|

|

|

Regional Council

LTP 2024-2034 (No 8)

Informal Workshop Pack

DATE: Wednesday

25 October 2023

COMMENCING After

conclusion of the Public Excluded Workshop (Scheduled from 9:30 am –

12:00 pm)

VENUE: Council Chambers, Regional House, 1 Elizabeth Street,

Tauranga and via Zoom (Audio Visual Link)

|

Informal

Workshop Papers

1 2024-2034

Long Term Plan - Budget Version 2 1

Attachment 1 -

Version 2 - 10 year forecast 1

Attachment 2 -

List of potential projects for external funding - Public Excluded

2 Revenue

and Financing Policy - Funding Assessments 1

Attachment 1 -

Illustration of RFP Step One methodology 1

Attachment 2 -

Activity assessments - RFP 2024 - draft Funding Needs Analysis 1

Attachment 3 -

Rates Examples Properties 1

Attachment 4 -

Allocation of QHL dividend - methodology 1

3 Verbal

Update on Engagement Process and Content

Presented by: Ange

Foster, Stephanie McDonald, Herewini Simpson

4 Activity

Plans - Part 1 1

Attachment 1 -

LTP24-34 Activity Plans - Part 1 1

5 Rates

Remission Policy Review - potential new remission categories 1

Attachment 1 -

Financial analysis - Conversion of Dry Stock to Carbon Forest 1

|

|

|

|

Informal Workshop Paper

|

|

To:

|

Regional

Council

|

|

|

25

October 2023

|

|

From:

|

Mark Le Comte, Principal Advisor,

Finance; Karlo Keogh, Senior Management Accountant; Gillian Payne, Principal

Advisor and Olive McVicker, Corporate Performance Team Lead

|

|

|

Evaleigh Rautjoki-Williams, Acting General Manager, Corporate

|

|

|

|

2024-2034 Long

Term Plan - Budget Version 2

1. Purpose

This paper provides Councillors with version 2 of the

budget for the 2024-2034 Draft Long Term Plan (DLTP) which has been updated

following Council workshops on expenditure levels for each activity held on 19

and 26 September 2023. Expenditure and levels of service for the Public Transport Services, Regional Development, Climate Change and

Spatial Planning activities are the subject of an upcoming

workshop.

As Councillors have provided guidance on expenditure

levels, this workshop is focussed on the use of financial levers to close the

remaining funding gap.

2. Guidance

Sought from Councillors

· Guidance

on the appropriate balance of funding levers to be applied to close the funding

gap including revenue and reserves.

3. Context

The results of general election on 14 October 2023

will have a significant impact on Regional Councils. Since the last Council

workshop, it is almost certain that there will be a National led government,

but there is still uncertainty about the final policy mix in a National/Act

coalition, or whether NZ First will have a role within Government. Based on

common policy statements from National and Act, Council should be prepared for

the likelihood of:

· Repeal

of the Natural and Built Environment Act and Spatial Planning Act.

· Further

Resource Management Act reform, to an unknown future state but likely to

include fast track consenting.

· Repeal

of the Affordable Water reforms.

· Increased

transport infrastructure investment, but reduced focus on passenger transport.

· Increased

focus on infrastructure investment.

Inflation and interest costs are high, and the country

is facing a cost-of-living crisis. The latest Consumer Price Index (CPI)

release on 17 October showed annual CPI had decreased from 6.0% to 5.6%. This

was lower than most economist forecasts (5.8-6.1%) and lower than forecast in

the last RBNZ Monetary Policy Statement forecast (6%). If the CPI results

continue to fall faster than expected, then interest rate forecasts may also

reduce. The next major announcement is the RBNZ Monetary Policy Statement on 29

November 2023.

4. LTP

Process

The first version of the DLTP budget was presented to

Councillors at the 19 September workshop. Further reviews of key activities are

scheduled for upcoming workshops, including Public Transport Services, Regional

Development, Climate Change and Spatial Planning; which could have a material

effect on budget version 2 of the DLTP.

Capital budgets have been incorporated into the Asset

Management Planning process, and staff are completing detailed deliverability

reviews to ensure that capital forecasts are as robust as they can be.

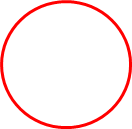

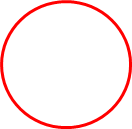

The diagram below shows the DLTP process. The focus of

this workshop is on funding and financing options.

Diagram 1. Connecting the Stages of the DLTP.

5. Draft

Budget and the Funding Gap

Staff have updated the DLTP budget in response to

Councillor direction received at 19 and 26 September workshops. The current

result is a total funding gap of $5.47 million in 2024/25, which includes both

general rate funded and targeted rate funded activities.

A summary of the process and decisions to reach the

funding gap for budget version 2, and key items to be confirmed in upcoming

budget versions is shown in the table on the next page. Key points to note

include:

· The

total rates increase to existing properties for year one has been capped at the

current forecast CPI increase which is 4.5% for year one then 2% thereafter.

The forecast total rates revenue for Council will also increase by a further

1.25% per annum due to growth in the rating base. These caps have been applied

to both general and targeted rates. An allowance for rates penalties has been

added as per scenario guidance at the previous workshops based on actual rates

penalty trends.

· The

timing of the Lake Tarawera and Rotorua Museum sewerage grants have been moved

from 2024/25 to years two and three respectively on advice from Rotorua Lakes

Council. These changes reduce expenditure in 2024/25, but do not affect the

funding gap as they are funded from reserves.

· Capital

budgets have been capped at $30 million pending the outcome of the capital

deliverability reviews. The outcome of the deliverability reviews will be

presented with budget version 3 at the 21 November workshop.

|

Item

|

Funding Surplus (Gap) $000

|

Comments

|

|

Version 1 Funding

Gap

|

(7,206)

|

|

|

Total

savings from financial scenarios workshops

|

4,462

|

|

|

Additional

costs Rivers and Drainage from financial scenarios

|

(1,674)

|

|

|

Additional

costs Public Transport from financial scenarios workshops

|

(1,895)

|

|

|

Net

other adjustments

|

843

|

Reduced

interest costs (capex deferrals) and allowance for litigation costs

|

|

Version 2 Funding

Gap

|

(5,470)

|

|

|

Items

to be confirmed in future versions

|

|

|

|

Asset Management Plans’ impact

|

TBC

|

Potential

to save interest costs through capital deliverability review

|

|

Key

activity reviews

|

TBC

|

Public

Transport Services, Regional Development, Climate Change, Spatial Planning

|

|

Grants

subsidies and collaboration projects not already identified

|

TBC

|

Refer

section 6.1.1 and Attachment 2 (Public Excluded)

|

|

Amount

of Quayside dividend

|

TBC

|

Determined

through Statement of Expectations for 2024/25

|

|

Revenue

and Financing Policy review

|

TBC

|

Mainly

affects Targeted rate/General rate split (no effect on funding gap) but Fees

and Charges may have a small effect – refer section 6.1.1

|

|

Version 3 Funding

Surplus (Gap)

|

TBC

|

|

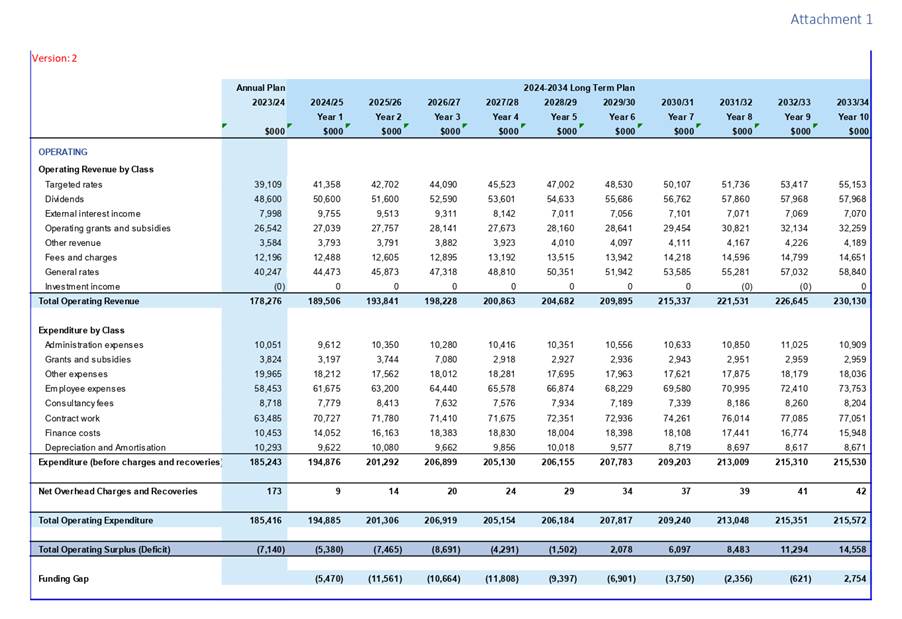

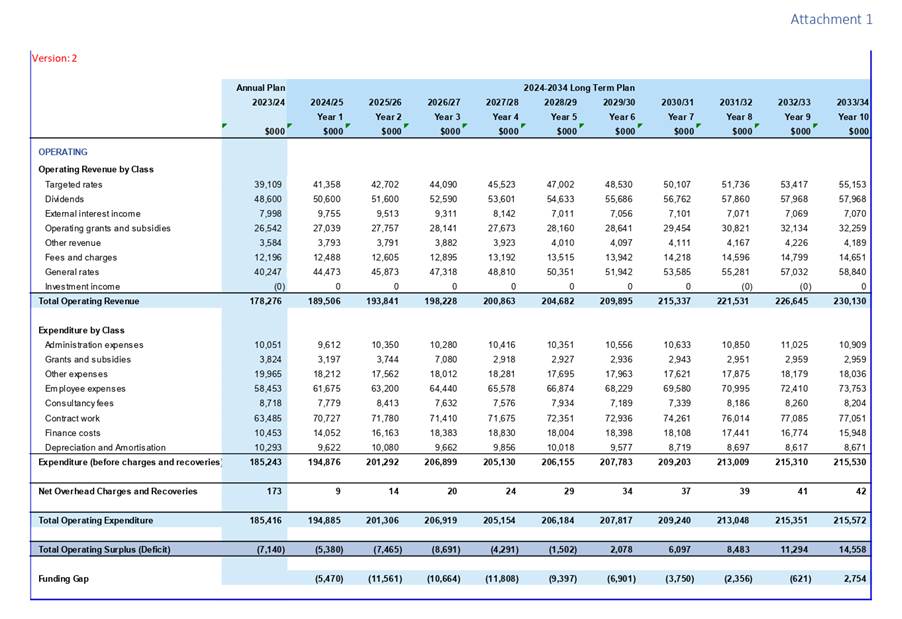

The ten-year view of the

budget, including the funding gap, is shown in Attachment 1.

The funding gap grows from $5.47 million in year one,

to a total of $27.7 million over the first three years, and to $59.8 million

over the 10 years. The main contributors to the funding gap increases from year

one to year two are higher borrowing costs due to the capital expenditure

forecasts (discussed in section 5.2) and less (already approved) use of

reserves in year two.

5.1 Capital

and Borrowing

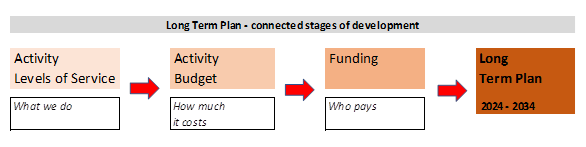

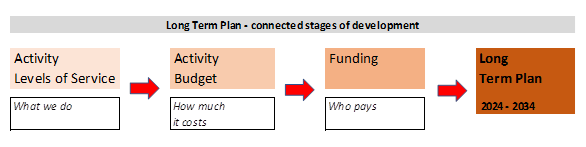

Current interest rates from the LGFA indicate that the

cost of borrowing will remain elevated for the foreseeable future. The latest

table of LGFA interest rates, from 11 October, is shown below.

Council currently has an AA credit rating, with a

negative credit watch from Standard and Poor’s. The financial impact of a

credit rating downgrade to AA- is to increase borrowing rates by 0.05%, which

means for each $100 million of borrowing, an extra interest cost of $50,000 per

year.

Council receives 5.5% (OCR) on the majority of its

cash holdings, which is less than its cost of new borrowing, so it is

preferable to first use available reserves and only borrow if required.

Forecasts show that Council would be able to fund

capital for 2024/25 from reserves but will need to borrow to fund the capital

programme for 2025/26 and 2026/27. All else being equal, this increases the

possibility of a credit rating downgrade.

Borrowing and interest rate forecasts will be updated

in subsequent workshops including consideration of:

· CPI

and OCR announcements - Bancorp and PWC will provide advice on the interest

rate outlook and the appropriate treasury management approach respectively.

· Capital

deliverability reviews. A $10 million capital expenditure delay for one-year

results in an interest expense saving of approximately $600,000.

· Group

level considerations including QHL forecasts.

6. Funding

and Financial Levers

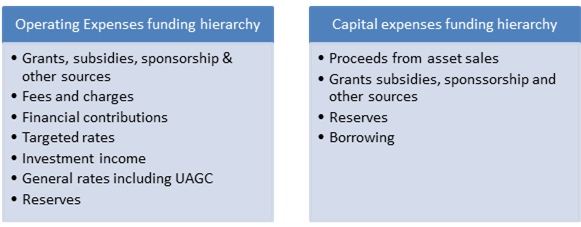

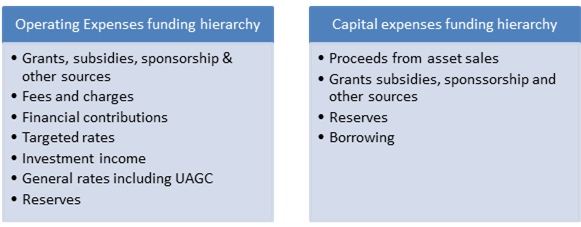

To address the funding gap, Council has several funding

and financial levers available. These funding levers were ranked in hierarchies

as part of the Financial Framework Review completed as part of LTP 2021-2031,

shown below.

The hierarchy generally expresses Council’s

preferences for funding sources, but it should be used and interpreted in

conjunction with the Revenue and Financing Policy (RFP) which takes into

account the characteristics of the activities being funded. For example,

increasing fees and charges is a high priority to consider but may be

constrained by consideration of beneficiaries, impacts on demand for the

service of changing fees, and legislation that limits what can be charged. The

RFP is currently under review as part of the DLTP process.

6.1 Levers

to address operating funding gap:

6.1.1 Increasing

Revenue

Increasing revenue is a sustainable

option to close the funding gap, however, this can be phased in over time.

Council would need to increase revenue by $12 million over three years to

achieve a balanced budget for year three of this DLTP. Any funding gap

that remains after considering the revenue levers would need to be funded from

reserves (if available).

The table below shows the impact on the

funding gap of increasing revenue cumulatively each year. The grey column,

total budget gap years 1-3) shows the total cumulative use of reserves that

would be required to smooth in the impacts of increasing revenue for years 1 to

3.

|

2024/25

Year 1

$000

|

2025/26

Year 2

$000

|

2026/27

Year 3

$000

|

Total

budget gap

years 1-3

$000

|

2027/28

Year 4

$000

|

|

Budget

V2 Funding Gap

|

(5,470)

|

(11,561)

|

(10,664)

|

(27,695)

|

(11,808)

|

|

Cumulative

Annual Revenue increase

$000

|

|

|

|

|

|

|

1,000

|

(4,470)

|

(9,561)

|

(7,664)

|

(21,695)

|

(7,808)

|

|

2,000

|

(3,470)

|

(7,561)

|

(4,664)

|

(15,695)

|

(3,808)

|

|

3,000

|

(2,470)

|

(5,561)

|

(1,664)

|

(9,695)

|

192

|

|

4,000

|

(1,470)

|

(3,561)

|

1,336

|

(3,695)

|

4,192

|

In order of the hierarchy, the revenue

funding levers Council can consider are discussed below:

· Grants

and subsidies - In addition to known and expected subsidies already factored

into budget version 2, there may be potential for external funding for

projects. A list of Council projects that may be proposed if funding

avenues materialise is in Attachment 2 (Public Excluded). It is too early to

budget for additional revenue from this source, and some of the items may

require additional Council funding that is not yet factored into budget version

2.

· Fees and

charges – Budget version 2 has increased fees and charges by inflation. A

further 10% increase across all fees and charges (subject to RFP and

legislative constraints) would yield $1.25m. This estimate includes bus fares,

resource consent/compliance monitoring charges and harbour dues.

· Financial

Contributions. Council does not currently have upcoming work planned that would

qualify for Financial Contributions to be charged.

· Investment

Income – Any change to the QHL Dividend depends on QHL’s corporate

setting. Using this lever means trading off the benefit of a higher dividend

now for reduced capital growth later. Council also receives investment income

from its reserve funds and other minor dividends from its shareholding in the

LGFA.

· Rates -

Currently capped for budget version 2 at the forecast inflation rate as per

Councillor guidance. Councillors could consider allowing an increase of

greater than the rate of inflation, which could start in year one or in later

years. A 1% increase, for either a general or targeted rate would yield

approximately $400,000 (based on the current Revenue and Financing Policy

ratios).

6.1.2 Using

reserves

Reserves are not generally sustainable

funding option, but their use can be appropriate to smooth change and for

specific one-off projects. The cumulative budget gap in 6.1.1. shows the total

amount of reserve use that would be required to smooth the impact of revenue

increases.

The table below shows the purpose of each

reserve type and the potential for reserve use, based on the forecasts of each

reserve. Staff update reserve forecasts after each version of the budget is

prepared.

|

Name and purpose of reserve

|

Potential of reserve to reduce funding gap

|

|

Regional Fund - This

reserve is used to fund infrastructure projects.

|

The current forecast,

based on Annual Report 2022/23 and early 2023/24 forecasts is that Regional

Fund will not be enough to cover the year one budget gap. This forecast will

be updated as the year progresses and for the Insight reporting in early

November.

This reserve was used in

LTP 2021-2031 to fund specific projects and to smooth rates increases from

2021/22 to 2023/24.

It is replenished

through budgeted contributions from activities, and is available for use by

all activities

|

|

Equalisation Reserve

- used to smooth general rates increases.

|

Currently forecast at

$Nil.

This reserve is a

consequence of actual performance results (overs and unders) from general

funded activities. Any underspends from general funded activities currently

reduce the amount of Regional Fund use.

|

|

Targeted Rates

Reserves - can only be used for the specific targeted rate it was

collected for.

|

Forecast in the 2023/24

Annual Plan to be $4.7 million in total across all targeted rates reserves.

Some targeted rates

reserves are forecast to have $Nil available.

|

|

Toi Moana Trust (TMT)

– used for Council funds that can be held for 3-5 years and invested

for higher returns than bank term deposits.

|

Valued at $69.6 million

as at 30 September 2023. If Council were to consider drawing down on the Toi

Moana reserve, it would need to stage the drawdown as TMT is currently

invested in shares and bonds. Council would also forego the investment

return budgeted at 5%.

|

6.2 Capital

Funding Levers

Capital budgeting does not result in a budget gap

because borrowing is an acceptable and available source of funding. Borrowing

spreads the cost of capital assets over their useful lives so that all

beneficiaries contribute towards the cost.

In order of hierarchy:

· Asset

sales – there do not appear to be any immediate opportunities.

· Grants

and subsidies – refer to comments on grants and subsidies in section

6.1.1 above. Some of the potential projects are capital items.

· Reserves

– Refer to comments in operating expenditure above, particularly in

respect of TMT. Given the expected return versus borrowing rates, Council

should consider using reserves instead of borrowing to fund capex. The budget

process has fully applied the Asset Replacement Reserves to fund capital

expenditure.

· Borrowing

generally provides for intergenerational equity and is discussed in section

5.1. The current budget requires new borrowing for the capital programme in

years two and three.

7. Next

steps

Following guidance at this workshop, and

the upcoming activity planning workshops, staff will commence preparing budget

version 3 for consideration at the 21 November workshop. This is intended to be

the final draft budget and the last opportunity for Councillors to provide

budget guidance before the LTP Consultation Document and supporting documents

are endorsed for audit at the 14 December Council meeting.

Attachments

Attachment 1 - Version 2 - 10 year forecast ⇩

Attachment 2 - List of potential projects for external funding

(Public Excluded) ⇩

Regional

Council 25 October 2023

Regional

Council 25 October 2023

Item 1

Public Excluded

Attachment 2

List of potential projects for external

funding

|

|

|

|

Informal Workshop Paper

|

|

To:

|

Regional

Council

|

|

|

25

October 2023

|

|

From:

|

Kumaren Perumal, Chief Financial

Officer; Mark Le Comte, Principal Advisor, Finance and Gillian Payne,

Principal Advisor

|

|

|

Evaleigh Rautjoki-Williams, Acting General Manager, Corporate

|

|

|

|

Revenue and

Financing Policy - Funding Assessments

1. Purpose

The purpose of this report is to present staff analysis of

the legislatively required assessments of Council’s activities to

identify appropriate funding sources and seek Council feedback on the

results.

This is the first step in the two-step process to develop

a draft Revenue and Financing Policy (RFP) for public consultation alongside

the Long-Term Plan 2024-2034 (LTP).

The second step is to aggregate the activity assessment

results, apply them to LTP budget version 2 and consider the resulting distribution

of rates and other funding requirements. Council considers the Step Two results

and the impact it would have, if unchanged, on community well-being. As

part of Step Two, funding sources identified in Step One can be adjusted, and

the rationale documented in the draft Revenue and Financing Policy, for

consultation.

2. Guidance

Sought from Councillors

Staff seek Council direction on:

· Assessments

of funding sources by activity (Step One), noting that Step Two considerations

will take place at a subsequent workshop.

For this workshop, feedback from Councillors is sought on

the rationale for assessment of beneficiaries, exacerbators (i.e., influencing

demand and incentivising behaviour change), and the costs and benefits of

separate funding for each activity (transparency and accountability).

In providing this direction, Councillors may wish to cross

reference some of the results of the latest community engagement pulse-check

conducted between 3 and 12 October, which will be tabled at the workshop. The

engagement results particularly relate to funding sources for the Public

Transport activity.

Considerations of overall effect on community wellbeing

(e.g., equity, affordability, achieving community outcomes, promoting the

preamble to the Te Ture Whenua Māori Act 1993) will be addressed in Step

Two and additional information will be presented to Councillors to help put

those considerations into perspective.

Suggestions for this information are outlined in section

4.1 of this report. It would be helpful to receive feedback from

Councillors on this section so that sufficient information is presented at the

workshop in November.

3. Discussion

3.1 Previous

work

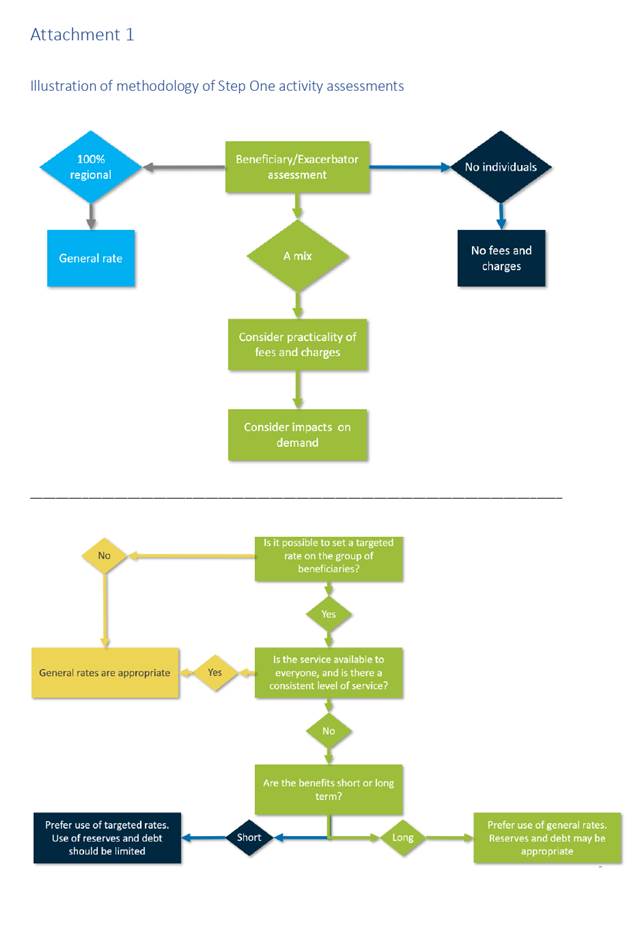

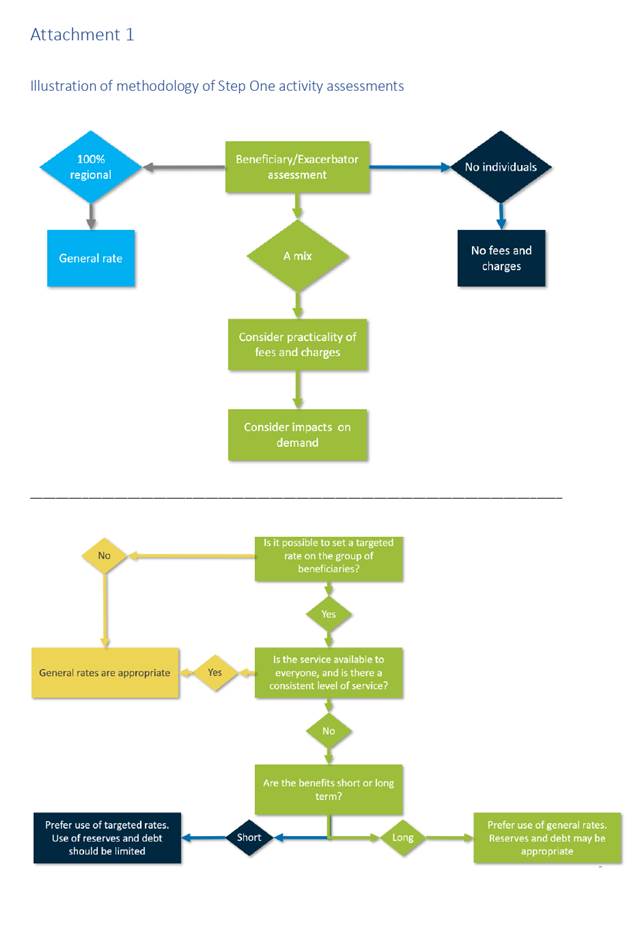

On 9 August 2023, at a Risk and

Assurance Committee (RAC) workshop, Morrison Low presented the proposed

methodology for the RFP for RAC endorsement. Councillors shared views on the

principles underpinning the funding considerations and the trade-offs that

would be required in coming to decisions on funding sources, through the review

process.

The methodology has been jointly

developed for Waikato and Otago Regional Councils, facilitated by external

independent advice from Morrison Low. It brings a structured approach to the

statutory activity funding analysis process and provides consistency in determining

appropriate funding methods across all of Council’s activities.

