|

Risk and Assurance Committee Informal Workshop Pack

DATE: Wednesday 14 June 2023 COMMENCING AT TIME: 1.00 PM VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga

|

|

Risk and Assurance Committee Informal Workshop Pack

DATE: Wednesday 14 June 2023 COMMENCING AT TIME: 1.00 PM VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga

|

Public Excluded Session

The table below sets out the general subject of each paper to be considered while the public is excluded from the proceedings of this workshop, the reason for excluding the public, and the specific grounds under section 48(1) of the Local Government Official Information and Meetings Act 1987 for excluding the public:

|

Item No. |

Subject of each paper to be considered |

Reason for excluding the public in relation to each paper |

Grounds under Section 48(1) for excluding the public |

When the paper can be released into the public |

|

3 |

Risk Management Overview |

Withholding the information is necessary to prevent the disclosure or use of official information for improper gain or improper advantage. |

48(1)(a)(i) Section 7 (2)(j). |

On the Chief Executive's approval. |

1 Risk Management Overview

Open Session

Informal Workshop Papers

2 Review of Financial Strategy and Treasury Policy 3

Attachment 1 - Financial Strategy 2021-2031 2

Attachment 2 - Council Reserves Summary 2

Attachment 3 - Treasury Policy 2

3 Review of Revenue and Financing Policy 2

Attachment 1 - 10 May 2023 Workshop paper - Revenue and Financing Policy 2

Attachment 2 - 2021-2031 Revenue and Financing Policy 2

Attachment 3 - Funding Needs Analysis 2021 2

Attachment 4 - Preamble to Te Ture Whenua Maori Act 1993 2

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Risk and Assurance Committee Workshop |

|

|

|

14 June 2023 |

|

|

From: |

Mark Le Comte, Principal Advisor, Finance; Kumaren Perumal, Chief Financial Officer; Gillian Payne, Principal Advisor and Karlo Keogh, Finance Support Team Lead |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Review of Financial Strategy and Treasury Policy

1. Purpose

The purpose of this paper is to commence the Risk and Assurance Committee’s input into the review of the Financial Strategy and Treasury Policy as part of the Long-Term Plan 2024-2034. This paper provides an outline of the principles set in the current Financial Strategy, requests direction on areas that Councillors would like to receive more detailed analysis on and provides an outline of reserves and borrowing as requested by Councillors.

Revenue, including rates, is discussed in more detail as part of the Revenue and Financing Policy approach. This paper briefly covers financial prudence benchmarks and treasury management implications for rates.

The Quayside dividend is intended to be discussed in more detail with Quayside staff, with independent support from PWC if required.

2. Guidance Sought from Councillors

Staff seek the Risk and Assurance Committee’s (the Committee) views on:

· Suggested changes to the principles of the financial strategy (refer section 5.1)

· Suggested changes to the goals of the financial strategy (refer section 5.2)

· The issues in section 5.3, which staff expect to form the basis of new or revised methods in the LTP 2024-2034 financial strategy

· any other topics that RAC members wish to raise for consideration through the development of the Financial Strategy

· Any information or analysis that the Committee would like prepared for the next Financial Strategy workshop.

3. Background

The Local Government Act (2002) (LGA) sets the requirements for the Financial Strategy and a range of Funding and Financial Policies.

The purpose of the Financial Strategy is defined in LGA s 101A as being to:

(a) facilitate prudent financial management by the local authority by providing a guide for the local authority to consider proposals for funding and expenditure against; and

(b) provide a context for consultation on the local authority’s proposals for funding and expenditure by making transparent the overall effects of those proposals on the local authority’s services, rates, debt, and investments.

