|

Regional Council Long Term Plan Workshop Pack

DATE: Wednesday 12 April 2023 COMMENCING AT TIME: 09:30 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga and via Zoom (Audio Visual Meeting)

|

|

Regional Council Long Term Plan Workshop Pack

DATE: Wednesday 12 April 2023 COMMENCING AT TIME: 09:30 am VENUE: Council Chambers, Regional House, 1 Elizabeth Street, Tauranga and via Zoom (Audio Visual Meeting)

|

Informal Workshop Papers

1 Overview 1

Attachment 1 - LTP Process Flowchart 1

2 Strategic Direction Setting - Long Term Plan 2024-2034 1

Attachment 1 - Strategic Direction (Draft 10) 1

Attachment 2 - Strategic Direction (Draft 9B) 1

3 Financial Strategy and Policies 1

4 Review of Rates Remission and Postponement Policy 1

Attachment 1 - Summary of Rates Remission Policy Coverage BOP 1

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

12 April 2023 |

|

|

From: |

Kumaren Perumal, Chief Financial Officer and Olive McVicker, Corporate Performance Team Lead |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Overview

1. Purpose

To provide Councillors with the context for this workshop and provide a high-level outline for the 2024 – 2034 Long Term Plan (LTP) process.

2. Guidance Sought from Councillors

To note the context within which the strategic framework will guide the development of the LTP. Guidance is required for the development of the Financial Strategy and the review of the Rates Remission and Postponement Policy.

3. This Workshop

This workshop has four distinct sections:

1. Introduction and overview of LTP components

2. Strategic Framework confirmation

3. LTP process overview is provided in Attachment 1. The purpose of this document is to inform Councillors of the LTP development process and highlight key decision points.

4. Strategy and Policy Reviews

a. Financial Strategy and Policies

i. An outline of strategic financial matters to be considered through the LTP process.

ii. The proposed review process for the Financial Strategy and Polices, including input from the Risk and Assurance Committee.

iii. A brief overview of legislative requirements.

b. Review of Rates Remission and Postponement Policy

i. Background information and strategic context

ii. Proposed review process and timetable.

Guidance provided at today’s workshop will be used to inform the reviews of the Financial Strategy and Policies planned for future Council and Risk and Assurance Committee workshops.

Attachment 1 - LTP process flowchart ⇩

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

12 April 2023 |

|

|

From: |

Fiona McTavish, Chief Executive |

|

|

|

Fiona McTavish, Chief Executive |

|

Strategic Direction Setting - Long Term Plan 2024-2034

1. Introduction

After the start of the new triennium of Council following the 2022 local body elections, councillors undertook an environmental scan and began preparatory work to work towards reviewing the current Bay of Plenty Regional Council Strategy Framework set within the context of the 2021-2031 Long Term Plan.

As a consequence of this early work there have been two Strategy and Policy Committee workshops in March 2023, facilitated by Anne Pattillo, that have provided direction and feedback from councillors on developing the future Strategic Direction for the Bay of Plenty Regional Council.

2. Strategic Direction

At the conclusion of the second workshop staff have continued to work with Councillors Thompson and Macmillan to prepare a draft one-page Strategic Direction document for Councillors to consider and refine at this LTP 2024-2034 workshop.

Attached at Appendix 1 is a draft of the Strategic Direction document for councillors to consider and discuss.

3. Outcomes, Objectives, and Goals

The latest draft of the Strategic Direction identifies broad Outcomes, with draft Goals being defined to provide a fuller explanation of what is trying to be achieved.

Tasks/Projects, Measures (with targets), and draft Activity Service Levels will be subsequently worked up to present to future workshops. The setting and prioritisation of these elements of the Long Term Plan will be assessed for deliverability and affordability.

4. Guidance Sought from Councillors

1. Councillors are requested to note the work so far to complete a Strategic Direction for the preparation of the 2024 – 2034 Long Term Plan.

2. Councillors are requested to discuss and give direction on the current draft Strategic Direction.

5. Next Steps

Following direction at the workshop, staff will prepare a fully worked up version of a Strategic Direction document for consideration and approval at a future Council meeting.

