|

Regional Council Long Term Plan Workshop Pack

DATE: Wednesday 10 May 2023 COMMENCING AT TIME: 10:00 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga and via Zoom (Audio Visual Meeting)

|

|

Regional Council Long Term Plan Workshop Pack

DATE: Wednesday 10 May 2023 COMMENCING AT TIME: 10:00 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga and via Zoom (Audio Visual Meeting)

|

Informal Workshop Papers

1 Strategic Framework 1

Attachment 1 - DRAFT Strategic Direction 1

2 History of Māori Land and Rates Information Presentation

Presentation by: Charlie Roddick, Kaitohutohu Matua, Whenua Maori (Rates Specialist)

3 Performance Framework 1

Attachment 1: Community outcomes and activities 1

4 Budget Setting Process 1

5 Section 77 Applicability 1

6 Delivering Better Outcomes Jointly and Collaboratively in the Bay of Plenty 1

7 Financial Strategy - Funding Levers 1

8 Review of Revenue and Financing Policy 1

Attachment 1 - Funding Needs Analysis 2021 1

Attachment 2 - Revenue and Financing Policy 2021 1

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

10 May 2023 |

|

|

From: |

Olive McVicker, Corporate Performance Team Lead and Namouta Poutasi, General Manager, Strategy & Science |

|

|

|

Namouta Poutasi, General Manager, Strategy & Science |

|

Strategic Framework

1. Purpose

The purpose of this paper is for Council to consider the draft strategic framework (Attachment 1) that has recently been developed by Councillors. Once supported this strategic framework will be used as the foundation for the activity structure and policy development required as part of the long-term planning process.

2. Guidance Sought from Councillors

Councillors are requested to consider as a way forward the draft Strategic Direction.

3. Strategic Direction Review

If the Strategic Direction document is considered as a key way forward, then we could expand it further to explain why it’s important in the style of the Waikato Regional Council Strategic Framework if desired.

The Strategic Direction information will be used as a basis for Councillors to engage with the community, stakeholders, and peer groups. Formal consultation of this direction will be included in the LTP consultation scheduled early in 2024.

Further it is to be a key foundational input in the development of the LTP.

4. Next Steps

If considered as a key way forward, staff will use the Strategic Direction document to form the direction and alignment of Council’s activities, plans, policies, and work programmes for the Long-Term Plan 2024 – 2034.

Attachment 1 - DRAFT Strategic Direction ⇩

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

10 May 2023 |

|

|

From: |

Olive McVicker, Corporate Performance Team Lead; Kumaren Perumal, Chief Financial Officer; Graeme Howard, Corporate Planning Lead and Gillian Payne, Principal Advisor |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Performance Framework

1. Purpose

The adoption of a new strategic framework will provide the opportunity for the review and alignment of the performance framework.

The purpose of this report is to inform Councillors of the performance framework requirements and how it is applied in the existing framework. It will also identify opportunities as part of the development of the 2024-2034 Long Term Plan (LTP).

2. Guidance Sought from Councillors

This session will provide Councillors with an opportunity to ask questions about the current performance management framework. It also provides an opportunity to identify any changes to the framework which can be incorporated into the development of the LTP.

3. Performance Monitoring Cycle

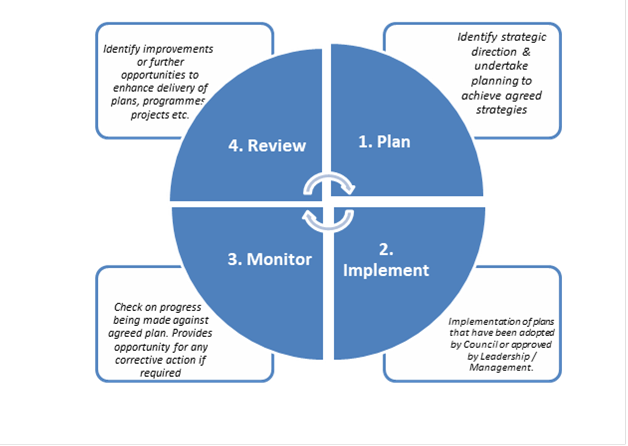

An outline of the performance monitoring cycle is illustrated in the diagram below. It is an iterative process where performance monitoring provides the opportunity to manage progress and results and ultimately track progress against agreed strategic direction. It also facilitates continuous improvement.

Performance Management Cycle

Performance Management Cycle

The operation of this cycle at Council is shown in the table below.

|

Plan |

Implement |

Monitor |

Review |

|

Strategic Direction Long Term Plan Annual Plans Activity Plans Regional Plans e.g. RLTP Project Plans |

Levels of service Projects Process Community engagement |

Annual Report Arotake Ad hoc Council reporting Detailed Financial Briefing Benchmarking |

Audit (internal & external) Efficiency & Effectiveness reviews Improvement opportunities Project reviews – lessons learned |

4. Statutory Requirements

4.1 Local Government Act 2002

The Local Government Act 2002 (LGA) s93 (6) identifies the purpose of a long-term plan, which includes the provision for the accountability of the local authority to the community. This is further elaborated in Schedule 10 (4) where a statement of the intended levels of service is required with corresponding performance measures and targets.

The Annual Report must report on the achievement of the performance measures identified in the LTP and are subject to the annual audit process.

There is currently no statutory obligation to report against community outcomes. The original requirement was repealed in 2010.

4.1.1 Mandatory Measures

Non-financial

In 2013, in compliance with s261B of the LGA the Secretary of Department of Internal Affairs issued regulations for the monitoring of mandatory measures. For the Regional Council these measures were in relation to flood protection and control works. These measures are identified in the 2021-2031 Long Term Plan as part of the levels of service for the flood protection activity.

