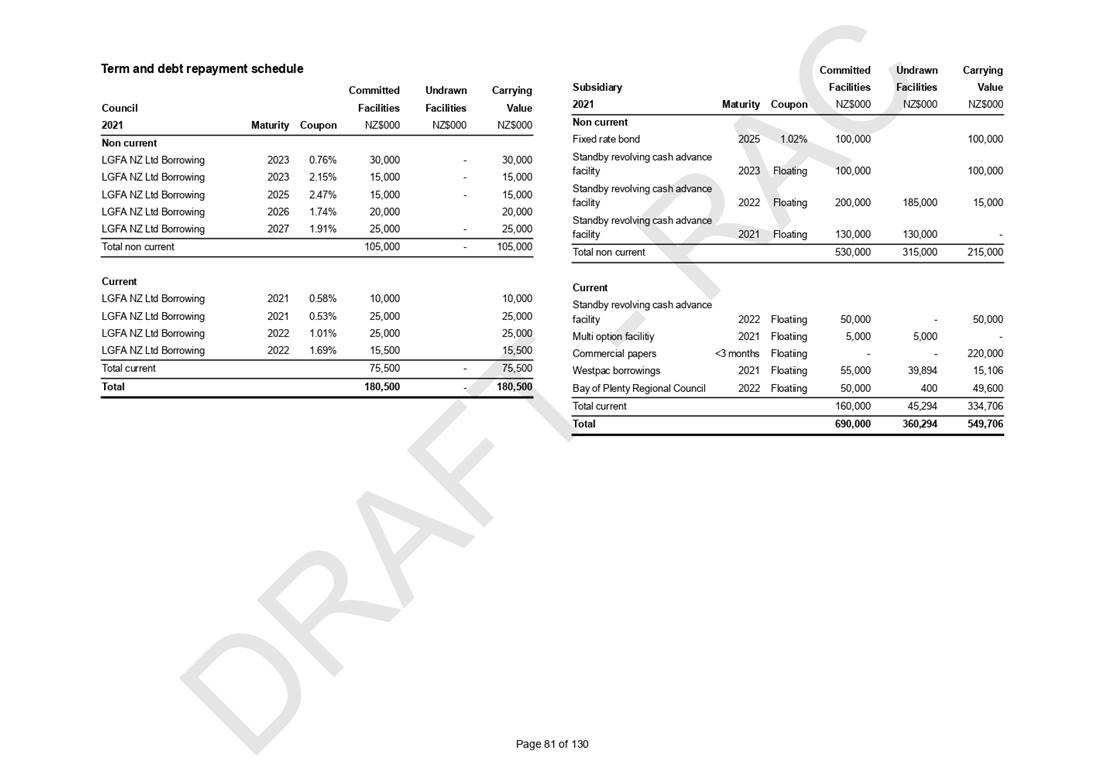

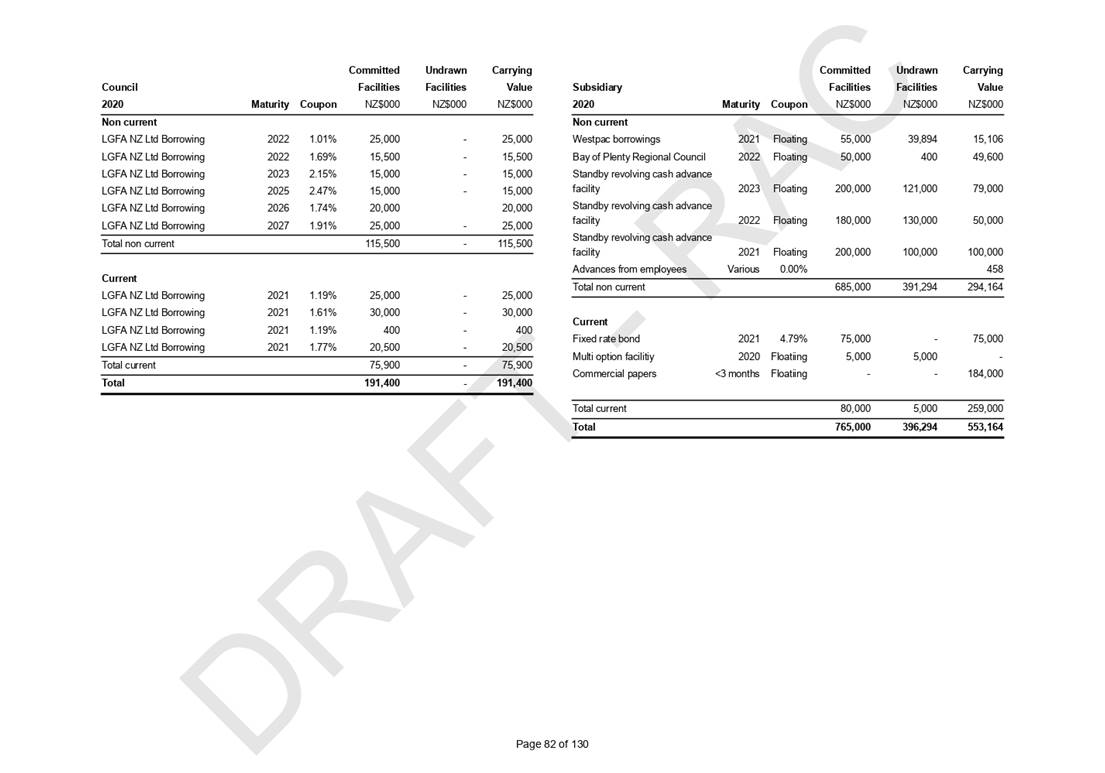

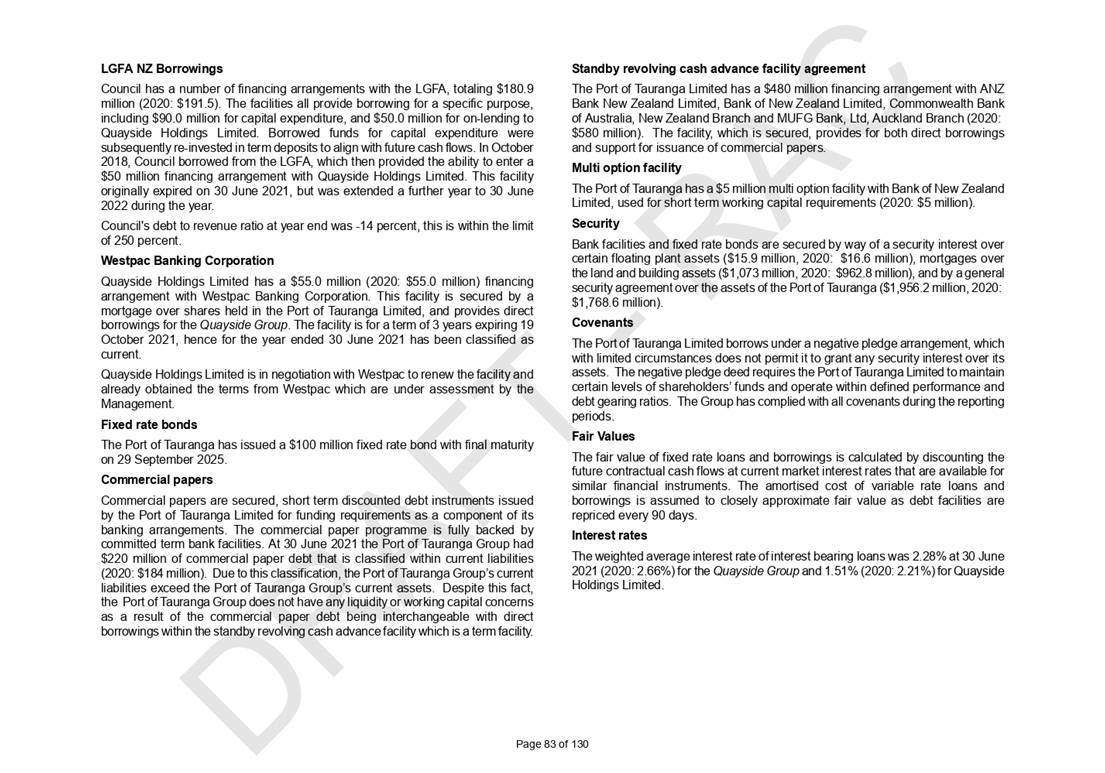

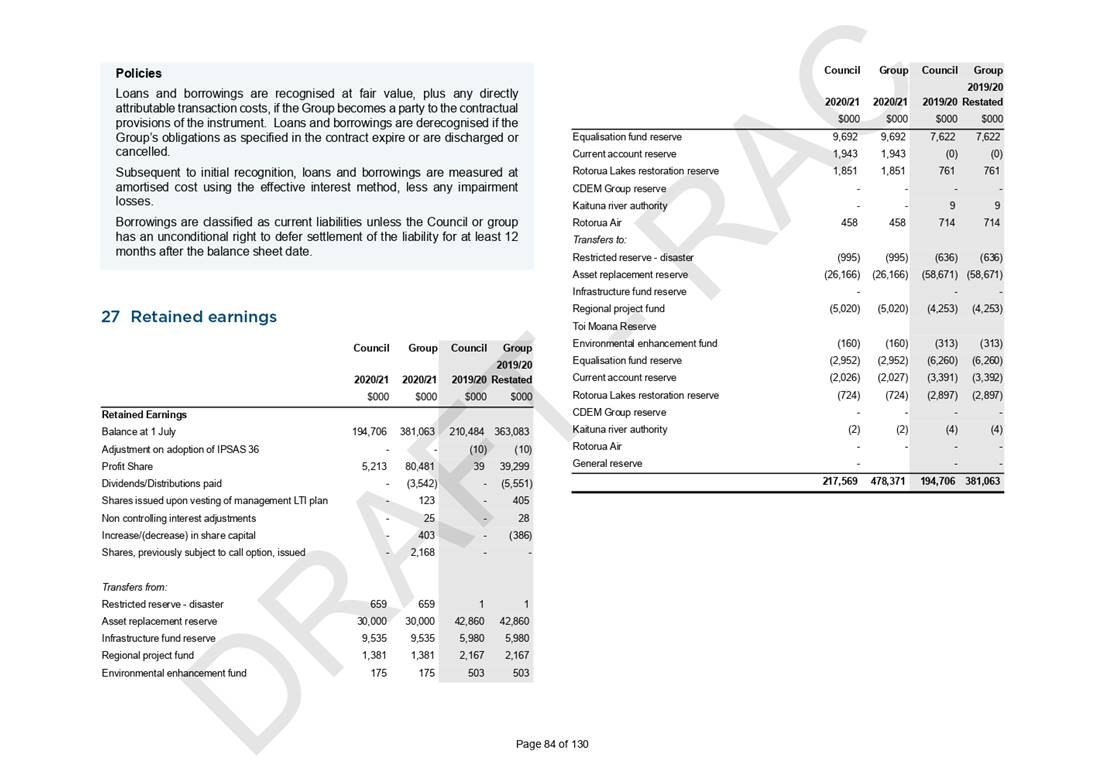

2.2.4 Treasury

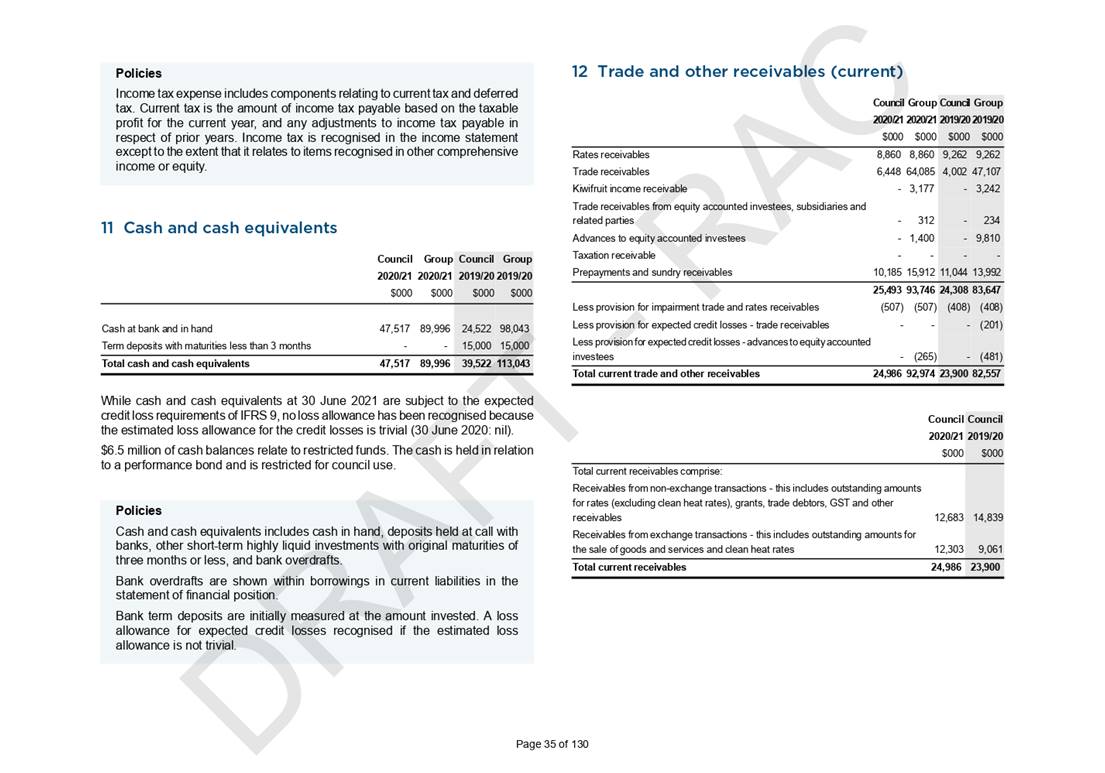

We are

recording total investments of $232.2 million (cash, cash equivalents

and other financial assets) which includes approximately $50 million on-lent to

Quayside. The $45 million Toi Moana Fund was transferred to Quayside on 1 July

2019. These funds are primarily attributed to general and restricted reserves,

as well as unspent funds borrowed from the LGFA to pre-fund capital expenditure

in advance.

During 2020/21

we reduced our total borrowings by $50.5 million to $180.9 million as at

30 June 2021. The facilities are provided by the Local Government Funding

Agency for a specific purpose including $130.9 million for capital investment

across multiple years of the Long Term Plan 2018-2028 of which $91.7 million is

core debt, and approximately $50 million for on-lending to our CCO Quayside

Holdings Limited which delivers benefits of lower borrowing costs to the Council

Group. The average cost of debt at 30 June 2021 is 1.36%.