This document will be in a format that facilitates community and stakeholder engagement and have the look and feel of the Waikato Regional Council style of document.

Attachment 1 - Strategic Direction (Draft 10) ⇩

Attachment 2 - Strategic Direction (Draft 9B) ⇩

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

12 April 2023 |

|

|

From: |

Mark Le Comte, Principal Advisor, Finance; Gillian Payne, Principal Advisor and Kumaren Perumal, Chief Financial Officer |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Financial Strategy and Policies

1. Purpose

The purpose of this paper is to outline the legislative requirements for the Financial Strategy and the various financial policies required for the Long-Term Plan, the inter-relationships between these, and the intended process for their review.

This workshop discussion will allow elected members to become familiar with key policy elements and the approach for each policy review. The setting of any financial policy components will be discussed at future workshops. At this stage of the Long-Term Plan (LTP) 2024-2034 process, it is important to keep financial strategy discussions focussed on broad issues because developing detail of individual policies too early can risk constraining effective identification of strategic options and analysis.

Councillor identification of key issues/concerns to be considered over the policy review process is welcomed.

2. Guidance Sought from Councillors

Guidance is sought from Councillors on:

2. The proposed review process.

3. Financial Planning

In broad terms, the purpose of the Long-Term Plan is to:

1. Describe the community outcomes for the region and describes the activities that Council intends to deliver. “What we aim to achieve”.

2. Provide a process that enables integrated decision making, co-ordination of resources, and a long-term focus for decisions. “What we are going to do” and “How is the work paid for”.

3. Provides a basis for accountability to the community. “How do we engage with the community and demonstrate how we meet their expectations”.

In practice, developing the Long-Term Plan requires several iterations as trade-offs are made between “What we are going to do” and “How is the work paid for”.

The Financial Strategy and the various financial policies set the guidelines for “How is the work paid for”. It is important to note that these policies are not purely driven by consideration of principles, but also must consider the overall impact of revenue needs on the current and future well-being of the community.

Consideration of “What we are going to do” is covered through activity planning, levels of service and performance measures, budget proposals, asset management plans and the Infrastructure Strategy.

4. What we have heard so far

Councillors have already raised several financial policy matters at meetings and workshops to date. Each of these matters may impact on multiple financial policies. The main recurring comments and the policies they could affect are listed below.

|

Comment |

Affected Policies |

|

Are rates affordable in the current cost of living environment |

Financial Strategy Revenue and Financing Policy Prudential Limits – i.e. rates increase limit Rates Remission and Postponement Forecasting Assumptions |

|

Rate increases need to be communicated simply and consistently (real vs nominal rates increases). |

Financial Strategy Prudential Limits – i.e. use of inflation and rate increase percentage trends

|

|

Concern whether some targeted rates are fair and equitable, and represent the purpose of the activity |

Revenue and Financing Policy Rates Remission and Postponement |

|

Cost efficiency is important (zero based budgeting?), need to demonstrably deliver value for ratepayer money |

Performance Framework Activity Planning |

|

Concern that inflation is eroding the value of reserves |

Financial Strategy Reserves Definitions Forecasting Assumptions |

|

The level of reserve use to support operating costs is unsustainable (reserve use is greater than reserve replenishment). |

Balanced Budget Financial Strategy Revenue and Financing Policy Reserves Definitions |

|

Concern whether Council, and therefore the community, can afford the impacts of climate change and increased frequency of severe weather |

Balanced Budget Financial Strategy Infrastructure Strategy Revenue and Financing Policy Quayside Statement of Intent |

|

Increasing borrowing costs and concern for long term sustainability of borrowings |

Financial Strategy Revenue and Financing Policy Reserves Definitions Treasury Policy |

|

The role of Quayside Holdings Limited and the appropriate level of dividend to Council |

Financial Strategy Quayside Distribution Policy Quayside Holdings limited Statement of Intent |

During the development of the Long-Term Plan, Councillors are encouraged to raise financial matters as they arise as this helps staff understand the factors that are important to Councillors and their constituents. At times, there will be a sequence in addressing comments as the policies that are impacted may need to be reviewed in a certain order. Staff may also need to conduct further research.