Results are reported quarterly in Arotake and annually in the Annual Report

Financial

The Local Government (Financial Reporting and Prudence) Regulations 2014 identify seven benchmarks Council is required to report in the Annual Report. The purpose of these are to enable the assessment of whether the Council is prudently managing its revenues, expenses, assets, liabilities, and general dealings. The benchmarks are:

- Rates affordability benchmark

- Debt affordability benchmark

- Balanced budget benchmark

- Essential services benchmark

- Debt service benchmark

- Debt control benchmark

- Operations control benchmark

5. Levels of Service

Levels of service are the attributes that residents receive or experience through the delivery of Council’s activities. Attachment A shows the alignment of Council activities to the Community Outcomes for the 2021-2031 Long Term Plan.

The levels of service identified for each of the council activities and subsequent results are reported quarterly. In determining levels of service and performance measures, key attributes to be considered are:

- the alignment with strategic direction (how the activity contributes to the needs of the community),

- a customer focus, within council’s control.

6. Current Performance Framework

The current performance framework is based on the performance measures identified in the 2021 – 2031 Long Term Plan. These measures are Council’s levels of service, performance measures and targets as required by LGA 2002. Results are reported through Arotake (quarterly) and the Annual Report.

Currently, the three significant impact areas have plans in place and identified measures which are reported to Council on a regular basis. These plans and measures are in addition to the current LTP performance framework, with a narrative provided in both Arotake and the Annual Report to identify key achievements.

Various reports and briefings are held during the year to monitor progress against the various plans and initiatives that are scheduled. These not only provide progress updates but contain insights to inform decision making during the year e.g. Detailed Financial Briefing.

There is currently no formal monitoring and reporting on indicators of community wellbeing.

Alongside this there are internal planning and monitoring mechanisms in place. These are designed to assist teams and activity managers to manage their work programmes and takes the form of service plans for each activity. These plans identify key deliverables of the activity’s work programme and key metrics. The metrics are monitored through dashboards monthly.

6.1 Insight Monitoring and Reporting

The Insight Monitoring and Reporting tool is being developed to provide monthly financial results, and quarterly non-financial results.

The development of the financial component of the system is now completed and provides an online monthly overview of Council’s financial position. This tool is interactive and enables the user to access the financial information in a timely manner. It is aligned with Council’s current strategic framework and enables the user to monitor results for each activity. It will also provide background information which will assist in the decision-making process.

Phase Two, the non-financial component is in the development phase. It will also be aligned with the strategic framework and will report on the levels of service measures as identified in the 2021 – 2031 Long Term Plan. It is anticipated the development of this component will be completed later in 2023.

Phase Three is seeking to provide a tool that would allow ‘what if’ scenarios to be performed by the user. This would use the funding and balance sheet levers available to enable optimal outcomes for the community and region to be explored. This will commence on the completion of Phase Two.

7. Next Steps

Council activities will be aligned with the new strategic direction, once approved, and levels of service will be identified.

In addition, the development and alignment of a full performance monitoring framework will be undertaken. This framework will not be limited to just LTP requirements but will incorporate new initiatives e.g. the Joint Outcomes Bay of Plenty initiative and benchmarking. It will also include how we intend to monitor and report on the organisation’s performance.

Attachment 1 : Community outcomes and activities ⇩

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

10 May 2023 |

|

|

From: |

Mark Le Comte, Principal Advisor, Finance; Karlo Keogh, Senior Management Accountant; Olive McVicker, Corporate Performance Team Lead and Gillian Payne, Principal Advisor |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Budget Setting Process

1. Purpose

The purpose of this paper is to outline the high-level budget setting process for the Long-Term Plan (LTP) 2024-2034.

2. Guidance Sought from Councillors

This session will provide Councillors with an opportunity to ask questions about the budget setting process.

3. Budget Setting Process

Establishing financial estimates, right up to the final budget setting stage in adopting the Long Term Plan, is an iterative process that has three core components:

· Expenditure – the expenditure requirements to deliver the agreed levels of service to achieve the Community Outcomes. This is primarily an output of activity planning.

· Financing – amount of borrowing and reserve use required to pay for expenditure, investment income (including the Quayside Holdings Limited Dividend) and the key assumptions like inflation and interest rates. This is the application of the Financial Strategy to agreed expenditure and sets the funding requirement for each activity.

· Funding – the total revenue required and the level of rates and fee revenue. This is the application of the Revenue and Financing Policy to the agreed funding requirements.

Each of the three components are updated at various times during the LTP process, and changes are managed through defined ‘versions’, with appropriate version control as more or better information becomes known. These versions are financial estimates and are not budgets until approved in the LTP.

Changes to any of the three components affects the total result of the budget including how rates are apportioned across the region.

In practice, this requires an iterative approach in which each component is reviewed multiple times to achieve the most appropriate balance between delivering the Community Outcomes and affordability for the community.

4. Expenditure

Expenditure is set through the activity planning process. Each activity describes how it contributes to the Community Outcomes through defined levels of service and performance measures. The work required to deliver the service is then planned and costs estimated.

Some of the key documents produced are Activity Plans and Asset Management Plans. Councillors provide guidance through this process including:

· Agreeing the levels of service, performance measures, and targets.

· Agreeing the work required to deliver the service and considering options.

· Agreeing the estimated cost of the work.

5. Financing

Once the cost for each activity is estimated, the Finance team applies various budgeting rules set through the Financial Strategy. This includes:

· Applying inflation assumptions to expenditure estimates.

· Estimating investment income, including the Quayside Dividend.

· Applying borrowing and planning for interest and principal repayments.

· Defined use of reserves (which may include accumulating funds for the future).

Councillors have a key role in setting the overall financial rules through the Financial Strategy and other financial policies and setting the Statement of Expectations for Quayside Holdings Limited.

Council is required to set, and have audited, all significant forecasting assumptions as part of its Long-Term Plan. The main financial assumptions are inflation rates, interest rates, and the number of rating units. These assumptions are updated during the LTP process based on published data (forecasts from the Reserve Bank, Treasury, Local Government Funding Agency Limited and BERL) and independent expert advice. Multiple inflation rates are used for different types of service.

Initial discussion on the main available funding levers, including first estimates of potential amounts available and trade-offs, are included in the separate paper on the Financial Strategy.

