|

Regional Council LTP 2024-2034 (No 5) Informal Workshop Pack

DATE: Tuesday 19 September 2023 COMMENCING AT TIME: 9:30 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga |

|

Regional Council LTP 2024-2034 (No 5) Informal Workshop Pack

DATE: Tuesday 19 September 2023 COMMENCING AT TIME: 9:30 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga |

Informal Workshop Papers

1 Draft Long Term Plan 2024-2034 Financial Estimates and Related Material 1

Attachment 1 - Bubble diagram 3

Attachment 2 - Prioritisation of Goals Summary 3

Attachment 3 - Activity Review 3

Attachment 4 - Summary of Step One Revenue and Financing Policy Assessments 3

Attachment 5 - Revenue and Financing Policy - Rates Incidence Modelling 3

Attachment 6 - Strategic Direction Poster A3 3

Attachment 7 - Strategic Direction Document 11 September 2023 3

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

19 September 2023 |

|

|

From: |

Kumaren Perumal, Chief Financial Officer; Mat Taylor, General Manager, Corporate and Olive McVicker, Corporate Performance Team Lead |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Draft Long Term Plan 2024-2034

Financial Estimates and Related Material

1. Purpose

The purpose of this paper is to provide financial information for the draft LTP 2024-2034 (DLTP) budget (version 1) and accompanying scenarios to seek direction from Councillors regarding the levels of service for Council activities over the term of the DLTP.

This will form the basis for detailed Activity Plans which will be presented to the LTP Workshop on 25 October 2023.

2. Direction Sought from Councillors

Give direction for

· each of the Forecasting Assumptions in Table 1 to create Version 2 DLTP budget.

· each Activity, and the preferred scenario, to determine which scenario to use to create Version 2 of the DLTP budget.

· each Activity as to the preferred funding mix to use to create Version 2 of the DLTP budget.

· any other aspect of the Draft LTP.

3. Introduction and context

3.1 Strategic Direction

The current operating environment is facing significant uncertainties and change. The general election is scheduled on 14 October 2023. While the outcome is not known, a change in government could result in changes to recent legislation which impacts the local government operating environment. Examples include the Resource Management Act reform and the recently enacted Spatial Planning Act 2023, Natural and Built Environment Act 2023.

Inflation is high and the country is facing a cost-of-living crisis. There are a number of economic headwinds, including a weaker outlook for the building sector as residential consents fell 20% in the June quarter from a year ago. Forestry prices are at the lowest since the 1980s. The primary sector is also facing headwinds with a fall in dairy prices, and a cut to the dairy pay-out, while farm costs have increased. This will curb spending across the primary sector.

3.2 Strategy-led approach

The Council is currently working in a very complex operating environment as it seeks to deliver environmental, economic, social and cultural outcomes to people and communities in the Bay of Plenty region.

Attachment 1 illustrates the complexities in the operating environment, against which Council’s new strategic direction was formed and will provide context for the development of the activity work programmes to deliver on the agreed direction.

To address the complexities Regional Council has options available for reducing expenditure. The reductions are focused on the levels of services provided, to meet statutory requirements.

3.3 Process steps for the LTP

Council’s Strategic Direction for preparing the Draft LTP has been finalised (Attachments 6 and 7) and the next phase is focussing on the development of the activity plans, budgets and levels of service.

A time horizon model has been applied to the goals identified in the Council’s new strategic direction. The summary is shown in Attachment 2. The time horizons identified were based on three, seven, and ten-year time horizons. This approach was confirmed by Council at the August LTP workshop. Four prioritisation principles were also agreed. They are:

i. Build on the existing three BOPRC impact statements.

ii. Recognise the importance of fiscal responsibility and the need to achieve further organisational efficiencies.

iii. Focused delivery of priorities

iv. Maintaining our culture and high-performance levels.