5. Review Process

Staff intend to use a ‘strategy led’ approach to reviewing the financial policies, rather than a ‘legislation led’ approach.

The strategy led approach is focussed on understanding the strategic context and key issues and then incorporating those into all appropriate policy reviews.

In this approach, legislative compliance is an important consideration but does not constrain thinking. This approach is more likely to result in major changes to policy settings.

In contrast, the legislation led approach is focussed on the legislative requirements for each policy and ensuring each requirement is met. The risk of this approach is that it can limit thinking to considering only the legislative requirements and requires an understanding of how all of the policies inter-relate to effectively address issues.

For example, rates affordability can be affected by multiple policies which have a cumulative impact. For example, the Revenue and Financing Policy sets the funding sources for each activity, but affordability will also be impacted by Treasury Policy considerations like loan repayments and reserve use, and by the Rates Remissions and Postponement Policy. In general, each of the financial policies will be addressed using the following key steps:

1. Understanding the current environment, key issues and relationship to the Strategic Framework set by Council for the LTP 2024-2034

2. Defining principles for each review

3. Testing the intended approach will meet legislative requirements

4. Investigating options, modelling impacts and checking for any unintended consequences

5. Checking overall impacts from the policy change including any considerations that impact on other policies (iterate as required)

The intended approach for the reviews is likely to require a substantial amount of analysis. Guidance from Audit New Zealand, and the practice of many councils is to involve the Risk and Assurance Committee (or similar committee) with reviews of financial policies, with Council being the final decision maker. In addition the independent member of the Risk and Assurance Committee of several Councils, could add substantial value to the discussions.

It is proposed that staff will programme full financial strategy and policy discussions at Risk and Assurance Committee workshops before taking recommendations to Council. Any Councillor may attend the Risk and Assurance Committee workshops.

6. Focus for next workshops

The upcoming financial strategy discussions are being designed to focus discussions on understanding the current state and key issues and commence defining key principles. These discussions will be centred on issues that are key drivers for the Financial Strategy and for rates affordability leading to the development of the Revenue and Financing Policy and Rates Remissions and Postponement Policy.

It is intended to progress these via future Council LTP workshops and a Risk and Assurance workshop on 14 June.

The 3 May Council workshop will include a presentation outlining the history of Māori Freehold Land as background to the Rates Remissions and Postponement Policy.

A Council workshop on 25 May (following Annual Plan deliberations) will focus on the Rates Remissions and Postponement Policy including:

· Principles/objectives

· TLA reasons for current remissions and identify properties that may be significantly affected by change (depending on availability)

· Confirm the engagement approach for remissions on General Land

· Update progress on engagement with Māori Freehold landowners

The 14 June Risk and Assurance Committee Workshop is intended to focus on major areas of the Financial Strategy and rates affordability/sustainability/resilience. The results of this workshop will be summarised for the August LTP workshop.

The Financial Strategy discussion is intended to include:

· Reviewing the financial principles, estimates and limits set in LTP 2021-2031 Financial Strategy.

· Comparing actual financial results with the LTP2021-2031 estimates.

· An outline of the financial levers and estimates of the amount of funding that could be available if required

· Comparing and assessing the current financial principles against the new draft Strategic Framework.

· Refining key topics to be addressed

· Reserve Funds including

o List of funds

o The current defined use for each fund

o Inflation and investment impacts on funds

o Key issues and principles for review

The rates affordability discussion is intended to include:

· Equity and sustainability/resilience impacts of general rates and targeted rates

· The potential for a sector wide review of rates issues, with a focus on flood mitigation/response, transport and environmental improvements.

· How to appropriately incorporate the current and future wellbeing of the community into revenue/liability/investment decisions.

7. Local Government Act Requirements

This paper provides a brief outline of the various financial management requirements and financial policies required by the Local Government Act 2002 (LGA). Limited extracts from the LGA have been included, and fuller explanations will be given at the appropriate workshops. These sections are provided for background information and are not intended to be discussed in detail at this workshop given the proposed ‘strategy led’ approach to the review of financial policies.