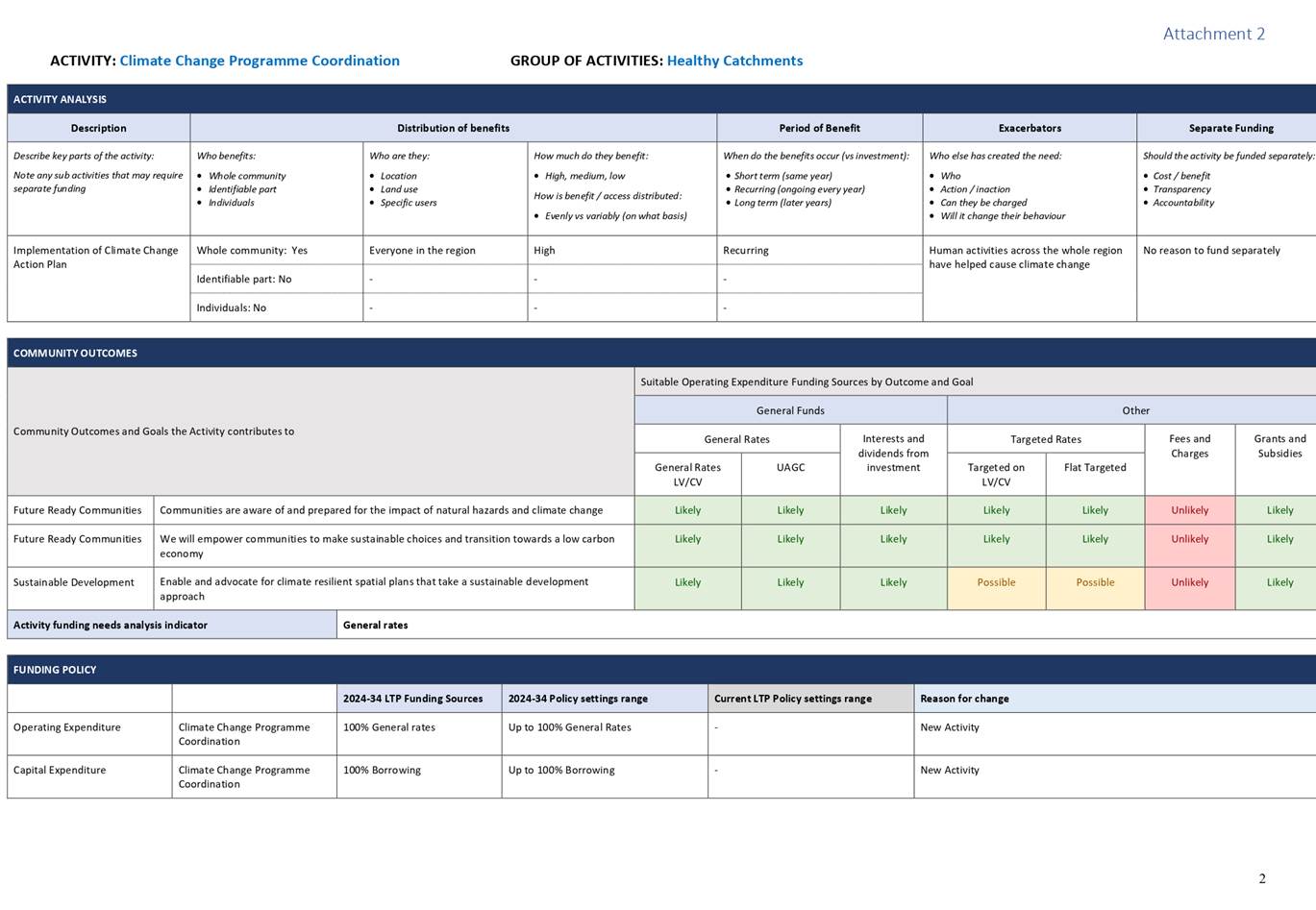

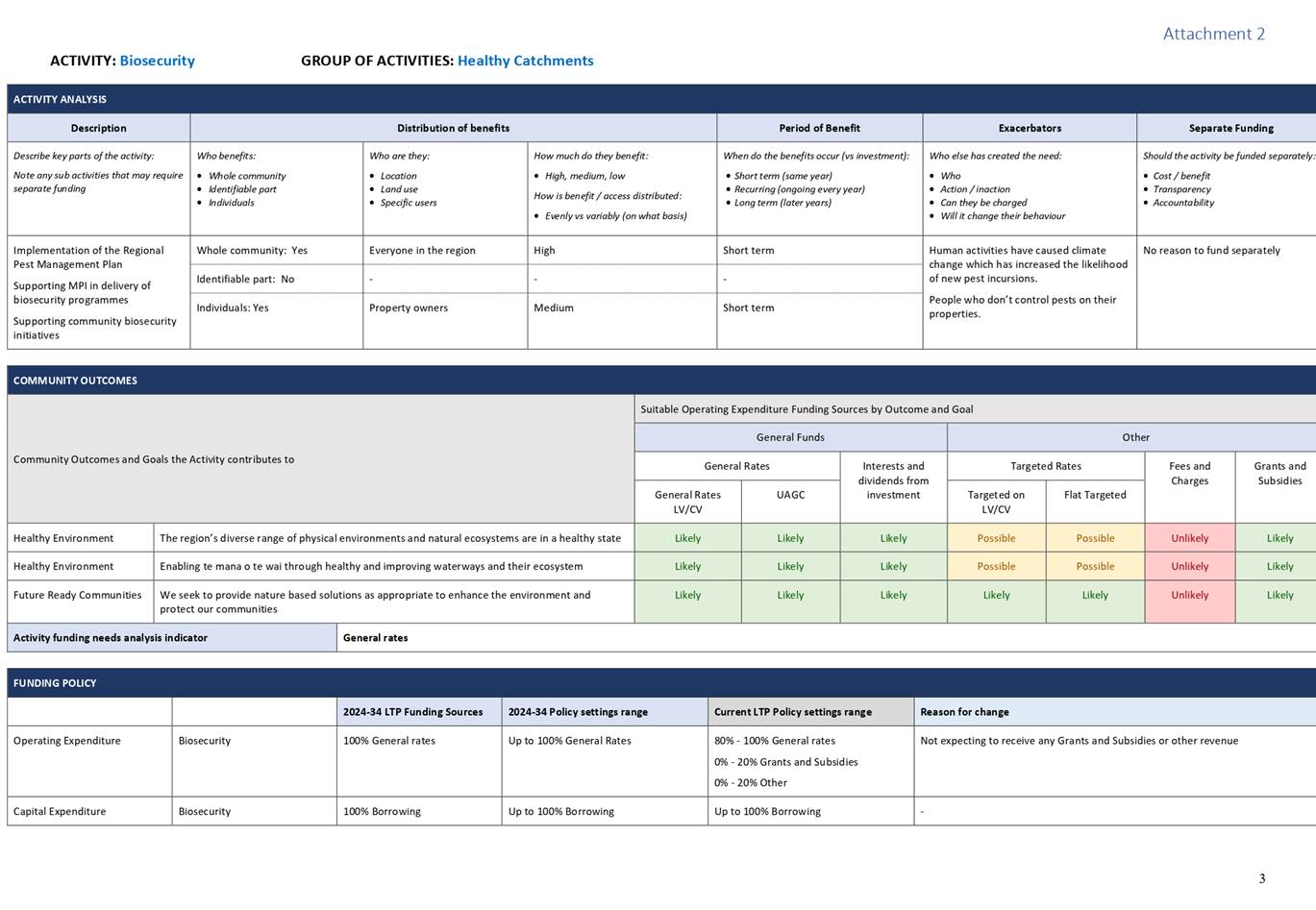

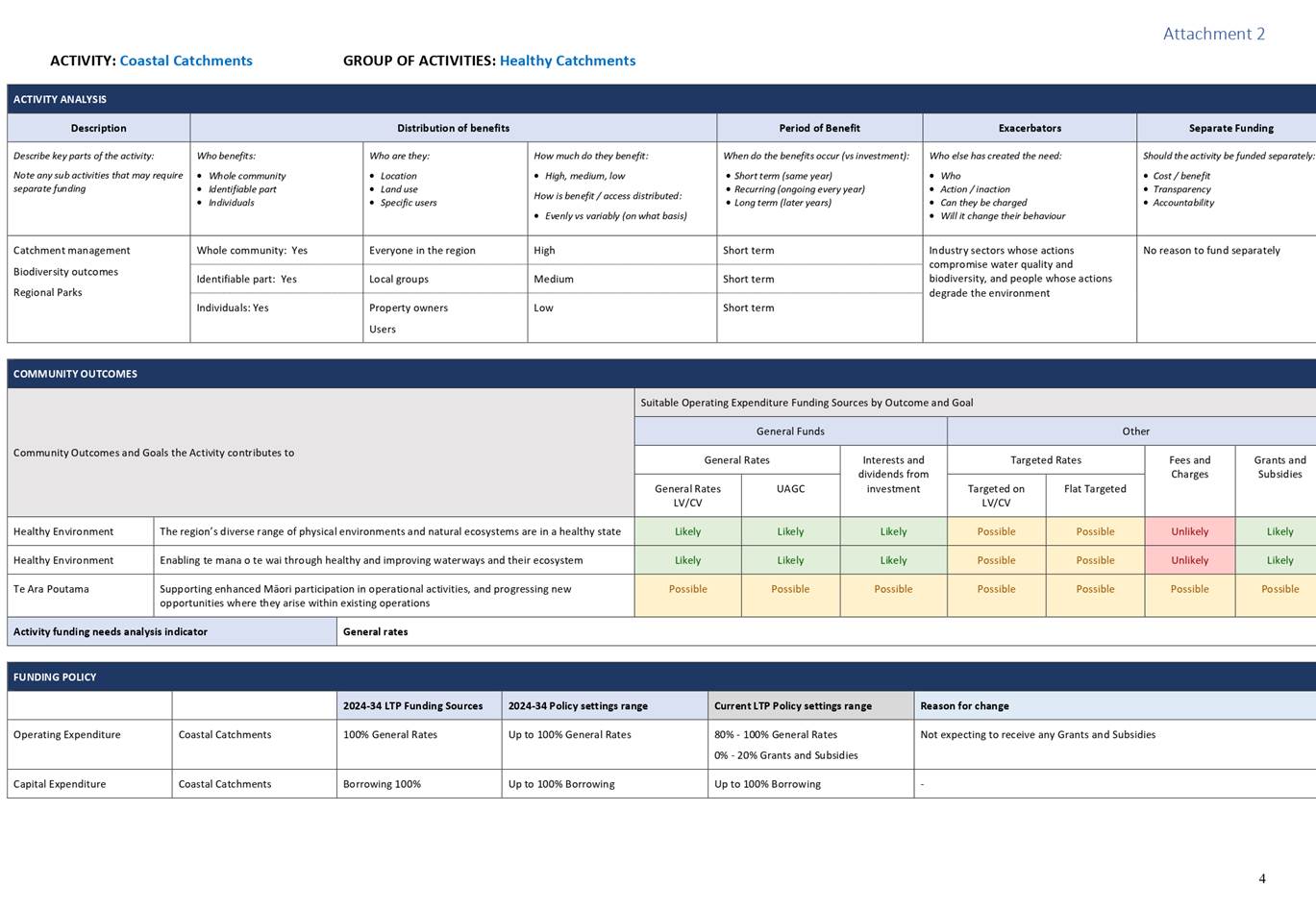

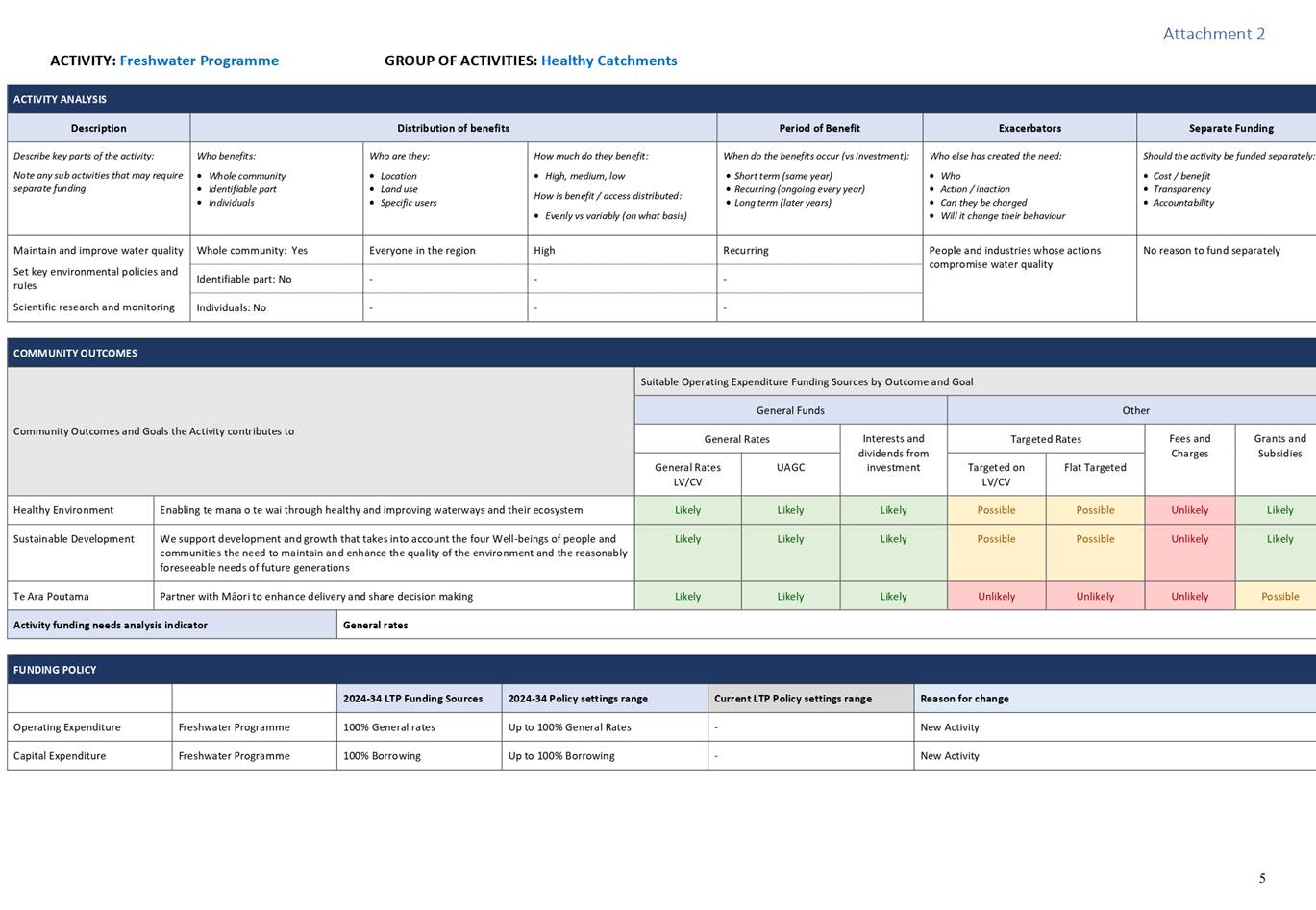

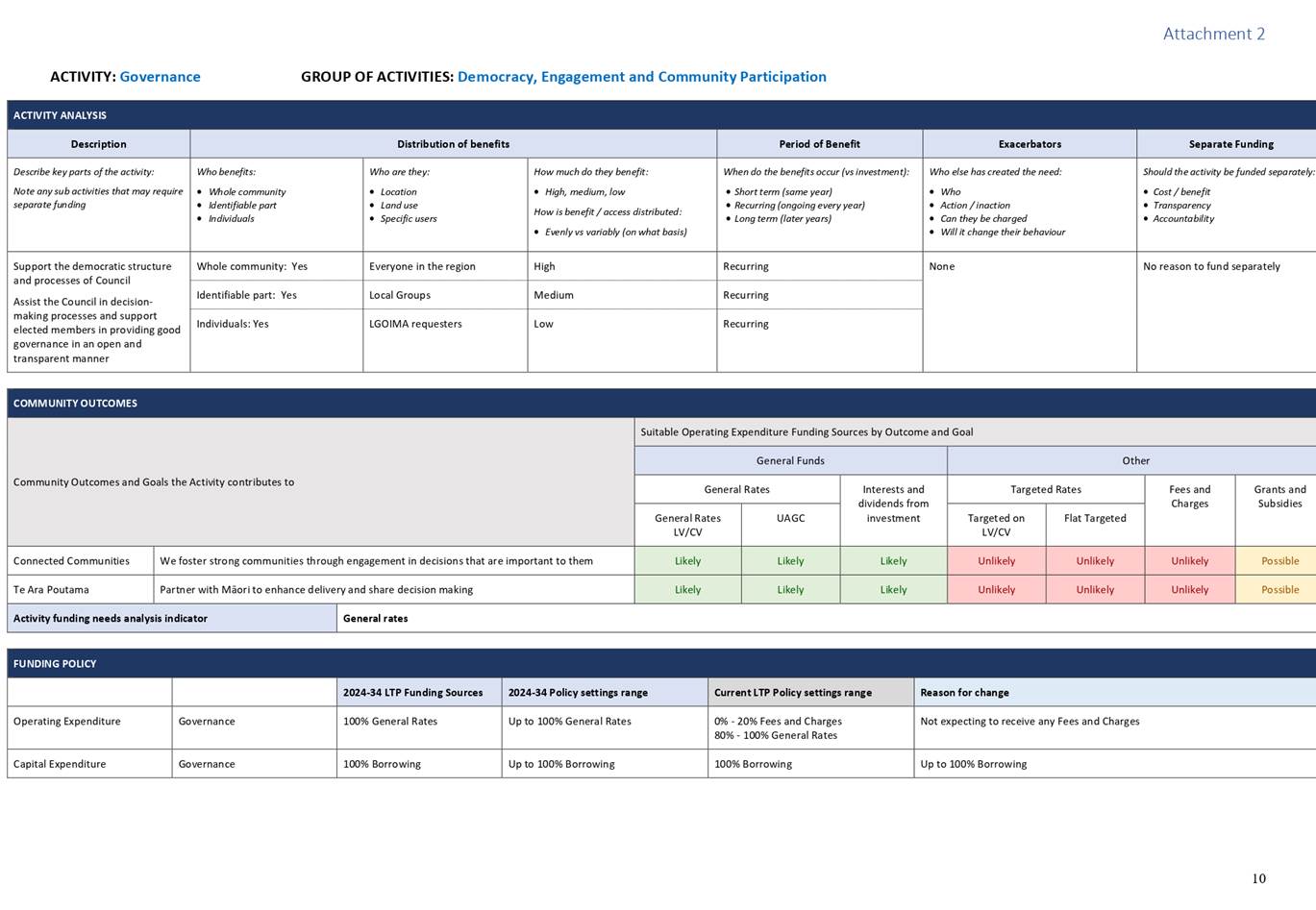

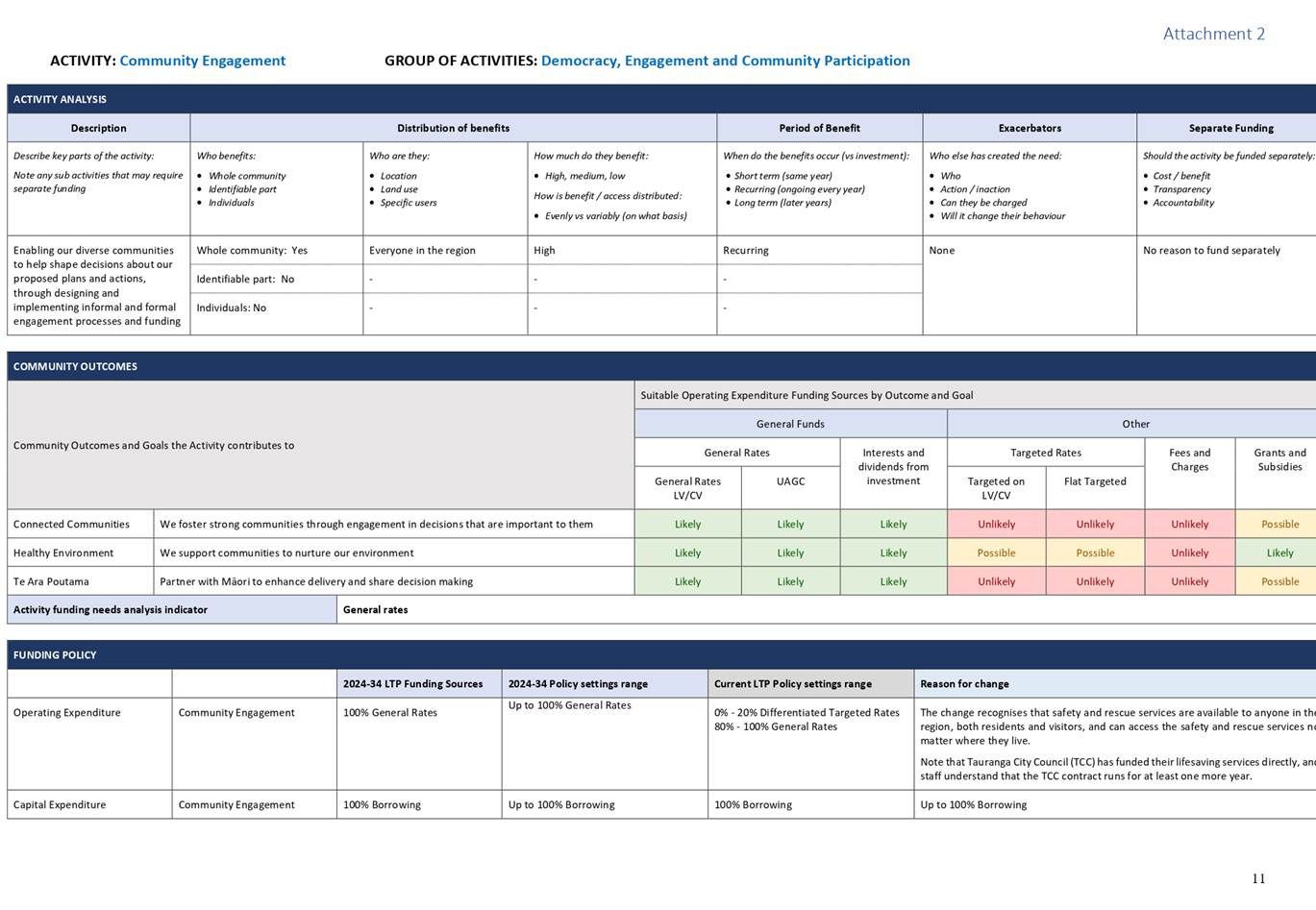

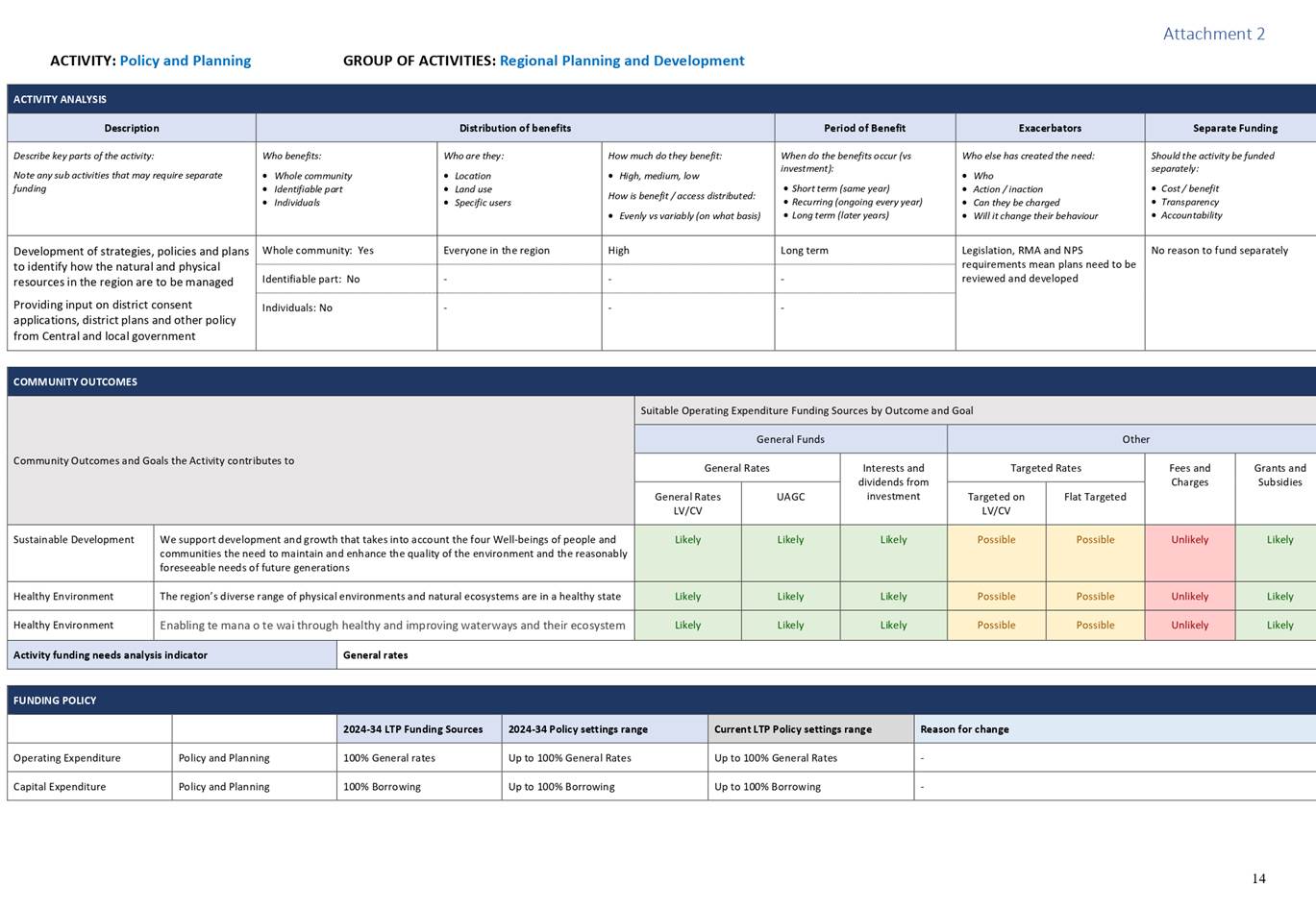

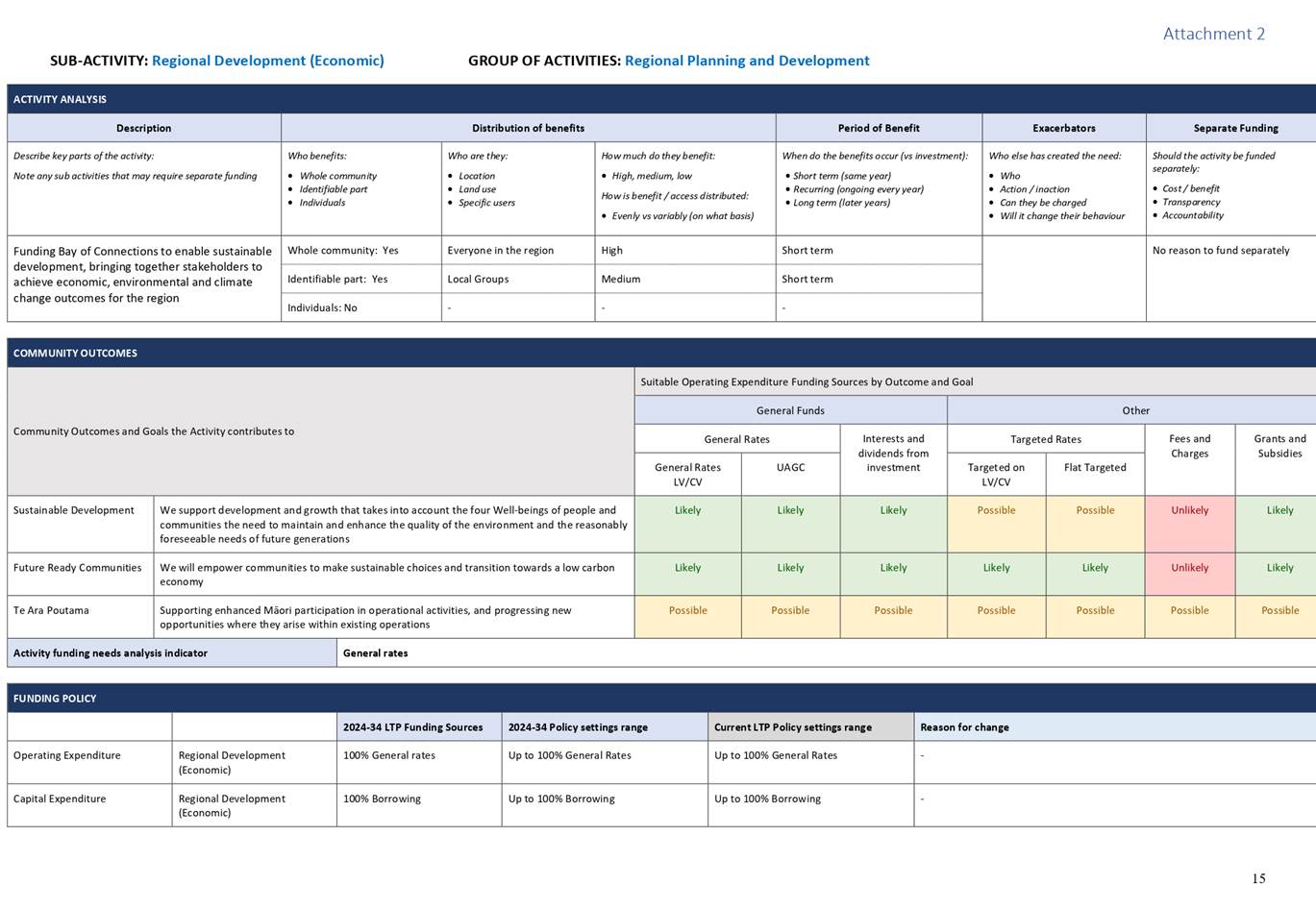

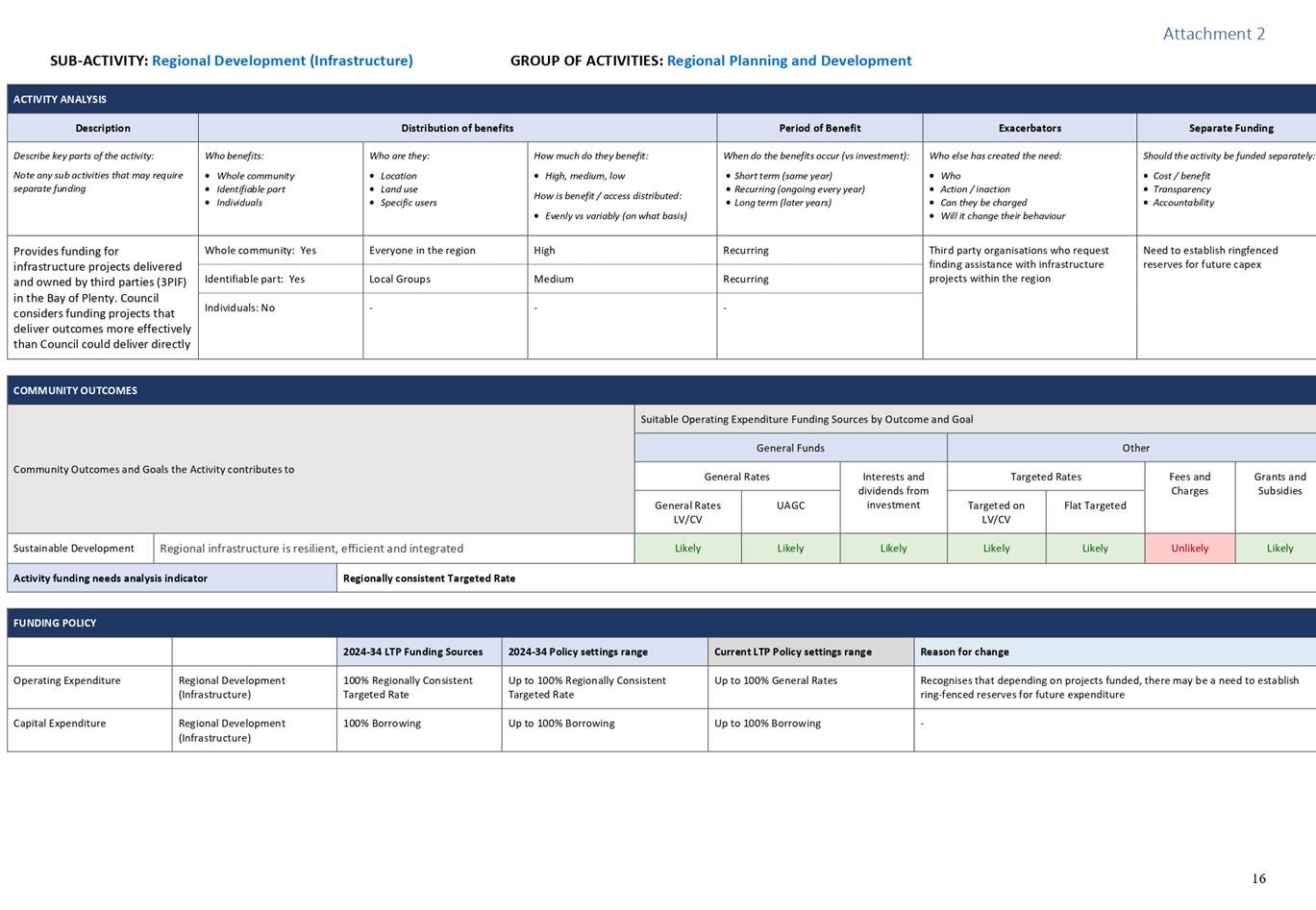

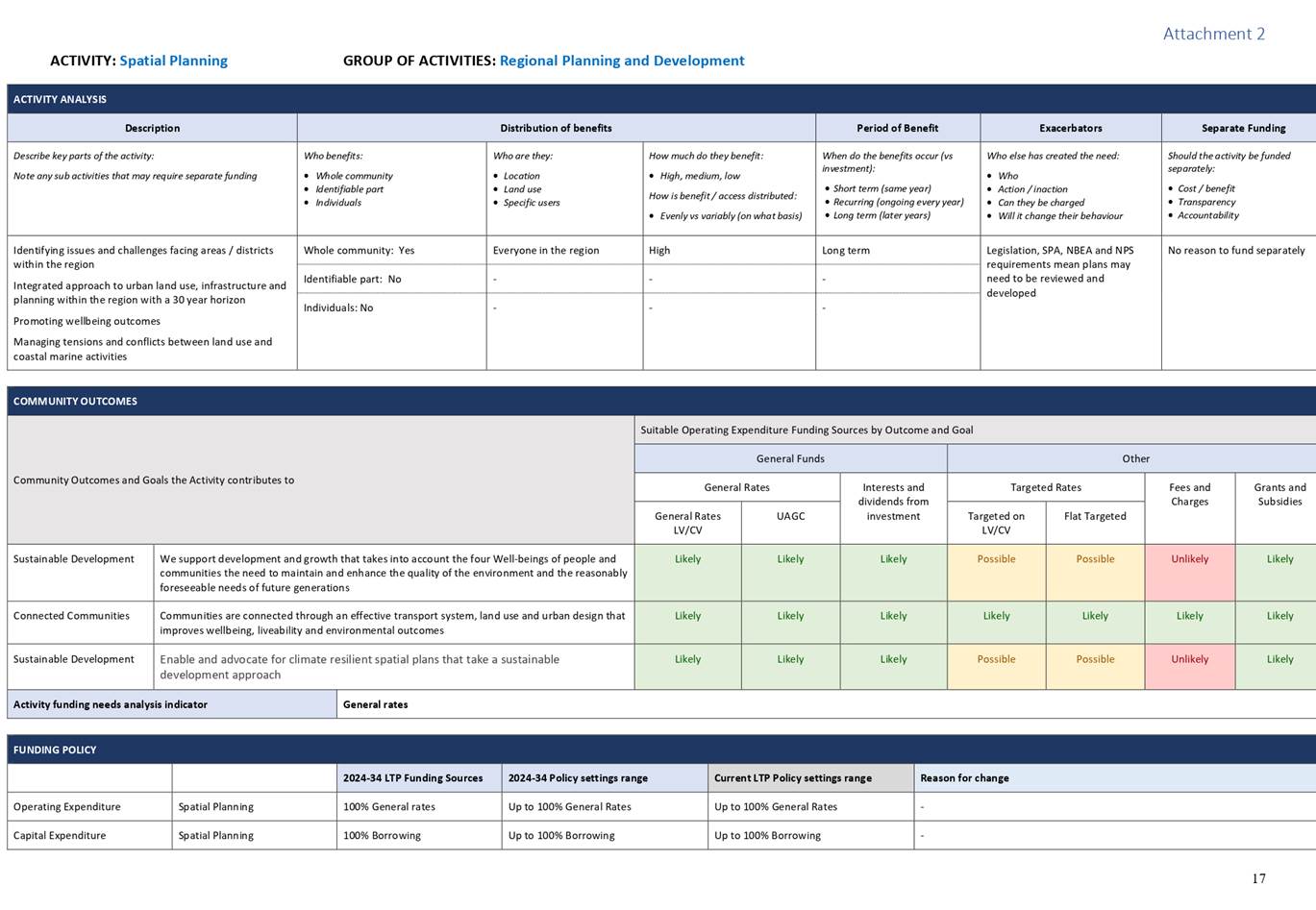

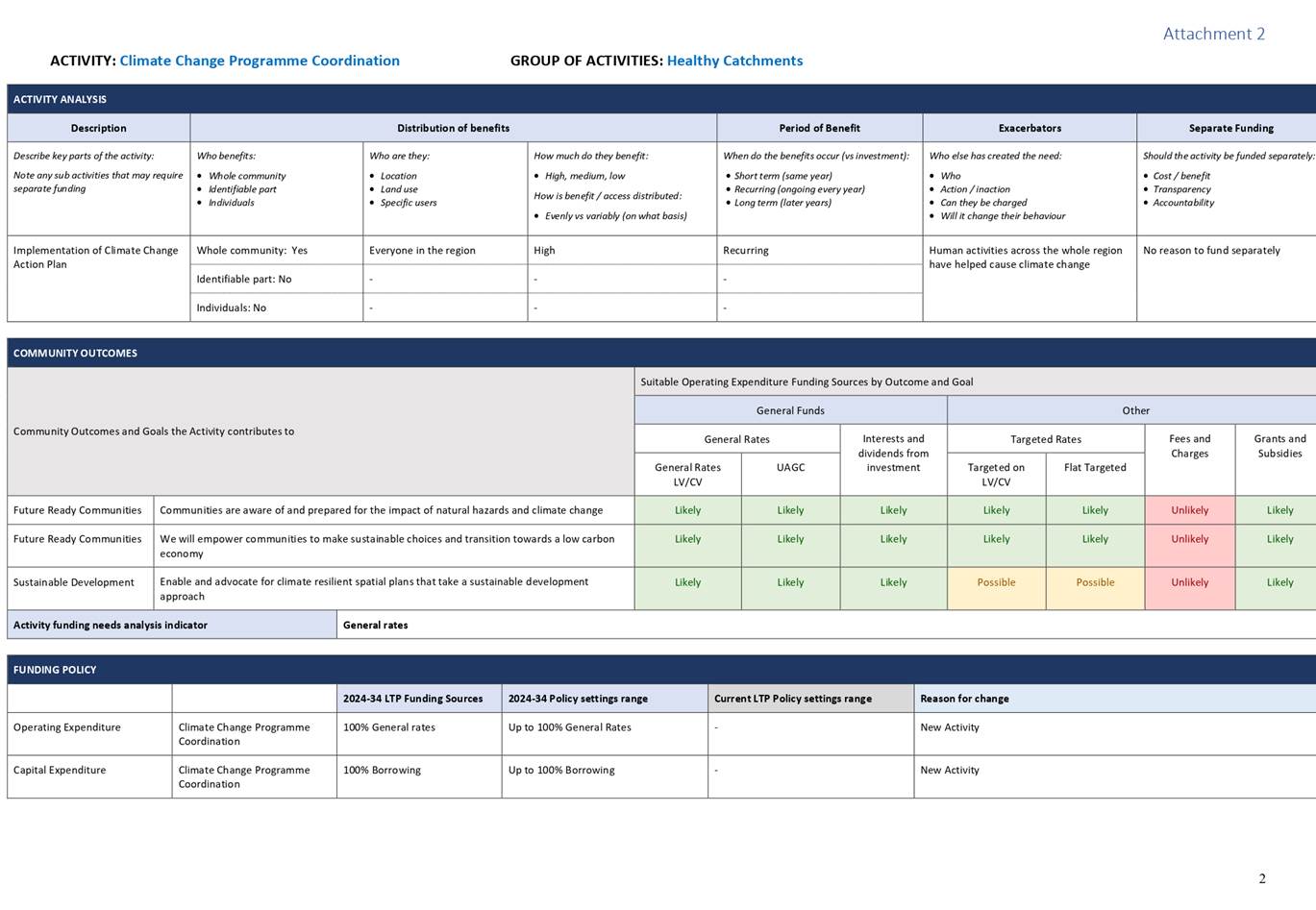

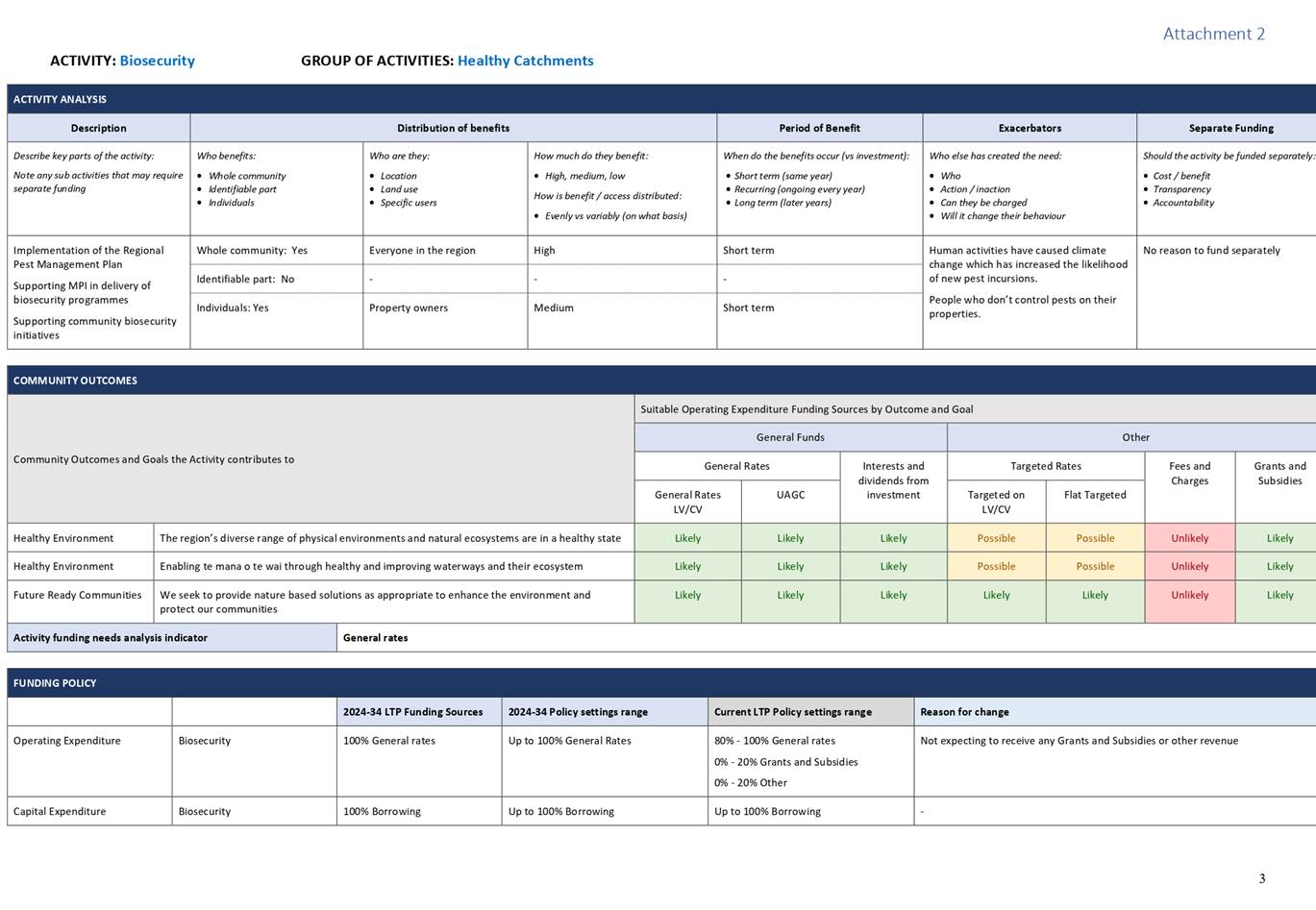

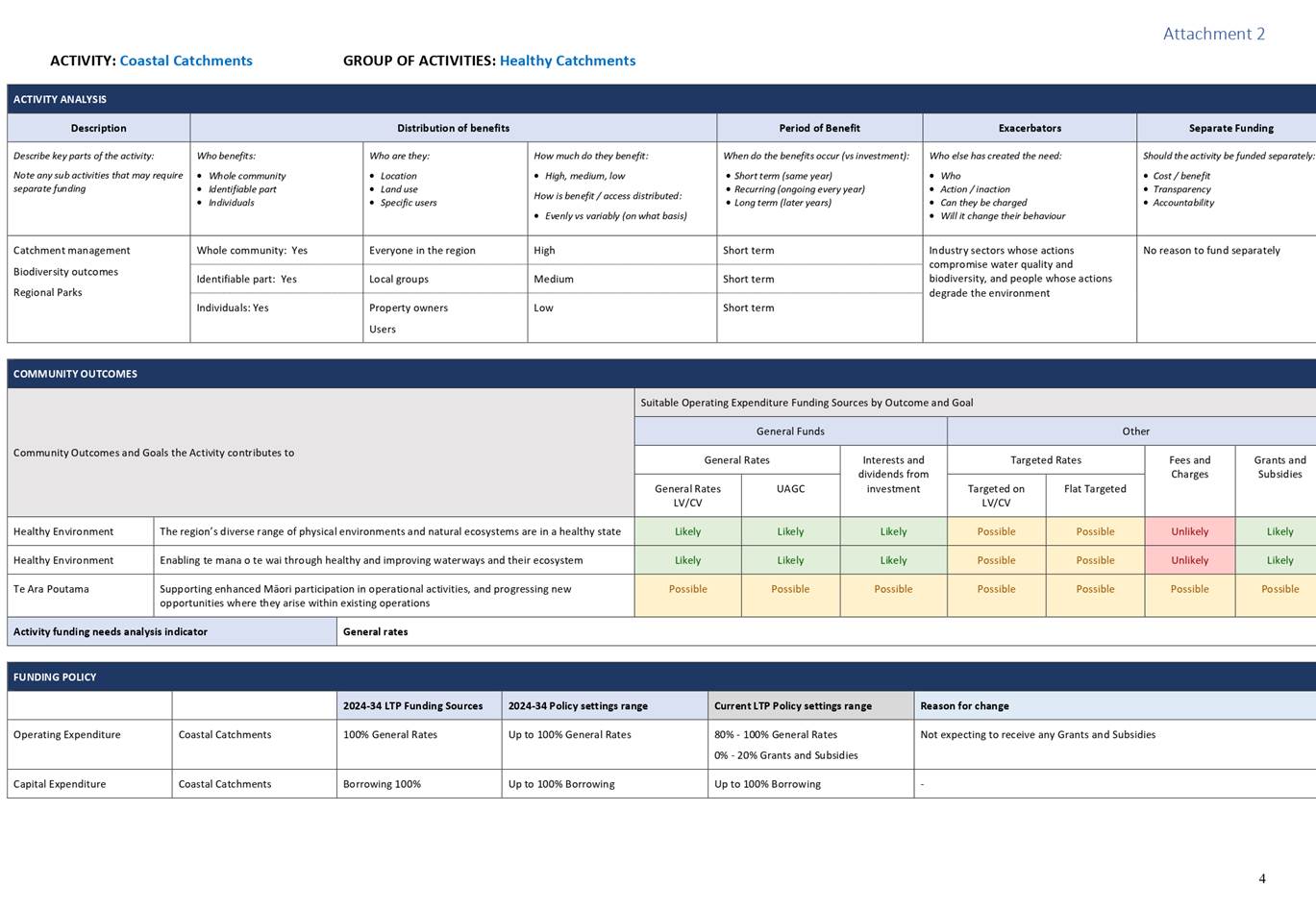

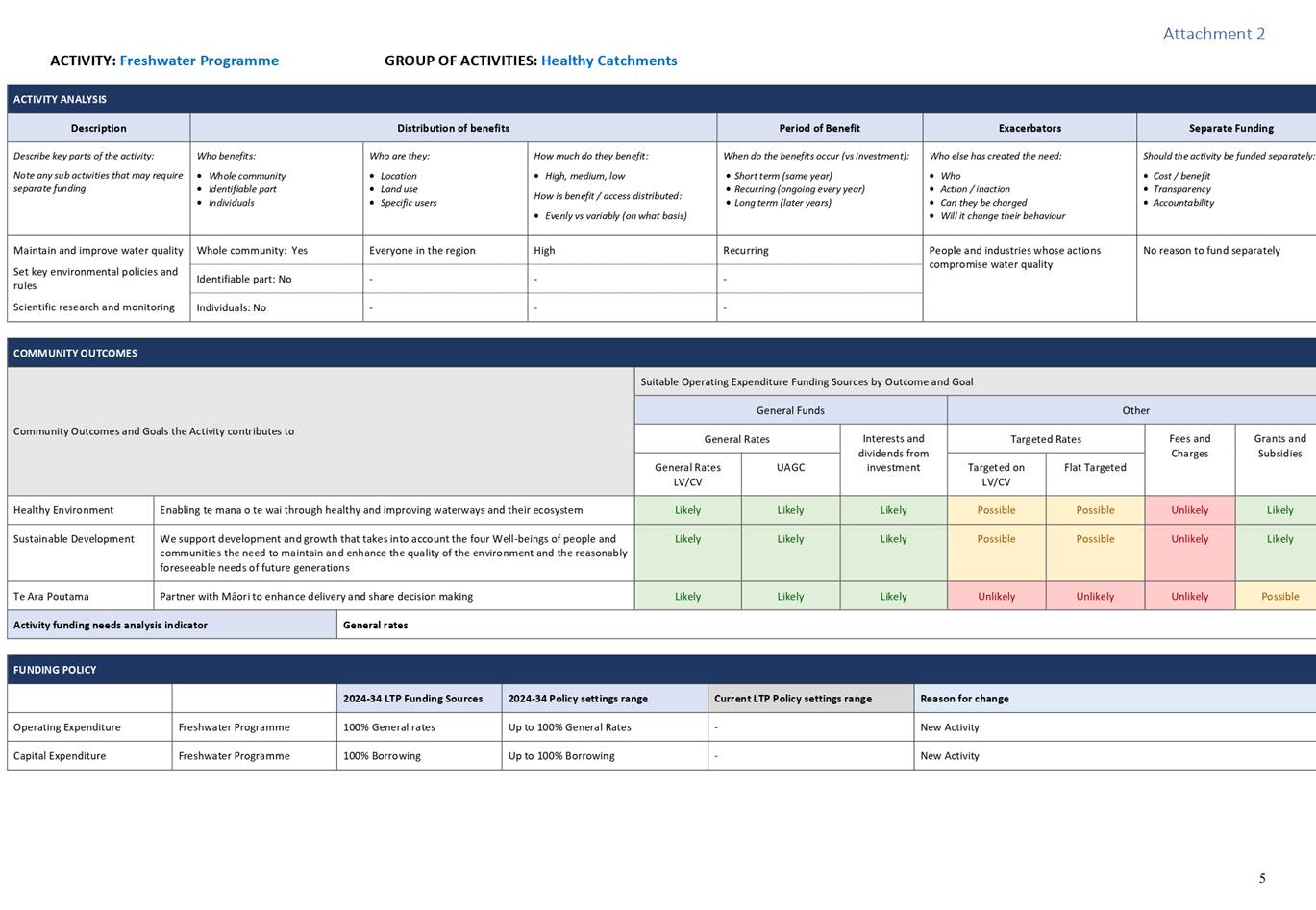

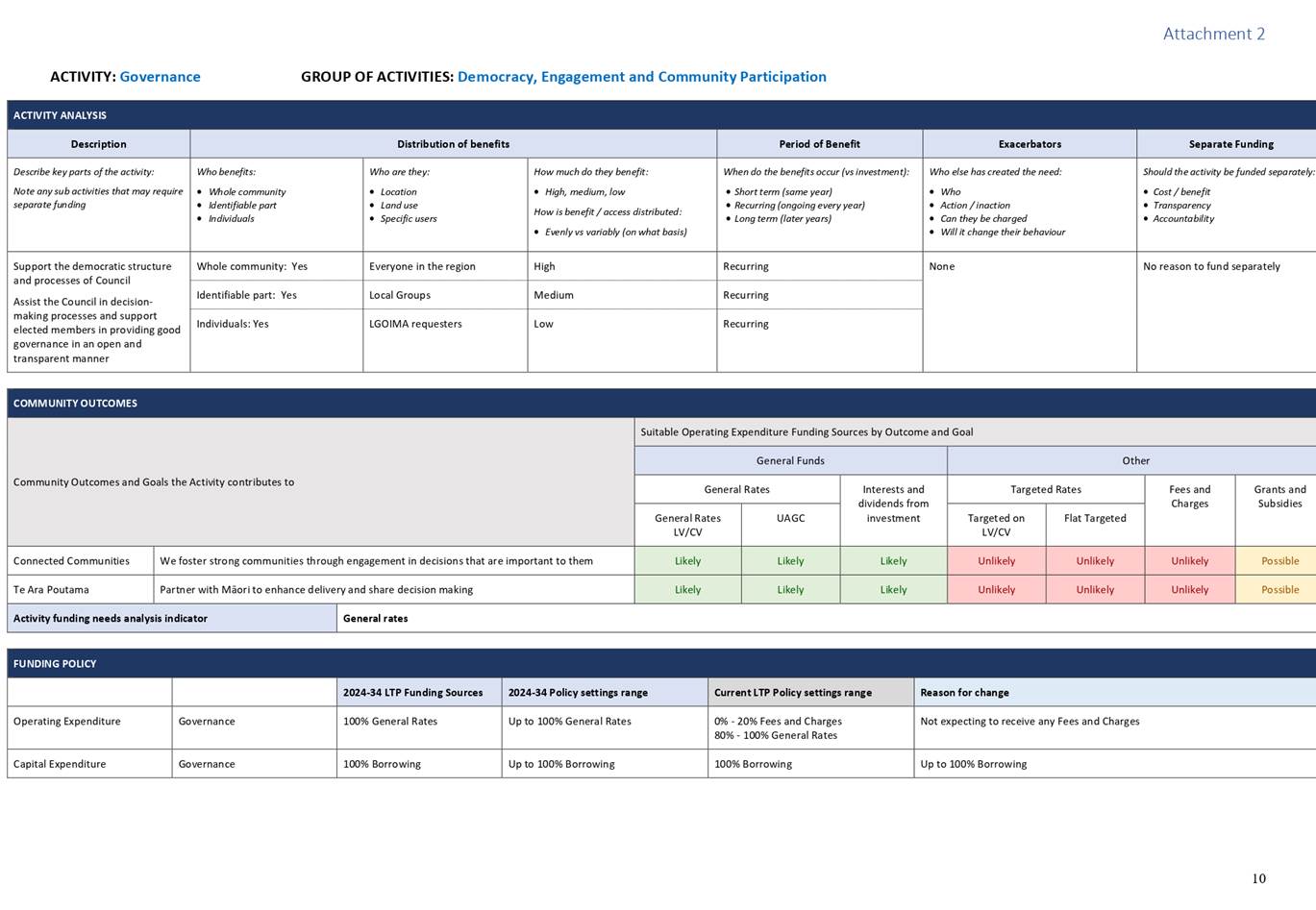

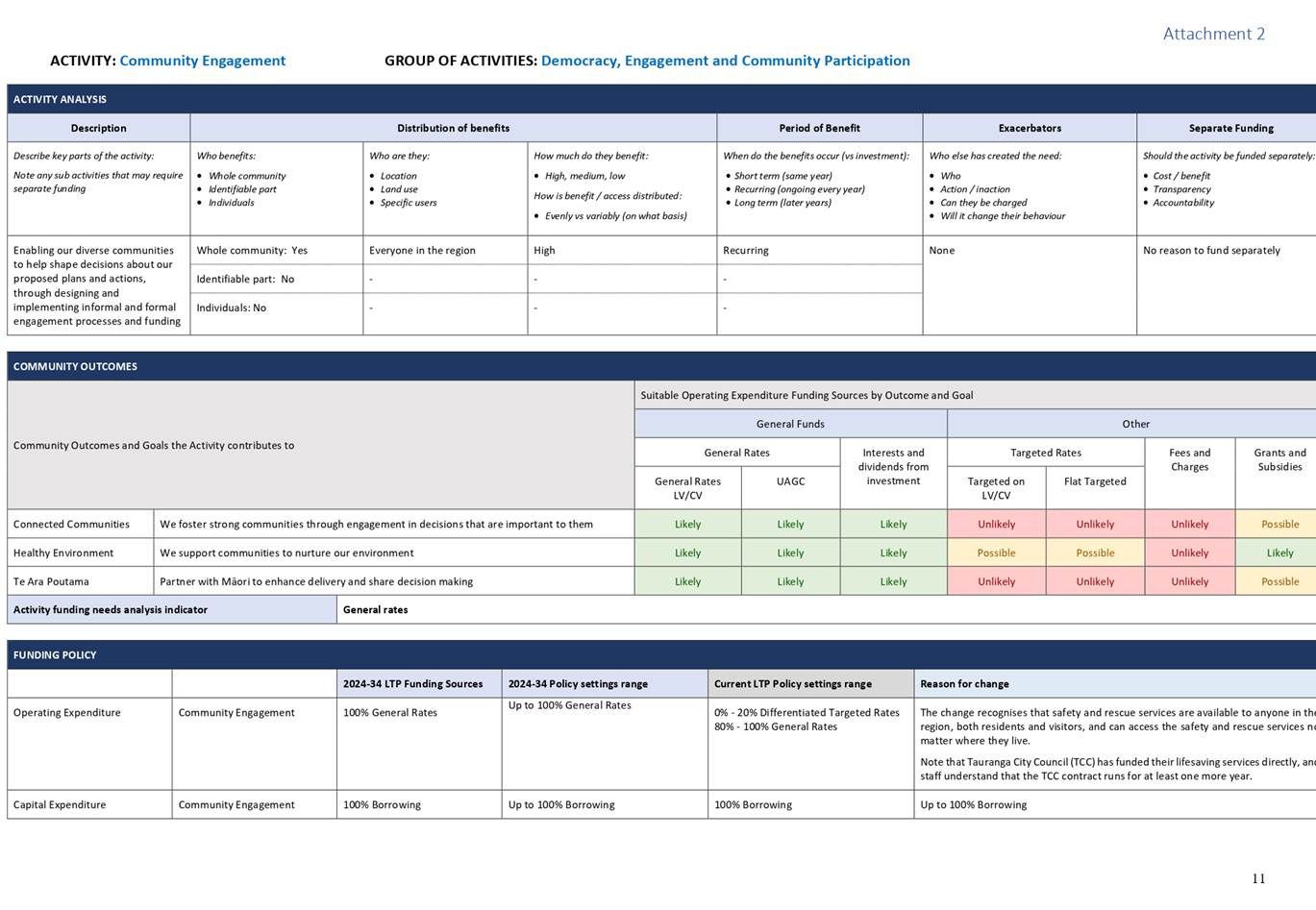

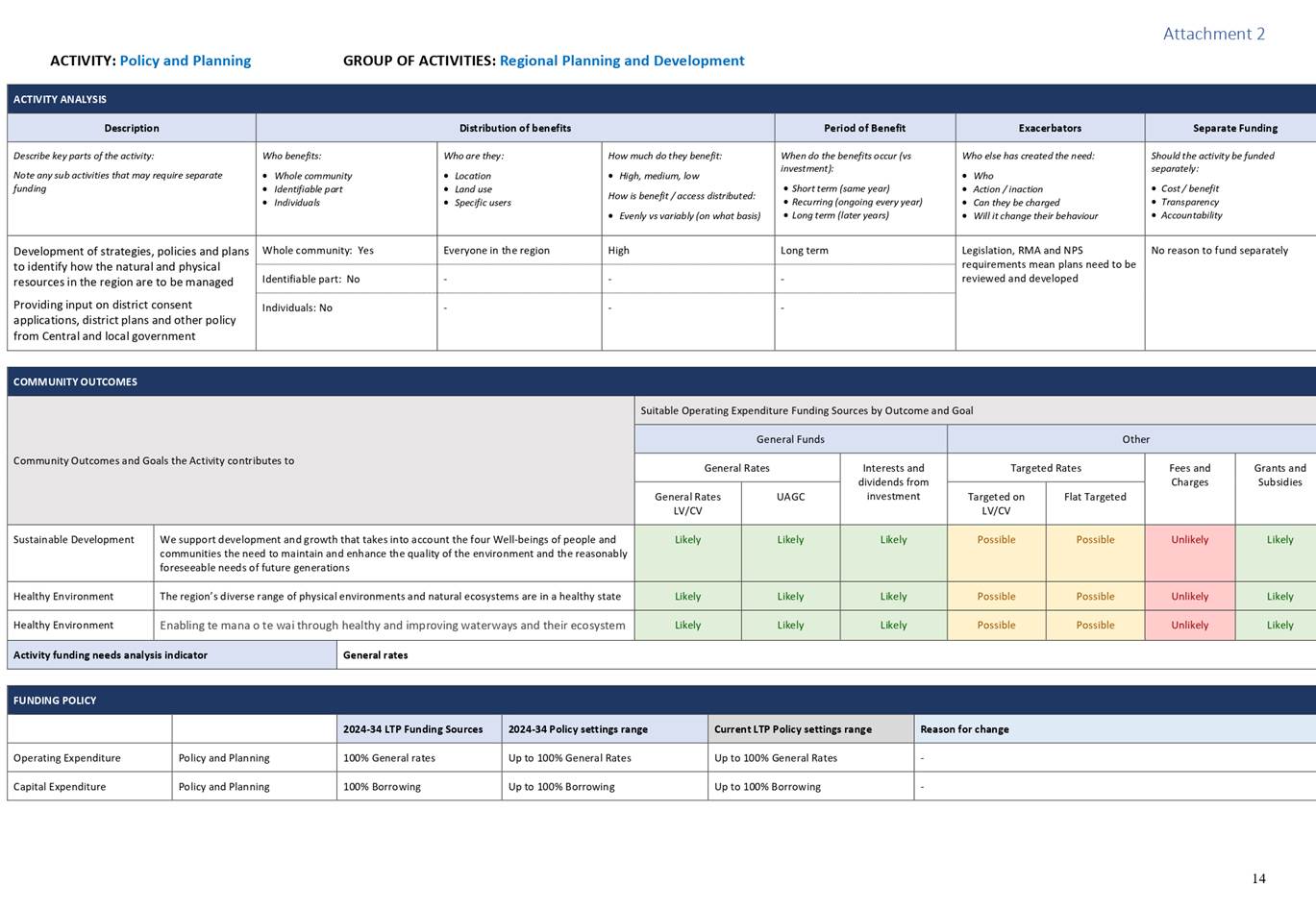

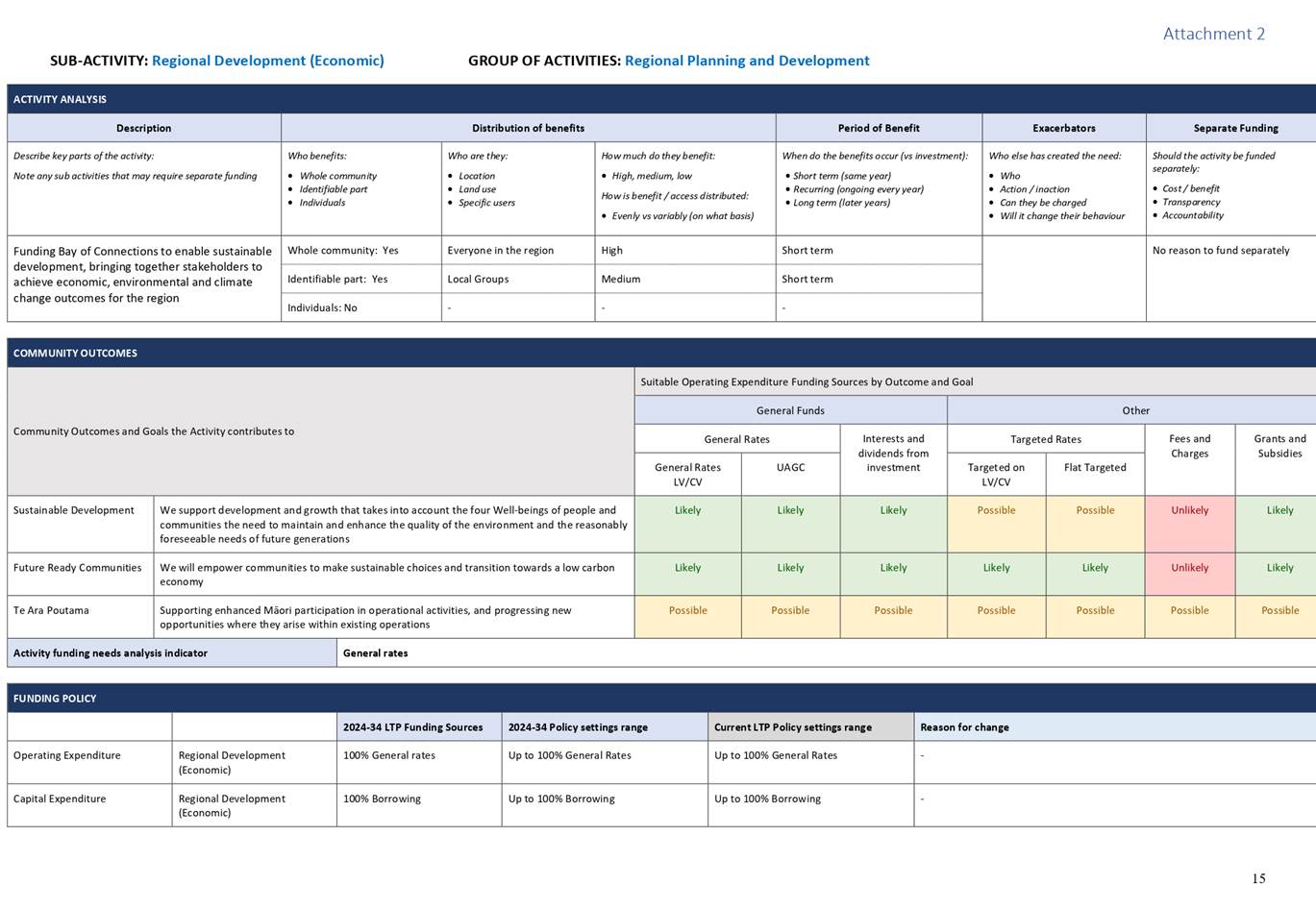

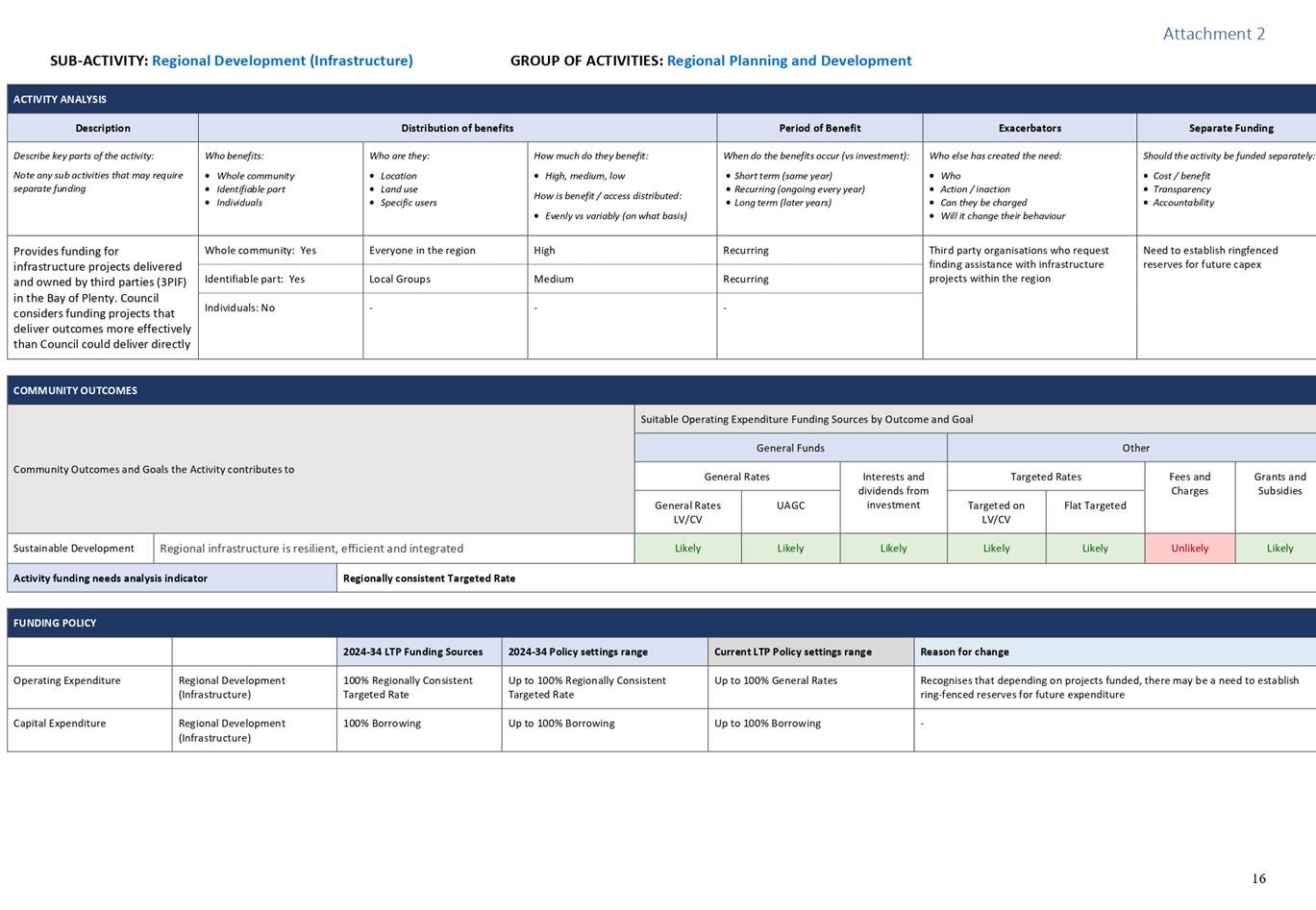

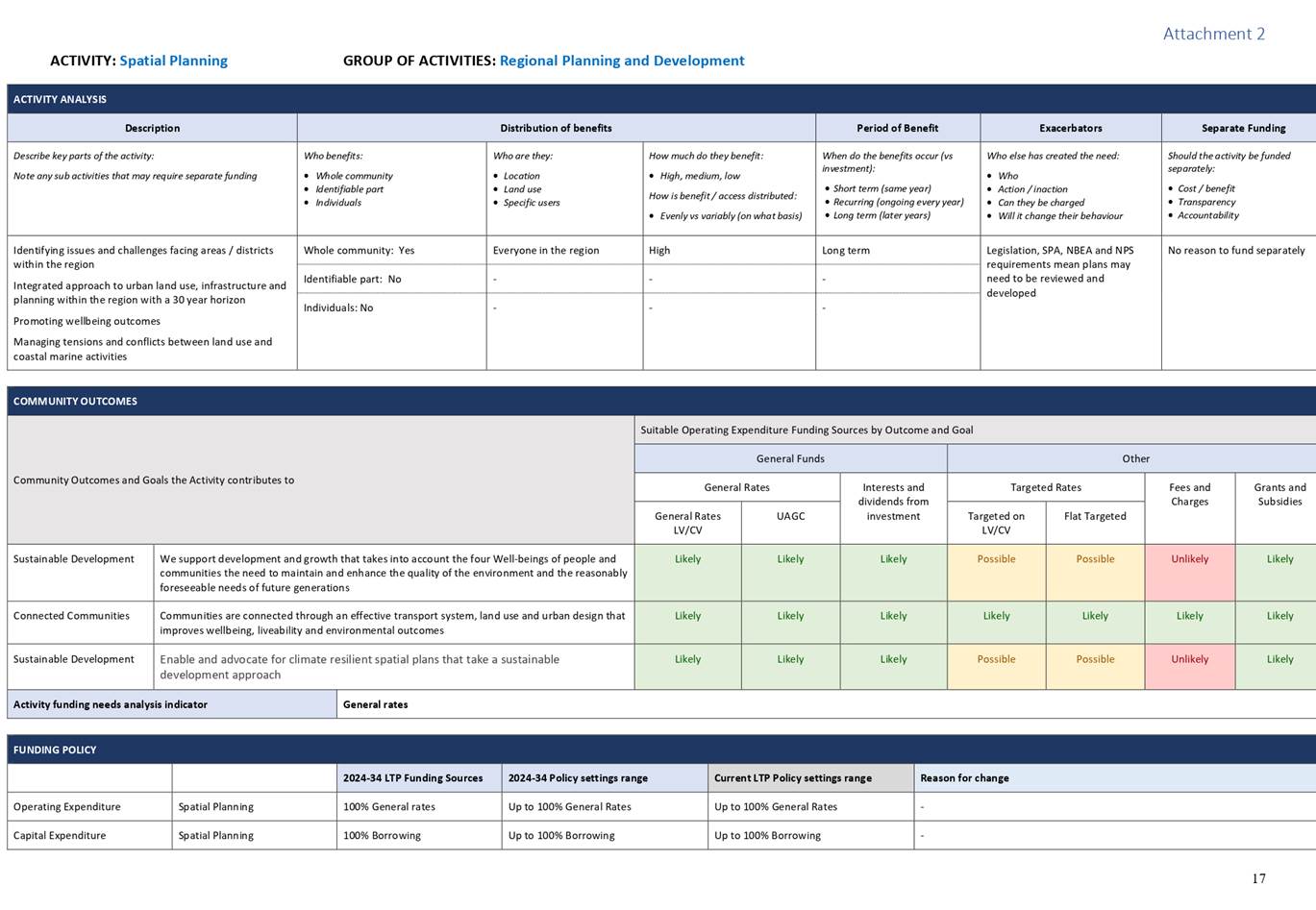

Attachment 1 illustrates the Step One methodology.

On 19 August Councillors

received a summary of the activity assessment results, for which more detail is

provided at this workshop.