The initial budget for the first three years of the 2024-2034 LTP were developed as years 4, 5, and 6 of the current LTP (2021-2031). Due to the changing operating environment a review has been completed of these budgets to ensure they accurately reflect the current environment, incorporate implemented efficiencies, and identify potential options for further savings. The outcome of this work is contained in Attachment 3, for Council consideration and direction.

Once Council has provided direction, the detailed activity plans will be developed to reflect council direction and will be considered at the workshop on 25 October.

Workshops during October to December will focus on refining the activity plans, developing key strategies e.g. Infrastructure Strategy, Financial Strategy, and a draft budget. These will inform the consultation document for Council adoption for Audit in December.

A watching brief will be maintained on the dynamic operating environment to ensure the LTP planning, and process, is agile and responsive. Likely influences include the development and consultation for the Regional Land Transport Plan, Tauranga City Council’s LTP consultation and the potential for further legislative change.

4. Current Draft Long Term Plan Financial Estimates

4.1 Levels of Service and the Budget

The process for setting levels of service (including KPIs) will be discussed at the workshop, with a starting point for each Activity being the current (approved) level of service. Many activity levels of service are linked to the statutory and regulatory frameworks that apply to functions. Regional Plans, and other related Policies, are generally set following public consultation, and submissions. These levels of service, and the budget to deliver them generally require time, and a detailed process, to change. They are also likely to be inter-connected to other Activities and other levels of service.

As a result, setting levels of service is a process which narrows at subsequent workshops - from the highest level (providing broad direction), to more detailed ‘drilling down’ into Activities and levels of service that Council wishes to devote most attention to.

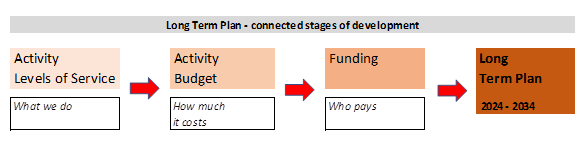

The first version of the full DLTP budget has been prepared within an assumed financial envelope to demonstrate the financial levers and their impact, and to facilitate Councillors’ direction setting. The following diagram highlights how each component discussed at this workshop is linked, and how it is sequenced.

Diagram 1. Connecting the Stages of the DLTP.

4.2 LTP 2024 – 2034 Draft Budget

The draft LTP Budget (DLTP) for 2024 – 2034 is being prepared within a very uncertain operating environment. The first section of this report has highlighted uncertainties, and economic headwinds that will likely affect the levels of services that Council provides. The prevailing economic situation will also have an impact on the crucial first three years of the ten-year planning cycle.

When creating a draft budget these uncertainties require assumptions to be made. These assumptions are an accepted and necessary part of financial forecasting. This part of the report sets out ‘significant forecasting assumptions’ that are used for each version of the DLTP, and regularly revisited and updated if required.

The current major financial assumptions, their source, and their financial impact are set out in the following table.

Table 1. Significant Forecasting Assumptions

|

Item |

Source |

Financial Impact |

When, and how, will this assumption be updated |

|

Assumption 1. Quayside Dividend |

Quayside Statement of Intent (SOI), inflation adjusted from 2027/28 |

$1 million of Dividend is equivalent to a 2.5% General Rates increase |

This assumption will be updated for each subsequent version of the DLTP based on Councillor direction |

|

Assumption 2. General inflationary increase to costs (excluding salaries) |

BERL Local Government Cost Adjustors Current assumptions are: Earthmoving 3.3% Property 3.08% Other costs 3.08% |

1% change is approximately $1.2 million which is equivalent to 1.5% total rates change |

Updated based on BERL final report due late October. |

|

Assumption 3 Salary increases |

CPI forecast from RBNZ August 2023 MPS. Current assumption is 4.5% |

1% change is approximately $600,000 which is equivalent to 0.8% total rates change |

Updated based on RBNZ MPS data 29 Nov 2023, 28 Feb 2024 and 22 May 2024 |

|

Assumption 4 Interest Rate cost increases |

LGFA forward rates, Bancorp advice. Current assumption is new/refinanced borrowing at 5.8%. |