7.1 Balanced Budget Requirement

S100 (1) of the LGA sets the requirement for councils to have a balanced budget. However, S100 (2) allows councils to set an unbalanced budget if the council resolves that it is financially prudent to do so, following consideration of a range of factors.

If the budget is not balanced, the Long-Term Plan must include a statement explaining the reasons for the decision and any implications. Council does not currently have a balanced budget and is using reserves to fund a range of operating costs.

A high-level assessment of the available funding levers will be prepared for the May LTP workshop and updated regularly throughout the LTP process.

7.2 Financial Prudence

S101 of the LGA specifies that:

(1) A local authority must manage its revenues, expenses, assets, liabilities, investments, and general financial dealings prudently and in a manner that promotes the current and future interests of the community.

(2) A local authority must make adequate and effective provision in its long-term plan and in its annual plan (where applicable) to meet the expenditure needs of the local authority identified in that long-term plan and annual plan.

Council must disclose the planned performance and limits for a range of financial prudence benchmarks in the LTP. These benchmarks include rates affordability, debt affordability, balanced budget, essential services, and debt servicing. Council has considerable latitude to set the limit for each of these benchmarks and, once they are set in the LTP, uses the same benchmarks for the Annual Plan and Annual Report.

The debt benchmarks are matched to LGFA borrowing covenants, and there can be financial implications if these are not met. The other limits are voluntary and, while they are an important mechanism for financial prudence and accountability, can be breached without a direct financial penalty.

8. Financial Strategy

S101A (2) of the LGA defines that the purpose of the Financial Strategy is to:

(a) facilitate prudent financial management by the local authority by providing a guide for the local authority to consider proposals for funding and expenditure against; and

(b) provide a context for consultation on the local authority’s proposals for funding and expenditure by making transparent the overall effects of those proposals on the local authority’s services, rates, debt, and investments.

The Financial Strategy is included as part of the LTP and includes an overview of the factors that are expected to have a significant impact on the Council. This is a broad strategic discussion and includes assumptions of future changes in population, land use and factors that are expected to impact on Council’s ability to maintain levels of service. This means that the Financial Strategy cannot be finalised until Council has completed consideration of levels of service and budgets, however, general principles and key components should be defined early in the LTP process.

Councillors received a briefing from Bancorp on the general economic outlook at the 5 April Detailed Financial Briefing.

9. Financial Policies

S102 of the Local Government act specifies a range of financial policies that Council must adopt. These are:

(a) a revenue and financing policy; and

(b) a liability management policy; and

(c) an investment policy; and

(d) a policy on development contributions or financial contributions; and

(e) a policy on the remission and postponement of rates on Māori freehold land; and

(3) A local authority may adopt either or both of the following policies:

(a) a rates remission policy:

(b) a rates postponement policy.

9.1 Revenue and Financing Policy

The Revenue and Financial Policy (R&FP) is arguably the most influential financial policy. This policy sets the funding sources for each activity i.e. the proportion that is funded from general rates, targeted rates, fees and charges, other revenue etc. The R&FP also specifies key parts of the rating system like the valuation system (rating basis).

The LGA s102 (3A) (a) specifies that the R&FP must support the principles set out in the Preamble to Te Ture Whenua Māori Act 1993

The R&FP must show how the Council has considered and complied with LGA s 101, which states:

(3) The funding needs of the local authority must be met from those sources that the local authority determines to be appropriate, following consideration of, —

(a) in relation to each activity to be funded, —

(i) the community outcomes to which the activity primarily contributes; and

(ii) the distribution of benefits between the community as a whole, any identifiable part of the community, and individuals; and

(iii) the period in or over which those benefits are expected to occur; and

(iv) the extent to which the actions or inaction of particular individuals or a group contribute to the need to undertake the activity; and

(v) the costs and benefits, including consequences for transparency and accountability, of funding the activity distinctly from other activities; and

(b) the overall impact of any allocation of liability for revenue needs on the current and future social, economic, environmental, and cultural well-being of the community.

While the R&FP must be included in the LTP, it must be adopted separately before the LTP.