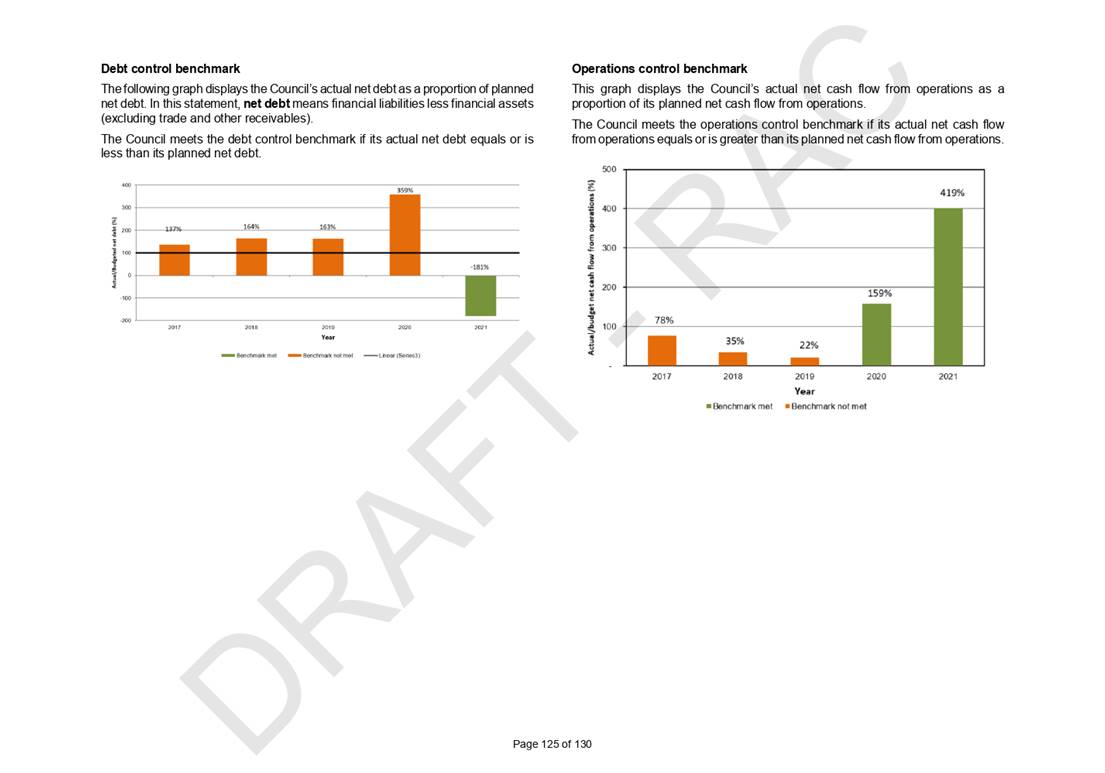

Our net debt is

($21 million) which means we have high levels of liquid assets relative to our

debt levels. Consequently our net debt to revenue ratio is (14%).