$70 million refinancing in 2024, 1% change in interest rate is $700,000, which is equivalent to 0.9% of total rates |

Updated in November (version for audit) and April (version for deliberations) |

|

Assumption 5 Toi Moana Trust return |

Toi Moana Trust SOI 5% return |

1% change is $700,000, which is equivalent to 1.75% of general rates |

Updated based on SOI discussions and actual returns in 2023/24. |

|

Assumption 6 Capital Programme Delivery |

Full delivery per draft budget |

Each $10 million delayed for one year results in a $500,000 interest benefit which is equivalent to 0.6% of total rates Delayed projects will also be subject to extra cost inflation (assumption 2) |

|

NB – Fees and Charge revenue has been estimated based on inflationary adjustments only. Fees and charges will be updated in future budget versions as a result on individual Activity by Activity direction from Councillors and any proposed changes to the Revenue and Financing Policy.

There are key dependencies for all assumptions, with Funding Levers in the current Council Financial Strategy expected to continue, at this early stage of the process. Version 1 of the DLTP budget estimates have been prepared using the current levels of service for all Activities with inflation adjustments made as required. This exercise results in a level of revenue and expenditure for each Activity and an aggregated summary “Whole of Council” position.

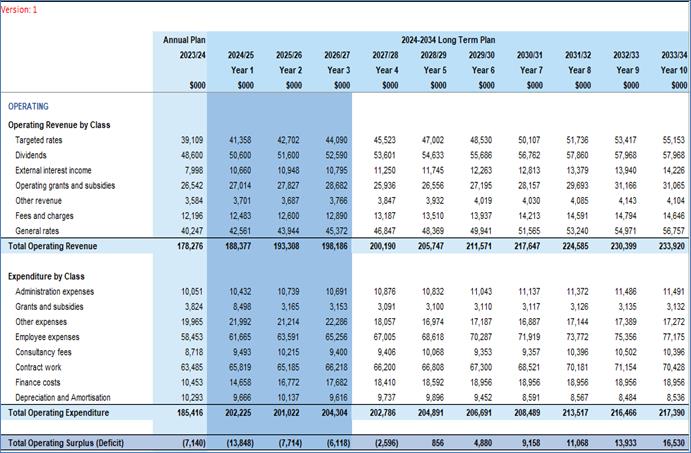

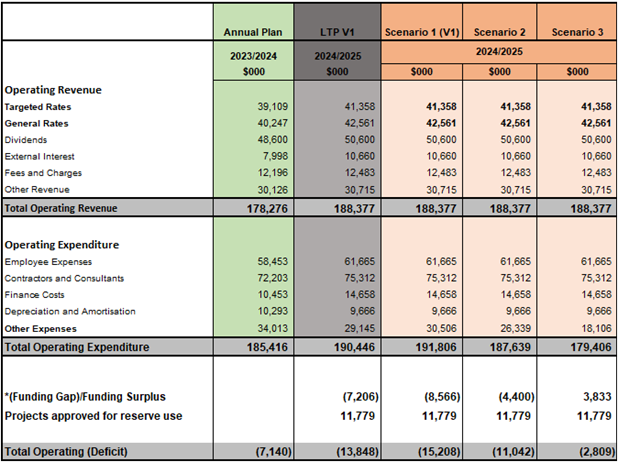

This summary is set out in the following table. Table 3 highlights that there is operating deficit 13.8m in year one of the LTP 2024 -2034. This means that DLTP operating expenditure is $13.8m higher than operating revenue in year one. Councillors will recall that in the current LTP Financial Strategy, Council approved using reserves to fund operating deficits in the first three years (2021/22 to 2023/24) of the LTP.

The approved use of reserves partially funds the operating deficit and results in a ‘funding gap’ of $7.2m.

This funding gap is based on:

· the sum total of all Activities,

· with existing (2023/24) levels of service,

· current funding model (current General Rate/Targeted Rate ratio mix),

· with applied assumptions for expenditure and revenue from Table 1.