9.2 Treasury Policy (Investment Policy and Liability Management Policy)

Council has adopted a Treasury Policy which includes both the required Investment Policy and Liability Management Policy. These policies are not included as part of the LTP and can be amended at any time following formal public consultation.

These policies set rules for how borrowing and investment is conducted and how risk is managed. Its scope does not include why the borrowing is required or the purpose of investment. That direction comes from the Revenue and Financing Policy and Financial Strategy respectively.

The LTP must include definitions of each reserve fund, including its purpose, activities to which the fund relates and estimated balances/withdrawals/deposits. Key considerations relate to the prudent and sustainable use of reserves and borrowing.

Staff from Council and Quayside Holdings Limited hold a regular Group Treasury Forum to ensure that treasury matters are considered on a ‘whole of group’ basis. This includes discussion on dividends, borrowing, investing, on-lending and general economic factors affecting the group.

9.3 Financial Contributions

Council must adopt a Financial Contributions Policy. This empowers any financial contributions that are required under a regional plan. In practice, this policy is only reviewed for alignment with changes to regional plans, like the Regional Natural Resources Plan, that specifies that Financial Contributions may be required.

9.4 Rates Remissions and Postponements

Council has adopted an interim Rates Remission and Postponement Policy that includes the policy on the remission and postponement of rates on Māori freehold land. This policy allows for rates to be reduced in ways that cannot effectively be achieved by altering the rating system.

10. Next Steps

Staff have planned several substantial policy discussions for future LTP workshops, but discussion at the April workshop may require those plans to change. Any financial policy considerations raised by Councillors will be programmed into the appropriate policy reviews.

|

|

|

|

|

Informal Workshop Paper |

||

|

To: |

Regional Council |

|

|

|

12 April 2023 |

|

|

From: |

Gillian Payne, Principal Advisor and Kumaren Perumal, Chief Financial Officer |

|

|

|

Mat Taylor, General Manager, Corporate |

|

Review of Rates Remission and Postponement Policy

1. Purpose

This paper is to present background information and strategic context to inform the review of Council’s Rates Remission and Postponement Policy.

It includes information on Council’s current Rates Remission and Postponement Policy (the Policy), work undertaken in late 2021, prior to the adoption of the Policy in June 2022.

Finally, the paper proposes a process and timetable for this review.

2. Guidance Sought from Councillors

Councillors are asked to consider the proposed Policy review process, milestones and indicative timelines and endorse or provide feedback on the planned approach.

At a subsequent workshop Council will be asked to consider principles and objectives of the policy.

3. Discussion

3.1 Background, legislative and policy contexts

3.1.1 Status of land for rating purposes

The Te Ture Whenua Māori Act 1993 (TTWM Act), s129 states that all land in New Zealand shall have one of the following statuses:

• Māori customary land

• Māori freehold land

• General land owned by Māori

• General land

• Crown land

• Crown land reserved for Māori.

The status of land affects how other pieces of legislation are applied, in particular, the Local Government (Rating) Act 2002, (LGRA), which exempts some types of land from paying rates or reduces the rates payable by 50%. These are listed in LGRA Schedule 1.

The LGRA was recently amended by the Local Government (Rating of Whenua Māori) Amendment Act 2021 (LGRWMAA). The amendment expanded the list of 100% and 50% non-rateable land in LGRA Schedule 1.

In addition, LGRWMAA enabled councils to remit rates on Māori freehold land under development, even if a remission was not explicitly part of a council’s rates remission policy. A summary of these and other changes to the LGRA and LGA made through the LGRWMAA was published in a seven-page booklet by Te Puni Kokiri:

https://www.tpk.govt.nz/docs/tpk-rating-maori-land-2021.pdf.