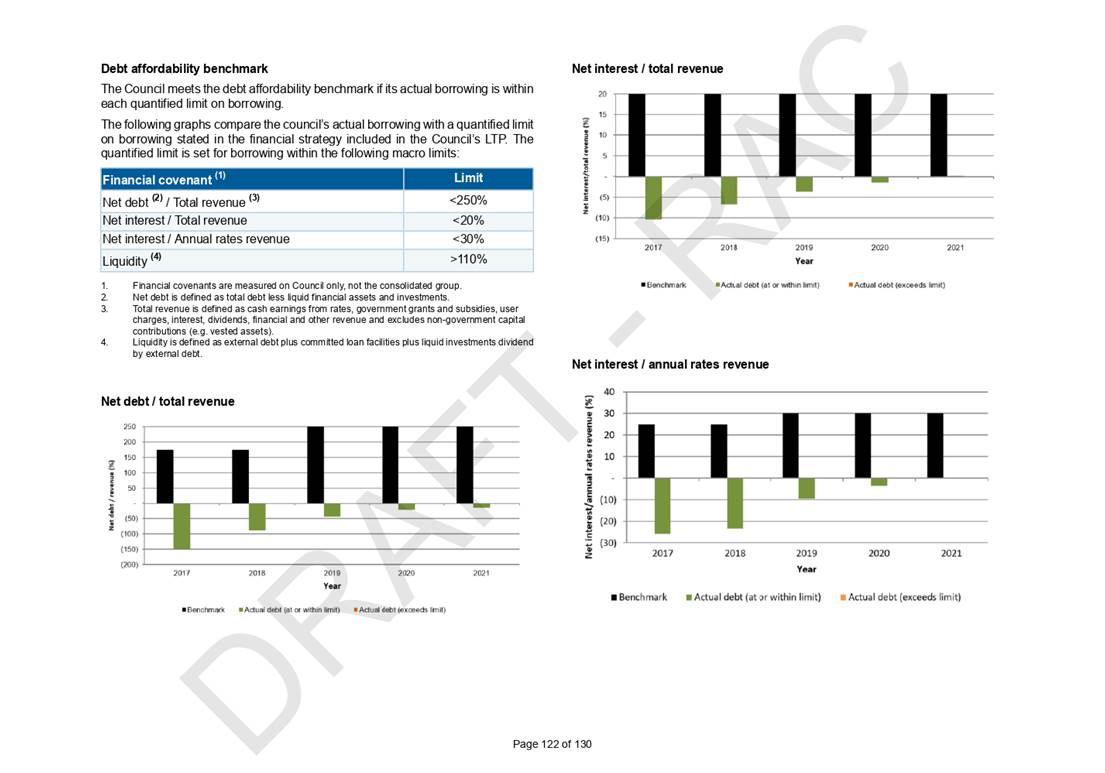

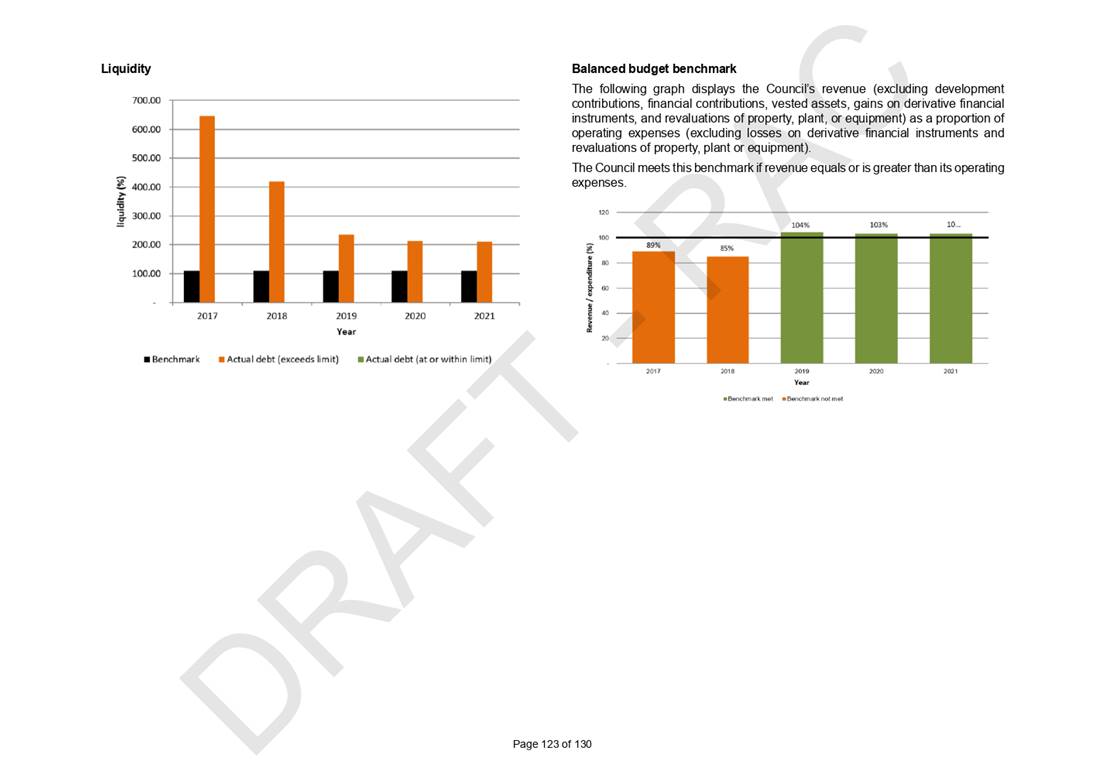

We take a

prudent approach to managing our debt by keeping our net debt to revenue ratio

significantly within our prudential limit of 250 per cent.

We have

maintained exceptional liquid cover and significant borrowing capacity to

support our capital investment and liquidity needs. This approach also offsets

risks associated with our high debt levels, including our exposure to

Quayside’s perpetual preference shares and expansion plans. This is

reflected in our AA credit rating which is one of the highest of Councils in

New Zealand.