NB – there have been some relatively minor adjustments to the costs of current levels of service where values are known or predictable.

Table 2 – Draft Long-Term Plan 2024 –

2034 Council

Table 2 – Draft Long-Term Plan 2024 –

2034 Council

Table 3 – Draft Long-Term Plan 2024 – 2034, Version 1

4.2.1 Draft Capital Budget

4.2.2 Council Reserves

The Annual Report, which is due for completion in October, will set the final balances for the reserves. As a result, details of the Council reserves will be provided in version 2 of the draft LTP budget.

4.2.3 Corporate overheads

Corporate overheads are allocated to activities based on various ‘cost drivers’ like staff time. An overhead recovery model is used to allocate costs to all activities based on the functions and services that each activity provides. Adjustments to activity budgets, and/or levels of service will result in a review of corporate overheads and a subsequent change for the next version of the budget. This ensures that where appropriate, reducing direct activity service levels and budgets has a consequential real reduction in corporate overheads.

4.3 Caveats and Financial Uncertainties

The basis for making financial estimates at this early stage of the process is intended to provide Councillors with the maximum level of flexibility to adjust levers in time to have a positive impact and minimise the negative impact.

The trade-off will be that the earlier in the process that financial estimates are prepared the higher the level of certainty, and accuracy is reduced. As the stages of the DLTP progress, better assumptions can be made, and more complete information will become known for each area of uncertainty.

5. Reducing Expenditure

5.1 Approach to Efficiencies, Savings, and Cost Reductions

The Annual and Long-Term planning approach at Council is to embed on-going savings and expenditure reductions into the base budget of all subsequent years.

Over the previous planning cycles, multi-million-dollar savings and reductions in costs to ratepayers have been realised. The most recent example was the Rates Collection project. This internally led and delivered project has generated approximately $10 million of savings in the Long-Term Plan 2021 – 2031.

Other examples that have led directly to savings for ratepayers include procurement savings generated through the jointly owned BOPLASS Council Controlled Organisations (CCO) partnership with other councils. This CCO undertakes joint large-scale procurement in areas such as insurance cover and equipment purchase. This will continue to build on the multi-million-dollar savings already generated.

This will be delivered irrespective of any initial ‘funding gap’ reduction exercise looking to make savings in expenditure, or due to prevailing economic circumstances.

The approach recognises that there is always a need to look for cost efficiencies when spending public money.

5.2 Efficiencies, Savings, and Cost Reductions included in the draft LTP 2024-2034

The Risk and Assurance Committee received an update report relating to ‘efficiency’ progress at the March 2023 meeting. This report explained that Activity Managers are responsible for identifying opportunities in their day-to-day work, both incremental improvements and more substantial reviews. The results of improvements are shared with Councillors as part of reports to various Committees. The Internal Audit Team, as part of their reviews, provide an independent view of operational processes and can help identify opportunities for improvement. These are shared with managers through recommendations. The Internal Audit Team reports quarterly to the Risk and Assurance Committee.

The following examples recent initiatives that have led to direct cost reductions and savings in the LTP 2024 – 2034.

Rates collection moves in-house.

|

What was changed? |

In-house collection of rates rather than contracting territorial authorities to collect rates on our behalf. |

|

Efficiency benefits realised |

As reported to the Monitoring and Operations Committee on 7 March 2023, efficiency benefits include: · producing service delivery cost savings for ratepayers · increased control of rates processes. · earlier cash receipts and additional interest revenue |

|

Effectiveness benefits realised |

As reported to the Monitoring and Operations Committee on 7 March 2023, effectiveness benefits include: · developing a customer centric service, · providing better visibility of the relationship between rates and the services they fund · establishing direct relationships with our ratepayers · improving the opportunity for collaboration with local authorities in the region |

|

Timeframe for benefits |

On-going |

Legal services – more in-house service

|

What was changed? |

In-house Legal Team created in 2020/21 |

|

Efficiency benefits realised |

As reported to Risk and Assurance Committee in September 2022: · since the team was created, external legal spend fell from $1.9 million in 2019/20 to $1.1 million in 2021/22. · the in-house team performs 7,124 hours of legal work per year. If this same number of hours were provided by local external legal partners, it would lead to a cost of around $2.9 million per annum. |

|

Timeframe for benefits |

On-going benefits. Further work is planned to identify additional opportunities to reduce external legal spend. |