3.2 Activity

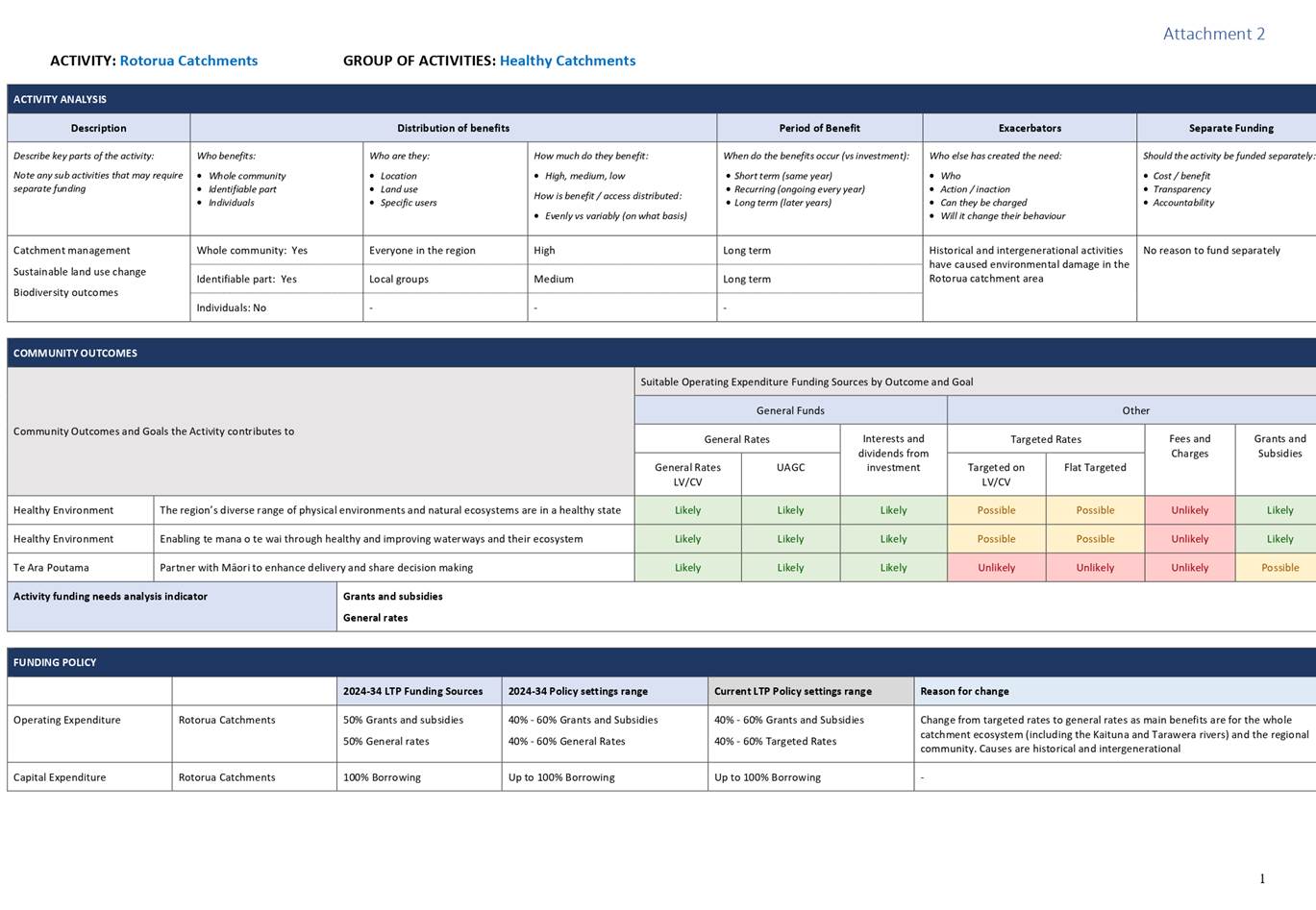

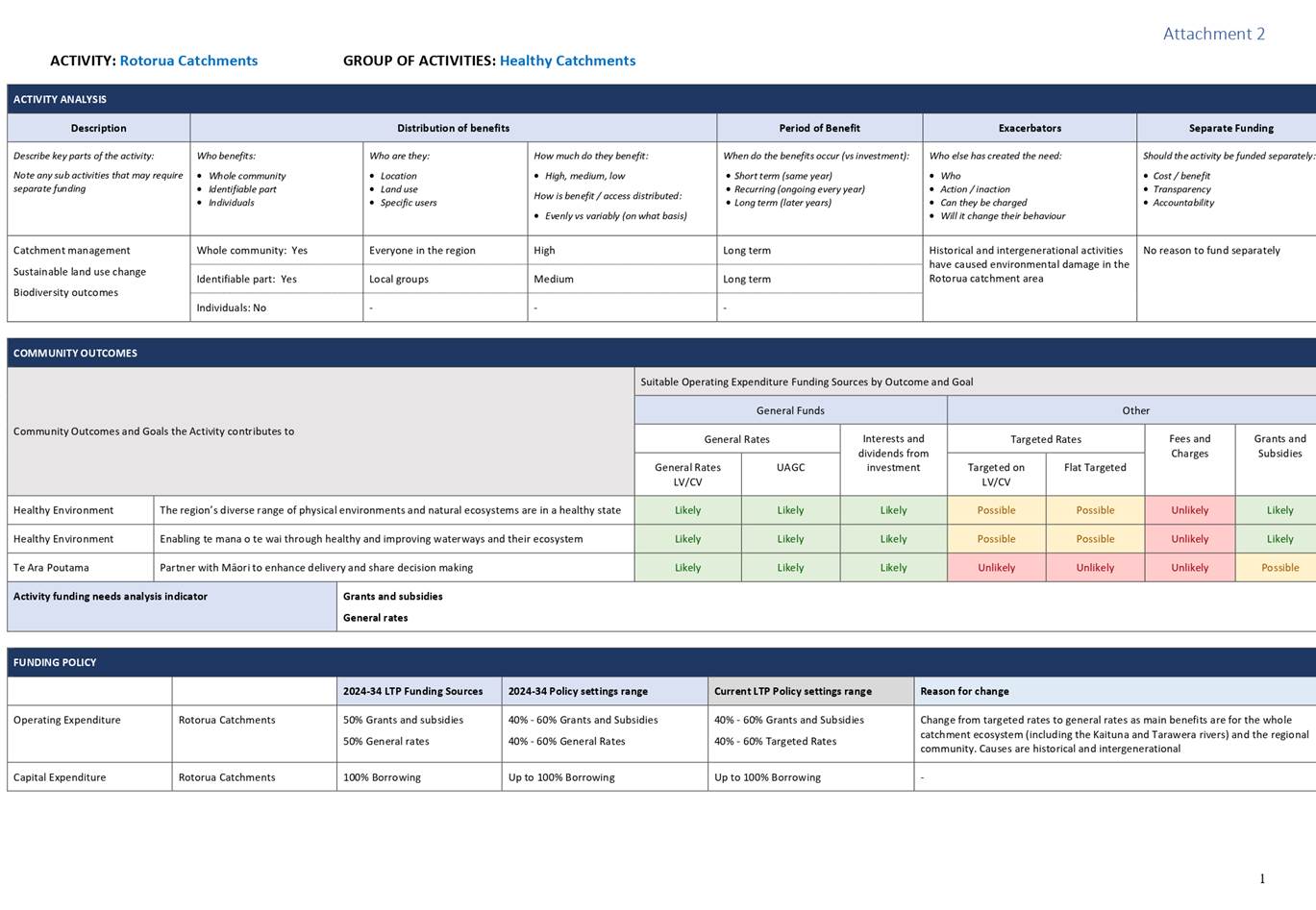

assessment results – Step One

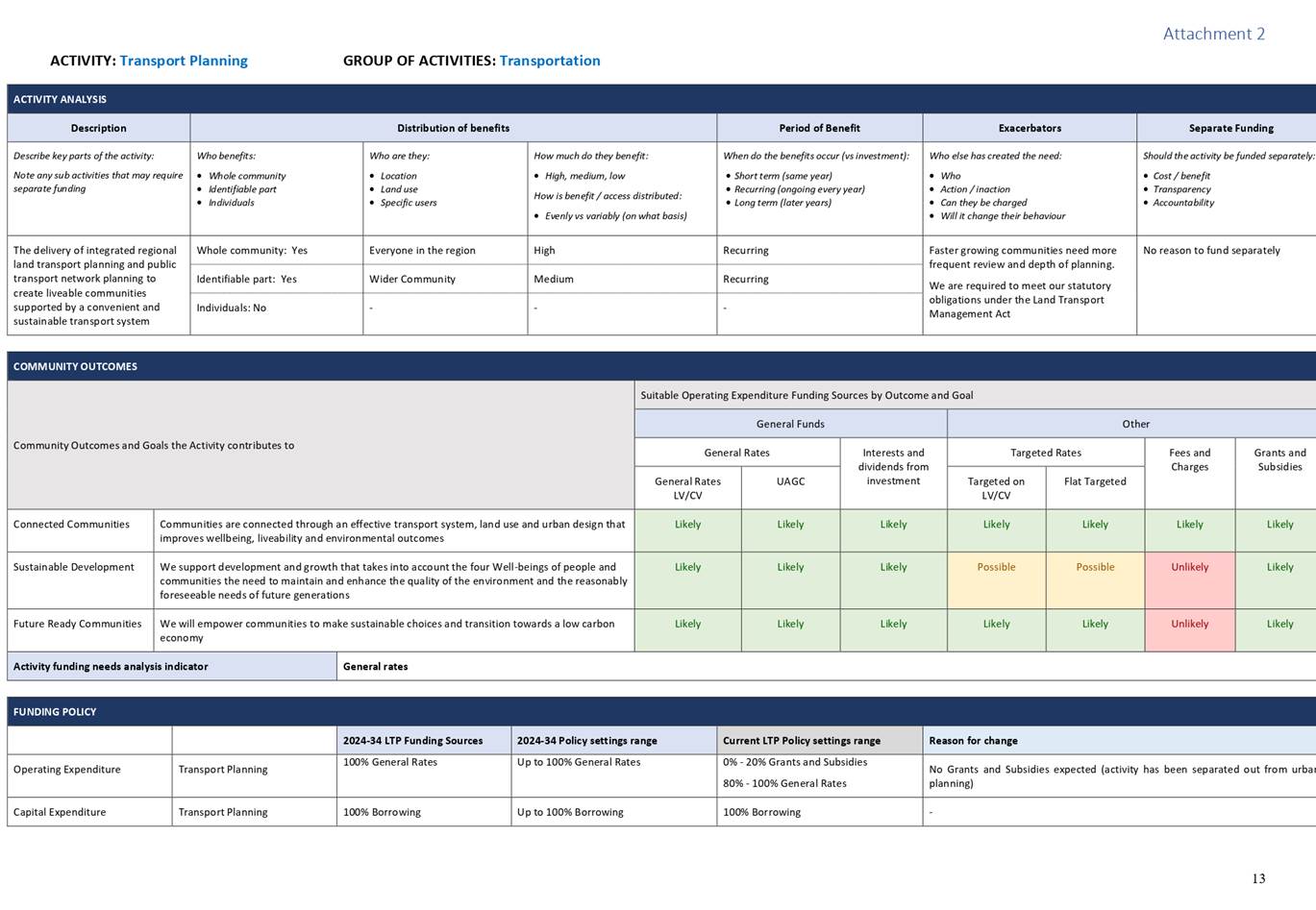

Staff have used the Morrison Low

methodology to consider the factors set out in Local Government Act 2002 (LGA)

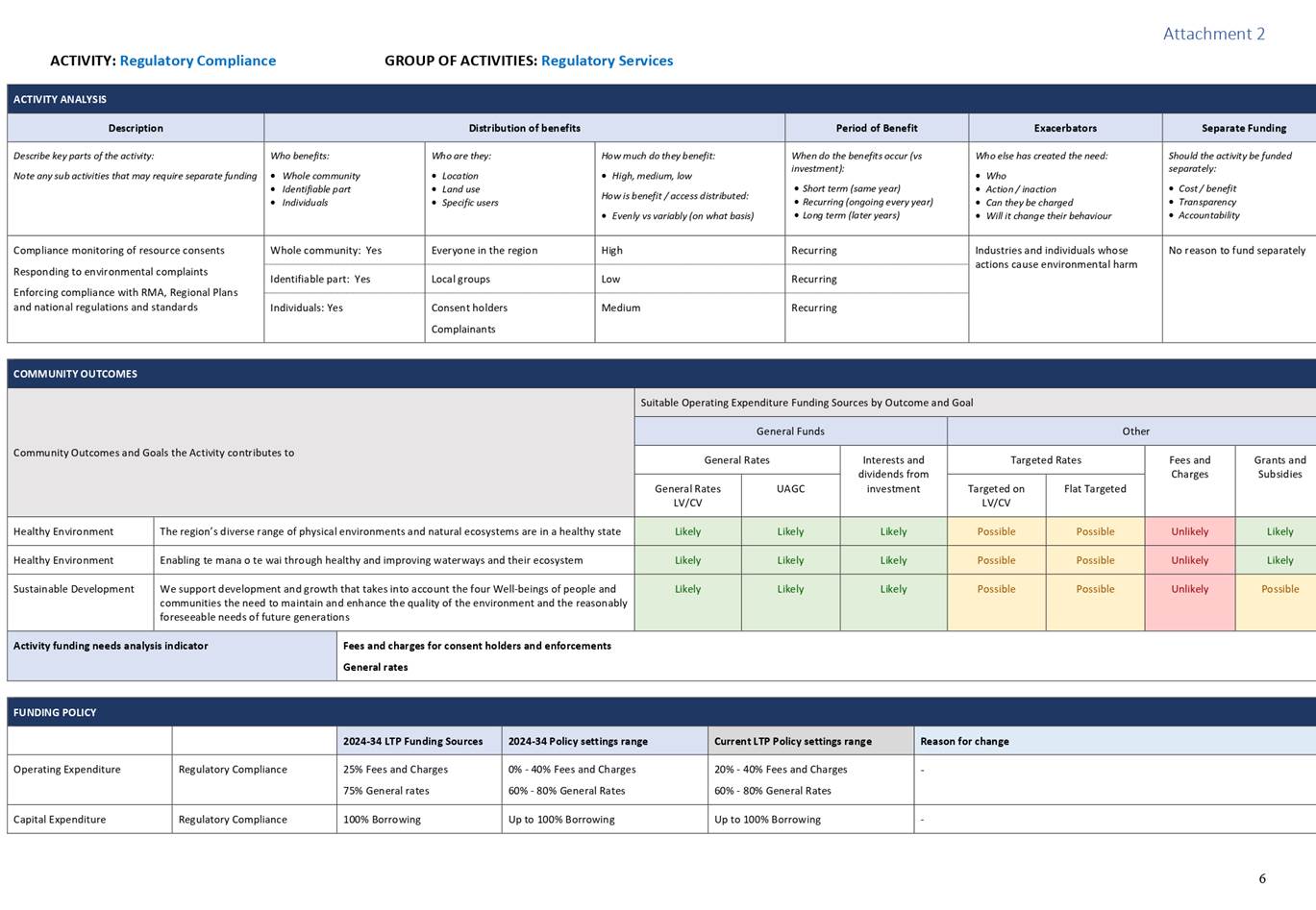

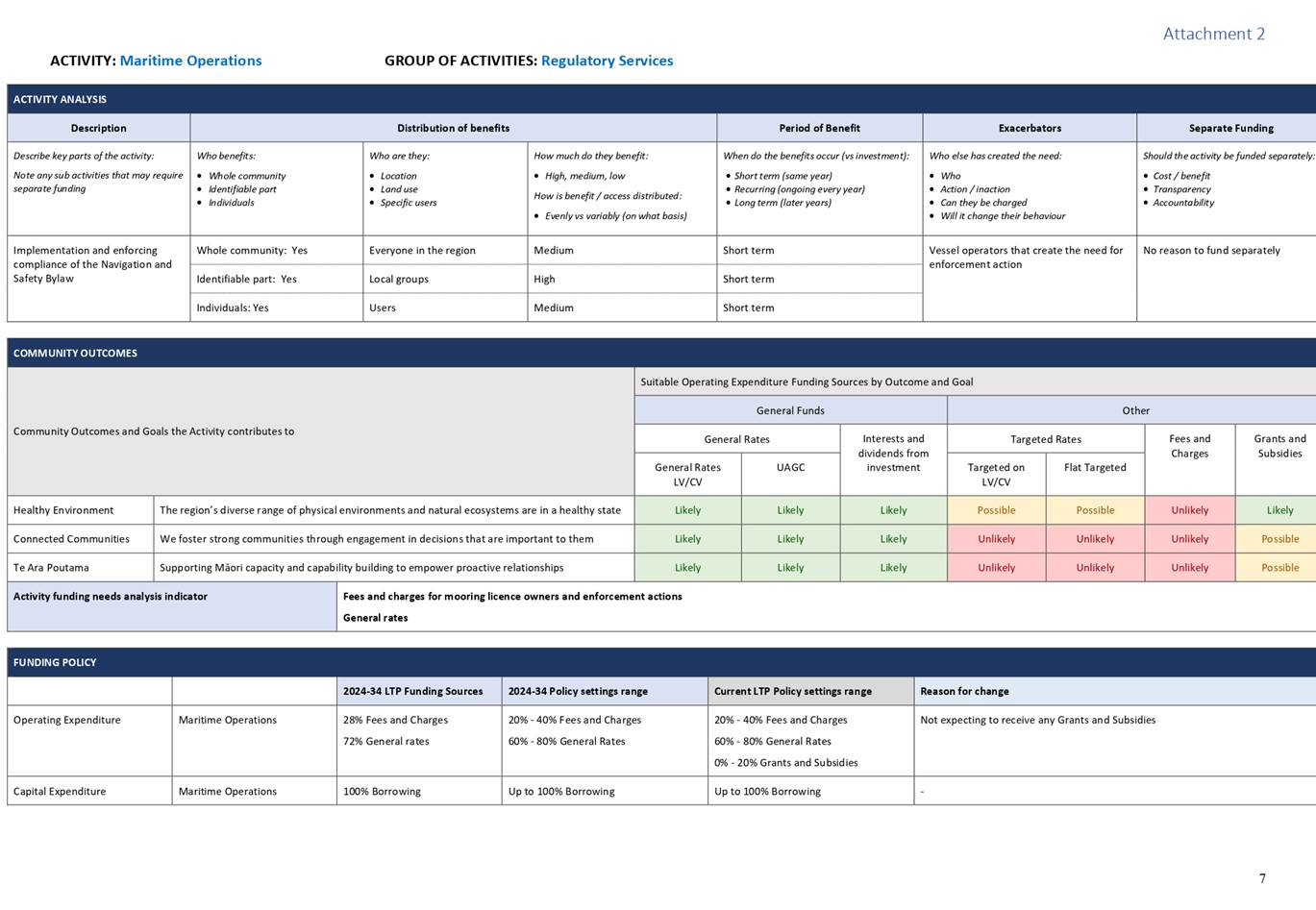

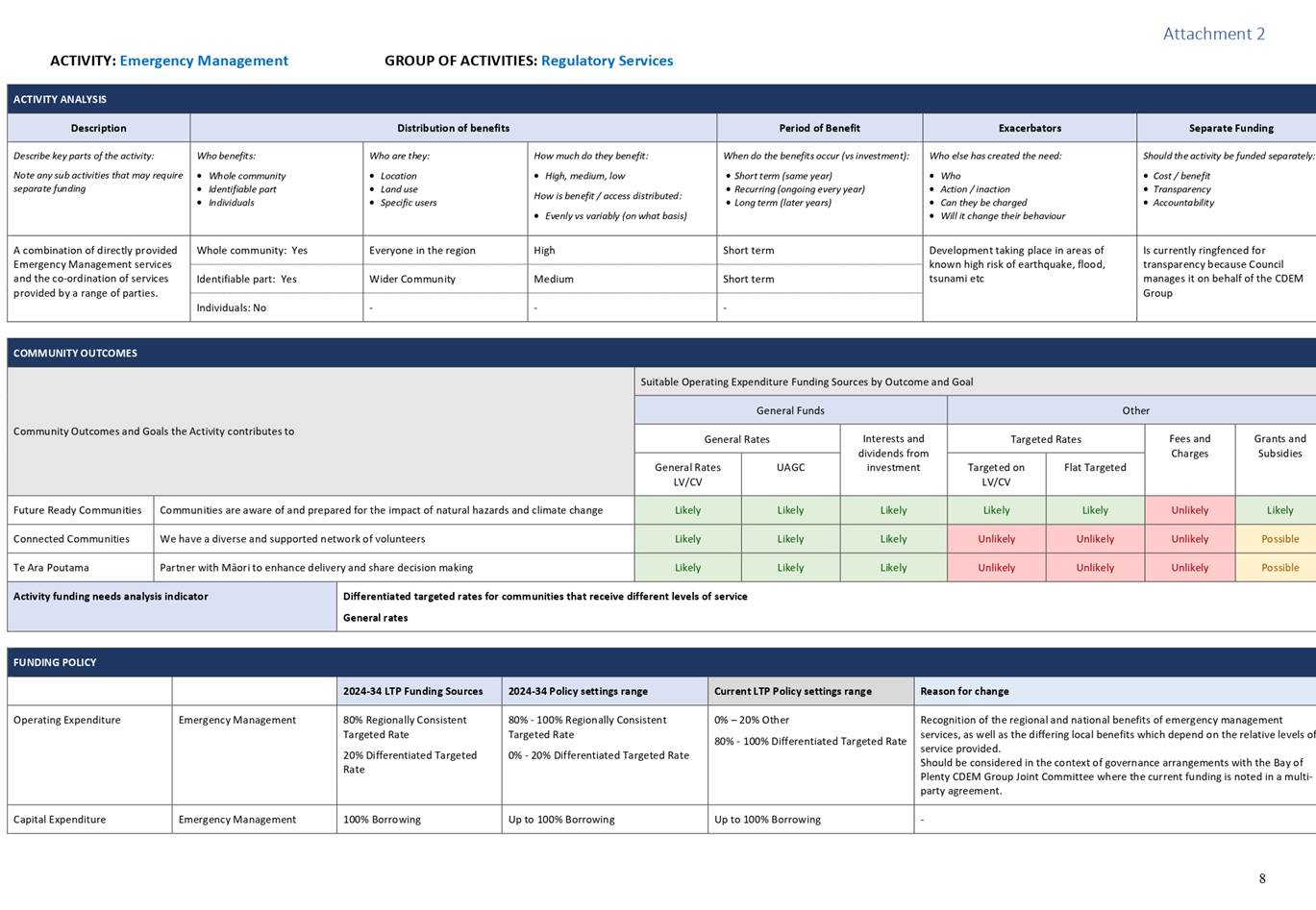

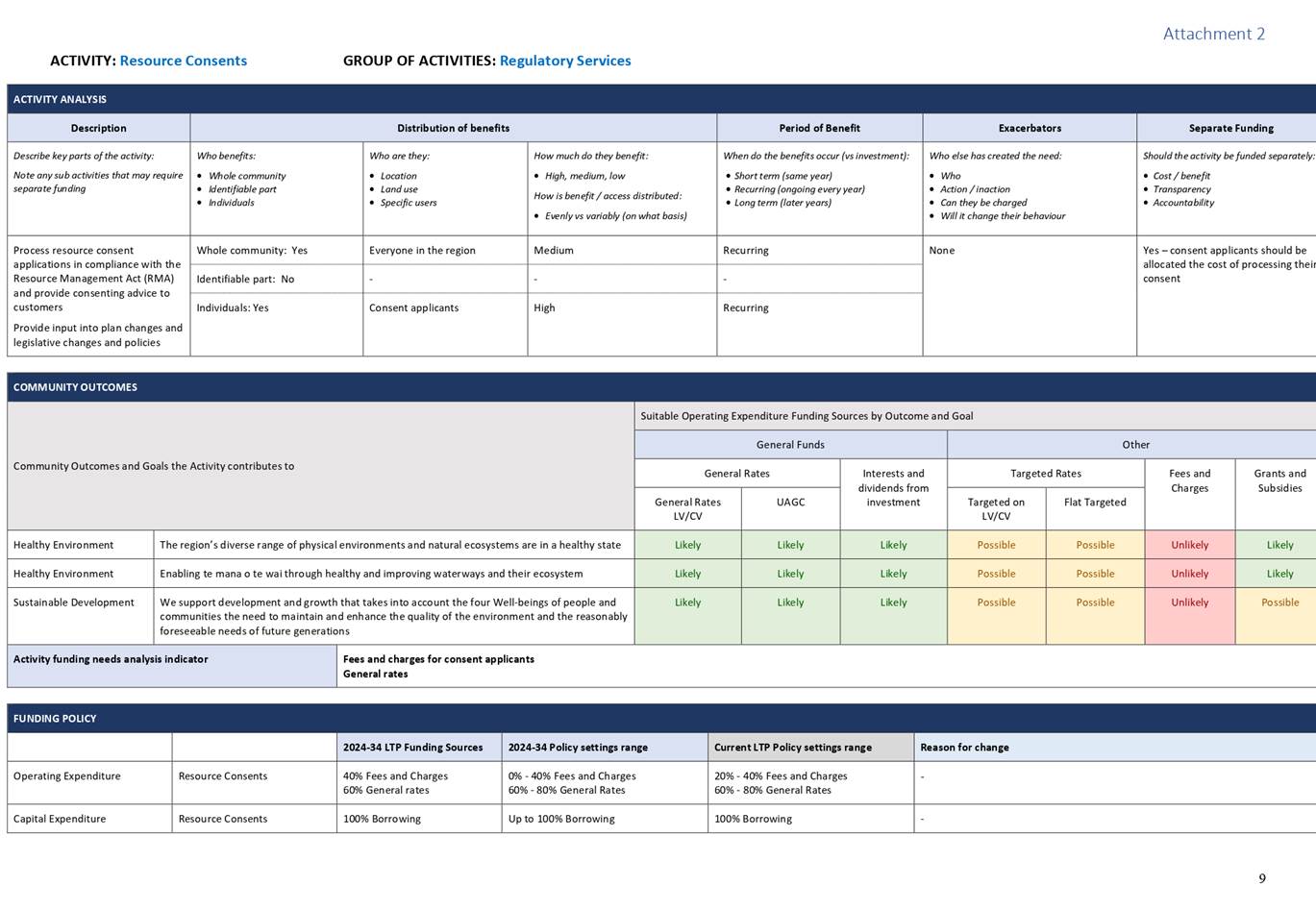

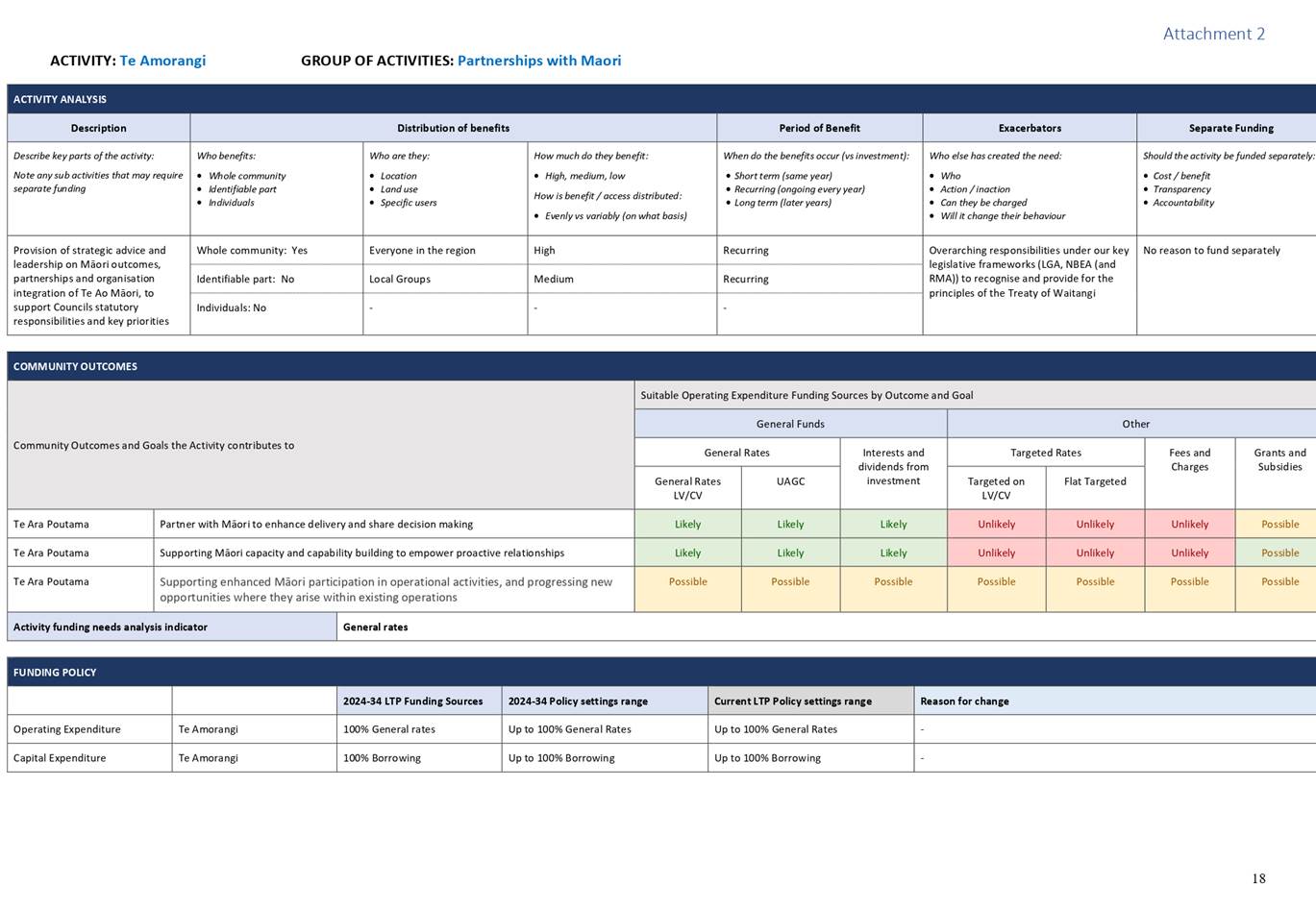

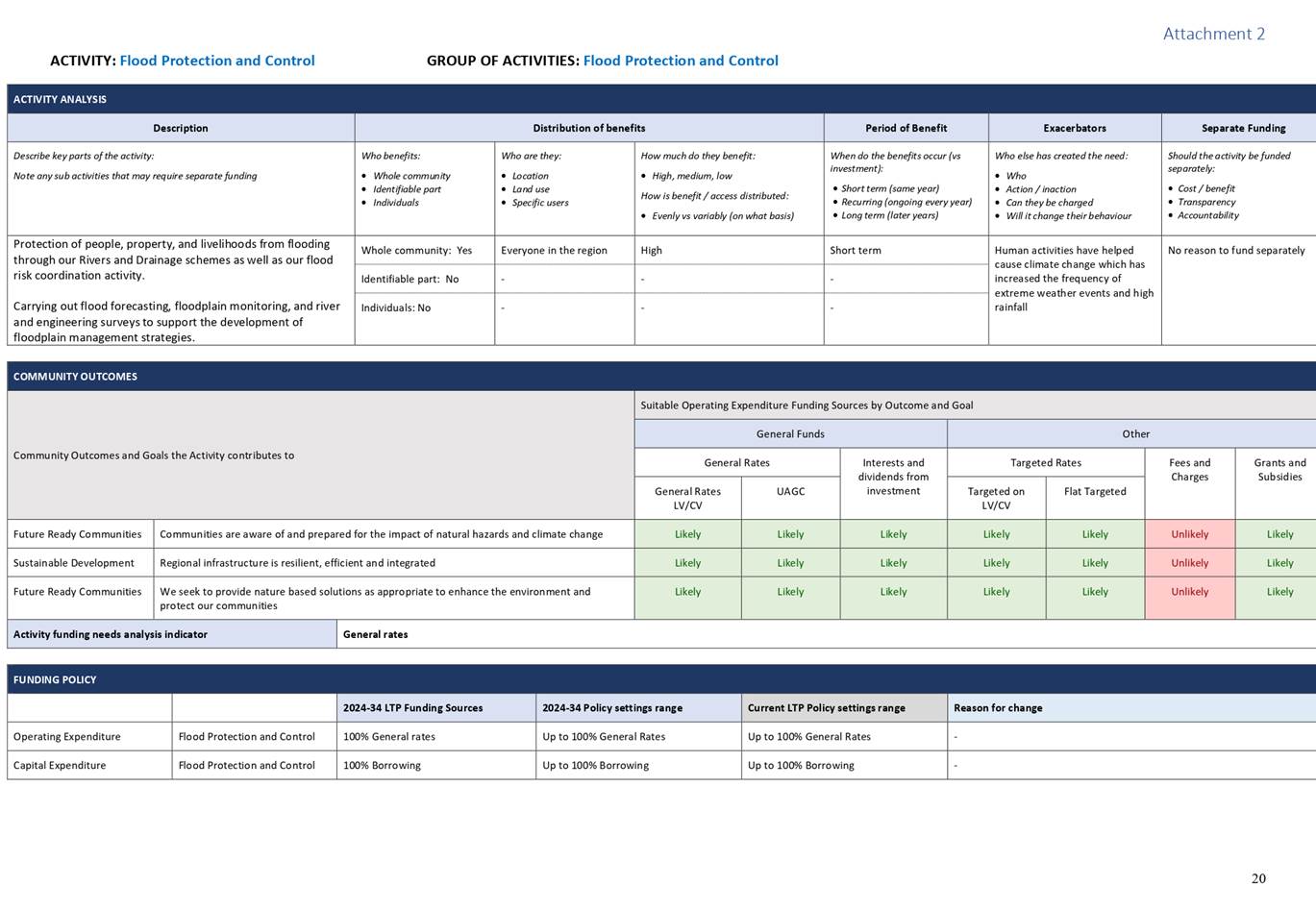

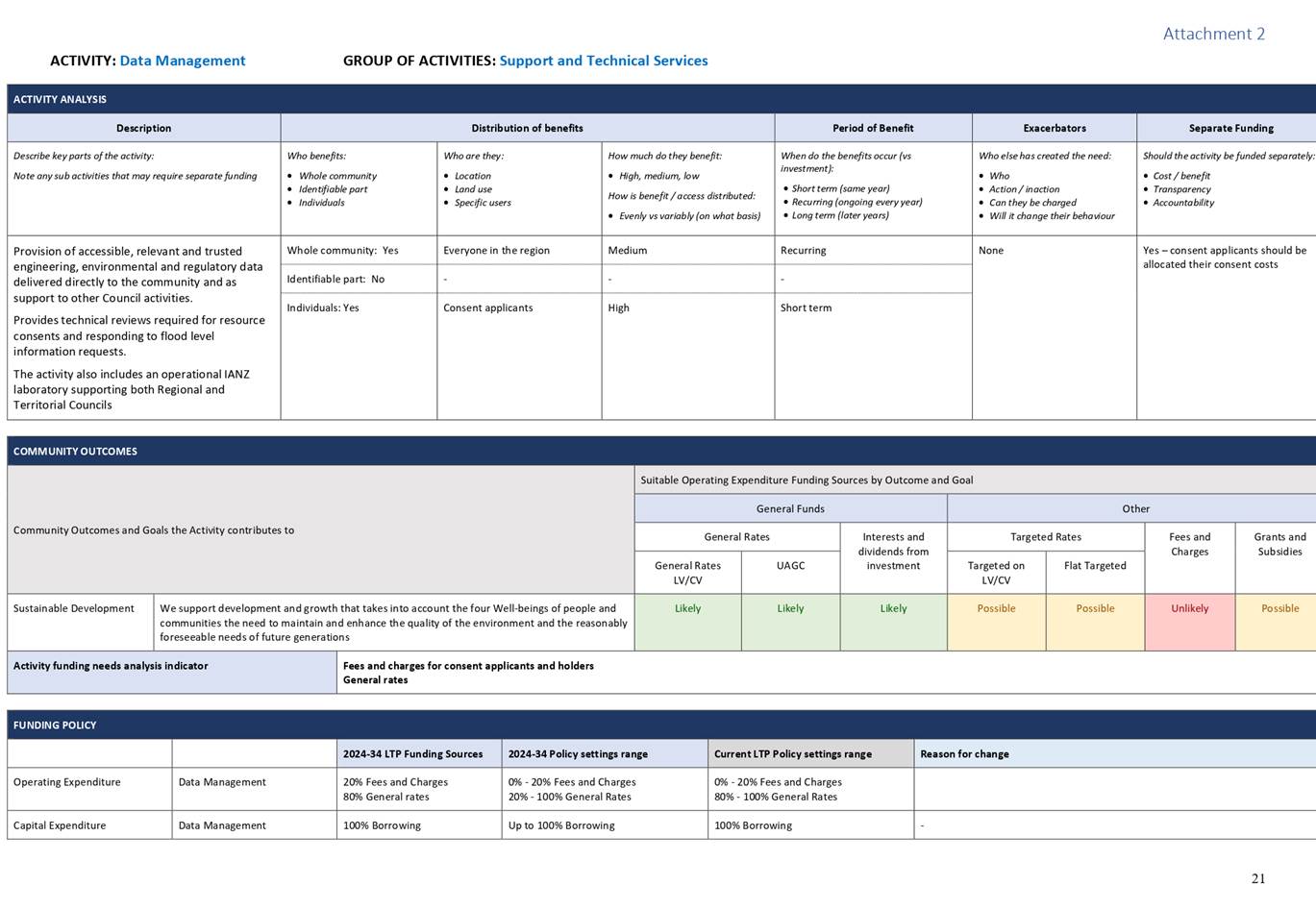

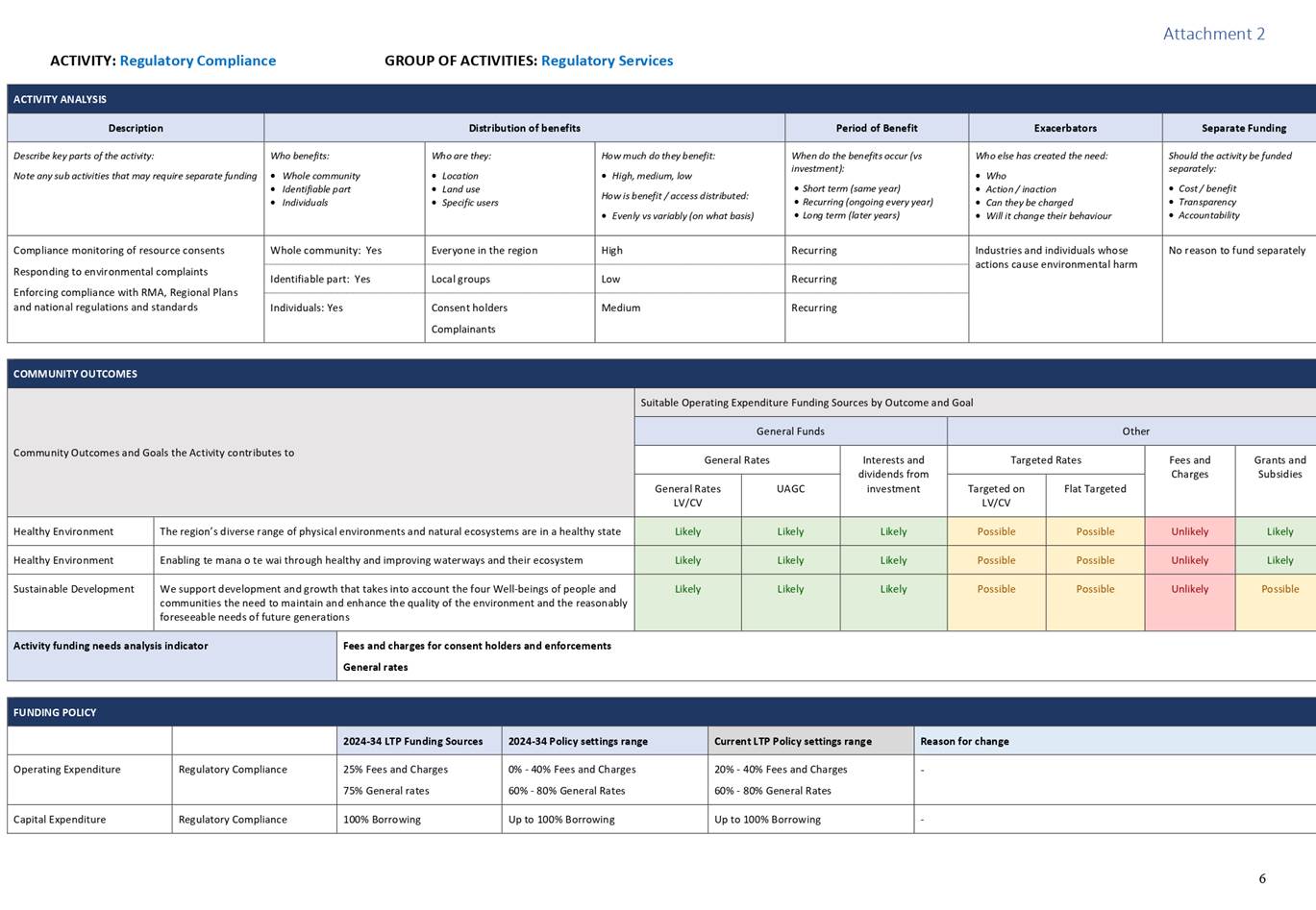

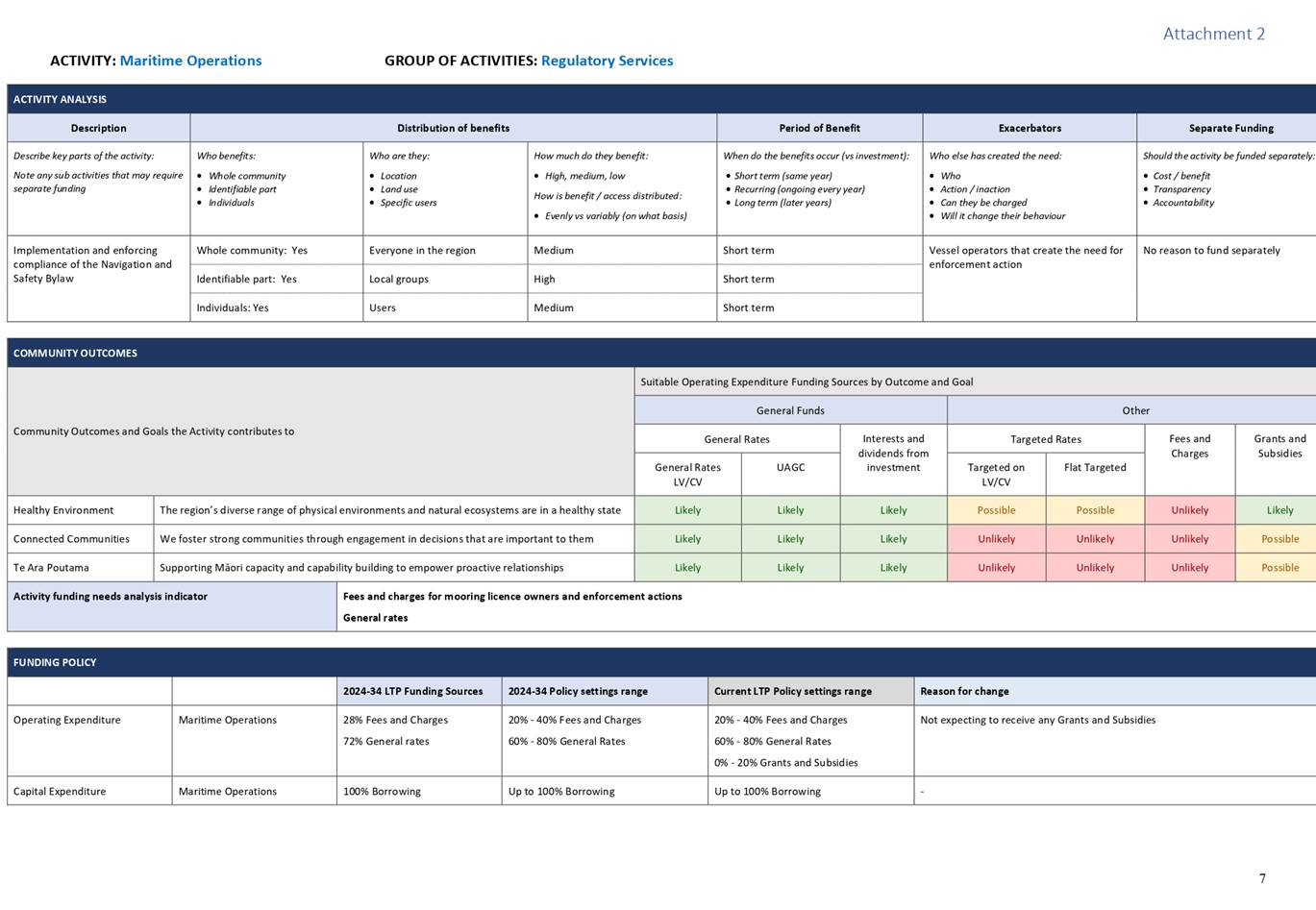

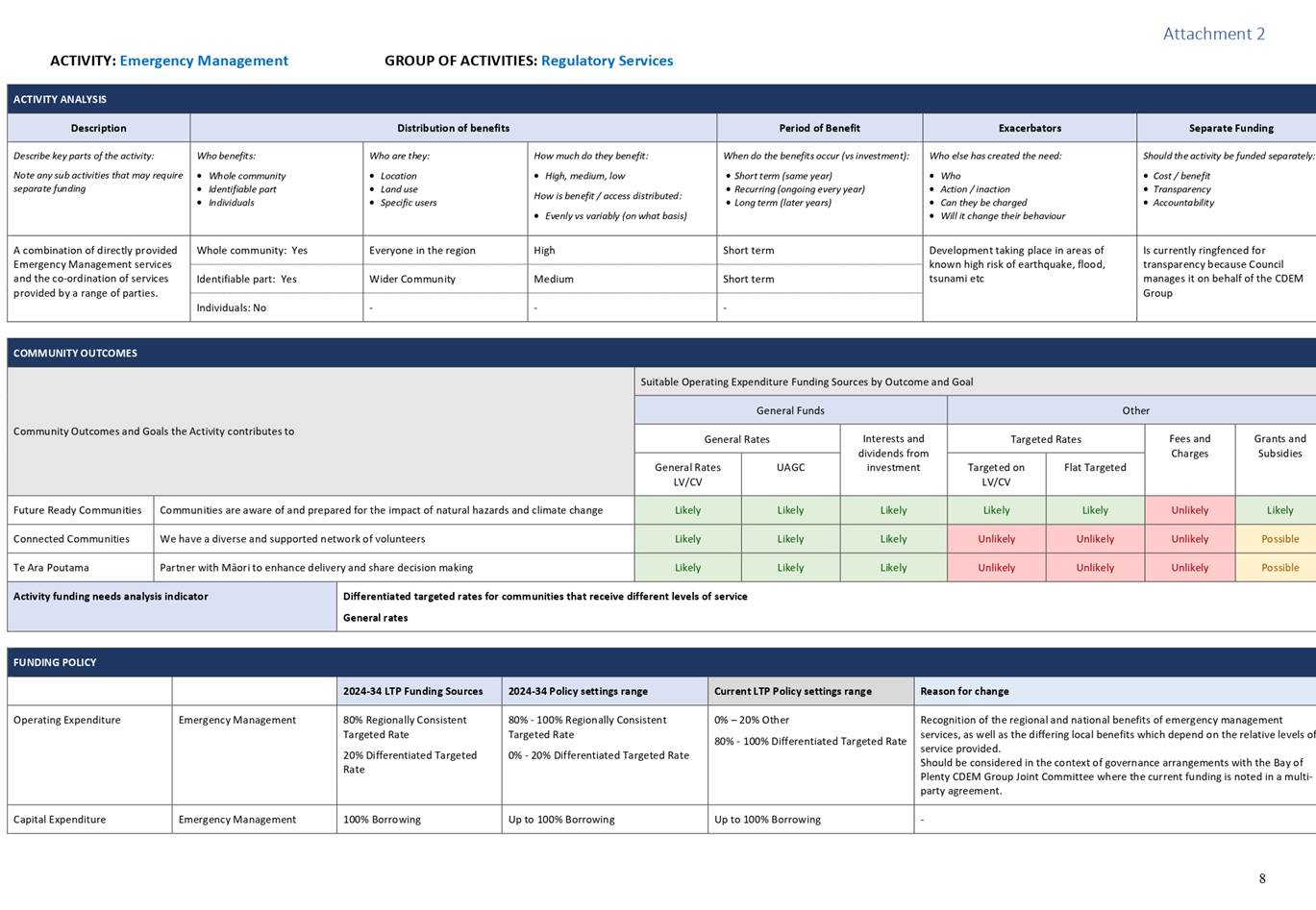

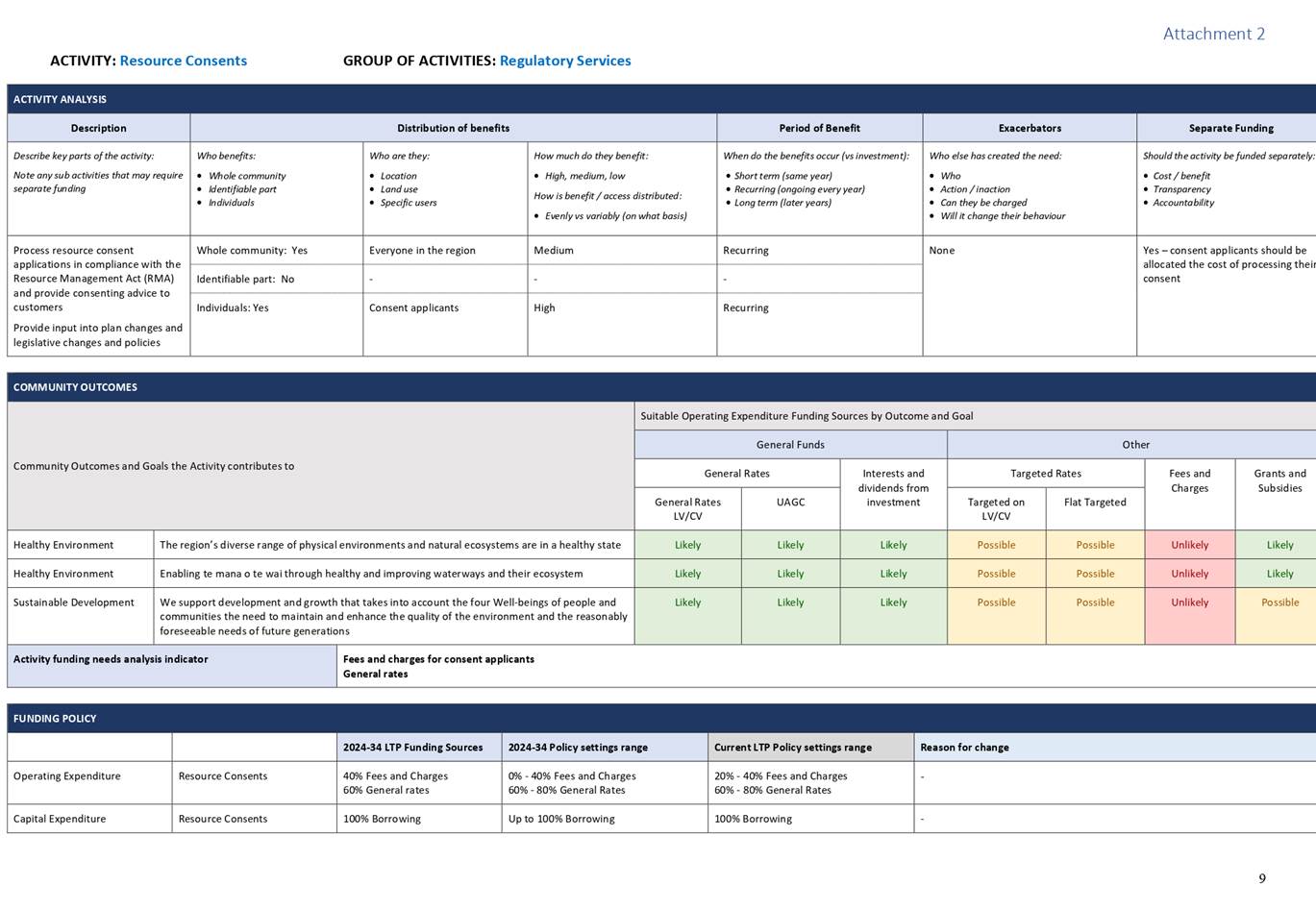

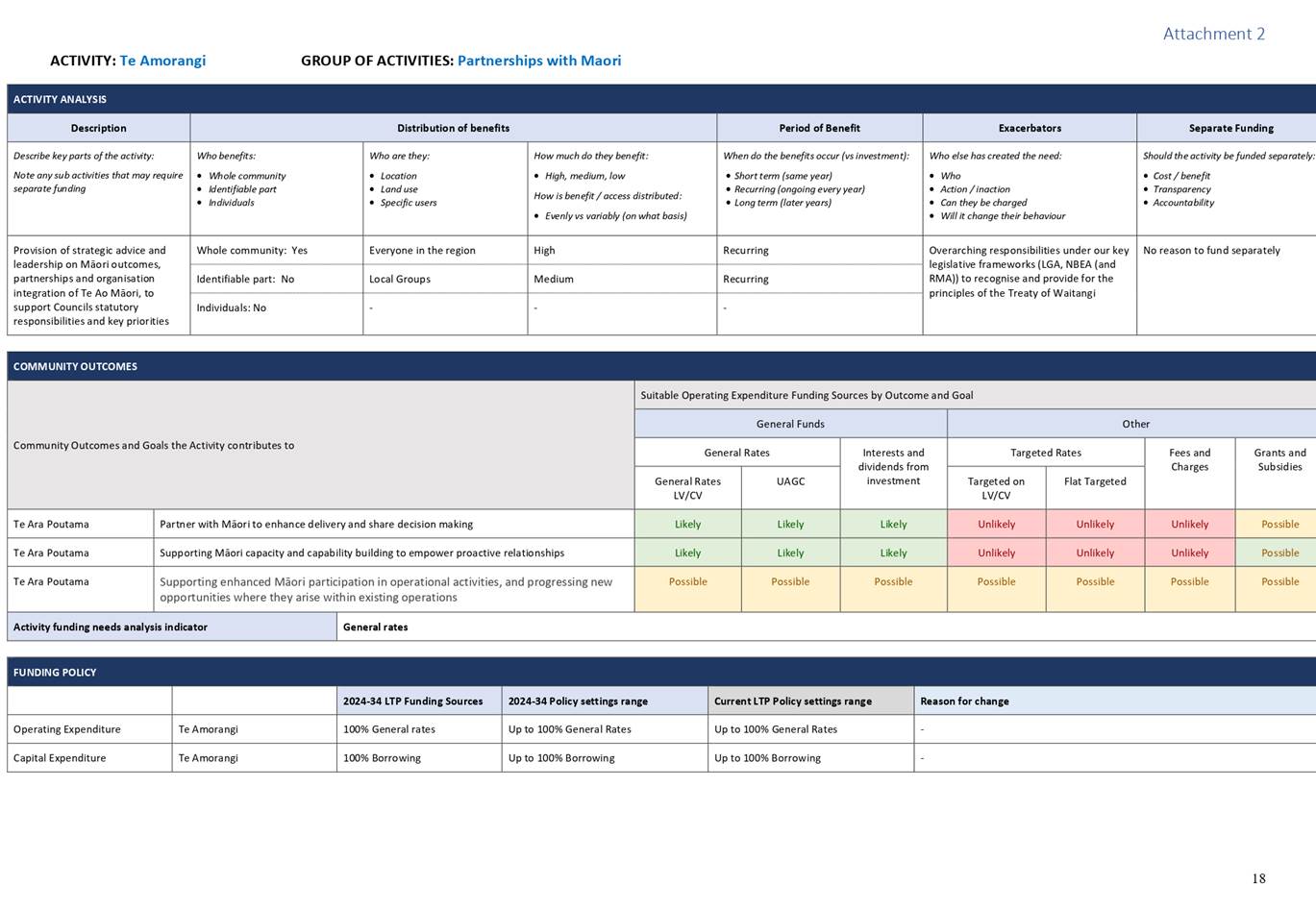

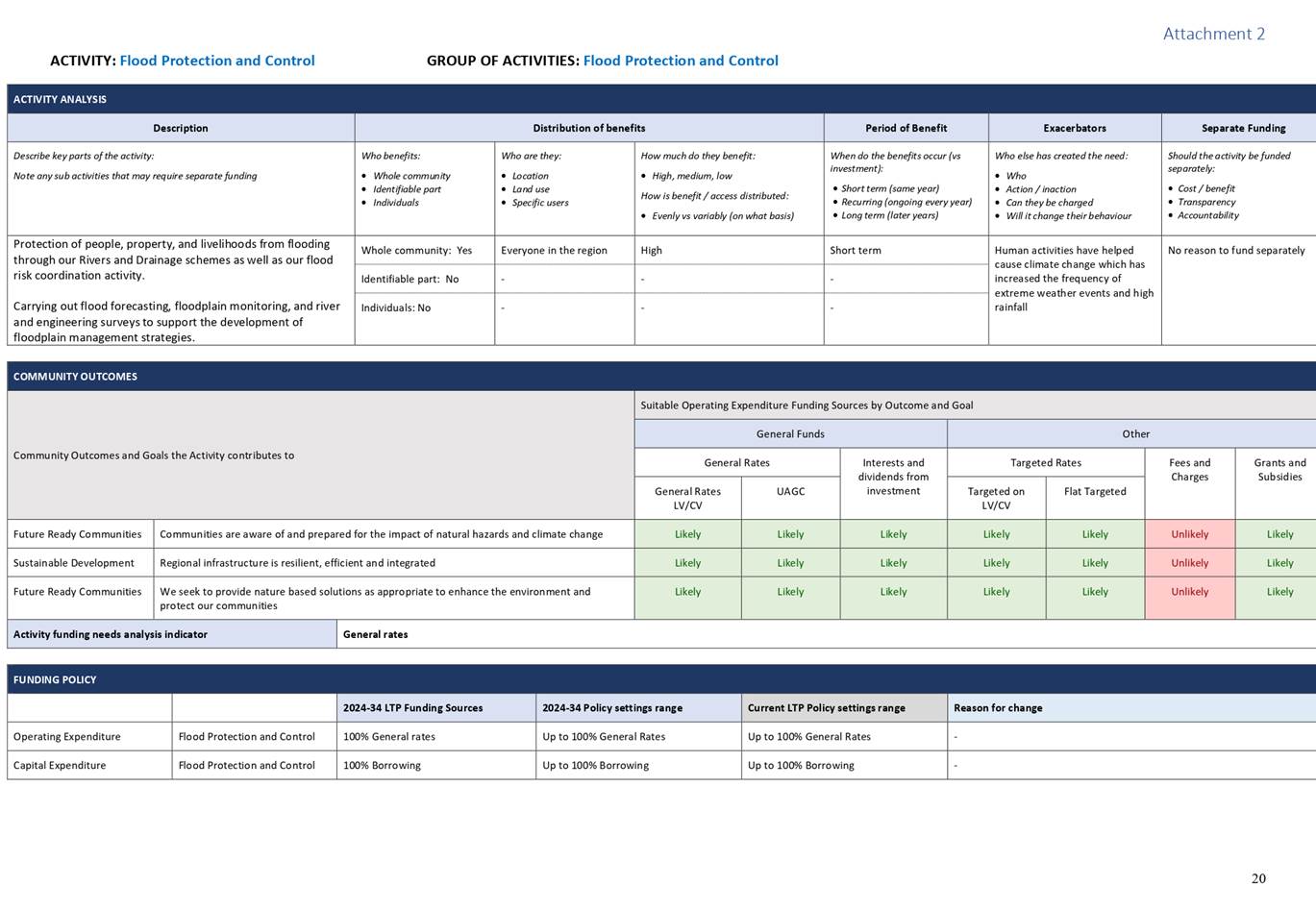

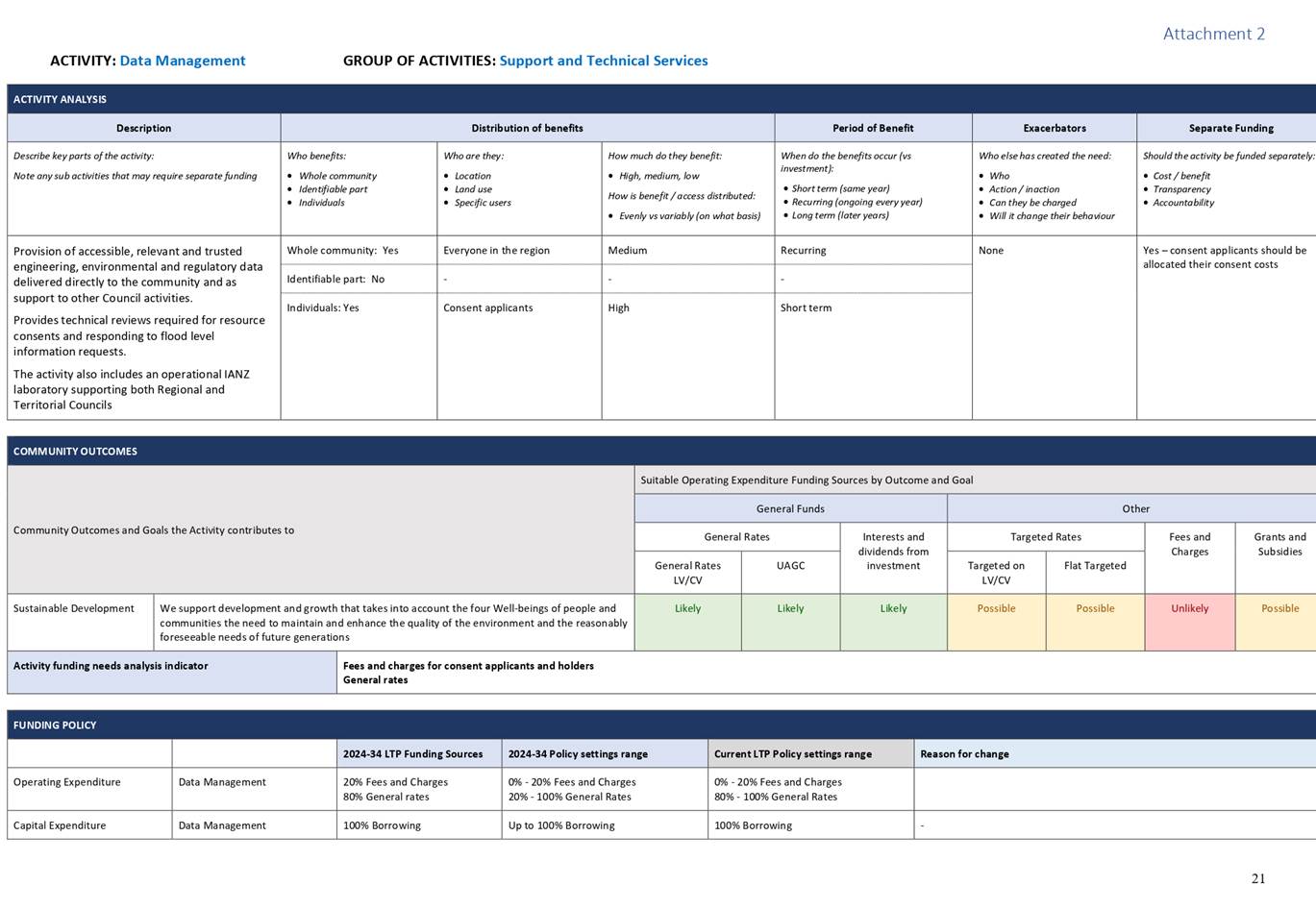

section 101(3)(a). The results are collated in Attachment 2.