6. Funding

The overall approach for the review of the Revenue and Financing Policy is discussed in a separate paper at this workshop. It is important to note that setting the funding sources is a two-step process.

The first step is based on a range of considerations for each activity which sets the hypothetical funding sources for each activity. The second step is consideration of the allocation of the overall liability for revenue, which requires applying the outputs of step one to the overall planned expenditure. The second step may result in changes to the modelled funding sources set in step one, to achieve a more appropriate overall result.

7. Draft Budget Versions and Next Steps

The following table outlines the draft budget versions that will be prepared as part of the LTP process, which meeting/workshop they will be presented at, and the expenditure/financing/funding updates that will be included in each version. Additional versions may be added if required.

This table highlights the pathway for a completed draft Long Term Plan, and all associated draft policies by December 2023 for external audit review.

|

Version |

LTP Workshop/Meeting |

Inclusions/Exclusions |

|

0 |

Internal process for building estimates |

Expenditure: Annual Plan 2023/24 baseline. Financing: Based on current Financial Strategy and updated inflation and interest rate assumptions. Funding: Based on current Revenue and Financing Policy. |

|

1 |

August - September workshops |

Expenditure: Updated activity plans and performance measures. Financing: Updated for Financial Strategy guidance received to date. Funding: Revenue requirements (Revenue and Financing Policy 101(3)a considerations). |

|

2 |

October - November workshops |

Expenditure: Direction from earlier workshops and finalising activity plans. Financing: Updated inflation and interest rate assumptions. Funding: Revenue and Financing Policy 101(3)b (affordability analysis and options). |

|

3 |

December Council meeting – draft LTP for Audit adoption meeting |

Pre-audited LTP financials to be endorsed by Council prior to commencement of the audit process.

|

|

4 |

February 2024 Council Meeting |

LTP financials updated as a result of the audit review process. Adoption of the audited LTP Consultation Document and supporting information. Adoption of Statement of Proposal for Revenue and Financing Policy (if any changes) |

|

5 |

May Meeting |

Funding and Financing: Changes in financial estimates arising from public submissions, (including on Revenue and Financing Policy) and updated inflation and interest assumptions. Expenditure: Changes in financial estimates arising from public submissions and Council deliberations. |

|

6 |

June Meeting |

Final Revenue and Financing Policy prepared for adoption. Final budget prepared for adoption. |

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

10 May 2023 |

|

|

From: |

Graeme Howard, Corporate Planning Lead; Mark Le Comte, Principal Advisor, Finance; Olive McVicker, Corporate Performance Team Lead and Kumaren Perumal, Chief Financial Officer |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Section 77 Applicability

1. Purpose

This report seeks to outline how council intends to give effect to the decision-making requirements set out in section 77, 78 and 79 of the Local Government Act (LGA) 2002 through the development of the Long term Plan (LTP).

2. Guidance Sought from Councillors

To note the contents of this report and provide any feedback to staff at the workshop.

3. Discussion

3.1 Background

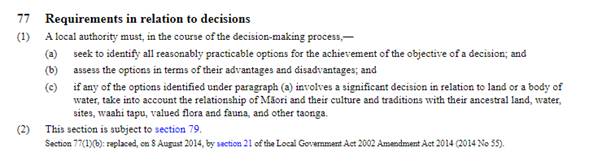

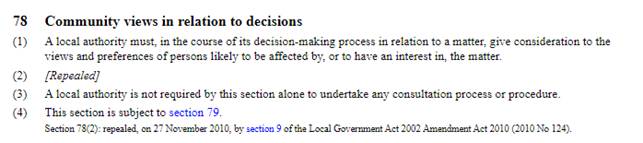

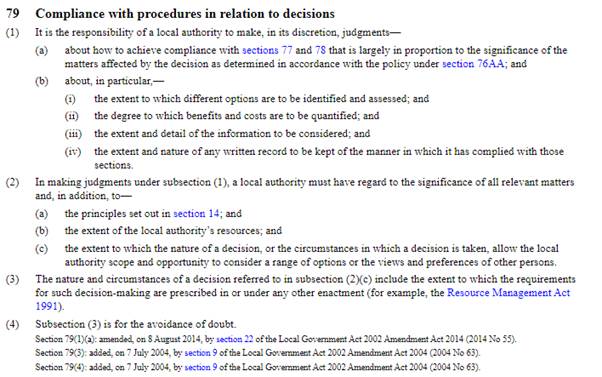

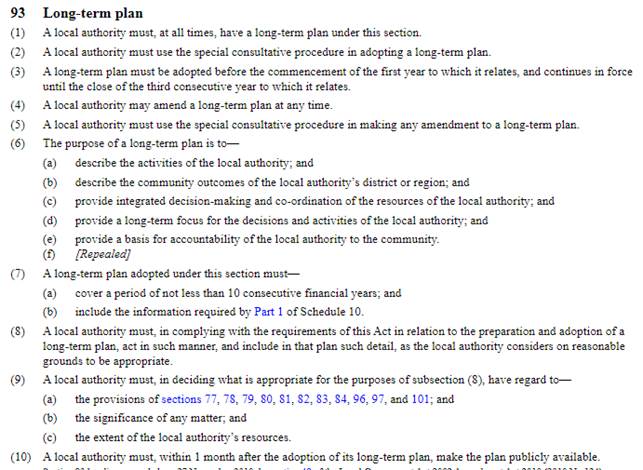

Decision making obligations for local authorities are set out in Part 6 - Planning, decision-making, and accountability of the LGA 2002. This report focuses on the interrelated sections 77, 78 and 79 within Part 6 in the context of the development of the Long Term Plan and follows a question raised at a recent LTP workshop on decision making under section 77 of the LGA 2002.