The following examples of other 2024 – 2034 savings and efficiencies and are provided to highlight that this continues in current Long-Term planning.

5.3 Regional Sector Collaboration

Collaborating, sharing skills and capacity, and services with other Regional Councils provides opportunities for scale efficiencies and cross sector working. To take these opportunities appropriate mechanisms and structures need to be put in place. Regional Software Holdings Limited (RSHL) is one of the CCOs that exists to help the regional sector achieve outcomes through service collaboration.

Regional Council activities and services that have significant investment requirements, are in high demand, and are critical to the outcomes and goals such as Data Services and Science provide opportunities to partner with other councils and share resources and skills. This would provide resilience and capacity in these activities where there is a skills shortage. As the draft Long Term Plan develops, opportunities and options will be costed and presented to Council for consideration.

Council received the RSHL Statement of Intent 2023/24 at the August 2023 Council meeting. RSHL delivers a broad scope of shared services to the regional sector and is looking to do more with the Te Uru Kahika (TUK) council network. Its programme of improvements includes the IRIS NextGen Project and other collaborative programmes on behalf of Regional and Unitary authorities.

The IRIS NextGen programme aims to deliver efficiency in councils through technology that offers flexible, mobile, and digital end-to-end processes standardised across the sector for multiple Regional Council business functions.

Benefits

A universally developed IT platform, with common operational and back-office work practices, provides shared service opportunities. The delivery structure of the IRIS NextGen programme provides an opportunity for BOPRC to implement the solution alongside other councils, such as Otago and the Waikato Regional Councils.

Working with our neighbours at WRC and other councils across the country provides the potential to deliver at a faster pace and scale and in an agile and adaptable way. The combined implementation allows us to share scarce project resources, knowledge, and capability.

Budget Implications

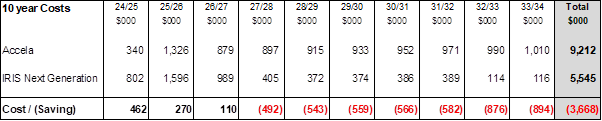

The cost for the IRIS NextGen programme is shared across the nine participating councils based on the RSHL council cost-sharing model. Under this model, this equates to a 17.9% contribution towards the programme costs. RSHL is engaging with other councils to potentially include them in the IRIS NextGen partnership, which will reduce programme costs. The following information highlights the forecasted costs if we maintain the Accela system compared to the current cost estimates for the IRIS NextGen programme and implementation at BOPRC.

In addition to the benefits detailed above, these figures show a significant financial benefit of transitioning from Accela to IRIS NextGen of more than $3.6M in savings across the LTP 2024-2034. To ensure an appropriate comparison the required transition to a cloud-based solution for the Accela System is compared to the ‘cloud based’ technology of the Datacom IRIS Next Gen System.

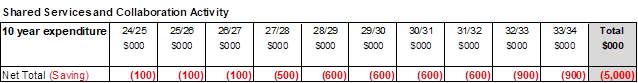

The following table highlights a summary of the estimated cost impact on the newly established Shared Services and Collaboration activity and reveals the significant savings to be realised through collaboration. This table highlights a ‘system only’ saving over the ten-year period and will be added to through other identified on-going efficiencies as IRIS Next Gen is designed and delivered across the partner councils.

The improved processes, in terms of good practice, resilience, and customer experience are key outcomes of this project are not yet quantified in the following table.