It is important to note that

these are not staff recommendations for the funding splits, they are just the

results of the first step in the RFP review process.

Many of the activity assessments

have yielded similar results to previous assessments. A few activities/sub-activities

have results that are different to those adopted in RFP 2021, which are:

· Rotorua

Catchments (refer page 1 Attachment 2)

· Emergency

Management (refer page 8 Attachment 2)

· Regional

Safety and Rescue Services, a component of Community Engagement (refer page 11

Attachment 2)

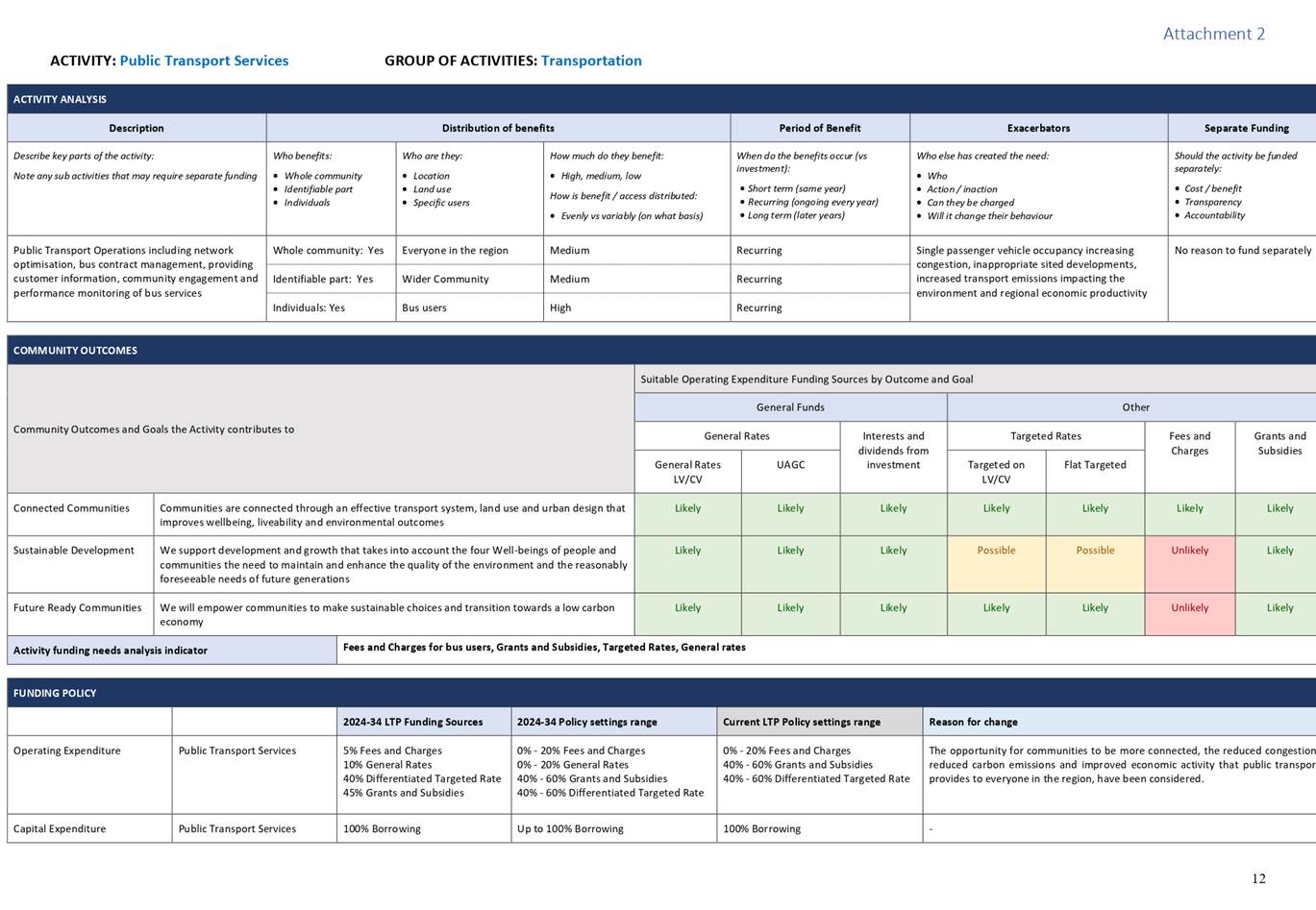

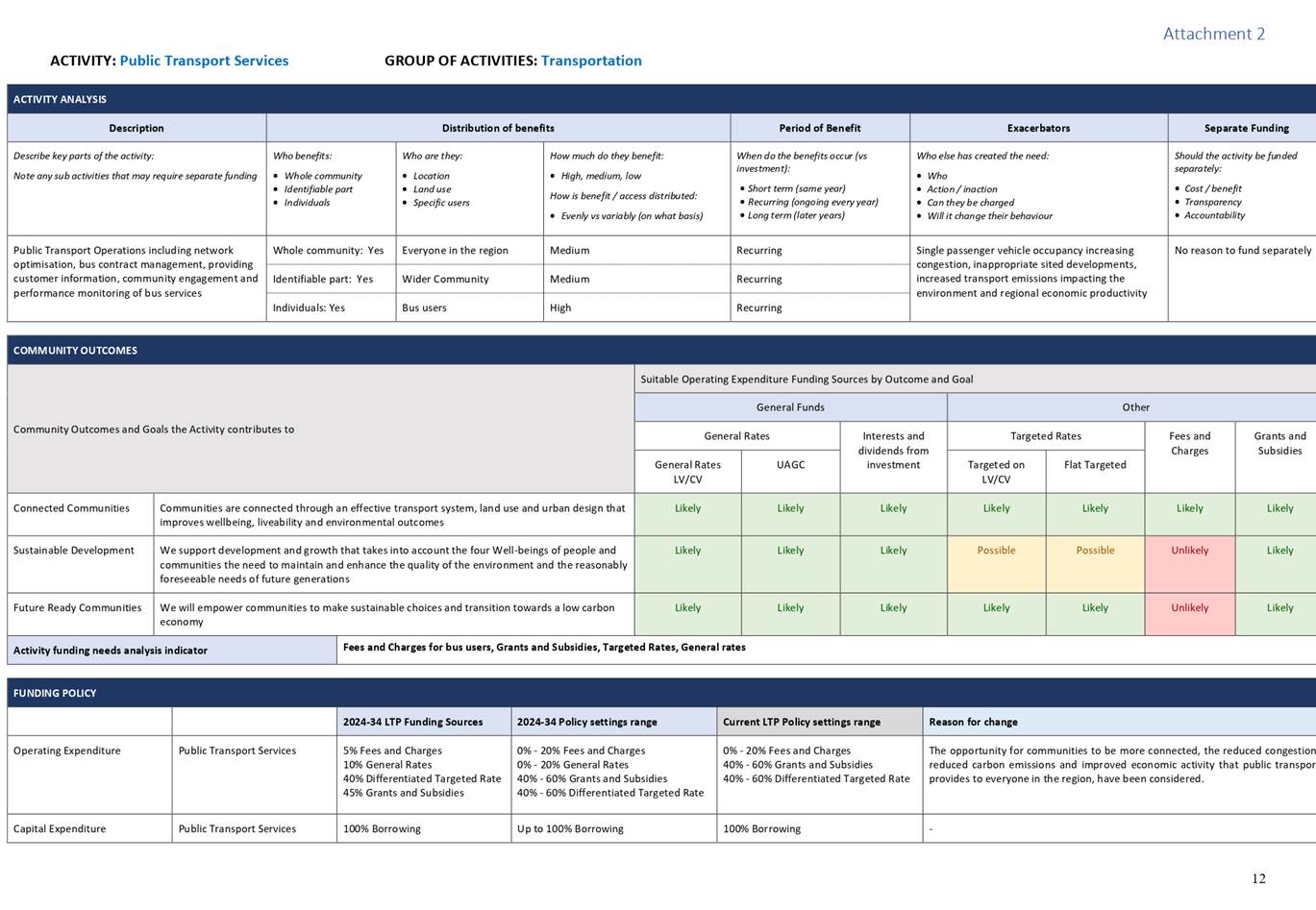

· Public

Transport Services (refer page 12 Attachment 2) and results of community

engagement (to be tabled at the workshop)

· Regional

Development (Infrastructure) (refer page 16 Attachment 2)

· Rivers

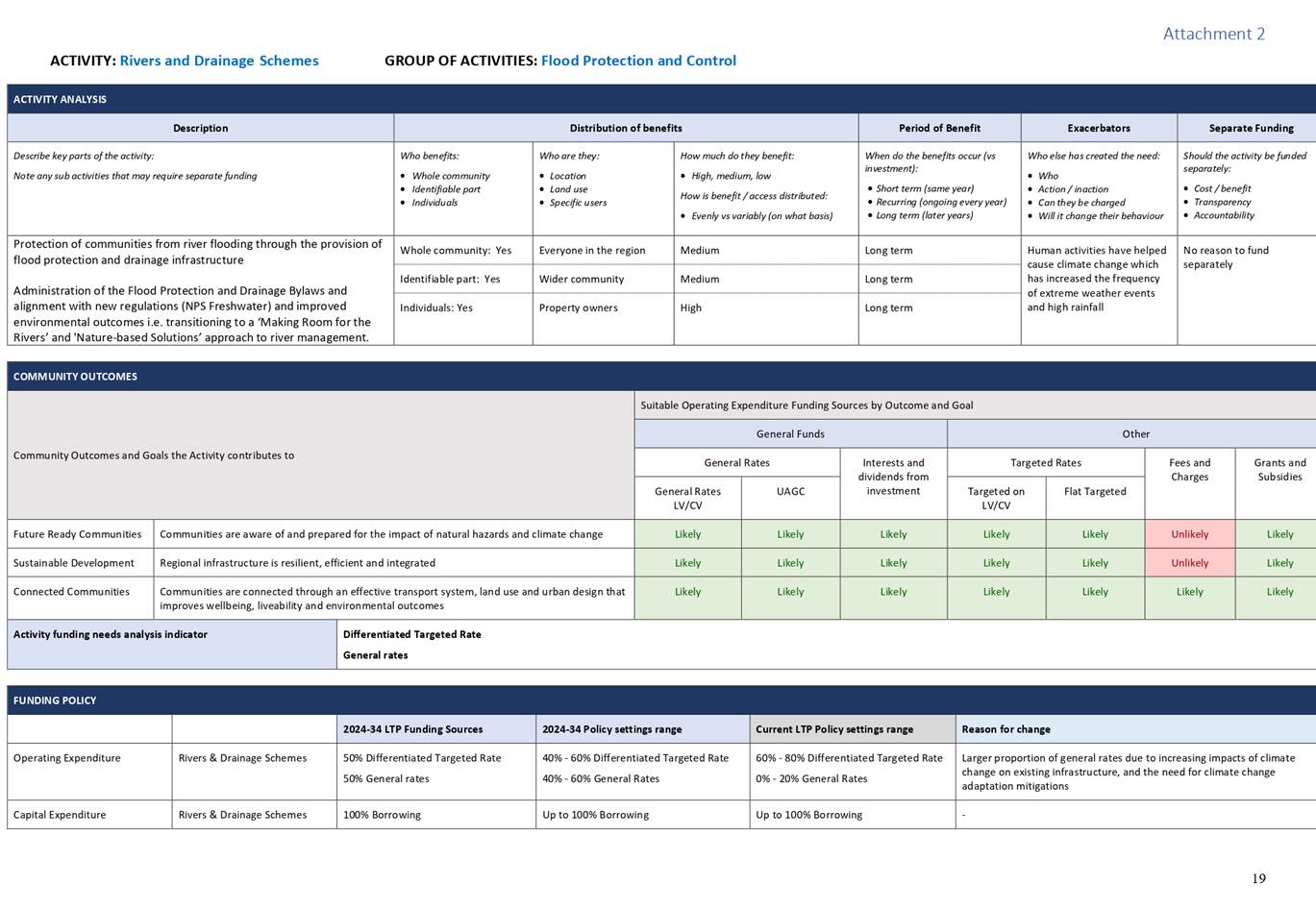

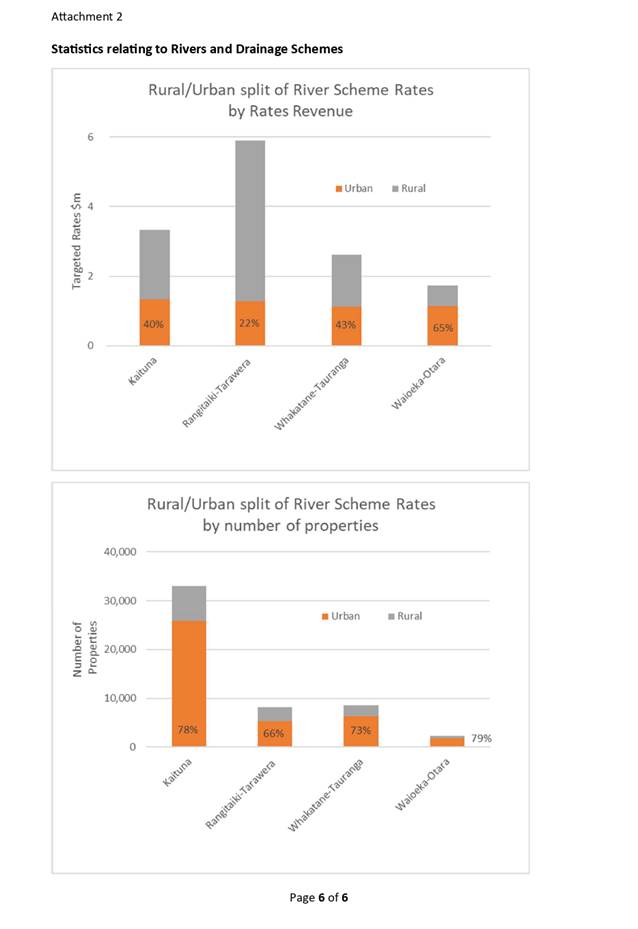

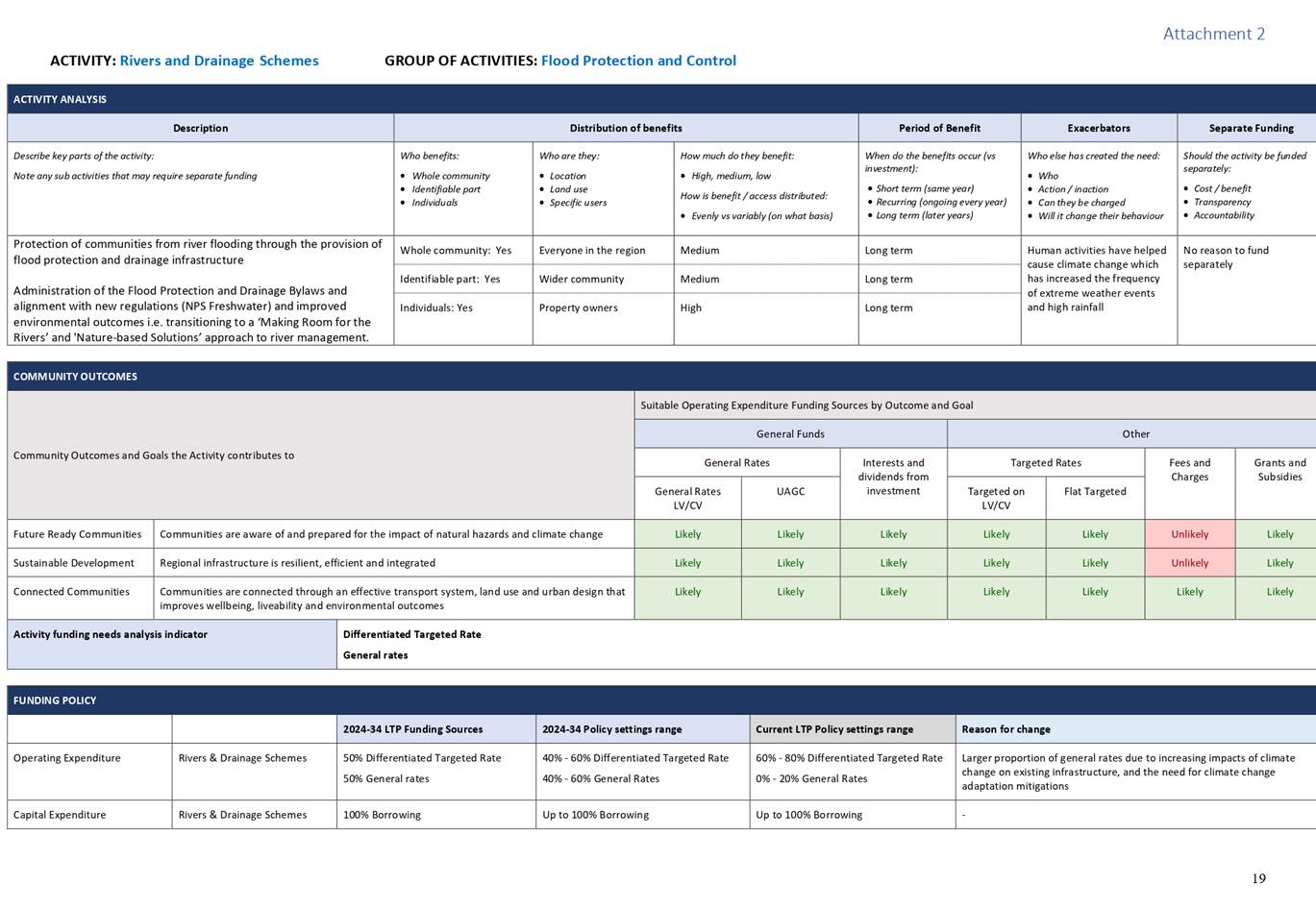

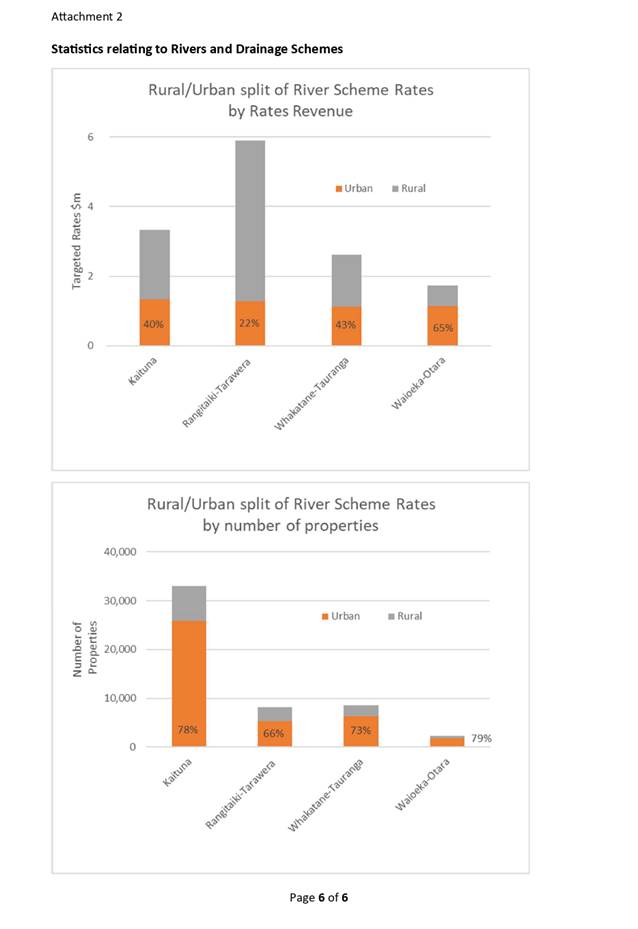

and Drainage Schemes (refer page 19 Attachment 2, and Attachment 3, page 6)

3.2.1 Further

work - Rivers and Drainage

Regarding the Rivers and Drainage Schemes activity,

Councillors will be aware that targeted rates are currently charged according

to a complex set of rating categories based on location, which have not been

reviewed in many years.

The scope of this Policy review does not include the

detailed work required to confirm or review those categories. It is intended to

consider a scope of work to undertake that review, starting in 2024/25,

investigating each River Scheme in turn.

This work is expected to involve:

· technical

analysis of the current and expected future distribution of benefits of the

scheme (i.e., those that the RFP identifies should be collected through

targeted rates)

· identifying

options for proposals for rating categories, supported by the technical

analysis

· extensive

consultation with landowners in the catchments that would be affected.

Work of this nature was proposed in 2014, and scheduled

over four years from 2016, but subsequently not undertaken. At that time

the cost of a review was estimated at $250,000 per scheme.

As a result, changes to the incidence of rates for Rivers

and Drainage will be proposed as part of this review (depending on Council

direction regarding the attached activity assessments) and could change again

in subsequent years, reflecting the outputs of detailed rating categories

reviews.

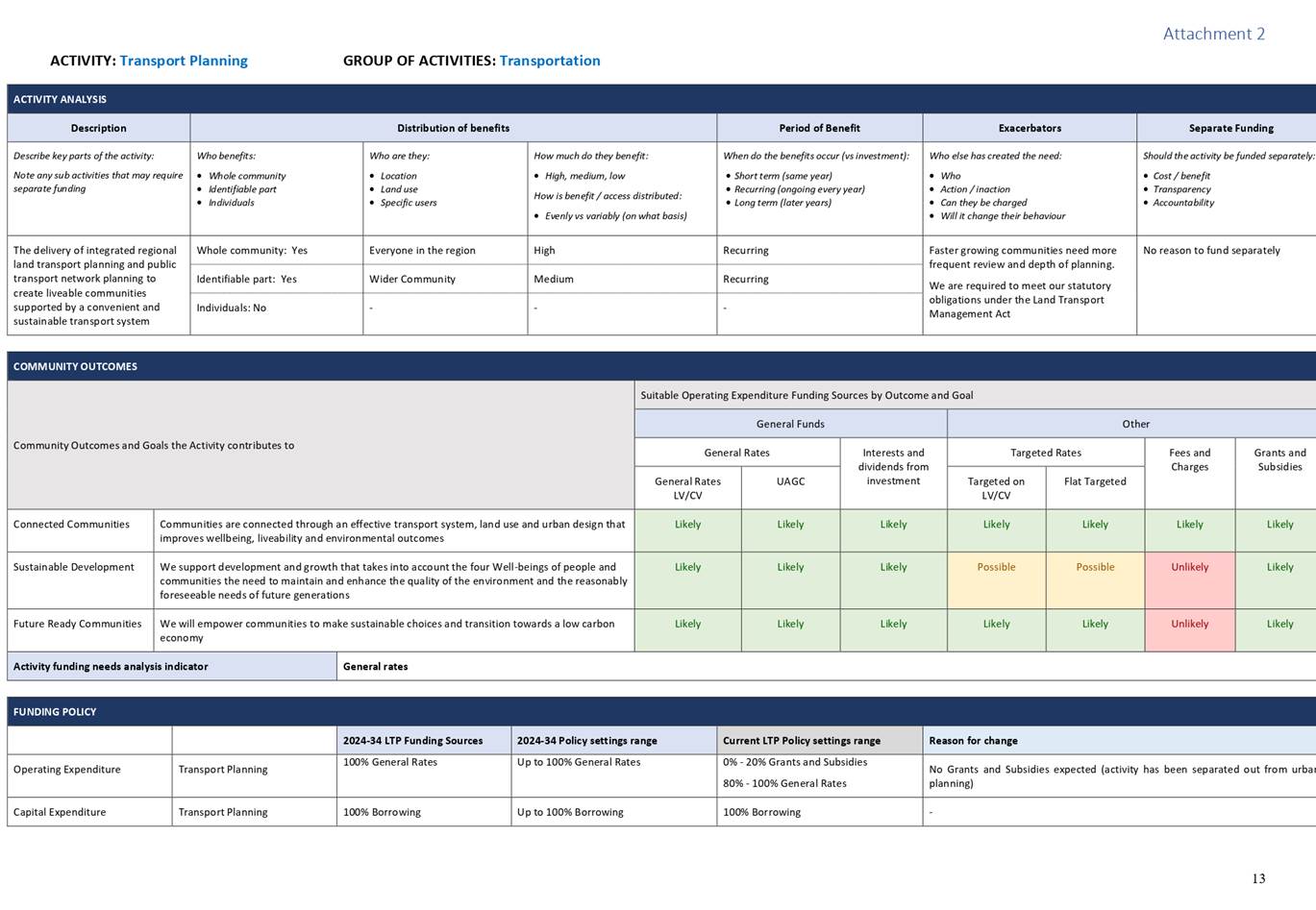

3.2.2 Further work - Transport

Similarly, for the Public Transport activity, as the

extent of the bus service expands or new services are introduced, Council may

wish to review the areas of benefit for any Public Transport targeted rates

that are currently within the defined boundaries of Tauranga City, urban Rotorua,

Western Bay district and the Whakatāne district.

3.3 Financial

implications of Step One assessments

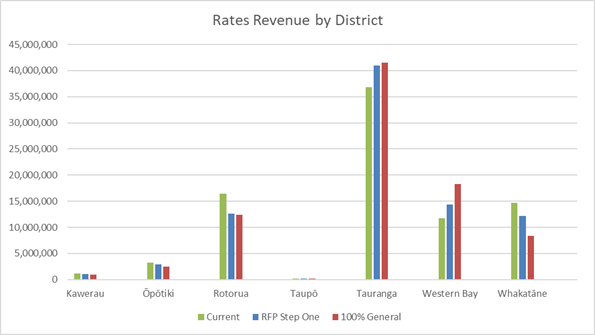

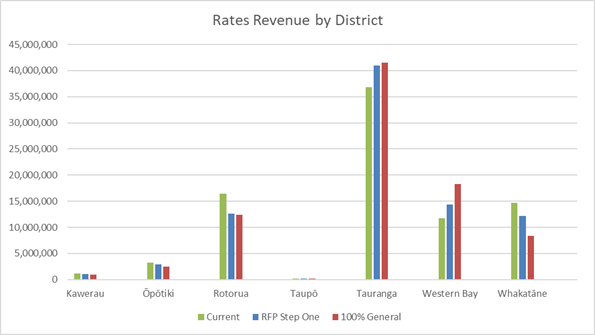

Staff have modelled three

options, not as recommendations, but to provide context for discussion.

Option 1 uses the funding

bands in the current RFP, and the percentages from Annual Plan 2023/24.

Option 2 is the result of

applying the Step One staff assessments.

Option 3 is for

comparative purposes and is to highlight financial impact. It is a high-level

model that shows all activities being 100% funded through General Rates

(including the Uniform Annual General Charge (UAGC) set at 30%) except for

Civil Defence which is the subject to an agreement with the Civil Defence

Management Group.

Drivers of change in

distribution of rates

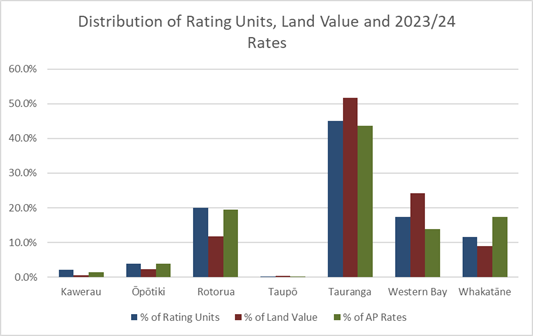

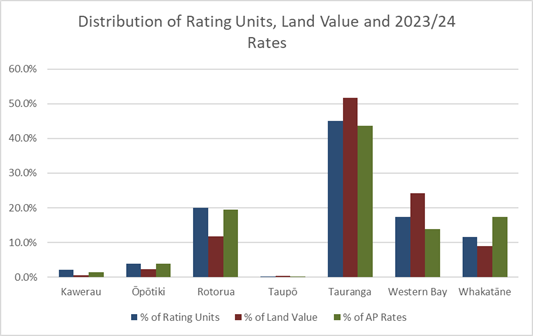

Overall, the proposed Step 1

assessment (if flowed through to changes to the Revenue and Financing Policy)

reduce total Targeted Rates and increase General Rates. The incidence of

General Rates for each district depends on the number of rating units and total

land value of properties in that district. These figures, along with the total

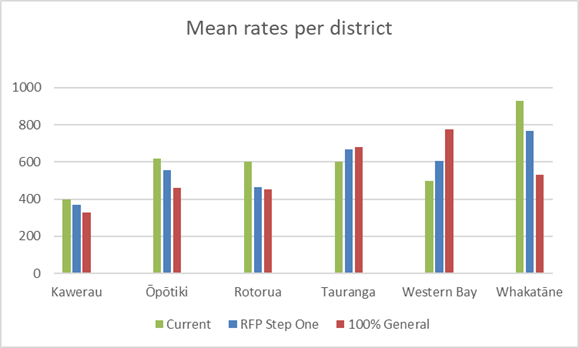

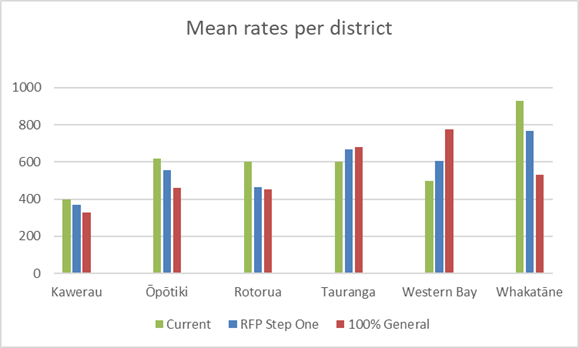

rates for each district in 2023/24 are shown in Figure 1 below.

Districts which have a higher

percentage of the total rating units and land value than they currently pay in

rates will generally be most affected by moving towards more general rates.

These districts are Tauranga and Western Bay.

Figure 1

Initial view of distribution

of rates – Version 2 of LTP budget

Figures 2 and 3 below show the

incidence of rates for each district based on budget version 2 of the LTP for each of the three options described

above.

Figures 2 and 3 are modelled on

the basis that targeted rates are set to be collected from the same categories

of land and calculated using the same factors (land value, area, etc) as for

the current RFP. Decisions that need to be made when setting targeted rates are

described more fully in section 3.4 below.

Whakatāne and Rotorua are

favourably affected due to the reduction of targeted rates for the river

schemes, air quality and Rotorua Lakes. Western Bay and Tauranga are adversely

affected by the reallocation of targeted rates to general rates (due to high

land values) which is partially offset by a reduction in the Tauranga Passenger

Transport targeted rate.

Figure 2

Figure 3 below shows the impact

on the mean rates per district for each of the three options.

Figure 3

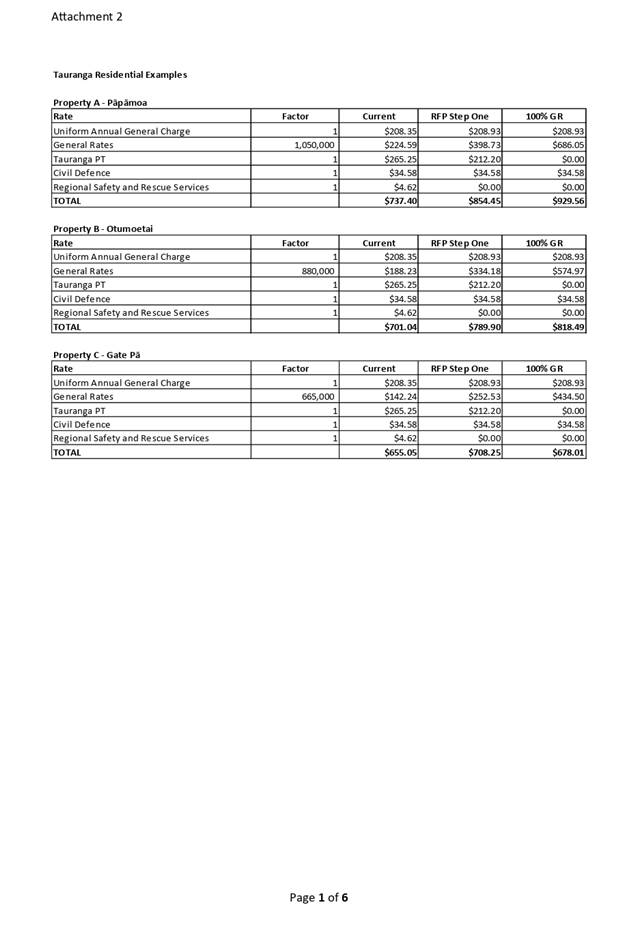

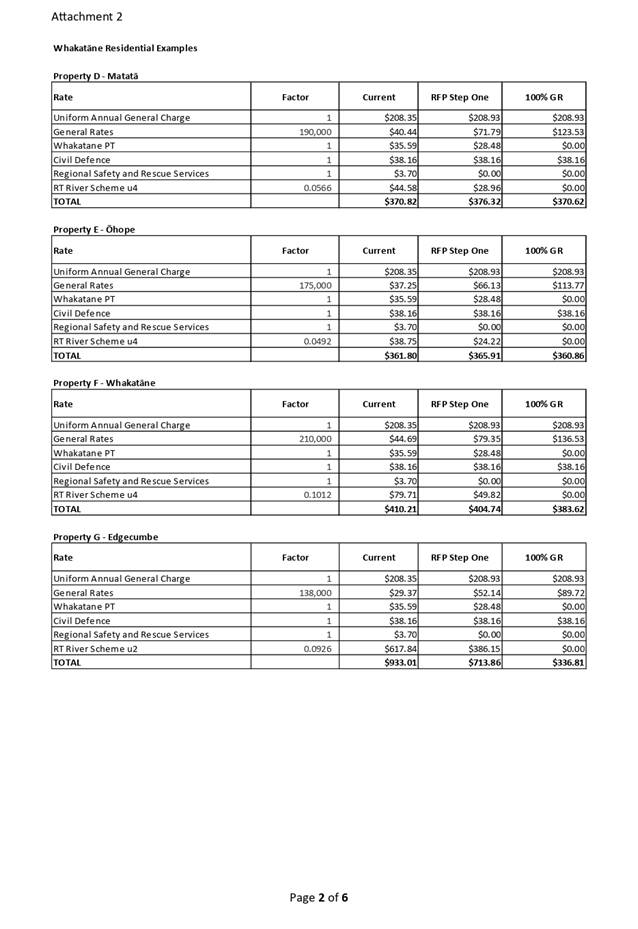

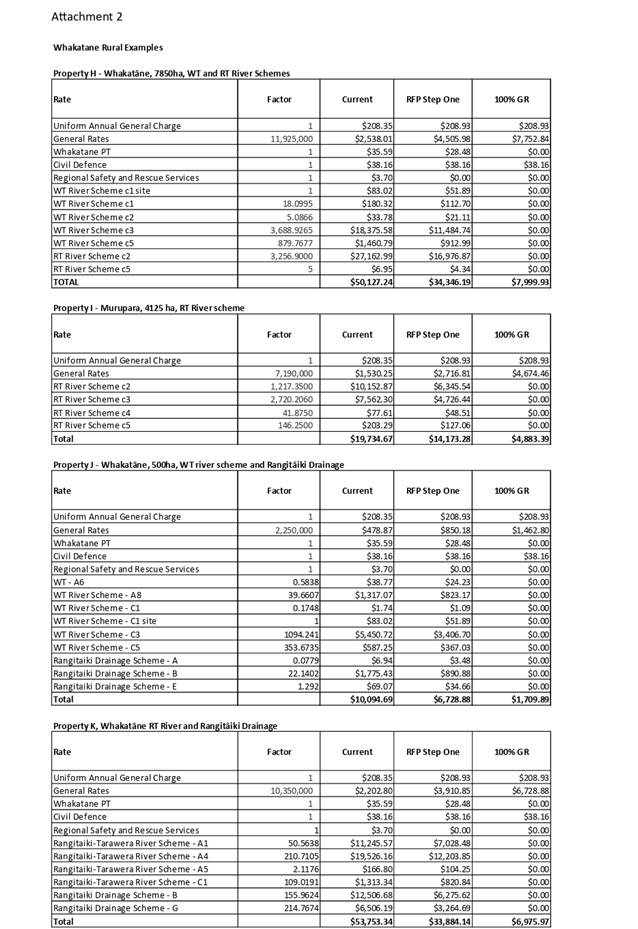

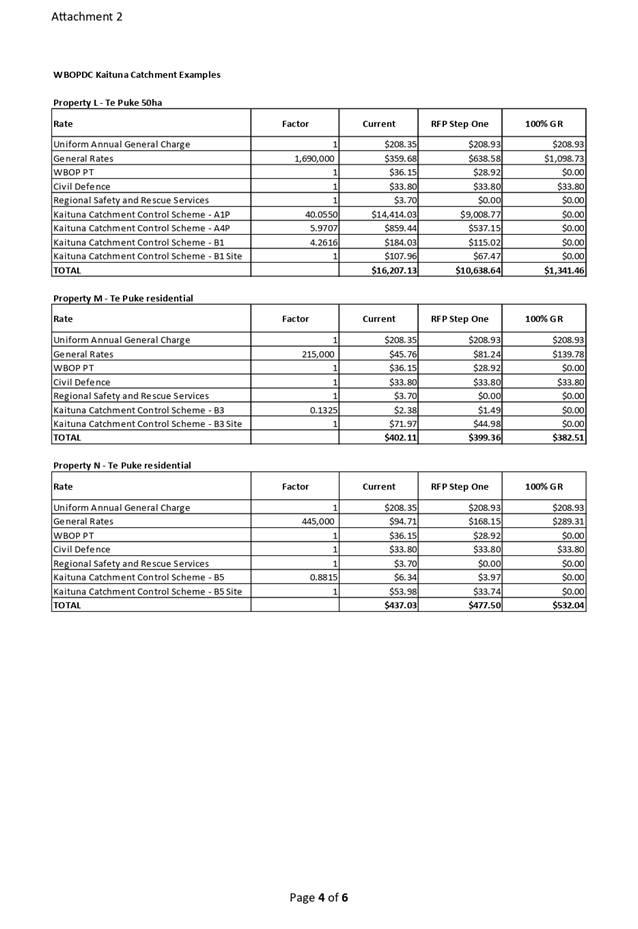

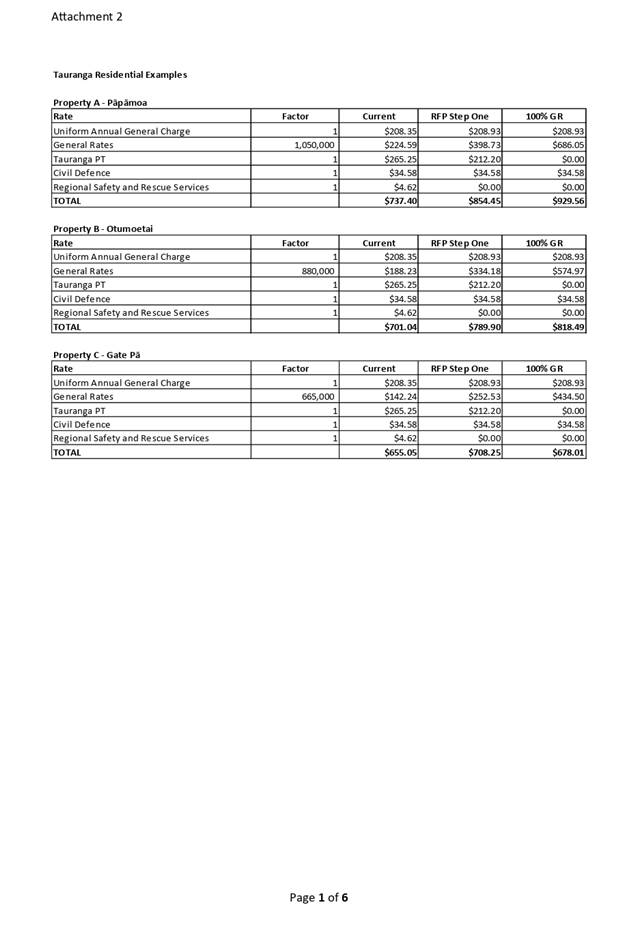

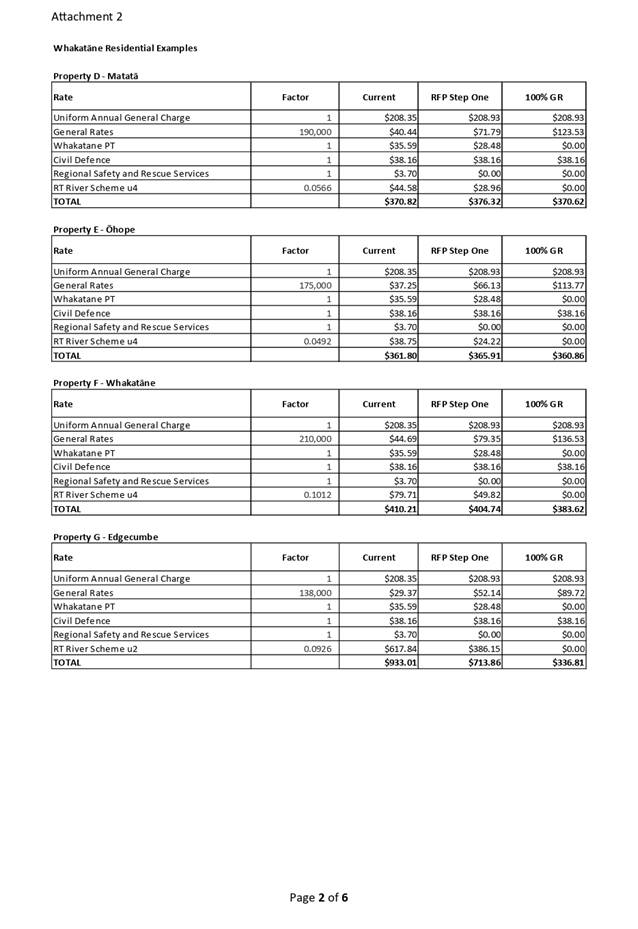

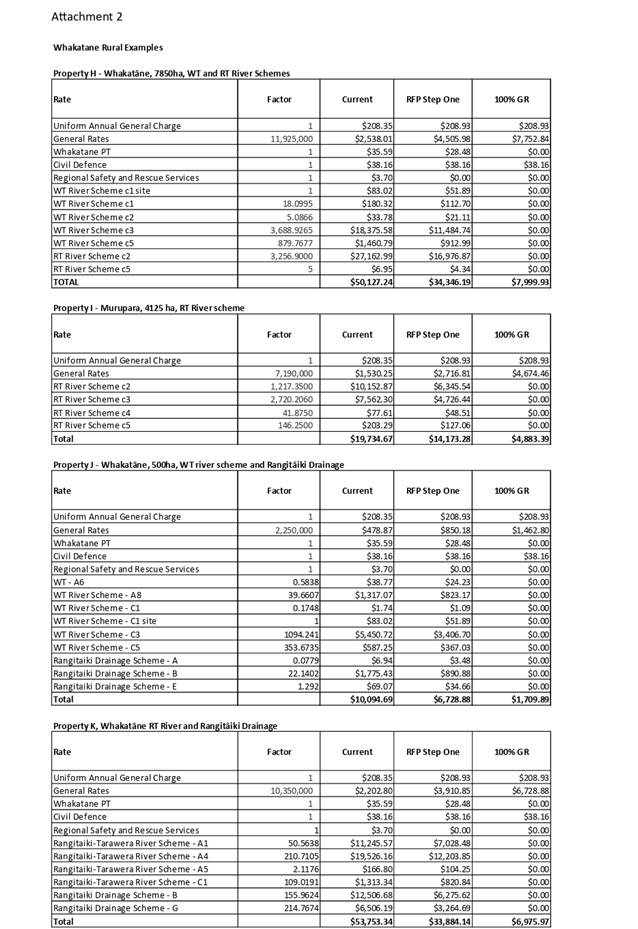

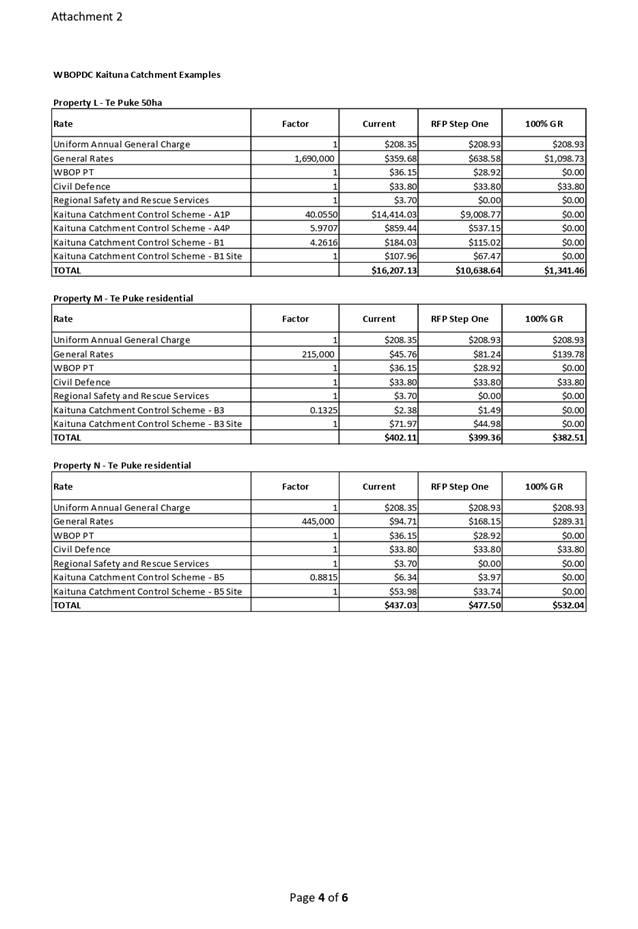

Detailed views of the

distribution of rates are shown in Attachment 2, which includes

modelling for representative locations and properties.

3.4 Setting

Targeted Rates

The Local Government Rating Act

2002 (LGRA) determines how targeted rates can be set.

LGRA Schedule 2 sets out the

matters Council can use to determine who should pay a targeted rate, and

LGRA Schedule 3 sets out the factors that can be used to calculate how much

the targeted rate should be for each property. This is summarised in the

table below:

|

Matters (who) and Factors (how much)

|

Who pays?

|

How much do they pay?

|

|

Land use

|

ü

|

|

|

Activity on

land – planned (e.g. residential zone)

|

ü

|

|

|

Activity on

land - proposed

|

ü

|

|

|

Area with

rating unit

|

ü

|

ü

|

|

Provision or

availability of a service

|

ü

|

|

|

Where land

is situated

|

ü

|

|

|

Annual value

of land

|

ü

|

ü

|

|

Capital

value of land

|

ü

|

ü

|

|

Land value

of land

|

ü

|

ü

|

|

Value of improvements

|

|

ü

|

|

Area sealed

paved or built on

|

|

ü

|

|

Number of

separately used or inhabited parts

|

|

ü

|

|

Extent of

provision of any service

|

|

ü

|

|

Number or

nature of connections

|

|

ü

|

|

Area

protected by a facility or amenity

|

|

ü

|

|

Area of

floor of buildings

|

|

ü

|

|

Number of

WCs or urinals

|

|

ü

|

|

Fixed amount

per rating unit

|

|

ü[1]

|

Currently Council sets targeted

rates as flat amounts per rating unit and per hectare for some Rivers and

Drainage schemes, but it has options to use other factors as well, including

land value, capital value and improvement value.

LGRA section 21 limits the size

of the UAGC and any other uniform rates to 30% of total rates revenue. In

this context, “uniform” means that for every rating unit charged,

the same amount is charged. The targeted rate does not have to be paid by

every rating unit in the region for it to be included in the 30% limit.

3.5 Other

considerations

3.5.1 Potential

for new Targeted Rate for climate-related initiatives

Explaining

the incremental cost/benefit of new proposals, and ensuring transparency in

their delivery, is frequently a challenge for Council. This is particularly the

case when the funding for new proposals is part of general rates or other

revenue streams that fund multiple activities.

One approach that other councils

have used to improve transparency and accountability is the use of targeted

rates (TR) for climate resilience (or similar) to fund specific initiatives.

For example, Auckland Council introduced a Climate Action (Transport) Targeted

Rate that is used to fund passenger transport improvements that reduce carbon

emissions. Examples of projects funded by this targeted rate are bus/ferry

electrification and new bus routes. Depending on how the TR was set, the

financial impact could be the same as using existing rating mechanisms.

Staff have discussed this

approach with Auckland Council staff, who said that this approach led to better

and more meaningful consultation at the time the new initiatives were proposed.

They also noted that the TR is an ongoing communication and accountability

mechanism, provided the initiatives being funded by it are clear when

established and relatively stable from year to year.

Care should be taken to ensure

that the defined uses of the Targeted Rate are flexible enough to avoid having

to frequently re-consult with the community when the focus or scope of projects

funded by the TR changes. This means balancing the transparency sought by

using TR and the flexibility Council desires or needs, to respond to changing

circumstances and best practice in addressing climate change.

Council could consider using a

Climate Resilience Targeted Rate to fund specified initiatives within

particular activities that are facing increased cost pressures due to climate

change.

The main options for Council to

use this mechanism is in place of the proposed general rates funding for new

initiatives within the Passenger Transport activity and increased maintenance

and investment costs in the Rivers and Drainage activity.

More information on this

potential approach will be presented at the workshop.

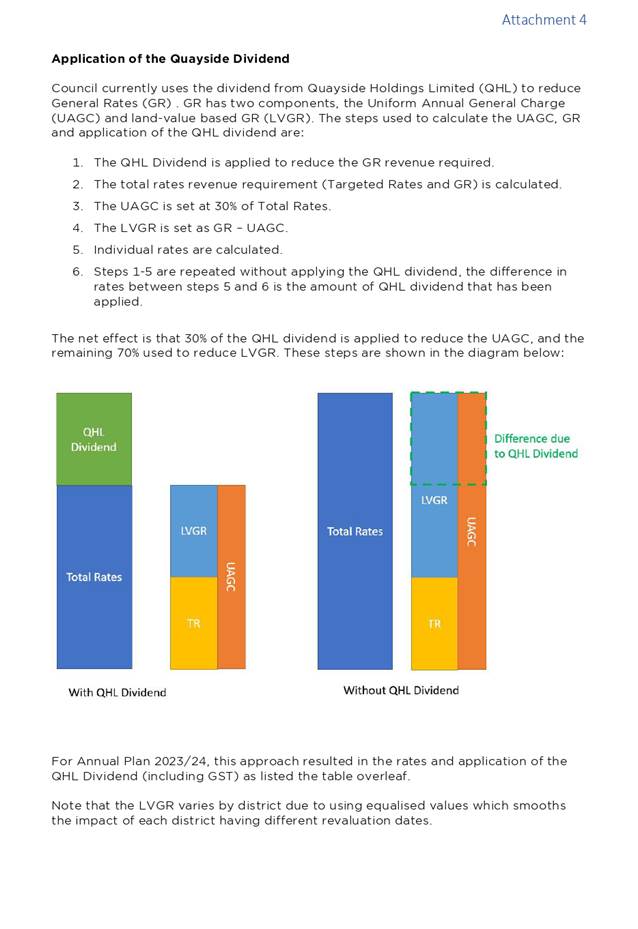

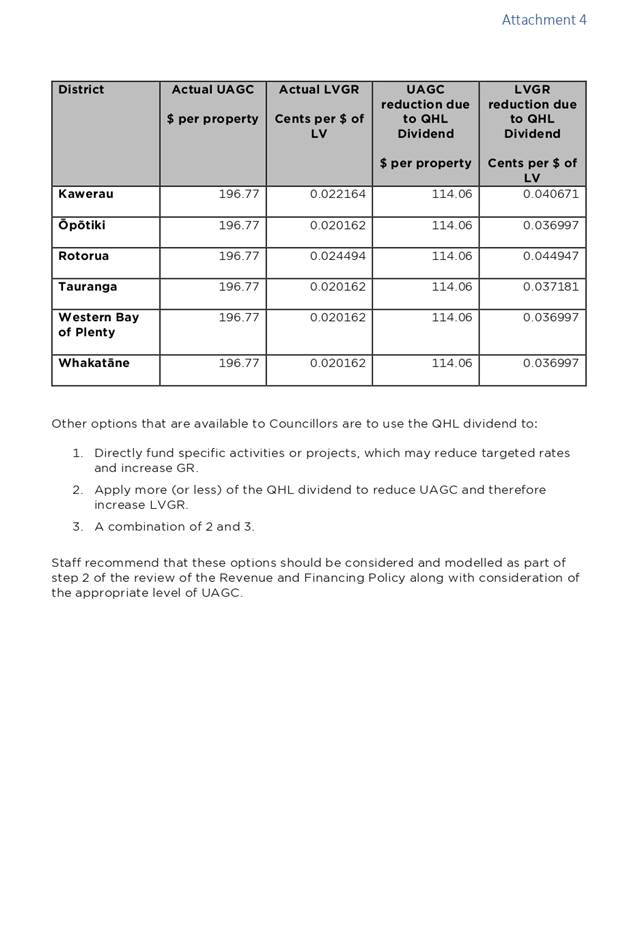

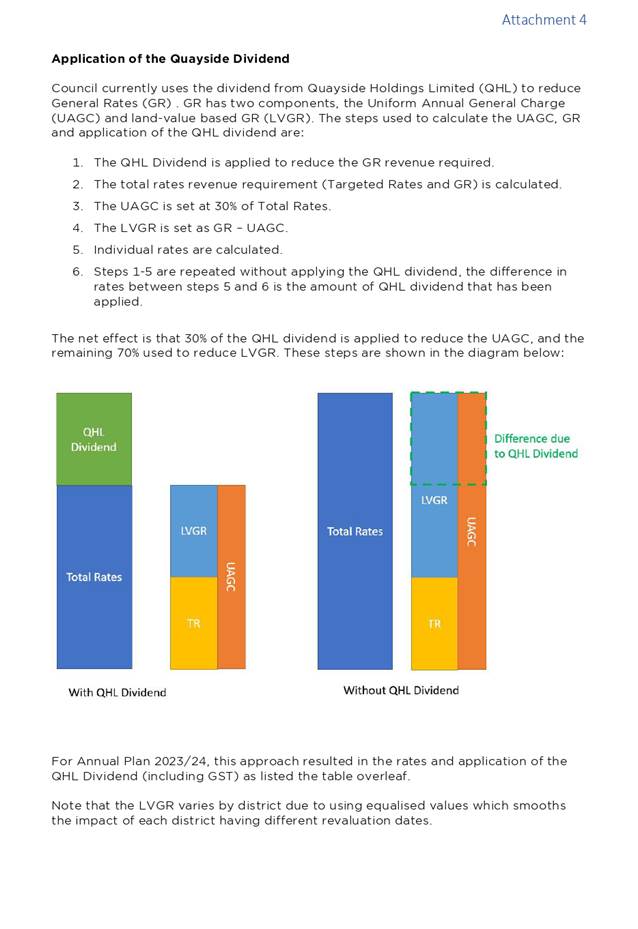

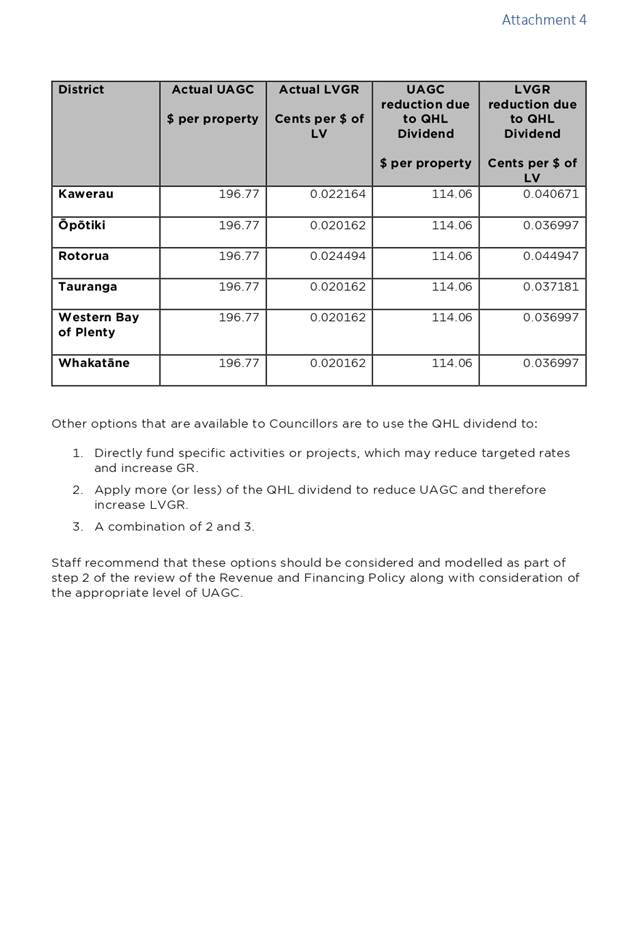

3.5.2 Application

of Quayside Dividend

Another key influence on net

amount of rates paid by each ratepayer is the methodology used to allocate investment

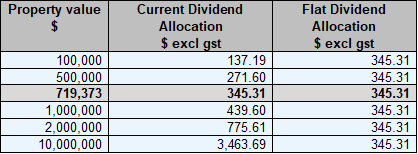

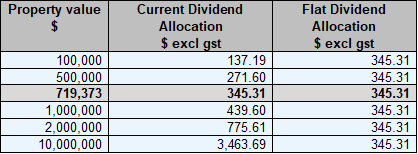

income (Quayside dividend). Attachment 4 explains how the dividend is

currently distributed and is provided at this workshop for information.