Relevant sections of the LGA 2002 are in Appendix 1, the full LGA 2002 is online at: https://www.legislation.govt.nz/act/public/2002/0084/latest/whole.html#DLM172319

3.1.1 LGA section 77 and 78

When making a decision, section 77 and 78 of the LGA requires local authorities to consider various options, impacts, views and preferences of persons likely to be affected by a decision. This includes:

- Seeking to identify and assess all reasonably practicable options for achieving the objective of a decision

- Where options involve a significant decision in relation to land or a body of water, take into account the relationship of Māori and their culture and traditions with their ancestral land, water, sites, waahi tapu, valued flora and fauna, and other taonga.

- Give consideration to the views and preferences of persons likely to be affected by or have an interest in the decision.

3.1.2 LGA section 79

Sections 77 and 78 are to be read together with section 79 of the LGA. Section 79 allows Council some discretion when considering how to comply with sections 77 and 78. In general the extent of the analysis required is proportional to the significance of the matters affected by the decision. Factors such as the nature of the decision and the resources available can be considered.

In other words, the more important the decision, the greater the extent to which various options, impacts, and community views should be analysed and considered. The principle in this approach is consistent with what is set out in Council’s Significance and Engagement Policy.

3.2 Long Term Plan development decision making

Decision making through the development of the LTP occurs at different levels, reflecting the broad nature of the LTP and the fact that it impacts on all areas of Council activity.

The LTP (and Annual Plan) sets out Council’s intentions for the period of the plan (section 96 (1) and (2) of the LGA) the LTP does not constitute a decision to act on any specific matter included within the plan. The decisions made in the LTP are for the purpose of budget appropriation, including setting revenue requirements. Decisions made outside of the LTP process, such as business case or procurement decisions, may involve more detailed options analysis including specifics of design solutions.

Council must include in the plan the level of detail that Council considers to be appropriate, section 93 (8). It is broadly up to Council to decide the level of analysis required within the context of Council’s decision-making process and policy framework.

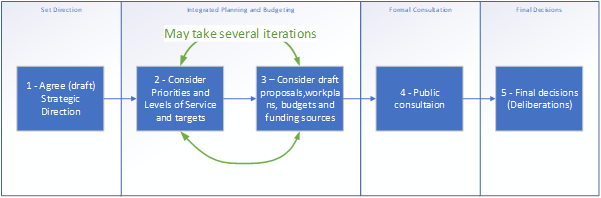

A simplified view of the LTP decision-making process is shown below. Steps 2-5 of this process in particular help give effect to the sections 77, 78 and 79 of the LGA.

3.2.1 Integrated Planning and budgeting (Steps 2 and 3)

Once Council confirms the draft Strategic Direction for the Long Term Plan, work is undertaken by staff and Councillors to turn this strategic direction (including high level direction in the Financial and Infrastructure Strategies) into a costed work programme for the LTP. This occurs through the steps below and relies on guidance and direction from Council via the planned series of Council LTP workshops:

1. Setting Levels of Service - Council provides direction around the Levels of Service that are intended to be delivered to the community to support delivery of Council’s strategic direction.

2. Develop costed work programme – staff develop costed Group of Activity work programmes to deliver on Council’s Strategic Direction and Levels of Service. This will include additional analysis and options assessment as required, usually more common for activity areas where significant change or investment is planned to meet desired levels of service, and where significant changes to funding options are being considered.

The options analysis in the LTP process needs to be sufficient for the purpose of setting a budget. It is not always possible or appropriate to analyse fully detailed options assessments for projects, for example, full design and detailed costs for capital projects (or transport networks, or community projects etc) may be made during the procurement decision process during implementation of the plan.

3. Councillors provide guidance on draft activity plans, options and funding.

This process also enables the development of a Consultation document that outlines the core components of the draft Long Term Plan, as well as key consultation topics or proposals on which Council seeks views from the community and people likely to be affected or interested, in line with requirements under s78 of the LGA.

3.2.2 Formal Consultation and Final Decisions (Steps 3 and 4)

Following a period of public consultation and considering submissions on the consultation document, Council will re-consider the key consultation topics and their options together with any other matters and make final decisions for the Long Term Plan.

3.3 Council liability if the Long Term Plan is not implemented

There is little relevant case law in this area, however it is difficult to see a context for how a person could bring a claim against Council to force Council to implement activities or projects in the LTP.

The LTP and Annual Plan indicate the local authority’s intentions, and do not constitute decisions to act on any specific matter within the plan. The local authority may make decisions inconsistent with its plans (subject to compliance with s 80). Pursuant to section 96 (4) of the LGA, the local authority cannot be forced to comply with its plans.

Public accountability for delivering the LTP is addressed through s98 if the LGA with the requirement to prepare and adopt an Annual Report for each financial year for the LTP or Annual Plan

3.4 Significance and Engagement Policy

Council’s Significance and Engagement Policy (SEP) sets out Council’s approach to identifying the significance of decisions and our broad approach to engaging with the community. The SEP also lists Council’s Strategic Assets.

The SEP is reviewed every three years with the timing aligned to the Long Term Plan development process. The current policy was adopted in 2017 as part of the LTP 2018 development, no changes were made to the policy during the LTP 2021-2031 review.

It is currently proposed to provide a report to the Strategy and Policy Workshop at the end of June on the review of the current SEP.

3.5 Matters outside Long Term Plan Process

The requirements of s77, s78 and s79 also apply to decisions taken outside the Long Term Plan process. To help meet the requirements, Council papers seeking decisions show:

· Assessment against Council’s Significance and Engagement Policy

· The alignment of the issue/decision with Council’s Strategic direction including Community Outcomes and Priorities.

· Analysis around options in relation to the decision, including the costs and benefits, at a level of detail proportionate to the significance of the decision

· The impact of the matter in relation to Māori, Climate Change and Community engagement.

· The financial impact of the options and decisions (if applicable)

4. Next Steps

Staff will incorporate any feedback on this paper into the LTP development process.

Appendix 1 – Sections of the LGA 2002 referenced in this report.

The below sections are copied from the Local Government Act 2002.