3.1.2 Key tools to provide rates relief

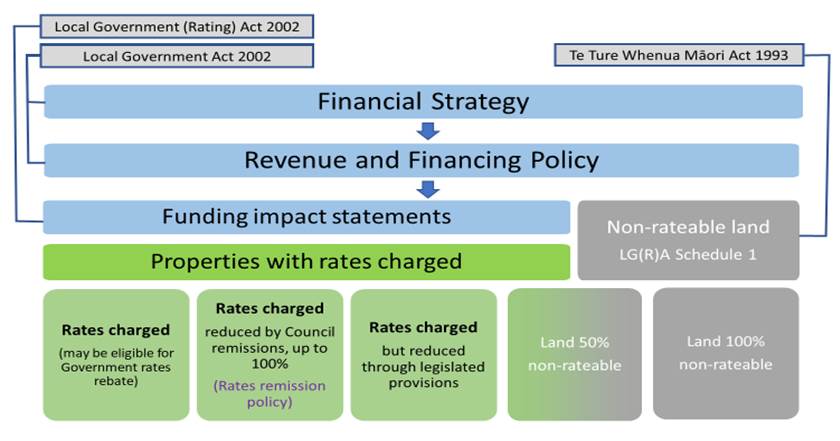

Rates relief mechanisms form part of the overall local authority revenue framework, working in tandem with Council’s financial strategy, revenue and financing policy to fine-tune the sources and timing of Council’s rates revenue.

Some landowners can receive assistance from central Government to pay rates, and through their policies, councils can reduce the amount of a property’s rates, or postpone rates:

· Rates rebates are financial assistance funded by central Government to help residents pay their rates, provided they meet criteria relating to property tenure and income/affordability.

· Rates remission policies are set by councils to reduce the rates ordinarily charged on types of property, or whose owners meet certain criteria.

· Rates postponement policies are set by councils to defer the timing of the obligation to pay rates.

3.1.3 Legislative and Policy Context

Figure 1, below, is an illustration of how legislation and Council’s strategies and policies affect landowners’ liability for rates.

3.1.4 Key legislation influencing the policy

In designing a policy, several key pieces of legislation need to be considered. Staff will ensure the policy meets these requirements.

LGA s102(2) requires Council to adopt a policy for Māori freehold land rates remissions and postponement. Regarding the policy:

· LGA Schedule 11 specifies considerations in developing the policy

· It must support the principles in the Preamble of the Te Ture Whenua Māori Act 1993.

LGRA s114A sets out considerations for remissions on Māori Freehold Land under development.

LGRA s90A-s90C gives the CEO authority to write off unrecoverable rates.

3.2 Existing Policy and Remissions Profile

3.2.1 Previous review

In 2021/22, alongside the project to bring rates collection in-house, the rates remission policies were reviewed, proposals were consulted on during March – May 2022 and a Remission and Postponement of Rates Policy (the Policy) adopted in June 2022.

Direction on those proposals was received from elected members through a series of workshops and meetings between September 2021 and March 2022. The final workshop in March 2022 noted lack of data to assess the impact for landowners and Council of moving away from implementing the Territorial Local Authorities’ (TLAs) policies, so a decision was made to include transition provisions pending a fuller review before 1 July 2024.

3.2.2 Current Policy Provisions

The BOPRC Policy provides remissions for:

· Rates on Māori Freehold Land (MFL)

o general remission that recognises some land is non-rateable through legislation and extends relief to similar land

o MFL being developed for economic use (both remission and postponement)

o MFL being developed for Papakāinga or other housing or accommodation

· Rates on land used for Māori Cultural Purposes

· Environmental and Sustainable Home Loan Repayment Scheme

· Forestry and Bush (limited to Rotorua Lakes Activity Targeted Rate area)

· Edgecumbe Urban River Scheme

· Queen Elizabeth II National Trust Open Space Covenants

· Rates Penalties

· Financial hardship

· Miscellaneous circumstances

· Transition –for properties receiving remissions in previous year (starting with 2021/22) BOPRC will remit rates as if TLA policies applied. Transition to remain until the policy is fully reviewed.

A stocktake of the scope of the Rates Remission and Postponement Policies of the Bay of Plenty TLAs has been done, and a summary of the results is shown in Attachment 1. Although the summary doesn’t capture the nuances and differences in each council’s policy, it gives a picture of the scope of rates relief available.

The most obvious difference between the TLA policies and Council’s is the area of recreation land. At future workshops, staff will seek Council direction on the scope of BOPRC’s future policy and a discussion about recreation land will be included.