The effect of the current

methodology is that 30% of the dividend reduces the UAGC and 70% of the dividend

reduces land value rates.

A

high-level comparison of applying the dividend under the current methodology

and as a flat amount per ratepayer is shown in the table below. Direction

on these options, and any other alternatives that Council wishes to

explore, will be part of Step Two considerations in

November.

4. Next Steps

Following the workshop, staff

will adjust the Step One funding models to reflect the direction on any matters

for consideration in this step, i.e. at activity level.

Council will consider Step Two

(overall impact on Community wellbeing) at a later workshop, along with the

potential impact of the policy direction on achieving the objectives set out in

the Preamble of the Te Ture Whenua Māori Act 1993.

4.1 Supporting information for Step Two considerations

Staff

seek Councillors’ guidance on the information they wish to see to inform

their Step Two considerations in late November.

Staff

will model the distribution of rates on typical properties across the region,

based on version 3 of the LTP budgets, so these can be considered alongside

indicators of the distribution of ability to pay, living conditions and other

demographic information.

Direction

will then be sought on altering the incidence of rates at an overall level.

Staff will present options for how rates could be altered, including:

· Level of the UAGC – should we maximise the UAGC as we

have done in the past or take a different approach?

· If the Quayside dividend continues to be used to subsidise

rates, how should it be distributed? Public feedback on this topic has

been received through the latest community engagement survey and results will

be tabled at this workshop.

4.2 Consideration

of transition arrangements

Council may also want to consider transition arrangements

if changes to funding sources are material for some groups of ratepayers.

This can also be considered as part of Step Two.

Attachments

Attachment 1 - Illustration of RFP Step One methodology ⇩

Attachment 2 - Activity assessments - RFP 2024 - draft Funding Needs

Analysis ⇩

Attachment 3 - Rates Examples Properties ⇩

Attachment 4 - Allocation of QHL dividend - methodology ⇩

Regional

Council 25 October 2023

Regional

Council 25 October 2023

Regional Council 25 October 2023

Regional Council 25 October 2023

|

|

|

|

Informal Workshop Paper

|

|

To:

|

Regional

Council

|

|

|

25

October 2023

|

|

From:

|

Olive McVicker, Corporate Performance

Team Lead; Graeme Howard, Corporate Planning Lead and Alicia Burningham,

Corporate Planner

|

|

|

Evaleigh Rautjoki-Williams, Acting General Manager, Corporate

|

|

|

|

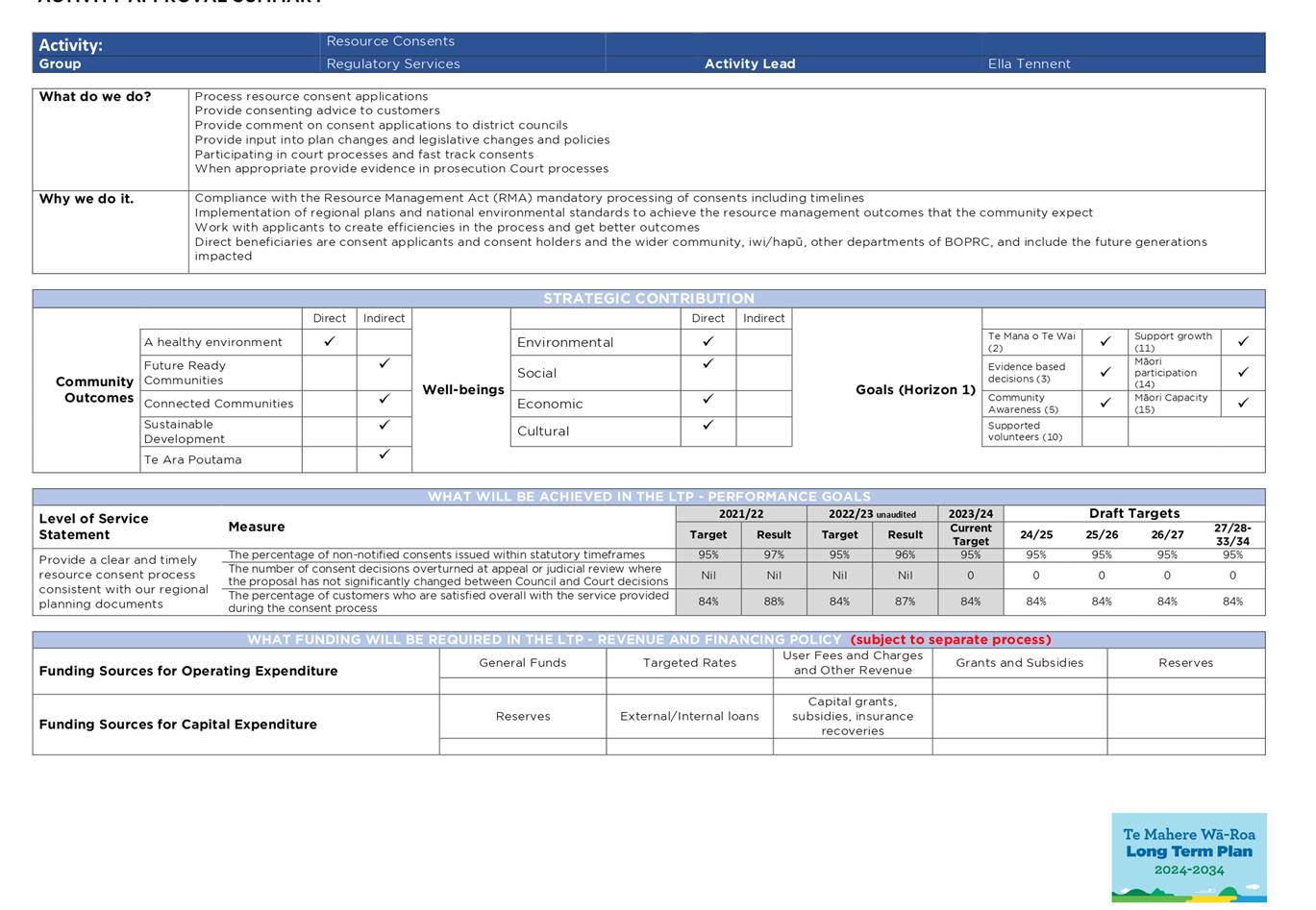

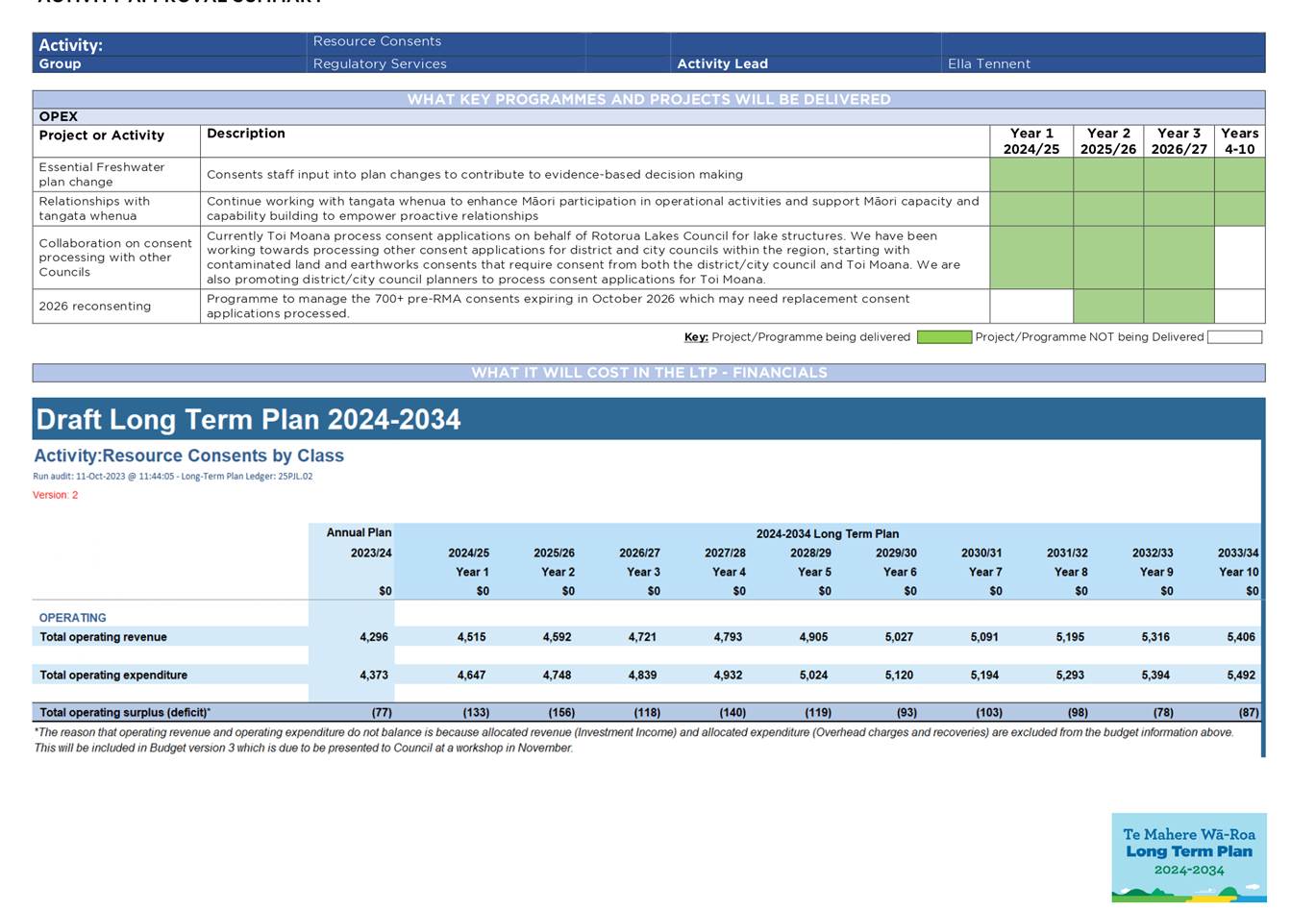

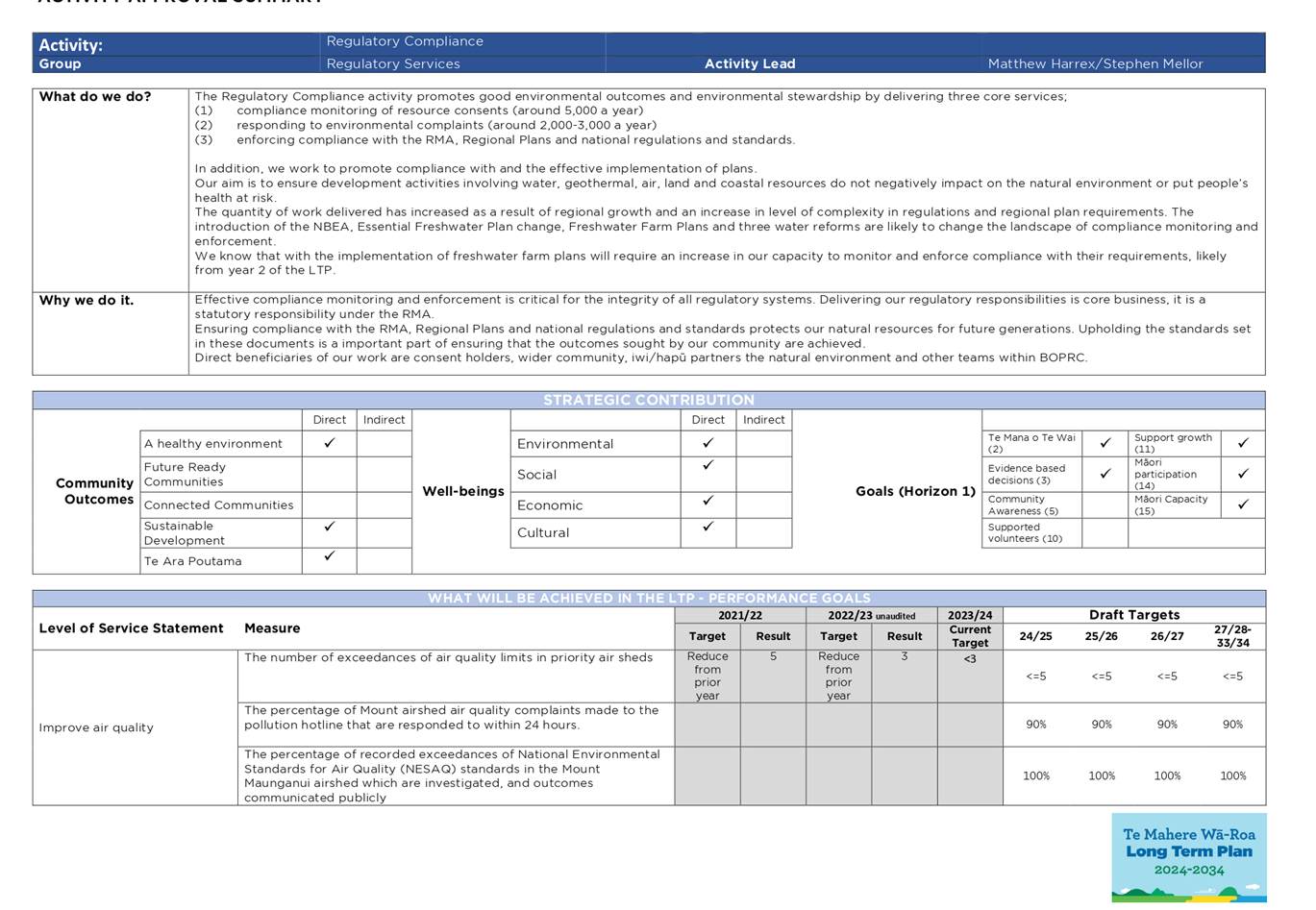

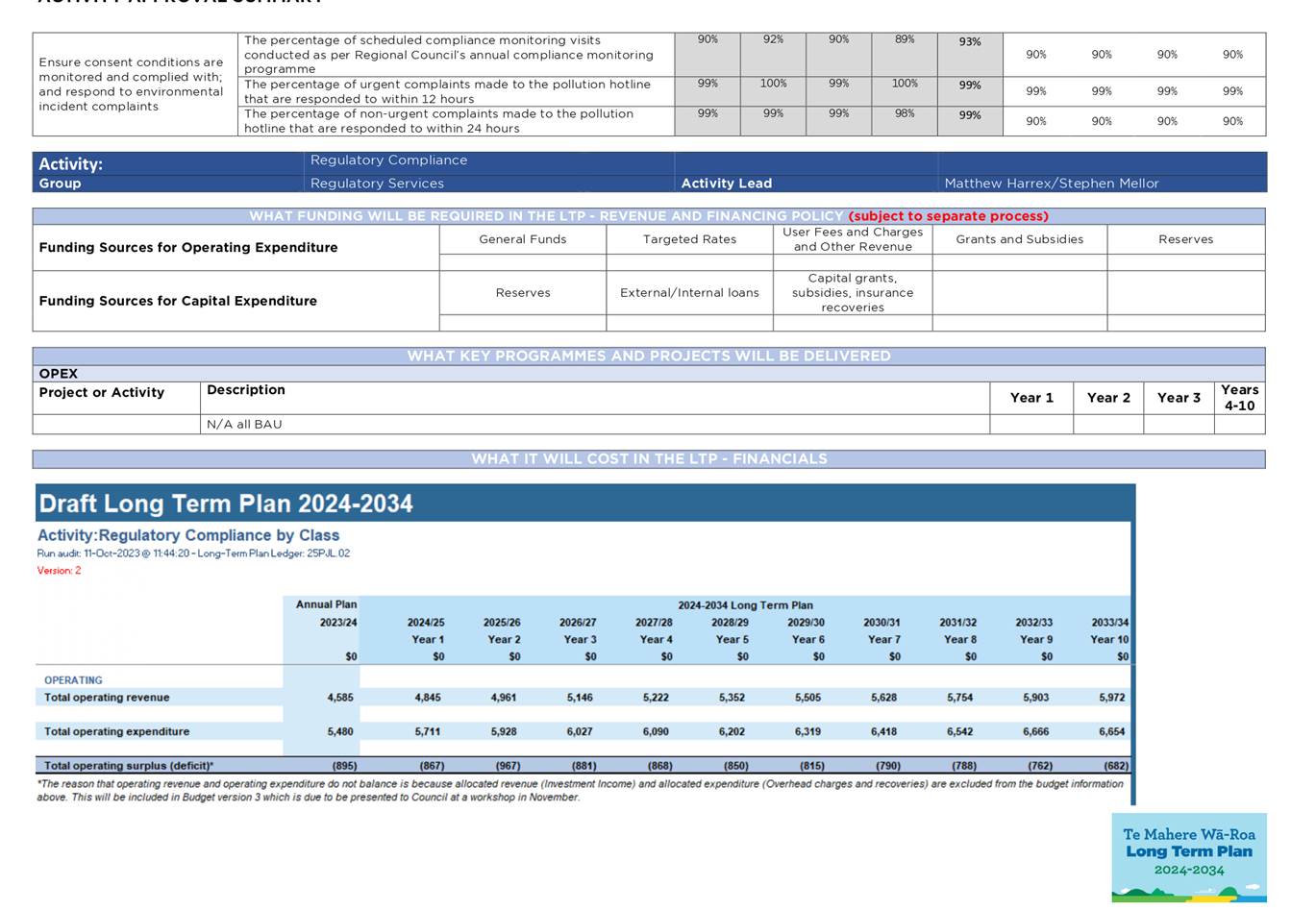

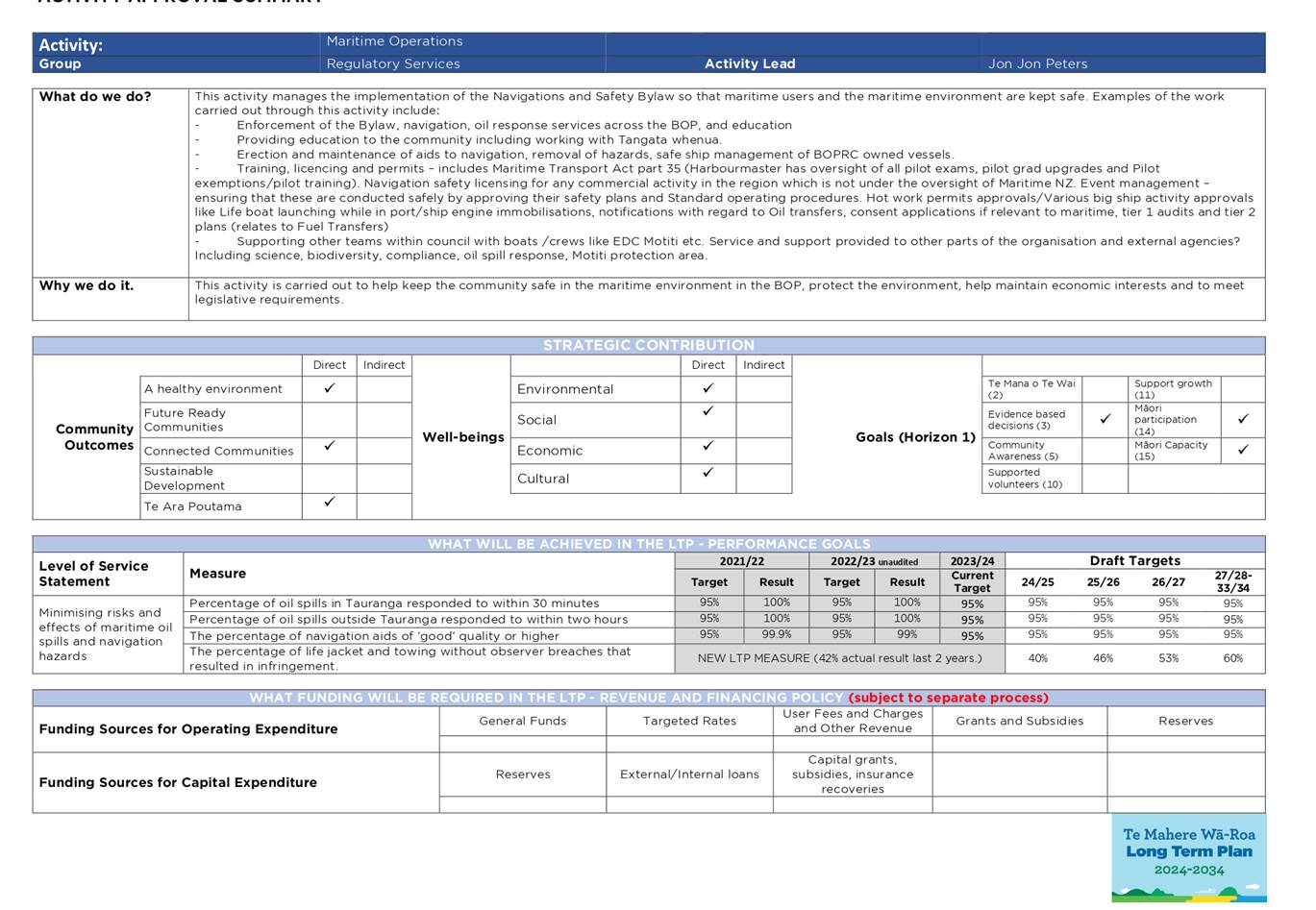

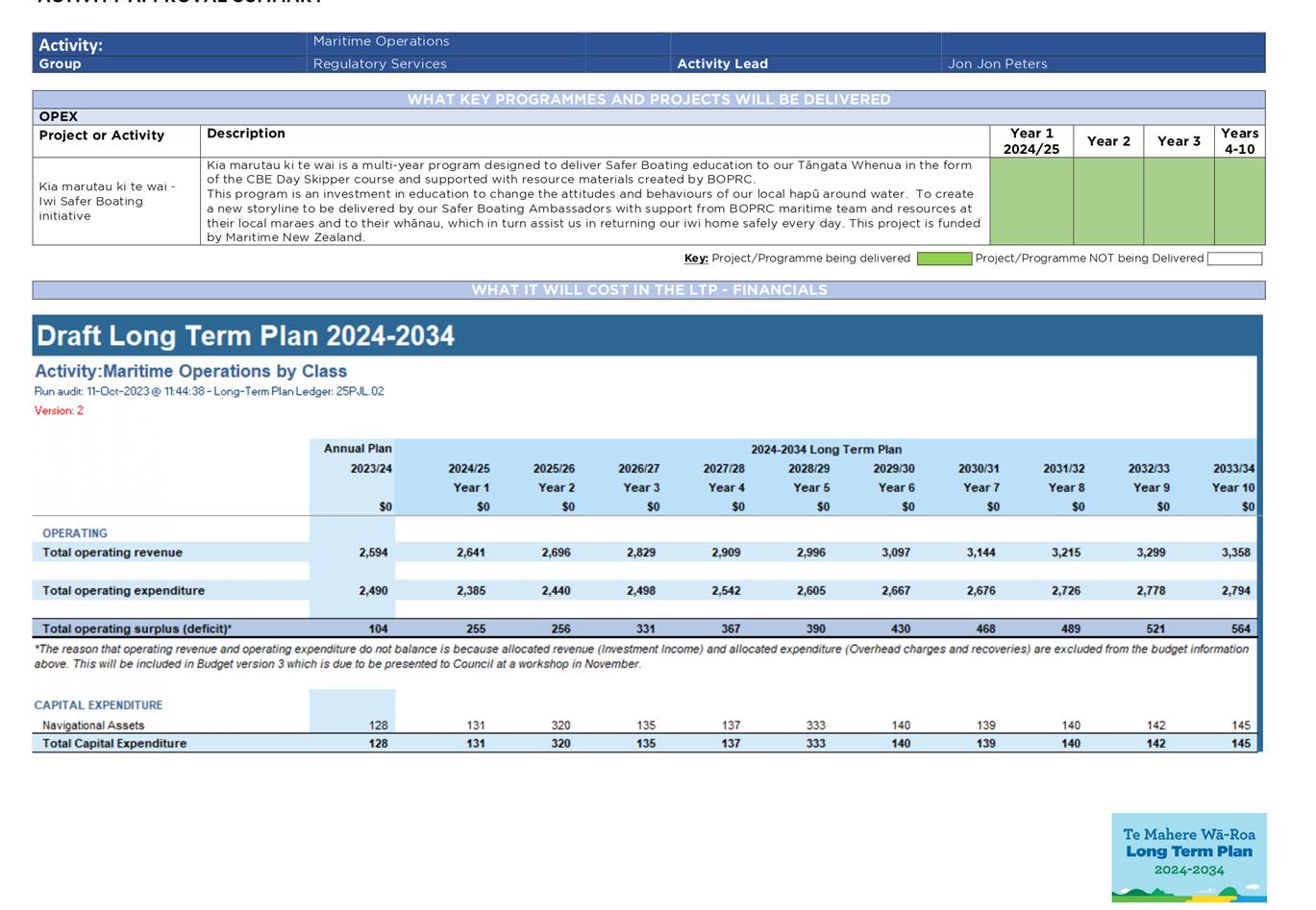

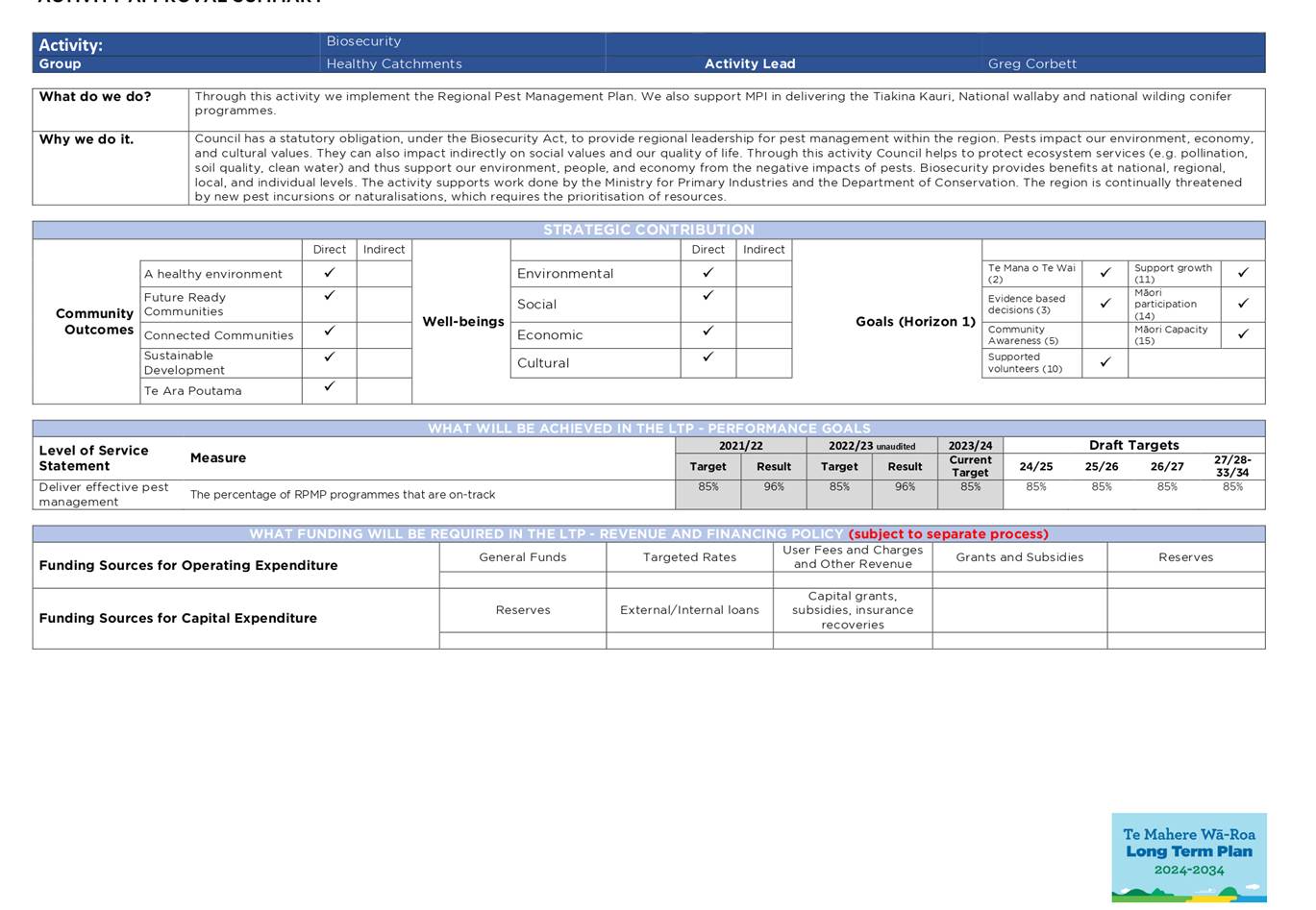

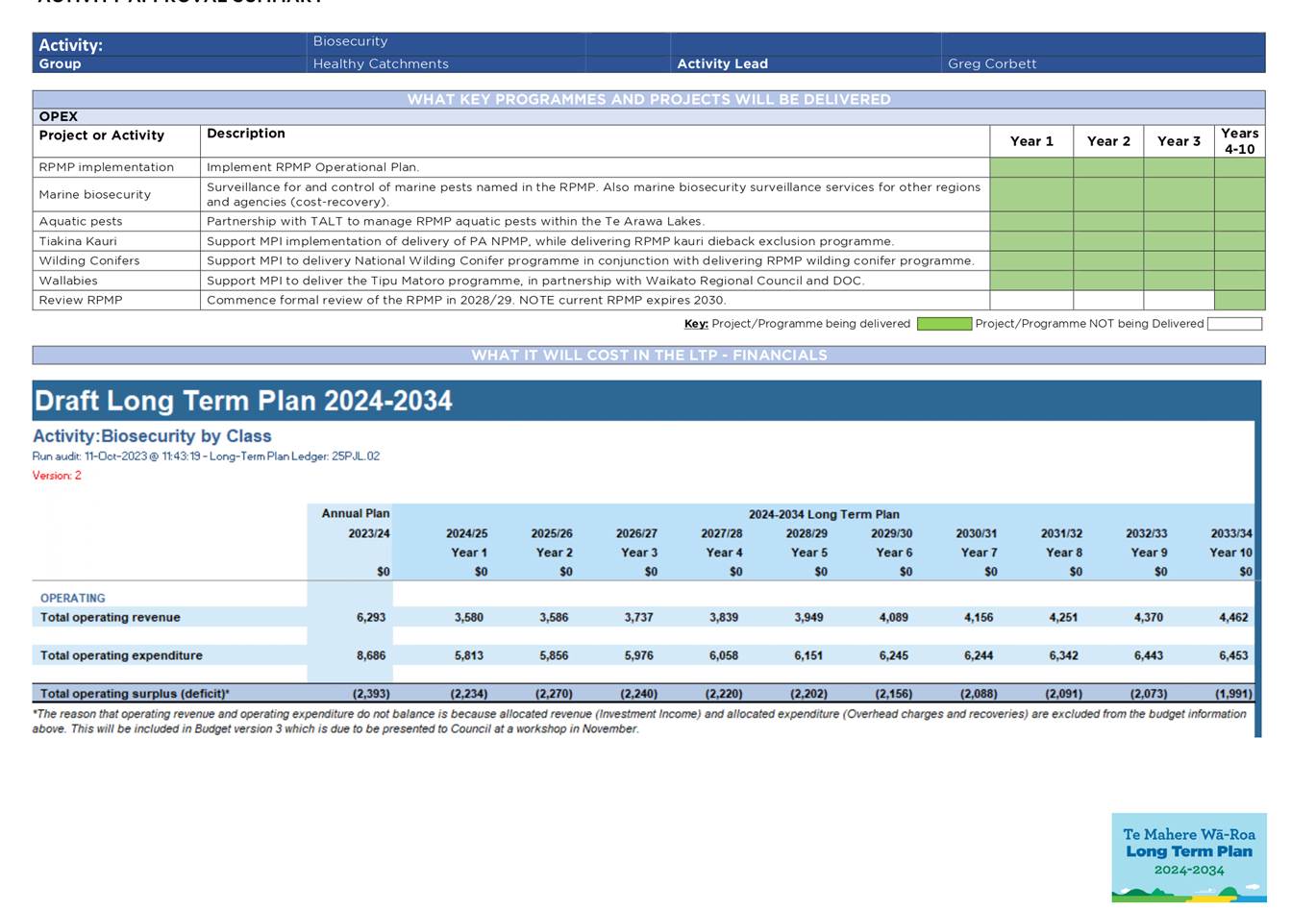

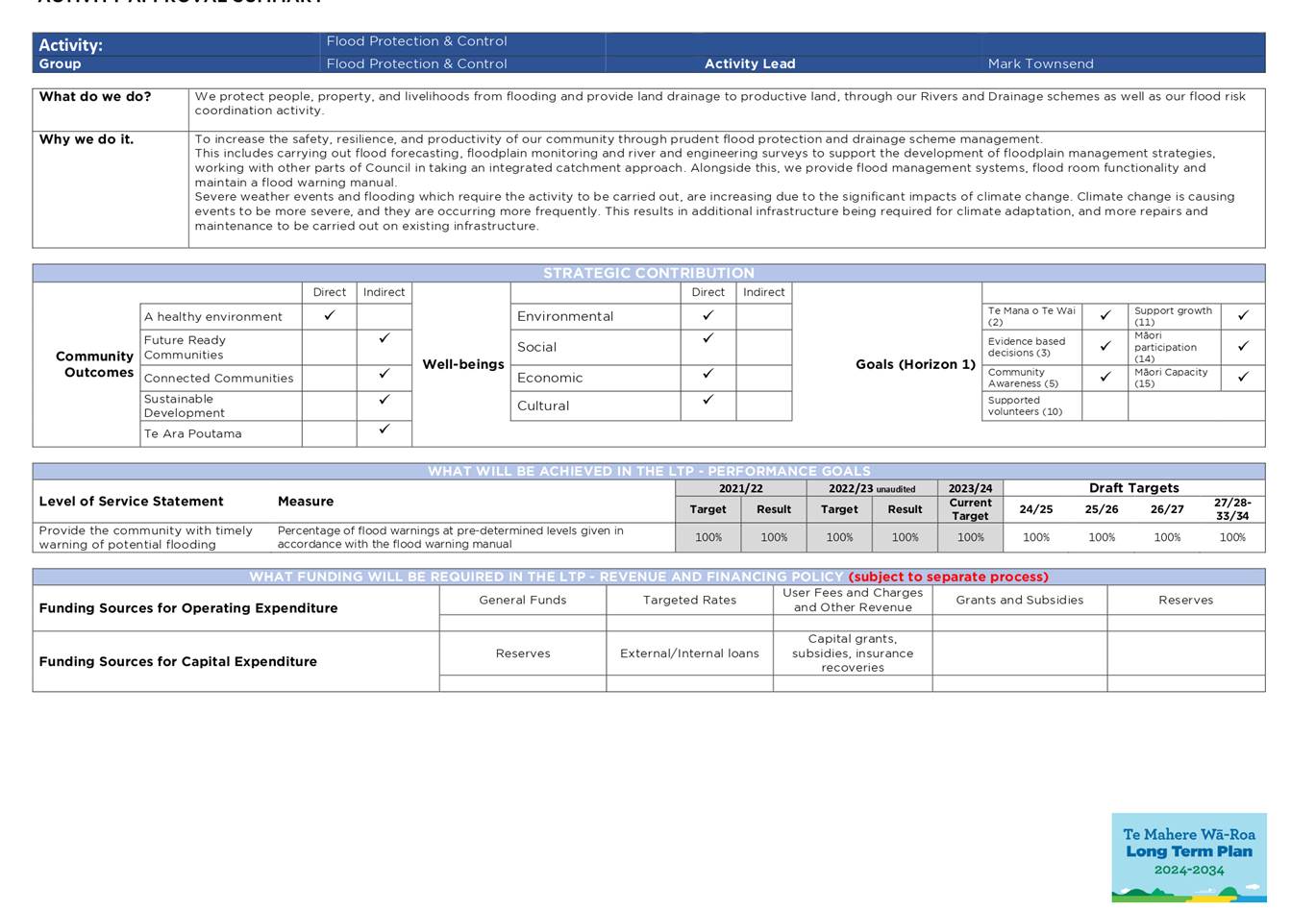

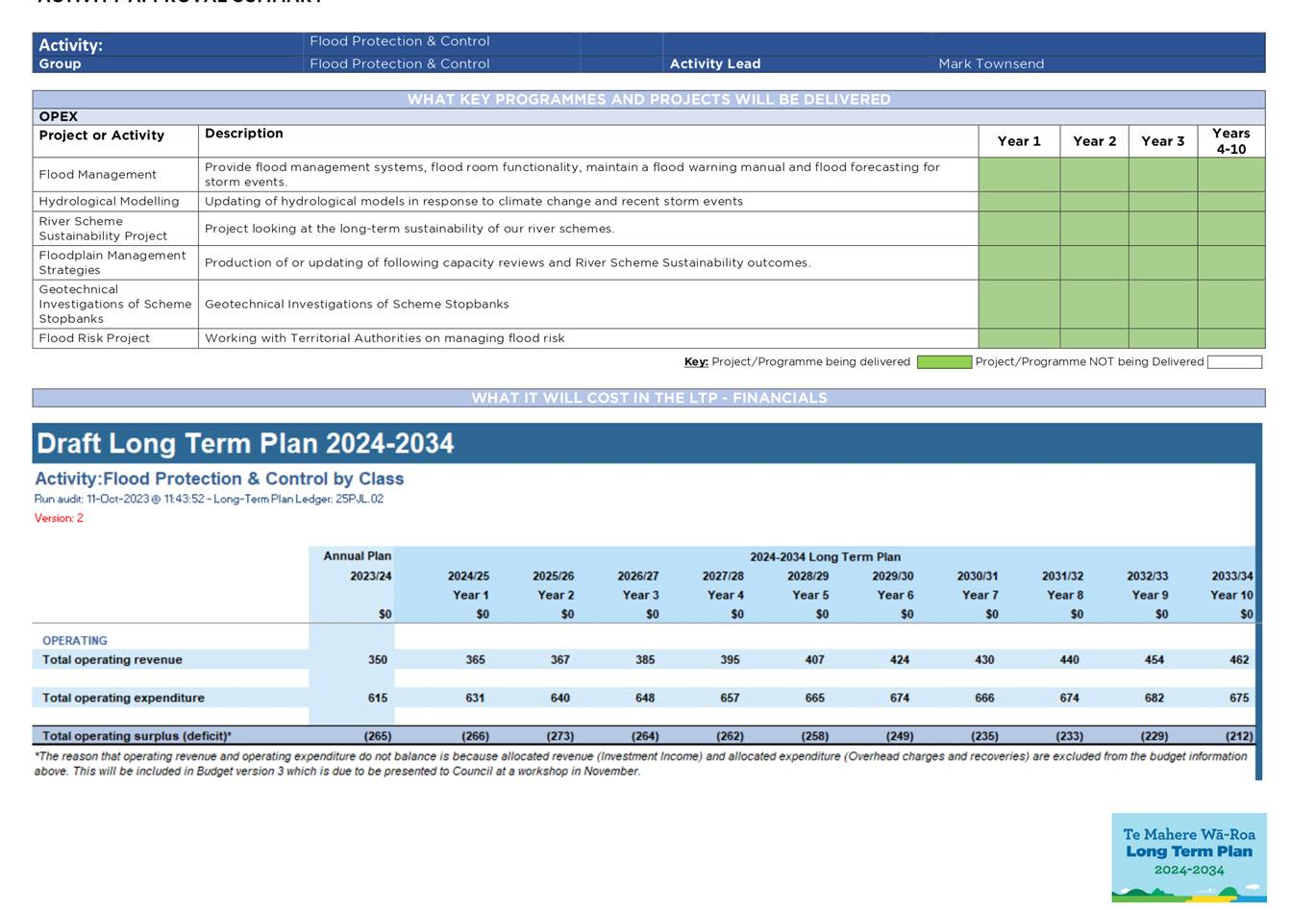

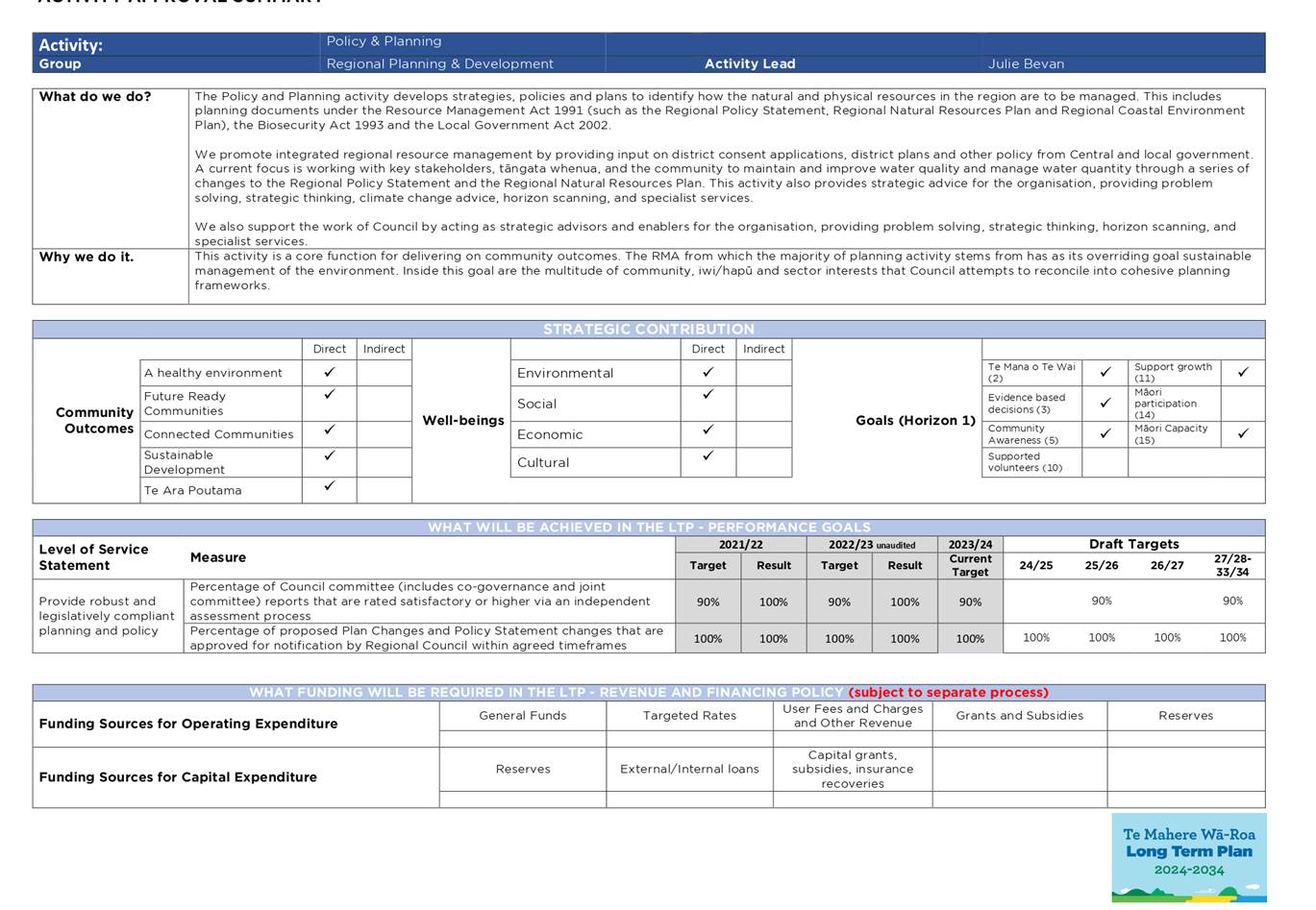

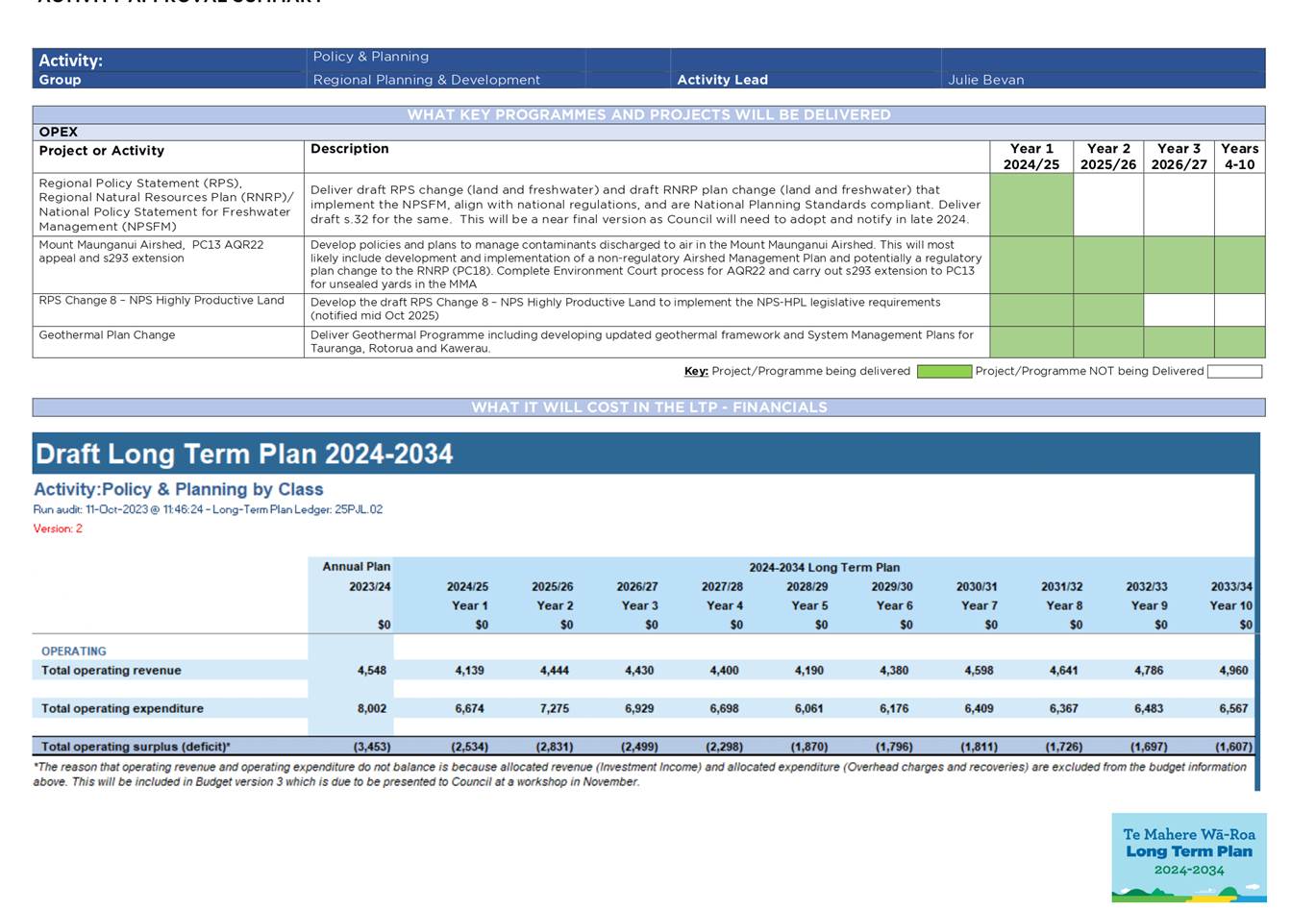

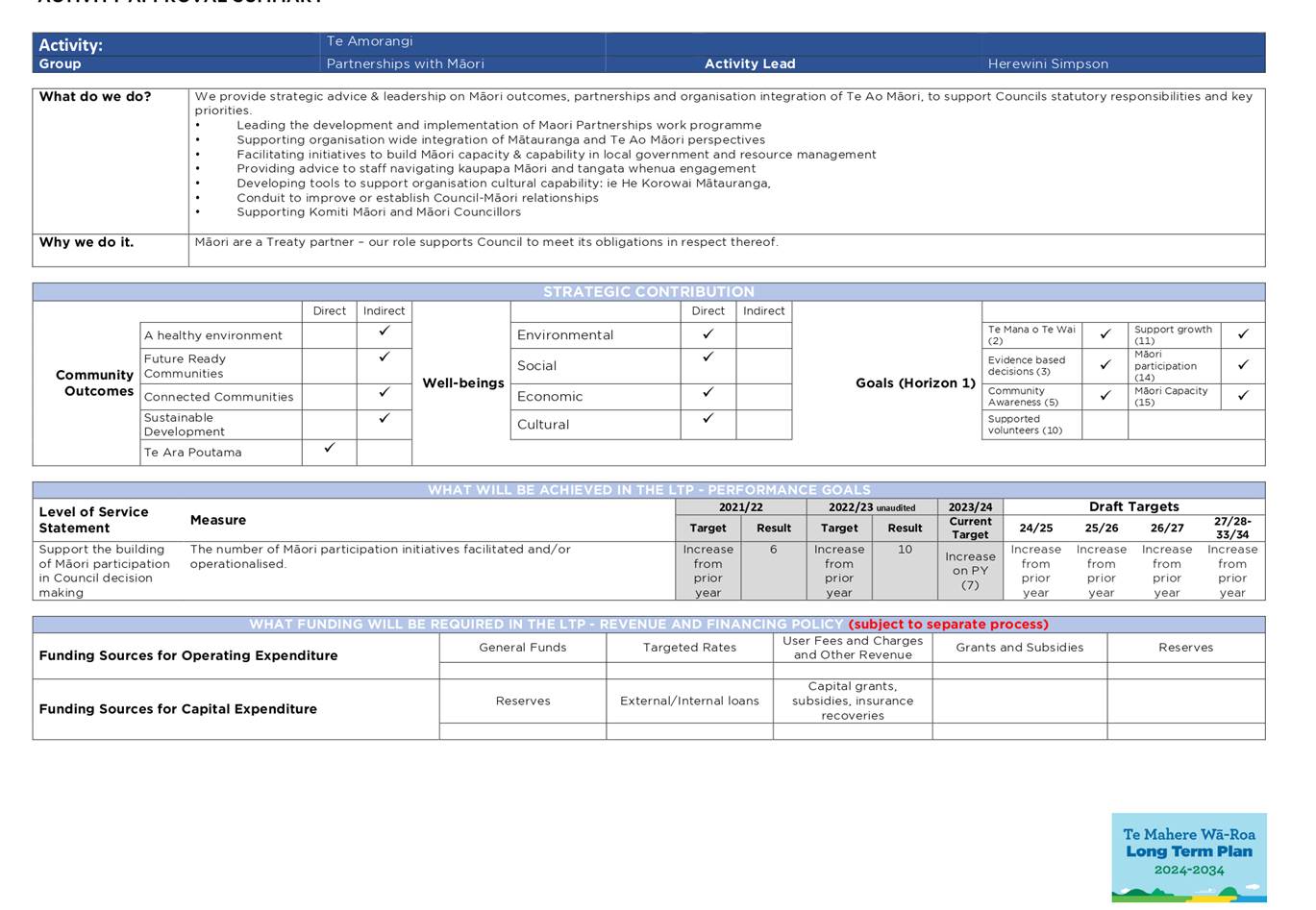

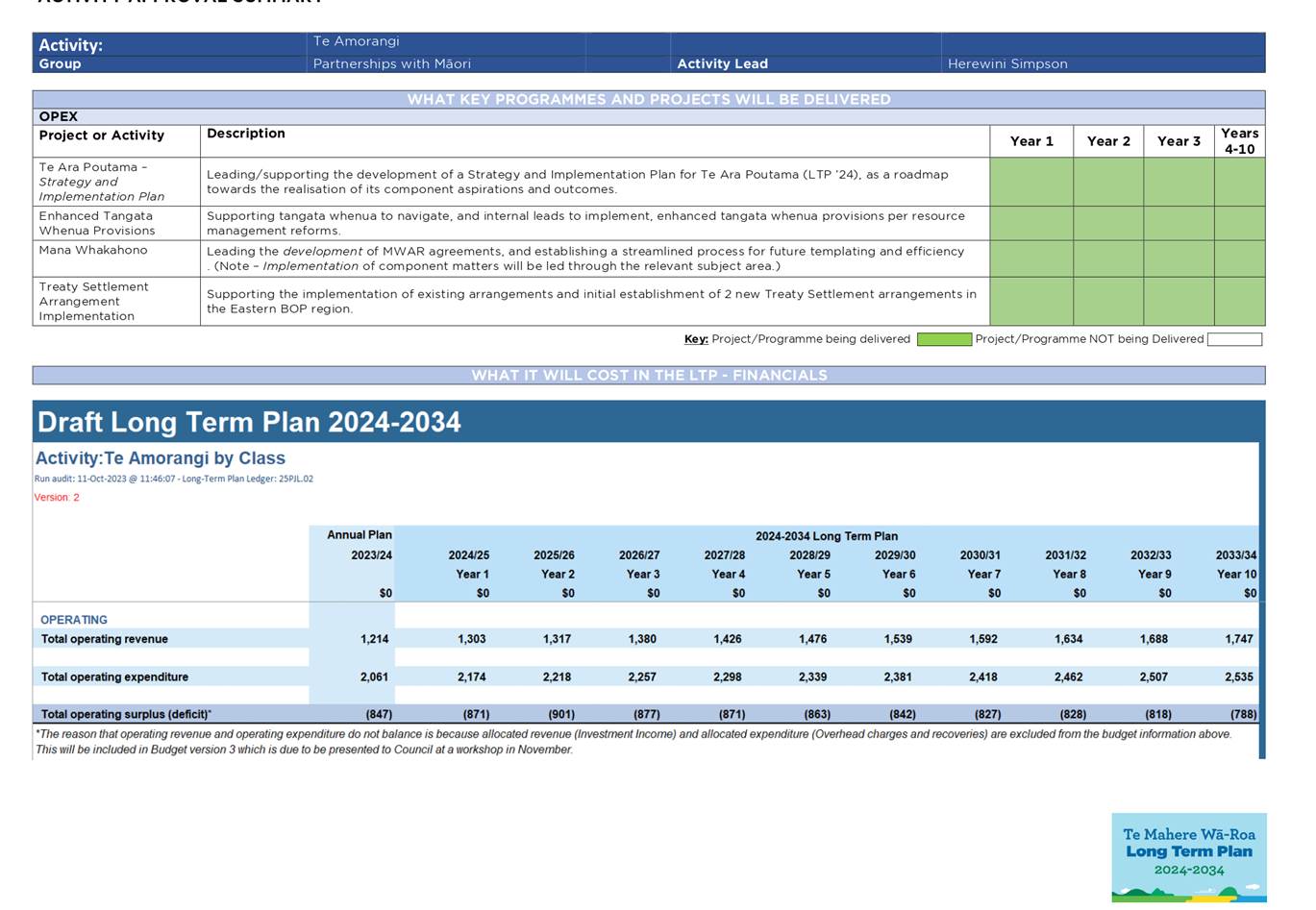

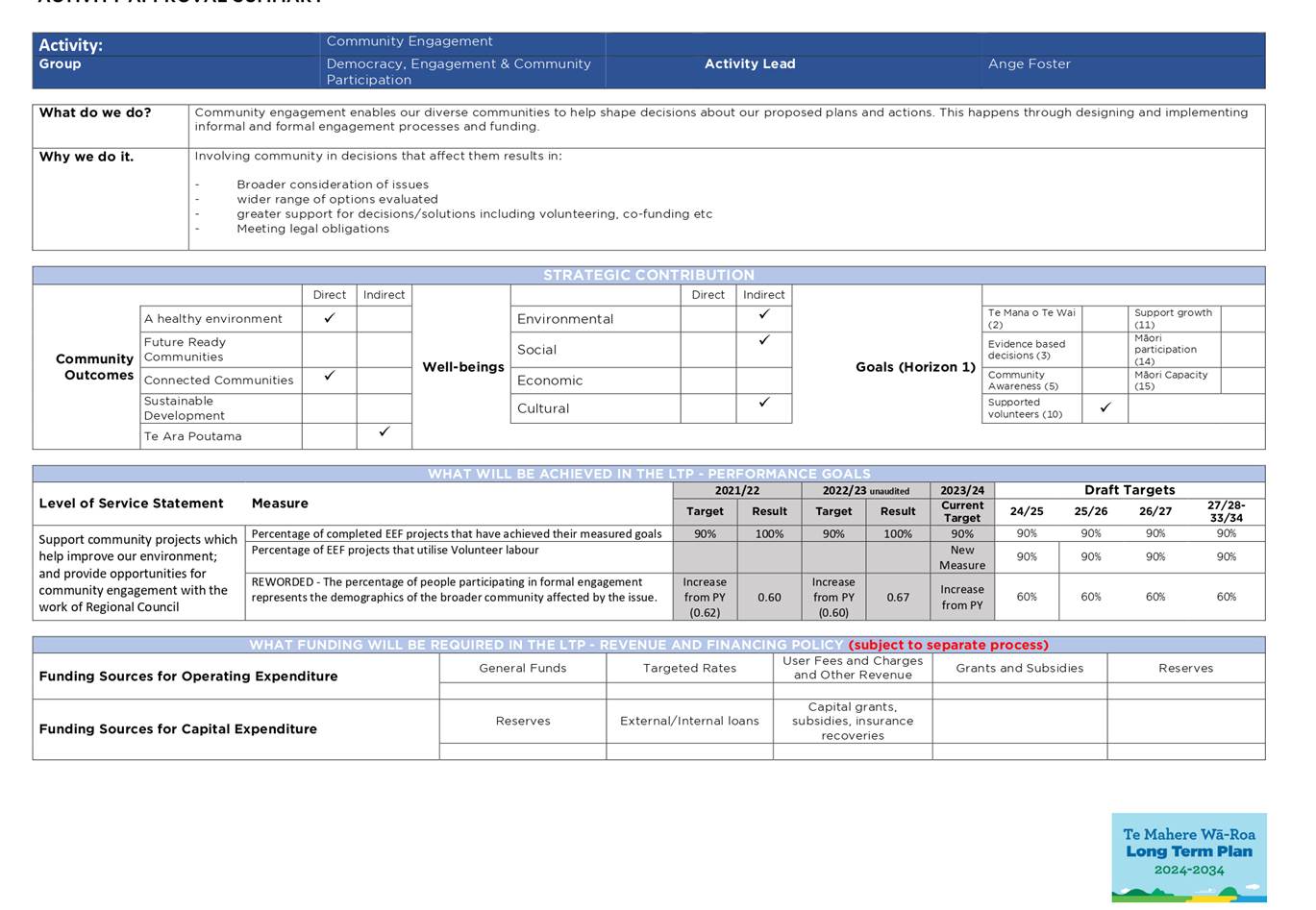

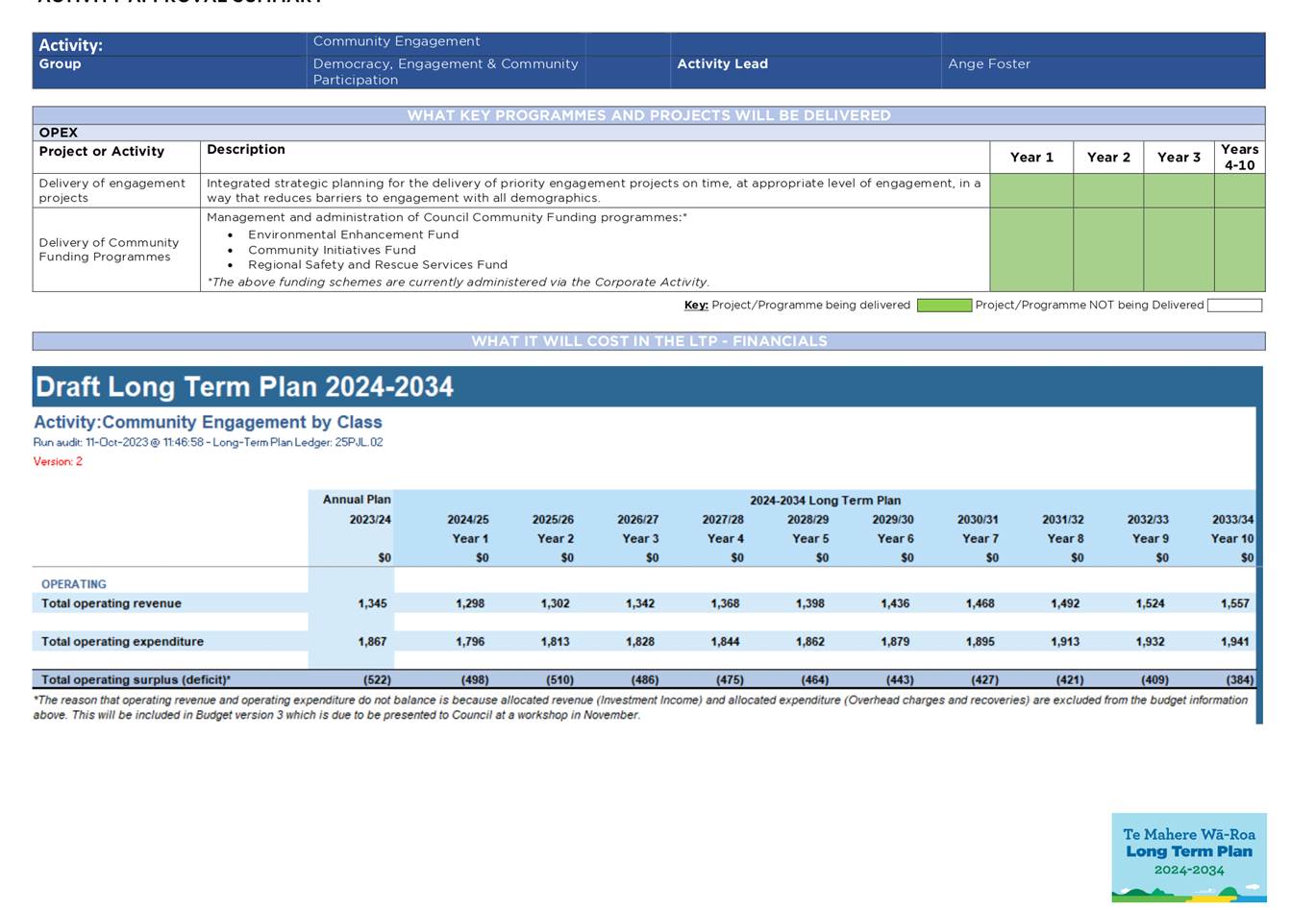

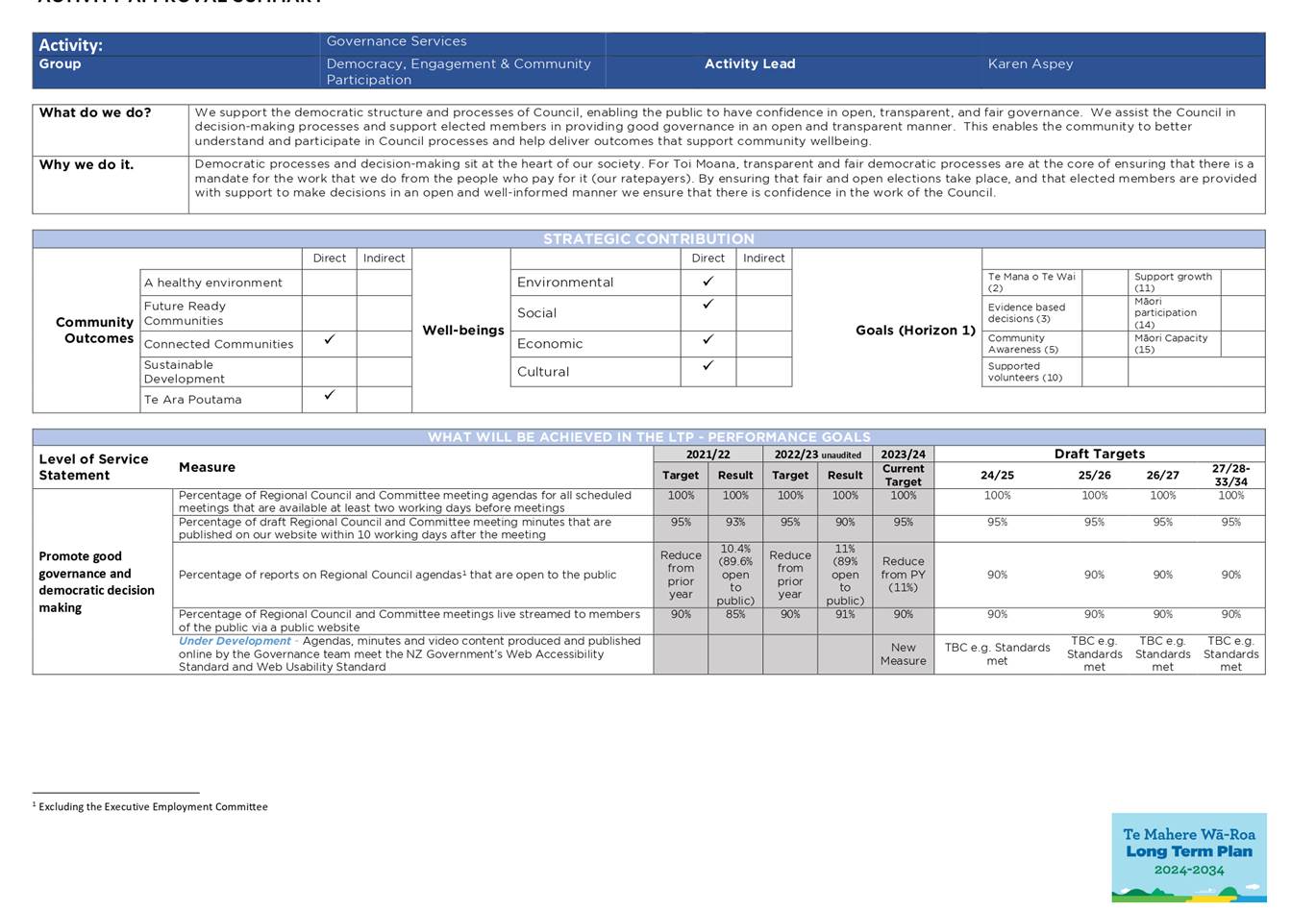

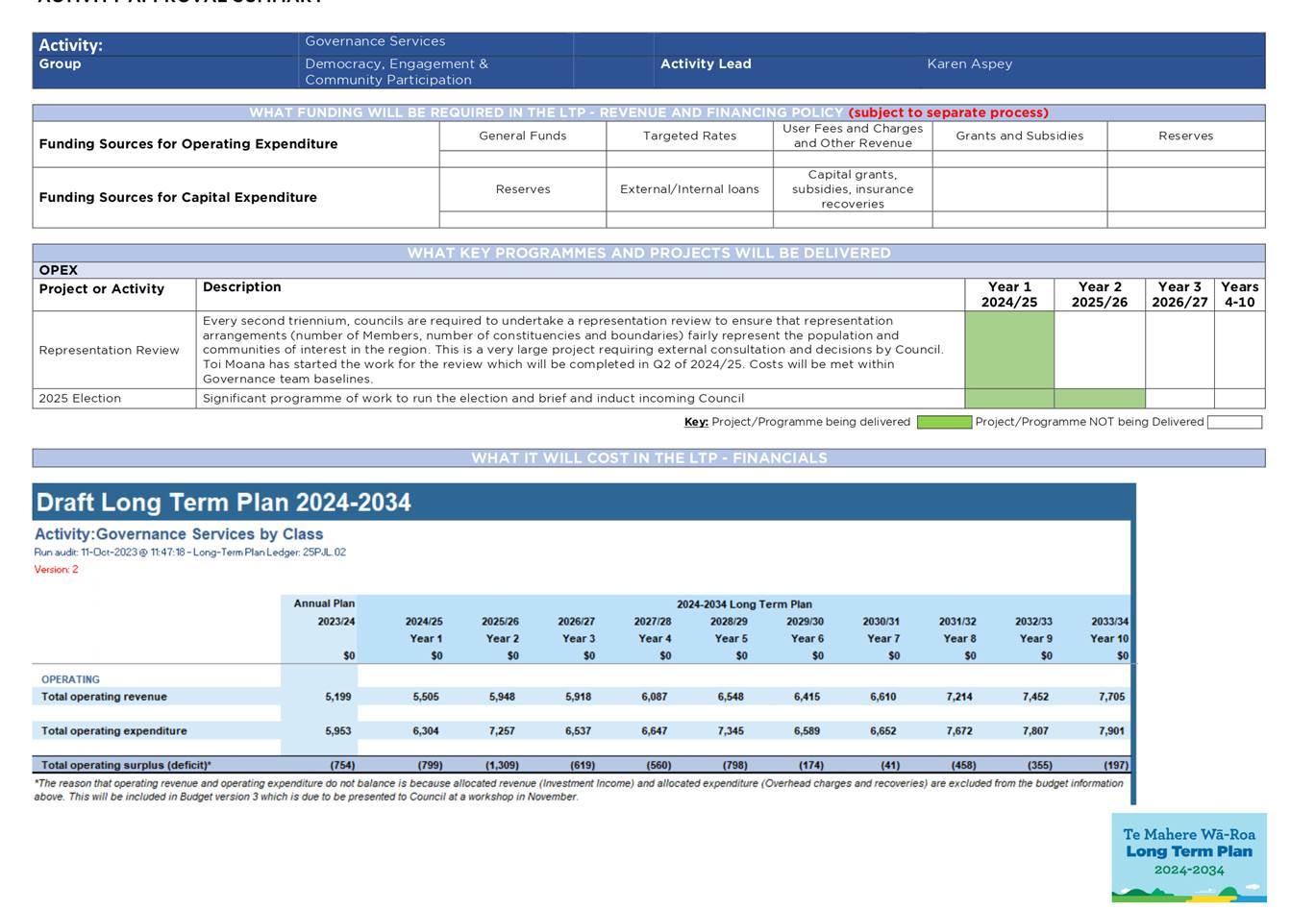

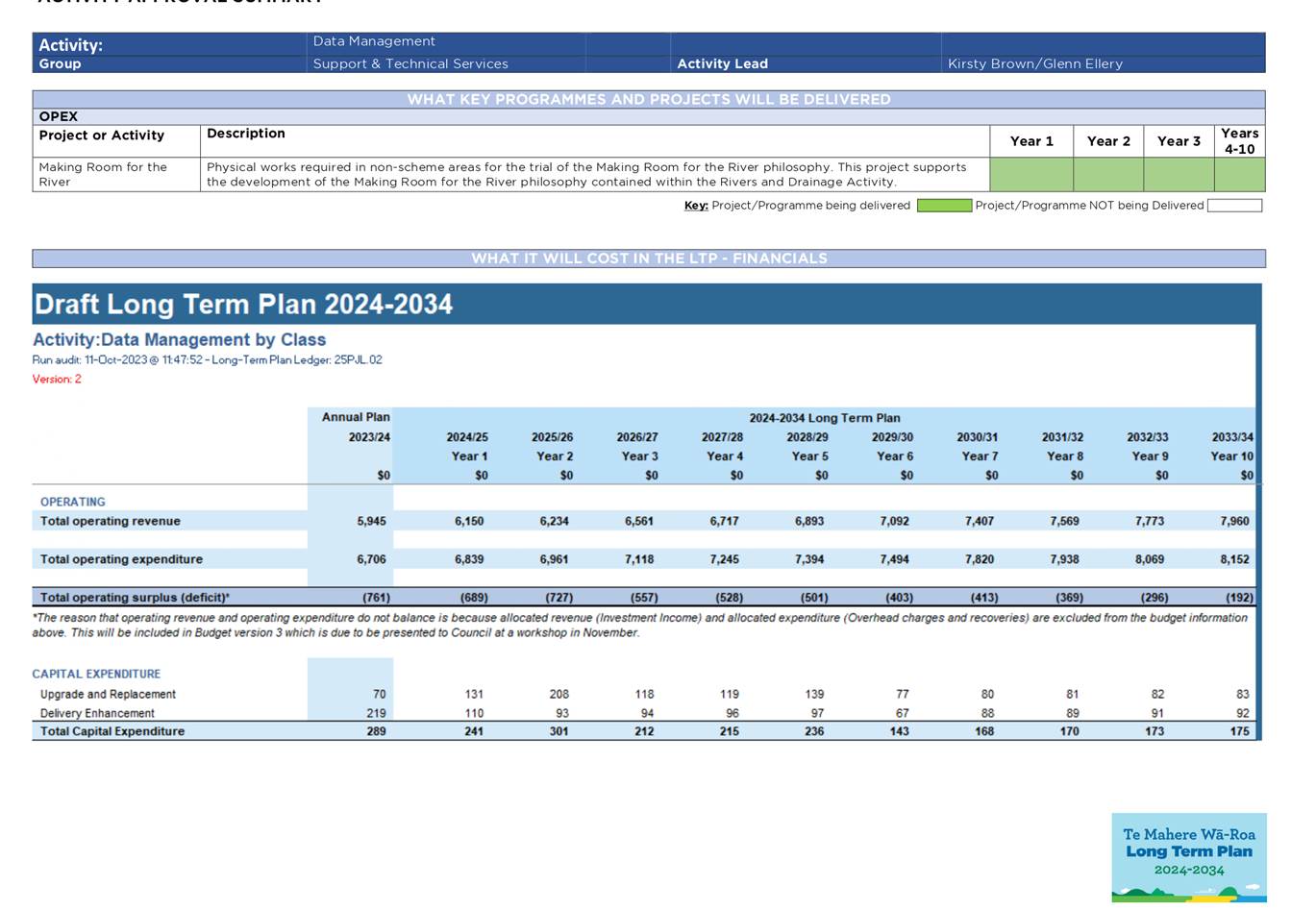

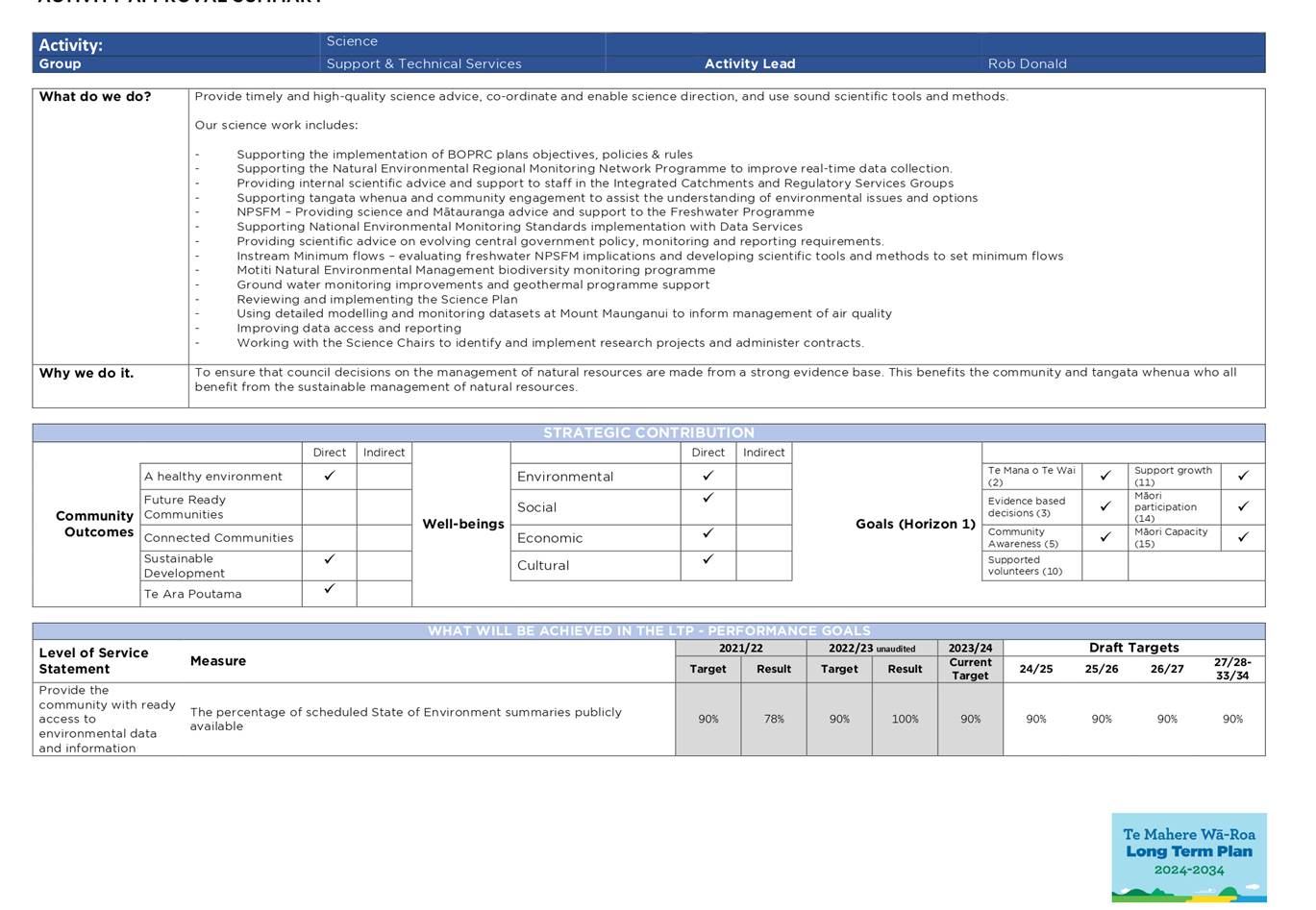

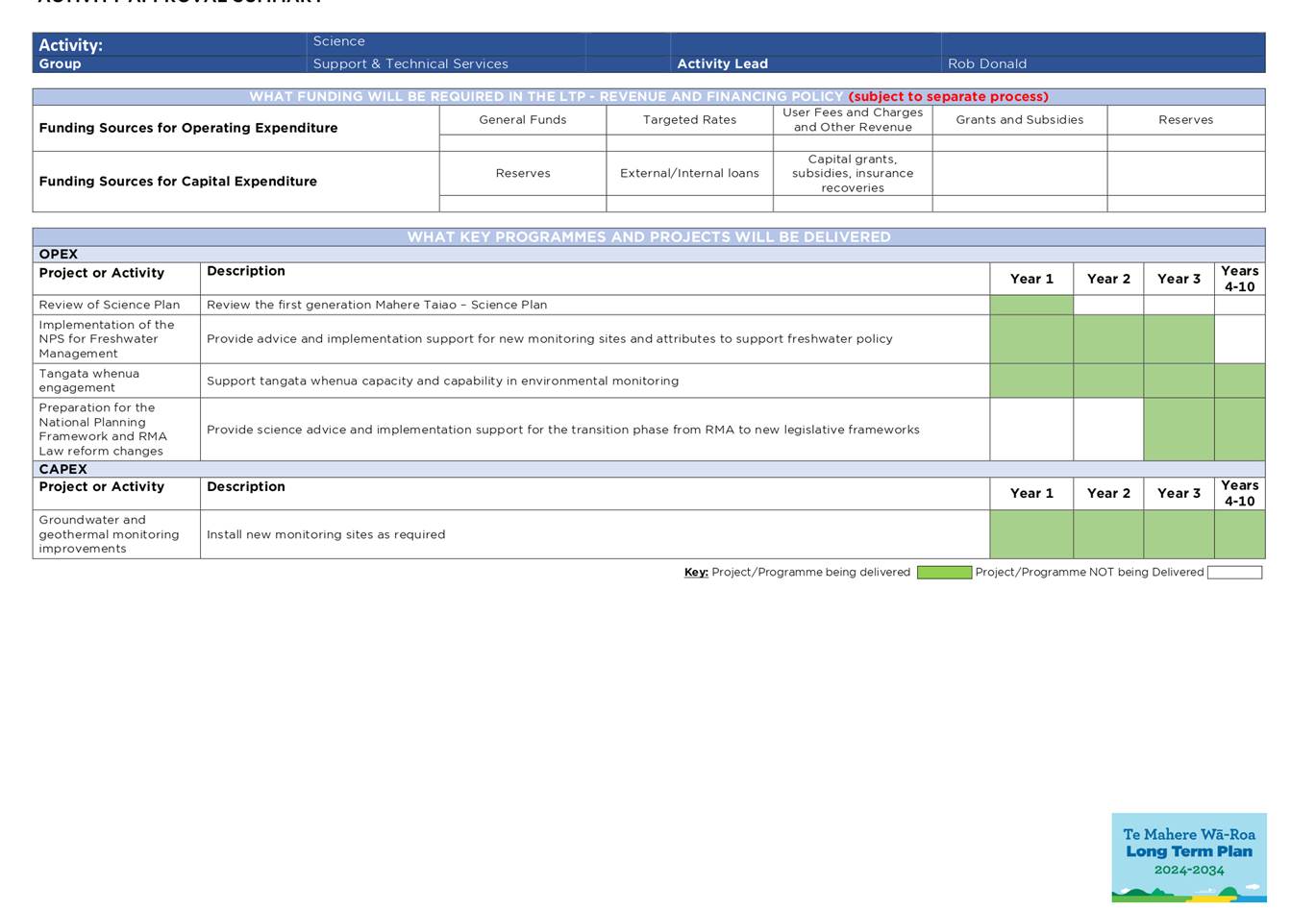

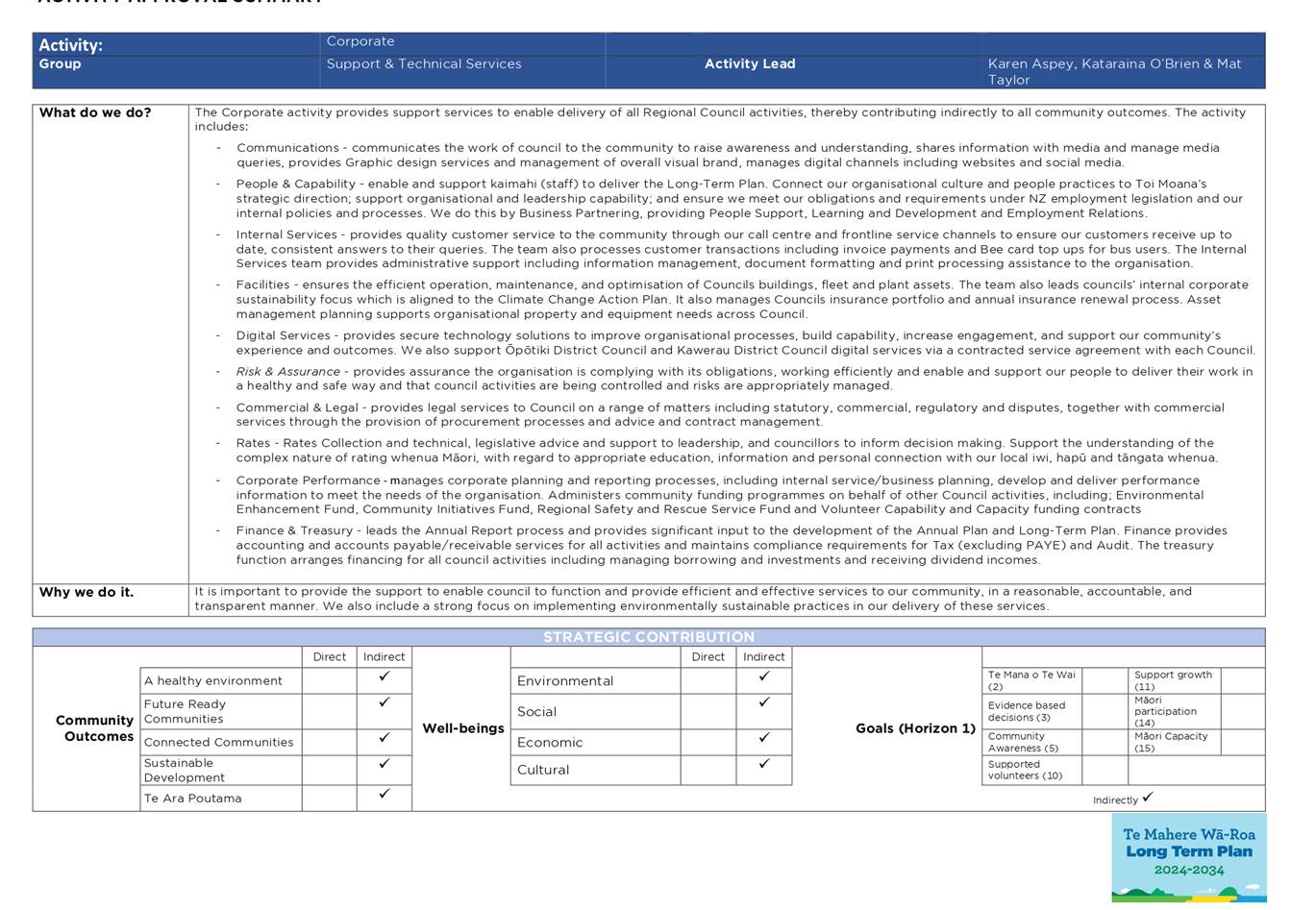

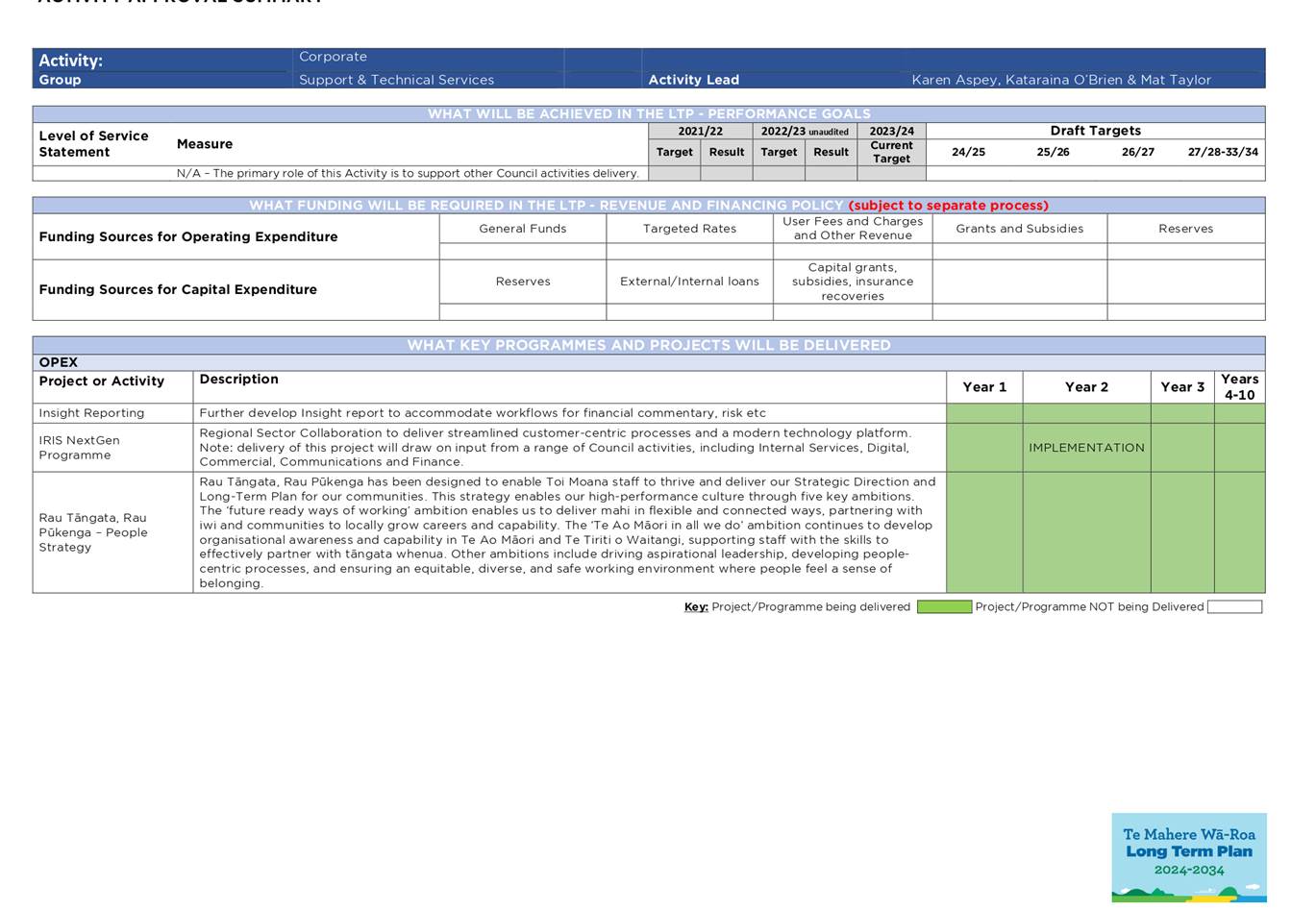

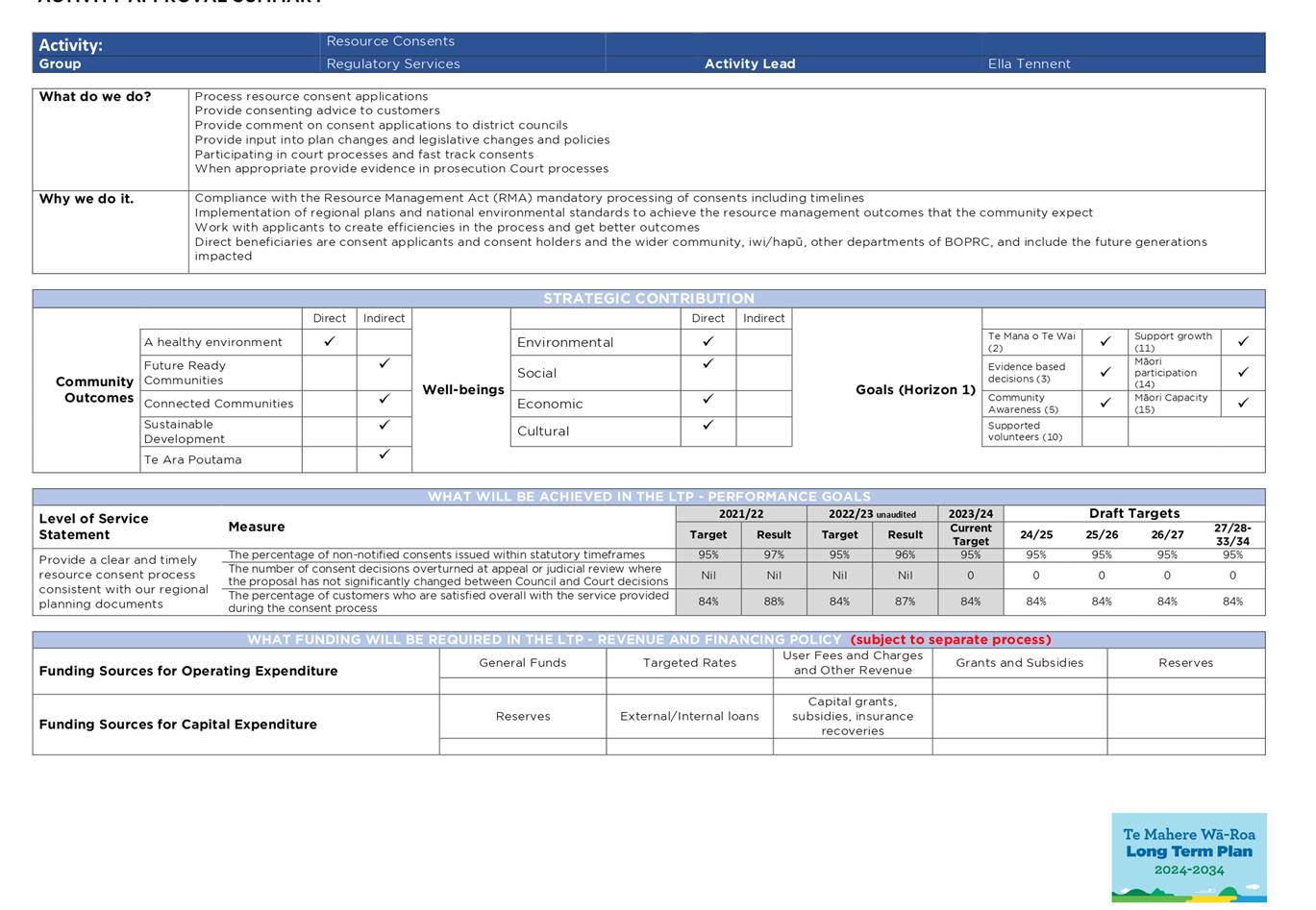

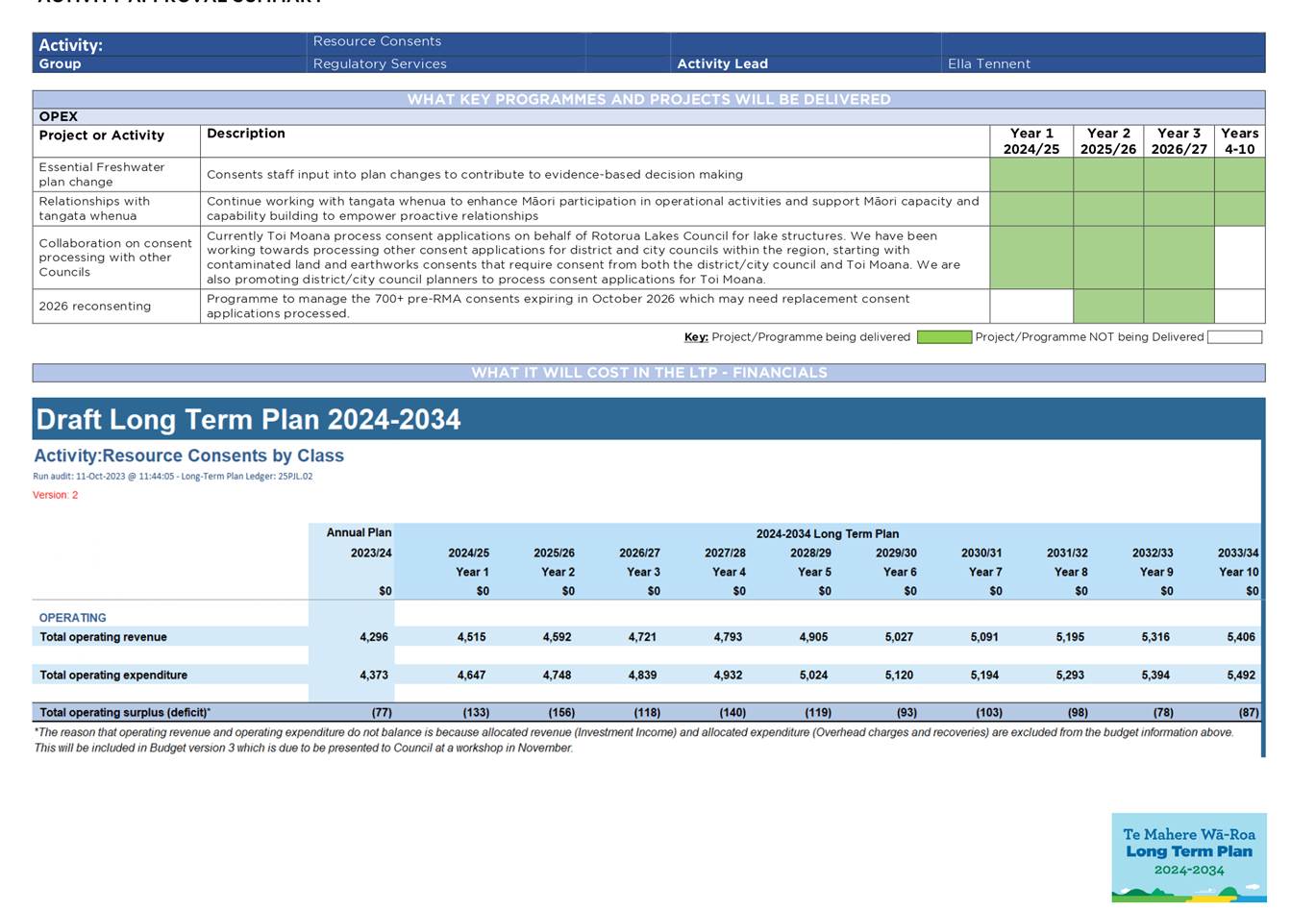

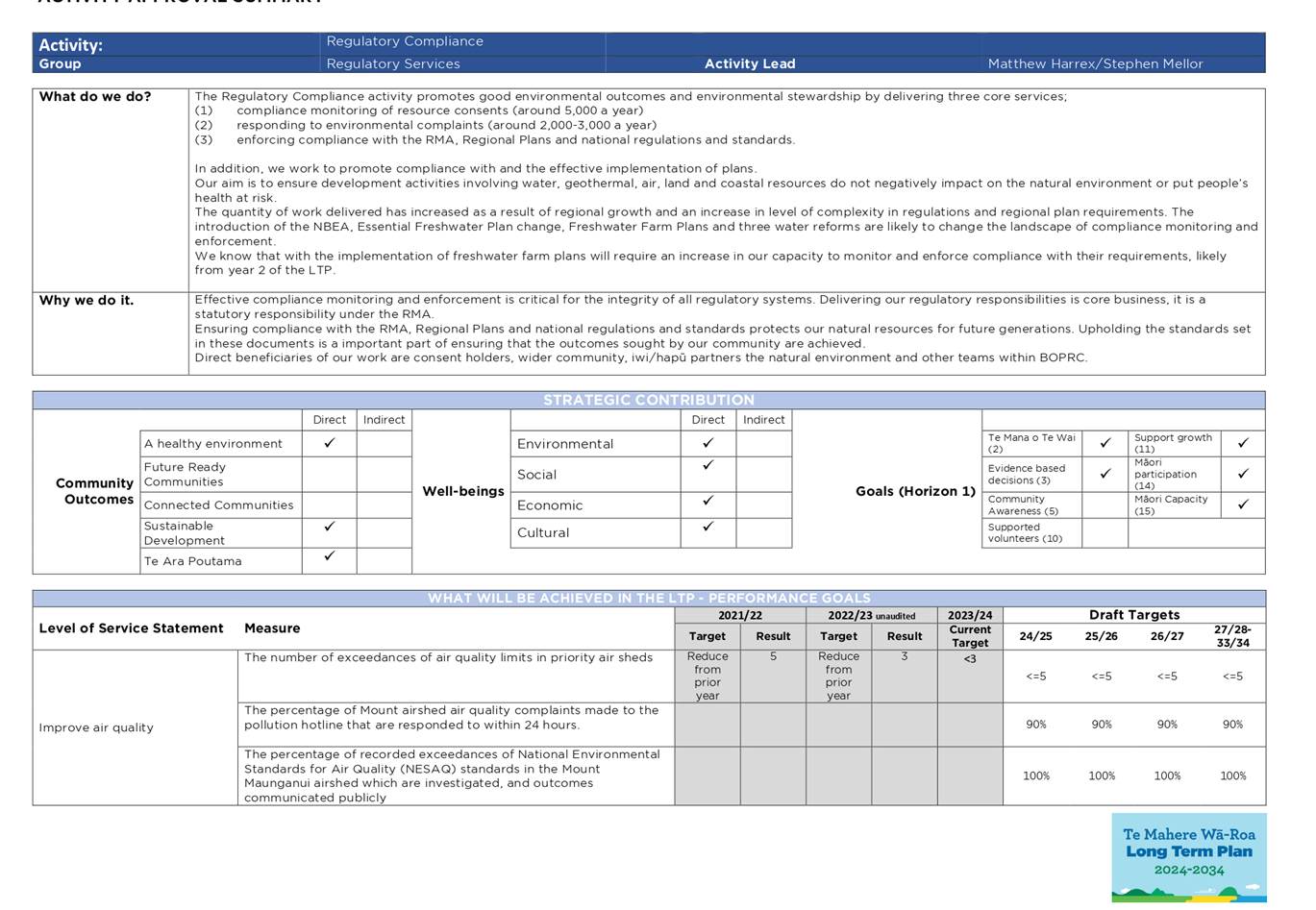

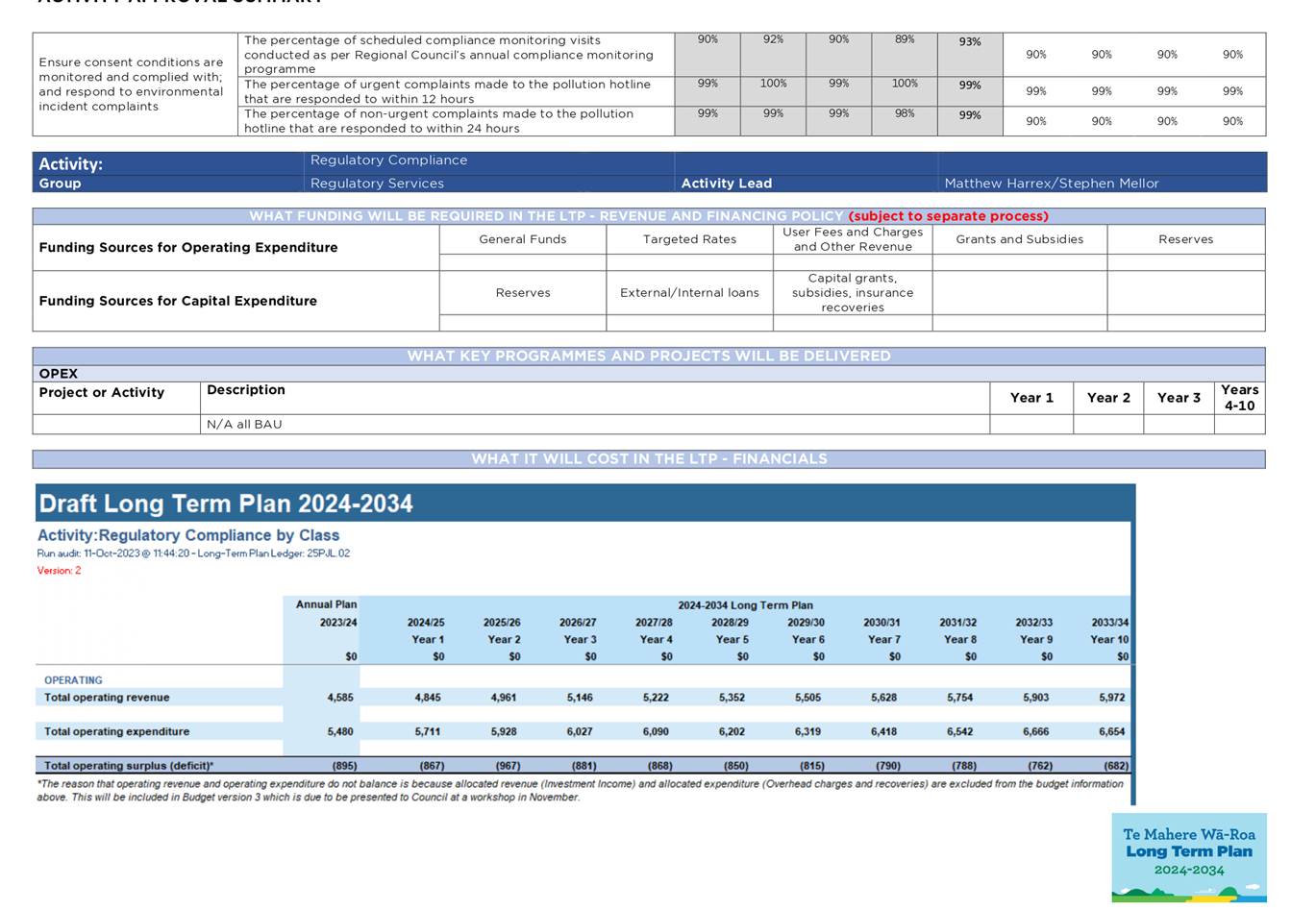

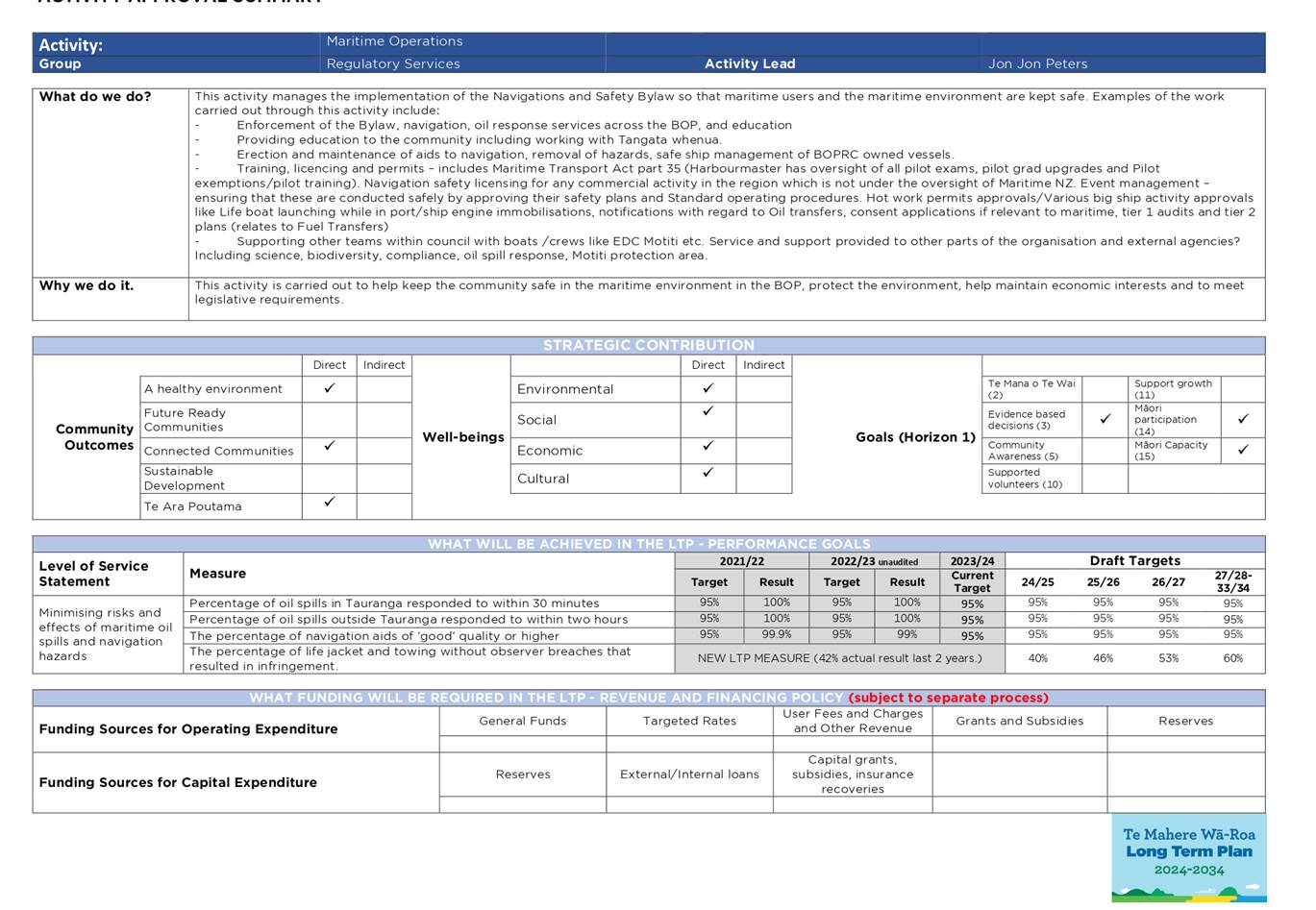

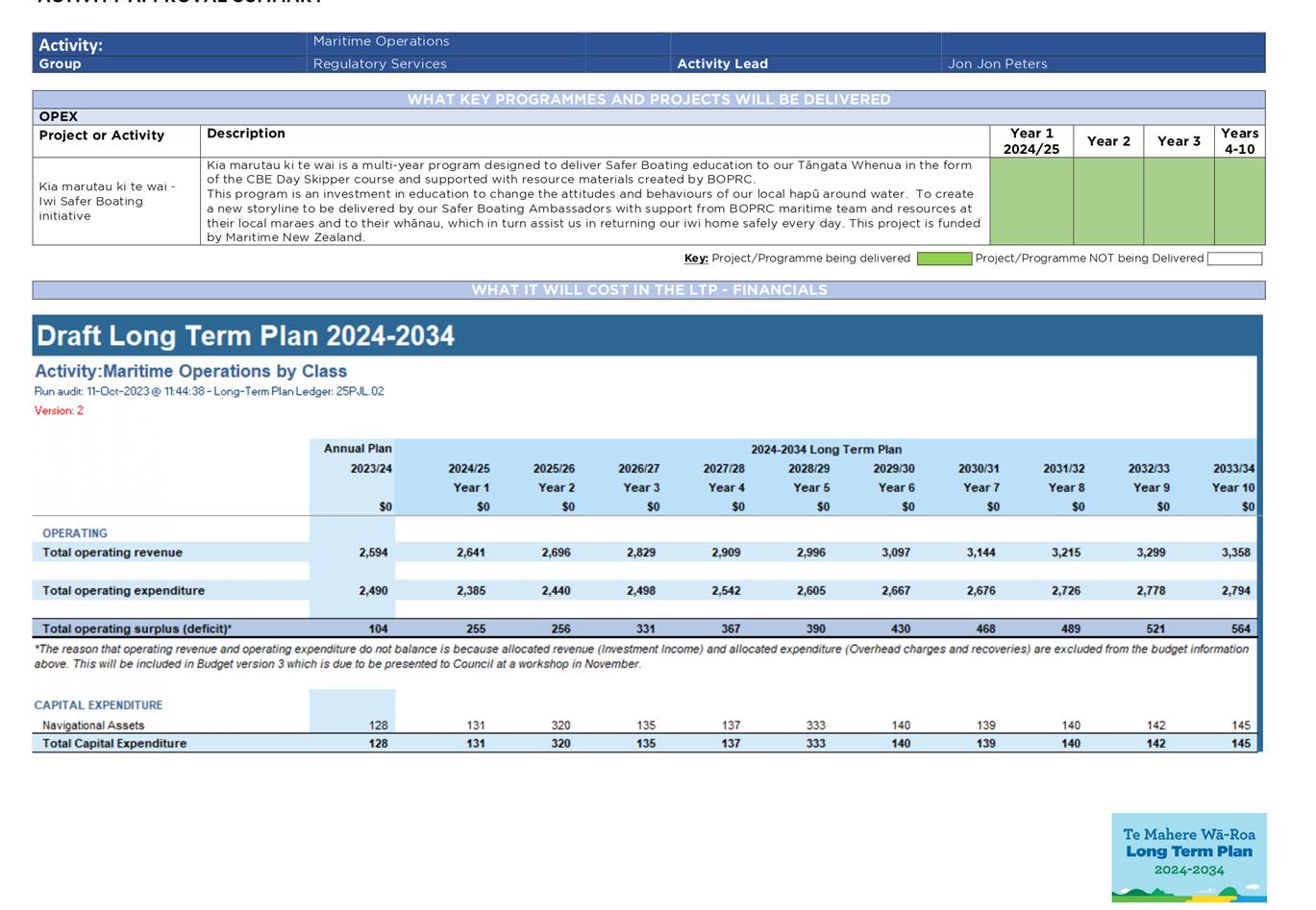

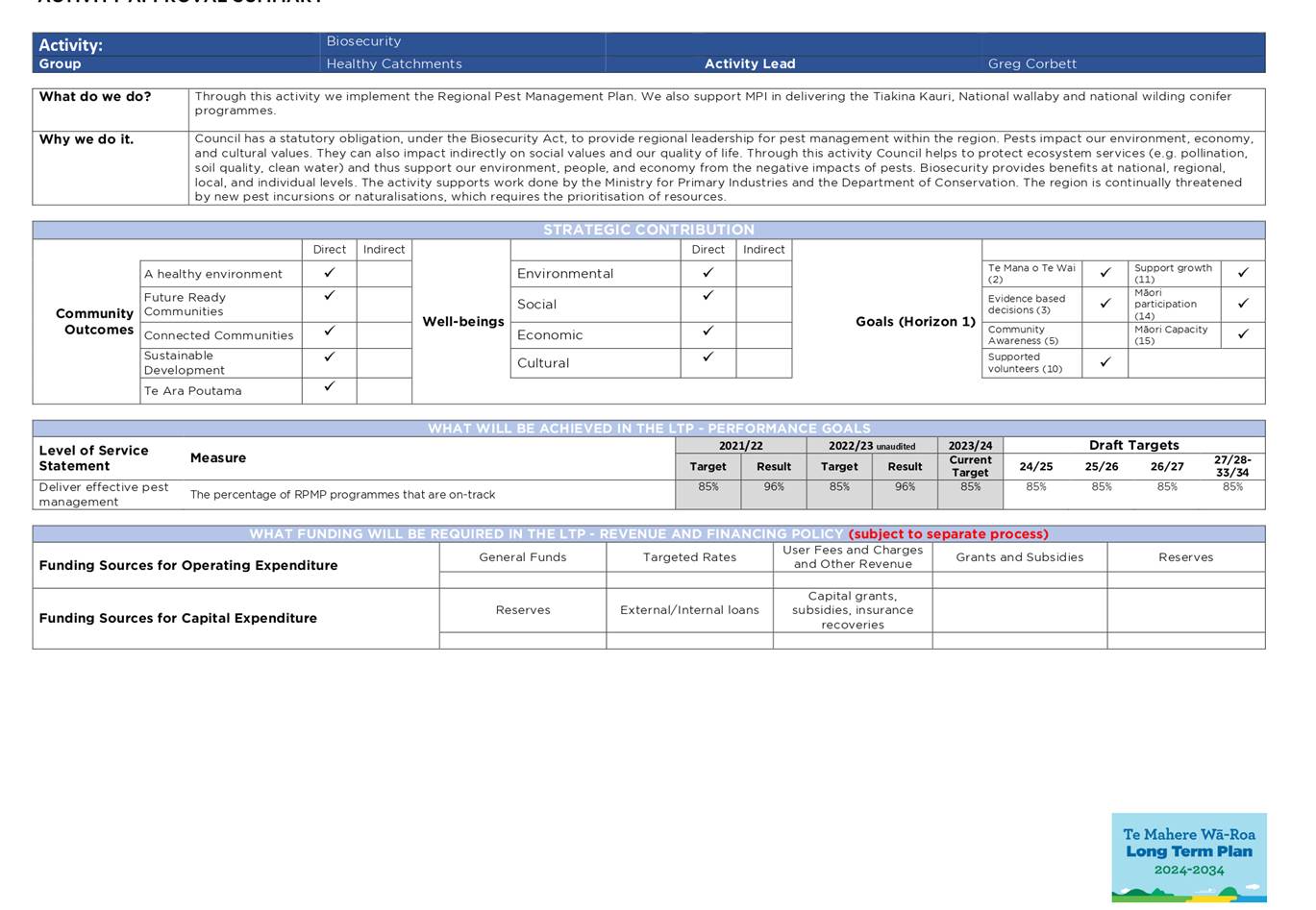

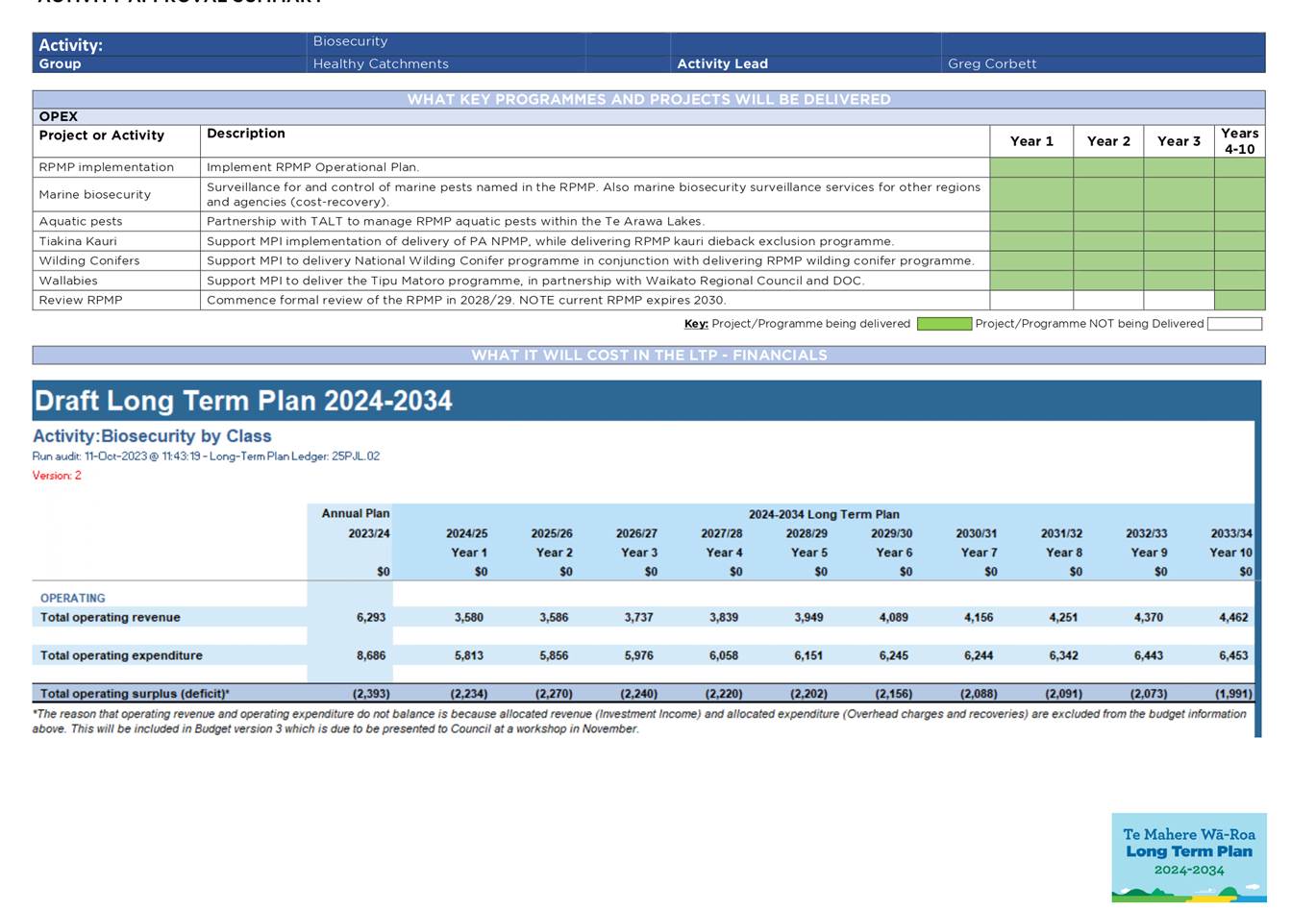

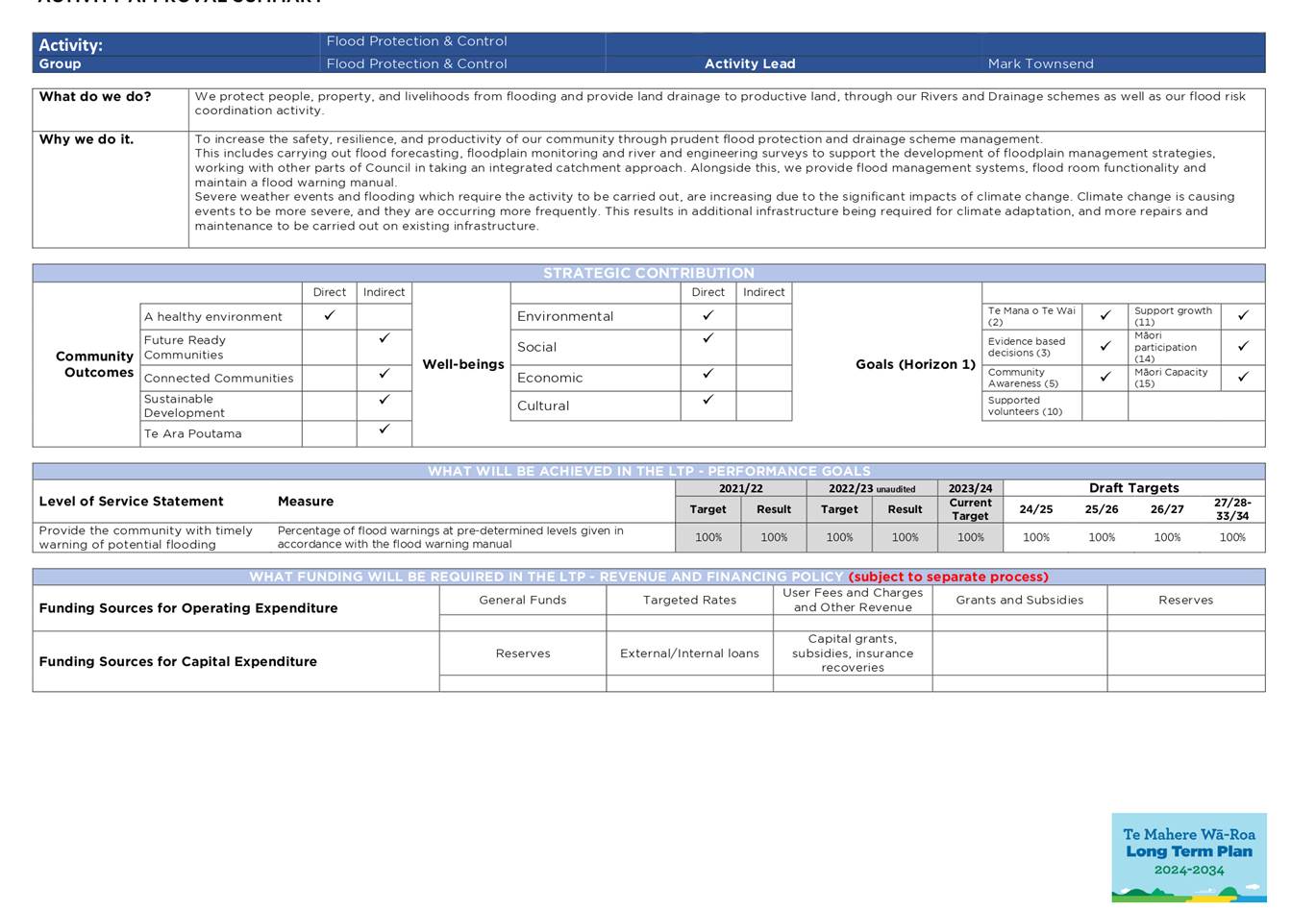

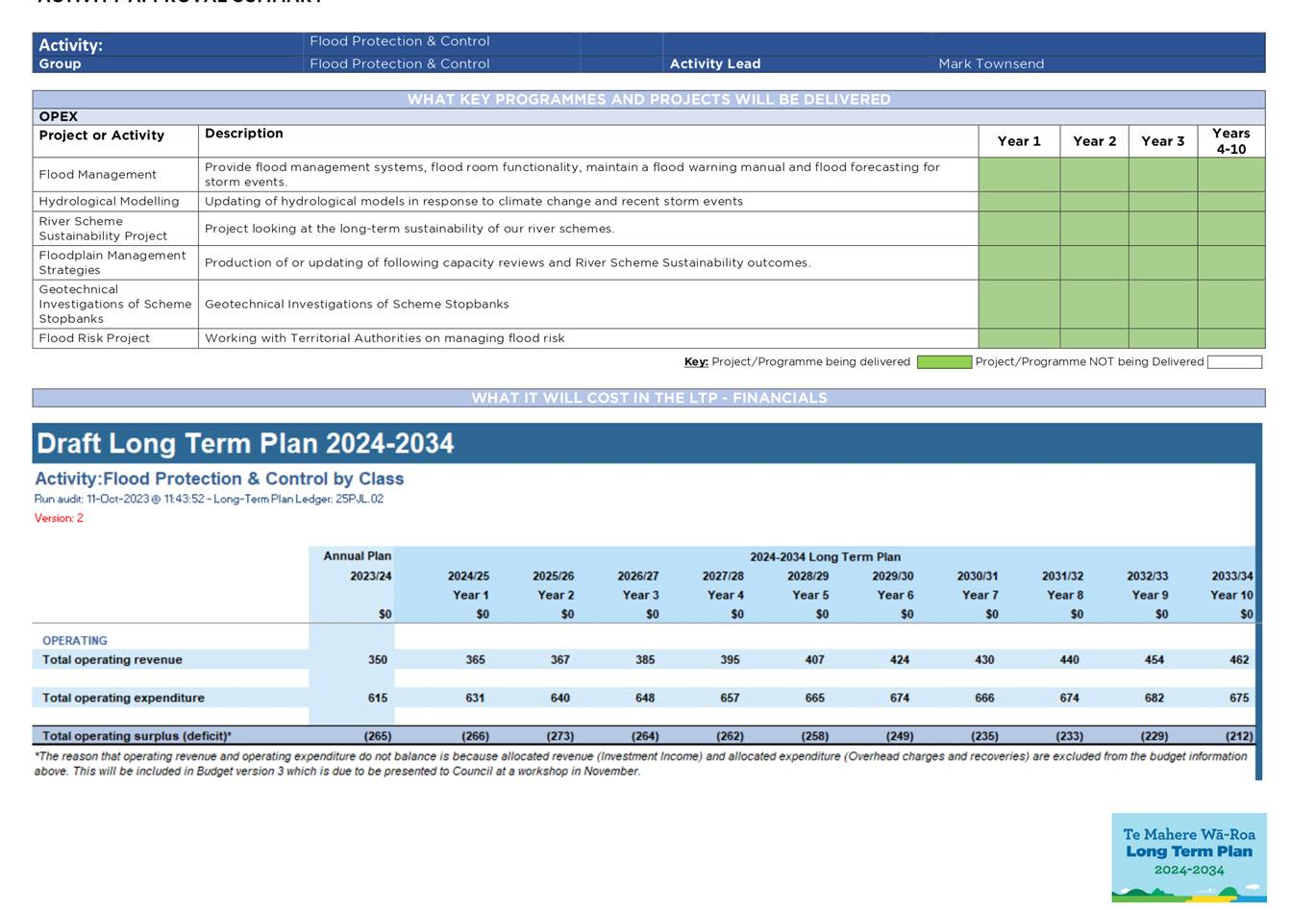

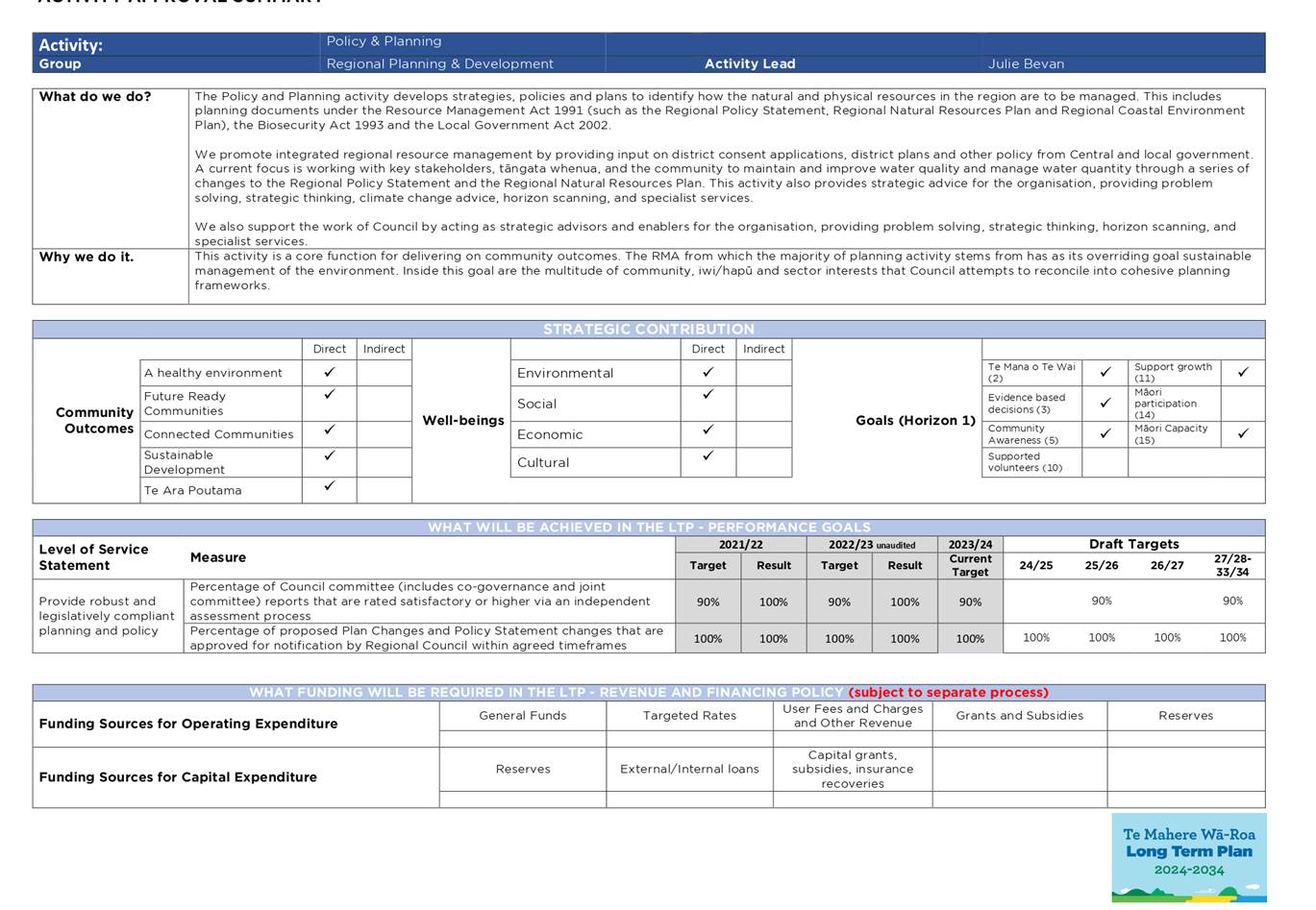

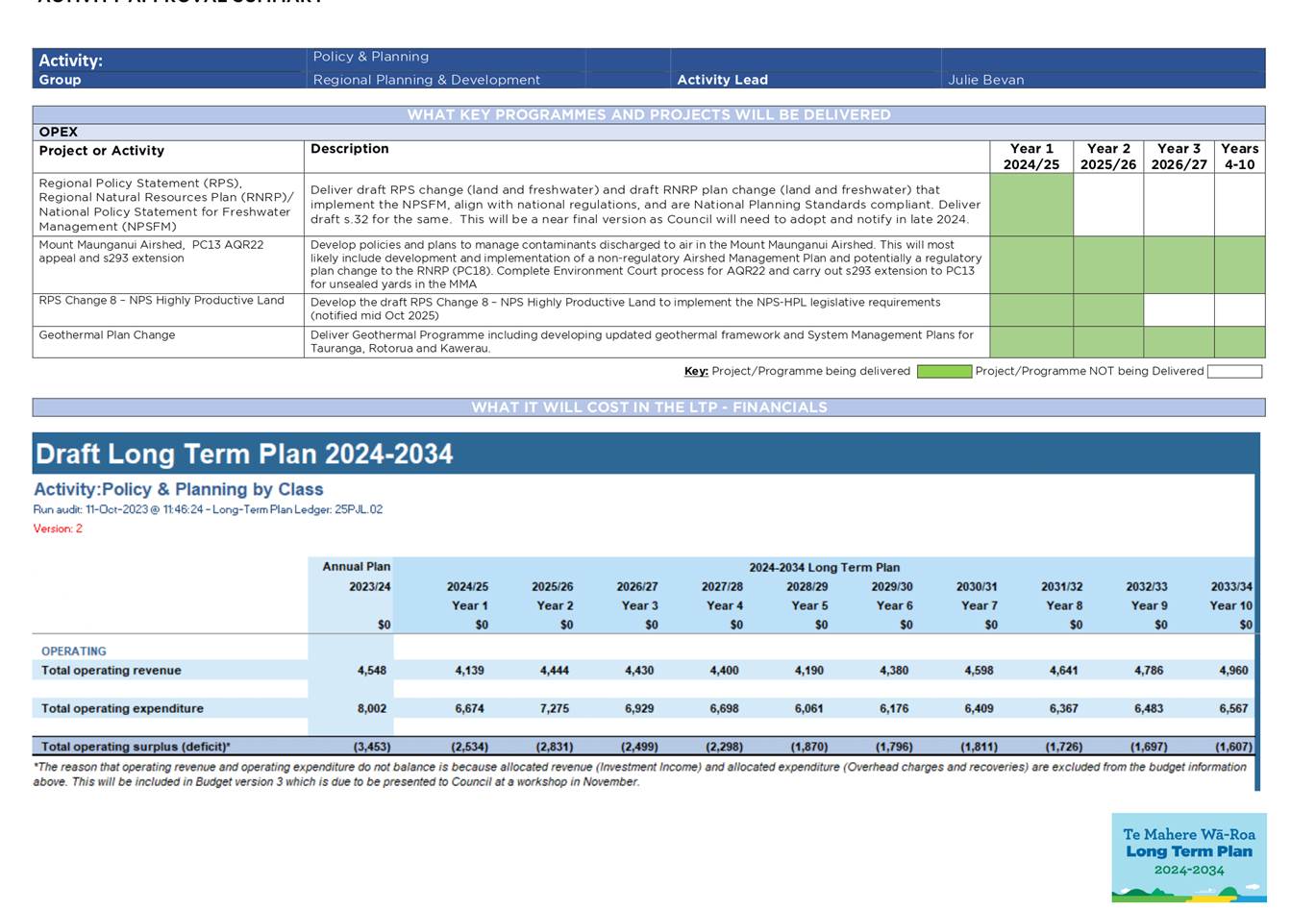

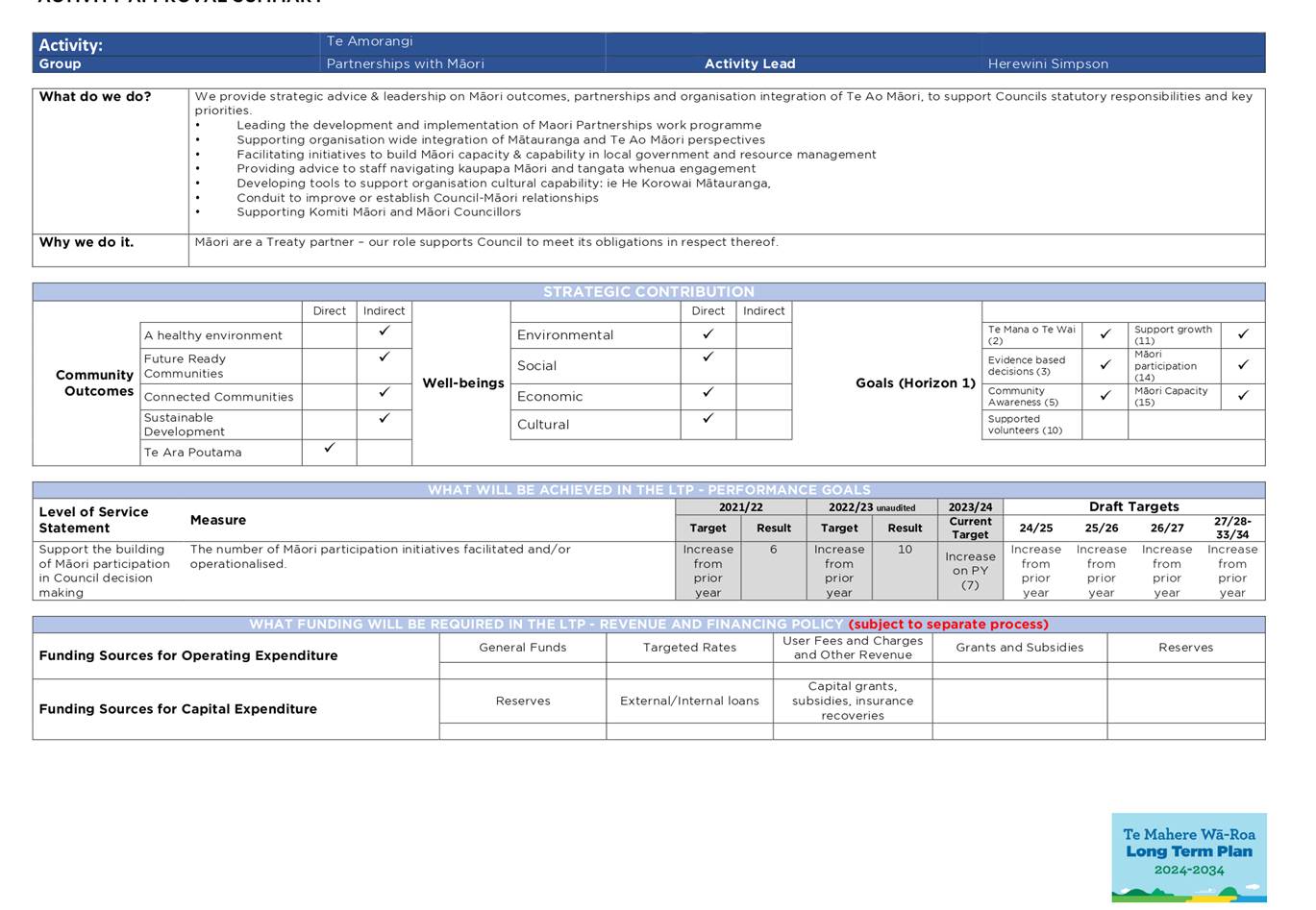

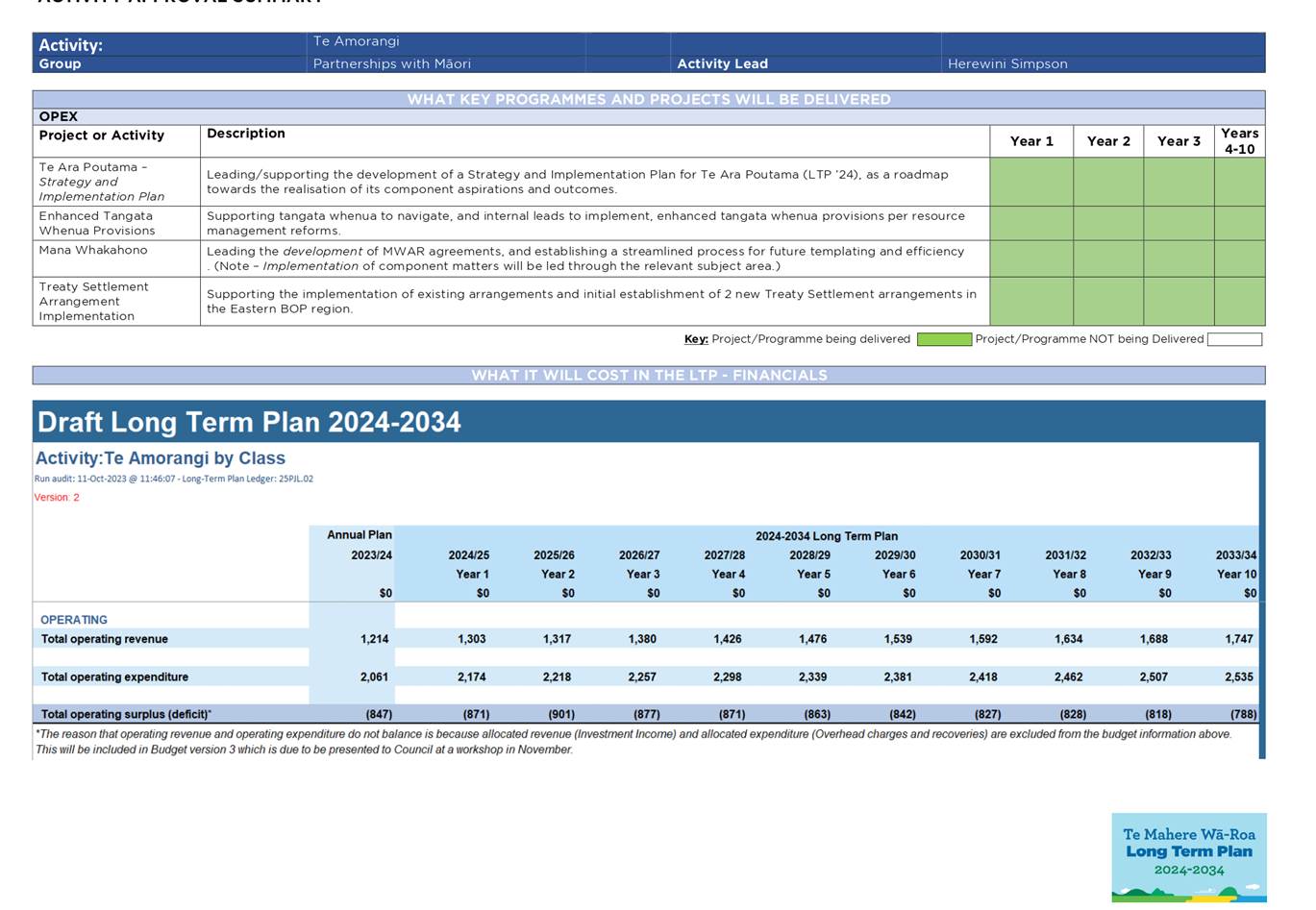

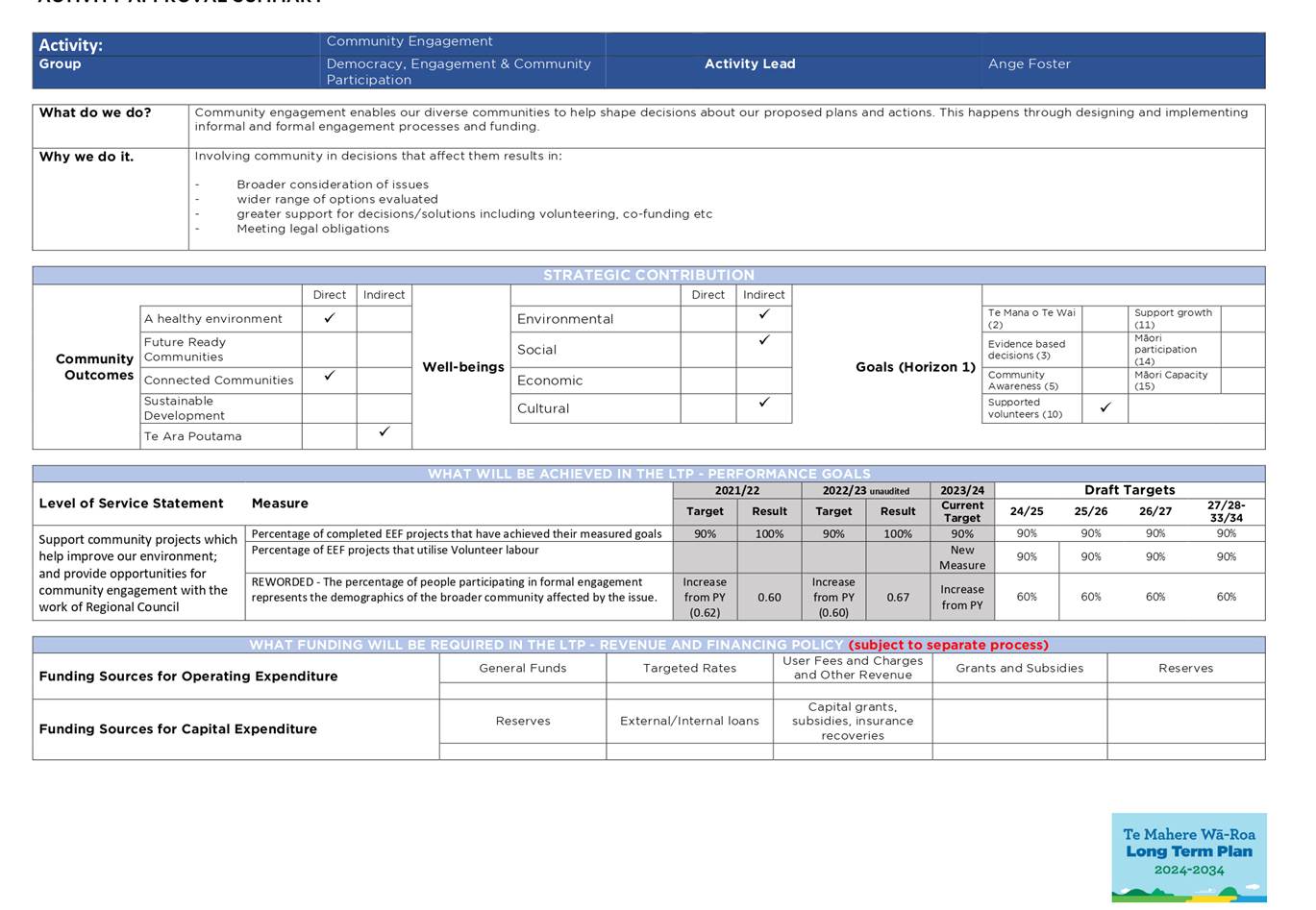

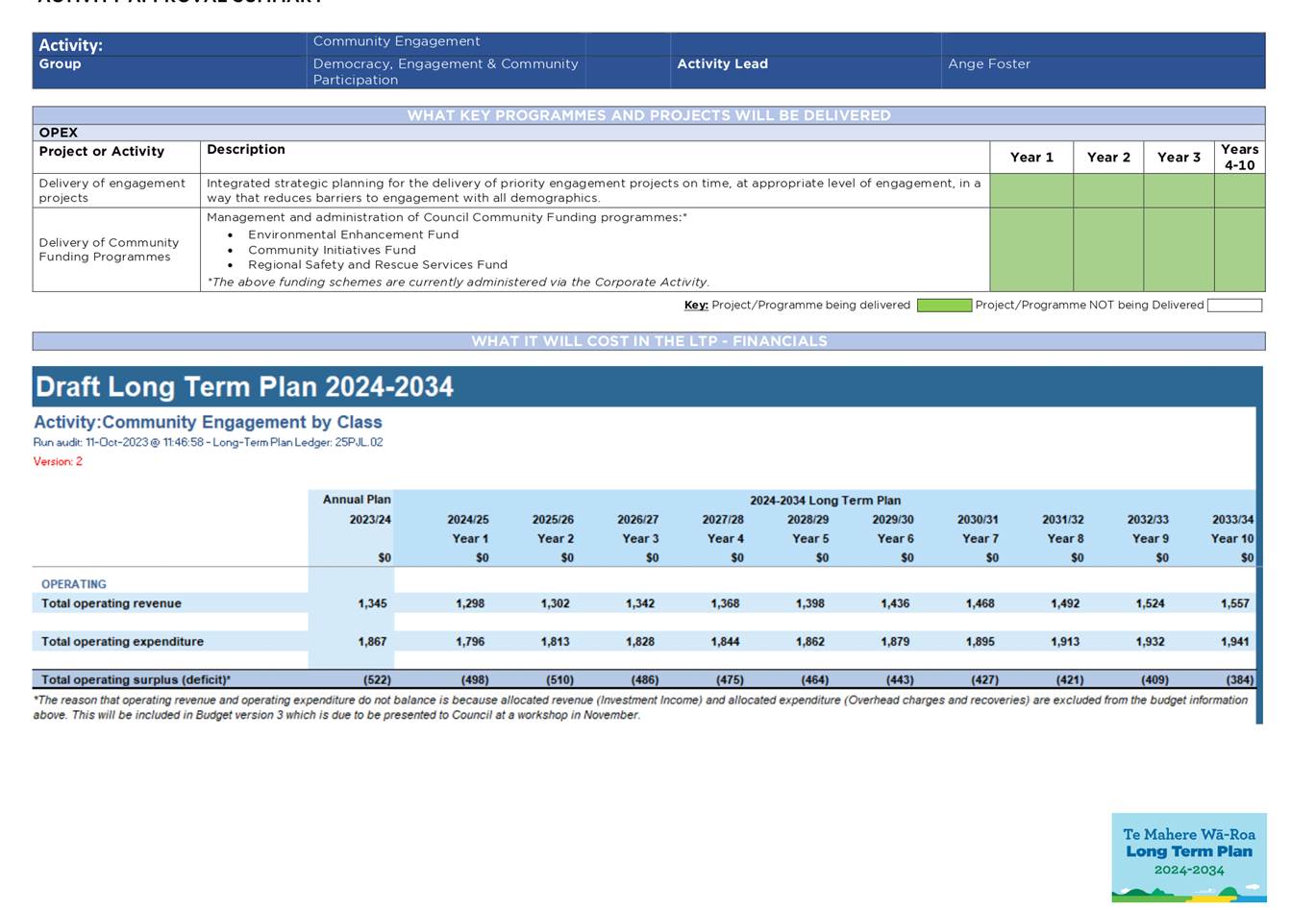

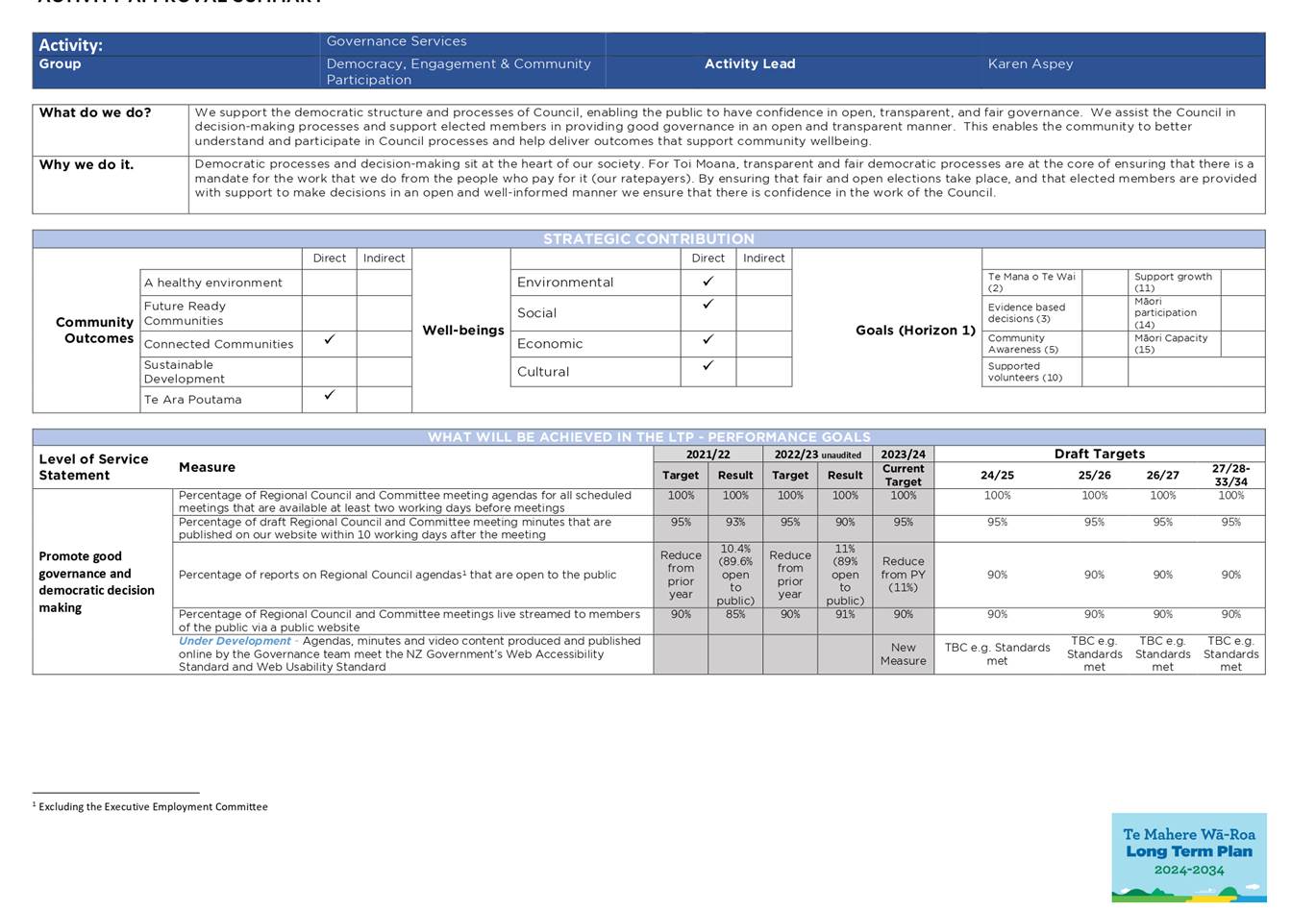

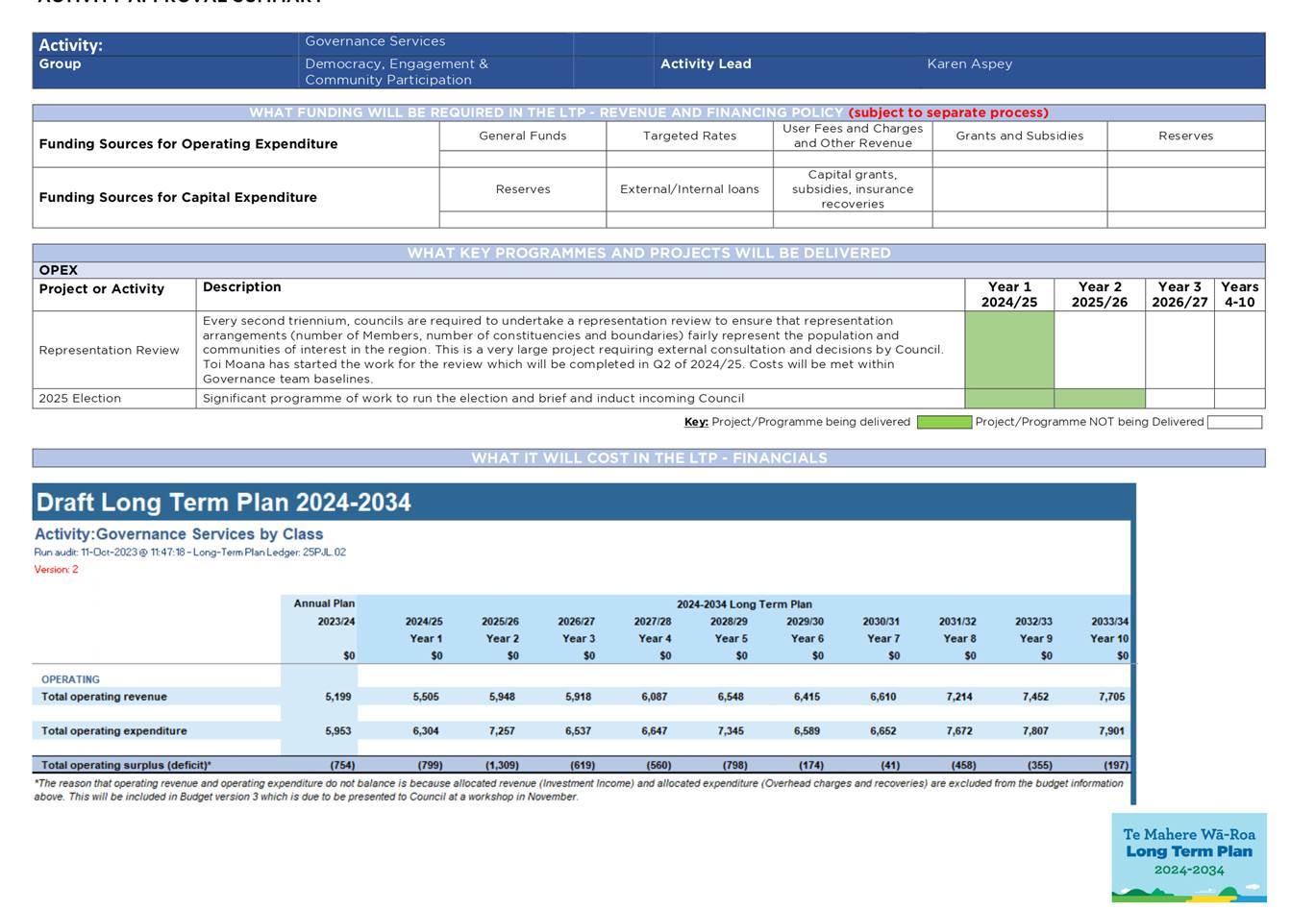

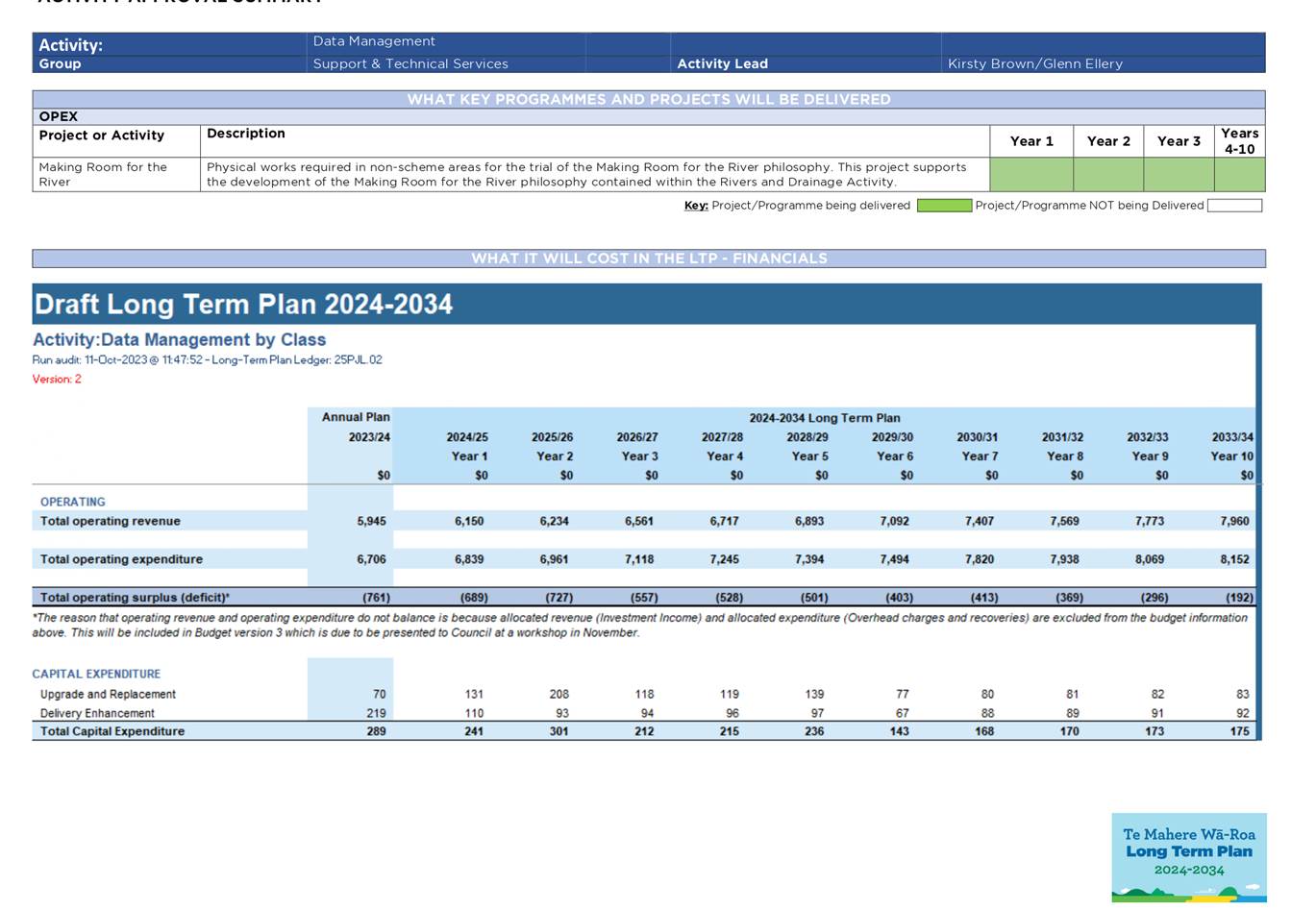

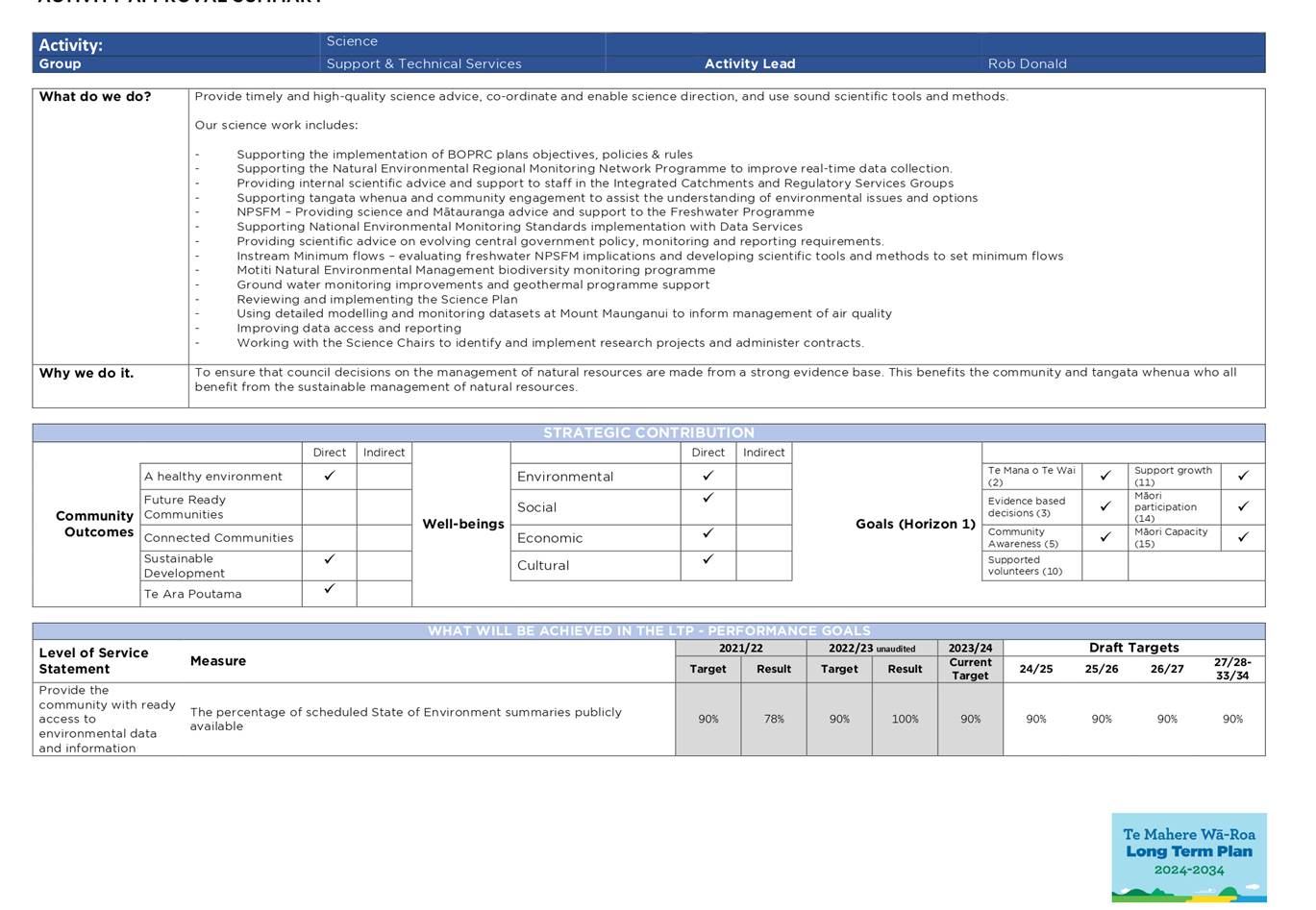

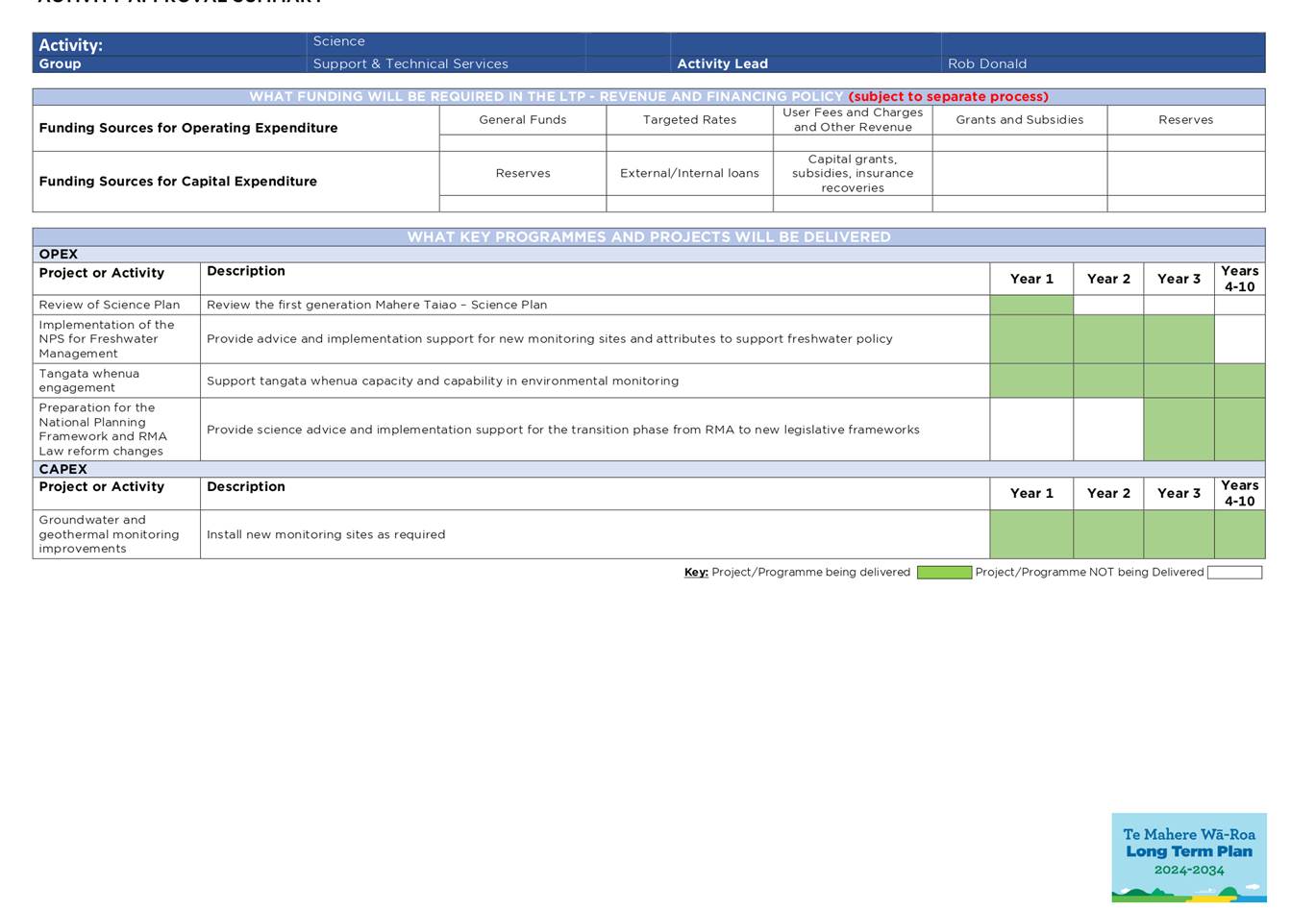

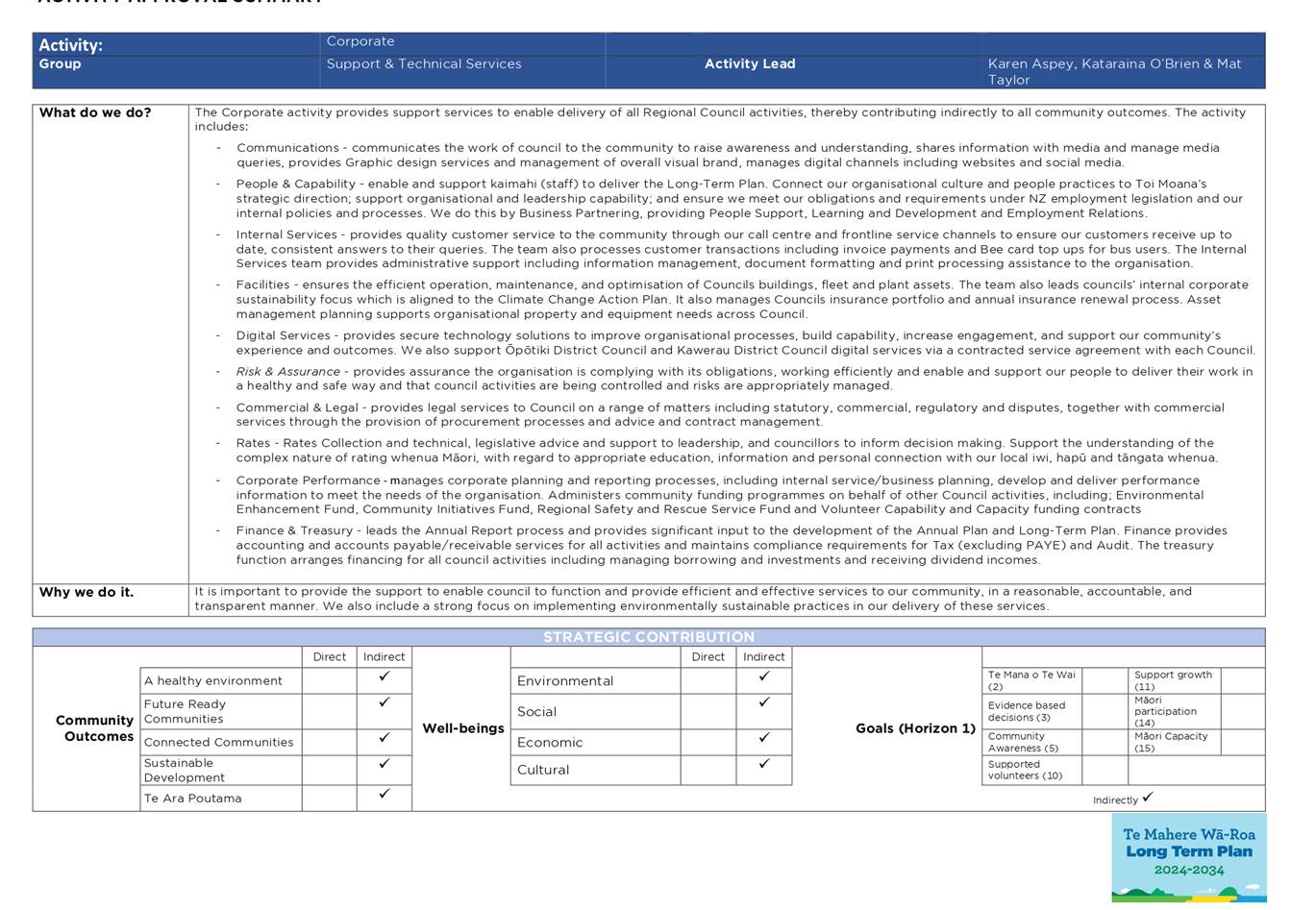

1. Purpose

This paper provides Councillors with the draft activity

plans for the 2024 – 2034 Long Term Plan (LTP). These plans have

been developed based on council direction at the workshops held on 19 and 26

September 2023.

Each activity plan identifies the draft level of service

(LOS), performance measures and budget expenditure following the guidance

received at LTP workshops on 19 and 26 September.

Activity plans where Council requested further information

will be considered in November and are summarised in section 4 of this report.

2. Guidance

Sought from Councillors

· Guidance

on the levels of service and performance measures for each activity

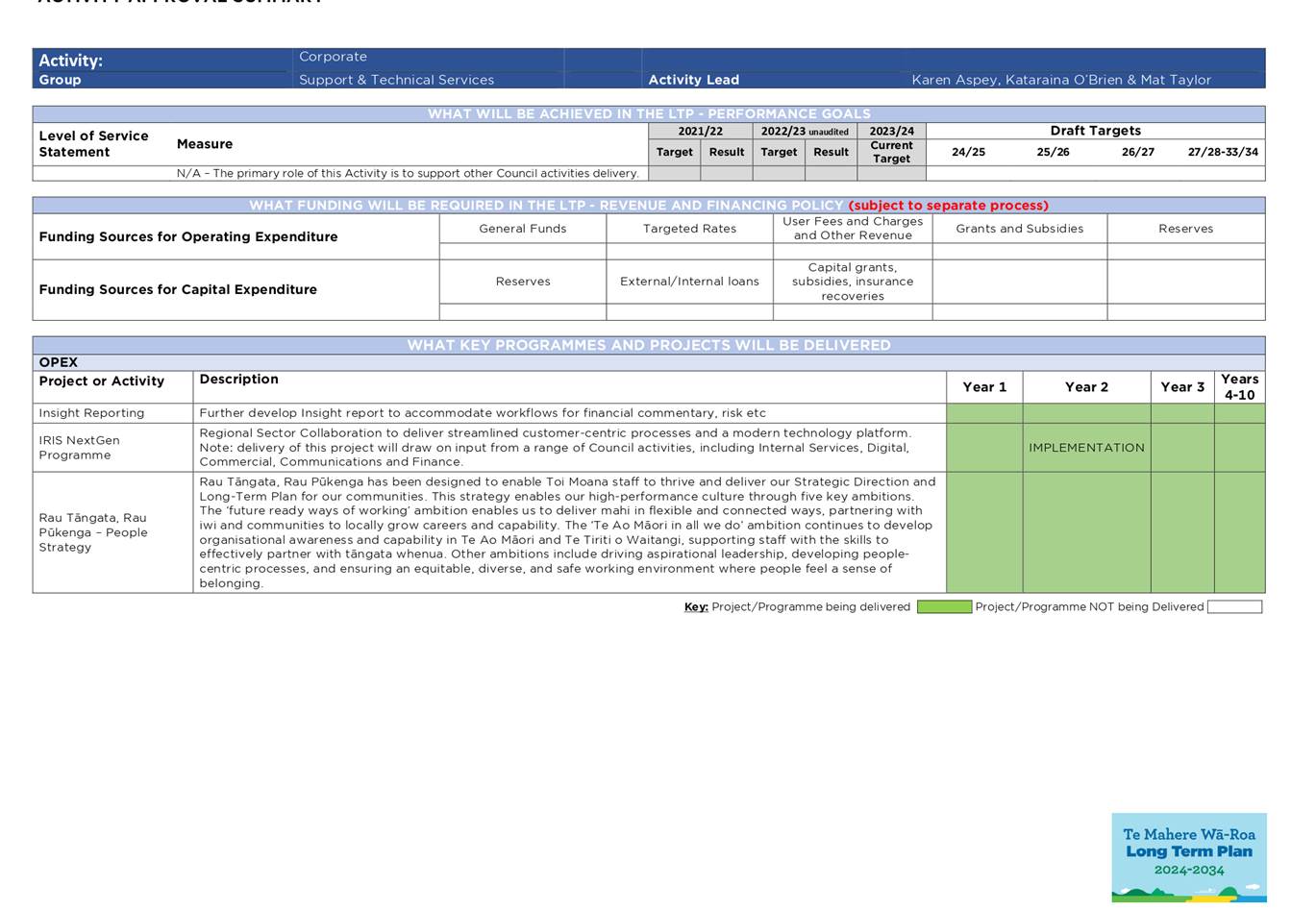

3. Discussion

3.1 Activity

Planning and Budgeting

At the Council workshops held on 19 and 26 September,

Councillors provided guidance on the budget scenarios for all activities.

A series of workshops were held with activity managers to focus on:

· Reviewing

draft activity budgets based on the budget scenarios directed by Council

· Reviewing

and updating the levels of service, performance measures and targets, based on

the level of investment (budget scenario) indicated by Council

· Key

projects or programmes of work planned to be delivered during the next LTP.

Refer to Attachment 1 for

the activity plans to be considered at this workshop.

3.1.1 Levels

of Service and Performance measures

Council’s levels of

service (LOS) have been reviewed for each activity. To monitor achievement

against the LOS, performance measures have been identified and targets set for

the 10 years of the LTP (refer to Attachment 1).

Many of these LOS and performance

measures are consistent with the current LTP, which provides the necessary

continuity to monitor achievements over time. Some LOS and/or performance

measures have been updated to reflect changes to the activity, or to enable

monitoring against new direction or requirements.

Monitoring of these performance

measures is managed and reported during the year through Arotake, the online

Insight tool and the Annual Report at year end.

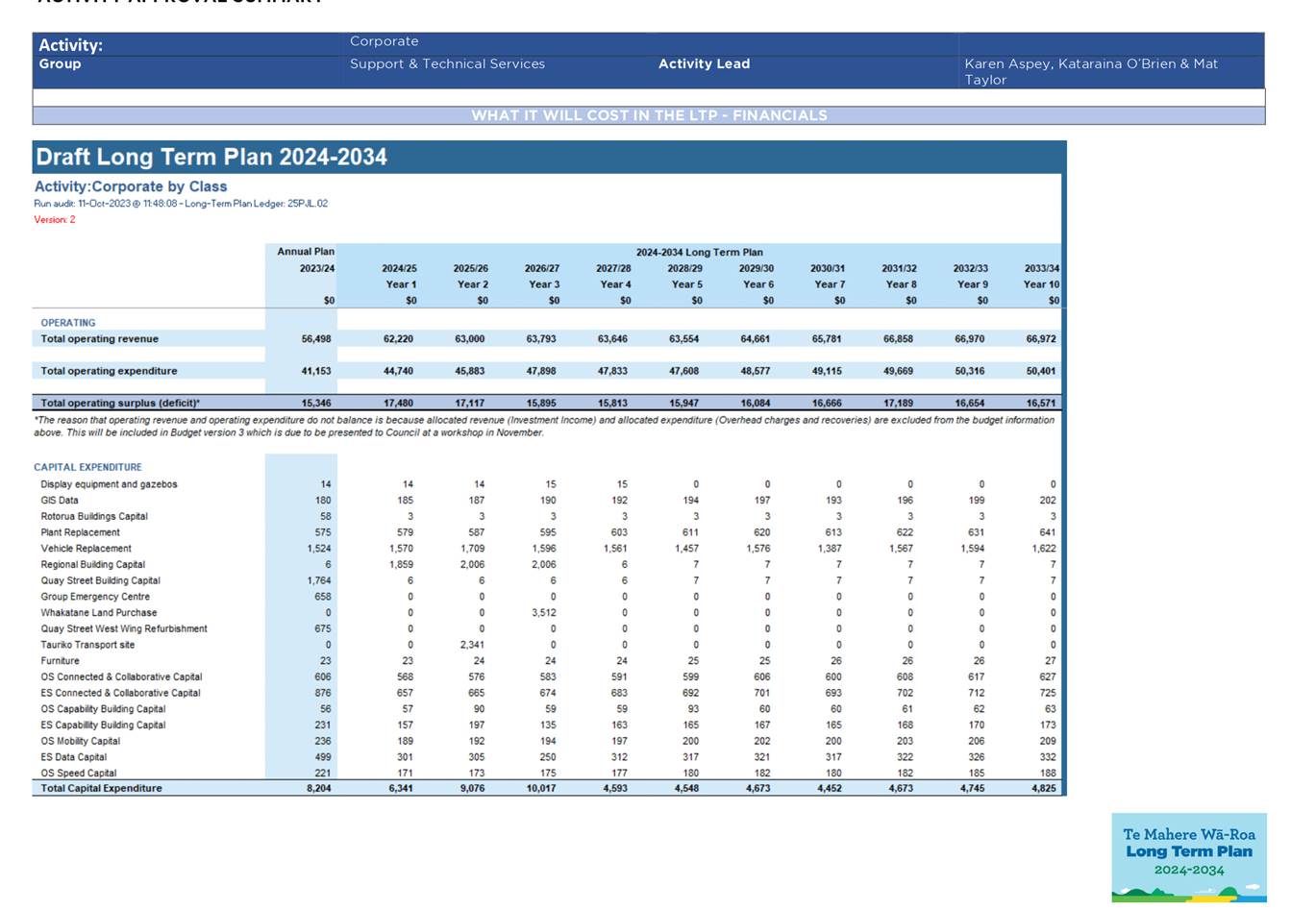

3.1.2 Financial

Information

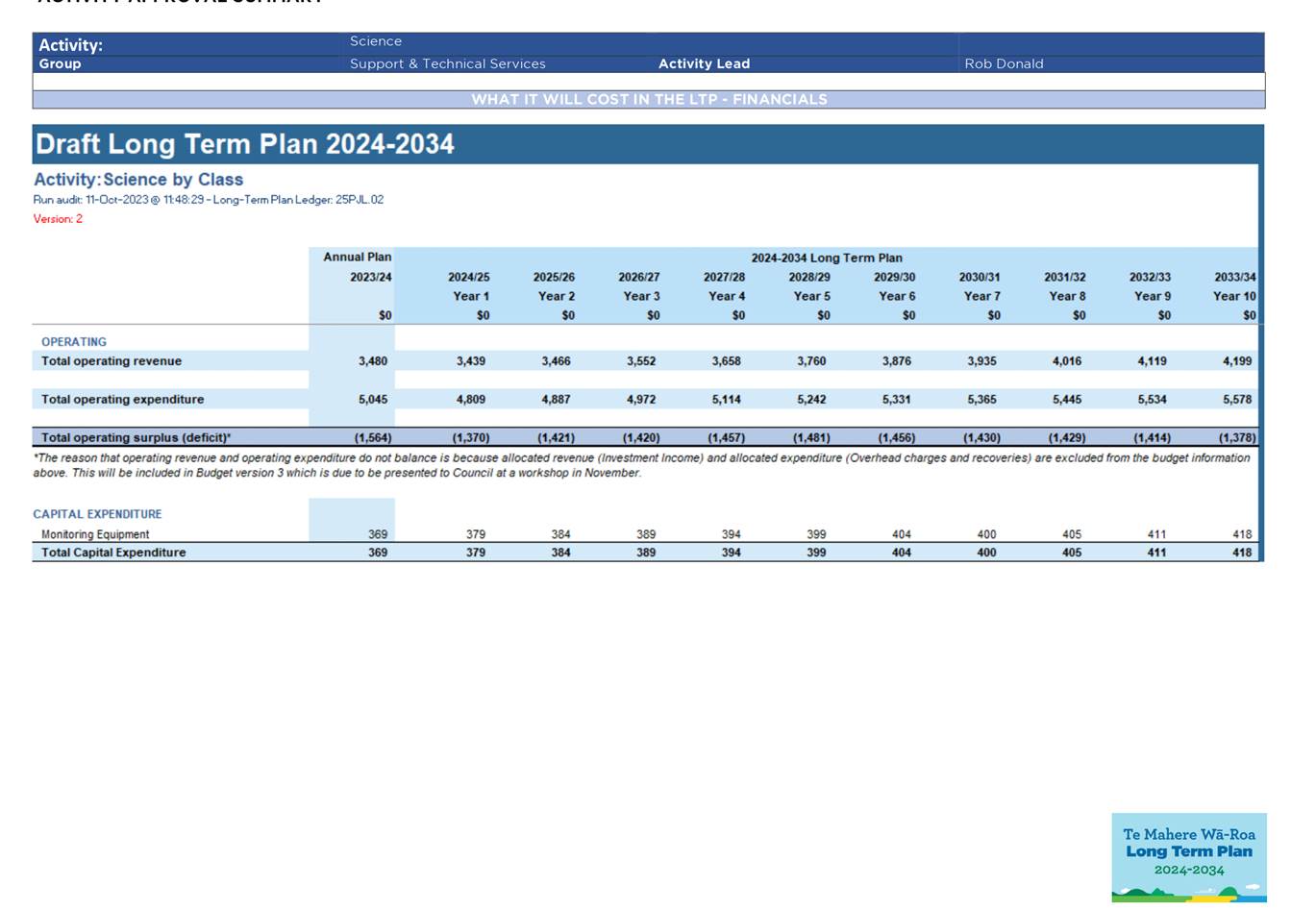

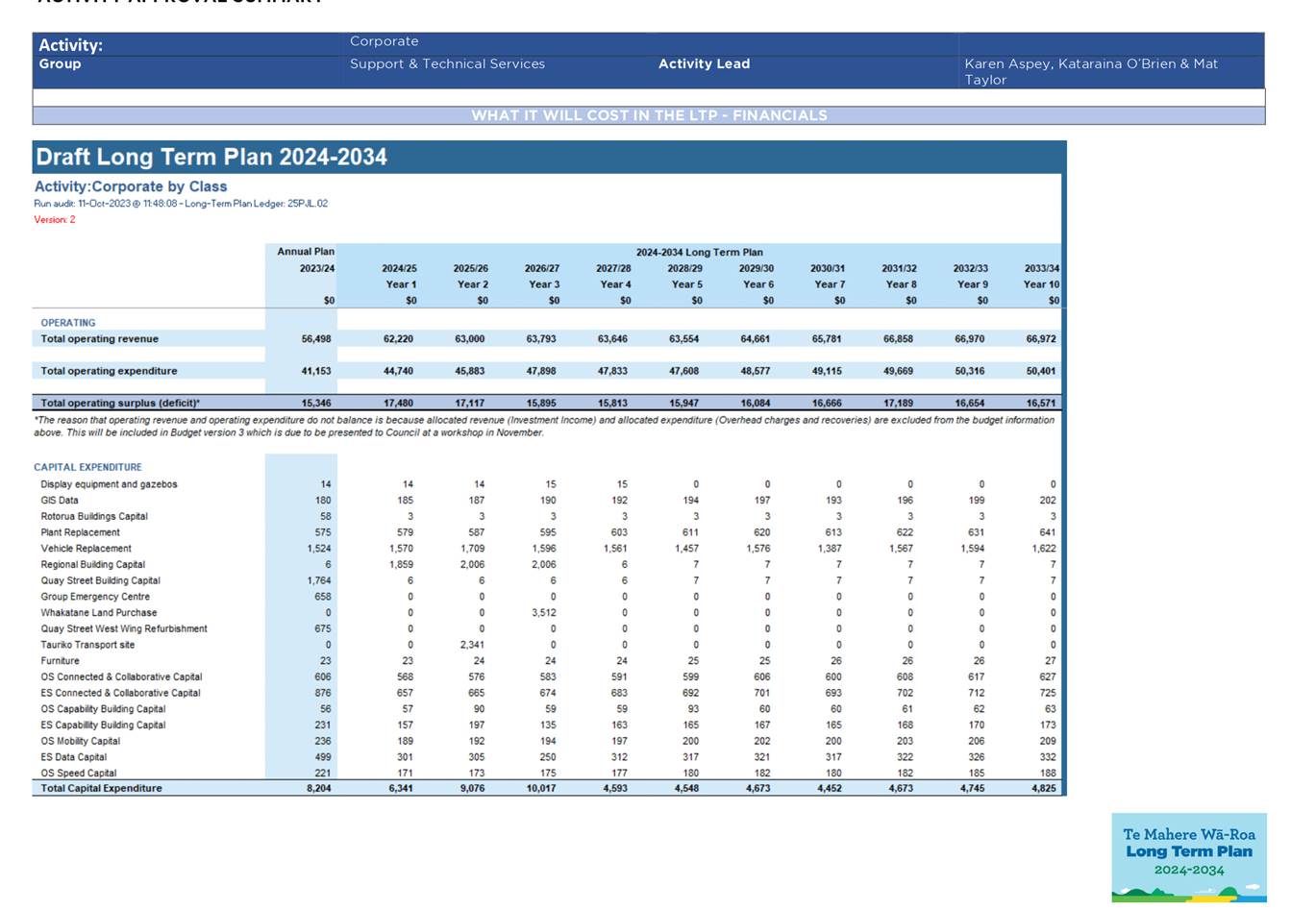

The financial information

included in the activity plans is version 2 of the LTP budget and operating

expenditure figures reflect the scenario savings discussed in previous

workshops.

The financial information

reflects revenue and expenditure directly attributable to each activity only.

Allocated costs and revenue components such as overhead charges and investment

income will be applied to each activity as part of version 3 of the LTP budget

which will be presented at the November workshops.

4. Activities

to be considered at future workshops

At the September LTP workshops several activities

required further investigation before draft activity plans could be

developed. These activities will be considered at the following

workshops.

· 3rd

November LTP Workshop

- Transport

Group of Activities (Transport Planning and Transport Delivery)

· 8th

November LTP Workshop

- Rotorua

and Coastal Catchments – consideration of Regional Parks

- Regional

Development – changes due to significant budget reduction (scenario 3)

- Freshwater,

Māori Capacity Building – new activities currently being assessed

- Climate

Change – council consideration of the next Climate Change Action Plan

- Rivers

and Drainage – capital programme subject to deliverability review.

Draft Infrastructure Strategy and Asset Management Plans will also be provided

- Spatial

Planning

- Emergency Management

5. Next

Steps

The activity plans will be updated to reflect the guidance

received at this workshop and incorporated into the draft LTP document.

The November workshops will complete the activity planning process and the

outputs will be incorporated into Version 3 of the LTP budget.

Attachments

Attachment 1 - LTP24-34 Activity Plans - Part 1 ⇩

Regional

Council 25 October 2023

|

|

|

|

Informal Workshop Paper

|

|

To:

|

Regional

Council

|

|

|

25

October 2023

|

|

From:

|

Gillian Payne, Principal Advisor;

Chris Ingle, General Manager, Integrated Catchments and Jo Pellew, Rates

Manager

|

|

|

Mat Taylor, General Manager,

Corporate

|

|

|

|

Rates Remission

Policy Review - potential new remission categories

1. Purpose

At a workshop on 25 May 2023 Councillors considered a

range of ideas from staff for new rates remissions to incentivise environmental

outcomes. Council direction at that workshop was to continue work on the ideas

and bring back options for consideration. Feedback from this workshop will

direct the development of a draft Rates Remission and Postponement Policy (RRP Policy) for public consultation in March-May 2024.

2. Guidance

Sought from Councillors

Staff seek guidance on approaches for:

· Protected

areas of ecological value not already receiving rates relief (Priority

Biodiversity Sites [PBSs] and Significant Natural Areas [SNAs])

· Incentives

to retire land and recognition of loss of productive potential of land as a

result of:

o Room

for the River

o Land

affected by natural events

o Council

assets on private land

o Retiring

productive land for environmental benefit.

· Incentivising

establishment of native forests or wetlands (including saltmarsh) on pastoral

land retired from production.

3. Discussion

At the workshop on 25 May,

Councillors gave direction to continue work to develop all seven of the new

remission ideas presented and where possible to provide estimates of revenue

foregone if the remissions were approved.

This paper presents financial

modelling of remission cost where estimates are feasible, and recommendations

for the policy approach and draft eligibility criteria for several new

remissions.

3.1 Protected areas

of ecological value not already receiving rates relief

3.1.1 Objective

To encourage landowners to

fence, protect and restore/enhance land such as Significant Natural Areas

(SNAs) and Priority Biodiversity Sites (PBSs). This would incentivise

landowners to support biodiversity outcomes, and reward those that continue to

do so.

Ecologically valuable Māori

Freehold Land (MFL) and Conservation land is already exempt from rates along

with QEII covenanted land. This policy would provide an opportunity to

assess relative fairness among similar types of land use, provided the restrictions

on the land (e.g., through covenants) were similar.

3.1.2 Strategic

context

Priority Biodiversity

Areas

Currently Council has 429 PBSs

identified (totalling 48,514 hectares) of which 44% are actively managed

through Environmental Programmes. The target for growing this percentage

is an additional 1% per year (LTP 2021-2031), at current levels of service.

In addition to any rates

remission incentives that may be proposed, PBS landowners are eligible for

Council grants for activities including fencing, planting, and pest control under

our Environmental Programme Grants Policy.

PBSs are split into three

‘priority levels’ based on the threat status of the ecosystem types

they contain. The priority level assigned to a PBS dictates the level of grant funding

available for active biodiversity management.

· Priority

1 PBS contain ecosystems reduced to <10% of their natural extent as well as

‘naturally uncommon’ ecosystems (NUE) that are Critically

Endangered. Examples are frost flats, geothermal habitats, and

very threatened forest types.

· Priority

2 PBS contain ecosystems reduced to 10-20% of their natural extent, along with

NUE that are Endangered and Vulnerable. Examples are wetlands

and sand dunes.

· Priority

3 PBS contain ecosystems that retain >20% of their natural extent, and NUE

that are not threatened.

Of the total of 429 PBSs, there

are 46 priority 1 sites (3,190 ha), 312 priority 2 sites (14,736 ha), and 71

priority 3 sites (31,588 ha).

Significant Natural Areas

SNAs are areas that support significant

indigenous vegetation or significant habitat of indigenous fauna.

Under the National Policy

Statement for Indigenous Biodiversity (NPS IB) councils are required to map

SNAs using set assessment criteria. Adverse effects on SNAs must be avoided (except

where an exception applies such as specified infrastructure). For exceptions,

the effects management hierarchy must be applied (avoid, minimise, remedy,

offset, or compensate, in that order).

Currently, SNAs cover 343,505

hectares, and some overlap with PBSs.

|

Table 1

|

|

|

Territorial

Local Authority

|

Total

SNA[2]

areas (ha)

|

|

Tauranga

|

1,386

|

|

Western Bay of Plenty

|

18,498

|

|

Rotorua

|

16,416

|

|

Whakatāne

|

222,529

|

|

Ōpōtiki

|

80,413

|

|

Kawerau

|

261

|

|

Taupo

|

4,002

|

|

Total

|

343,505

|

Other incentives to

protect biodiversity

Land management staff report

that for landowners, recognition of their conservation efforts by local

authorities and the public is a significant motivator, complementing any land

management advice and financial assistance. This is especially true for PBSs on

Māori Freehold Land (MFL) that are legislatively non-rateable.

Central government is currently

consulting on a biodiversity credit system[3],

which in time could result in additional incentives for landowners. A draft

BOPRC submission on this consultation will be considered at the Strategy &