A full copy of the LGA 2002 is available at:

https://www.legislation.govt.nz/act/public/2002/0084/latest/whole.html#DLM172319

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

10 May 2023 |

|

|

From: |

Gillian Payne, Principal Advisor and Kumaren Perumal, Chief Financial Officer |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Delivering Better Outcomes Jointly and Collaboratively in the Bay of Plenty

1. Purpose

This report provides an update on the approach being taken through the development of the Long Term Plan to support more collaboration and joined up delivery of outcomes with partner organisations and stakeholders.

The approach and methodology has been developed and shared with staff of other councils in the region, and it is currently known as ‘Joint Outcomes Bay of Plenty’ (JOBOP).

2. Guidance Sought from Councillors

This report provides Councillors the opportunity to understand the progress and direction of the project so far, provide feedback and ask questions.

3. Discussion

3.1 Opportunities identified

During the development of their Long Term Plans (LTP) councils identify community outcomes that will promote the present and future social, economic, environmental and cultural wellbeing of their district or region.

Often these outcomes overlap, complement or support outcomes being sought by neighbouring or similar councils and there are opportunities to work together for mutual benefit. In addition, some activities delivered by territorial local authorities produce benefits that extend well beyond their boundaries and help neighbouring councils achieve their outcomes too.

Previous collaboration opportunities have been pursued through a variety of channels, including joint ownership and cost-sharing agreements, shared services, and cross-council funding grants. These tools remain valid options for councils to consider and JOBOP is not expected to replace them.

JOBOP is a complementary approach that focuses on demonstrating to communities the value of collaboration, and would compare the expected outcomes of joint projects to what could otherwise be achieved working separately and individually.

Where successful voluntary collaboration is demonstrated, it is more likely that other funders, including central government and charitable trusts, will join local authorities to help fund initiatives.

The JOBOP project also provides an opportunity to collaborate in ways that will likely be necessary to implement Spatial Plans in future. Through JOBOP, Bay of Plenty local authorities can strengthen relationships and pilot processes in anticipation of future change.

3.2 Co-design with other councils

It is recognised that for JOBOP to be successful, the approach needs to be shared and promoted but the framework and processes must be designed collaboratively to gain buy-in and ensure the initiative meets the needs of those with an opportunity to take part.

A document has been prepared to facilitate discussion with other councils. It includes a table outlining the scope and some key features:

|

Joint Outcomes BOP: |

|

|

What it is: |

What it is not: |

|

R Voluntary collaboration toward common goals R Maintains individually identified priorities R Opportunity for co-design innovation R Opportunity to optimise collective resources R Opportunity to leverage/increase funding from central government and other funding sources. |

§ Not a top-down centralised directive § No onerous reporting requirements § No mandatory requirements. |

The proposed approach recognises that each council has its own jurisdiction over it’s own strategic framework that defines community outcomes and priorities.

Where these outcomes may overlap or complement each other, discussion on joint outcomes can occur. This could mean any combination of two or more councils may benefit from working together for their respective communities. The diagram below illustrates this:

Staff across councils with responsibility for LTP processes will identify common outcomes that two or more councils are seeking and look for practicable and feasible ways to collaborate on programmes or projects that are recognised by the respective councils as important contributors to their common outcomes[1].

Details of collaboration would then be worked through, and approval would follow the normal processes for approving projects and funding through the development of LTPs or Annual Plans within each council.

Part of the co-design work with the councils will involve coming to a common understanding of:

· how to measure and communicate the benefits of the joint projects collectively to the region without undermining individual councils’ accountability

· how to work together without creating the need for cumbersome additional decision-making layers and processes

· how to avoid complicating the development of LTPs, and annual plans and the audit of annual reports, particularly with respect to performance targets and measures.

3.3 Progress to date

Introductory meetings have been held between the CFOs and leaders of the LTP processes across the region and there is strong interest at staff level from all councils in developing the approach further. In promoting the concept, Council staff recognise the uncertainty and additional workload that recent changes to the Three Waters Reform programme may create for our potential partner councils.

It is recognised that without endorsement and support from elected members across the region, the staff at each council will not have a mandate to work on the JOBOP initiative. It is also recognised that other partners, not limited to the initial TLAs, would be included in a wider and deeper approach to delivering outcomes for our communities.

4. Next Steps

A plan is being developed to brief all elected members across the region and seek buy-in and support because this approach could be visible throughout the LTP process at each council.

Concurrently, further staff engagement through existing contact forums is planned, as well as a collective meeting of the staff ‘champions’ (e.g. CFOs) in each council.

This would be followed by individual meetings with the Region’s councils to identify and understand project and opportunity details. The timing of this phase would depend on the timetables for each council’s Long Term Plan development, both relating to outcomes setting, and later identification of projects and initiatives.

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

10 May 2023 |

|

|

From: |

Mark Le Comte, Principal Advisor, Finance; Kumaren Perumal, Chief Financial Officer; Gillian Payne, Principal Advisor and Karlo Keogh, Senior Management Accountant |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Financial Strategy - Funding Levers

1. Purpose

The purpose of this paper is to outline the macro funding options available to Councillors during this Long Term Plan (LTP). Figures in this paper are early estimates and subject to revision of interest rate assumptions, inflation, investment returns and financial estimates through the LTP process.

2. Guidance Sought from Councillors

As this is an information session, Councillors are able to ask questions and/or raise any matters regarding the current funding approaches. Any feedback will be incorporated into upcoming information as part of future LTP Financial Strategy workshops.