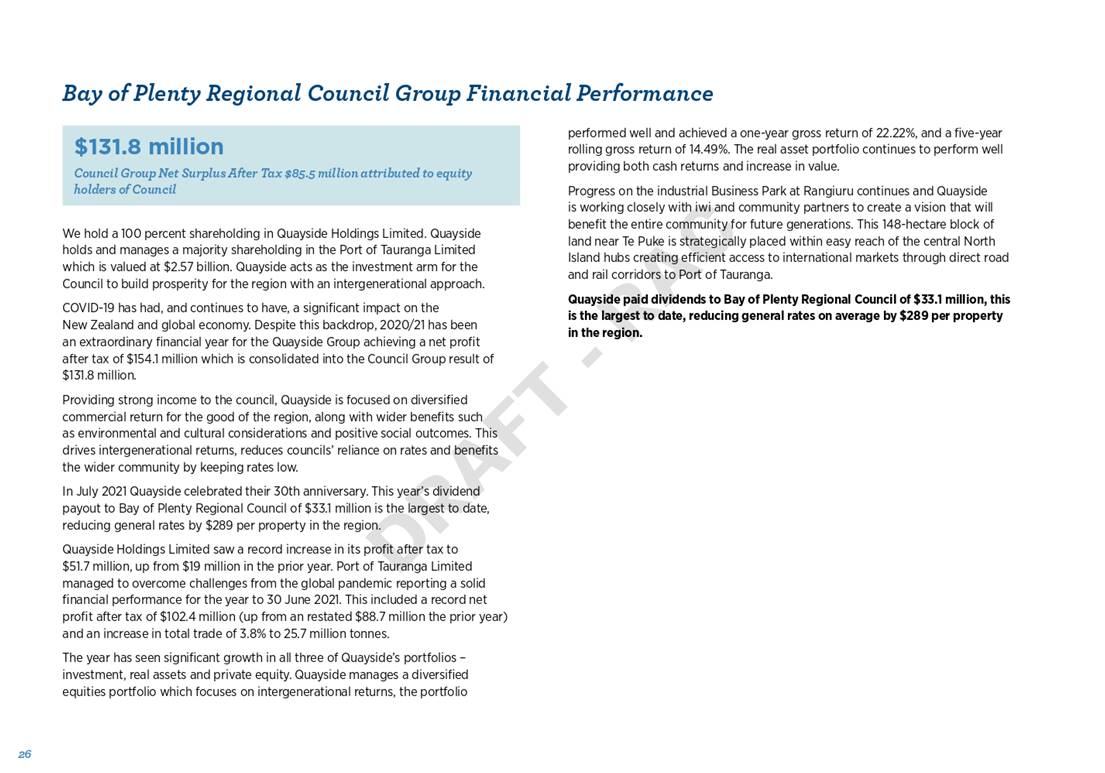

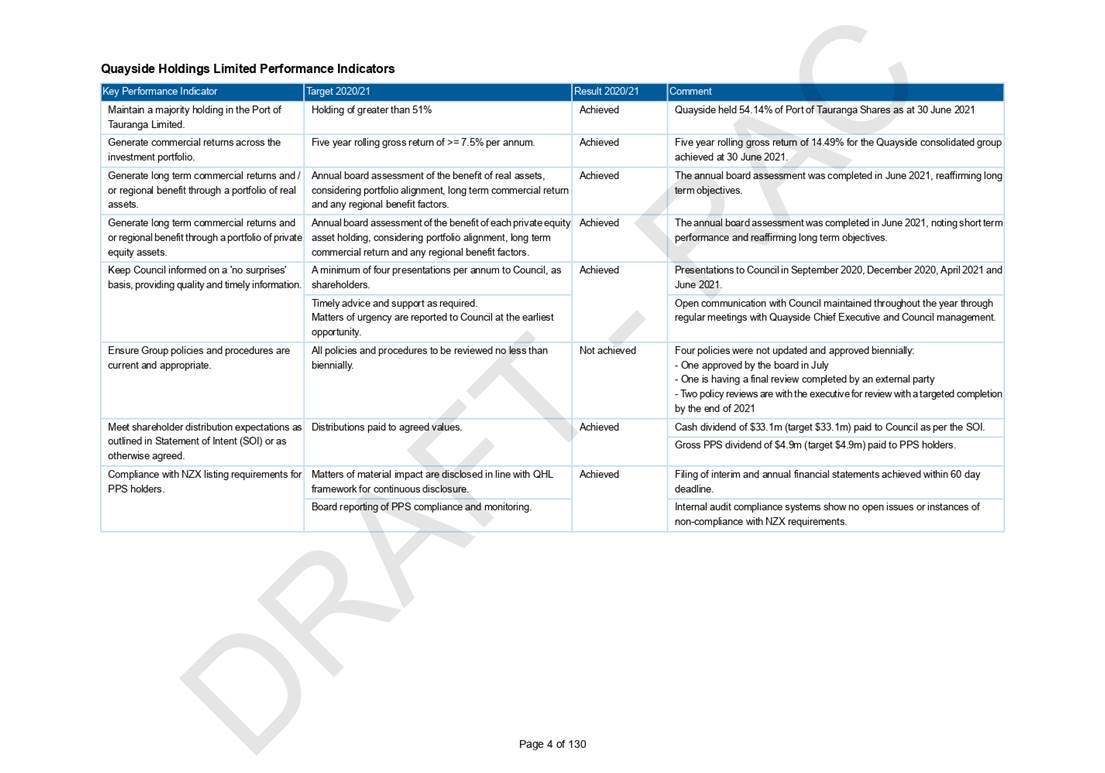

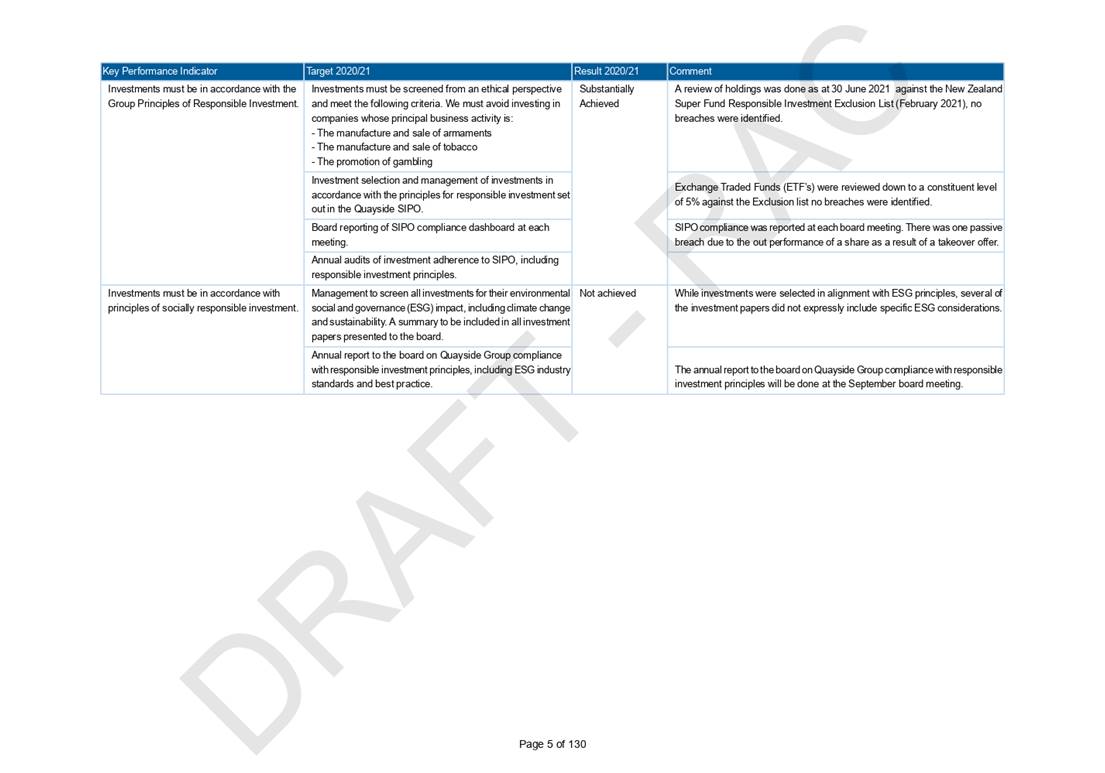

2.2.5 Council Group

The Draft

Annual Report 2020/21 contains both Council and Group results. Group results

include our 100 percent Council-owned subsidiary, Quayside Holdings Limited.

Quayside’s Annual Report 2020/21 was approved by its board of directors

in September 2021 and received by Council on 30 September 2021, along with the

annual report for the Toi Moana Trust and several Quayside subsidiaries.