3.2.3 Information on 2022/23 remissions

Total Value and Distribution

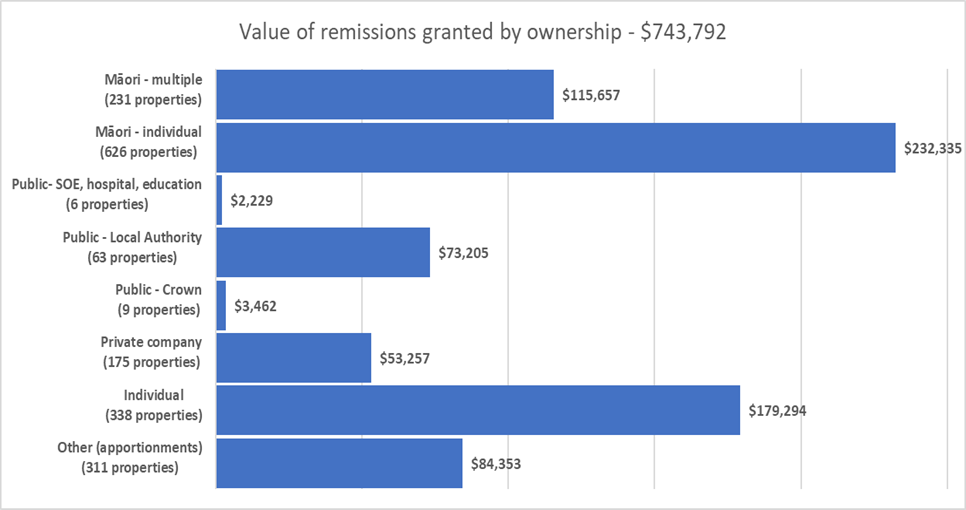

Under current policies and transition arrangements, 1759 properties receive a remission. The amounts remitted for each property vary considerably; 80% of the remissions are under $500, another 10% are between $501 and $670, with the top 10% of remissions ranging from $695 to $44,277.

Figure 2 shows the ownership profile of the properties currently receiving remissions, both the number of properties and the total value of remissions granted for each ownership type.

The last category on each graph is labelled Other (apportionments)[1]. To establish the underlying owner category of the 311 apportionments receiving a remission, staff will inspect each record individually. All relate to General Land.

Figure 2

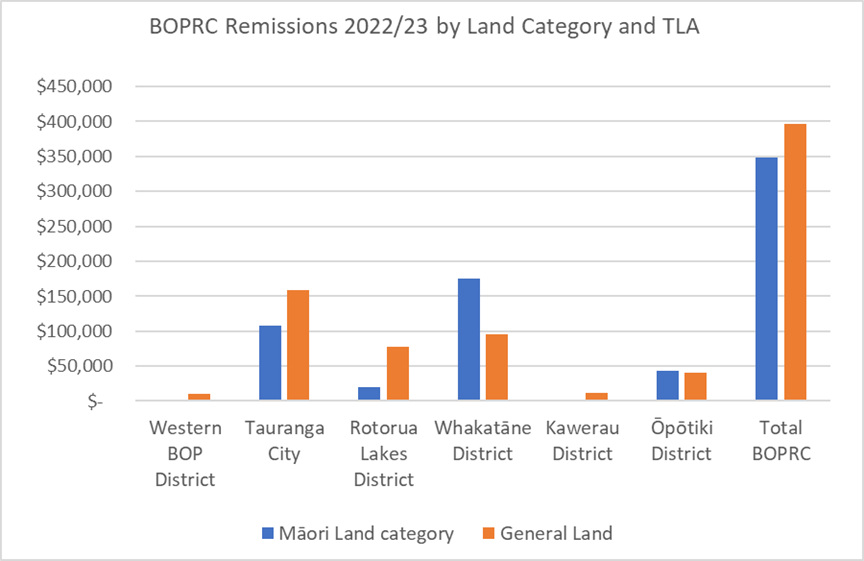

Land category and location

Figure 3 below shows the locations of properties receiving BOPRC remissions, broken down into the categories of Māori Land and General Land. This profile will be useful later in the review process as a base-line view of the geographical spread of remissions currently. Once Council has provided direction on future policies, staff could run a remissions scenario based on that direction and identify which areas would be most affected by a policy change.