3. Background

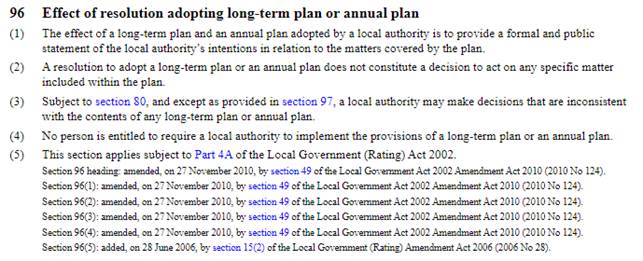

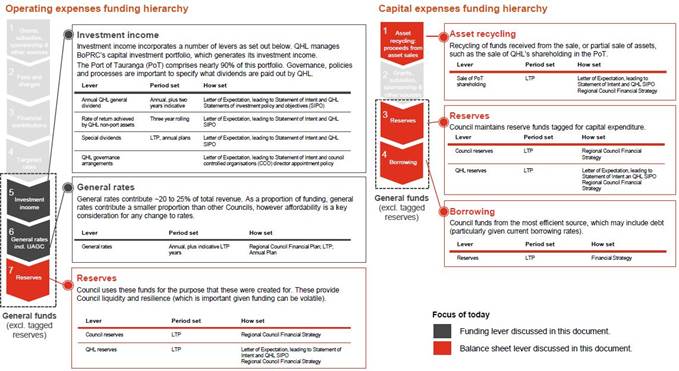

The Financial Framework Review (FFR) was completed as a key part of LTP 2021-2031. The FFR informed the development of the Financial Strategy and Financial Policies. The FFR developed several conceptual models including the funding levers and implications of changing settings, as a way to visualise the financial implications and trade-off decisions, shown in Figure 1 on the next page. For example (all else being equal) a decrease in the QHL dividend requirement would lead to an increase in general rates and increased QHL growth in non-port assets.

In addition, funding hierarchies were set that outlined the order in which funding sources for operational expenditure and capital expenditure would be considered. These hierarchies were used in the Financial Strategy and Revenue and Financing Policy and are shown in Figure 2 on the next page. In general, these funding hierarchies focuses on the beneficiary/exacerbator principle and may be reconsidered through the development of the Revenue and Financing Policy and consideration of the funding considerations in the Local Government Act s101(3).

Figure

1: Funding Levers Diagram

Figure 2: Funding Hierarchies

4. Financial Resilience

Council has a range of financial levers that can be applied to fund its work or to accumulate funds for future work. Each of these financial levers influence the overall financial position in different ways where the settings for a combination of applied levers may need to be adjusted to achieve the desired overall result. For example:

· To fund the cost to respond to an emergency Council could choose to:

o Borrow to fund immediate costs

o Pursue insurance recoveries or government funding to repay borrowings

o Use insurance proceeds to repay borrowing to the extent possible

o Reset rates and other revenue sources to achieve a revised balanced budget.

· To reduce a targeted rate that is considered unaffordable Council could choose to:

o Consider lengthening the time over which loans are repaid

o Alter fees and charges/targeted rate/general rate funding proportions or basis for allocating rates through the Revenue and Financing Policy

o Consider the use of reserves to smooth cost changes across activities

o Discuss dividend forecasts with Quayside

o Review/reduce the level of service and expenditure level.

As the LTP is developed, financial estimates will become more detailed and supported by assumptions and the best available information at the time. As a result, the need to review the settings for each financial lever over the course of this process is required as new or updated information becomes available. When considering the settings of each financial lever (e.g. increasing borrowing or changing rates allocations) through the LTP process, Council should consider the amount of financial headroom to be retained for financial resilience to respond to future challenges.

5. Funding Levers

The estimated level of financial resilience available through some of the main funding levers is outlined below. These estimates are preliminary at this stage and subject to revision through the LTP process.

5.1 Rates

Council has key decisions to make over the Long Term Plan about the total amount of rates to be collected and the overall distribution of rates across the community.

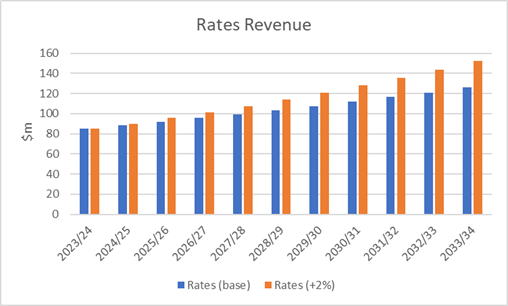

Over the ten years of LTP 2024-2034, Council is estimated to collect around $1 billion in rates revenue. This estimate is based on $85 million of rates revenue in 2023/24 and an assumed increase of 4% per annum, which reflects long term estimates of inflation and growth.

If Council decides it needs to collect more rates over time, the cumulative impact of small annual percentage increases compounds. For example, an additional 2% increase per annum leads to approximately $125 million over ten years. The extra revenue increase is gradual, with approximately $10 million extra in total over the first three years, $30 million the following three years and $85 million in the final four years.

Figure 3 – Rates

Rates are factored into financial prudence limits[2] and also impact borrowing capacity and our credit rating.

5.2 Borrowing Capacity

Council’s borrowing capacity is governed by financial limits set by Council in its financial strategy and borrowing covenants. The main limit used by Council and the Local Government Funding Agency (LGFA) is the net debt to income ratio.

Council’s borrowing limit is based on net debt, which is gross borrowing less liquid investments. Council currently has more investments than borrowing and therefore has negative net debt.

This position is forecast to change over time due to the timing of revenue and expenditure.

Council could take on new borrowing of approximately $400 million now, and a further $200 million as income increases over the next ten years. Borrowing and on-lending to Quayside is not counted as net debt, which means future on-lending for Rangiuru Business Park would not reduce Council’s ability to borrow from the LGFA.

The borrowing capacity estimate is a theoretical maximum and, at this stage, implications of changes to credit ratings have not been factored into analysis as a limit.

5.3 Regional Fund and Toi Moana Trust

Council’s two main reserves that are available for general use are the Regional Fund (RF) and Toi Moana Trust (TMT).

The balance of the RF has decreased over time as current withdrawals are greater than deposits. The RF is forecast to receive approximately $6 million of deposits per annum, totalling $60 million over the next 10 years.

The current commitments under the RF are mainly one-off expenditure items over the next few years (e.g. Ōpōtiki Harbour, Rotorua Museum) and rates smoothing decisions through LTP 2021-2031 (e.g. using the RF to reduce general rates). The RF will begin to replenish following the last of these major withdrawals against the fund.

Council has invested $70 million in TMT. The target for this investment is to return 5% annual dividend to council and maintain the original $70 million investment value.