The LGA s104 and 105 requires a Liability Management Policy and an Investment Policy. Council has adopted these Policies as a Treasury Policy with sections on Liability and Investment Management. These policies must state the Council’s policies in respect to:

borrowing and other liabilities, including—

(a) interest rate exposure; and

(b) liquidity; and

(c) credit exposure; and

(d) debt repayment.

state the local authority’s policies in respect of investments, including—

(a)[Repealed]

(b) the mix of investments; and

(c) the acquisition of new investments; and

(d) an outline of the procedures by which investments are managed and reported on to the local authority; and

(e) an outline of how risks associated with investments are assessed and managed

The Local Government (Financial Reporting and Prudence) Regulations requires that Council must disclose certain benchmarks in the LTP, Annual Plan, and Annual Report. The Prudence Benchmarks are not limits that must be complied with in their own right, however, performance against each benchmark must be disclosed. Benchmarks related to borrowing are usually matched with borrowing covenants which do need to be complied with.

4. Review Process

Council is working with PWC and Morrison Low on reviews of the Funding and Financial Policies.

Council has delegated to the Committee the power to oversee the review process and provide technical advice to Council on the draft Financial Strategy and draft Funding and Financial Policies required by the Local Government Act (2002) sections 101A and 102 for Long Term Plan 2024-2034.

5. Financial Strategy 2021-2031

5.1 Principles

Council’s Financial Strategy for the LTP 2021-2031 is included as Attachment 1. This financial strategy outlined five financial principles to guide decisions, which are:

1. Council balances operating expenditure and revenue except where an alternative approach is more financially prudent.

2. Council achieves the right mix to fund its activities, and keep rates, and fees and charges, affordable, fair and equitable now and for the future.

3. Council promotes effective and efficient use of resources to achieve better value for money.

4. Council creates resilience through robust and agile management practices which minimise or mitigate risk to achieving its financial objectives.

5. Council supports investment in solutions that are the most appropriate in the long term.

Suggestions for change in LTP 2024-2034

The financial principles were intended to be enduring statements that would be appropriate in most foreseeable situations. These principles have been compared to Council’s new Strategic Direction.

Possible updates that could be considered are:

· Principle 2 could be expanded to include reference to intergenerational well-being. This could also be expanded to include specific reference to equitable approaches to well-being for Māori.

· Principle 3 could be expanded to include working with partners, stakeholders and the community as a way to achieve better value for money. This could also include alignment to Community Outcome 5 “Te Ara Poutama/Pathway to Excellence” to support Māori participation, capacity, capability and partnership, shared decision making.

· Principle 5 could be expanded to include specific reference to resilience to natural hazards and/or supporting sustainable development and/or supporting an equitable and sustainable transition to a low emissions future.

Councillors are requested to provide feedback on the potential changes listed above, and any other changes that could be made to the financial principles to improve alignment with Council’s Strategic Direction for LTP 2024-2034.

5.2 Goals

The 2021-2031 Financial Strategy set two short/medium term financial results (goals) which were:

1. Increasing financial resilience to respond to Climate Change and other challenges

2. Keeping rates affordable as we recover economically from COVID-19.

Over the last 12 months, the global economic environment of high inflation and continued supply chain disruptions has affected the New Zealand economy sharply and significant weather events and their aftermath have brought into focus the increased scale of financial resilience that will be needed to avoid rating volatility in future. Higher borrowing costs will result in higher interest costs to all activities which will lead to a need to increase funding for capital intensive activities.

Infrastructure strategy implications

The Infrastructure Strategy is the key document for outlining issues and options for the Flood Protection and Control group of activities, which is the group of activities with the most capital expenditure. Implications of likely requirements for capital expenditure and insurance costs or availability will be a key consideration for the level of financial resilience that Council requires.

As the Infrastructure Strategy is developed, the scale of implications identified may lead to further consideration of goals for the Financial Strategy.

Suggestions for LTP 2024-2034

These 2021-2031 financial goals appear to remain consistent with Council’s 2024-2034 Strategic Direction. The second goal could change its focus to the cost of living and inflationary impacts rather than economic recovery from COVID-19.