Policy workshop on 28 September 2023.

3.1.3 Approach,

scope, criteria and exclusions

A rates remission provision

could set broad eligibility criteria with clear objectives and matters for

consideration and rely on staff (rates staff and land management staff) to

assess the level of remission appropriate on a case-by-case basis.

Options for scope, eligibility

and assessment criteria are summarised in the table below.

|

Table 2

|

|

Topic

|

Options

|

Notes and recommendations

|

|

A:

Scope

|

i. Both

SNAs and PBSs eligible

|

Staff consider PBSs are

a higher priority for receiving rates relief compared to SNAs because they

have already been assessed as having biodiversity value which is understood

and prioritised.

SNAs are typically

identified by TLAs and may not have biodiversity value, even though they have

been recognised as significant natural areas.

Council direction

sought

|

|

ii. Only

PBSs eligible

|

|

iii. Only

PBSs with Priorities 1 and 2 eligible (e.g. frost flats, geothermal habitats,

and very threatened forest types, wetlands and sand dunes).

|

|

B:

Eligibility requirements

|

i. Establishment

and implementation of a management plan for ongoing maintenance of works and

promotion of biodiversity

|

Working with

land management staff to develop a plan, including potential for grants where

eligible.

Recommended

|

|

ii. Suitable

protection of land and/or works

|

Land

management staff would arrange suitable protection of land and/or works

through legal instruments (covenant or agreement) to provide a level of

protection proportionate to the rates relief being offered.

Recommended

|

|

C:

Size of remission

|

i. Consideration

of the relativity of rates relief sought, compared to rates relief available

through legislation or other avenues (e.g. QEII covenants).

|

Rates staff

would have regard for the fairness of any rates relief granted, referencing

the way similarly protected and ecologically important land in the Bay of

Plenty land was rated.

Recommended

|

|

ii. Ecological

importance of the land and the impact of the potential extent of rates

remission in incentivising behaviour change by the landowner

|

Land management

staff would advise on these matters, based on their knowledge of the

applicant’s situation and the requirements and provisions in the

management plan in B(i) above.

Recommended

|

|

|

iii. Remission

recommendations would take into account the extent of protected land within a

rating unit. This could range between

Option 1

– remission applies to proportion of general rates on land value, to

Option 2 –

remission applies to proportion of all rates (refer analysis in section 3.1.4

below)

|

If a rating

apportionment or SRA has been established, then it would be appropriate to

remit all the rates on the protected area, subject to the relativity

considerations in C(i) above.

Council

direction sought

|

Land management staff do not recommend setting a minimum

size of PBS or SNA to qualify for consideration. Many threatened

ecosystems have already been reduced to small areas so excluding them from

consideration would not support the objective of the policy.

Remissions could be for a fixed term with periodic

renewal, or permanent. The intent would be to ensure that maintenance activity

(such as pest control) is ongoing. This should reflect on the

duration of the protection required, refer C(ii) in Table 2.

3.1.4 Financial

implications

Staff seek Council direction on the scope of

eligibility, and extent of remission possible (subject to staff recommendation)

considering the potential rates foregone listed in Table 3 below. The

figures below assume that all eligible rating units receive the maximum

remission indicated by each option and that all rating units meet the other

criteria recommended in Table 2.

Actual take-up of remissions

would be limited by staff capacity to support the requirements of criteria B(i)

and B(ii) in Table 2 above, for any properties that do not already meet those

criteria.

|

Table 3

|

|

|

|

|

Eligibility options

|

Area

|

Option 1 – remission is General Rates on LV

($)

|

Option 2 – remission is relative proportion of

total rates ($)

|

|

SNA and PBS

|

351,048 ha

|

384,240

|

904,625

|

|

All PBS

|

49,514

ha

|

156,735

|

337,498

|

|

PBS

Priority 1

|

3,190 ha

|

7,178

|

42,489

|

|

PBS

Priority 2

|

14,736

ha

|

120,206

|

221,586

|

|

PBS

Priority 3

|

31,588

ha

|

29,349

|

73,422

|

|

SNA

|

343,523

ha

|

336,384

|

785,542

|

3.1.5 Way

forward for policy development

Based on Councillors’

feedback on Table 1, and any other matters, a draft policy for consultation

will be developed for further feedback and eventual adoption in early

2024.

3.2 Catchment

management, Rivers and drainage - incentives to retire land and adjustments for

loss of productive land

3.2.1 Objectives

The workshop paper considered on

25 May 2023 dealt with five topics separately:

- Room for

the River

- Access

compromised where river changes its course

- Land

between rivers and stop banks

- Retired

land with low or no ecological value

- Council

assets on private land.

Further work on the five

opportunities has indicated that a broadly scoped policy could deal with the

similar objectives or impacts in each. This approach would simplify the

implementation for both staff and applicants enabling a response to

applicants’ circumstances in a proportionate way.

The objectives of the remission

would include:

· recognising

the reduction in productive land as a result of natural river movement, for

example where a river changes course and formerly productive land is in the

riverbed or becomes “stranded” without access on the other side of

the river.

· incentivising

the retirement of productive land to provide significant environmental benefits

and/or enable natural river management approaches, for example:

o landowners

work with Council to implement natural river management approaches that require

the retirement of productive land, which may include planting trees on

productive land to create buffer areas for river edge erosion.

o landowners

work with Council to retire land between rivers and stop banks, to improve

water quality and enhance river biodiversity.

o landowners

work with Council to retire land that is expected to be affected by sea level

rise, including salt marsh areas and land likely to return to wetlands.

· Recognising

instances where Council assets located on private land may reduce the

productive potential of private land.

3.2.2 Strategic

context

Room for the River

is a global approach to river and flood management that is expected to become

more widely used in future and involves working more with natural river

processes and relying less on hard protection structures. This approach may

mean that some landowners, who formerly expected Council’s infrastructure

to protect their land, would accept more frequent river edge erosion and be

willing to use natural methods to manage the effects of the river on their

land.

This approach would be less costly than the alternative,

taken by some other regional councils, to buy the land in question, retire it

and have Council manage it.

An enabling policy, to allow for

staff discretion within broad guidelines, could be useful to support the

management of the Kaituna Catchment Control Scheme, Waioeka-Otara

Rivers Scheme, Whakatāne-Tauranga Rivers Scheme, and

Rangitāiki-Tarawera River Schemes, over the next few years.

As river courses change,

surveyed titles are not updated; although valuers would take account of the

change and adjust land values, areas of title are not changed. For

rates that are value-based there is automatic adjustment, but for area-based

rates, they will continue to be charged on the area listed in the title, unless

rating adjustments are made. These can either be made through altering

the area defined as rateable, or by providing an avenue to apply for

remission.

Where the loss is material,

continuing to charge area-based river scheme rates on inaccessible or riverbed

land could undermine the relationships with landowners which will be crucial in

implementing new river management approaches.

Providing incentives for retiring

formerly productive land with low or no ecological value (for

example between rivers and stop banks, or former salt-marsh or

wetlands) would provide environmental benefits, but is considered a lower

priority compared pursuing other opportunities presented in this paper. This is

because the areas that could be eligible are large and the administrative and

monitoring effort required would be high, particularly where there are no

existing environmental programmes established.

3.2.3 Approach,

scope, criteria and exclusions

Approach and scope

Eligible land would be

identified by staff involved in management of land, rivers or flood control as

meeting any of the objectives in section 3.2.1 above. They would work

with rates staff to establish the extent of loss of productive land, whether rates

incentives are needed to change current land use or behaviour, noting that

other incentives may be available, whether from Council or other sources.

Staff to recommend remission

(size of remission and period) to the Group Manager responsible for land or

river management and the Rates Manager for decision under delegation.

Regular monitoring by staff as

part of their normal land, river and asset management activities would

determine whether the remissions should continue, once established.

Criteria

Applications must be either

· part

of a plan or programme supported or initiated by Council (e.g. environmental

plan, level of service change, asset construction) that results in a

significant loss of income on formerly productive land

Or

· in

response to an event that has already occurred, e.g. change in river course,

which has resulted in a loss of formerly productive land.

Applications must be supported by evidence gathered by

staff working with applicants to document the rationale for a remission, noting

any environmental benefits, the extent of loss or compromise of productive

land, or the consequences of a natural event.

The rationale and remission recommendation should

· be

consistent with the principles of the RRFP, in particular:

§ Council

may assist property owners to use or develop their property in a way that

provides wider benefits to the community or assists Council with its core

activities.

§ Some

land is made non-rateable by the Local Government (Rating) Act 2002. Council

wishes to extend relief by way of remission to rateable land that has

characteristics similar to non-rateable land.

· Have

regard for horizontal equity (similar properties are treated similarly) and

vertical equity (those that can afford to pay more should do so)

· Consider

whether the decision would create a precedent that would be unsustainable in

the foreseeable future.

Exclusions

· Where

only part of a rating unit met the criteria for remission, remissions will be

limited to a proportionate reduction in land value or area-based rates.

Area-based rates for river and drainage schemes would only be remitted to

address issues of equity relating to re-assessment of benefit under the new

land use.

· Flat

charges would not be remitted as it is appropriate that they continue to be

paid on the remaining portion of the property.

· Where

an entire rating unit was eligible, all types of rates could be considered for