The use RF and TMT reserves under Council’s financial strategy will consider the sustainability and use of these reserves.

5.4 Quayside Holdings Limited non-port assets

Quayside Holdings Limited’s (Quayside) non-port assets provide cash revenue and capital growth. Council could consider whether the current balance between current dividend payments, future dividend growth and asset values are still appropriate.

Future work exploring scenarios will need to be completed in partnership with Quayside to understand the Group implications. A wider consideration of investment risk and portfolio management implications should also be considered.

6. Next Steps

The Financial Strategy will be discussed further at the 14 June 2023 Risk and Assurance Committee LTP workshop.

This workshop will focus on the reviewing the principles of the current Financial Strategy, the purpose and use of reserve fund, and any other major financial factors that will impact on the development of the Financial Strategy.

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

10 May 2023 |

|

|

From: |

Gillian Payne, Principal Advisor; Kumaren Perumal, Chief Financial Officer and Mark Le Comte, Principal Advisor, Finance |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Review of Revenue and Financing Policy

1. Purpose

The Revenue and Financing Policy (RFP) sets the funding sources for each council activity, including targeted rates, general rates, dividends, and fees and charges.

Through the process of developing the Long Term Plan 2024 – 2034 all activities and their funding and financing arrangements will need to be reviewed, assessed, and ultimately set.

Councillors have at previous workshops and briefings expressed a desire to review current settings and examine, for example, whether the amount of some targeted rates is equitable and appropriate, considering both the current and future direction for Council’s activities.

Various stakeholder submissions to previous Regional Council Long Term Plans have also highlighted areas that Council could consider as part of a detailed review of funding and financing.

This report provides an overview of the process, considerations, and decision-making steps to follow if Council were to make material changes to its RFP. It builds on a previous report presented at the LTP workshop on 12 April 2023 outlining the role and connectedness of the RFP to the Financial Strategy and other policies.

2. Context

Our communities are facing significant issues including the long tail impacts of Covid-19 and the rising costs of living, which means that previously sensitive and contentious issues like equity, and the affordability of the level of rates that the Council set, are again likely to be key topics.

Coupled with these challenges, the Local Government sector is facing large scale legislative reform and continued financial pressures in funding its activities. One of the biggest challenges is the additional work required to mitigate the impacts of, and adaptation to, climate change. This work involves significant capital works to adapt our flood protection and control infrastructure to cope with the predicted change in weather patterns and flooding events.

Another example is the importance of providing a comprehensive regional public transport network and services as an important tool in reducing carbon emissions in our region. The national, and local balance of funding options for transport services and carbon reduction has changed significantly in recent times, and since the current LTP (and Regional Land Transport Plan) was prepared and adopted.

While there are funding streams currently available from Central Government to assist Councils with these fiscal challenges, it’s important to note that funding is uncertain, often has conditions attached, and cannot always be relied upon. It is therefore prudent for Council to ensure that to deliver core responsibilities and services the funding mechanisms available under the Local Government Act 2002 are optimised.

The recent flooding events caused by Cyclone Gabrielle have highlighted that when this type of disaster occurs, the whole community feels the impacts, not only those people and properties that are flooded. The impacts on infrastructure and the region’s economy as a whole can be significant. Current indications are that in the Hawkes’s Bay the effects of the damage caused to crops has led to the cost of fruit and vegetables nationwide significantly increasing due to the impact on supply.

In the Bay of Plenty the impacts of this and other significant weather events have also been broader and effected the wider community and economy because of the impact of damage to critical infrastructure like rail and roads.

Within this context the review of the Revenue and Financing Policy will include a detailed and analytical review of policy options and settings to ensure the provisions of sections 101-103 of the Local Government Act 2002 are followed and applied appropriately.

3. Guidance Sought from Councillors

This session will provide Councillors with an opportunity to ask questions about the process for reviewing the RFP, including the required considerations, sources of information, process risks and their mitigation.

It is also an opportunity to identify any topics Councillors wish to be included in the scope of the review.

4. Discussion

4.1 Legislative and policy framework

Two key Council financial policies and the Local Government (Rating) Act 2002 (LGRA) determine how Council’s activities are funded, and ultimately who pays and how much.

Council’s RFP determines how activities should be funded (e.g. through borrowing, fees, rates etc), who should be charged and how that is calculated. The Rates Remission and Postponement Policy determines the circumstances in which relief from any rates liabilities may be applied, either by reducing the rates due, or postponing them. LGRA exempts or reduces some categories of properties from paying rates (Schedule 1) and prescribes tools Council can use when collecting rates from properties that are liable (Schedules 2 and 3).

4.2 Review process for the RFP

In determining the sources of funding for its activities, the legislation requires Council to undertake a sequential two-step process. Changes to the Local Government Act 2002 (LGA) in 2021 also require that the RFP supports the principles set out in the Preamble to the Te Ture Whenua Māori Act 1993[3] (TTWMA).

The sequential steps, set out in the LG Act, will be followed to ensure good process. This will include providing information at workshops to seek direction for the next or subsequent workshops including the outputs of each step.

Sequential Steps from the LGA Section 101 (Financial management)

(1) A local authority must manage its revenues, expenses, assets, liabilities, investments, and general financial dealings prudently and in a manner that promotes the current and future interests of the community.

(2) A local authority must make adequate and effective provision in its long-term plan and in its annual plan (where applicable) to meet the expenditure needs of the local authority identified in that long-term plan and annual plan.

(3) The funding needs of the local authority must be met from those sources that the local authority determines to be appropriate, following consideration of,

(a) in relation to each activity to be funded,

(i) the community outcomes to which the activity primarily contributes; and

(ii) the distribution of benefits between the community as a whole, any identifiable part of the community, and individuals; and

(iii) the period in or over which those benefits are expected to occur; and

(iv) the extent to which the actions or inaction of particular individuals or a group contribute to the need to undertake the activity; and

(v) the costs and benefits, including consequences for transparency and accountability, of funding the activity distinctly from other activities; and

It is at this stage that it will be appropriate to consider how the first step distribution of rates liability supports the principles set out in the TTWMA.