The economic outlook provided by Bancorp in the 31 May 2023 treasury management report stated that:

Like the RBA, the Reserve Bank of New Zealand (“RBNZ”) surprised markets when it lifted its cash target rate by 25bp to 5.50% although the surprise was not the hike but the signal that this was probably the end of the current hiking cycle. In fact, the internal discussion was whether to pause or to hike 25bps, whereas bank forecasters thought the debate would revolve around a 25bps or 50bps rate hike, with the potential for a cash rate peak of 6.00% possible due to strong immigration flows.

In the May OCR review, the RBNZ continues to expect a ‘mild’ recession with negative growth over the second and third quarters implying 0.0% growth for 2023. Its projection for 2024 is for a 1.30% growth. The latest ANZ-Roy Morgan consumer confidence survey for May was flat at 79.2 (from 79.3) although the proportion of people who thought it was a good time to buy a major household item, a key retail indicator, fell 3.0 points to reach -34.0. There was some good news for the RBNZ with inflation expectations dropping to 4.80% from 5.20%.

In contrast business confidence increased in May although a change from -43.8 to -31.1 is hardly time to break out the bubbles. Investment intentions were unchanged at -6.8 and employment intentions fell from -2.4 to -5.7, probably one of the reasons why consumer confidence remains fragile.

Interest Rate Outlook

Financial markets are now pricing in a 5.50% OCR peak with the first 0.25% cut by April next year. This is in contrast to the RBNZ’s latest projections that imply no cuts until late 2024. Some bank analysts are still projecting further hikes, but we think they are underestimating the pressure the economy is under while, at the same time, overstating the positive impact from a higher number of tourists and immigration.

We anticipate the RBNZ’s rhetoric over coming months will be consistent with the post-MPS comments from RBNZ Assistant Governor Karen Silk stating, “rates need to stay on hold for an extended period. We must be watchful of over-tightening policy. We can hold now and see what develops.”

5.3 Methods

The Financial Strategy outlined three methods to achieve the financial results.

1. Growing dividends from Quayside Holdings

2. Using financial reserves where appropriate

3. Maintaining our ability to borrow.

The methods above were identified to address the issues that were current or foreseeable in 2021. The immediate focus was on post-Covid economic recovery, with a longer-term goal of maintaining its financial resilience, whether through borrowing capacity or expected future returns on investment.

5.3.1 Dividends from Quayside Holdings

Given the importance and size of the Quayside dividend, achieving the right balance between dividends, growth, risk and sustainability is one of key financial strategy discussions and decisions.

In the 2024-2034 Financial Strategy, Council’s direction on this matter could be expressed prominently to make trade-offs clearer and provide a better context for the Quayside Dividend Policy and the planned increase in non-port assets.

This key issue will require discussion between Council and Quayside, supported with independent advice where required. At the appropriate time these discussions will need to be formalised through the Statement of Expectations and Statement of Intent processes.

Councillors are requested to discuss any areas that they would like to receive advice on that have not already been signalled.

5.3.2 Using financial reserves where appropriate

Discussion on the use of ‘one off’ Council reserves are generally a separate consideration to the size and use of Quayside dividends through the way the current policy settings are designed – with the dividend currently used to fund operating expenditure/reduce general rates.

Generally, Council reserve funding processes are designed to maintain the overall value of reserves over time.

Staff will prepare projections of Council reserves with each draft budget version of the 2024-2034 LTP. The projections will be relevant in assessing Council’s capacity to smooth rates over the life of the 2024-2034 LTP as well as a providing a resilience buffer for unexpected events.

In using reserves as a funding source, Council will have to make judgements about balancing rates, risk, and equity, within the Region and for current and future generations.

In the LTP 2021-2031, Council approved using the Regional Fund Reserve (RF) (refer section 6.1.1) to reduce rates in 2021/22 – 2023/24. This means that in 2024/25 to balance the budget, Council may need to:

· Increase rates to cover the impact of stopping/reducing reserve use,

· Find other revenue sources,

· Review levels of service, or

· A combination of these (including the potential to incrementally reduce RF use over time).