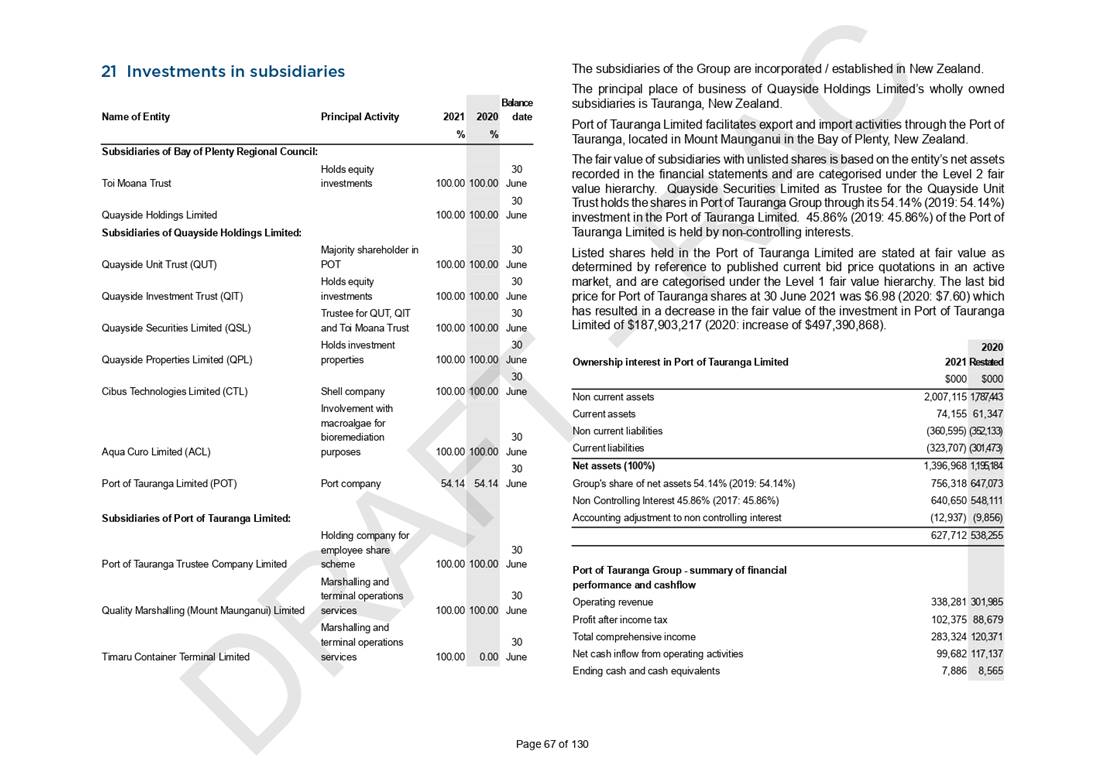

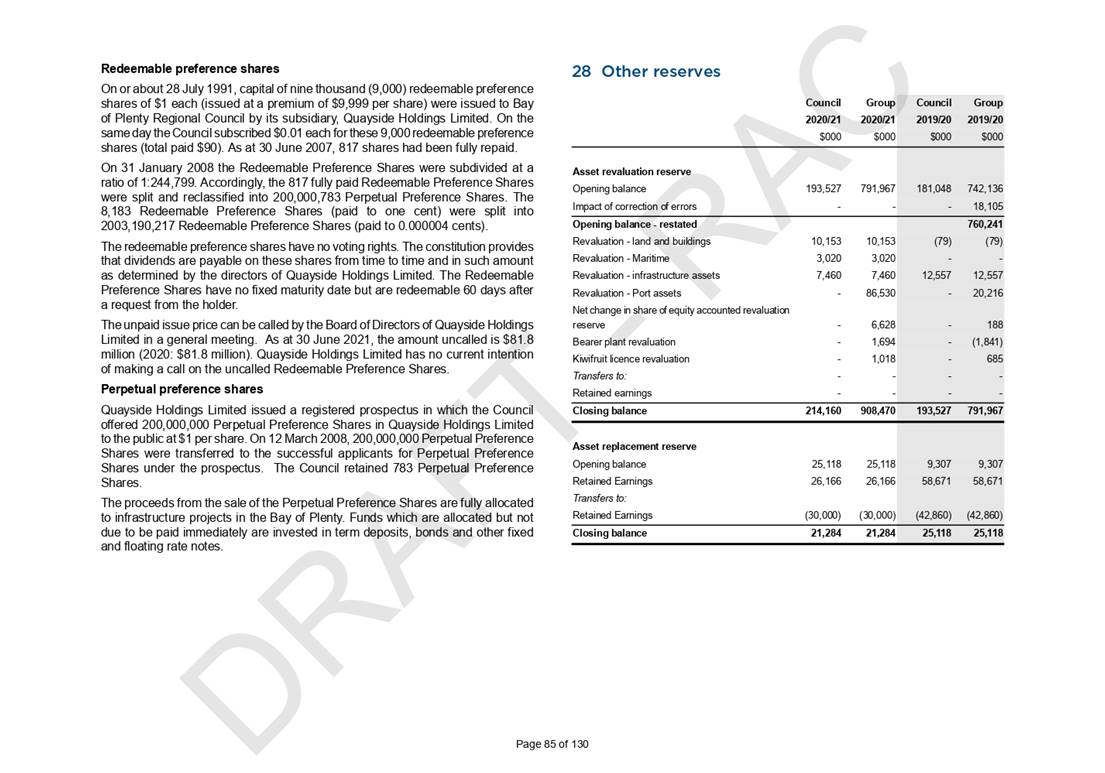

We hold a 100

percent shareholding in Quayside Holdings Limited. Quayside holds and manages a

majority shareholding in the Port of Tauranga Limited which is valued at $2.57

billion. Quayside acts as the investment arm for the Council to build

prosperity for the region with an intergenerational approach.

COVID-19 has

had, and continues to have, a significant impact on the New Zealand

and global economy. Despite this backdrop, 2020/21 has been an extraordinary

financial year for the Quayside Group achieving a net profit after tax of

$154.1 million which is consolidated into the Council Group draft net profit after

tax of $131.8 million, of which $85.5 million is attributed to equity holders /

Council.

This year’s dividend payout to Bay of Plenty

Regional Council of $33.1 million is the largest to date, reducing general

rates by $289 per property in the region. The Toi Moana Trust, which is an

investment fund managed by Quayside, also paid a dividend to Council of $2.25

million in 2020/21 in line with its Statement of Intent.

The approved

Annual Report 2020/21 for Quayside and Council’s subsidiaries can be

found on the Bay of Plenty Regional Council website.

3. Considerations

3.1 Risks and Mitigations

There are no direct risk

implications arising as a result of this report.

3.2 Climate Change

There are no direct climate

change implications arising as a result of this report.

Climate Change is identified as

a strategic challenge facing the Bay of Plenty Region. The Draft Annual

Report 2020/21 provides a report on the financial and non-financial performance

of Council this includes work delivered through Groups of Activities to

understand the implications of and to respond to the implications of Climate

Change.

3.3 Implications for

Māori

There are no direct implications