Process

The process requires an absence of pre-determination through the sequence of steps taken and conclusions reached. The staff process is designed to minimise the risk of a successful legal challenge for this important and impactful policy.

In developing Council’s existing RFP (adopted in 2021), the detail of step one was published as Council’s Funding Needs Assessment (Attachment 1). Step two, together with overall funding principles and resulting allocation of funding sources, is documented in the RFP itself (Attachment 2).

The RFP must be published as part of the LTP, and it must be adopted before the LTP. Consultation on a new or revised RFP can take place concurrently with consultation on the LTP, but the Statement of Proposal for the RFP must be adopted before the LTP consultation document is adopted. The LTP consultation document would use the proposed funding sources in the Statement of Proposal for the RFP to explain the financial impact of any identified issues.

4.3 Step one - assessment by Activity

Council currently has 19 Activities; following the approval of the 2024 – 2034 LTP strategic direction, this number may change. Each Activity requires separate consideration for step one of the processes.

Council is not required to give any specified weight to each matter listed in 4.2 above. To inform Council’s considerations, staff will provide information on each activity accordingly.

4.3.1 Inputs and data sources to inform activity assessment

The following information will be used to inform the analysis for each activity:

|

Information |

Source of information |

|

|

Activity outcomes

(for updated set of activities if changed) |

Broad scope of the activity and what it aims to achieve or deliver.

Recognition of significant changes, since the last review, to the purpose of the activity |

LTP 2024-2034 strategic framework, draft priorities, draft strategic asset management plans. RPTP - strategic direction for public transport Any legislative requirements (if they are driving the activity) |

|

Amount and type of funding sought for the activity.

Period over which benefits will occur |

Scale and purpose of the expected expenditure over medium term (aligning to the expected life of the RFP). Balance between capital and operational expenditure. |

LTP 2021-2031, supplemented with material changes proposed for 2024-2034 Updated asset management plans. |

|

Benefits distribution

(between the community as a whole and any identifiable part of the community) |

Assessments of the distribution and timing of benefits

Extent to which beneficiaries can be separately identified

Drivers for significant new project proposals. |

Staff estimates of benefit distribution

Asset management plans

Business cases for proposals relating to future expenditure. |

|

Whose actions or inactions create the need for expenditure |

Drivers for significant new project proposals Extent to which exacerbators can be separately identified. |

Business cases for significant proposals relating to future expenditure Staff assessment.

|

|

Costs and benefits of funding the activity separately |

|

Staff assessments of practicality, and feasibility in terms of legislation. |

4.3.2 Decisions by activity

The Councillor direction to staff on the step one considerations above will enable staff to prepare information for step two.

For further context, LGA 2002 Section 103 specifically relates to the Revenue and Financing Policy. This part sets out the sources of funding available to Council when setting its policy for each Activity:

(a) the local authority’s policies in respect of the funding of operating expenses from the sources listed in subsection (2); and

(b) the local authority’s policies in respect of the funding of capital expenditure from the sources listed in subsection (2).

(2) The sources referred to are as follows:

(a) general rates, including—

(i) choice of valuation system; and

(ii) differential rating; and

(iii) uniform annual general charges:

(b) targeted rates:

(ba) lump sum contributions:

(c) fees and charges:

(d) interest and dividends from investments:

(e) borrowing:

(f) proceeds from asset sales:

(g) development contributions:

(h) financial contributions under the Resource Management Act 1991:

(i) grants and subsidies:

(ia) regional fuel taxes under the Land Transport Management Act 2003:

(j) any other source.

Modelling and estimating the revenue derived from each source, and the impact on the community and customers, will require establishing a realistic and practicable range for each of these distinct sources of funding. This requires an understanding of current and future flexibility, and the trade-off relationships between sources that could fund the same activity. This will be modelled, and scenarios provided at future workshops for councillor direction.

4.4 Step two - overall assessment

This part addresses Section 101 (3) (b) – the overall impact of any allocation of liability for revenue needs on the current and future social, economic, environmental, and cultural well-being of the community.

For the overall assessment, staff will prepare information that reflects the step one rating allocations, applied to the (in progress) draft LTP budget decisions, including all expenditure and all funding sources.

At this point, consideration should also take account of existing and proposed rates relief tools that are also under review.

4.4.1 Inputs and data sources for overall consideration

The following information will inform the overall assessment:

|

Information |

Source of information |

||

|

Position of Māori landowners |

|||

|

To what extent does distribution of liability for revenue (rates, fees and charges, user fees etc) strengthen the position of Māori landowners to retain ownership of the land and to use the land for the benefit of themselves, their whānau, and their hapū? |

Modelling of distribution of rates on Māori Land

Complementary policy levers that can mitigate the negative effects (e.g. rates remission and postponement policies) and further rates modelling and analysis after applying complementary policies;

|

Rates modelling on Māori Land Impact of proposed Rates Remission and Postponement Policy (under concurrent review).

|

|

|

Current and future wellbeing |

|||

|

Equity (including affordability) of the distribution

|

Modelling of distribution of rates.

Analysis of any known community about the impact that the proposed distribution would have on well-being, behaviour, actions and any unforeseen consequences. |

Rates modelling Proposed Rates Remission and Postponement Policy (under concurrent review).

|

|

|

Balance between current and future ratepayers

|

|||

|

Environmental, cultural, economic, and social impacts /consequences

|

|||

5. Next Steps

Following this workshop, staff will update the detailed project plan and continue the review process.

Attachment 1 - Funding Needs Analysis 2021 ⇩

Attachment 2 - Revenue and Financing Policy 2021 ⇩

[1] This is different to one council proceeding with a project independently by identifying residents beyond their boundary that they believe receive a benefit and should help fund it.

[2] Council is required to include Financial Prudence limits in the Long Term Plan, including benchmarks rates affordability, debt affordability and debt servicing. These benchmarks will be reviewed as part of upcoming Financial Strategy discussions.