Councillors have requested more information on the purpose and use of each type of reserve. This is included in Attachment 2.

5.3.3 Maintaining our ability to borrow

Council had borrowed to pre-fund capital expenditure in 2021/22 and part of 2022/23.

Borrowing limits

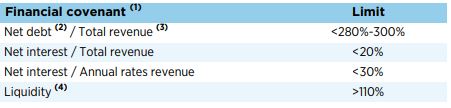

The Local Government (Financial Reporting and Prudence) Regulations requires Council to disclose borrowing benchmarks. Council, like most other local authorities, uses the LGFA borrowing covenant limits for these benchmarks. The benchmarks are:

NOTES

1. Financial covenants are measured on Council only, not the consolidated group.

2. Net debt is defined as total debt less financial assets and investments.

3. Total revenue is defined as cash earnings from rates, government grants and subsidies, user charges, interest, dividends, financial and other revenue and excludes non-government capital contributions (e.g. vested assets).

4. Liquidity is defined as external debt plus committed loan facilities plus liquid investments divided by external debt.

Council currently has negative net debt which means we have more invested than borrowed. As a result, Council has access to substantial borrowing capacity.

Credit rating

Standard and Poors (S&P) views Council’s borrowing differently to the LGFA for credit rating purposes. S&P views the entity as Council and QHL without the Port of Tauranga. S&P also views:

· PPS as debt

· Any committed loan facility as being fully drawn

· Assets separately from borrowing to assess risk of any asset devaluations.

So, while LGFA considers Council as having negative net debt, S&P views the Council group as having approximately $490 million of borrowing. S&P views this as a high level of debt, but notes that Council has exceptional liquidity and a sufficient asset base to pay off this debt.

6. Treasury

This section covers both investment and borrowing, and draws on material from the Financial Strategy, Treasury Policy (Attachment 3), and Financial Prudence Benchmarks.

Treasury modelling requires updated financial estimates and assumptions for borrowing, investing and inflation rates. These will be updated throughout the LTP process.

6.1 Reserves and investments

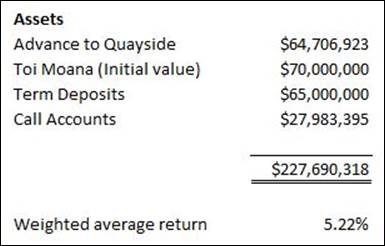

As at 31 May 2023, Council had a total of $227.7 million of cash and investments achieving a weighted average return of 5.2% per year, as shown below. The Treasury Policy provides limits on the types of investments that Council can make and rules for managing risk.

This portfolio of cash and investment is comprised of Council’s cash reserves, working capital, and pre-funded borrowing for future capital works. Councillors have requested further discussion on Council’s cash reserves including their purpose, how they are accumulated, and how they are replenished after use. Forecasts of each reserve balance will be included with each budget version.

6.2 Borrowing

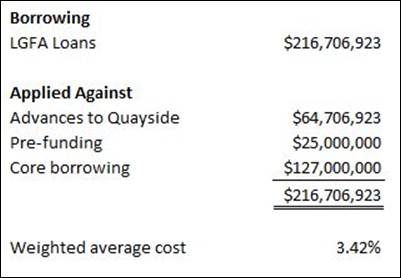

As at 30 April 2023, Council had a total of $216.7 million of borrowing at a weighted average cost of 3.4% as shown below.

This borrowing is comprised of on-lending to QHL and Council borrowing, both core Council borrowing and Council pre-funding for future capital expenditure.

6.2.1 Council borrowing

Council core borrowing is borrowing that has been applied to capital projects. Pre-funding is borrowing that has been drawn-down in advance of when the funds are needed, and the proceeds are invested until needed.