Table 4. Long Term Plan 2024 – 2034 Savings Profile, IRIS Next Gen Implementation

5.4 Shared Services and Collaboration Activity

For the Long-Term Plan 2024 – 2034 a new Council Activity is being established. This activity will aggregate current and future savings projections that arise due to the work set out within collaboration networks such as those shown in Section 5.

For this reason, it is anticipated that the net expenditure budget for this activity will always be a ‘credit’ based on the expectation that Shared Services and Collaboration will, over the long term, lead to savings for ratepayers in addition to the other tangible and intangible benefits. This approach also serves to set a financial target to be achieved as one of the tangible outcomes of service and partner collaboration.

The following table highlights the draft Long Term Plan 2024 – 2034 net expenditure budget for the Shared Services and Collaboration Activity.

Table 5. Shared Services and Collaboration Activity

This Activity will necessarily be the holding account cost centre for this class of savings for all other council direct and corporate activities that will in due course have the service cost reduction embedded within that function. These savings will be realised within these other activities as they are identified through the procurement and implementation phase of each program and project.

5.5 Three Scenario Modelling, and Three Time Horizons

5.5.1 The Three Scenarios

In recent weeks all activity budgets have been reviewed, based on three scenarios. These scenarios were described to Council at the August LTP workshop. The scenarios applied are defined as follows:

Scenario 1 - Current levels of service, updated to include spend to meet any new legislative requirements.

Scenario 2 - Review of existing work programmes to identify what could be delayed or removed given the new strategic framework.

Scenario 3 - Identify the baseline level of service, i.e. delivering to the minimum statutory requirements or agreements currently in place.

The scenarios are based on Version 1 of the budget and focus on the first three years of the DLTP. Further detail on the financial and level of service impacts are contained in Attachment 3.

5.5.2 The Three Time Horizons

At the Council LTP workshop on 7 September, it was agreed that the time horizon methodology would be used to prioritise the goals in the new strategic direction. Attachment 2 shows the three-time horizons and the relevant goals for each horizon.

The first-time horizon (three years) and respective goals were considered for the three scenarios applied to each activity (as per Attachment 2). Using a colour scale (green, yellow, red) where the scenario and change to level of service aligns with the goal it is green, partial alignment is yellow and where it doesn’t it is red.

6. Funding Expenditure – The Revenue and Financing Policy

Process Steps and Methodology

Following the Council Long Term Plan 2024 -2034 Workshop direction, the Risk and Assurance Committee has held two workshops to develop a methodology to review and set a Revenue and Financing Policy (RFP) to assist Council in determining appropriate funding sources for Activities. This methodology has been developed specifically to comply with the requirements of the Local Government Act, both in terms of rigour and flexibility.

At the Risk and Assurance Committee Workshops Councillors were presented with a proposed methodology for the RFP for approval. Councillors shared views on the principles underpinning the funding considerations and the trade-offs that would be required in coming to decisions on funding sources, through the review process.

The methodology has been jointly developed with Waikato and Otago Regional Councils, facilitated by external independent advice from Morrison Low.

This section of this report summarises the current status of the RFP development and provides some overall indication of the funding sources identified. At an ‘in-depth’ LTP workshop on the 26 September Councillors will consider an activity-by-activity view in more detail. The purpose of this initial overview at the 19 September workshop is to set out the process so far, and what the draft results are indicating.

6.1 Activity Draft Assessment Results – Stage/Step One

Staff have used the methodology to consider the factors set out in the Local Government Act 2002 (LGA) section 101(3)(a). The results are summarised in Attachment 4. It is important to note that these are not staff recommendations for the funding ratios, they are the results of the staff assessment of the first step in the RFP review process.

As expected, many of the Activity assessments have yielded similar results to the current LTP funding assessments. The adoption of the Strategic Direction for the development of the LTP 2024 – 2034 and a recognition of a range of economic and environmental factors in the methodology, there have been some differences between this draft “step 1” assessment, and the current funding mix for Activities. Two examples, with more involved process steps are highlighted below.