Figure 3

Reasons for remissions

Research is underway to fully understand the reasons for the transitional remissions (based on TLA policies) that are represented above. At present there are some gaps in the information provided by TLAs and staff are working to improve the datasets.

Once this is done, staff will identify the properties receiving significant remissions that could potentially be affected by changes to the BOPRC policy through this review. This is important to understand to identify groups of landowners (particularly of general land) that should be identified for early engagement, and to forecast the financial impact of policy options that may be put forward to Council for consideration.

3.3 Process for this review

3.3.1 Timeline

The phases of the policy review are outlined in Figure 4:

Figure 4

3.3.2 Building on the work done in 2022

During the formal consultation on the 2022 interim policy, some of the issues raised by submitters were not addressed because of the decision to hold this later, fuller review. This feedback, together with issues and opportunities raised by Councillors during the 2021 and 2022 workshops will be brought back to Council to consider during this review.

3.3.3 Parallel engagement for General Land and Māori Land remissions

Engagement with Māori Freehold Land (MFL) owners and occupiers will follow a different approach and timeline to that for owners of General Land. This is driven by:

· the complexity of legislation affecting MFL remissions and the relative absence of legislated direction on General Land

· the practicalities of identifying the affected owners in each group

· the different scope of conversations that will take place.

These engagement processes are an opportunity to promote the work that Council does, and link rates paid to the outcomes BOPRC is working towards.

Approach for Māori Freehold Land

In 2021 Councillors requested that a co-design process, particularly involving the Māori constituency councillors, be followed for engagement on MFL remissions.

This means that engagement needs to include and acknowledge:

· history of rates on MFL

· what landowners have already said to us, especially during the 2021/22 review process

· sharing background information so that all parties are well-informed to take part

· sharing realistic expectations.

In 2021 there was also a desire to include the MFL rates staff of other BOP councils so that any opportunities for streamlining and aligning policies could be identified; succeeding in that would help MFL owners navigate the application processes and strengthen the coherence of both TLA and BOPRC policies. As a result, TLAs will be invited and encouraged to attend engagement sessions.

In terms of engagement channels, it is recognised that material needs to:

· be tailored to the specific audiences (whether trustees, individual landowners, professional advisers or TLA staff) in both level of detail and language

· use a suite of channels and tools to engage the digital audiences, the paper-based and the face-to-face audiences

· use engagement sessions planned for other activities (e.g. freshwater) to promote awareness of this review, but not impinge on the other kaupapa.

Approach for General Land

The approach for engaging owners of General Land will be to identify the individual properties that are receiving significant rates remissions under the transitional provisions, that would be vulnerable to a change in policy. This will be possible once staff have preliminary direction on principles and objectives for General Land so that an assessment can be done to identify which properties may be affected.

Once that is clear, the intention is to engage with the landowners to understand the impact a policy change could have on them, so that Council can factor that information into their assessment of potential policy options in the Consider phase (refer timeline above).

Formal consultation together

Once the Engage and Consider phases have been completed, a draft policy will be formally adopted for public consultation. This is the opportunity for anyone to provide feedback on any aspect of the draft policy, whether it relates to Māori or General Land.

4. Next Steps

4.1.1 Setting principles and objectives

At a subsequent workshop, Council will have the opportunity to identify a set of principles to underpin the policy. The principles will help staff implementing the policy to interpret Council’s intent when considering a decision in circumstances that may not have been anticipated when the policy was adopted. For Māori Freehold Land, legislation prescribes principles Council must promote in its rating and remission policies which are contained in the preamble to Te Ture Whenua Māori Land Act 1993.

The principles would be supported by a set of objectives that communicate in more detail what Council is trying to achieve through the policy provisions.

4.1.2 Gathering further information

Staff will continue work to fill information gaps to identify landowners for targeted consultation on General Land.

At the same time, engagement with Māori landowners will commence.

Attachment 1 - Summary of Rates Remission Policy Coverage BOP ⇩

[1] Apportionments arise where a rating unit is divided into separate rating areas to enable different rating treatments for each, depending on the activity or land use of each part.