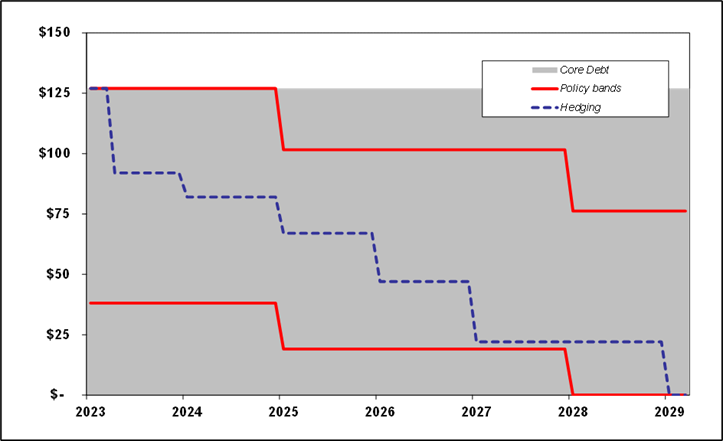

Core borrowing

Council’s Treasury Policy requires that interest rate risk is managed for core borrowing by having a percentage range of fixed interest rates at different maturities. This hedging is currently achieved by using fixed rate borrowing but can also be achieved using derivative like interest rates swaps.

Pre-funding

The Treasury Policy allows Council to pre-fund capital expenditure up to two years in advance. This can be advantageous if access to borrowing may be limited in the future and/or if a gain can be made by investing in safe term deposits paying a higher interest rate than the cost of borrowing.

Opportunities for pre-funding are monitored regularly. These opportunities are not common currently, however, during 2018-2021 there were regular opportunities for net income gains of 1% or more.

6.2.2 Quayside on-lending

Council has agreements to borrow from the LGFA and on-lend to QHL up to $50 million (general facility) and $100 million (for Rangiuru Business Park development). Council makes a 0.2% margin on this arrangement to comply with the Local Government Act 2002 rules for lending to Council Controlled Organisations.

Quayside and Council are investigating whether to transition to a direct lending arrangement between QHL and the LGFA subject to Council approval. This could potentially be used to refinance other borrowing that QHL has at lower rates than they currently pay.

7. Rates

Rates and the appropriate balance of funding sources is intended to be discussed first through the Revenue and Financing Policy (RFP). An overview of the prescribed process for developing the RFP was presented to a Council LTP workshop on 12 April 2023 as part of the paper on Financial Strategy and Policies.

The process requires initial consideration of funding sources by activity followed by consideration of the long-term impacts on community well-being (including affordability) as a second stage of consideration.

The general rates requirement is reduced by net income from treasury operations, which are treated as general funds. Over the next few years, Council will have:

· increased borrowing costs as fixed term loans on low rates mature

· reduced interest income as interest rates reduce from their current levels

· changed from being a net investor to a net borrower

These changes will result in less net treasury income and, everything else being equal, require an increase general rates.

Councillors are requested to provide guidance on information they would like to receive on rates affordability. For example:

· Rates as a percentage of GDP, income, or disposable income.

· The level of granularity of data in terms of geographic areas and income/demographic breakdowns.

Staff will conduct any further investigation, analysis and policy work requested by Councillors and incorporate any guidance into the 2024-2034 LTP budgeting process.

The Financial Strategy will be updated throughout the 2024-2034 LTP process as strategic direction is provided.

Detailed modelling on reserves and borrowing will be completed for each budget version using the most up to date interest rate assumptions.

The Treasury Policy will be reviewed against current best practice and opportunities to optimise results in the current market environment will be identified.