for Māori arising as a result of this report. The Draft Annual Report

2020/21 provides a report on the financial and non-financial performance of

Council. This includes reporting on work to support Māori participation in

Council decision-making processes.

3.4 Community Engagement

|

1.

|

Engagement with the community is not required as the

recommended proposal / decision relates to internal Council matters only.

|

3.5 Financial

Implications

This report and

the supporting documents highlight a strong financial performance by Council

despite the impacts of the Covid-19 pandemic on Council’s service delivery.

The majority of the capital budget underspend in 2020/21 has been carried

forward to future years through the Long Term Plan 2021-2031 process. As part

of the adoption of the Annual Report 2020/21 on 10 November 2021, Council will

be asked to approve further capital budget carry forwards from 2020/21 of

approximately $16 million of which $13 million is required in Draft Annual Plan

2022/23. Council has pre-funded its capital works programme through borrowings

from the Local Government Funding Agency. These figures will be confirmed once

the final audit is completed by Audit NZ.

4. Next Steps

At the time of

this report, the external audit of the Bay of Plenty Regional Council for the

year ended 30 June 2021 is currently being finalised and staff anticipate that

Council will receive verbal audit clearance from Audit New Zealand in early

November 2021. As such, some minor changes to the Draft Annual Report 2020/21

may be required. Further changes, for example rounding, may be made for

the final Annual Report. The final Annual Report for 2020/21 will be presented

for adoption by Council, at this stage, on 10 November 2021.

Attachments

Attachment 1 - BOPRC Draft Annual Report

2020/21 (Volume A) - RAC Review ⇩

Attachment 2 - BOPRC Draft Annual Report

2020/21 - Volume Two (Financials) - RAC Review ⇩