6.1.1 Emergency Management

The draft step 1 assessment indicates a shift from the current 100% Differentiated targeted rates to a Regionally consistent targeted rate (80%-100%), together with a minor portion from Differentiated targeted rates (0-20%). This recognises the regional and national benefits of emergency management services as well as the differing local benefits which depend on the relative levels of service provided. This assessment needs to be considered in the context of governance arrangements and established agreements regarding funding. In terms of the Bay of Plenty Civil Defence Emergency Management Partnership Agreement (the Agreement), Council acts as administering agent and sets a Civil Defence Emergency Management Regional Targeted Rate to fund the budget approved by the Bay of Plenty Civil Defence Emergency Management Group. Schedule C of the Agreement notes that:

A targeted rate is set differentially in accordance with Sections 16,17 and 18 of the Local Government (Rating) Act 2002 as an amount per rating unit on all rateable properties within defined boundaries of Kawerau, Ōpōtiki, Rotorua, Tauranga, Western Bay of Plenty and Whakatāne constituent districts and calculated on the extent of service provided.

If Council sees benefit in altering the way rates are collected, in terms of the Agreement any proposed change would need to be endorsed by the Bay of Plenty CDEM Coordinating Executive Group (CEG) and approved by the Bay of Plenty CDEM Group Joint Committee.

6.1.2 Community Engagement (Regional Safety and Rescue Services targeted rate)

The assessment indicates a shift from a minor funding source of Differentiated targeted rates (relating to Regional Safety and Rescue Services) to wholly funded by General rates. The change recognises that safety and rescue services are available to anyone in the region, both residents and visitors, and can access the safety and rescue services no matter where they live.

It should be noted that Tauranga City Council (TCC) has funded their lifesaving services directly, and staff understand that the TCC contract runs for at least one more year. Councillors may wish to take this into account when considering the appropriate funding source or it could decide based on principle.

6.1.3 Flat Rate or Differential

Council should also bear in mind that setting a flat ‘regionally consistent’ targeted rate would affect the potential size of the UAGC (Uniform Annual General Charge) because some of the headroom in the statutory limit of uniform flat rates (30% of total rates) would be taken up by a flat rate. Council could however set a regionally consistent targeted rate on land value, which would not affect the UAGC, but would result in a different distribution of rates. This can be more fully considered in Step Two of the RFP process.

6.2 Results

An initial evaluation of the overall impact of the draft Stage 1 assessments is shown in in Attachment 4, including comparisons to the current funding ratios. Initial modelling of the incidence of rates per district (excluding gst) is shown in Attachment 5.

The 26th September workshop will receive individual Activity Funding assessments. This will also include modelling for representative locations and properties where this highlights a significant impact from any change.

7. Activity Plans on a page

A review of all activities has been completed to:

· Align the activity with the new strategic direction

· Update the activity description and provide current levels of service (as defined in 2021-2031 LTP)

· Consider and apply the three scenarios outlined in 5.4.2 to v1 of the activity budget

· Assess the impact of the three scenarios and identify any potential risks

The results of this work is contained in Attachment 3 which provides details for all activities (external and internal).

8. Next Steps

The detailed activity plans and levels of service will be developed based on Council direction received at this workshop.

The 26th September 2023 Workshop is available and set aside for further detailed information on individual activities that there isn’t time to cover on the 19th.

The outputs of this work will be provided to councillors at the workshop scheduled for 25 October 2023 for consideration and further direction.

Attachment 1 - Bubble diagram ⇩

Attachment 2 - Prioritisation of Goals Summary ⇩

Attachment 3 - Activity Review ⇩

Attachment 4 - Summary of Step One Revenue and Financing Policy Assessments ⇩

Attachment 5 - Revenue and Financing Policy - Rates Incidence Modelling ⇩

Attachment 6 - Strategic Direction Poster A3 ⇩

Attachment 7 - Strategic Direction Document 11 September 2023 ⇩