Attachment 1 - Financial Strategy 2021-2031 ⇩

Attachment 2 - Council Reserves Summary ⇩

Attachment 3 - Treasury Policy ⇩

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Risk and Assurance Committee Workshop |

|

|

|

14 June 2023 |

|

|

From: |

Kumaren Perumal, Chief Financial Officer and Gillian Payne, Principal Advisor |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Review of Revenue and Financing Policy

1. Purpose

On 25 May 2023, Council delegated to the Committee “the power to oversee the review process and provide technical advice to Council on the draft Financial Strategy and draft Funding and Financial Policies required by the Local Government Act (2002) sections 101A and 102 for Long Term Plan 2024-2034”.

The purpose of this paper is to seek input from the Risk and Assurance Committee (the Committee) regarding the review of Council’s Revenue and Financing Policy (RFP) which is a policy required under section 102 of the Local Government Act 2002 (LGA).

At the workshop there will be a presentation from Council’s advisor on this review, Morrison Low, who will provide information on the current approaches that other regional councils take to fund their activities and discuss an iterative approach to developing principles for the policy.

The paper draws together information already presented in recent Council LTP workshops to facilitate discussion at this workshop.

2. Guidance Sought from the Committee

Staff seek the Committee’s views on the scope and focus of the RFP review, in particular:

· The iterative approach to developing policy principles

· the comprehensiveness and adequacy of the information that is planned to be presented to Councillors during the review (refer section 3.3 below) and any additional topics the Committee would like Council to consider

· any risks that require particular attention during the review

· any additional matters that the Committee considers staff should take into account when planning and undertaking the RFP review.

3. Discussion

3.1 Background

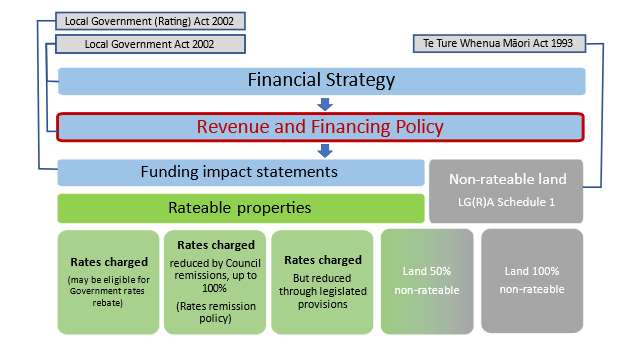

The RFP is a key policy through which Council implements its Financial Strategy and, the RFP underpins the rates setting process, as illustrated in Figure 1 below

Figure 1

In the report presented to a Council workshop on 10 May 2023 introducing the review of the RFP, (refer Attachment 1, section 2), the following drivers for a comprehensive review of the RFP were noted:

· sensitive and contentious issues like equity, and the affordability of the level of rates that the Council set, are again likely to be key topics (for the LTP 2024-2034)

· the Local Government sector is facing large scale legislative reform and continued financial pressures in funding its activities

· adaptation to climate change (will) involve significant capital works to adapt our flood protection and control infrastructure to cope with the predicted change in weather patterns and flooding events

· providing a comprehensive regional public transport network and services as an important tool in reducing carbon emissions

· funding streams (are) currently available from Central Government to assist Councils with these fiscal challenges, (but) it’s important to note that funding is uncertain, often has conditions attached, and cannot always be relied upon

· Cyclone Gabrielle (has) highlighted that when this type of disaster occurs, the whole community feels the impacts, not only those people and properties that are flooded.

It was also noted that the review should include a detailed and analytical review of policy options and settings to ensure the provisions of sections 101-103 of the LGA are followed and applied appropriately.

Bay of Plenty Regional Council has established a cohort of other Regional Councils to review current council policy and establish potentially consistent process, and legislatively compliant, good practice that could be applied widely for the Regional Sector as a whole.

3.2 Process for RFP review and key information inputs

The prescribed two-step process is comprehensively described in Attachment 1 (sections 4.2 through 4.4), the paper presented on 10 May 2023 as part of a Council LTP workshop.

The prescribed process does not limit Council’s considerations, because it does not influence the outcome of the RFP development – it only requires the matters to be considered and done in transparent sequential stages.