remission, subject to rationale and staff recommendation.

· To

the extent that the productive potential of land is compromised by a natural

event or a change of use, but income can still be derived from the land,

remissions will not be considered.

3.2.4 Financial

implications

It is not possible to predict

the likely uptake of remissions under such a policy because it would depend on

the:

· occurrence

of natural events

· willingness

of landowners to change their land use and capacity of staff to work with them

to develop environmental plans and recommendations for remission.

· progress

on implementation of the Room for Rivers approach.

· the

area and value of land that is intended for change of use and the impact of

that change on productive potential.

To mitigate the risk that remissions could become

cumulatively unsustainable, staff could regularly report to Council on the

financial impact of the new remissions granted and the cumulative total under

these provisions. Alternatively, Council could set a limit for new

remissions under this category, annually.

3.2.5 Way

forward for policy development

Based on Councillors’ feedback on the approach,

scope, criteria and exclusions in section 3.2.3 above, and any other matters

raised, a draft policy for consultation would be prepared for consideration and

adoption in early 2024.

3.3 Incentivising

establishment of native forests and wetlands on land retired from production.

3.3.1 Objective

Rate remissions could

incentivise landowners that choose to (or are required to) retire marginal

pastoral land, to establish native forests, as opposed to exotic forestry, or

wetlands (including saltmarsh). This would support Council’s climate

change and water quality aspirations.

3.3.2 Strategic

context

Large scale conversion of

pasture to pine (primarily for carbon farming) can result in significant financial

returns. This type of land use change has been observed across the country,

although not so much in the Bay of Plenty to date, and has resulted in concerns

from environmental, rural community and farming interests.

Conversion of pasture to native

forest generally has a much weaker financial performance, and often relies on

additional support (e.g., Council grants, emissions trading scheme (ETS)

income, etc.) so it is not as common. As a land use, native forest has greater

environmental benefits compared to marginal pasture and pine. Likewise,

wetlands do not generally provide any financial return for landowners, even

though they can provide significant environmental benefits. A remission policy

could be designed to provide an additional incentive to landowners that choose

to retire marginal pastoral land into native forests or wetlands.

Although central government is

considering or reviewing incentives provided for these types of land use

changes[4],

at this stage there is no certainty about the outcome of these considerations

and reviews.

3.3.3 Approach,

scope, criteria and exclusions

Approach and scope

Eligible land would be portions

of, or entire, properties where landowners retire pastoral land use and convert

to a native forest or wetland land use, either voluntarily, or in response to

central or local government environmental regulation (e.g., any new land use

rules resulting from the Essential Freshwater Policy Programme).

Criteria

To ensure that Council was

incentivising land use change that would make a material difference to

environmental enhancement, Council could set a minimum area to be

converted.

Remissions could be subject to a

land covenant or encumbrance. Administration to establish covenants or

encumbrances would be required as well as regular confirmation that the

affected properties remain in a native forest or wetland use and are receiving

suitable ongoing maintenance e.g weed control. This could be done through aerial

or satellite imagery but may occasionally require ground-truthing. If land use

changed from native forest or wetland, the rates remission would cease.

For properties that become

registered as permanent forests under the ETS, covenants or encumbrances may not

be required, because once registered they will be monitored by the Ministry for

Primary Industries (MPI) and would be required to make an ETS return every five

years. If owners of registered permanent forests change their land use,

they are required under ETS to repay the value of the ETS credits they have

received.

Exclusions

Land which has already been

converted from pasture to native forests or wetlands should not be eligible for

remission under this category because it is designed to incentivise choices

that have not yet been made. Some existing native forests and wetlands, when

adequately protected through covenants, may be eligible for remission under

other Council policies (refer section 3.1 above) or be non-rated under

legislation (QEII covenants or Conservation land). Existing native forest

blocks and wetlands may have received already received Council grants to become

established.

3.3.4 Financial

implications

The financial impact of this

remission policy on Council would be entirely dependent on landowners’

willingness to retire marginal pasture into native forests and wetlands and the

rate at which that conversion occurs. This would be influenced by economic

conditions and regulatory settings, as well as personal aspirations of the landowner

and, where relevant, Council’s staff capacity and budgets for supporting

the conversion with advice and establishment of Environmental Plans.

Drivers toward conversion would

include regulatory settings to achieve environmental outcomes, other incentives

(eg ETS, financial assistance to establish native forests or wetland,

biodiversity credits etc.) and the relative cost of managing the land compared

to other land uses.

Inhibitors of conversion include

the opportunity cost of financial return on other land uses, cost and

availability of finance to establish native forests or wetlands, and personal

desire to continue with existing or traditional land use.

Council’s current

operating expenditure budget for grants to support water quality improvements

through the Focus Catchments programme is around $2 million per year, with

funding rates usually ranging from 25% to 80% of the cost of eligible works,

including native planting, depending on the location and the type of

conversion, and up to 100% for estuarine coastal wetlands.

Factoring in current costs per

hectare for conversion to native forests, Table 2 shows the maximum number of

hectares in any year that could potentially receive grant funding if a new

grants policy and prioritisation approach was considered to apply Council

funding. This would also act as an effective limit on the area eligible for

remissions in any one year. There is already an established prioritisation

approach to grant administration for water quality that would need to be varied

significantly if this approach was pursued.

Remissions limited to General

Rate on Land Value

At an average land value of

$40,000 per hectare for marginal land, the general rates on land value (GRLV)

remitted each year is estimated at $9 per hectare[5]. The annual incremental

remission, given the constraint of the $2 million environmental grants budget

and different levels of support, are shown in Table 4.

|

Table 4

|

|

|

|

|

|

Grant

= 25% of cost

|

Grant

= 50% of cost

|

Grant

=80% of cost

|

|

Cost per ha

|

1,037

|

2,074

|

3,539

|

|

Ha funded

|

1,929

|

964

|

565

|

|

Annual incremental remission GRLV

|

$15,429

|

$7,715

|

$4,521

|

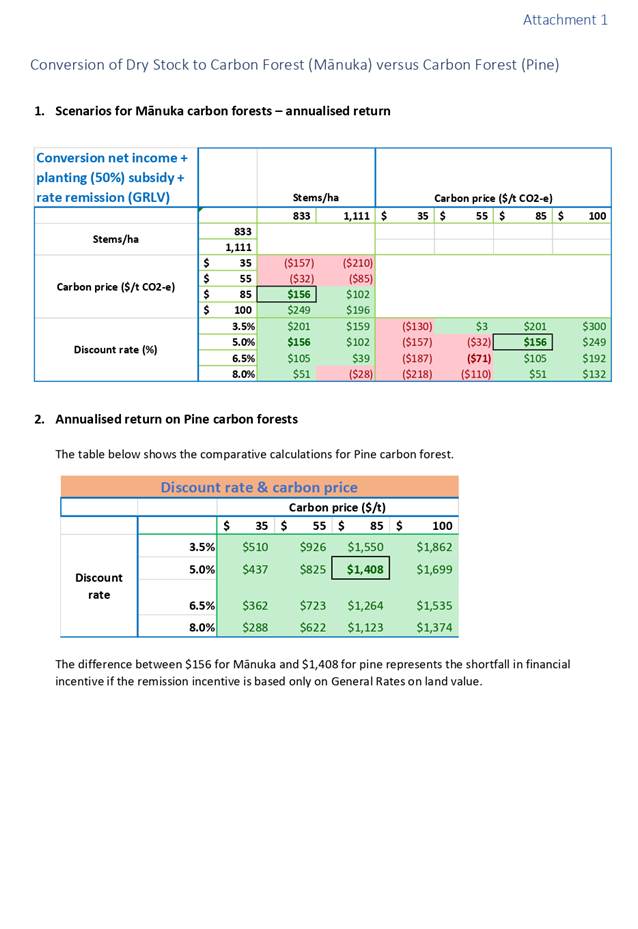

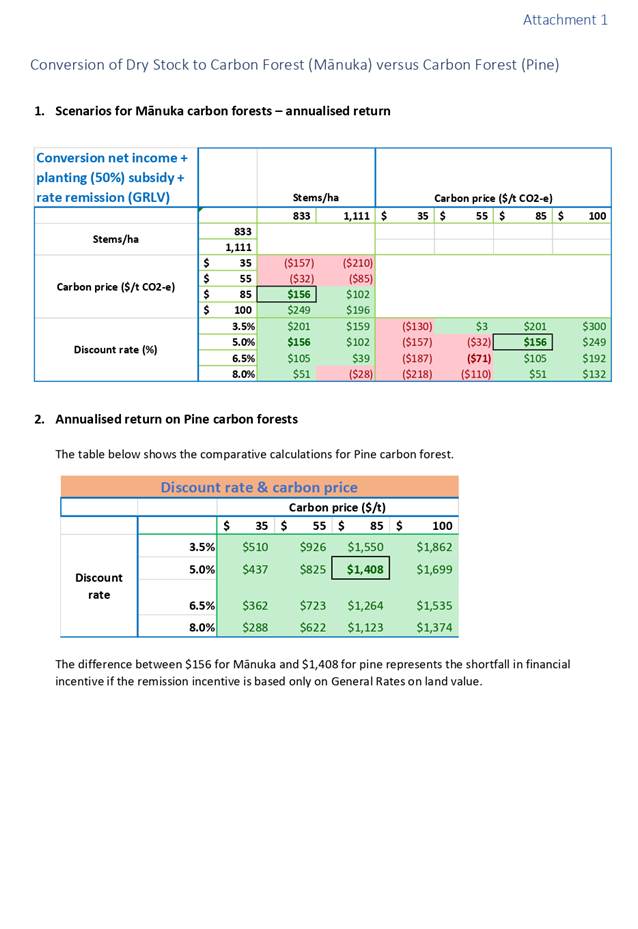

Financial modelling undertaken

by the Environmental Strategy Team team examines the financial viability of

choosing native forests (mānuka) over pine. The inclusion of a rates

remission limited to GRLV makes a marginal impact on the choice between pine or

native forests.

A summary of the economic

analysis for mānuka forest is in Attachment 1, which shows the net present

value of an annuity per hectare (NPV) for a range of discount rates, densities

of planting, and carbon prices. For example, at a planting density of 833 stems

per ha, a carbon price of $85 per tonne CO2-e and a discount rate of 5%, the

annuity over 51 years for Mānuka carbon forest is $145 per hectare, and

the annuity would increase to $267 with planting (50%) subsidy and rate remission.

By comparison, the annuity for pine carbon forests is $1,402 per hectare and

the difference represents the shortfall in the financial incentive for native

forests if it is base only on GRLV. This analysis does not take into

account the opportunity cost of the alternative pastoral land use or other

potential income opportunities (e.g., honey, timber, etc.).

Widening the scope of

remissions

A more generous remission would

have a greater impact and including area-based rates in the remission scope is

a logical step. However, the financial impact for Council is difficult to

estimate given the uncertainty of the location of land undergoing conversion

which affects the rates per hectare that would be foregone.

For 2023/24, area-based rates

range widely, as listed in Table 5.

|

Table 5

|

|

|

|

|

Range per ha, targeted rate

|

|

|

Lowest

rate

|

Highest

rate

|

|

Kaituna

Catchment Control Scheme

|

$1.02

|

$340.29

|

|

Rangitaiki-Tarawera Rivers Control

Scheme

|

$1.31

|

$6,703.66

|

|

Whakatane-Tauranga Rivers Control Scheme

|

$1.57

|

$706.56

|

|

Waioeka-Otara

Rivers Control Scheme

|

$1.28

|

$1,918.49

|

|

Rangitāiki Drainage

|

$10.11

|

$168.51

|

For this reason, staff do not

recommend that area-based rates are included in the scope of this remission.

3.3.5 Way

forward for policy development

Staff believe that despite the

small impact of a GRLV based remission on the gap between financial returns on

Mānuka and Pine, and likely also small incentive for establishment of

other native forests or wetlands, it would be helpful to establish a policy for

such remission because financial impact is not the only driver such land use

changes. This is partly because it is possible that the gap may close

further if alternative income (e.g., honey production) and other incentives or

policies being considered by central government (e.g., biodiversity credits,

forestry rules under the ETS, etc.) become available. Having a remission policy

adopted, alongside other existing incentives:

§ may be sufficient to convince some

landowners to voluntarily retire part of their land into native forests or

wetlands;

§ would enable staff to be more

responsive to changing circumstances when any new central government incentives

become available; and

§ would slightly reduce costs on

landowners from any relevant land use rules resulting from the Essential

Freshwater Policy Programme (EFPP)[6].

Subject to Council direction at

this workshop, provision could be made in the draft policy for adoption for public

consultation in early 2024.

4. Next

Steps

Staff will take Council direction from this workshop and

draft appropriate policy and/or prepare additional information for subsequent

workshops, accordingly.

Public consultation on a draft policy would take place in

February/March 2024, alongside the Long Term Plan consultation.

Attachments

Attachment 1 - Financial analysis - Conversion of Dry Stock to

Carbon Forest ⇩

Regional

Council 25 October 2023