Morrison Low have been asked to recommend a methodology for considering these matters, to be presented to the Committee at a future workshop (anticipated to be in August 2023).

Tables in sections 4.3.1. and 4.4.1 of Attachment 1 outline the information staff plan to present during the development of the RFP, subject to Morrison Low’s advice on methodology. Staff seek the Committee’s views on the comprehensiveness and adequacy of the information listed.

3.3 Existing RFP principles

Council’s existing RFP (Attachment 2) does not explicitly state principles but refers to Financial Principles contained in the Financial Strategy adopted as part of the Long Term Plan 2021 – 2031.:

· Principle 1: Council balances operating expenditure and revenue except where an alternative approach is more financially prudent.

· Principle 2: Council achieves the right mix to fund its activities, and keep rates, and fees and charges, affordable, fair and equitable now and for the future.

· Principle 3: Council promotes effective and efficient use of resources to achieve better value for money.

· Principle 4: Council creates resilience through robust and agile management practices which minimise or mitigate risk to achieving its financial objectives.

· Principle 5: Council supports investment in solutions that are the most appropriate in the long term.

The current RFP notes that having considered the principles above and undertaken the legislative analysis (two-step process), Council identified a preferred order of funding sources for operating expenditure - refer Figure 2 below. The current RFP does not identify a priority order for funding capital expenditure.

Figure 2

|

Priorities for funding operating expenditure |

|

|

Priority |

Funding sources |

|

1 |

· Grants, subsidies, sponsorship and other sources of revenue · Fees and charges where benefit can be assigned to individuals · Financial contributions (not currently used) |

|

2 |

· Targeted rates where benefit can be assigned geographically or to itemise specific rates requirements |

|

3 |

· Investment income (interest and dividends) · General rates including UAGC |

|

4 |

· Reserves · Borrowing |

This order of priority and the RFP’s text reflect the conclusions Council reached after undertaking the required analysis. The RFP notes that Council recognised a mix of private and public benefits from its activities and in some cases, groups whose actions or inactions created demand for the activity (exacerbators). These considerations are more fully described in Council’s 2021 Funding Needs Analysis, Attachment 3.

The current RFP goes on to describe how Council considered the overall impact of any allocation of liability for revenue needs on the community, as required by LGA section 101(3)(b). It provides examples of how Council balanced its approach, including referring to Council’s Rates Remission Policy, seeking external funding and the use of reserves and general funds to smooth and adjust the incidence of rates.

3.4 Developing principles for the new RFP

Although Figure 1 above shows a neat hierarchy of strategic direction and policy interaction, the development of those components of the LTP is perhaps not as structured and requires an iterative process.

This is particularly the case for the RFP because the outputs of the Step One analysis need to be modelled by applying them to the (still evolving) versions of activity budgets as the LTP is developed, before the Step Two analysis can be undertaken.

3.4.1 Initial alignment with Financial Strategy principles

Despite that, high level direction for the new RFP can come from Council’s 2024-2034 Financial Strategy principles (once identified) and used to guide Council’s considerations of the legislated matters. Legislation also requires that the RFP supports the principles set out in the Preamble to the Te Ture Whenua Māori Act 1993, set out in Attachment 4.

An example of how this may work (using the 2021-2031 Financial Principles) is illustrated in Figure 3.

Figure 3

|

Step One Considerations LGA s101(3)(a) |

Associated Financial Principles 2021-2031 |

|

Activity outcomes; Amount and type of funding sought for the activity. |

Principle 1: Council balances operating expenditure and revenue except where an alternative approach is more financially prudent. Principle 5: Council supports investment in solutions that are the most appropriate in the long term. |

|

Benefits distribution (between the community as a whole and any identifiable part of the community). Period over which benefits will occur. Whose actions or inactions create the need for expenditure. |

Principle 2: Council achieves the right mix to fund its activities, and keep rates, and fees and charges, affordable, fair and equitable now and for the future. |

|

Costs and benefits of funding the activity separately. |

Principle 3: Council promotes effective and efficient use of resources to achieve better value for money. |

|

Step Two Considerations LGA s101(3)(b) |

Associated Financial Principles 2021-2031 |

|

Position of Māori landowners |

TTWMA Preamble: Council promotes the retention of land in the hands of its owners, their whanau, and their hapu, and protects wahi tapu: and to facilitate the occupation, development, and utilisation of that land for the benefit of its owners, their whanau, and their hapū”. Principle 1: Council balances operating expenditure and revenue except where an alternative approach is more financially prudent. Principle 2: Council achieves the right mix to fund its activities, and keep rates, and fees and charges, affordable, fair and equitable now and for the future. |

|

To what extent does distribution of liability for revenue (rates, fees and charges, user fees etc) strengthen the position of Māori landowners to retain ownership of the land and to use the land for the benefit of themselves, their whānau, and their hapū? |

|

|

Current and future wellbeing |

|

|

Equity (including affordability) of the distribution |

|

|

Balance between current and future ratepayers |

|

|

Environmental, cultural, economic, and social impacts /consequences. |

3.4.2 RFP principles emerge through Step Two

The two-step process prompts Council to consider a series of (often competing) economic and taxation principles, for example user-pays, exacerbator pays, equity (both current and future), transparency and efficiency, as well as other considerations like policy longevity and unintended consequences. These concepts will be discussed in more detail at the workshop, as part of a presentation from Morrison Low.

The discussion among Councillors during Step Two will elicit Council’s collective view on the relative importance of the competing economic and taxation principles. The trade-offs and compromises that Councillors consider appropriate for the context of our communities and activities could then be described and expressed as statements of policy principle in the proposed RFP for consultation.

3.4.3 Planned process improvements

The initial Step One assessments that staff are undertaking are being designed to provide the results of deep thinking relating to both direct and indirect beneficiaries of activities, including considering the consequences for communities if the activity were not undertaken.

This could result in material changes in the Funding Needs Analysis outputs, compared to the 2021 version.

The Committee may wish to suggest additional perspectives to be included in the Step One or Step Two analysis, subject to the advice of Morrison Low regarding the review methodology.

3.5 Risks and mitigation

Figure 4 lists key risks in the review process, along with possible mitigation strategies. Planning and resourcing of some of the mitigation strategies are not yet complete.

The Committee may wish to add to or highlight risks.

Figure 4

|

Risk category |

Description |

Mitigation |

|

Political and public perception |

Significant changes to funding sources may meet resistance from groups or communities on the grounds of fairness |

Effective stakeholder management and public communication strategies to build understanding and consensus; |

|

Economic |

Significant changes to funding sources may lead to unexpected changes in behaviour by groups and individuals, particularly regarding desired/acceptable levels of service. |

Effective pre-consultation with targeted groups to understand the impact of policy options before a preferred option is identified. |

|

Implementation |

Inadequate or inaccurate financial modelling of policy options could result in unexpected rating outcomes once implemented. |

Effective planning and resourcing of financial modelling of policy analysis. Use of efficient analysis tools. |

|

Legal |

Failure to consider legislated matters in two-step process. Pre-determining an outcome of the two-step process, for example, ruling out or devaluing the use of a particular funding source as a matter of principle before undertaking the two-step process. |

Seek advice of consultants and legal counsel |

4. Next Steps

The direction provided by the Committee will inform further project planning by staff and will influence work done on Step One methodology during June and July 2023.

A further Committee workshop is expected to be scheduled in August 2023.

Attachment 1 - 10 May 2023 Workshop paper - Revenue and Financing Policy ⇩

Attachment 2 - 2021-2031 Revenue and Financing Policy ⇩

Attachment 3 - Funding Needs Analysis 2021 ⇩

Attachment 4 - Preamble to Te Ture Whenua Maori Act 1993 ⇩